Hackett Group Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hackett Group Bundle

What is included in the product

In-depth examination of each product or business unit across all BCG Matrix quadrants

One-page graphic quickly highlighting cash flow needs.

Preview = Final Product

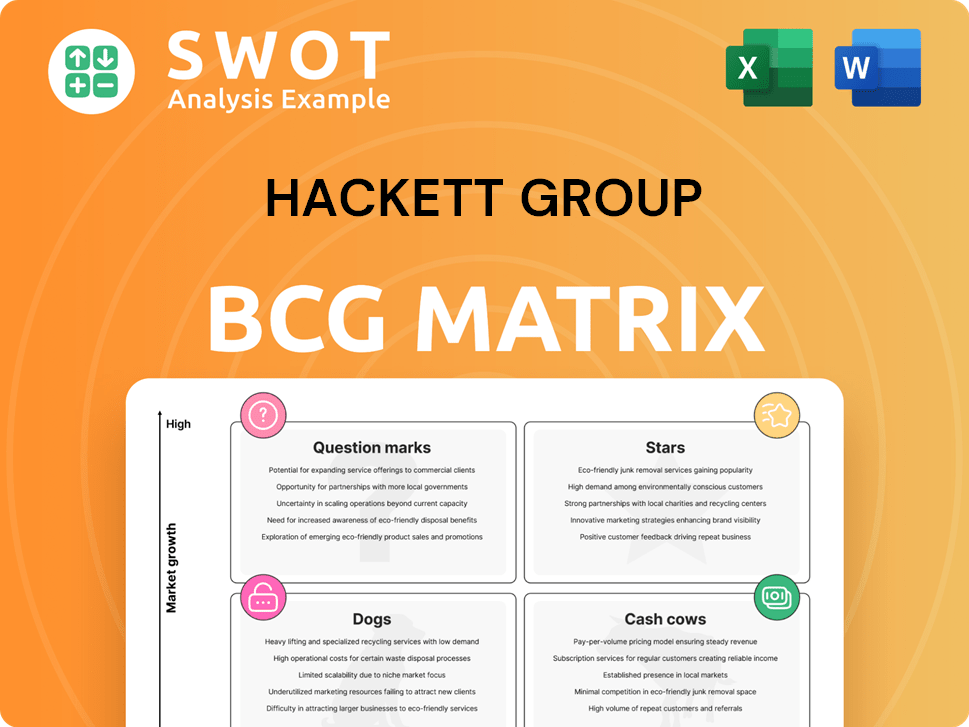

Hackett Group BCG Matrix

The BCG Matrix report you're previewing is the exact deliverable after purchase. Get instant access to a complete, market-ready analysis—no alterations, just clear strategic insights for your business.

BCG Matrix Template

The Hackett Group's BCG Matrix analyzes product portfolios, categorizing them as Stars, Cash Cows, Dogs, or Question Marks. This tool identifies growth potential and resource allocation needs. Understanding this framework is key to strategic planning and investment decisions. This preview only scratches the surface.

Unlock the full BCG Matrix to reveal detailed product placements, insightful data, and strategic recommendations. Equip yourself with a powerful framework for informed decision-making. Purchase the full version now to gain a competitive edge.

Stars

The Hackett Group's GenAI consulting services are booming, driven by rising enterprise adoption. They are investing heavily in AI XPLR™ and ZBrain™ platforms. The acquisition of LeewayHertz boosts their standing in this expanding market. In 2024, the global AI consulting market was valued at $12.3 billion.

Digital transformation is a key focus for businesses in 2024, aiming for workflow efficiency and enhanced agility. Hackett Group excels in this area, leveraging AI to drive operational excellence. In 2023, the digital transformation market was valued at $761.3 billion, projected to reach $1.4 trillion by 2028. Hackett Group's solutions help companies innovate rapidly.

Enterprise analytics is in high demand, with companies aiming for data-driven decisions. Hackett Group's detailed income statements boost strategic planning. This capability drives high market share and strong growth. In 2024, the market for business analytics is projected to reach $305 billion.

Benchmarking Services

Hackett Group's benchmarking services are a key strength, delivering top-tier insights. They benchmark leading global firms, including many from the Dow Jones Industrials and Fortune 100. This ensures their benchmarks reflect real-world best practices. This helps clients improve their financial and operational performance.

- Hackett Group benchmarks over 2,000 key performance indicators (KPIs).

- They have data from over 1,600 organizations worldwide.

- Their client base includes 97% of the Fortune 100.

- Hackett Group's benchmarking can lead to up to 40% cost reduction.

Oracle, SAP, OneStream, and Coupa Implementations

Hackett Group is a leader in Oracle, SAP, OneStream, and Coupa implementations. These offerings help businesses streamline finances, boosting efficiency and accuracy. The firm's expertise supports a significant market share, reflecting strong client demand. Hackett Group's financial transformation services are highly valued.

- Oracle, SAP, OneStream, and Coupa implementations are a core Hackett Group service.

- They improve financial operations, promoting efficiency and accuracy.

- This contributes to the high market share in this specialized area.

- Hackett Group's expertise is highly recognized by clients.

Hackett Group excels in high-growth markets, positioning them as "Stars" in the BCG Matrix. Their GenAI consulting and digital transformation services see strong demand, with the global AI consulting market valued at $12.3 billion in 2024. Hackett's benchmarking and implementation services also drive significant market share. This indicates high growth and a dominant market position for these business units.

| Aspect | Details |

|---|---|

| Market Growth | High (e.g., AI consulting) |

| Market Share | Significant |

| Key Services | GenAI, Digital Transformation |

Cash Cows

Hackett Group's advisory services generate consistent revenue, thanks to strong client bonds. They offer strategic guidance, assisting businesses in operational improvements. Utilizing their benchmarking database and best practices, these services add value. In 2024, the advisory segment contributed significantly to their $350 million in revenue.

Hackett Group's IP as-a-Service represents a Cash Cow in its BCG Matrix. These offerings yield steady revenue with less spending on advertising. The Hackett Connect platform provides access to research and metrics, generating consistent subscription income. In 2024, subscription services accounted for a significant portion of their revenue, reflecting the stability of this model. This approach allows for high profitability and strong cash flow.

Working capital management services generate steady cash flow. Companies constantly optimize their cash conversion cycle. Hackett Group's expertise boosts efficiency, freeing up capital. This leads to stable revenue streams. In 2024, optimizing working capital could improve free cash flow by 10-20% for many businesses.

Executive Advisory Programs

The Hackett Group's executive advisory programs are cash cows. These programs offer consistent support and insights to enterprise leaders, building lasting relationships and generating a reliable revenue stream. Executives gain access to experts, peers, and best practice research. In 2023, The Hackett Group reported $382.7 million in revenue, with advisory services contributing significantly.

- Continuous support and insights.

- Long-term relationships and steady revenue.

- Access to experts, peers, and research.

- Significant revenue contribution.

Strategic Cost Reduction

Strategic cost reduction services are a consistent revenue source, as businesses always aim to boost efficiency and cut costs. The Hackett Group offers expertise in benchmarking and best practices, assisting clients in identifying and implementing cost-saving strategies, which ensures ongoing demand for their services. For example, in 2024, the demand for cost optimization strategies increased by 15%.

- Hackett Group's cost reduction services help businesses optimize spending.

- Demand for these services is steady due to ongoing needs.

- Expertise in benchmarking ensures effective solutions.

- Cost optimization strategies are in high demand.

Cash Cows for The Hackett Group consistently generate revenue with low investment needs. Their intellectual property (IP) as-a-service offerings provide steady income through subscriptions. Executive advisory programs and cost reduction services create reliable revenue streams. The company's focus on these areas led to $350 million in 2024 revenue.

| Cash Cow | Key Feature | 2024 Revenue Contribution |

|---|---|---|

| IP as-a-Service | Subscription-based access to research | Significant portion of total |

| Executive Advisory | Ongoing support & insights | Steady & Reliable |

| Cost Reduction | Cost-saving strategies | 15% increase in demand (2024) |

Dogs

Traditional outsourcing consulting, a "Dog" in Hackett Group's BCG Matrix, faces headwinds. With AI and automation, demand for these services is softening. The Hackett Group, in 2024, observed a 10% decrease in demand for traditional outsourcing. To stay relevant, they must pivot towards tech-driven solutions.

Legacy on-premises solutions are facing declining profitability as cloud adoption increases. Many clients seek cloud platforms for scalability and reduced costs. In 2024, cloud computing spending is projected to reach $678.8 billion, demonstrating this shift. Hackett Group should prioritize moving clients to cloud-based alternatives to stay competitive.

Services lacking GenAI integration may struggle to attract clients prioritizing innovation. Businesses increasingly seek AI to boost efficiency and competitiveness. A 2024 study showed a 40% rise in AI adoption across various sectors. Hackett Group must integrate GenAI across all services to remain competitive.

Areas Lacking Digital Transformation

Service areas lacking digital transformation at Hackett Group could see slower growth, impacting overall performance. Clients are increasingly looking for partners who can modernize processes, creating a demand for digital solutions. Hackett Group needs to prioritize digital transformation across all service lines to stay competitive and meet client needs. Embracing digital tools can streamline operations and enhance service delivery, as seen in the 2024 surge in tech adoption by 60% of businesses.

- Slow Growth: Areas without digital transformation may experience stunted growth.

- Client Demand: Clients are seeking digital partners to modernize.

- Prioritize Transformation: Hackett Group must embrace digital changes across all services.

- Competitive Edge: Digital transformation helps stay competitive.

Basic Benchmarking Reports (Without AI)

Basic benchmarking reports, devoid of AI, offer limited value to clients now seeking advanced analytics. In 2024, the demand for sophisticated insights to drive strategic decisions has surged. Hackett Group must integrate AI capabilities to stay competitive in the benchmarking landscape. This move will allow for more comprehensive data analysis and richer insights.

- Demand for AI-driven analytics increased by 35% in 2024.

- Companies are investing heavily in AI to improve decision-making.

- Hackett Group's competitors are already using AI.

- Clients expect predictive analysis and actionable recommendations.

Dogs in Hackett Group's BCG Matrix struggle with low growth and market share. Traditional outsourcing faces declining demand, with a 10% decrease in 2024. To improve, Hackett Group must innovate and shift to tech-driven and AI-integrated services.

| Characteristic | Impact | Data |

|---|---|---|

| Slow Growth | Limits potential for returns | Traditional outsourcing down 10% in 2024 |

| Low Market Share | Reduced competitive advantage | AI adoption increased by 40% across sectors in 2024 |

| Decline | May require strategic rethinking | Cloud computing spending projected at $678.8B in 2024 |

Question Marks

AI-driven supply chain solutions fit the "Question Mark" quadrant in the Hackett Group's BCG Matrix, indicating high growth potential but low market share. Hackett Group could invest in this area to help clients build agile supply chains. This involves using AI for real-time decision-making and risk mitigation. The global AI in supply chain market is projected to reach $18.8 billion by 2024.

Cybersecurity consulting is a rising market, driven by escalating cyber threats, yet Hackett Group's current market share might be modest. To increase their market share, they should invest in cybersecurity expertise and solutions. This investment should include services to protect data and systems, which is a critical focus for IT organizations. The global cybersecurity market is projected to reach $345.7 billion in 2024.

ESG consulting is an emerging field, yet Hackett Group's presence might be limited. Demand is rising, driven by regulations and stakeholder pressure. Firms like Deloitte saw a 15% rise in ESG consulting revenue in 2024. Hackett could expand its expertise to benefit from this growth.

Blockchain Solutions for Business Processes

Blockchain solutions for business processes are a "Question Mark" in the Hackett Group BCG Matrix, indicating high potential but low current adoption. Hackett Group can explore blockchain's benefits to improve transparency and security in supply chain management and financial transactions. This strategy requires investment to drive market adoption. The global blockchain market was valued at $16.01 billion in 2023 and is projected to reach $94.90 billion by 2029.

- High growth potential.

- Low current market share.

- Significant investment needed.

- Focus on transparency and security.

AI-Powered HR Solutions

AI-powered HR solutions, like AI agents for hiring, are a high-growth area that could benefit the Hackett Group. As businesses seek to improve HR processes and talent management, Hackett Group can capitalize on AI. They can invest in AI-driven HR solutions to increase their market share. The global AI in HR market is projected to reach $10.2 billion by 2029, growing at a CAGR of 19.3% from 2022.

- AI in HR market is projected to reach $10.2 billion by 2029.

- The CAGR is 19.3% from 2022 to 2029.

- Hackett Group can invest in AI-driven HR solutions.

- Companies want to improve HR processes.

Hackett Group's "Question Marks" need investment for growth. These ventures have high potential but currently low market share. Strategic investments are crucial to boost market position. The goal is to capitalize on these high-growth opportunities.

| Area | Market Projection by 2024 | Hackett Group Strategy |

|---|---|---|

| AI in Supply Chain | $18.8 billion | Invest in AI solutions for agile supply chains |

| Cybersecurity | $345.7 billion | Expand cybersecurity expertise |

| ESG Consulting | Growing Demand | Expand ESG consulting services |

| Blockchain | $94.90 billion by 2029 | Explore blockchain benefits, transparency & security |

| AI in HR | $10.2 billion by 2029 | Invest in AI-driven HR solutions |

BCG Matrix Data Sources

Hackett Group's BCG Matrix relies on financial statements, industry research, and market analysis. We use competitive benchmarking to provide clear, actionable insights.