T-Mobile US Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

T-Mobile US Bundle

What is included in the product

Analyzes T-Mobile US's competitive position, assessing industry dynamics, including threats & opportunities.

Easily visualize competitive threats with a dynamic spider chart, highlighting key areas.

Preview Before You Purchase

T-Mobile US Porter's Five Forces Analysis

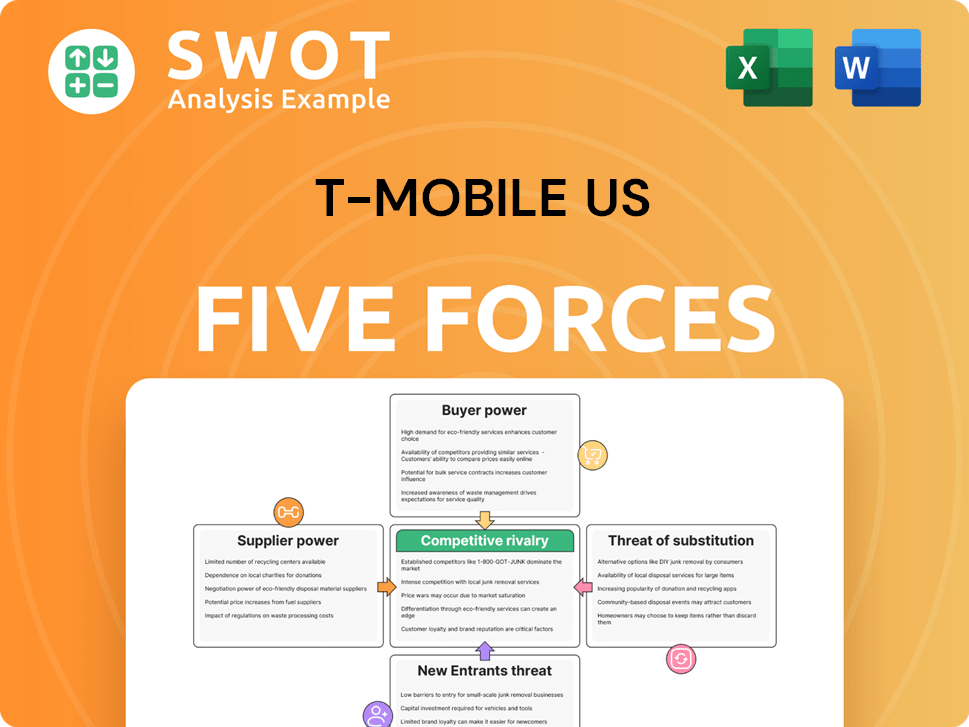

This preview showcases the complete T-Mobile US Porter's Five Forces analysis. It details competitive rivalry, supplier power, buyer power, threat of substitution, and threat of new entrants.

The analysis is professionally written, providing insights into T-Mobile's competitive landscape and market dynamics.

You'll find key strategies, challenges, and opportunities within the document.

The document you see here is exactly what you’ll be able to download after payment.

Get instant access and leverage this valuable report to elevate your understanding of T-Mobile.

Porter's Five Forces Analysis Template

T-Mobile US faces robust competition, especially from AT&T and Verizon. Buyer power is moderate due to customer choice and pricing sensitivity. Suppliers, like equipment vendors, have some influence. The threat of new entrants is tempered by high capital costs. Substitutes, such as Wi-Fi, pose a limited threat.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore T-Mobile US’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

T-Mobile US faces supplier power from a limited infrastructure provider base. High switching costs due to complex integration requirements further strengthen supplier influence. Suppliers' innovation and pricing directly affect T-Mobile's costs. In 2024, network infrastructure spending reached billions, highlighting supplier impact on profitability. This situation necessitates careful vendor management.

T-Mobile US relies on semiconductor chips for its network infrastructure, making it vulnerable to supplier dynamics. A chip shortage or price hike can disrupt operations, as seen in 2024, with a global chip market valued at over $500 billion. Suppliers of these specialized components have substantial power. Alternative sourcing is challenging and time-consuming, hindering T-Mobile's ability to quickly adapt.

T-Mobile US relies on software and technology licenses from vendors. These agreements, with their terms, give software providers leverage. Dependence on proprietary tech creates risks. In 2024, T-Mobile spent billions on tech, highlighting this dependence. For example, in 2024, T-Mobile’s capital expenditures were around $9.5 billion.

Network equipment manufacturers

T-Mobile US's bargaining power with network equipment manufacturers, like Ericsson and Nokia, is a key aspect of its operations. T-Mobile's significant network investments influence this dynamic. Long-term contracts and technology roadmaps also play a role in these relationships. The availability of alternative vendors and the rate of technological change are important factors. In 2024, T-Mobile invested billions in network infrastructure.

- Significant network investments give T-Mobile leverage.

- Long-term contracts with vendors stabilize relationships.

- Alternative vendors provide competitive options.

- Technological advancements can shift bargaining power.

Content providers for bundled services

When T-Mobile bundles content services with wireless plans, the bargaining power of content providers becomes significant. Popular content enhances T-Mobile's offerings, providing leverage to content providers during negotiations. The advent of exclusive content further solidifies their position. This dynamic impacts pricing and the overall attractiveness of T-Mobile's bundled services. The more desirable the content, the stronger the content providers' negotiating stance.

- In 2024, the streaming market is valued at over $100 billion, with significant growth expected.

- Exclusive content drives up to 30% of subscriber acquisition for streaming services.

- Content providers can demand higher fees, impacting T-Mobile's profit margins.

- Successful bundling relies on favorable content deals.

T-Mobile faces strong supplier power due to infrastructure limitations and high switching costs. Chip shortages and software licensing terms further empower suppliers. In 2024, network infrastructure spending totaled billions, impacting T-Mobile's costs.

| Supplier Type | Impact on T-Mobile | 2024 Data |

|---|---|---|

| Network Equipment | High capital expenditure | $9.5B in capital expenditures |

| Semiconductor | Supply chain disruptions | Global chip market valued at $500B+ |

| Content Providers | Pricing and bundle attractiveness | Streaming market over $100B |

Customers Bargaining Power

The wireless market is intensely competitive, making customers highly price-sensitive. Even minor price variations can cause customers to switch providers. In 2024, T-Mobile's customer churn rate was around 1%, emphasizing price's impact. T-Mobile must carefully manage pricing to attract and keep customers. This strategy is vital in a market where price wars are common.

Low switching costs significantly boost customer bargaining power. Number portability and unlocked devices simplify switching carriers. This erodes customer loyalty, giving them more leverage. T-Mobile competes by offering strong network performance and unique services. In 2024, T-Mobile's churn rate was around 0.9%, showing ongoing challenges.

The wireless market features numerous competitors like Verizon and AT&T, offering customers many options. This abundance of choices strengthens customer bargaining power, enabling them to seek better deals. T-Mobile must differentiate itself from the competition to retain subscribers. As of Q4 2023, T-Mobile reported 1.6 million net customer additions, highlighting the ongoing competition.

Access to transparent information

Customers wield considerable power due to easy access to pricing and performance data via online reviews and comparison websites. This transparency allows for informed decisions, intensifying price sensitivity. T-Mobile must actively manage its brand image and ensure data accuracy to retain customer loyalty. In 2024, the telecom sector saw a 12% increase in customers switching providers, reflecting this increased bargaining power.

- Online platforms enhance price comparison.

- Brand reputation directly impacts customer retention.

- Accurate information is crucial for trust.

- Increased switching rates highlight customer power.

Group buying and family plans

Group buying and family plans significantly amplify the bargaining power of customers. This concentration allows these larger accounts to negotiate better prices and demand more favorable terms. In 2024, T-Mobile reported that a substantial portion of its revenue comes from these types of plans. T-Mobile must prioritize the needs of these key customer segments to maintain its competitive edge.

- T-Mobile's revenue from family plans constitutes a large percentage.

- Negotiating power is increased due to the volume of service.

- Customers can switch providers based on better deals.

- T-Mobile must adapt to customer demands.

Customer bargaining power significantly impacts T-Mobile's financial strategies.

Factors include low switching costs and price transparency. The market saw a 12% increase in customer switching in 2024.

T-Mobile focuses on network performance and competitive pricing to retain customers.

| Aspect | Impact | 2024 Data |

|---|---|---|

| Churn Rate | Customer Retention | ~0.9-1.0% |

| Switching Rate | Customer Mobility | 12% increase |

| Revenue from family plans | Negotiating power | Significant percentage |

Rivalry Among Competitors

The wireless industry is fiercely competitive, with T-Mobile US, along with rivals like Verizon and AT&T, frequently engaging in price wars. This constant battle for customers, marked by promotional offers and discounts, pressures profit margins. In 2024, T-Mobile's average revenue per user (ARPU) faced pressure, demonstrating the impact of competitive pricing. T-Mobile needs to focus on offering superior value through services.

Network performance is a significant differentiator in the wireless industry. Carriers constantly invest in network enhancements to stay competitive. T-Mobile, with its 5G leadership, must keep its network superior. In Q4 2023, T-Mobile's 5G covered 98% of Americans, crucial for customer attraction and retention.

Carriers aggressively compete through service innovation. T-Mobile, alongside rivals like AT&T and Verizon, continually introduces new offerings. For instance, T-Mobile's Q3 2024 revenue was $20 billion. These innovations, such as 5G and home internet, aim to attract and retain customers. Staying ahead is vital for T-Mobile's market position.

Marketing and advertising spend

Marketing and advertising are crucial in the wireless industry, as carriers compete for customer attention and loyalty. This intense competition drives up marketing spend, creating a significant barrier for new entrants. T-Mobile, like its rivals, must invest heavily in advertising to maintain and grow its market share. Effective targeting and ROI maximization are critical for T-Mobile's marketing strategy.

- In 2023, T-Mobile's marketing expenses were approximately $6.5 billion.

- Verizon and AT&T also spend billions annually on advertising.

- T-Mobile's marketing efforts focus on value and 5G network.

- The industry's high marketing spend impacts profitability.

Customer experience

Customer experience is vital in the wireless market, intensifying competitive rivalry. Carriers are focusing on customer service improvements, process streamlining, and personalization. T-Mobile must offer a superior experience to foster loyalty and retain customers. A study revealed that 88% of consumers consider customer experience crucial in their purchasing decisions. This focus directly impacts brand perception and customer retention rates.

- T-Mobile's customer satisfaction scores have shown steady improvement.

- Investment in digital tools and self-service options is a key strategy.

- Personalized offers and proactive customer support are gaining traction.

- Competition drives continuous enhancement of customer experience initiatives.

Competitive rivalry in the wireless industry is intense. T-Mobile battles Verizon and AT&T through pricing, network, and service innovation. Marketing and customer experience are also key battlegrounds, impacting profitability. T-Mobile's 2024 ARPU pressure highlights this.

| Aspect | Details | Impact |

|---|---|---|

| Pricing | Constant promotions, discounts | Pressure on profit margins |

| Network | 5G leadership focus | Customer attraction/retention |

| Service | Innovation in offerings | Market position |

SSubstitutes Threaten

The rise of Wi-Fi presents a notable threat to T-Mobile. Free Wi-Fi access at home, work, and public places lets customers bypass cellular data. In 2024, Wi-Fi offload accounted for a significant portion of mobile data traffic. T-Mobile must enhance Wi-Fi integration to stay competitive. This could involve offering seamless Wi-Fi calling and data services.

Over-the-top (OTT) communication apps, such as WhatsApp, Skype, and Zoom, pose a threat. These apps provide alternatives to T-Mobile's traditional voice and messaging services. By using data connections, they bypass carrier charges. In 2024, Statista projected the global OTT market to reach $181.4 billion. T-Mobile must innovate to remain competitive.

Free public Wi-Fi hotspots, found in cafes and libraries, serve as a substitute for cellular data. This substitution reduces the demand for costly data plans from providers. In 2024, the average cost of a T-Mobile unlimited data plan was about $85 per month. To counter this, T-Mobile must offer attractive incentives. They need to convince users to opt for cellular data, despite the availability of free Wi-Fi, by enhancing their services.

Landline phones

Landline phones present a substitute threat to T-Mobile's mobile voice services, especially in homes. Their appeal remains strongest among older demographics, who may prefer them for reliability and familiarity. In 2024, approximately 25% of U.S. households still had landlines. T-Mobile must tailor offerings to these customers to mitigate this threat.

- Landlines offer a familiar alternative.

- Older demographics are a key market.

- Approximately 25% of U.S. households used landlines in 2024.

Satellite internet

Satellite internet poses a threat to T-Mobile, especially in rural areas with poor cellular coverage. This alternative offers internet access where T-Mobile's network might be weak. Although satellite internet often has higher latency and lower speeds, it remains a competitor. T-Mobile must aggressively expand its coverage to mitigate this threat effectively. In 2024, satellite internet providers like Starlink gained significant traction.

- Starlink reported over 2 million subscribers globally by late 2023.

- Satellite internet average download speeds increased, reaching up to 100 Mbps.

- The cost of satellite internet equipment decreased slightly in 2024, making it more accessible.

- T-Mobile's 5G network covered over 300 million people in the U.S. by early 2024.

Several alternatives threaten T-Mobile's customer base. OTT apps and Wi-Fi hotspots offer cheaper communication options. In 2024, the OTT market was valued at $181.4 billion. This necessitates T-Mobile's focus on service innovation.

| Substitute | Impact | 2024 Data |

|---|---|---|

| Wi-Fi | Bypasses cellular data. | Significant data offload. |

| OTT Apps | Alternative to voice & messaging. | $181.4B market size. |

| Landlines | Alternative voice service. | 25% of US households. |

Entrants Threaten

Building a nationwide wireless network is extremely capital-intensive, posing a major hurdle for new companies. This high capital requirement makes it difficult for new competitors to enter the market. T-Mobile has a significant advantage due to its existing infrastructure, which has been developed over time. In 2024, the company invested billions in network expansion and upgrades, showcasing the ongoing financial commitment needed.

Access to spectrum is crucial for wireless services, and it's both limited and costly. New companies must buy spectrum through auctions or from others. T-Mobile benefits from its existing spectrum, giving it an edge. In 2024, spectrum auction prices remained high, with significant costs for new entrants. T-Mobile's spectrum portfolio supports its 5G network, a key competitive advantage.

Established wireless carriers, such as T-Mobile US, benefit from robust brand recognition and customer loyalty, a significant barrier for new entrants. New companies face substantial marketing and advertising costs to build brand awareness, which is essential to attract customers. T-Mobile's brand equity gives it a competitive edge, as evidenced by its 2024 customer retention rate of approximately 70%. This reduces the threat from new competitors.

Regulatory hurdles

Regulatory hurdles pose a significant threat to new entrants in the telecom sector. The industry is burdened by complex regulations, demanding substantial time and capital for compliance. T-Mobile US benefits from its established regulatory experience, creating a barrier. New entrants face challenges in obtaining licenses and permits, increasing the risk of market entry. This regulatory burden can significantly impact the profitability and viability of new ventures.

- Regulatory compliance costs for telecom companies can reach billions.

- The FCC's regulatory process can take several years.

- T-Mobile has invested heavily in regulatory compliance.

- New entrants often struggle with spectrum allocation.

Economies of scale

Established wireless carriers like T-Mobile benefit significantly from economies of scale, which translate into lower operational costs and the ability to offer competitive pricing. This scale allows for substantial investments in crucial network upgrades, ensuring superior service quality. New entrants face considerable hurdles in matching these advantages, struggling to compete on both price and the breadth of service offerings. T-Mobile's extensive infrastructure and subscriber base provide a distinct cost advantage, making it difficult for new players to gain traction.

- T-Mobile's network covers 99% of Americans as of 2024.

- In Q1 2024, T-Mobile added 531,000 net new postpaid customers.

- T-Mobile invested $3.7 billion in capital expenditures in 2023.

New wireless carriers face high capital costs and spectrum expenses, hindering entry. Brand recognition and regulatory hurdles create barriers, favoring established firms like T-Mobile. Economies of scale give T-Mobile a cost advantage.

| Factor | Impact on New Entrants | T-Mobile's Advantage (2024) |

|---|---|---|

| Capital Requirements | High investment needed for infrastructure. | Existing network, $3.7B CapEx in 2023. |

| Spectrum Costs | Expensive to acquire; limited availability. | Existing spectrum portfolio. |

| Brand & Regulatory | High marketing costs, compliance burdens. | Strong brand, compliance experience. |

Porter's Five Forces Analysis Data Sources

The analysis leverages SEC filings, market reports, and competitor data. It also incorporates industry publications for accurate strategic assessments.