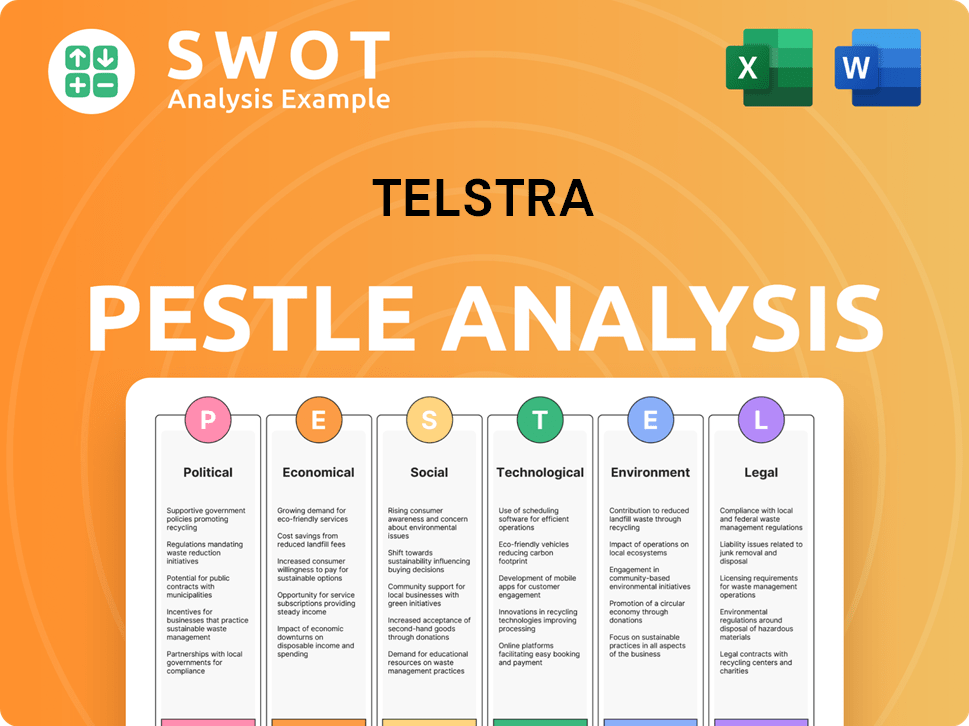

Telstra PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Telstra Bundle

What is included in the product

Analyzes how external factors influence Telstra. It helps identify threats and opportunities for strategic planning.

Helps support discussions on external risk and market positioning during planning sessions.

What You See Is What You Get

Telstra PESTLE Analysis

The content and structure shown in the preview is the same document you’ll download after payment. This Telstra PESTLE Analysis explores key Political, Economic, Social, Technological, Legal, and Environmental factors. It offers insights and data ready for strategic decision-making. All elements, including formatting, will be in the final document.

PESTLE Analysis Template

Telstra faces a dynamic external environment. Political shifts and economic conditions significantly impact its strategies. Social trends and technological advancements add further complexity. A robust PESTLE analysis provides clarity.

Understand regulatory challenges and market opportunities. This expertly crafted analysis delivers actionable insights. Perfect for strategic planning and competitive advantage. Download now to unlock Telstra's complete picture.

Political factors

Telstra faces stringent regulations from the ACMA, impacting its operations. The Telecommunications Act 1997 imposes compliance costs, affecting profitability. Mandatory service levels influence strategic decisions and resource allocation. In 2024, Telstra invested heavily in regulatory compliance, with costs exceeding $500 million. These regulations shape Telstra's market strategies.

Australia's political stability, a key factor in Telstra's success, is consistently ranked highly on global indices. This stability creates a secure environment for long-term investments. The Global Peace Index consistently places Australia among the most peaceful nations. This stability is essential for attracting both domestic and international investment, supporting Telstra's strategic initiatives.

Government policies, like the Digital Economy Strategy, shape digital connectivity nationwide. These strategies often include significant government investment in digital infrastructure, which directly affects Telstra. For example, the Australian government announced over $1 billion for regional connectivity projects in 2024, directly impacting Telstra's expansion plans. These investments boost network coverage and service offerings, especially in regional zones.

Universal Service Obligation (USO) evolution

The Australian government is reforming the Universal Service Obligation (USO). This includes a Universal Outdoor Mobile Obligation (UOMO), set to be legislated in 2025. Telstra, as a major mobile operator, will likely need to expand baseline outdoor mobile coverage nationwide. This might involve satellite technology for direct-to-device services.

- Legislation expected in 2025 will mandate UOMO.

- Telstra will be required to provide extensive outdoor mobile coverage.

- New tech, like satellite, could be utilized.

Competition regulation and scrutiny

The Australian Competition and Consumer Commission (ACCC) closely monitors the telecommunications sector to ensure fair competition. This involves scrutinizing digital platform services and investigating potential anti-competitive behaviors. Telstra, like other major players, faces ACCC scrutiny, which can result in required changes to its commercial practices. In 2024, the ACCC focused on digital platform services, potentially impacting Telstra's operations.

- ACCC investigations can lead to significant undertakings by Telstra.

- The ACCC's focus includes digital platform services and anti-competitive conduct.

- Changes in commercial arrangements may be required.

Telstra must navigate rigorous regulatory hurdles overseen by ACMA, impacting operations and financial strategy. Political stability in Australia supports long-term investment with the Digital Economy Strategy injecting over $1B in 2024. Government policy pushes expansion, with reform like USO (UOMO), set for 2025, mandating wider mobile reach.

| Regulatory Bodies | Impacts on Telstra | Recent Data/Facts |

|---|---|---|

| ACMA, ACCC | Compliance costs, market strategies, competition scrutiny | 2024: Compliance costs > $500M; $1B in government regional projects |

| Government Policies | Infrastructure Investment, service coverage | Digital Economy Strategy. |

| USO (UOMO) Legislation | Wider mobile reach (2025) & network expansion. | Expansion plans using satellite. |

Economic factors

Telstra's performance is significantly tied to Australia's economic health. Economic growth directly affects consumer and business spending on telecom services. In 2024, Australia's GDP growth was around 1.5%, influencing demand. Consumer confidence is also key; a drop can curb spending on non-essentials like premium telecom plans. Business confidence levels impact enterprise spending on Telstra's services.

The Australian telecommunications market is highly competitive, featuring Telstra, Optus, and TPG Telecom. This rivalry affects pricing and pushes for innovation. Telstra's mobile market share was around 40.7% in late 2023, facing constant pressure. Competition influences investment decisions and service improvements.

The surge in demand for high-speed internet and mobile connectivity significantly impacts Telstra's economic landscape. This is driven by rising data consumption and the shift towards remote work. Investments in network upgrades are crucial, with Telstra spending $3 billion on infrastructure in FY24. The 5G rollout continues to be a key area of focus, with 90% population coverage expected by mid-2025.

Investments in network modernization and expansion

Telstra's economic performance is closely linked to its investments in network upgrades. These include expanding 5G and improving fibre networks. This is vital for handling rising data needs and staying competitive. In FY24, Telstra invested $2.4 billion in its network.

- FY24 Network Investment: $2.4 billion.

- 5G Coverage: Over 80% of the population.

- Fibre Rollout: Ongoing expansion.

- Data Demand: Continues to increase.

Potential for value creation through asset divestments

Telstra faces opportunities for value creation through asset divestments. Analysts point to significant value in divesting assets like InfraCo Fixed and the NBN payment stream. Such moves could unlock substantial financial gains. For example, in 2024, Telstra's net profit after tax was AUD 1.9 billion. This includes a focus on strategic asset management.

- Asset monetization could provide significant financial benefits.

- Telstra's strategic asset management is a key focus.

- 2024 net profit after tax was AUD 1.9 billion.

Australia's economic state directly influences Telstra's financial outcomes, affecting consumer spending on services. In 2024, Australia's GDP grew around 1.5%, impacting demand. Telstra invested significantly in network upgrades. Their 2024 net profit after tax reached AUD 1.9 billion.

| Factor | Impact | Data |

|---|---|---|

| GDP Growth | Influences consumer and business spending | 1.5% (2024) |

| Network Investment | Crucial for handling rising data needs. | $2.4B in FY24 |

| Net Profit | Reflects overall financial performance | AUD 1.9B (2024) |

Sociological factors

Societal reliance on high-speed internet and mobile connectivity is soaring. Driven by remote work, online education, and digital entertainment, this trend is rapidly changing consumer expectations. Telstra must meet the demand for reliable network access. In 2024, Australians used an average of 20GB of mobile data per month, reflecting this shift.

Consumer behavior is shifting towards digital services, a trend accelerated by the COVID-19 pandemic. In 2024, over 70% of Australians used online banking. This requires Telstra to focus on digital offerings. Enhancing digital interfaces and customer experience is crucial. Digital transformation spending globally reached $2.8 trillion in 2024.

Australia's aging population is a significant sociological factor. This demographic shift impacts service demands, requiring tailored solutions. Telstra might need to create user-friendly interfaces and offer dedicated support. For instance, by 2024, about 17% of Australians are aged 65 or older, a number that will continue growing. This necessitates Telstra to develop services that cater to the needs of older citizens, such as easy-to-use technology and specialized customer support.

Urbanization trends increase service demand in cities

Australia's ongoing urbanization concentrates populations in cities, driving up service demands. This migration boosts the need for strong telecommunications infrastructure and better services in urban areas. As of 2024, over 86% of Australians live in urban areas, increasing pressure on networks. Telstra must adapt to meet these rising urban demands.

- Urban population growth intensifies the need for advanced telecom services.

- Higher urban densities require improved network capacity and coverage.

- Telstra must invest in urban infrastructure to meet demand.

- Urbanization influences strategic market positioning for Telstra.

Focus on diversity and inclusion in marketing and hiring

Telstra actively champions diversity and inclusion in both its marketing and hiring strategies. This commitment reflects a broader societal shift towards valuing diverse perspectives and representation. Telstra has set measurable targets for gender balance and Indigenous employment to foster a more inclusive workplace. These efforts aim to resonate with an increasingly diverse customer base and ensure fair opportunities.

- In 2024, Telstra reported that 44.8% of its employees were women, with a goal to reach 50% by 2025.

- Telstra's Reconciliation Action Plan (RAP) outlines its commitment to Indigenous employment, aiming for 5% of its workforce to be Indigenous Australians.

- Telstra's marketing campaigns increasingly feature diverse representation, reflecting the demographics of its customer base.

Digital reliance demands robust connectivity; in 2024, Australians used 20GB monthly mobile data. Shifting consumer behaviors toward digital services like online banking require Telstra to optimize digital offerings. By 2024, 17% of Australians were over 65, and urbanization is crucial.

| Factor | Impact | 2024 Data |

|---|---|---|

| Digital Reliance | Demand for reliable internet/mobile | 20GB mobile data usage/month |

| Consumer Behavior | Focus on digital services & UX | 70%+ used online banking |

| Aging Population | Need for tailored services | 17% aged 65+ |

Technological factors

The telecommunications sector sees rapid tech advances, especially in mobile and internet. Telstra must invest in 5G and other tech to stay competitive. In 2024, 5G adoption grew, with 40% of Australians using it. Telstra's capital expenditure in FY24 was $3.7 billion, focusing on network upgrades.

The rise of IoT creates chances and hurdles. Telstra integrates IoT solutions, meeting demand for connected devices. In 2024, the global IoT market was valued at $200 billion. Telstra's IoT revenue grew by 15% in the last year, showing its strategic focus. This move supports the expanding need for robust networks.

Telstra's substantial investment in 5G infrastructure is a crucial technological driver. The company is actively expanding its 5G network. As of late 2024, Telstra's 5G network covers over 80% of the Australian population. This expansion is essential for delivering advanced mobile services and applications.

Development of direct-to-device satellite technology

Direct-to-device (D2D) satellite tech, utilizing low Earth orbit (LEO) satellites, is emerging. Telstra is actively exploring D2D tech to enhance remote area coverage. This could unlock new service offerings. Telstra's investment in this tech aligns with industry trends.

- Telstra's 2024 revenue: $23.7 billion.

- D2D market expected to reach $7.5 billion by 2028.

Artificial Intelligence (AI) and automation in operations

Artificial Intelligence (AI) and automation are transforming Telstra's operations. They are being integrated into network management, customer service, and enhancing overall efficiency. In 2024, the global AI in telecom market was valued at USD 2.3 billion, with expected significant growth. Telstra is investing to improve its services.

- AI-driven network optimization could reduce operational costs by 15-20%.

- Automated customer service chatbots are handling 30% of customer inquiries.

- Telstra aims to automate 40% of its internal processes by 2025.

Telstra's tech strategy centers on 5G, IoT, and AI, driving efficiency. 5G covers 80% of Aussies, showing strong network expansion. AI automates operations, aiming for 40% internal process automation by 2025.

| Technology | Focus | Impact |

|---|---|---|

| 5G | Network Expansion | 80% coverage in late 2024 |

| AI | Automation | 30% customer inquiry handled |

| D2D | Remote coverage | Market $7.5B by 2028 |

Legal factors

Telstra's operations are significantly shaped by legal factors, especially compliance with telecommunications regulations. The Australian Communications and Media Authority (ACMA) oversees the legal framework. This necessitates consistent effort and investment to meet legal obligations. In 2024, Telstra allocated a substantial portion of its budget to ensure regulatory compliance. For instance, in its 2024 annual report, Telstra highlighted a $500 million investment in regulatory compliance measures and related legal expenses.

Telstra faces stringent obligations under privacy laws like the Privacy Act 1988. These regulations dictate how customer data is handled. Data breaches can lead to hefty fines; in 2024, penalties could reach millions of dollars. Compliance requires robust data protection measures and ongoing investment.

Telstra operates under Australia's Consumer Law, ensuring fair and transparent service agreements. This law significantly impacts how Telstra structures customer contracts, requiring clear terms. For example, in 2024, the Australian Competition and Consumer Commission (ACCC) received over 16,000 complaints about telecommunications services. Telstra's customer complaint handling is also directly affected by these legal standards.

Regulatory scrutiny on competition and market practices

Telstra faces continuous legal scrutiny from the Australian Competition and Consumer Commission (ACCC) regarding its competitive practices. The ACCC monitors Telstra's business activities and agreements to prevent anti-competitive behavior, which can result in legal battles and enforced operational adjustments. In 2024, the ACCC has focused on digital platforms and potential market dominance, areas relevant to Telstra's operations. This regulatory oversight is crucial for maintaining fair market competition.

- ACCC investigations can lead to significant fines.

- Telstra must comply with strict consumer protection laws.

- The regulatory environment evolves with technology advancements.

Modern slavery and human rights legislation compliance

Telstra must comply with modern slavery and human rights laws, a critical legal factor. This includes thorough due diligence across its operations and supply chains. The company's reporting on these efforts aligns with rising ethical and legal demands. Telstra's 2023 Modern Slavery Statement highlights these commitments.

- Focus on human rights due diligence in its supply chains.

- Continued efforts to identify and mitigate modern slavery risks.

- Regular reporting and transparency on human rights performance.

Telstra is heavily regulated by Australian laws, needing to comply with consumer protection and privacy rules. It faces ACCC scrutiny regarding competition. In 2024, substantial investments, like $500M, went into regulatory compliance and associated legal expenses.

| Regulatory Body | Area of Focus | Impact on Telstra |

|---|---|---|

| ACMA | Telecommunications Regulations | Ensures compliance, influences investment |

| ACCC | Competition & Consumer Law | Competitive practices, complaint handling |

| Privacy Regulators | Privacy Act 1988 | Data protection, potential fines for breaches |

Environmental factors

Telstra demonstrates a strong commitment to environmental sustainability. The company aims for net-zero emissions by 2050. By 2030, Telstra targets considerable cuts in Scope 1, 2, and 3 emissions. In 2024, Telstra is actively investing in decarbonization initiatives, reducing reliance on carbon credits.

Telstra actively supports renewable energy generation. In 2024, Telstra announced plans to source 100% of its electricity from renewable sources by 2025. This involves investments in solar and battery storage. Telstra aims to reduce its carbon footprint. These initiatives align with environmental sustainability goals.

Telstra's infrastructure development faces environmental challenges. Building and maintaining telecommunications assets affect the environment. Telstra focuses on sustainability, shown by energy-efficient lighting upgrades. In 2024, Telstra aims to cut emissions by 50% from 2019 levels. This showcases their commitment to environmental responsibility.

Waste reduction and recycling initiatives

Telstra actively pursues waste reduction and recycling. The company focuses on recycling targets, aiming to minimize environmental impact. Telstra enhances packaging sustainability and manages electronic waste disposal responsibly. The company's efforts align with broader sustainability goals. These initiatives are crucial for environmental responsibility and regulatory compliance.

- Telstra has reduced waste sent to landfill by 70% since 2018.

- In FY24, Telstra recycled 99% of its operational waste.

- Telstra aims for 100% sustainable packaging by 2025.

Consideration of climate change impacts on operations

Telstra acknowledges the potential physical impacts of climate change on its infrastructure, service delivery, and supply chains. The company is actively assessing these risks and striving to develop more robust networks to face environmental challenges. In 2024, Telstra invested significantly in network resilience, allocating $200 million to improve its infrastructure's ability to withstand extreme weather events. Telstra aims to achieve net-zero emissions by 2030, reducing its carbon footprint.

- $200 million investment in network resilience (2024).

- Net-zero emissions target by 2030.

- Focus on building resilient networks.

Telstra emphasizes environmental sustainability with net-zero targets by 2050 and significant emission cuts by 2030. In 2024, they invested in renewable energy, aiming for 100% renewable electricity by 2025, and are also focusing on waste reduction, like achieving 99% operational waste recycling in FY24. Telstra also proactively addresses climate risks, investing $200 million in network resilience in 2024 to counter environmental challenges.

| Initiative | Target | Status (2024/2025) |

|---|---|---|

| Emissions | Net-zero by 2050 | Decarbonization investments underway; significant Scope 1, 2, and 3 emission cuts by 2030. |

| Renewable Energy | 100% renewable electricity | Target for 2025; includes solar and battery storage investments. |

| Waste Reduction | Sustainable packaging by 2025 | 99% of operational waste recycled in FY24. 70% reduction in waste sent to landfill since 2018. |

PESTLE Analysis Data Sources

Our Telstra PESTLE draws on government data, market research, and tech analysis, incorporating credible insights.