Tenet Health Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Tenet Health Bundle

What is included in the product

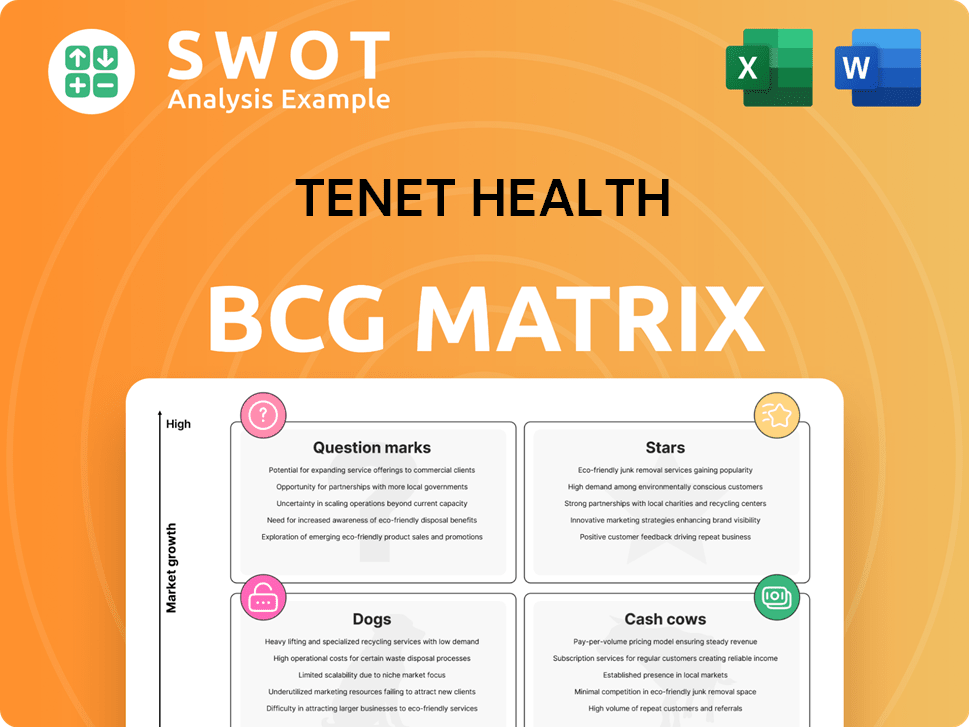

In-depth examination of Tenet's units across BCG Matrix quadrants. Provides strategic insights for each, plus investment decisions.

A concise visual guide enabling quick strategic assessments of each Tenet Health business unit.

Delivered as Shown

Tenet Health BCG Matrix

The Tenet Health BCG Matrix preview showcases the complete document you receive upon purchase. This is the fully formatted, analysis-ready report, free of watermarks or hidden content, designed for your strategic decision-making.

BCG Matrix Template

Tenet Health navigates a complex healthcare landscape. Their BCG Matrix categorizes services, showing growth potential and resource needs. Understanding quadrant placements—Stars, Cash Cows, Dogs, Question Marks—is crucial. This helps with strategic allocation and investment decisions. Analyze their market share and growth rates. Gain a competitive edge by identifying strengths and weaknesses. Purchase the full BCG Matrix for a complete roadmap to strategic success.

Stars

Tenet Healthcare's USPI, its ASC division, shines as a Star. They're strategically expanding, with around $250M earmarked yearly for ambulatory M&A. In 2025, they plan to open 10-12 new centers, fueling growth. This expansion boosts Tenet's market presence and financial performance. USPI's strong position highlights this strategic focus.

USPI's Star status is fueled by the growth in high-acuity procedures. Tenet's strategy of increasing these cases is succeeding. In 2024, same-store revenue growth exceeded expectations. This reflects strong performance in areas like total joint replacements. Cardiovascular interventions also drive this positive trend.

USPI's strong financial performance, reflected a 16.9% rise in Q4 2024 net operating revenues, driven by per-case revenue growth and added ASCs, solidifies its Star status. Adjusted EBITDA grew 17% in 2024, fueled by a 7.8% increase in same-facility revenues. High-acuity cases grew 19% year-over-year.

Strategic M&A Activity in Ambulatory Space

Tenet's aggressive M&A strategy in the ambulatory space solidifies its "Star" position. In 2024, Tenet added roughly 70 ambulatory surgery centers (ASCs) through acquisitions and openings. This expansion aligns with the growing trend towards outpatient care. This strategic move is expected to boost its financial performance.

- 2024 ASC additions: ~70

- Strategic focus: Outpatient care expansion

- Impact: Enhanced financial outlook

Favorable Payer Mix in USPI

USPI's improved payer mix boosts revenue per case, enhancing its "Star" status within Tenet's BCG matrix. This favorable mix, alongside its freestanding ASC structure, insulates it from site-neutral payment changes. The company's financial stability and growth are supported by these factors. In 2024, USPI's revenue grew by 8%, driven by such improvements.

- Revenue per case growth.

- ASC positioning (freestanding).

- Financial stability.

- 2024 Revenue Growth of 8%.

USPI, as Tenet's Star, excels in the ambulatory surgery market. Aggressive M&A added roughly 70 ASCs in 2024. Revenue per case and a favorable payer mix boosted 2024 revenue by 8%.

| Metric | Details |

|---|---|

| 2024 ASC Additions | ~70 |

| 2024 Revenue Growth | 8% |

| High-acuity cases growth (YoY) | 19% |

Cash Cows

Tenet's acute care hospitals in core markets are cash cows, known for stability and efficiency. These hospitals consistently generate revenue, supporting other investments. In 2024, Tenet's hospital segment saw a 6.6% increase in net patient revenue. This steady financial performance solidifies their cash cow status.

Tenet Healthcare's focus on Medicare profitability within its acute care segment reflects a Cash Cow strategy. This means they're aiming to get the most profit from a stable market. In 2024, Medicare represented a significant portion of hospital revenue, around 35% on average. This strategy involves cost control and efficiency improvements.

Conifer Health Solutions, a Tenet subsidiary, is a cash cow. It offers revenue cycle management services, ensuring steady revenue streams. These services support hospitals, health systems, and practices, boosting Tenet's cash flow. In 2024, Conifer's revenue was a significant part of Tenet's financial stability.

Managed Care Rate Increases

Managed care rate increases are crucial for Tenet's hospital revenue stability. These negotiated increases, typically between 3-5%, help offset inflation. They are vital for maintaining profitability within the hospital segment. In 2024, this was essential for financial health.

- Rate increases offset rising costs.

- They are critical for hospital profit margins.

- These are negotiated with insurance providers.

- Helps maintain a stable financial outlook.

Efficiency in Hospital Operations

Tenet Healthcare's focus on operational efficiency solidifies its Cash Cow position within the BCG Matrix. This involves stringent cost management and a drive for operational excellence across its hospital network. Reducing expenses, particularly contract labor costs, directly boosts profitability. In 2024, Tenet reported significant improvements in these areas, enhancing its financial stability.

- Improved profitability through reduced expenses.

- Focus on operational excellence.

- Effective management of contract labor costs.

- Enhanced financial stability in 2024.

Tenet Healthcare's cash cows include acute care hospitals and Conifer Health Solutions, consistently generating substantial revenue. In 2024, the hospital segment saw a 6.6% rise in net patient revenue, and Conifer played a crucial role in financial stability. Medicare's significant contribution and managed care rate increases, typically 3-5%, further supported their financial position.

| Cash Cow Element | Description | 2024 Data/Impact |

|---|---|---|

| Acute Care Hospitals | Core markets, known for stability. | 6.6% increase in net patient revenue. |

| Conifer Health Solutions | Revenue cycle management services. | Significant contribution to financial stability. |

| Managed Care Rates | Negotiated rate increases. | 3-5% increase, crucial for profit margins. |

Dogs

The 14 hospitals Tenet divested in 2024 can be classified as "Dogs" in a BCG Matrix. These facilities, representing approximately $3 billion in revenue, were likely underperforming. Tenet's strategic shift prioritized ambulatory surgery centers and higher-growth markets. This move aimed to improve overall profitability and streamline operations, as seen in their Q3 2024 earnings.

Hospitals in non-core markets are those where Tenet has a weak presence. These facilities often face challenges in profitability and growth. In 2024, Tenet divested several hospitals, focusing on core markets. For instance, the company sold three hospitals in California.

Service lines like certain inpatient rehab or specific surgical procedures within Tenet Healthcare could be considered Dogs. These areas often struggle with low market share and limited growth prospects. For example, in 2024, some specialized surgical services saw less than a 2% increase in patient volume. Investing heavily in these services might not yield substantial financial returns, potentially diverting resources from more promising areas.

Facilities with High Operating Costs

Hospitals with high operational costs and low efficiency can be "Dogs" in the Tenet Health BCG Matrix. These facilities often face challenges in generating profits, making them less competitive. For example, in 2024, some hospitals within Tenet reported higher operating expenses relative to their revenue. This can indicate inefficiencies, which can lead to financial strain. These hospitals might require significant restructuring or divestiture to improve their financial performance.

- High operating costs can include staff, supplies, and infrastructure.

- Low efficiency leads to reduced patient throughput and revenue.

- Financial strain can result in decreased profitability.

- Restructuring or divestiture may be needed to improve performance.

Underperforming Contracts

Underperforming contracts within Tenet Health, according to a BCG Matrix analysis, are those failing to meet revenue or profitability targets. These agreements drag down overall financial performance and may need strategic adjustments. For example, in 2024, several hospital service contracts underperformed by more than 15%, impacting net income. Renegotiation or termination becomes crucial to enhance financial health.

- Identify: Contracts not meeting financial goals.

- Impact: Lowers revenue and profitability.

- Action: Renegotiate or terminate agreements.

- Example: Underperforming service contracts in 2024.

Dogs in the BCG Matrix for Tenet Health include hospitals or services with low market share and growth. In 2024, Tenet divested $3 billion in revenue from underperforming hospitals, aiming to boost profitability. This strategic shift prioritized areas with better growth prospects, streamlining operations.

| Category | Characteristics | Action |

|---|---|---|

| Underperforming Hospitals | Low market share, high costs | Divest, restructure |

| Specific Service Lines | Limited growth, low volume | Reduce investment |

| Unprofitable Contracts | Failing targets | Renegotiate or terminate |

Question Marks

Tenet Health's new hospital campus in San Antonio is a Question Mark due to market competition. Success hinges on patient attraction and presence. The San Antonio healthcare market in 2024 had a projected revenue of $10.2 billion, with Tenet aiming for a significant share.

Tenet's push to expand into higher acuity services, a 'key hospital growth opportunity,' aligns with a Question Mark strategy. These services demand considerable capital, potentially facing hurdles like regulatory approvals or intense competition. In 2024, Tenet's capital expenditures totaled approximately $1.1 billion, reflecting investments in such initiatives. The success of these ventures is uncertain, classifying them as Question Marks within the BCG Matrix.

Tenet Healthcare plans to open 10 to 12 new ambulatory surgery centers (ASCs) in 2025. Success hinges on factors like location and service offerings. These de novo facilities require investment to attract patients and become profitable. In 2024, Tenet's ASC segment generated approximately $6.4 billion in revenue.

Potential New Service Offerings

Exploring new service offerings at Tenet Health aligns with a Question Mark strategy. Such initiatives involve investments with uncertain market acceptance. For instance, in 2024, Tenet invested in ambulatory services, a high-growth area. These ventures could face reimbursement risks, as seen with evolving insurance policies.

- Tenet's 2024 revenue from ambulatory services grew, indicating potential.

- New services face reimbursement uncertainties from payers.

- Investments require careful financial planning and market analysis.

- Success depends on adoption rates and payer agreements.

Strategic Partnerships with Health Systems

Strategic partnerships with other health systems or providers present a significant opportunity for Tenet Health. These collaborations could enhance service offerings and expand market reach, potentially boosting revenue. However, the success hinges on effective collaboration and the alignment of goals between partners. Mutual benefits, such as shared resources and expertise, are critical for these partnerships to thrive and generate value in 2024. Consider that in 2023, partnerships in the healthcare sector saw an increase in transaction volume by 15%.

- Partnerships can lead to expanded service offerings and market reach.

- Effective collaboration and goal alignment are critical for success.

- Mutual benefits, like shared resources, are essential.

- Healthcare partnership transaction volume increased by 15% in 2023.

Tenet's Question Marks face uncertain outcomes, from market competition to service acceptance. Success depends on patient attraction and strategic partnerships. Investments in 2024 totaled approximately $1.1 billion.

| Category | Details | 2024 Data |

|---|---|---|

| New Hospital Campus | Market Entry, Competition | San Antonio Market: $10.2B projected revenue |

| High Acuity Services | Capital Intensive, Regulatory Hurdles | Tenet's Capital Expenditures: ~$1.1B |

| Ambulatory Surgery Centers | Expansion, Profitability | ASC segment revenue: ~$6.4B |

BCG Matrix Data Sources

The Tenet Health BCG Matrix relies on company financial statements, industry reports, and market trend analysis for data.