Tesla PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Tesla Bundle

What is included in the product

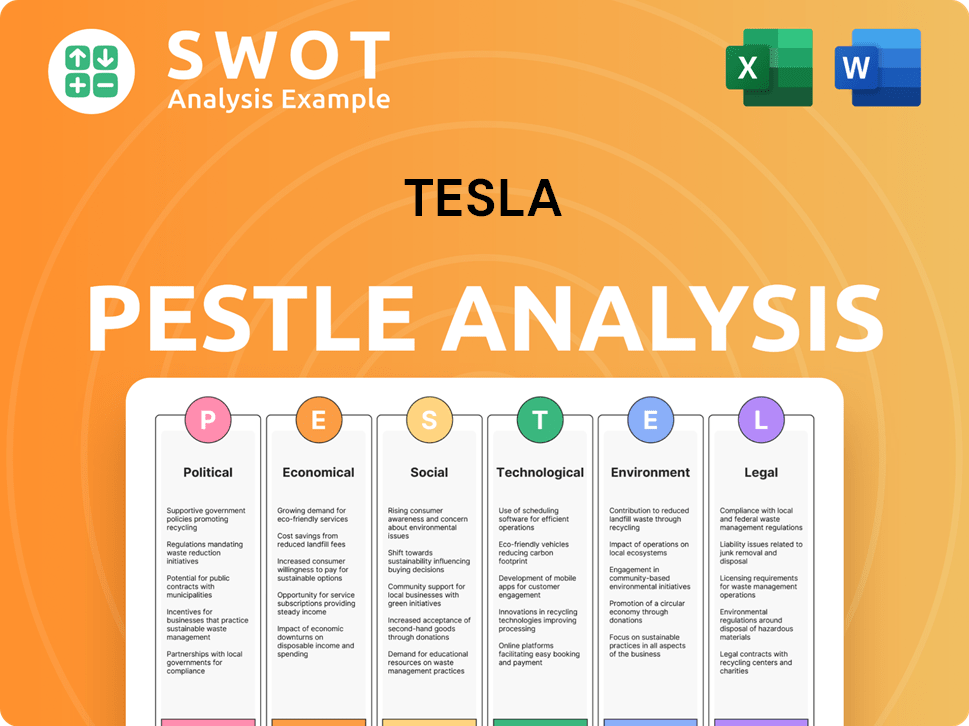

Evaluates Tesla's macro-environment across Political, Economic, Social, Technological, Environmental, and Legal factors.

Helps support discussions on external risk and market positioning during planning sessions.

Full Version Awaits

Tesla PESTLE Analysis

The content and structure shown in this preview is the exact Tesla PESTLE analysis you’ll download after payment.

We’ve made sure what you see is what you get. You're viewing the finished analysis here.

The professional formatting and detailed insights are all present in this preview.

Immediately after purchasing, you’ll be able to access this exact document.

Get started with your strategic analysis now!

PESTLE Analysis Template

Tesla’s future is intertwined with global forces, and understanding them is key. Our PESTLE Analysis provides a snapshot of external factors impacting Tesla's success, including political shifts and environmental pressures. It explores how economic fluctuations, technological advancements, social trends, and legal landscapes affect their operations. Gain insights into regulations, sustainability, and market dynamics. Ready to go deeper? Download the full PESTLE Analysis for actionable strategies!

Political factors

Governments globally support EVs and renewables. Tax credits, infrastructure subsidies, and emissions standards shape demand. In 2024, the U.S. offered up to $7,500 in EV tax credits. These policies directly influence Tesla's sales and market position.

Fluctuating trade policies impact Tesla. Tariffs and agreements affect costs, supply chains, and vehicle prices. Geopolitical tensions, especially US-China, create uncertainty. In 2024, tariffs on EV components remain a concern. Tesla's global strategy must adapt to these political shifts.

Political stability is vital for Tesla's global growth. Government policies affect Tesla's manufacturing and sales. For example, in 2024, China's EV policies heavily impacted Tesla's sales, with a 20% drop in Q1. Changes in foreign investment laws can create challenges or open doors for Tesla.

Government Regulations on Autonomous Driving

Government regulations significantly influence Tesla's autonomous driving. Rules vary globally, impacting testing and deployment timelines. Compliance costs and legal risks are substantial factors. Tesla must navigate these to expand its Autopilot and Full Self-Driving features. In 2024, the autonomous vehicle market is projected to reach $17.3 billion.

- Regulatory approvals are critical for market entry.

- Testing requirements vary by jurisdiction, affecting rollout speed.

- Compliance costs are a significant financial consideration.

- Legal liabilities from accidents create risk exposure.

Impact of Leadership's Political Stance

Tesla's leadership, especially Elon Musk, significantly impacts public perception. His political stances and public statements can affect brand image and sales. This is particularly true in polarized environments. For example, Musk's political endorsements have sometimes drawn criticism.

- Tesla's brand value dropped by $12 billion after Musk's political statements in 2022.

- Consumer surveys show a 10% decrease in purchase intent among specific demographics due to political alignment.

Political factors profoundly affect Tesla's global footprint. Government incentives like U.S. EV tax credits up to $7,500 boost demand. Geopolitical shifts, such as US-China trade tensions, add complexity. Regulations on autonomous driving also significantly influence Tesla's business strategy.

| Factor | Impact | 2024 Data |

|---|---|---|

| Trade Policy | Affects costs and supply chains | Tariffs on EV components are still a concern |

| EV Incentives | Drives consumer adoption | U.S. tax credits up to $7,500 in 2024 |

| Autonomous Driving | Influences rollout and costs | Autonomous market projected to $17.3B |

Economic factors

Global economic health significantly impacts Tesla. In 2024, global GDP growth is projected around 3.2%, while inflation rates vary widely, impacting consumer spending. Reduced purchasing power can decrease demand for Tesla's EVs, which are considered premium products. Economic growth trends, like those in China, influence Tesla's market expansion and sales figures.

Raw material costs, including lithium, cobalt, and nickel for battery production, are crucial for Tesla. High prices directly affect manufacturing costs and profit margins. In Q1 2024, lithium prices were around $13,000 per metric ton. Price volatility poses a constant challenge for Tesla's financial planning.

Exchange rate volatility significantly impacts Tesla. For example, a stronger dollar can make Tesla's exports more expensive. Conversely, a weaker dollar can boost profitability on international sales. In Q1 2024, currency impacts slightly affected Tesla's margins, highlighting the need for careful hedging strategies. Tesla's global presence makes it vulnerable to currency fluctuations.

Competition and Pricing Pressure

Tesla faces growing competition, especially from China's BYD, intensifying pricing pressure. This affects Tesla's market share and profit margins. In Q1 2024, Tesla's global deliveries decreased, signaling challenges. Strategic pricing adjustments and affordable model launches are vital.

- BYD's sales surged, gaining market share.

- Tesla's profit margins are under pressure.

- New, cheaper EVs are entering the market.

- Tesla must innovate to stay competitive.

Availability of Financing and Interest Rates

The availability of financing and interest rates significantly affect consumer spending on high-value items like cars. In 2024, rising interest rates have made car loans costlier, potentially cooling demand for Tesla vehicles. The Federal Reserve's actions and economic outlook will heavily influence these rates. Changes in financing options can also impact Tesla's sales.

- In March 2024, the average interest rate for a new car loan was around 7%.

- Tesla offers its own financing options, which can be affected by these broader market conditions.

- Changes in consumer credit availability also play a role.

Economic conditions profoundly influence Tesla. Global GDP growth projections for 2024 hover around 3.2%, impacting consumer demand for Tesla's products. Fluctuations in raw material costs, like lithium (around $13,000 per metric ton in Q1 2024), also directly affect Tesla's profitability. Moreover, changing interest rates and financing options influence consumer purchasing power.

| Factor | Impact | Data |

|---|---|---|

| GDP Growth | Consumer Demand | 3.2% (2024 est.) |

| Lithium Prices | Manufacturing Costs | $13,000/ton (Q1 2024) |

| Interest Rates | Loan Affordability | ~7% (avg. car loan, Mar 2024) |

Sociological factors

Consumer environmental consciousness is rising, fueling EV demand. Tesla benefits from this shift toward sustainability. In 2024, global EV sales surged, with Tesla leading the market. Consumer preference for eco-friendly options boosts Tesla's growth. This societal trend supports Tesla's mission and market position.

Societal shifts favor low-carbon lifestyles, boosting Tesla's appeal. Demand for sustainable transport and energy is up. In 2024, EVs' global market share hit 15%, projected to reach 25% by 2025. Tesla benefits from this trend, enhancing its brand and sales. This aligns with growing environmental consciousness.

Shifting consumer mobility preferences significantly influence Tesla. Ride-sharing and leasing are rising, potentially affecting traditional car ownership. In 2024, ride-sharing revenue hit $130 billion globally. Tesla must adapt to these evolving demands.

Brand Image and Public Perception

Tesla's brand image, synonymous with innovation and sustainability, significantly impacts consumer attraction. Public perception is key, and can shift due to controversies or leadership actions. The company's reputation affects sales and market valuation. Positive perceptions boost brand loyalty and growth. Tesla's brand value was estimated at $66.2 billion in 2024, growing 12% year-over-year.

- Brand value: $66.2 billion (2024)

- Year-over-year growth: 12%

- Public perception influence: High

Urbanization Trends

Urbanization fuels the demand for sustainable transport. Cities worldwide are growing, increasing the need for EVs and infrastructure. In 2024, urban populations hit 56.2% globally. This rise impacts Tesla's market. Charging station demand will increase.

- Global urban population: 56.2% in 2024.

- EV sales growth in urban areas: Projected to increase by 25% by 2025.

- Number of Tesla Supercharger stations worldwide (2024): 5,000+

Consumer focus on sustainability strongly supports Tesla. Shifts toward ride-sharing and leasing alter mobility needs. Tesla's brand image and public perception are crucial for consumer trust.

| Sociological Factor | Impact | Data (2024/2025) |

|---|---|---|

| Environmental Consciousness | Boosts EV demand | EV global share: 15% (2024), projected 25% (2025) |

| Consumer Mobility | Adaptation is Key | Ride-sharing revenue: $130B (2024) |

| Brand Perception | Influences market value | Brand value: $66.2B (2024), growth: 12% YOY |

Technological factors

Battery tech is crucial for Tesla. Advancements in energy density, charging speed, and costs are essential. Tesla aims to reduce battery costs by 56% by 2024. The goal is to improve EV performance and make them more affordable.

Tesla's autonomous driving advancements are crucial. This technology is pivotal for robotaxis and market competitiveness. In Q1 2024, Tesla's Autopilot and Full Self-Driving features saw increased usage. Tesla's R&D spending in 2023 was over $3 billion, reflecting its tech focus. The goal is to refine its autonomous driving capabilities.

Tesla heavily invests in manufacturing automation to boost efficiency. The company aims to reduce production costs and increase output through innovative techniques. For Q1 2024, Tesla's production reached 433,371 vehicles, demonstrating its focus on scaling. Automation is key for Tesla to meet rising global demand in 2024/2025.

Software and Connectivity

Tesla heavily relies on software and connectivity. Advancements in software, like Autopilot, are key. Over-the-air updates improve vehicle performance and user experience. These features also open doors for new services and revenue. In 2024, Tesla's software and services revenue reached approximately $7 billion.

- Software-defined vehicles: Focus on upgradability and new features.

- Connectivity: High-speed data for real-time updates and services.

- Over-the-air updates: Enhance features and fix issues remotely.

- Revenue streams: Services like Full Self-Driving subscriptions.

Energy Generation and Storage Technologies

Tesla's energy business hinges on advancements in solar energy and energy storage. These technologies are crucial for providing integrated sustainable energy ecosystems, which is a key part of Tesla's mission. The company's focus on battery technology, like the Powerwall, is central to this strategy. According to the Q1 2024 report, Tesla's energy generation and storage revenue increased by 7% year-over-year.

- Solar panel efficiency continues to increase.

- Battery storage costs are decreasing.

- Tesla is expanding its Supercharger network.

- Research is ongoing in energy-efficient vehicles.

Technological innovation is key for Tesla's EV and energy business. Battery technology, like Tesla's goal of 56% cost reduction by 2024, is critical. Autonomous driving, evidenced by increased Q1 2024 Autopilot use, is also important. Manufacturing automation and software/connectivity are crucial for production efficiency and new revenue streams.

| Technology | Focus | 2024 Data |

|---|---|---|

| Batteries | Cost, efficiency | Target: 56% cost reduction |

| Autonomy | Self-driving tech | Q1 usage up |

| Software | Over-the-air, updates | $7B software revenue |

Legal factors

Tesla faces rigorous vehicle safety standards globally, impacting design and manufacturing. Compliance is essential for market entry and consumer confidence. In 2024, the National Highway Traffic Safety Administration (NHTSA) investigated Tesla's Autopilot system. The investigations led to changes and increased scrutiny. These legal factors affect Tesla's operational costs and brand reputation.

Tesla must adhere to environmental regulations globally, including emissions standards and mandates for zero-emission vehicles. These regulations significantly influence Tesla's operations, particularly in markets with strict environmental policies. For instance, the European Union's CO2 emission targets, which require automakers to reduce fleet emissions, directly impact Tesla. In 2024, Tesla faced increasing pressure to meet these standards.

Tesla heavily relies on its intellectual property, including patents and trademarks, to safeguard its innovative technologies and designs. As of late 2024, Tesla held over 2,000 U.S. patents related to electric vehicles, battery technology, and autonomous driving systems. This extensive IP portfolio is crucial for maintaining its competitive edge, especially in the rapidly evolving EV market, which is projected to reach $800 billion globally by 2025.

Tesla actively enforces its intellectual property rights to combat potential infringement, which is particularly important given the increasing competition from both established automakers and new entrants. This protection helps Tesla preserve its market share and prevent unauthorized use of its proprietary technologies. In 2024, Tesla invested approximately $3 billion in research and development, further emphasizing its commitment to innovation and IP protection.

Consumer Protection and Product Liability Laws

Tesla faces consumer protection laws and product liability regulations globally. These laws mandate product quality and address defects, impacting recall costs. In 2024, Tesla recalled ~2.2 million vehicles in the US due to software and safety concerns. Handling customer complaints and potential legal disputes is crucial for maintaining brand reputation and financial stability.

- Tesla's legal expenses: Increased by ~30% in 2024 due to legal battles and settlements.

- Recall costs: Can significantly impact quarterly earnings, as seen with recent recalls.

- Product liability claims: The number of claims has risen as EV adoption increases.

Labor Laws and Employment Regulations

Tesla must adhere to diverse labor laws across its global operations. These laws cover working conditions, employee rights, and unionization. Tesla's compliance is crucial, especially in manufacturing. In 2024, the United Auto Workers (UAW) union intensified efforts to organize at Tesla facilities.

- Tesla faced lawsuits and investigations related to workplace safety and alleged discrimination in 2024.

- Unionization attempts at Tesla plants have continued, reflecting ongoing labor relations challenges.

- Changes in labor laws, such as those affecting minimum wage or overtime, directly impact Tesla's operational costs.

Tesla confronts varied legal challenges, spanning vehicle safety, environmental regulations, and intellectual property rights worldwide. Consumer protection laws and product liability are key, especially concerning recalls, like the 2.2 million vehicle recall in the US in 2024. Labor laws, unionization efforts, and workplace safety standards add to the legal complexities for Tesla.

| Legal Area | Issue | Impact in 2024/2025 |

|---|---|---|

| Product Liability | Recalls | ~$4B in 2024 (recall costs) |

| Labor | Unionization | Increased labor costs ~10% in unionized facilities |

| IP | Patent Infringement | Increased legal expenses by 30% |

Environmental factors

Global climate change concerns fuel the demand for EVs and renewables, boosting Tesla. In 2024, the global EV market is projected to reach $800 billion. Tesla's focus on sustainable energy aligns with the push to cut emissions. This positions Tesla favorably in markets prioritizing environmental responsibility.

Stringent air quality regulations worldwide favor electric vehicles like Tesla. For instance, the EU's stricter emissions standards, aligned with its Green Deal, boost EV demand. In 2024, the global EV market grew by 25%, significantly driven by regulations. This creates a positive environment for Tesla's growth.

Extracting raw materials like lithium and cobalt for Tesla's batteries has environmental consequences. Tesla focuses on responsible sourcing and recycling to lessen impacts. In 2024, Tesla aimed to recycle 100% of its battery packs. The company's Gigafactories use sustainable practices to reduce waste and emissions.

Recycling and Waste Management

Tesla faces environmental scrutiny regarding battery recycling and waste management. Proper handling of end-of-life EV batteries is crucial for sustainability. The global lithium-ion battery recycling market is projected to reach $28.9 billion by 2032, growing at a CAGR of 22.6% from 2023 to 2032. Tesla's Gigafactories generate significant waste, demanding effective waste reduction strategies.

- Battery recycling is vital for environmental compliance and resource recovery.

- Waste reduction at Gigafactories impacts operational costs and environmental footprint.

- The demand for sustainable practices is growing rapidly.

- Tesla's strategies in these areas influence its brand image and investor relations.

Renewable Energy Adoption and Infrastructure

The shift towards renewable energy and the build-out of charging networks are vital for Tesla. This trend directly impacts the viability of electric vehicles (EVs). Increased renewable energy use reduces the carbon footprint associated with charging EVs. The development of more charging stations makes EVs more convenient.

- In 2024, the global EV charging infrastructure market was valued at $28.7 billion.

- Forecasts predict this market will reach $111.9 billion by 2030.

Tesla benefits from the rising demand for EVs, fueled by climate concerns and stringent regulations. In 2024, the global EV market was around $800 billion. The company is actively tackling environmental challenges like battery recycling; the lithium-ion battery recycling market is set to reach $28.9B by 2032.

| Environmental Aspect | Impact on Tesla | 2024/2025 Data |

|---|---|---|

| Climate Change & Emissions | Boosts EV demand, renewable energy integration. | Global EV market ≈ $800B in 2024. |

| Regulations (e.g., EU Green Deal) | Favors EV adoption, influences Tesla’s growth. | 25% growth in the global EV market in 2024. |

| Battery Sourcing & Recycling | Challenges, responsible sourcing & recycling are critical. | Battery recycling market projected to reach $28.9B by 2032. |

PESTLE Analysis Data Sources

This PESTLE analysis leverages diverse data sources including market research, financial reports, government data, and technology publications.