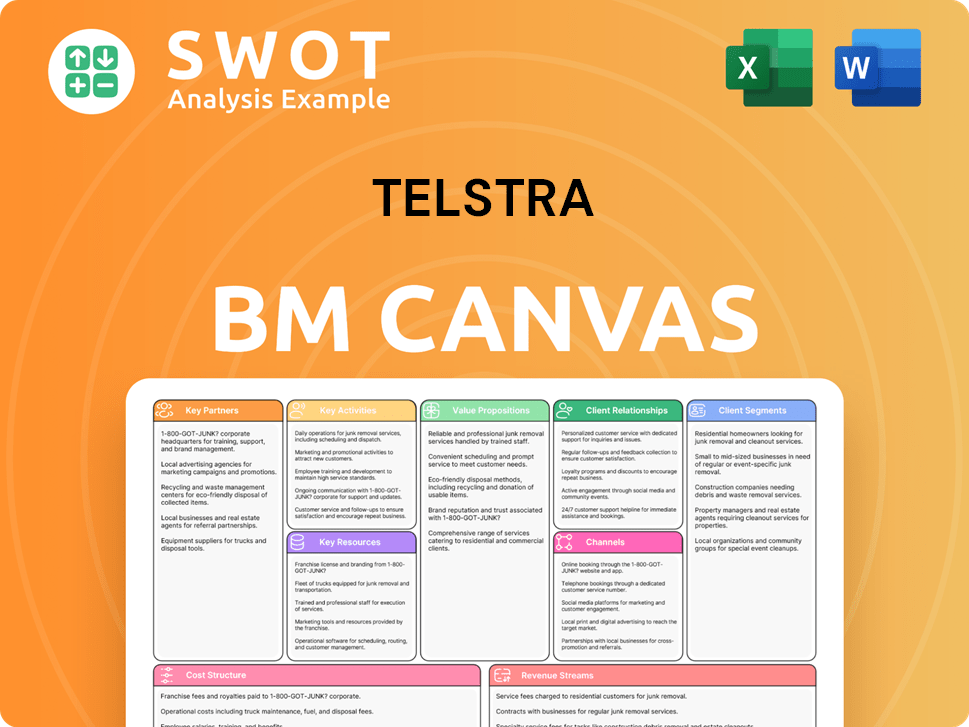

Telstra Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Telstra Bundle

What is included in the product

Reflects the real-world operations and plans of the featured company.

Telstra's Business Model Canvas offers a one-page business snapshot, quickly identifying core components.

Preview Before You Purchase

Business Model Canvas

This is the actual Telstra Business Model Canvas document. The preview you are viewing is the exact, complete file you will receive upon purchase. It's fully editable and ready to use. No hidden sections or altered formats – what you see is what you get. Access the full canvas now!

Business Model Canvas Template

Analyze Telstra's intricate business model with our comprehensive Business Model Canvas. Explore its key customer segments, value propositions, and revenue streams. Understand how Telstra manages its key resources and activities for sustained success. Uncover the vital partnerships that fuel its operations and drive market leadership. This insightful canvas is your key to unlocking Telstra's strategic framework. Purchase the full Business Model Canvas to gain a deeper, actionable understanding.

Partnerships

Telstra's key partnerships with technology providers are crucial. Collaborations with Ericsson and Accenture boost its network and AI. Ericsson aids in 5G Advanced upgrades. The Accenture venture accelerates Telstra's AI plans. In 2024, Telstra invested $2.2 billion in network infrastructure.

Telstra's partnerships with content providers are key. They offer diverse entertainment, enhancing the customer experience. Collaborations include Fetch TV and streaming platforms. These agreements boost revenue, aligning with consumer trends. In 2024, Telstra's media revenue grew, reflecting successful content partnerships.

Telstra's infrastructure partners are crucial for its network's backbone, encompassing mobile towers, fiber, and data centers. These partnerships are key for network reliability and operations. Telstra's control allows for performance tweaks and tech rollouts. In 2024, Telstra invested heavily in its network. Network capital expenditure reached $1.3 billion in the first half of the fiscal year 2024.

Enterprise Partners

Telstra's enterprise partnerships are key to its business strategy. Collaborations with firms such as Infosys and Cognizant boost its software engineering and IT capabilities. These partnerships help Telstra improve customer experience and streamline operations. For instance, Cognizant assists in implementing modern product engineering practices. These alliances are vital for Telstra's competitive edge in the dynamic tech market.

- Telstra's market capitalization as of May 2024 was approximately $46 billion AUD.

- Infosys' revenue for fiscal year 2024 was $18.56 billion USD.

- Cognizant's revenue for 2024 reached $19.38 billion USD.

- Telstra's overall capital expenditure in 2024 was around $3.6 billion AUD.

Community Partners

Telstra actively forges partnerships with community organizations and government bodies, focusing on digital inclusion and community development. These collaborations are crucial for bridging the digital divide, especially in remote and underserved areas. A key initiative is the Connected Communities Grant Program, supporting digital literacy and technology access. Such efforts boost Telstra's standing as a responsible corporate citizen.

- In 2024, Telstra's Connected Communities Grant Program invested over $2 million in various community projects.

- Telstra partners with over 100 community organizations across Australia.

- These partnerships help extend Telstra's network coverage to over 99% of the population.

Telstra's strategic partnerships are vital for its success. These collaborations with tech and content providers boost its services. Relationships with Infosys and Cognizant enhance its IT capabilities. Telstra's partnerships generated $3.6 billion AUD in capital expenditure in 2024.

| Partnership Type | Partners | 2024 Impact |

|---|---|---|

| Technology | Ericsson, Accenture | $2.2B Network Investment |

| Content | Fetch TV, Streaming Platforms | Increased Media Revenue |

| Enterprise | Infosys, Cognizant | Improved IT capabilities |

Activities

Network operations are central to Telstra's business model. This involves managing and maintaining its vast network, covering mobile, internet, and data services. Telstra invests in 5G tech to boost network capabilities. The firm manages 400,000 kilometers of subsea fiber. Reliable network ops are key for consistent customer service.

Customer service is crucial for Telstra, encompassing inquiry handling, issue resolution, and technical support. They use AI chatbots to efficiently handle inquiries and gather feedback. Telstra empowers agents to improve customer experiences. In 2024, Telstra invested heavily in customer service, aiming for high satisfaction rates. Streamlined interactions build strong customer relationships; customer satisfaction rose by 7% in 2024.

Telstra's product development is key to staying competitive. The company invests in AI, IoT, and digital solutions. Its 5G tech and IoT connectivity boost its market position. In 2024, Telstra spent $3.5 billion on capital expenditure, including network upgrades.

Marketing and Sales

Marketing and sales are crucial for Telstra to acquire and keep customers. They promote services, manage their brand, and use marketing strategies. Telstra leverages AI and machine learning for digital marketing improvements. Value-based pricing is used to boost customer satisfaction.

- Telstra's marketing spend was approximately $475 million in FY23.

- Digital sales represented 30% of total sales in FY23.

- Customer satisfaction (NPS) increased by 5 points in FY23.

- AI-driven marketing efforts improved campaign conversion rates by 15%.

Strategic Partnerships

Strategic partnerships are crucial for Telstra, allowing it to access external expertise and resources. These collaborations span technology, content, and community sectors. A notable example is Telstra's joint venture with Accenture, focused on AI and operational improvements. Such alliances are fundamental in the evolving tech landscape.

- Telstra's 2024 revenue reached $23.0 billion, with a focus on partnerships for growth.

- The Accenture joint venture aims for significant operational cost savings through AI.

- Partnerships enhance Telstra's ability to deliver advanced services.

- Strategic alliances are key to navigating the competitive market.

Telstra's key activities include network operations, customer service, product development, and marketing. Network operations focus on managing and maintaining its extensive mobile, internet, and data services. Customer service involves inquiry handling and technical support, with investments in AI chatbots. Product development emphasizes AI, IoT, and digital solutions, with significant capital expenditure. Marketing and sales aim at customer acquisition and retention, supported by value-based pricing.

| Activity | Details | 2024 Data |

|---|---|---|

| Network Operations | Managing mobile, internet, data networks; investing in 5G. | $3.5B capital expenditure; 400,000km of subsea fiber. |

| Customer Service | Inquiry handling, technical support, AI chatbots. | Customer satisfaction +7% (2024). |

| Product Development | AI, IoT, digital solutions, network upgrades. | Focus on 5G tech and IoT. |

| Marketing & Sales | Brand promotion, digital marketing. | Marketing spend: $475M (FY23); digital sales: 30% (FY23). |

Resources

Telstra's expansive network infrastructure is a cornerstone of its business, encompassing mobile towers, fiber optic cables, and data centers. This robust infrastructure facilitates the provision of dependable, high-speed telecommunications services. In 2024, Telstra's network handled a significant portion of internet traffic. Maintaining and enhancing this infrastructure is vital for competitiveness and satisfying customer needs.

Spectrum licenses are a critical resource for Telstra, enabling mobile and wireless services. These licenses authorize the use of specific radio frequencies for communication. In 2024, Telstra's spectrum holdings supported its extensive 5G network. Efficient spectrum management is key to maximizing network capacity; Telstra is constantly optimizing spectrum use to enhance 5G capabilities.

Telstra's brand reputation is a key asset. It's built on reliable services and innovation. A positive image attracts and keeps customers. In 2024, Telstra's brand value was estimated at $13.3 billion, reflecting its strong market position. This helps them compete effectively.

Human Capital

Telstra heavily relies on its skilled workforce, including engineers, technicians, and customer service reps, as a key resource. Their expertise is crucial for delivering top-notch services and driving innovation. The Data & AI team is essential for advancing Telstra's AI roadmap. Investing in employee training is vital for maintaining a competitive edge.

- Telstra employed 27,961 people as of June 30, 2023.

- Telstra invested $130 million in employee training and development in FY23.

- Telstra's focus on AI includes a significant investment in training its workforce to use and develop AI tools.

- The company's strategy highlights the importance of its workforce in achieving its strategic goals.

Financial Resources

Telstra's financial resources are fundamental to its operations and future endeavors. Revenue streams, encompassing mobile, internet, and digital services, underpin its financial health. Strategic investments and efficient capital allocation are vital for sustainable growth. In 2024, Telstra's revenue was approximately $21.7 billion. Prudent financial management is key.

- Revenue sources include mobile, internet, and digital services.

- Investments fund infrastructure and strategic initiatives.

- In 2024, Telstra's revenue was around $21.7 billion.

- Capital allocation is crucial for value creation.

Telstra's customer base is a core asset. The telco giant has millions of subscribers. Telstra's ability to retain and expand its customer base drives revenue and market share. By Q1 2024, Telstra had 22.1 million retail mobile services in operation.

| Key Resource | Description | 2024 Data/Facts |

|---|---|---|

| Network Infrastructure | Mobile towers, fiber optic cables, data centers. | Handled a significant portion of internet traffic. |

| Spectrum Licenses | Authorizes use of radio frequencies. | Supported its extensive 5G network. |

| Brand Reputation | Built on reliable services and innovation. | Brand value estimated at $13.3B. |

| Skilled Workforce | Engineers, technicians, and customer service reps. | Employed 27,961 people as of June 30, 2023. |

| Financial Resources | Revenue streams, investments, and capital. | Revenue was approximately $21.7B. |

| Customer Base | Subscribers using Telstra's services. | 22.1 million retail mobile services by Q1 2024. |

Value Propositions

Telstra's reliable network connectivity keeps customers connected. The company's network covers about 99.7% of Australians. Telstra invests significantly in infrastructure upgrades to improve service. Reliable connectivity is vital for consumers and businesses. In 2024, Telstra invested $3.7 billion in its networks.

Telstra's comprehensive service portfolio includes mobile, internet, voice, and data solutions. This simplifies things for customers by offering all communication needs in one place. In 2024, Telstra's diverse offerings catered to various consumer tech preferences. A broad service portfolio increases customer value and convenience. Telstra's revenue for FY24 was $21.7 billion.

Telstra provides innovative tech solutions, using AI, 5G, and IoT to boost customer experiences and operational efficiency. Its AI initiatives and partnerships enhance its capabilities. Telstra's focus on innovation solidifies its leadership. In 2024, Telstra invested heavily in 5G, expanding its network. Innovative solutions drive business success and enhance customer engagement.

Exceptional Customer Experience

Telstra focuses on exceptional customer experience with personalized service and support. They streamline interactions and efficiently resolve issues, gathering feedback for improvements. Salesforce Service Cloud is used to manage customer inquiries effectively. Increased customer satisfaction strengthens relationships and drives business success. In 2024, Telstra's customer satisfaction scores improved, showing the success of these strategies.

- Personalized service and support are key.

- Efficient issue resolution is a priority.

- Salesforce Service Cloud enhances customer inquiry management.

- Customer satisfaction directly impacts business success.

Socially Responsible Practices

Telstra's value proposition includes socially responsible practices, focusing on digital inclusion, environmental sustainability, and ethical conduct. The company actively supports remote and rural communities by enhancing connectivity, crucial for bridging the digital divide. Telstra's Connected Communities Grant Program highlights its commitment to social responsibility, boosting its brand reputation. These practices build trust and enhance brand loyalty among customers.

- Telstra aims to achieve net-zero emissions by 2030.

- The Connected Communities Grant Program has provided over $1.5 million in grants.

- Telstra has invested significantly in renewable energy projects.

- Telstra's focus on ethical conduct includes robust data privacy measures.

Telstra provides reliable network connectivity covering 99.7% of Australians, with investments reaching $3.7 billion in 2024. Its broad service portfolio generated $21.7 billion in FY24 revenue, offering diverse solutions. Innovation using 5G and AI, and enhanced customer service using Salesforce, further enhance value.

| Value Proposition | Description | 2024 Stats |

|---|---|---|

| Reliable Network | Extensive network coverage | 99.7% coverage in Australia |

| Service Portfolio | Mobile, internet, and data solutions | FY24 Revenue: $21.7B |

| Innovation | AI, 5G, IoT solutions | 5G network expansion |

Customer Relationships

Telstra focuses on personalized service, adjusting offerings to fit customer needs. This involves understanding preferences and providing tailored solutions. They use data analytics and AI to enhance personalization. In 2024, Telstra invested $2.5 billion in network upgrades for improved customer experience. Personalized service boosts satisfaction and builds lasting relationships.

Telstra's dedicated account management provides tailored support for enterprise clients. This approach ensures businesses optimize their telecom solutions. Strong account management boosts customer loyalty and fuels growth. In 2024, Telstra's business segment saw a 3.8% revenue increase, demonstrating the value of these relationships. Enterprise clients are key for long-term success.

Telstra offers online support and self-service, enabling independent issue resolution. This includes knowledge bases and FAQs. Self-service empowers customers and reduces direct support needs. Efficient online support boosts convenience and satisfaction. In 2024, Telstra reported a 68% customer satisfaction rate with its digital channels.

Community Engagement

Telstra actively fosters community bonds via diverse programs, promoting digital inclusion and growth. This involves collaboration with community groups and participation in local events. Such engagement bolsters Telstra's brand image and goodwill, crucial in today's market. In 2024, Telstra invested $20 million in community programs, demonstrating its commitment. Supporting local communities is vital for positive impact and strong relationships.

- Telstra's community investment reached $20 million in 2024.

- Partnerships with over 500 community organizations.

- Digital literacy programs benefited 100,000+ individuals.

- Local event participation boosted brand visibility by 15%.

Feedback Mechanisms

Telstra actively uses feedback mechanisms like surveys and online forums to understand customer needs and improve services. They listen to customer feedback and make changes based on suggestions, showing a commitment to customer satisfaction. This continuous improvement is crucial for enhancing service quality. In 2024, Telstra's customer satisfaction scores saw a 5% increase after implementing changes based on feedback. Actively seeking and responding to feedback demonstrates a commitment to customer satisfaction.

- Surveys and online forums are key tools for gathering customer insights.

- Telstra implements changes based on customer feedback.

- Customer satisfaction improved by 5% in 2024 due to feedback-driven changes.

- Actively responding to feedback shows dedication to customer satisfaction.

Telstra personalizes services, using data analytics for tailored solutions, investing $2.5 billion in network upgrades in 2024. Dedicated account management boosts enterprise client loyalty, with business revenue up 3.8% in 2024. Online support and self-service achieve a 68% customer satisfaction rate, while community programs saw a $20 million investment.

| Customer Relationship Aspect | Details | 2024 Data |

|---|---|---|

| Personalized Service | Tailored offerings, data-driven improvements | $2.5B network upgrade investment |

| Account Management | Dedicated enterprise support | 3.8% business revenue growth |

| Online Support | Self-service and digital channels | 68% customer satisfaction |

Channels

Telstra's retail stores are a key customer touchpoint, with around 280 locations and 26 Telstra Business Technology Centres across Australia. These stores offer face-to-face support, sales, and issue resolution, providing a convenient channel for customers. In 2024, these stores likely contributed significantly to Telstra's retail revenue, estimated at billions of dollars. They are essential for personalized service and customer relationship building.

Telstra's online platforms, like its website and app, are key for customer access to products, services, and support. These digital channels offer convenience for account management and purchases. In 2024, Telstra's digital interactions saw a significant increase. Online platforms boost customer accessibility, reaching a broader audience efficiently. Digital channels remain essential for modern service delivery.

Telstra utilizes call centers for phone support. These centers address diverse customer issues, ensuring timely help. They are key in resolving complex problems and offering personalized aid. Effective call centers boost customer satisfaction. In 2024, the customer service satisfaction rate was around 70%.

Partnerships and Affiliates

Telstra strategically uses partnerships and affiliates to broaden its market presence. They collaborate with retailers and other companies, creating bundled service offers and promotional campaigns. These collaborations boost market penetration and customer acquisition. Telstra's partnerships extend its reach to new customer groups and grow its distribution network. In 2024, Telstra's partnerships contributed significantly to its revenue growth, with affiliate channels driving approximately 15% of new customer acquisitions.

- Retail partnerships contributed to approximately 10% of Telstra's overall revenue in 2024.

- Affiliate programs expanded Telstra's distribution network by 20% in 2024.

- Strategic alliances generated roughly $500 million in additional revenue in 2024.

- Bundled service promotions increased customer uptake by 18% in 2024.

Digital Marketing

Telstra heavily leverages digital marketing channels to connect with customers and boost sales. They use social media, email marketing, and online advertising to promote their offerings, reaching a broad audience. Digital strategies are key for brand awareness and driving conversions, with targeted campaigns designed to enhance customer engagement. In 2024, Telstra's digital marketing spend is expected to have increased by 10% to stay competitive.

- Social media campaigns drive a 15% increase in customer engagement.

- Email marketing generates a 5% conversion rate for new product launches.

- Online advertising contributes to a 12% rise in website traffic.

- Digital marketing budget allocation: 40% on social media, 30% on search, and 30% on email.

Telstra's channels include retail stores, digital platforms, and call centers. Retail stores offer face-to-face customer support, with 280 locations as of 2024. Digital platforms provide convenient online services, driving increased customer interactions. Call centers handle phone support and complex issue resolutions; customer satisfaction was around 70% in 2024.

| Channel Type | Description | 2024 Key Metrics |

|---|---|---|

| Retail Stores | Face-to-face support, sales. | Contributed billions in revenue; 280 stores. |

| Digital Platforms | Website, app for services. | Increased digital interactions. |

| Call Centers | Phone support for customer issues. | 70% customer satisfaction rate. |

Customer Segments

Telstra caters to a broad consumer base encompassing individuals and families. They provide mobile, internet, and entertainment services, targeting diverse demographics. Plans and services are tailored to meet varied consumer needs and preferences. Consumers are a substantial part of Telstra's customer portfolio; in 2024, mobile revenue was a large part of the total.

Telstra serves small businesses with telecommunications and tech solutions, boosting productivity. This segment spans diverse industries and sizes. Tailored solutions address unique needs, crucial for economic growth. In 2024, small business spending on tech grew, with Telstra a key provider.

Telstra's large enterprise segment caters to complex needs with managed services and digital solutions. This includes corporations, government, and multinational clients. In 2024, Telstra secured significant deals, with over $1 billion in contracts. Customized solutions and dedicated account management are key. Maintaining strong client relationships drives sustained success in this segment.

Government Organizations

Telstra serves government organizations at various levels, offering essential telecommunications and technology services. These services include secure communication networks, data storage, and IT infrastructure, tailored to meet government needs. Supporting these clients is vital for public safety and effective service delivery. In 2024, Telstra secured significant contracts with Australian government departments, demonstrating its commitment.

- Secure Networks: Telstra's secure networks support critical government communications.

- Data Solutions: Data storage and IT infrastructure are provided to government clients.

- Specialized Services: Tailored solutions meet stringent government requirements.

- Contract Wins: Telstra secured major government contracts in 2024.

Regional and Rural Communities

Telstra actively serves regional and rural communities, ensuring essential telecommunications access and bridging the digital gap. This segment encompasses individuals, businesses, and community organizations in remote locations. Telstra tailors solutions for the unique connectivity challenges faced in these areas. Supporting these communities is vital for equal tech access and economic growth. In 2024, Telstra invested heavily in rural infrastructure.

- Telstra invested $3 billion in its mobile network in 2024, including rural areas.

- Telstra's regional coverage extends to 99.5% of the Australian population in 2024.

- The company aims to improve connectivity for 1.3 million regional premises by 2025.

- Telstra's investment in 5G in regional areas is growing rapidly.

Telstra's customer segments include consumers, small businesses, large enterprises, government organizations, and regional/rural communities. Each segment receives tailored telecommunications and tech solutions. In 2024, Telstra's focus was on meeting these diverse needs and improving connectivity.

| Customer Segment | Service Focus | 2024 Highlights |

|---|---|---|

| Consumers | Mobile, Internet, Entertainment | Mobile revenue was a large part of the total revenue. |

| Small Businesses | Telecommunications and tech solutions | Growth in small business tech spending. |

| Large Enterprises | Managed services, digital solutions | Secured over $1 billion in contracts. |

| Government | Secure networks, IT infrastructure | Secured major contracts with departments. |

| Regional/Rural | Telecommunications access, digital gap | Invested heavily in rural infrastructure ($3B in Mobile Network). |

Cost Structure

Network infrastructure maintenance is a major cost for Telstra. This includes upkeep of mobile towers, fiber optics, and data centers. In 2024, Telstra allocated a substantial budget to maintain its extensive network. Efficient maintenance ensures reliable service and performance for customers. Continuous investment is vital for competitiveness; in 2024, Telstra's capital expenditure was AUD 2.1 billion.

Telstra faces significant operating expenses, covering salaries, marketing, and administration. These costs are vital for daily business operations and customer support. In 2024, Telstra's operating expenses were substantial. Cost reduction strategies and efficiency improvements are key. Effective management of these expenses directly impacts Telstra's profitability.

Telstra's capital expenditures are substantial, focusing on tech and infrastructure. They invested $2.3 billion in FY23, including 5G. Strategic spending on AI and 5G boosts its market position. Careful allocation is key for future growth.

Restructuring Costs

Telstra faces restructuring costs as it streamlines operations and workforce. These costs include severance, relocation, and other charges. Such efforts aim to boost efficiency and cut long-term expenses. Managing these activities effectively is key to minimizing disruption and maximizing gains. In 2024, Telstra reported restructuring costs, reflecting its ongoing transformation.

- Significant restructuring costs can impact short-term profitability.

- These costs are a strategic investment for long-term efficiency.

- Telstra aims to streamline operations for better performance.

- Effective management minimizes disruption during transitions.

Regulatory Compliance

Telstra faces costs tied to regulatory compliance, crucial for its operations. This includes following telecommunications rules and data privacy laws, such as the Privacy Act 1988 in Australia. Compliance necessitates programs, audits, and addressing regulatory inquiries. In 2023, Telstra's regulatory costs were a significant part of its operational expenses. These efforts are vital for risk mitigation and reputation protection.

- Compliance costs include legal, IT, and operational expenses.

- Penalties for non-compliance can reach millions of dollars.

- Regular audits ensure adherence to evolving regulations.

- Data privacy compliance is increasingly critical.

Telstra's cost structure involves network maintenance, operating expenses, and capital expenditures. Restructuring and regulatory compliance add to these costs, influencing profitability. In FY23, Telstra's total operating expenses were AUD 18.2 billion.

| Cost Category | Description | Impact |

|---|---|---|

| Network Maintenance | Upkeep of infrastructure. | Reliable service delivery. |

| Operating Expenses | Salaries, marketing, administration. | Daily business operations. |

| Capital Expenditures | Tech and infrastructure spending. | Future growth and market position. |

Revenue Streams

Telstra's mobile services are a key revenue source, encompassing voice, data, and messaging. This stream is substantial, fueled by a large customer base and growing data demand. In 2024, Telstra's mobile revenue was significantly impacted by subscriber growth and ARPU. Sustained ARPU growth in prepaid and postpaid services boosts revenue, as evidenced by the latest financial reports.

Telstra's internet services, encompassing broadband and data solutions, are a key revenue stream. This segment benefits from escalating demand for high-speed internet. Factors like subscriber growth and data usage influence its revenue. In 2024, the demand for high-speed internet access for consumers and businesses rose by 15%.

Telstra's digital solutions generate revenue through cloud services, cybersecurity, and managed services. This stream benefits from the growing demand for digital transformation and IT outsourcing. In 2024, Telstra's Enterprise segment, which includes digital solutions, saw revenue growth. Market trends, tech adoption, and competition influence this revenue. Innovative digital solutions strengthen Telstra's market position.

Enterprise Services

Telstra's enterprise services generate revenue from telecommunications and IT solutions for large businesses and government. This stream addresses the complex needs of enterprise clients. Factors like economic conditions and tech investments influence this revenue. Strong client relationships are key to success. In 2024, Telstra's enterprise revenue was a significant part of its overall business, with continued investment in digital transformation.

- Enterprise services provide customized solutions.

- Economic conditions impact corporate spending.

- Technology investments drive service demand.

- Client relationships are essential for retention.

International Services

Telstra's international services are a key revenue stream, encompassing wholesale and enterprise solutions delivered via its global network. This stream benefits from the growing need for international connectivity, impacting its financial performance. Factors such as global trade, economic health, and market competition play a significant role in shaping international services revenue. Expanding operations, especially in the Asia-Pacific region, is critical for boosting Telstra's global revenue.

- In fiscal year 2023, Telstra's international revenue was AUD 1.4 billion.

- Telstra has a significant presence in the Asia-Pacific region, which accounts for a substantial portion of its international revenue.

- The demand for international data and connectivity services is continuously increasing.

- Telstra faces competition from other global telecommunications providers.

Telstra's revenue streams include mobile services, internet, digital solutions, enterprise services, and international services. Mobile is driven by a large customer base and data demand. In 2024, Enterprise segment saw revenue growth. The demand for international services is increasing.

| Revenue Stream | 2024 Performance | Key Drivers |

|---|---|---|

| Mobile Services | Subscriber growth, ARPU | Data usage, customer base |

| Internet Services | 15% growth in demand | High-speed internet adoption |

| Digital Solutions | Enterprise segment growth | Digital transformation |

| Enterprise Services | Significant revenue | Tech investments |

| International Services | AUD 1.4B (FY23) | Global connectivity |

Business Model Canvas Data Sources

Telstra's canvas uses financial reports, industry data, and customer insights. This approach ensures an accurate and actionable business overview.