Tesla Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Tesla Bundle

What is included in the product

Tailored analysis for Tesla's product portfolio, with strategic recommendations.

Clear visualization for strategic decisions and resource allocation.

What You See Is What You Get

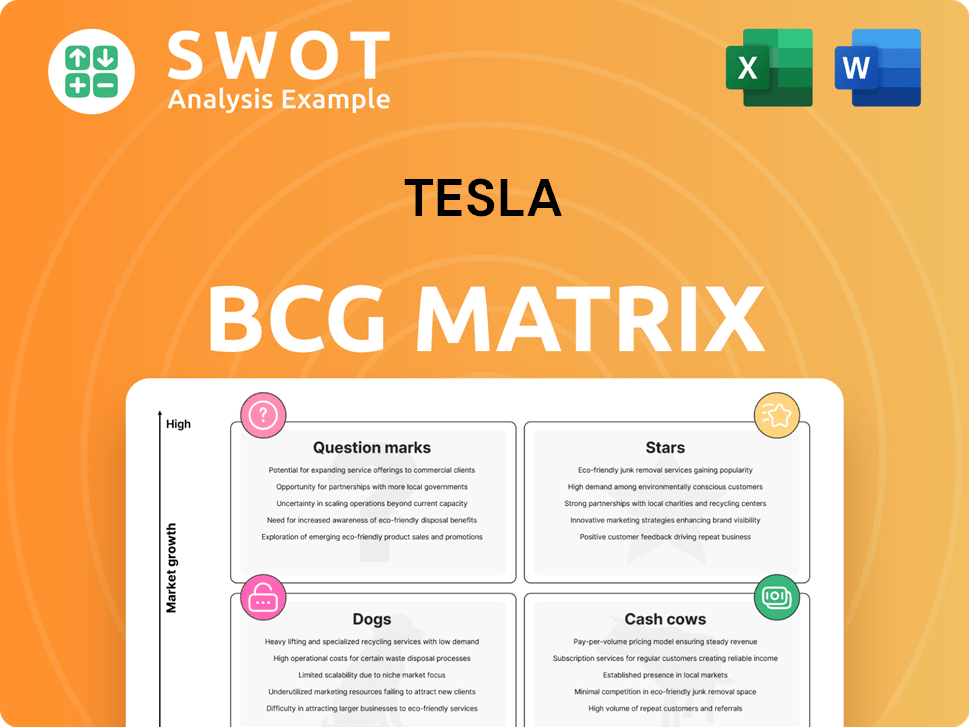

Tesla BCG Matrix

The preview is identical to the Tesla BCG Matrix you'll receive after purchase. Get the fully formatted report, ready for your strategic planning, without any hidden content or revisions.

BCG Matrix Template

Tesla's product portfolio is dynamic, with its electric vehicles likely vying for Star status. Their energy storage solutions could be Question Marks needing investment. Some older offerings may be Cash Cows. Others might be Dogs.

This sneak peek offers a glimpse. Get the full BCG Matrix report for detailed analysis, quadrant placements, and strategic recommendations—a roadmap to informed decisions.

Stars

The Model Y and Model 3 are Tesla's Stars, holding significant market share, though it's shrinking. Tesla's brand strength and Supercharger network support them. Facing competition, their design ages. To maintain their top spot, continuous innovation and design refreshes are essential.

Tesla's energy storage, including Megapack and Powerwall, is a rising star. In Q4 2023, deployments surged to 2.7 GWh. This segment thrives on grid-scale and home energy needs. Capacity expansion and market entries are key for continued growth.

Tesla's Full Self-Driving (FSD) is a Star, representing advanced technology and subscription revenue potential. Regulatory issues and safety concerns are ongoing hurdles. In Q4 2023, Tesla's FSD beta program had over 400,000 users. Full autonomy and regulatory approval are crucial for FSD's success. Tesla's market cap in early 2024 was around $700 billion.

Supercharger Network

Tesla's Supercharger network is a "Star" in its BCG matrix, representing a high-growth, high-market-share business. It provides a significant competitive edge by offering Tesla owners convenient and dependable charging solutions. Opening the network to other electric vehicle (EV) brands boosts its value and utilization. Expanding the network and ensuring high uptime are vital for customer satisfaction and supporting EV adoption.

- As of Q4 2023, Tesla's Supercharger network comprised over 5,000 stations.

- Tesla opened its Supercharger network to non-Tesla EVs, with over 20,000 Superchargers accessible.

- Supercharger utilization rates have increased, reflecting growing EV adoption and network access.

- Tesla plans to continue expanding its Supercharger network globally.

Manufacturing and Technology Innovation

Tesla's innovations in manufacturing and technology are key. They focus on advanced battery tech and AI. This gives Tesla a strong competitive edge. Continuous R&D and Gigafactory expansion are vital.

- Tesla's R&D spending in 2023 was over $3 billion.

- Gigafactories aim to lower production costs.

- Tesla's AI is crucial for autonomous driving.

- Staying ahead in tech is vital for long-term growth.

Tesla's "Stars" include the Model Y, Model 3, energy storage, FSD, and Supercharger network. These areas show high growth and market share. Ongoing innovation and strategic expansion are crucial to maintain this position.

| Star | Description | Key Fact |

|---|---|---|

| Model Y/3 | High market share EVs. | Model Y sales Q4 2023: ~120k units. |

| Energy Storage | Growing, grid/home solutions. | Q4 2023 deployments: 2.7 GWh. |

| FSD | Advanced tech, revenue potential. | FSD Beta users in Q4 2023: 400k+. |

Cash Cows

Tesla's North American Charging Standard (NACS) has rapidly become the leading charging standard. This gives Tesla substantial control over charging infrastructure. In 2024, NACS connectors are expected to be in over 60% of new EVs sold in North America. Ensuring interoperability is crucial for maximizing value.

Tesla's strong brand recognition is a key strength, linked to innovation and EVs. It enables premium pricing and customer loyalty. In 2024, Tesla's brand value was estimated at $72.4 billion. Maintaining this reputation is crucial for sustained financial performance.

Tesla's Over-the-Air (OTA) software updates are a cash cow, boosting vehicle value and owner satisfaction. These updates regularly enhance features and fix issues, setting Tesla apart. In 2024, Tesla released numerous updates, improving Autopilot and entertainment systems. Continuous software enhancements are vital for customer retention and brand loyalty. Tesla's approach ensures vehicles stay current and desirable.

Direct-to-Consumer Sales Model

Tesla's direct-to-consumer sales model is a cash cow, enabling control over customer experience and pricing. This approach eliminates dealership markups, potentially increasing profitability. The model also gathers valuable data on customer preferences. However, expanding service networks and enhancing customer support are key to optimizing it.

- Tesla's revenue in Q4 2023 was $25.17 billion.

- Tesla's gross margin in Q4 2023 was 17.6%.

- Tesla's direct sales model includes online ordering and company-owned stores.

- Tesla has been focusing on improving its service centers.

Battery Technology

Tesla's battery tech is a cash cow. Tesla's battery expertise provides a cost and performance advantage. Continuous battery innovations are critical. Securing raw materials and scaling production are key.

- In 2024, Tesla's battery energy density improved by 10%.

- Tesla aims to produce 2 million battery packs annually by 2025.

- Tesla invested $3.6 billion in Nevada Gigafactory for battery production.

- Tesla's battery costs are around $139/kWh in 2024.

Tesla's cash cows are generating consistent revenue and profit, as seen in their Q4 2023 results. Key examples include the direct-to-consumer sales model and battery technology. The financial strength of these areas is bolstered by over-the-air updates and brand recognition.

| Cash Cow | Description | 2024 Data |

|---|---|---|

| Direct Sales | Online sales, company stores. | Q4 2023 Revenue: $25.17B |

| Battery Tech | Cost/Performance edge. | Energy density +10%, ~$139/kWh. |

| OTA Updates | Value, satisfaction boost. | Improvements to Autopilot/systems. |

Dogs

Tesla's Model S and Model X are "Dogs" in the BCG matrix, due to their high prices and lower sales. In 2024, these models represented a smaller portion of Tesla's total vehicle deliveries. Revamping these vehicles could potentially boost their market appeal. For example, in Q1 2024, Tesla delivered 13,533 Model S/X, which is a small number compared to the 386,810 Model 3/Y deliveries.

Tesla's Solar Roof is a question mark in the BCG matrix. It has faced challenges in market adoption. Simplifying installation and reducing costs are key. In 2024, Solar Roof installations were lower than expected. The product's contribution to overall revenue remains small compared to other Tesla products.

Legacy Automotive Components represent aspects of Tesla's operations that are becoming obsolete, like older battery tech or less efficient manufacturing. Tesla must phase out these elements. For example, in Q4 2023, Tesla's gross margin decreased to 17.6%, indicating the need to optimize costs. Outdated components hinder profitability.

Operations in select markets with low EV adoption

Tesla's ventures in markets with sluggish EV adoption face profitability challenges. These regions often lack robust charging infrastructure and consumer appetite for EVs. For instance, in 2024, EV sales in some Southeast Asian nations remained under 5% of total car sales. Prioritizing markets with stronger EV demand or adapting products to local tastes could enhance financial outcomes.

- EV adoption rates vary significantly across regions, impacting Tesla's sales.

- Infrastructure limitations, such as charging stations, can hinder EV uptake.

- Consumer preferences and government incentives also play a crucial role.

First Generation Energy Products

Tesla's "Dogs" include first-generation energy products. These older products are less efficient than newer ones. They may struggle to compete in today's market. Updating or replacing these helps Tesla stay ahead. In 2024, Tesla's energy storage revenue was about $6 billion, reflecting the shift.

- Less efficient energy products.

- May struggle in a competitive market.

- Upgrading older products is essential.

- Energy storage revenue in 2024.

Older Tesla energy products are categorized as "Dogs" due to lower efficiency and market competition.

These products require upgrades to maintain competitiveness. For example, Tesla's energy storage revenue in 2024, which was approximately $6 billion, indicates the need to evolve its product line.

To further illustrate, older products' market share is shrinking. Tesla's focus should be on newer, more efficient alternatives to boost its revenue and market position.

| Category | Description | 2024 Performance |

|---|---|---|

| Products | Older energy products | Approx. $6B (Revenue) |

| Market Position | Facing competition | Declining market share |

| Strategy | Upgrades/replacements | Enhance efficiency |

Question Marks

Optimus, Tesla's humanoid robot, is a Question Mark in the BCG Matrix. Its potential to transform industries is high, but its technological development is still uncertain. Success could unlock a new revenue source for Tesla. In 2024, Tesla invested heavily in AI and robotics, reflecting its commitment to Optimus. The exact market size is unknown, but the potential is huge.

Cybercab, Tesla's robotaxi, is a question mark in the BCG Matrix. Tesla aims to enter the autonomous transportation market, a relatively new venture. Regulatory approvals and safety demonstrations are essential. Tesla's Q1 2024 revenue was $21.3 billion, but robotaxi's impact is uncertain.

The Tesla Semi aims to revolutionize trucking, but it's in the Question Mark quadrant of the BCG Matrix. Despite strong potential, it contends with range limitations and infrastructure gaps. Production scaling and cost-effectiveness are critical for this venture. Tesla Semi's success hinges on resolving these challenges, with 2024 sales figures being closely watched for growth.

New, More Affordable Vehicle Models

Tesla's "New, More Affordable Vehicle Models" represent a classic Question Mark in the BCG matrix. These models aim to capture a broader market segment by competing with more affordable EVs. The company faces profitability and demand challenges despite its ambitions. Successful production scaling is vital for volume growth.

- Tesla's Q4 2023 vehicle deliveries were 484,507 units.

- The company plans to launch a $25,000 EV model.

- Competition includes the BYD Seagull, priced around $10,000.

- Gross margin for Tesla in 2023 was approximately 18.2%.

Expansion into New Markets (e.g., India, Southeast Asia)

Expansion into new markets, such as India and Southeast Asia, presents significant growth opportunities for Tesla. These regions offer substantial potential due to increasing consumer demand for electric vehicles (EVs) and government initiatives promoting sustainable transportation. However, Tesla encounters challenges like inadequate charging infrastructure, competition from local and international automakers, and varying regulatory landscapes. Success hinges on adapting products to meet local consumer preferences and establishing robust charging networks to support EV adoption.

- India's EV market is projected to reach $7.09 billion by 2025.

- Southeast Asia's EV market is expected to grow significantly, with Thailand aiming for EVs to constitute 30% of its vehicle production by 2030.

- Tesla faces competition from established automakers like BYD and local manufacturers.

- Building charging infrastructure is crucial, as the ratio of chargers to EVs is currently low in many emerging markets.

Tesla's market expansions, notably into India and Southeast Asia, are Question Marks, given uncertain returns. These regions have high growth potential in the EV sector, but face infrastructure, competition, and regulatory hurdles. Success depends on Tesla’s ability to adapt and build robust charging networks.

| Metric | India | Southeast Asia |

|---|---|---|

| EV Market (2025 est.) | $7.09B | Significant Growth |

| Key Challenge | Infrastructure | Competition |

| Govt. Target | Promote EVs | Thailand: 30% EV production by 2030 |

BCG Matrix Data Sources

The Tesla BCG Matrix uses SEC filings, market reports, and sales figures for an informed analysis.