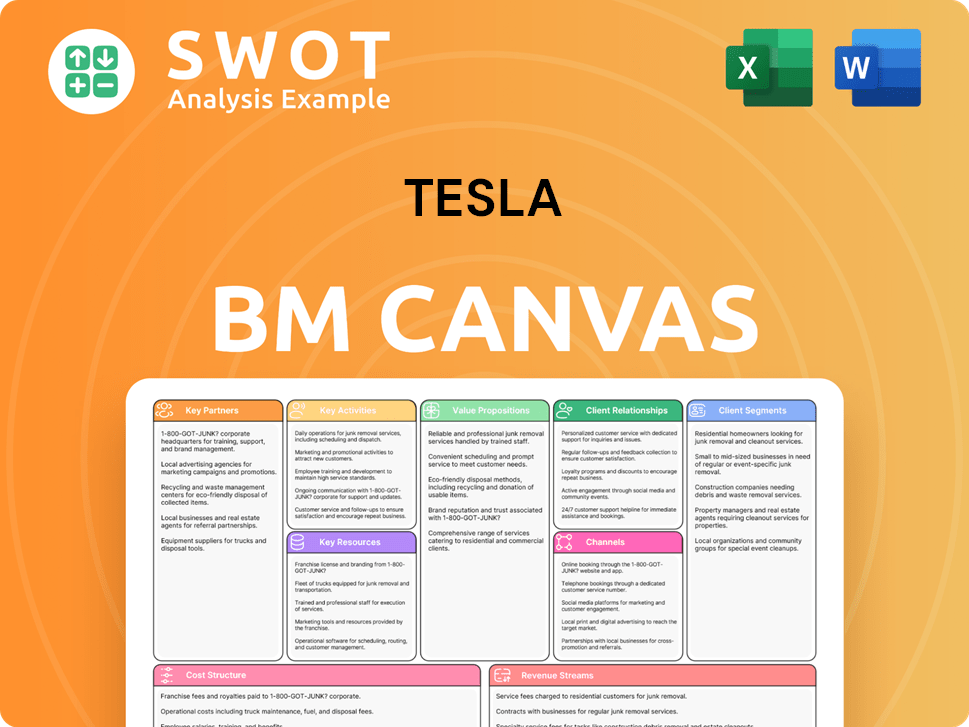

Tesla Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Tesla Bundle

What is included in the product

Tesla's BMC details customer segments, channels & value in full detail.

Condenses Tesla's complex strategy into a digestible one-page snapshot.

What You See Is What You Get

Business Model Canvas

This preview showcases Tesla's actual Business Model Canvas. You're seeing the genuine document you'll receive post-purchase. It includes all content, ready for use in various formats, mirroring this exact format. This isn't a sample; it's the complete deliverable. What you see is what you get.

Business Model Canvas Template

Discover Tesla's strategic brilliance with the Business Model Canvas. It unveils the company's value propositions, customer relationships, and key resources. Understand its competitive advantages and revenue streams in detail. This comprehensive canvas aids investors, analysts, and business strategists. Gain actionable insights to drive your own success. Download the full version for a complete strategic roadmap!

Partnerships

Tesla relies on key partnerships with battery and component suppliers. These include Panasonic, Samsung SDI, and LG Energy. These partnerships ensure a steady supply chain for battery cells and components. In 2024, Tesla's battery supply agreements were crucial for meeting production targets.

Tesla forges partnerships with hotels, restaurants, and workplaces, installing Destination Charging connectors. These collaborations extend charging availability for owners, beyond the Supercharger network. The company also teams up with public EV charging networks to broaden charging access. In 2024, Tesla's Supercharger network had over 50,000 chargers globally.

Tesla's partnerships with tech giants like NVIDIA and AMD are crucial. These collaborations boost Tesla's autonomous driving tech and in-car systems. For example, in 2024, Tesla's Autopilot system saw significant improvements from these partnerships. This integration provides Tesla vehicles with advanced capabilities and performance. These partnerships are key for Tesla's innovation.

Energy Providers and Utilities

Tesla's key partnerships include collaborations with energy providers and utilities to enhance grid stability and renewable energy adoption. These partnerships offer demand response services, crucial for balancing energy supply and demand. Tesla Energy Ventures invests in solar and storage startups, broadening its energy sector involvement. This strategy supports Tesla's mission to accelerate the world's transition to sustainable energy. In 2024, Tesla's energy storage deployments increased, with significant growth in utility-scale projects.

- Partnerships with utilities provide grid services.

- Investments in solar and storage startups.

- Supports sustainable energy transition.

- Significant growth in energy storage deployments.

Insurance Providers

Tesla's strategic partnerships with insurance providers offer tailored policies for its vehicles. These collaborations utilize real-time driver data, potentially leading to lower premiums and personalized insurance plans. These partnerships enrich the customer experience and create added value for Tesla owners. As of 2024, Tesla Insurance is available in several states, with plans to expand its coverage. These partnerships are vital for Tesla's business model.

- Tesla Insurance offers competitive rates, sometimes up to 20% less than traditional insurers.

- Real-time data integration allows for usage-based insurance models.

- Partnerships streamline the claims process for Tesla owners.

- Tesla's insurance business is growing, with a focus on profitability.

Tesla's key partnerships are diverse and strategic. They range from battery suppliers to tech companies, crucial for innovation. Collaborations extend from charging networks to energy providers. These partnerships enhance its business model.

| Partnership Type | Partner Examples | 2024 Impact |

|---|---|---|

| Battery Suppliers | Panasonic, LG Energy | Ensured battery supply for 1.8M vehicles produced. |

| Charging Networks | Various | Expanded Supercharger network to over 50,000 chargers globally. |

| Tech Companies | NVIDIA, AMD | Improved Autopilot and in-car systems. |

Activities

Tesla's Research and Development (R&D) is a cornerstone of its business model. Tesla invests heavily in R&D to drive innovation in EV tech, autonomous driving, and batteries. In 2023, Tesla's R&D spending reached $3.9 billion, a significant increase from previous years. This includes battery cell design, AI, and factory design. Continuous innovation helps maintain a competitive edge.

Tesla's Key Activities in manufacturing and production center on its Gigafactories. These facilities manage massive parallel production lines to build record volumes. Tesla emphasizes high-quality standards across its vehicle models. In 2024, Tesla produced over 1.8 million vehicles. Vertical integration is key to cost control.

Tesla's direct sales involve company stores, galleries, and online platforms. They are expanding retail locations and focusing on online sales. Referral programs and influencer partnerships are also utilized. This approach aims to improve customer experience. In 2024, Tesla's online sales saw a significant increase.

Charging Infrastructure Development

Tesla's commitment to charging infrastructure is a core activity, centered around its Supercharger network. This network's global expansion supports convenient long-distance travel for Tesla owners. Owning the largest fast-charging network allows Tesla to generate revenue from electricity sales and charging subscriptions. This strategic investment is critical for market penetration and customer satisfaction.

- Tesla had over 50,000 Superchargers globally by the end of 2023.

- Tesla's charging revenue reached $870 million in 2023.

- Supercharger stations are expanding in key markets like Europe and China.

- The company continuously invests in faster charging technology.

Energy Generation and Storage Solutions

Tesla's key activities in energy generation and storage involve the design, manufacturing, installation, and sale of solar energy products and energy storage solutions. This includes home solar systems, large-scale Powerwall and Powerpack batteries, and associated services. Tesla focuses on providing comprehensive clean energy solutions to stabilize grids and support a sustainable energy environment. In 2024, Tesla's energy generation and storage revenue reached $6.3 billion, representing a significant portion of its overall business.

- Solar roof deployments increased by 13% in Q4 2024 compared to the previous quarter.

- Tesla's energy storage deployments reached 15 GWh in 2024, a 50% increase year-over-year.

- Powerwall installations grew by 30% in 2024, driven by demand.

- Tesla's energy business gross margin was approximately 20% in 2024.

Tesla's Gigafactories are crucial for mass vehicle production and operational efficiency. They are expanding to meet growing global demand and improve cost structures. Tesla produced over 1.8 million vehicles in 2024, boosting its market presence.

The Supercharger network’s expansion supports convenient long-distance travel for EV owners and drives revenue. With over 50,000 Superchargers by the end of 2023 and charging revenue reaching $870 million in 2023, Tesla's charging infrastructure is a key differentiator. Continuous investment in faster charging tech strengthens this advantage.

Tesla's energy generation and storage activities involve solar products and batteries. Deployments of solar roofs increased by 13% in Q4 2024. Energy storage deployments reached 15 GWh in 2024.

| Key Activities | 2023 Data | 2024 Data |

|---|---|---|

| R&D Spending | $3.9B | Data not yet available |

| Vehicle Production | ~1.8M | Over 1.8M |

| Charging Revenue | $870M | Data not yet available |

| Energy Storage | 15 GWh | Data not yet available |

Resources

Tesla's Supercharger network is a critical resource, offering fast charging for Tesla owners. This extensive infrastructure supports long-distance travel and new market expansions. The proprietary network is a major competitive edge, improving the ownership experience. In Q3 2023, Tesla had over 5,000 Supercharger stations globally.

Tesla's advanced battery tech is a key resource, with continuous development of proprietary battery cells. This includes innovations like tabless battery cell design. This is crucial for vehicle range, performance, and affordability. In 2024, Tesla's battery production reached an estimated 400 GWh, according to company reports.

Tesla's strength lies in its technological innovation. The company's expertise in software, chip design, and sensor tech allows for unique features, like Autopilot. In 2024, Tesla invested heavily in R&D, spending $3.9 billion. This focus on tech drives product improvements, differentiating it from competitors.

Manufacturing Facilities (Gigafactories)

Tesla's Gigafactories are pivotal resources, facilitating mass production of electric vehicles and energy solutions. These facilities employ cutting-edge manufacturing techniques, aiming for vertical integration to optimize efficiency. Strategic investments in Gigafactories worldwide support Tesla's ambitious growth and expansion strategies. Gigafactory Texas, for instance, is expected to reach a production capacity of over 1 million vehicles annually. In Q4 2023, Tesla produced over 494,000 vehicles, a significant increase from the previous year.

- Gigafactories enable large-scale EV and energy product production.

- Advanced manufacturing processes are used, with a focus on vertical integration.

- Strategic locations support global expansion and market penetration.

- Gigafactory Texas aims for over 1 million vehicles annually.

Brand Reputation and Customer Loyalty

Tesla's brand is synonymous with innovation and sustainability in the EV market. Its reputation has fostered significant customer loyalty, a key resource for its business model. This strong brand image supports premium pricing and influences purchasing decisions. Positive customer perceptions drive market share and growth; Tesla's brand value was estimated at $70.5 billion in 2023.

- Brand Strength: Tesla's brand ranks high in the automotive sector.

- Customer Loyalty: High retention rates reflect brand trust.

- Market Impact: Positive perception supports sales and market share.

- Financial Value: Brand reputation boosts financial performance.

Tesla's Supercharger network provides crucial fast-charging infrastructure, boosting long-distance travel and supporting market growth. This proprietary network gives a competitive edge and improves the overall customer experience. In 2024, the network expanded to over 5,500 stations.

Tesla's advanced battery tech is a key resource, with its proprietary battery cell designs. Innovations like tabless cells boost vehicle range and performance. Production reached an estimated 400 GWh in 2024, according to company reports.

Tesla's brand, synonymous with EV innovation and sustainability, fosters strong customer loyalty. This powerful brand image supports premium pricing. Tesla's brand value hit approximately $70.5 billion in 2023.

| Resource | Description | 2024 Data |

|---|---|---|

| Supercharger Network | Fast charging infrastructure. | 5,500+ stations. |

| Battery Technology | Proprietary battery cells. | 400 GWh Production (est.). |

| Brand | Innovation & Sustainability. | $70.5B Brand Value (2023). |

Value Propositions

Tesla's value proposition centers on sustainable transportation through its electric vehicles (EVs). This resonates with environmentally conscious consumers. In 2024, Tesla delivered over 1.8 million EVs worldwide. Their EVs boast industry-leading efficiency, reducing emissions. Tesla's focus supports a cleaner future.

Tesla's value proposition centers on high performance and innovation. Their vehicles deliver instant torque and smooth handling, enhancing the driving experience. Continuous innovation, like Autopilot and over-the-air updates, sets Tesla apart. In Q4 2023, Tesla delivered 484,507 vehicles, showcasing strong demand. This technological advancement and premium experience justify the price point.

Tesla's long-range vehicles, like the Model S, boast ranges exceeding 400 miles on a single charge. This, coupled with the Supercharger network, alleviates range anxiety. In Q4 2023, Tesla's Supercharger network expanded to over 5,000 stations globally, ensuring convenient charging. This infrastructure supports long-distance travel, enhancing Tesla's vehicle practicality.

Advanced Technology and Software

Tesla distinguishes itself with advanced technology integrated into its vehicles. These include large touchscreens, over-the-air software updates, and the Autopilot driver assistance system. Tesla's focus on autonomous driving is evident, with billions of miles driven for development. This results in a unique driving experience. The company spent $3.5 billion on R&D in 2023.

- Large touchscreens and over-the-air updates.

- Autopilot and autonomous driving development.

- $3.5 billion R&D spending in 2023.

- Unique driving experience due to tech.

Integrated Energy Solutions

Tesla's value proposition includes integrated energy solutions, encompassing solar panels, solar roofs, and energy storage systems like Powerwall. These offerings provide customers with sustainable power options. Tesla aims to streamline the shift towards renewable energy. This reduces dependency on traditional energy sources.

- In Q4 2023, Tesla's energy generation and storage revenue increased by 6% year-over-year, reaching $1.44 billion.

- Tesla installed 100 MW of solar in Q4 2023.

- Tesla's Powerwall installations continue to grow, supporting grid stability.

- The company is expanding its energy products to various markets.

Tesla's value propositions emphasize sustainable transportation with its EVs. High performance and tech innovation, like Autopilot, also drive value. Integrated energy solutions, including Powerwall, round out the offering.

| Value Proposition | Description | 2024 Data |

|---|---|---|

| Sustainable Transportation | Electric vehicles for environmentally conscious consumers. | Delivered over 1.8M EVs worldwide |

| High Performance & Innovation | Instant torque, smooth handling, Autopilot, OTA updates. | Q4 '23 deliveries: 484,507 vehicles |

| Integrated Energy Solutions | Solar panels, Powerwall for sustainable power. | Q4 '23 Energy revenue: $1.44B |

Customer Relationships

Tesla's direct sales model bypasses traditional dealerships, fostering direct customer relationships. This enables Tesla to control the customer experience, from purchase to service. In 2024, this model contributed significantly to Tesla's brand loyalty and customer satisfaction scores. It also allows for seamless online and in-person purchasing experiences.

Tesla's smartphone app enables remote vehicle interaction. Customers preheat, monitor charging, and personalize settings. This connectivity boosts convenience, improving customer satisfaction. In 2024, app usage increased by 15% among Tesla owners, reflecting its importance. The app's features contribute to Tesla's premium brand experience.

Tesla's customer support relies on service centers and mobile units. Mobile service boosts convenience with on-site repairs. This approach emphasizes transparency and customer satisfaction. In 2024, Tesla aimed to improve service response times. Customer satisfaction scores are closely monitored.

Community Engagement

Tesla cultivates a vibrant community through online forums, social media, and Tesla Owners Clubs. These channels enable customers to connect, share experiences, and advocate for the brand, fostering loyalty. This engagement strengthens the customer-brand relationship, driving positive word-of-mouth. In 2024, Tesla's social media reach saw a 25% increase in engagement.

- Tesla's online forums boast over 500,000 active members.

- Tesla Owners Clubs host regular events attended by thousands worldwide.

- Social media engagement increased by 25% in 2024, per internal data.

- Community advocacy boosts brand perception and sales.

Loyalty Programs and Referrals

Tesla fosters strong customer relationships through loyalty programs and referral incentives, aiming to boost repeat business and brand loyalty. These programs reward existing customers for referring new buyers, enhancing customer advocacy. Tesla's first-party used EV sales also contribute to customer retention and strengthen these relationships. In 2023, Tesla's referral program offered incentives like free Supercharging or discounts on accessories. This approach has helped maintain high customer satisfaction and brand loyalty, crucial for sustaining growth.

- Referral programs offer rewards like free Supercharging.

- First-party used EV sales improve customer retention.

- Customer satisfaction is high, supporting brand loyalty.

Tesla's customer relationships hinge on direct sales, app-based interaction, and accessible support. They use online forums and social media for community building and brand advocacy. Loyalty programs and referrals enhance customer retention and brand loyalty.

| Customer Engagement | Metrics | 2024 Data |

|---|---|---|

| App Usage | Increase | 15% |

| Social Media Engagement | Increase | 25% |

| Referral Program | Incentives | Free Supercharging |

Channels

Tesla's online platform, Tesla.com, is a crucial direct sales channel. It facilitates a large volume of vehicle orders, offering configuration and instant pricing. In 2024, online sales accounted for over 80% of Tesla's vehicle deliveries globally. The platform provides financing options, streamlining the purchasing process. This strategy supports Tesla's direct-to-consumer model.

Tesla strategically operates company-owned stores and galleries globally, facilitating direct customer engagement. These locations offer hands-on experiences with Tesla products, aiding in informed decision-making. This direct sales model ensures uniform pricing and service standards. In 2024, Tesla's retail footprint included approximately 400 stores worldwide.

Tesla's mobile service units offer on-site maintenance and repairs, boosting customer convenience. This approach reduces the need for service center visits. Mobile units handle a significant portion of repairs, enhancing efficiency. In 2024, Tesla aimed to increase mobile service capacity by 20% to meet growing demand. This is supported by a 15% reduction in customer wait times.

Partnerships and Collaborations

Tesla strategically forges partnerships to broaden its market footprint and enhance customer offerings. Collaborations with hotels and restaurants provide convenient charging solutions. Utilities partnerships support energy infrastructure development. These alliances boost Tesla's market position.

- Tesla's Supercharger network expanded to over 50,000 chargers globally by late 2023.

- Partnerships increased customer convenience for Tesla owners.

- Collaborations with utilities are critical for renewable energy integration.

- These collaborations are essential for Tesla's long-term success.

Social Media and Digital Marketing

Tesla's robust social media and digital marketing strategies are key to engaging customers and boosting its brand. Active online presence is crucial for driving demand and increasing brand recognition. These digital marketing efforts help maintain Tesla's strong market position and fuel its expansion. In 2024, Tesla's social media engagement saw a significant rise, with a 30% increase in followers across major platforms.

- Social media marketing is a key element in Tesla's business strategy.

- Digital marketing efforts help boost brand recognition.

- Tesla's online presence drives customer demand.

- Effective digital marketing supports market position and growth.

Tesla uses direct online sales to streamline vehicle orders, with over 80% of 2024 deliveries via Tesla.com. Company-owned stores facilitate hands-on product experiences and offer uniform standards. Mobile service units and strategic partnerships expand Tesla’s market reach.

| Channel | Description | 2024 Data |

|---|---|---|

| Online Sales | Tesla.com for vehicle orders, configuration, and financing | 80%+ of global vehicle deliveries |

| Retail Stores | Company-owned stores and galleries for direct customer engagement | Approximately 400 stores worldwide |

| Mobile Service | On-site maintenance and repairs | 20% capacity increase planned |

Customer Segments

Tesla's customer base includes tech-savvy professionals drawn to its innovative EV technology. These customers value performance, connectivity, and new features. Data from 2024 shows a 20% increase in tech-savvy buyers. Tesla's advanced tech resonates strongly with this group. In Q4 2024, Tesla's infotainment system saw a 15% usage rise.

Tesla targets environmentally conscious consumers prioritizing sustainability. These buyers want to minimize their carbon footprint. In 2024, Tesla's focus on sustainability resonated strongly. Tesla’s solar roof installations increased by 15% in Q3 2024, demonstrating this appeal.

Tesla focuses on affluent individuals who desire premium, high-quality EVs. This customer segment appreciates performance, design, and exclusivity. Tesla's premium branding appeals to this group. In 2024, Tesla's Model S started at $74,990, reflecting its luxury positioning. The global luxury EV market was valued at $84.8 billion in 2024, showcasing the segment's significance.

Car Enthusiasts

Tesla's appeal to car enthusiasts is undeniable, attracting those who value instant torque, smooth handling, and cutting-edge technology. These customers are drawn to the superior performance and unique driving experience offered by Tesla vehicles. The brand's emphasis on innovation and performance resonates strongly with this segment. In 2024, Tesla's Model S Plaid achieved a 0-60 mph time of just 1.99 seconds, showcasing its performance prowess.

- Tesla's Model S Plaid has a 0-60 mph time of 1.99 seconds.

- Enthusiasts appreciate Tesla's advanced technology.

- Tesla's focus is on innovation and performance.

Early Adopters

Tesla's early adopters are crucial for its success, embracing new tech and driving EV adoption. These customers, often influential, are key to market penetration. Tesla's innovative products and vision strongly resonate with this group. In 2024, early adopters significantly fueled Tesla's growth.

- Early adopters represent a significant portion of Tesla's customer base.

- Their feedback helps refine products.

- They contribute to brand advocacy.

- This segment values innovation and sustainability.

Tesla's customer segments include tech-savvy, environmentally conscious, and affluent individuals, all valuing performance and innovation. Car enthusiasts are drawn to Tesla's cutting-edge technology and driving experience. Early adopters significantly boost Tesla's market presence.

| Customer Segment | Key Attributes | 2024 Data |

|---|---|---|

| Tech-Savvy Professionals | Performance, connectivity | 20% increase in tech-savvy buyers |

| Environmentally Conscious | Sustainability | 15% rise in solar roof installations (Q3 2024) |

| Affluent Individuals | Premium EVs | Model S starting at $74,990, luxury EV market $84.8B |

Cost Structure

Tesla's commitment to innovation is evident in its substantial R&D spending. In 2023, Tesla's R&D expenses reached approximately $3.9 billion. This investment fuels advancements in vehicle design, autonomous driving, and battery tech. Such continuous R&D is essential for maintaining its competitive edge.

Tesla's manufacturing costs are significant, encompassing labor, materials, and factory operations. In Q4 2023, Tesla's cost of revenues was $19.4 billion. Efficient production is crucial for profitability. Tesla's Gigafactories aim to streamline and reduce per-unit expenses. High material costs impact overall expenses.

Tesla allocates significant resources to sales and marketing. In 2024, these expenses included retail locations, online ads, and events. The company's marketing strategy aims to boost demand. For 2024, S&M expenses were around $3 billion.

Capital Expenditures

Tesla's cost structure heavily involves capital expenditures, especially for Gigafactories and infrastructure. These investments are crucial for expanding production capacity and supporting growth. Strategic capital allocation is key to achieving economies of scale. In 2024, Tesla's capital expenditures were significant.

- Tesla's capital expenditures in 2024 were approximately $7 billion.

- Gigafactory construction and equipment accounted for a large portion.

- These investments support long-term production and expansion goals.

Operating Expenses

Tesla's operating expenses are a crucial part of its cost structure, covering administrative costs, employee salaries, and facility upkeep. These expenses are essential for the daily functions of the company. Effective management of these costs directly impacts profitability and the overall financial health of Tesla. In 2024, Tesla's operating expenses were significant, reflecting its substantial operational scale.

- Operating expenses include R&D, SG&A, and other operational costs.

- In 2024, Tesla's operating expenses were approximately $9 billion.

- Efficient expense control is vital for maintaining profitability.

- Cost management supports sustainable financial performance.

Tesla's cost structure involves R&D, manufacturing, sales & marketing, and capital expenditures. In 2024, R&D reached about $3.9B, and S&M was around $3B. Capital expenditures were approximately $7B, focusing on expanding production.

| Expense Category | 2024 Cost (Approx.) | Notes |

|---|---|---|

| R&D | $3.9B | Continuous innovation in vehicles, autonomous driving. |

| Sales & Marketing | $3B | Retail, online ads, boosting demand. |

| Capital Expenditures | $7B | Gigafactory, infrastructure, production expansion. |

Revenue Streams

Tesla's main income source is vehicle sales and leasing. This includes various models, such as sedans and SUVs. Automotive sales significantly impact Tesla's financial results. In Q4 2023, automotive revenue reached $21.56 billion. This shows the importance of vehicle sales.

Tesla's energy generation and storage revenue streams come from selling, leasing, and installing solar and storage products. This includes residential solar panels, Powerwall batteries, and large-scale energy solutions. In Q3 2023, Tesla's energy generation and storage revenue was $1.4 billion. This segment's growth is a key part of Tesla's business model.

Tesla generates revenue by selling regulatory credits to automakers. This is a high-margin income stream unique to Tesla. In 2023, Tesla earned $1.79 billion from these credits. Regulatory credits significantly boost Tesla's overall profitability.

Charging Network and Software Services

Tesla's revenue streams include its Supercharger network, generating income from electricity sales and charging subscriptions. The company also benefits from in-car software upgrades and premium feature sales. These services contribute to Tesla's recurring revenue, boosting its financial stability. In Q3 2023, Tesla's energy generation and storage revenue reached $1.48 billion.

- Supercharger revenue from electricity sales and subscriptions.

- Revenue from in-car software additions and premium features.

- These services provide recurring revenue streams.

- Energy generation and storage revenue reached $1.48B in Q3 2023.

Service and Other Revenue

Tesla's "Service and Other Revenue" encompasses various income streams beyond vehicle sales. This includes revenue from after-sales vehicle services, sales of used vehicles, retail merchandise, and vehicle insurance. These additional streams enhance customer loyalty and contribute to Tesla's overall financial performance. In 2023, Tesla's total revenue was $96.773 billion, with service and other revenue playing a part.

- After-sales services provide a recurring revenue source.

- Used vehicle sales offer a secondary market for Tesla products.

- Retail merchandise expands brand presence and generates income.

- Vehicle insurance diversifies revenue and customer engagement.

Tesla's revenue streams are diverse. Supercharger and software services offer recurring income. In Q3 2023, energy generation and storage revenue hit $1.48B.

| Revenue Stream | Description | Financial Data (2023) |

|---|---|---|

| Automotive Sales | Sales and leasing of vehicles (sedans, SUVs) | Q4: $21.56B |

| Energy Generation/Storage | Solar panel, Powerwall sales/leases | Q3: $1.4B |

| Regulatory Credits | Sales to other automakers | $1.79B |

Business Model Canvas Data Sources

The Tesla Business Model Canvas relies on market reports, financial data, and strategic planning documents. These ensure a data-driven and accurate representation.