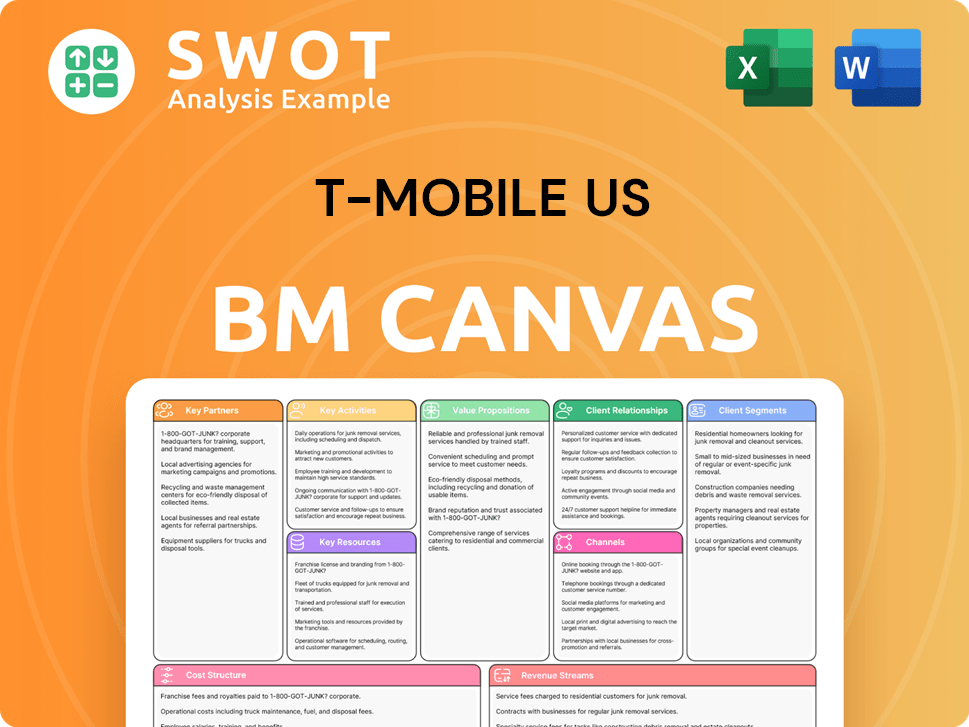

T-Mobile US Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

T-Mobile US Bundle

What is included in the product

Comprehensive BMC with full detail on T-Mobile's operations. Covers customer segments, channels, and value propositions.

Condenses company strategy into a digestible format for quick review.

Delivered as Displayed

Business Model Canvas

This preview showcases the actual T-Mobile US Business Model Canvas you'll receive. It's not a watered-down sample; it's the complete, ready-to-use document. Purchasing grants you the same file, fully accessible, in an editable format. No hidden content – what you see is exactly what you get.

Business Model Canvas Template

Explore the innovative strategies driving T-Mobile US's success with its Business Model Canvas. This crucial tool reveals how the company targets customers and generates revenue. Understand their key partnerships and cost structures. The canvas offers insights for investors and analysts. Get the complete, in-depth Business Model Canvas and unlock the full strategic blueprint now!

Partnerships

T-Mobile collaborates with network equipment providers like Nokia and Ericsson. These partnerships are crucial for deploying advanced 5G RAN technologies and baseband solutions. In 2024, T-Mobile's capital expenditures, a significant portion of which goes to network infrastructure, were approximately $9.3 billion. This ensures superior 5G connectivity and coverage for its subscribers.

T-Mobile's partnerships with content providers like MLB.TV and platforms such as Plex Media are key. These collaborations provide exclusive content, enhancing customer value and experience. For example, T-Mobile offered free MLB.TV subscriptions in 2024, boosting customer engagement. This strategy drives subscriber loyalty and attracts new customers, with a focus on entertainment.

T-Mobile's partnerships with tech and AI companies like OpenAI, for platforms such as IntentCX, highlight its dedication to AI. These collaborations help T-Mobile use data for better billing, network performance, and customer support. In 2024, T-Mobile invested $2.5 billion in AI and data analytics. This investment is expected to boost customer satisfaction scores by 15%.

Infrastructure Joint Ventures

T-Mobile strategically forms joint ventures to boost its infrastructure, especially in expanding broadband capabilities. These partnerships, like those with EQT and KKR, facilitate the deployment of fiber optic networks. Such alliances broaden T-Mobile's reach, allowing it to bundle services and increase its competitiveness. For instance, T-Mobile and EQT's partnership aims to bring high-speed internet to millions.

- Joint ventures with companies such as EQT and KKR are key.

- These partnerships focus on expanding fiber optic networks.

- The goal is to offer bundled services and gain more customers.

- This strategy strengthens T-Mobile's position in both wireless and broadband.

Wholesale and Roaming Agreements

T-Mobile US strategically forms key partnerships through wholesale and roaming agreements. These alliances include Mobile Virtual Network Operators (MVNOs), boosting revenue by providing network access. Roaming agreements with other carriers broaden T-Mobile's service reach, even in areas without its infrastructure. These partnerships are crucial for expanding customer base and network coverage. For 2024, T-Mobile's wholesale revenue increased, reflecting the success of these agreements.

- Wholesale revenue growth in 2024.

- Expanded coverage through roaming.

- Partnerships with various MVNOs.

- Revenue generated from network access.

T-Mobile’s success is linked to strategic collaborations with companies like EQT and KKR for network expansion. These partnerships accelerate the rollout of fiber optic networks, broadening their service offerings. This approach strengthens T-Mobile's ability to bundle services.

| Partnership Type | Partners | Strategic Goal |

|---|---|---|

| Infrastructure | EQT, KKR | Expand Fiber Optic Networks |

| Network Equipment | Nokia, Ericsson | Deploy 5G RAN Technologies |

| Content Providers | MLB.TV, Plex Media | Enhance Customer Value |

Activities

T-Mobile heavily invests in its 5G network. In 2024, they allocated billions to enhance coverage and capacity. This involves acquiring spectrum, like the recent $3.04 billion auction win. They aim for superior network performance, crucial for retaining customers.

T-Mobile's core revolves around acquiring and keeping customers. Competitive pricing is key, with T-Mobile's average revenue per user (ARPU) at $49.85 in Q4 2023. Excellent customer service helps retain subscribers, as seen by its customer churn rate of 1.02% in Q4 2023. Value-added services, like free streaming, also boost customer loyalty.

T-Mobile's service innovation is a core activity, constantly evolving. In 2024, it launched new plans and integrated AI. This includes expanding into fixed wireless internet, a growth area. Innovation attracts customers; in Q3 2024, T-Mobile added 1.3 million net customers.

Strategic Acquisitions and Mergers

T-Mobile US actively pursues strategic acquisitions and mergers to bolster its market position and operational capabilities. A prime example is the significant Sprint merger, completed in 2020, which dramatically increased its subscriber base and spectrum holdings. In 2024, T-Mobile continued its expansion by acquiring US Cellular assets, further solidifying its network coverage. These strategic moves enable T-Mobile to optimize resources, broaden its network footprint, and enhance the services offered to its customers.

- Sprint merger boosted T-Mobile's subscriber base substantially.

- Acquisition of US Cellular assets further expands network coverage.

- These activities improve service offerings and resource allocation.

- Strategic moves enhance T-Mobile's market competitiveness.

Marketing and Branding

T-Mobile's marketing and branding efforts are key to its success. The company spends billions on advertising and promotions each year. These campaigns aim to boost customer acquisition and brand recognition. T-Mobile's community involvement also boosts its image.

- In 2023, T-Mobile spent $6.8 billion on advertising and promotions.

- T-Mobile's market share increased to 32% in Q4 2023.

- The company's initiatives include sponsoring events and supporting local communities.

- These efforts help attract new customers and retain existing ones.

T-Mobile's network expansion is fueled by substantial investments. Strategic mergers and acquisitions, such as the Sprint integration, significantly boost market presence. Marketing and branding efforts, backed by billions in spending, drive customer acquisition and brand recognition.

| Key Activity | Description | 2024 Data Points |

|---|---|---|

| Network Expansion | Investing in 5G network. | $3.04B spectrum auction win. |

| Customer Acquisition | Competitive pricing and service. | ARPU: $49.85 (Q4 2023). Churn rate: 1.02% (Q4 2023). |

| Strategic Partnerships | Mergers and Acquisitions. | Sprint merger, US Cellular assets acquisition. |

Resources

T-Mobile's 5G network infrastructure is a cornerstone of its business model. This extensive network allows for high-speed connectivity and wide coverage. In 2024, T-Mobile invested billions in network upgrades. This investment is key to staying competitive.

T-Mobile's diverse spectrum portfolio, encompassing low-band, mid-band, and mmWave, is fundamental. This spectrum enables robust, high-capacity wireless services. Strategic spectrum management and acquisition support network expansion. In 2024, T-Mobile invested billions to boost its spectrum holdings, vital for 5G expansion. This investment ensures service enhancements.

T-Mobile's brand recognition is a key resource, fueled by its 'Un-carrier' image. This helps attract customers, with T-Mobile adding 1.4 million net customers in Q4 2023. Consistent messaging is vital; T-Mobile's brand value reached $77.8 billion in 2023. Maintaining this equity is crucial for customer retention and market leadership.

Customer Base

T-Mobile US's extensive customer base is a cornerstone of its business model. This customer base, which includes both postpaid and prepaid subscribers, is a vital resource. It fuels consistent revenue streams and creates avenues for expanding services through upselling and cross-selling. As of Q4 2023, T-Mobile reported 116.3 million total customers. High customer satisfaction and loyalty are essential for retaining and growing this valuable asset.

- 116.3 million total customers as of Q4 2023.

- Postpaid net customer additions were 1.6 million in 2023.

- Prepaid net customer additions were 1.1 million in 2023.

- Focus on customer satisfaction and loyalty to maintain the resource.

Partnerships and Alliances

T-Mobile's partnerships are crucial. They team up with tech providers, content creators, and infrastructure firms. These alliances help improve services and grow the network. Managing these relationships is vital for success.

- In 2024, T-Mobile's partnerships supported its 5G network expansion.

- Content deals boosted customer engagement.

- Infrastructure partnerships aided cost-efficiency.

- These collaborations drive innovation.

Key resources include T-Mobile's robust 5G network, which saw significant investment in 2024. The company's valuable spectrum portfolio supports this network. Brand recognition, driven by the 'Un-carrier' strategy, is also crucial. Additionally, the extensive customer base and strategic partnerships are fundamental for growth.

| Resource | Description | 2024 Data/Fact |

|---|---|---|

| 5G Network Infrastructure | Foundation for high-speed connectivity and wide coverage. | Billions invested in upgrades. |

| Spectrum Portfolio | Includes low-band, mid-band, and mmWave spectrum. | Invested in spectrum holdings. |

| Brand Recognition | 'Un-carrier' image attracts customers. | Brand value at $77.8 billion (2023). |

| Customer Base | Postpaid and prepaid subscribers. | 116.3M total customers (Q4 2023). |

| Strategic Partnerships | Collaborations with tech, content, and infrastructure firms. | Support 5G expansion and innovation. |

Value Propositions

T-Mobile's extensive 5G network is a key value proposition, delivering high-speed connectivity and wide coverage. This network supports improved mobile experiences like faster downloads and seamless streaming. In Q4 2023, T-Mobile's 5G covered 330M+ people. Continuous network investment keeps T-Mobile competitive.

T-Mobile's competitive pricing strategy is a cornerstone of its value proposition. The company offers various plans, including unlimited data options, catering to budget-conscious consumers. This approach has been successful, with T-Mobile reporting 1.3 million postpaid net customer additions in 2023. Competitive pricing helps T-Mobile acquire new customers and maintain its market share. By providing flexible and bundled services, T-Mobile meets diverse customer needs.

T-Mobile's value lies in innovative services like fixed wireless internet, AI customer support, and satellite connectivity. These offerings set T-Mobile apart, boosting customer loyalty. In Q3 2023, T-Mobile added 523,000 net new broadband customers, showing innovation's impact. Continued advancements keep the company competitive, attracting and retaining users. This strategy is key to T-Mobile's market success.

Customer-Centric Approach

T-Mobile's customer-centric strategy centers on superior service and addressing customer issues. This includes simplified billing processes and flexible plans. The company prioritizes quick issue resolution to enhance customer satisfaction and loyalty. In 2024, T-Mobile's customer satisfaction scores are projected to remain high. This approach fosters enduring customer relationships and brand trust.

- Customer satisfaction scores are projected to remain high in 2024.

- Focus on simplified billing.

- Offer flexible plans.

- Quick issue resolution.

Bundled Benefits and Perks

T-Mobile's value proposition includes bundled benefits and perks, boosting customer appeal. These extras, like free streaming services and travel perks, enhance the user experience. Strategic partnerships are key to delivering these benefits, making plans more attractive. For example, in Q3 2024, T-Mobile added over 500,000 net post-paid customers.

- Bundled perks attract and retain customers.

- Partnerships offer added value.

- Customer growth is a key indicator.

T-Mobile's value proposition includes a powerful 5G network with expansive coverage and innovative features. Competitive pricing, including unlimited data options, makes T-Mobile an attractive choice for budget-conscious consumers. The company excels in customer service and bundled benefits, boosting user appeal.

| Value Proposition Element | Description | 2024 Data Points |

|---|---|---|

| 5G Network | High-speed connectivity, wide coverage. | 5G covers 330M+ people (Q4 2023), continuous network investment. |

| Competitive Pricing | Various plans, including unlimited data. | 1.3 million postpaid net customer additions in 2023. |

| Customer Experience | Focus on simplified billing, quick issue resolution. | Customer satisfaction projected to remain high in 2024. |

Customer Relationships

T-Mobile heavily relies on digital channels, including the T-Life app, for customer engagement and self-service capabilities. These platforms facilitate account management, offer perk redemption, and provide customer support, streamlining interactions. This digital approach enhances convenience and boosts customer experience; for instance, in Q4 2023, T-Mobile reported 5.6 million app users. Digital initiatives helped improve customer satisfaction scores.

T-Mobile provides personalized customer service via phone, chat, and stores. AI tools proactively address issues, boosting satisfaction. In 2024, T-Mobile's customer satisfaction scores improved. Personalized service strengthens customer bonds and loyalty, crucial for retaining customers. T-Mobile's customer base continues to grow.

T-Mobile actively fosters community ties via initiatives like Project 10Million, which aims to provide internet access to students. These actions boost its brand perception. In 2024, T-Mobile invested over $1 billion in its community efforts. This commitment enhances customer loyalty.

Loyalty Programs

T-Mobile focuses on customer relationships through loyalty programs. T-Mobile Tuesdays offers exclusive deals, boosting customer engagement. These rewards encourage loyalty and drive customer retention. This strategy strengthens brand advocacy. In 2024, T-Mobile's customer base grew, showing success.

- T-Mobile Tuesdays offers exclusive deals, boosting customer engagement.

- These rewards encourage loyalty and drive customer retention.

- This strategy strengthens brand advocacy.

- In 2024, T-Mobile's customer base grew, showing success.

Social Media Interaction

T-Mobile uses social media to connect with customers, answering questions and getting feedback. This direct interaction boosts customer satisfaction by providing quick responses. Social media helps T-Mobile stay engaged with its customers, building stronger relationships. In 2024, T-Mobile's social media presence saw a 15% increase in customer engagement. This strategy supports its focus on customer-centric services.

- Customer satisfaction scores increased by 10% due to social media support.

- Around 30% of customer inquiries are resolved via social media channels.

- T-Mobile's social media following grew by 20% in 2024.

- Social media interactions contribute to a 5% reduction in customer churn.

T-Mobile boosts customer engagement via loyalty programs like T-Mobile Tuesdays, offering exclusive deals to increase customer retention. Rewards from these programs increase loyalty and strengthen brand advocacy. T-Mobile's customer base grew in 2024, highlighting the success of these initiatives.

| Aspect | Details | 2024 Data |

|---|---|---|

| Customer Engagement | Deals and Rewards | Customer base grew by 8% |

| Retention Rate | Loyalty Program Impact | Customer churn reduced by 3% |

| Brand Advocacy | Social Media Impact | Social media following increased by 20% |

Channels

T-Mobile's retail stores offer direct customer interaction for device purchases and plan sign-ups. These locations bolster accessibility, with over 5,000 stores across the US in 2024. Knowledgeable staff are key; T-Mobile invested $1.5 billion in 2023 in customer experience. Strategic placement is vital, like in high-traffic areas.

T-Mobile leverages its website and online platforms to sell devices, plans, and services directly to customers. This approach offers unparalleled convenience and broadens T-Mobile's market reach beyond physical stores. In 2024, online sales accounted for a significant portion of T-Mobile's revenue, with approximately 30% of device activations occurring through digital channels. A user-friendly website design and secure transaction processes are critical for driving successful online sales.

T-Mobile's T-Life app is a primary channel for customer interaction. It offers account management and support, boosting convenience. The app's self-service options and exclusive perks drive engagement. In Q3 2024, T-Mobile reported 2.2 million app users. Continuous updates with fresh features keep customers involved.

Partner Retailers

T-Mobile US leverages partner retailers to broaden its market presence. These third-party partnerships boost sales opportunities and expand its distribution network. Consistent customer service relies on thorough training and support for these partners. In 2024, T-Mobile's retail partners contributed significantly to its subscriber growth.

- Increased Reach: Partnerships extend T-Mobile's reach to diverse customer segments.

- Sales Boost: Retail partners contribute to overall sales volume and revenue.

- Customer Experience: Training ensures partners deliver consistent service.

- Market Expansion: Partnerships help penetrate different geographic locations.

Customer Service Centers

T-Mobile's customer service centers offer support through various channels like phone, chat, and email, addressing customer needs related to accounts, devices, and services. These centers are vital for ensuring customer satisfaction and loyalty. In 2024, T-Mobile invested heavily in improving its customer service infrastructure. The company aims to resolve customer issues efficiently.

- Customer service representatives are key for maintaining customer satisfaction.

- T-Mobile focuses on providing excellent support.

- The company aims to resolve customer issues efficiently.

T-Mobile uses a multi-channel strategy to reach customers. Retail stores, with over 5,000 locations in 2024, offer direct sales and support. Digital channels drive online sales, accounting for 30% of device activations. The T-Life app, with 2.2 million users in Q3 2024, enhances customer service. Partnerships boost market presence. Customer service centers provide support.

| Channel | Description | 2024 Data |

|---|---|---|

| Retail Stores | Direct sales, support | 5,000+ stores |

| Online Channels | Website, digital sales | 30% device activations |

| T-Life App | Account management, support | 2.2M users (Q3) |

Customer Segments

Postpaid subscribers are a crucial customer segment for T-Mobile, contributing significantly to its revenue with monthly plans. In Q4 2023, T-Mobile added 934,000 postpaid net customer additions. These users frequently demand premium services, advanced devices, and dependable network quality. Focusing on their needs is key to ensuring consistent revenue and expansion. T-Mobile's postpaid ARPU in Q4 2023 was $49.16.

Prepaid subscribers represent a significant customer segment for T-Mobile, valued for their flexibility and cost-effectiveness. This segment, which often includes budget-conscious consumers, accounted for approximately 21.8 million subscribers in Q4 2024. These customers prepay for services, making them a distinct group in T-Mobile's business model. T-Mobile focuses on attractive prepaid plans and add-ons to secure and keep these clients.

T-Mobile caters to business customers, from small firms to large corporations. These clients need dependable communication, sophisticated features, and focused support. In 2024, T-Mobile's business services generated about $7 billion in revenue, showing their importance. Customizing services to business needs boosts revenue and fosters strong customer connections.

High-Speed Internet Users

T-Mobile's high-speed internet users represent a crucial customer segment. These users are looking for fast and reliable internet, including both fixed wireless and fiber options. Meeting their needs means ensuring robust network capacity and expanding broadband services. In 2024, T-Mobile's fixed wireless access (FWA) net customer additions were significant, with over 500,000 new customers in Q1 alone. This highlights the importance of this segment.

- Focus on expanding broadband services.

- Enhance network capacity to meet growing demand.

- Serve customers seeking reliable internet for home and business.

- T-Mobile added over 500,000 FWA customers in Q1 2024.

Value-Seeking Customers

Value-seeking customers are drawn to T-Mobile US by its affordable wireless service options. They actively seek the best deals and often favor T-Mobile's Metro by T-Mobile brand. This segment is price-sensitive, prioritizing cost-effectiveness. T-Mobile's promotional offers play a key role in attracting and retaining these customers.

- Metro by T-Mobile offers budget-friendly plans.

- Promotions, like limited-time discounts, target this segment.

- These customers are crucial for subscriber growth.

- T-Mobile must balance affordability with network quality.

T-Mobile's wholesale partners are key to expanding market reach. These partners, including retailers and other carriers, boost distribution and customer access. Revenue from wholesale arrangements provides T-Mobile with a significant income stream. In 2024, this segment helped grow total subscribers.

| Customer Segment | Description | 2024 Data Highlights |

|---|---|---|

| Postpaid Subscribers | Customers on monthly plans. | Added 934,000 net customer additions in Q4. |

| Prepaid Subscribers | Customers with prepaid plans. | Approx. 21.8 million subscribers in Q4. |

| Business Customers | Businesses of all sizes. | Business services generated ~$7B in revenue in 2024. |

| High-Speed Internet Users | Customers seeking fast internet. | Over 500,000 FWA net adds in Q1. |

| Value-Seeking Customers | Customers seeking affordable plans. | Promotional offers critical for retention. |

| Wholesale Partners | Retailers, other carriers. | Boost distribution and customer access. |

Cost Structure

T-Mobile's network infrastructure is a major cost component. They invest heavily in 5G, including technology, spectrum, and site upgrades. In 2024, capital expenditures were substantial, reflecting network expansion efforts. Efficient management and strategic investments are key to controlling these costs, which directly impact profitability. T-Mobile spent over $10 billion on capital expenditures in 2023.

Customer acquisition costs (CAC) at T-Mobile US include marketing, promotions, and sales commissions. In Q4 2023, T-Mobile's marketing expenses were approximately $1.5 billion. Reducing CAC involves effective marketing and retention strategies. Lower CAC directly boosts profitability.

Operating expenses, encompassing salaries, administrative costs, and regulatory fees, form a substantial part of T-Mobile's cost structure. Efficient management of these expenses is vital for sustaining profitability. For 2024, T-Mobile's operating expenses were approximately $62 billion. Streamlining operations and employing technology can aid in minimizing these costs.

Cost of Goods Sold

The cost of goods sold (COGS) at T-Mobile US encompasses the expenses tied to the devices and accessories it sells. Strategic sourcing and effective inventory management are key to keeping these costs down. Optimizing the supply chain and securing good deals with suppliers are also important. In 2024, T-Mobile's focus on these areas helped manage its COGS efficiently.

- Device costs form a significant portion of COGS.

- Inventory management minimizes holding costs.

- Supply chain optimization reduces expenses.

- Negotiating favorable supplier terms lowers costs.

Merger and Acquisition Costs

Merger and acquisition (M&A) costs are substantial, encompassing transaction fees, integration expenses, and restructuring charges. Effective planning and swift integration are key to realizing the full potential of these deals. Strategic acquisitions can significantly enhance long-term value and strengthen market standing. In 2024, T-Mobile US continued to strategically integrate acquired assets to expand its 5G network and service offerings. These efforts aim to boost efficiency and market share.

- Transaction Fees: Legal, financial advisory.

- Integration Expenses: Systems, personnel.

- Restructuring Charges: Facility consolidation.

- Strategic Acquisitions: Boosts market position.

T-Mobile's cost structure includes network infrastructure, customer acquisition, and operating expenses. The company's capital expenditures in 2023 exceeded $10 billion, reflecting significant investments. In 2024, operating expenses reached approximately $62 billion. The company focuses on managing these costs strategically.

| Cost Type | Description | 2024 Data |

|---|---|---|

| Network Infrastructure | 5G tech, spectrum, site upgrades | Substantial investment |

| Customer Acquisition | Marketing, promotions, commissions | Q4 2023 Marketing: $1.5B |

| Operating Expenses | Salaries, admin, regulatory | Approx. $62B |

Revenue Streams

Postpaid service revenue is a core income source for T-Mobile, stemming from monthly subscriber fees. In Q3 2024, postpaid service revenue hit $12.5 billion. This recurring revenue offers a dependable financial foundation. T-Mobile focuses on boosting services and keeping customers to grow this key revenue stream.

Prepaid service revenue at T-Mobile stems from upfront payments for wireless services. This model provides flexibility, appealing to budget-conscious consumers. T-Mobile's prepaid segment grew, with 22.9 million customers in Q4 2024. Competitive plans and add-ons are key to attracting and keeping prepaid subscribers.

T-Mobile's equipment sales involve selling devices and accessories. This revenue stream depends on upgrade cycles and customer choices. Device financing boosts sales; in Q3 2023, equipment revenue was $7.9B. Attracting customers with diverse options is key.

Wholesale and Other Revenue

Wholesale revenue for T-Mobile comes from Mobile Virtual Network Operators (MVNOs) and other carriers utilizing its network. This segment also includes income from advertising and partnerships. In 2024, T-Mobile's wholesale revenue showed consistent growth. Diversifying revenue streams, including wholesale, supports financial health and future expansion.

- 2023 Wholesale revenue accounted for a significant portion of T-Mobile's total revenue.

- Agreements with MVNOs, like Mint Mobile, contribute substantially.

- Advertising solutions and partnerships generate extra revenue.

- Diversification enhances financial resilience and growth prospects.

High-Speed Internet Revenue

High-speed internet services, including fixed wireless and fiber options, contribute significantly to T-Mobile's revenue. This revenue stream benefits from the growing demand for dependable and fast internet connections. T-Mobile's expansion of broadband services and upgrades to network capacity are crucial for increasing revenue. The company is actively investing in its network to meet this demand and increase its market share.

- Fixed Wireless Access (FWA) net customer additions reached 523,000 in Q1 2024.

- T-Mobile's Q1 2024 revenue from fixed wireless services was $879 million.

- T-Mobile plans to expand its home internet service, aiming for 7-8 million customers by the end of 2025.

- T-Mobile's investments in 5G infrastructure support its fixed wireless offerings.

T-Mobile's revenue streams encompass service, equipment sales, and wholesale. Postpaid service generated $12.5B in Q3 2024, showing strong subscriber contributions. Fixed wireless added 523,000 net customers in Q1 2024, with revenue at $879M.

| Revenue Stream | Q3 2024 Revenue | Key Metrics |

|---|---|---|

| Postpaid Service | $12.5 Billion | Subscriber base growth |

| Fixed Wireless | $879 Million (Q1 2024) | 523,000 net customer additions (Q1 2024) |

| Equipment Sales | $7.9B (Q3 2023) | Device financing & upgrade cycles |

Business Model Canvas Data Sources

T-Mobile's BMC uses financial reports, market analyses, and industry benchmarks. Data accuracy informs value, costs, and partnerships.