Tenet Health SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Tenet Health Bundle

What is included in the product

Analyzes Tenet Health’s competitive position through key internal and external factors.

Facilitates interactive planning with a structured, at-a-glance view.

Preview Before You Purchase

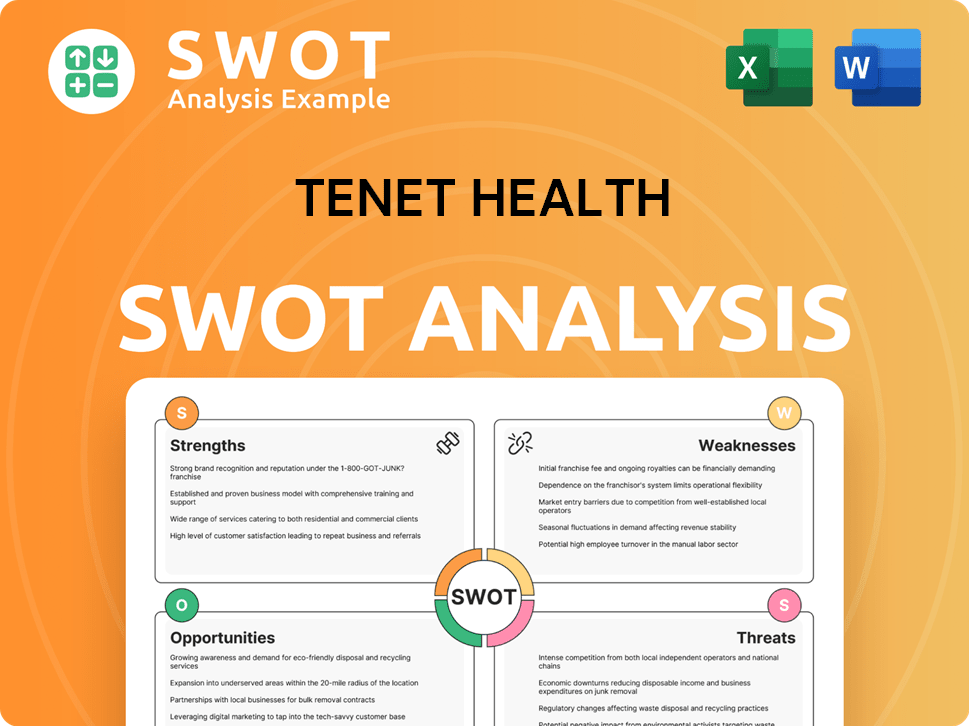

Tenet Health SWOT Analysis

The preview below gives you a direct look at the actual Tenet Health SWOT analysis. What you see is what you get—the complete document.

SWOT Analysis Template

This preview hints at Tenet Health's complex landscape. Strengths in their diverse network are counterbalanced by weaknesses like debt. Opportunities in telehealth are challenged by competitive threats. Strategic planning is vital to navigate this arena.

Want the full story behind the company’s strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Tenet's wide network includes hospitals and outpatient facilities, plus ASCs via USPI. This allows access to a large patient base. Tenet strategically expands its ASC footprint. In Q1 2024, USPI added 10 centers. Diversified revenue streams are a key strength.

Tenet Healthcare has shown robust financial health, marked by notable revenue increases and enhanced profitability. The company has strategically improved its financial position. This includes selling hospitals to reduce debt. This financial strategy boosts investor appeal.

Tenet Health is concentrating on high-acuity care and expanding its ambulatory surgery center division, USPI. This strategy involves investing in new ASCs and surgical robotics. The aim is to grow procedures like total joint replacements and cardiovascular interventions. This focus meets market demand and can improve margins. In Q1 2024, USPI saw a 7.9% same-facility system-wide revenue growth.

Effective Cost Management and Operational Discipline

Tenet's effective cost management is a key strength. They've focused on controlling costs, especially contract labor. This discipline boosts financial performance and patient satisfaction. The company's adjusted EBITDA margin has improved.

- Tenet's Q1 2024 saw a 7.4% increase in net patient service revenue.

- They've increased their adjusted EBITDA.

- Tenet's focus on operational efficiency is clear.

Insulation from Certain Policy Changes

Tenet Health's substantial involvement in freestanding ASCs via USPI offers protection against shifts in site neutrality rules, as these centers are reimbursed differently from hospital outpatient departments. Furthermore, their ASCs' limited exposure to Medicaid shields them from possible reductions in Medicaid funding. This strategic diversification enhances financial stability. In Q1 2024, USPI same-facility system-wide revenues grew by 8.3%.

- USPI's growth in Q1 2024 highlights this strength.

- Low Medicaid exposure in ASCs is a key benefit.

- Site neutrality regulations have different impacts.

- Financial stability is improved.

Tenet Healthcare demonstrates strong financial performance with significant revenue and profitability gains. Strategic cost management and operational efficiency enhance financial health. Diversified revenue streams and ASC focus bolster stability.

| Strength | Details | Data (2024) |

|---|---|---|

| Financial Performance | Revenue growth, improved margins, debt reduction | Q1 2024 net patient revenue up 7.4%, adjusted EBITDA increase. |

| Operational Efficiency | Cost controls, USPI expansion | USPI same-facility revenue up 8.3% (Q1 2024). 10 new ASCs added. |

| Diversification | ASC focus, site neutrality protection | USPI's growth and limited Medicaid exposure are strategic advantages. |

Weaknesses

Tenet Healthcare's financial health is vulnerable due to its reliance on government reimbursements. A significant portion of Tenet's revenue comes from Medicare and Medicaid. Any reductions to reimbursement rates or shifts in eligibility requirements could hurt the company's finances. In 2023, approximately 53% of Tenet's revenue came from government programs.

Tenet Health faces considerable financial constraints due to high debt levels. The company's long-term debt remains substantial, even after divestitures. This can restrict the company's financial flexibility. In 2024, Tenet's debt-to-EBITDA ratio was around 4.0. High debt can hinder investments in future growth.

Tenet's hospital segment faces revenue challenges, contrasting with ASC growth. Facility sales contribute to the decline. Same-hospital metrics show improvement, but divestitures impact overall revenue. In Q1 2024, hospital revenue decreased. Careful management is essential.

Seasonality and Volume Concerns in Elective Procedures

Tenet Healthcare faces weaknesses related to elective procedures. Seasonality and external factors influence elective surgery demand, impacting ASCs. High deductibles and weather can affect patient decisions, causing volume fluctuations. These variations may lead to revenue volatility in specific periods. This financial instability poses a challenge for Tenet.

- Fluctuations in case volumes can affect quarterly revenues.

- High deductibles influence patient decisions, reducing demand.

- Weather conditions can further impact procedure volumes.

Competitive Landscape

Tenet Healthcare operates within a fiercely competitive healthcare landscape. They compete with major healthcare systems and local providers, all striving for market share. This competition extends to ambulatory services, where both large and smaller entities, often well-funded, are present. To stay ahead, Tenet must continuously invest in its operations and strategically position itself within the market.

- Tenet's competitors include HCA Healthcare and Community Health Systems.

- In 2024, the healthcare services market was valued at over $4 trillion in the U.S.

- Ambulatory care is a fast-growing segment, with significant investment.

Tenet’s reliance on government funding makes it sensitive to reimbursement changes. High debt levels constrain its financial flexibility. Revenue challenges, especially in the hospital segment, are present. Fluctuating patient volumes due to elective procedure trends add further risks. Competition intensifies, putting pressure on market share. The ASC growth offers potential but requires strategic focus.

| Weakness | Impact | Data |

|---|---|---|

| Government Dependence | Reimbursement Risks | ~53% revenue from Medicare/Medicaid (2023) |

| High Debt | Financial Constraints | Debt/EBITDA ratio ~4.0 (2024) |

| Revenue Challenges | Segment Decline | Hospital revenue decrease in Q1 2024 |

Opportunities

Tenet Healthcare's strategy includes expanding Ambulatory Surgery Centers (ASCs). This is driven by the increasing demand for outpatient procedures. Tenet is actively investing, with a pipeline of opportunities. In Q1 2024, Tenet's ASC revenue grew, showing the strategy's impact. The ASC market is projected to grow, offering continued expansion potential.

Tenet Healthcare can capitalize on the rising demand for high-acuity services. This includes complex procedures in ASCs and hospitals. These services offer higher reimbursement rates. In Q1 2024, Tenet's adjusted EBITDA from its hospital segment was $835 million. Strategic investments in technology and physician partnerships are key to growth.

Tenet Health can acquire or partner strategically to grow. They're expanding into new markets and improving services. Tenet has earmarked funds for M&A, especially in outpatient care. In 2024, they invested $1.3B in acquisitions. This strategy boosts their market presence.

Improved Operational Efficiency and Cost Management

Tenet Healthcare can enhance margins and profitability by continually focusing on operational efficiency, cost control, and technology adoption. Managing expenses, particularly labor costs, is crucial for better financial results. For instance, in Q1 2024, Tenet's adjusted EBITDA was $829 million, showing efficient cost management. Furthermore, the company's strategic initiatives aim at reducing costs and improving efficiency across its hospital network.

- Focus on operational improvements.

- Control labor costs.

- Use technology for efficiency.

- Improve profitability.

Demographic Trends and Increased Demand for Healthcare

Tenet Healthcare benefits from an aging population, boosting demand for healthcare, especially surgical and specialty services. This demographic shift supports volume growth across its facilities. For instance, the 65+ population is projected to reach over 73 million by 2030. This growth fuels opportunities in specialized care.

- Aging population drives healthcare demand.

- Focus on surgical and specialty care.

- Opportunities for volume expansion.

- Favorable tailwind for business.

Tenet's ASC expansion and high-acuity services capitalize on growing healthcare demands. Strategic acquisitions and partnerships, like the $1.3B investment in 2024, fuel market presence. Operational efficiency and cost control, exemplified by Q1 2024's $829M adjusted EBITDA, enhance margins. An aging population provides a strong demand for surgical and specialized care.

| Opportunity | Details | Data |

|---|---|---|

| ASC Growth | Expanding outpatient services | ASC revenue grew in Q1 2024 |

| High-Acuity Services | Focusing on complex procedures | Q1 2024 hospital segment EBITDA: $835M |

| Strategic Expansion | M&A and Partnerships | $1.3B invested in acquisitions in 2024 |

Threats

The possible end of ACA subsidies by late 2025 is a big worry. It might cause fewer people to have health insurance. This could mean lower patient numbers and more unpaid care for hospitals like Tenet. According to the Kaiser Family Foundation, over 16 million people could lose coverage without ACA subsidies.

Changes to Medicaid funding and healthcare policy pose significant threats. Proposed shifts in Medicaid funding and evolving regulations create ongoing policy risks. Reductions in Medicaid reimbursement rates could negatively impact Tenet's revenue. In 2024, Medicaid accounted for a substantial portion of U.S. healthcare spending. The hospital segment faces particular vulnerability to these changes.

Tenet Healthcare faces significant threats from labor shortages and wage pressures. The healthcare sector is grappling with these issues, which are driving up operational costs. For instance, in 2024, the average hourly earnings for healthcare workers increased by 4.5%. This can strain facilities' ability to maintain adequate staffing levels. Ultimately, this impacts service quality and financial outcomes.

Intense Competition

Tenet Health faces significant threats from intense competition in the healthcare market. Numerous providers constantly compete for patients and market share, creating pricing pressures. Maintaining a competitive edge requires continuous investment in services and technology. This environment necessitates strategic agility and efficiency to stay ahead. In 2024, the healthcare industry saw increased competition, with hospital M&A activity up 15% compared to the previous year, according to a report by Kaufman Hall.

- Increased competition leads to pricing pressure.

- Requires continuous investment for competitive advantage.

- Strategic agility is crucial for survival.

- Hospital M&A activity increased by 15% in 2024.

Increasing Pressure on Payors

Sustained high inpatient trends and rising healthcare expenses are intensifying pressure on payors. This situation might lead to tougher negotiations regarding reimbursement rates and benefit structures, which could negatively affect Tenet's financial performance. For instance, in 2024, several major insurance companies reported increased scrutiny on hospital billing practices. This trend is expected to continue into 2025.

- Payors are implementing stricter utilization reviews.

- Negotiations are becoming more focused on value-based care models.

- Benefit designs shift costs to patients.

Tenet Healthcare faces potential risks from ending ACA subsidies by 2025, potentially reducing patient numbers. Shifts in Medicaid funding and healthcare regulations could affect revenue. Labor shortages and competition also pose threats.

| Threat | Impact | Data (2024/2025) |

|---|---|---|

| ACA Subsidy Changes | Fewer insured patients | KFF: 16M could lose coverage |

| Medicaid & Policy | Reduced revenue | Medicaid: substantial spending in healthcare |

| Labor Shortages | Increased costs | Avg. hourly earnings for HC workers: +4.5% in 2024 |

SWOT Analysis Data Sources

The SWOT analysis leverages financial reports, market analyses, and industry publications. This ensures dependable, data-backed strategic evaluations.