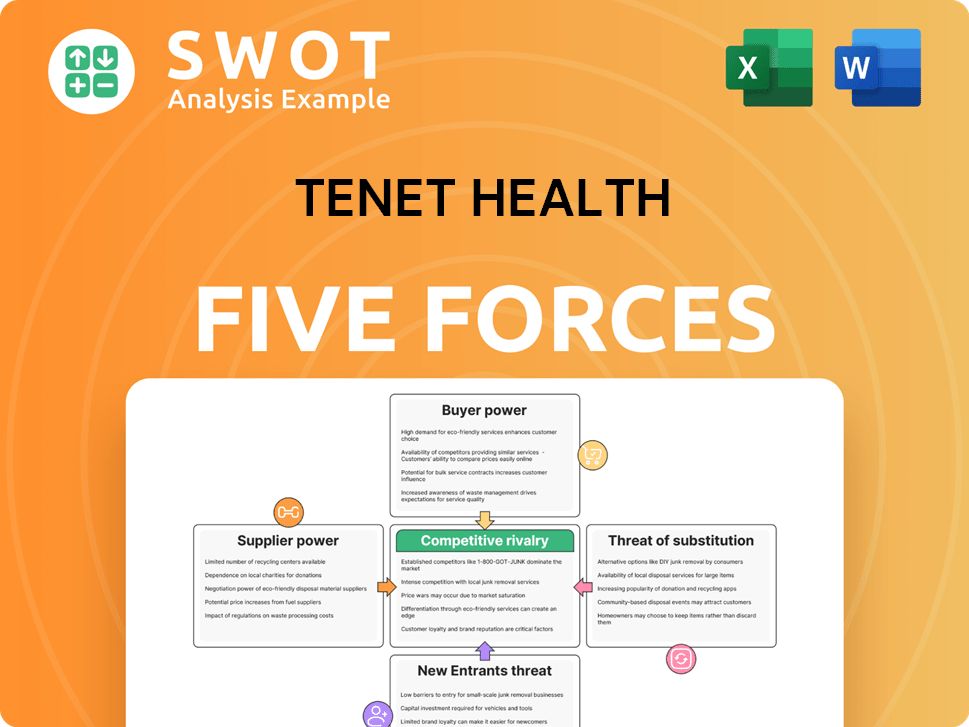

Tenet Health Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Tenet Health Bundle

What is included in the product

Analyzes Tenet Health's competitive forces, from rivals to buyers, assessing its market position and profitability.

Customize pressure levels based on new data or evolving market trends.

Full Version Awaits

Tenet Health Porter's Five Forces Analysis

You're previewing the complete Tenet Health Porter's Five Forces analysis. The document you see is the same in full, ready for download after purchase.

Porter's Five Forces Analysis Template

Tenet Health faces a complex healthcare landscape, navigating challenges from powerful buyers like insurance providers and government payers. The threat of new entrants remains moderate, given the high capital costs and regulatory hurdles. Supplier power, particularly from pharmaceutical companies and specialized medical equipment providers, is significant. Competitive rivalry within the hospital industry is intense. The availability of substitute services, like outpatient clinics, also exerts pressure.

Ready to move beyond the basics? Get a full strategic breakdown of Tenet Health’s market position, competitive intensity, and external threats—all in one powerful analysis.

Suppliers Bargaining Power

Tenet Health faces high supplier power due to a limited supplier base in medical equipment and technology. This concentration, with major players like Medtronic, GE Healthcare, and Philips, gives suppliers significant leverage. For example, in 2024, Medtronic's revenue was $32.3 billion, highlighting its market dominance. Switching suppliers is often costly, further reducing Tenet's bargaining power.

High switching costs significantly bolster supplier bargaining power in healthcare. Replacing specialized medical equipment such as MRI and CT scanners, can cost millions. This financial burden reduces the likelihood of switching suppliers. Tenet Health's 2023 capital expenditures reached $1.1 billion, demonstrating these substantial investments.

The healthcare supplier industry is seeing increased consolidation, which limits choices for providers like Tenet Health. This shift boosts suppliers' leverage due to fewer alternatives. For example, in 2024, the top three medical device companies controlled over 60% of the market. This gives them considerable pricing power, impacting Tenet Health's costs.

Pharmaceutical Costs

Rising drug prices are a significant factor for Tenet Health's financial health. Pharmacy expenses constitute a large portion of their operational costs. This impacts the hospital's ability to negotiate favorable terms with suppliers. These factors significantly affect budget constraints, which is a key challenge.

- In 2024, pharmaceutical spending rose by 10% in the U.S.

- Tenet's pharmacy costs accounted for about 30% of its total operational expenses.

- Increased drug prices directly influenced Tenet's profitability.

- Negotiating lower drug prices is crucial for Tenet's financial performance.

Technological Dependence

Tenet Healthcare's reliance on specific suppliers for essential medical technologies significantly influences its operations. Contracts with these suppliers, crucial for providing advanced healthcare services, typically span 5-7 years, with annual values ranging from $50 million to $150 million. This dependence gives suppliers substantial bargaining power, affecting Tenet's costs and operational flexibility. The nature of these high-value, long-term agreements places suppliers in a strong position.

- Supplier contracts average 5-7 years.

- Annual contract values vary from $50M to $150M.

- Technological dependency boosts supplier power.

Tenet Health's supplier power is high, influenced by limited supplier options for medical tech, like Medtronic. High switching costs, such as those for MRI machines which can cost millions. This limits negotiation power. Consolidation in the supplier market further restricts choices. Tenet's reliance on specific suppliers, with contracts averaging 5-7 years, and annual values from $50M to $150M, increases their leverage.

| Factor | Impact | Example (2024 Data) |

|---|---|---|

| Concentrated Suppliers | Reduced bargaining power | Medtronic's revenue: $32.3B |

| High Switching Costs | Limits supplier changes | MRI/CT scanner costs in millions |

| Rising Drug Prices | Increased expenses | Pharma spending rose 10% |

Customers Bargaining Power

Tenet Healthcare's hospital network spans numerous states, yet patient options are often restricted geographically, particularly in rural locales. This limited patient choice diminishes their bargaining power. For instance, in 2024, rural hospital closures impacted access significantly. Around 180 rural hospitals closed between 2010-2024, reducing patient options. This lack of competition allows providers to exert more control over service terms and pricing.

Insurance companies wield considerable power in healthcare. The top three private insurers control a large portion of the market. They negotiate hospital rates, affecting patient costs. These negotiated rates often exceed Medicare rates significantly. For example, in 2024, commercial insurers paid hospitals 247% of what Medicare paid.

A considerable portion of the U.S. population faces medical debt, with an average of $2,845 per person. High healthcare expenses, which averaged over $12,910 per capita in 2023, make patients cost-conscious. This financial burden pushes patients to look for affordable options and compare prices, thereby increasing their ability to negotiate costs.

Transparency Demands

Patients' bargaining power is rising due to transparency. They now research costs and quality online, impacting providers like Tenet. This scrutiny pushes providers to offer competitive pricing. Patients can now easily switch providers for better value.

- 2024: The No Surprises Act enhanced price transparency.

- Websites like Healthcare Bluebook and others are growing.

- Patient reviews and ratings influence provider choices.

- Tenet's revenue in 2023 was about $19.4 billion.

Price Comparison

Customers' bargaining power significantly influences Tenet Health. Price comparison shopping is common, compelling providers to offer competitive rates. This shift gives patients more control over healthcare choices.

- Healthcare costs rose 7.5% in 2023, encouraging price sensitivity.

- Over 60% of patients consider price when selecting a provider.

- Tenet must compete with value-based care models to retain patients.

- The rise of telehealth enhances patient choice and price transparency.

Patients' bargaining power affects Tenet Health, especially with healthcare costs rising. Price transparency tools and patient reviews have increased, influencing consumer choices. Healthcare costs grew 7.5% in 2023, making price a key factor.

| Aspect | Impact | Data |

|---|---|---|

| Price Sensitivity | Patients compare prices | Over 60% consider price. |

| Transparency Tools | Enhance choice | No Surprises Act improved pricing. |

| Tenet's Revenue | Financial context | $19.4B in 2023. |

Rivalry Among Competitors

Tenet Healthcare operates in a highly competitive healthcare services market, contending with major providers nationwide. This rivalry forces continuous innovation and differentiation to maintain market share. In 2024, the healthcare industry saw mergers and acquisitions, intensifying competition. For instance, in Q3 2024, Tenet's revenue was $4.9 billion, reflecting the competitive landscape.

Tenet Health faces fierce competition from major players like HCA Healthcare, UnitedHealth Group, Community Health Systems, and Universal Health Services. These rivals boast significant market share, leading to intense price wars and service differentiation. HCA Healthcare, for instance, generated $65 billion in revenue in 2023, showcasing its substantial competitive advantage. This rivalry impacts Tenet's profitability and strategic decisions.

Service differentiation is crucial for Tenet Health. Investing in digital health and AI can set them apart. Telehealth and advanced diagnostics improve patient care. In 2024, telehealth use surged, highlighting its impact.

Market Concentration

Hospital markets often show high concentration, meaning a few big companies control a large portion of the market. This concentration fuels intense competition as these major players compete for market leadership in different areas. This can lead to price wars and increased investments in services to attract patients. For example, in 2024, the top 10 U.S. hospital systems controlled about 25% of all hospital beds.

- Market concentration can lead to aggressive competition.

- Major players compete for market dominance.

- Price wars and service investments may happen.

- Top hospital systems have significant market share.

Focus on High-Acuity

Tenet Healthcare's strategic pivot toward high-acuity services intensifies competitive rivalry. This focus on high-margin specialties, like cardiovascular and orthopedics, draws competition from other major healthcare providers. This competition is particularly fierce in urban markets, where facilities vie for lucrative procedures and patient populations. In 2024, Tenet's same-store revenue increased by 6.9% due to a higher patient volume.

- Tenet's focus on high-acuity services increases competition.

- Competition is heightened in urban markets.

- High-margin procedures drive rivalry among providers.

- Tenet's same-store revenue rose by 6.9% in 2024.

Competitive rivalry in Tenet's market is intense. Major players like HCA Healthcare drive competition through mergers and acquisitions, and price wars. Tenet focuses on high-acuity services to differentiate itself. In 2024, the top 10 U.S. hospital systems controlled about 25% of all hospital beds, reflecting the market's concentration.

| Metric | Value | Year |

|---|---|---|

| Tenet Revenue | $4.9B (Q3) | 2024 |

| HCA Revenue | $65B | 2023 |

| Same-Store Revenue Increase | 6.9% | 2024 |

SSubstitutes Threaten

The telemedicine market is booming, providing a convenient alternative to in-person care. This surge in telehealth, valued at $61.4 billion in 2023, presents a threat to Tenet's traditional services. Telemedicine's accessibility and lower costs attract patients, potentially reducing demand for Tenet's hospitals and clinics. This shift requires Tenet to adapt to stay competitive. The telehealth market is projected to reach $165.3 billion by 2030.

Urgent care centers offer a more affordable option for immediate, non-critical medical needs. The growing number of these centers, along with their increasing patient volume, poses a real threat. In 2024, the urgent care market is projected to reach $45.5 billion, showing its substantial influence. This expansion directly challenges hospital emergency rooms and outpatient services. The shift impacts Tenet Health's market share and revenue streams.

The threat of substitutes is significant, especially with the rise in preventive healthcare. Consumers are increasingly favoring wellness programs and digital health tools. This trend could decrease demand for acute care services. For instance, the global wellness market was valued at $5.6 trillion in 2023.

Home Healthcare

The home healthcare market poses a growing threat to Tenet Health. It offers remote monitoring and care, substituting hospital stays and outpatient visits. This shift is driven by cost savings and convenience, attracting patients. The home healthcare market is projected to reach $496.7 billion by 2024, with a CAGR of 7.9% from 2024 to 2032.

- Market growth is fueled by the aging population and technological advancements.

- Remote patient monitoring devices are becoming increasingly sophisticated.

- Home healthcare services offer significant cost advantages compared to traditional hospital care.

- Convenience and patient preference are key drivers for this market.

Digital Health Platforms

Digital health platforms and apps are growing substitutes for traditional healthcare. They offer virtual consultations, remote monitoring, and digital therapeutics, providing convenient and accessible options. This shift poses a threat to traditional providers. The global digital health market was valued at $175.6 billion in 2023. It's projected to reach $660.1 billion by 2030.

- Market growth fuels increased competition.

- Platforms offer lower-cost alternatives.

- Accessibility is a key advantage.

- Traditional providers must adapt.

Tenet Health faces substantial threats from substitutes like telemedicine and urgent care centers, which offer more convenient and cost-effective alternatives. Preventative healthcare and home healthcare are also gaining popularity, potentially reducing demand for traditional hospital services. These shifts, accelerated by digital health platforms, require Tenet to adapt and innovate to maintain market share.

| Substitute | Market Size (2024) | Projected Growth |

|---|---|---|

| Telemedicine | $70.5 billion | $165.3B by 2030 |

| Urgent Care | $45.5 billion | Ongoing Expansion |

| Home Healthcare | $496.7 billion | 7.9% CAGR (2024-2032) |

Entrants Threaten

Establishing new hospitals and healthcare facilities demands significant financial investment. Building new facilities and acquiring medical equipment create a high barrier for new entrants. In 2024, the average cost to build a new hospital in the U.S. was around $600 million. This financial burden deters potential competitors. High capital needs limit market entry.

The healthcare industry faces significant regulatory hurdles. Strict licensing and compliance requirements act as barriers, deterring new entrants. These regulations, including those from the Centers for Medicare & Medicaid Services (CMS), demand substantial investment. For example, in 2024, CMS implemented new rules, increasing the compliance burden and costs for healthcare providers. This makes it harder for new ventures to compete.

Established healthcare providers like Tenet Healthcare leverage economies of scale to reduce costs. This advantage allows for more competitive pricing, a significant barrier to new competitors. For example, in 2024, Tenet's operating expenses were about $18.5 billion, reflecting efficiencies. New entrants face higher per-unit costs, making it tough to compete.

Established Networks

Tenet Health and other major healthcare providers, like HCA Healthcare, possess extensive networks of hospitals, clinics, and physician practices. These established networks create a significant barrier for new entrants. Building a comparable network demands considerable time and financial resources, with initial costs often exceeding hundreds of millions of dollars. For example, HCA Healthcare's capital expenditures in 2023 were approximately $4.4 billion, reflecting ongoing investments in its network.

- High Capital Requirements: New entrants face enormous upfront costs to replicate existing infrastructure.

- Regulatory Hurdles: Compliance with healthcare regulations further complicates and delays market entry.

- Brand Recognition: Established providers have strong brand recognition and patient loyalty.

- Economies of Scale: Existing networks benefit from economies of scale, reducing operational costs.

Technological Advancements

Technological advancements in healthcare pose a significant threat to new entrants. Keeping up with the latest innovations demands substantial investment in both resources and expertise. New players often struggle to match the technological capabilities of established healthcare providers. This disparity can create a competitive disadvantage, limiting their ability to compete effectively.

- The healthcare industry's tech spending is projected to reach $1.1 trillion by 2024.

- Adoption of AI in healthcare is expected to grow, with a market size reaching $67.5 billion by 2024.

- Established players like Tenet Health have existing infrastructure and skilled staff.

- New entrants may struggle with the high costs and rapid changes in technology.

Threat of new entrants in healthcare is moderate. High capital needs and regulatory hurdles create significant barriers. Established players leverage economies of scale and brand recognition.

| Factor | Impact | Data |

|---|---|---|

| Capital Needs | High Entry Cost | Avg. hospital build cost: $600M (2024) |

| Regulations | Compliance Burden | CMS rules increased costs in 2024 |

| Economies of Scale | Cost Advantage | Tenet's 2024 operating expenses: ~$18.5B |

Porter's Five Forces Analysis Data Sources

Our Porter's analysis leverages data from SEC filings, market reports, and healthcare industry publications for a comprehensive overview.