Hackett Group SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hackett Group Bundle

What is included in the product

Analyzes Hackett Group’s competitive position through key internal and external factors.

Facilitates interactive planning with a structured, at-a-glance view.

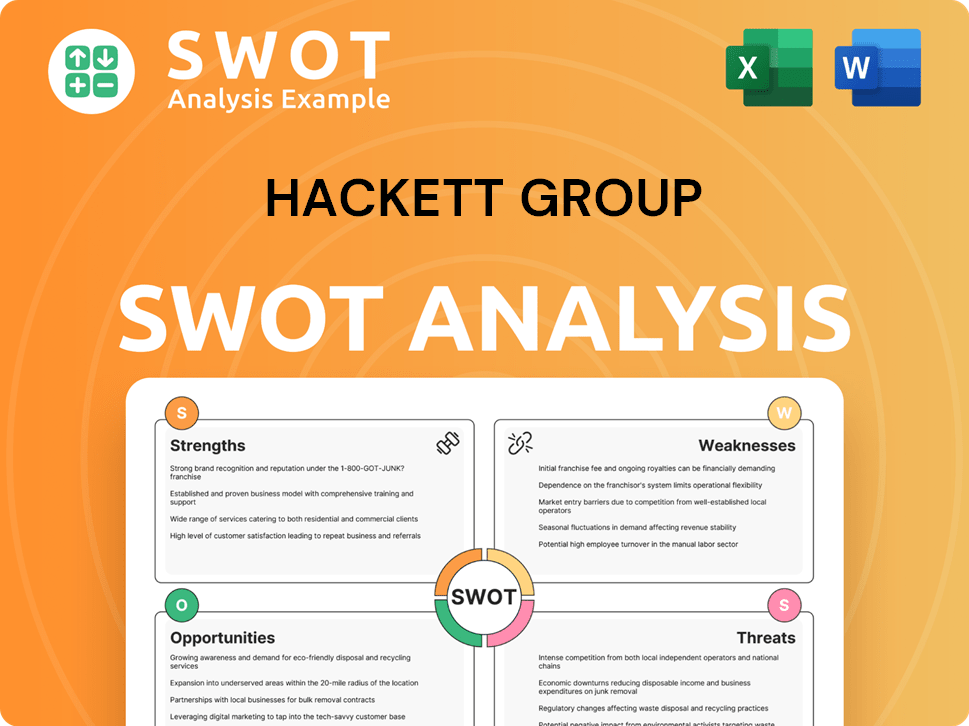

Preview the Actual Deliverable

Hackett Group SWOT Analysis

This is a live preview of the actual SWOT analysis file.

You’ll receive the identical document post-purchase.

See the comprehensive details now.

Purchase unlocks the entire, in-depth report for your use.

It's professional, thorough, and actionable.

SWOT Analysis Template

Our analysis of The Hackett Group identifies key strengths in its consulting expertise and market leadership. We also pinpoint weaknesses like its reliance on specific industries and cyclical revenue. Threats include increasing competition and evolving client needs. But, consider the growth opportunities presented by digital transformation and expansion.

Discover the complete picture behind the company’s market position with our full SWOT analysis. This in-depth report reveals actionable insights, financial context, and strategic takeaways—ideal for entrepreneurs, analysts, and investors.

Strengths

The Hackett Group's strength lies in its robust intellectual property. It has over 26,000 benchmark studies. This offers a significant advantage in advising clients. Their Digital World Class® insights provide cutting-edge advice. Clients gain empirical data to compare performance.

Hackett Group holds a leading position in digital transformation, providing enterprise analytics and digital strategy services. They help businesses boost efficiency and effectiveness through technology adoption. The company's expertise is vital as digital initiatives drive competitiveness. For example, in 2024, the digital transformation market was valued at $760 billion globally, a key area for Hackett's services.

Hackett Group's strategic focus on Generative AI is a key strength. They've invested in Gen AI, acquiring LeewayHertz. Platforms like AI XPLR and ZBrain showcase their end-to-end capabilities. This positions them well in the growing $1.3 trillion Gen AI market by 2032.

Solid Financial Performance

The Hackett Group's financial health is a key strength. Recent reports show revenue surpassing expectations, with strong adjusted earnings per share. While GAAP earnings have varied, the company's cash flow remains robust. Consistent financial growth supports strategic investments. For example, in Q1 2024, The Hackett Group reported revenue of $73.6 million.

- Revenue exceeding guidance.

- Strong adjusted earnings per share.

- Healthy cash flow from operations.

- Consistent financial growth.

High-Quality Client Base

Hackett Group's strength lies in its high-quality client base, which includes a substantial number of Fortune 500 and Global 2000 companies. This prestigious clientele demonstrates the company's strong market reputation and the trust it has earned. Serving these leading global businesses offers valuable insights and opportunities for extensive, high-value engagements. As of 2024, over 97% of Hackett's revenue comes from repeat clients, showcasing strong client retention. The ability to work with such prominent clients significantly enhances the company's credibility.

- 97% Revenue from repeat clients (2024)

- Significant presence in Fortune 500 and Global 2000 companies

- Enhances market reputation and trust

- Provides valuable insights and opportunities

The Hackett Group benefits from strong IP with 26,000+ benchmark studies. It is a leader in digital transformation and Gen AI, with the 2024 market reaching $760 billion.

Its financial health is a strength. Recent Q1 2024 revenue reached $73.6 million. Healthy cash flow supports strategic initiatives. High-quality Fortune 500 client base, with 97% revenue from repeat clients, is a key asset.

| Key Strength | Details | Data (2024/2025) |

|---|---|---|

| Intellectual Property | Extensive benchmark studies, Digital World Class® | 26,000+ studies, market size for digital transformation $760B (2024) |

| Digital Transformation & Gen AI | Enterprise analytics, digital strategy services | Investment in Gen AI; $1.3T market by 2032 |

| Financial Health | Revenue growth, strong cash flow | Q1 2024 Revenue $73.6M, 97% repeat client revenue |

| High-Quality Client Base | Fortune 500/Global 2000 | 97% revenue from repeat clients (2024) |

Weaknesses

The Hackett Group's smaller size, with a market cap of $640 million as of May 2024, compared to Accenture's $200+ billion, presents a competitive disadvantage. This scale difference can restrict their ability to secure massive global contracts. Smaller revenue, approximately $300 million in 2024, also limits investment in global infrastructure and marketing.

The Hackett Group's revenue streams are concentrated in sectors like technology and financial services, and solutions linked to platforms such as Oracle and SAP. A downturn in these sectors or significant platform changes could severely affect the company's finances. In Q4 2024, 60% of Hackett's revenue came from these key areas. Relying heavily on specific tech ecosystems introduces market risks. Changes in client spending habits or tech shifts pose threats.

The Hackett Group's consulting services are vulnerable to economic downturns. Economic uncertainty often delays client decisions, curbing consulting spending. During economic slowdowns, clients might cut or postpone consulting projects. In 2024, the consulting market faced challenges, with slower growth than anticipated. This economic sensitivity makes revenue growth susceptible to broader economic factors.

Challenges in Talent Management

The Hackett Group's talent management faces significant hurdles. Recruiting and retaining skilled professionals, especially in digital transformation and AI, is a constant struggle. High attrition rates and the need for continuous upskilling create operational difficulties. This can directly affect service quality and growth.

- The average attrition rate in the consulting industry is around 15-20% annually.

- Demand for AI and digital transformation skills is projected to increase by 30% in 2024-2025.

Early Stage Adoption of New Offerings

Hackett Group faces weaknesses in early adoption of new offerings, such as Gen AI platforms like AI XPLR. Initial conversion rates from exploratory meetings have been low, potentially delaying revenue generation. This indicates challenges in translating interest into sales and the need for improved sales and implementation strategies. The market is still evolving for advanced AI services.

- Low conversion rates from initial meetings for AI XPLR.

- Potential delay in revenue generation from new platforms.

- Need to refine sales and implementation processes.

Hackett's size limits it, facing giants like Accenture. Sector and platform concentration risks financial impacts. Economic sensitivity hampers consulting growth; talent and early tech adoption present challenges.

| Weakness | Impact | Data Point (2024-2025) |

|---|---|---|

| Smaller Size | Restricts contracts, investment | $640M Market Cap (May 2024); Revenue ~$300M |

| Sector Concentration | Vulnerable to downturns | 60% revenue from key areas (Q4 2024) |

| Economic Sensitivity | Slows revenue growth | Consulting market slower growth in 2024 |

Opportunities

The demand for Gen AI consulting is surging as companies adopt AI for efficiency. Hackett Group's investments in this area are timely, positioning them for growth. Clients are prioritizing Gen AI, creating significant opportunities. The global AI market is projected to reach $200 billion by 2025. This presents a huge chance for Hackett Group.

The Hackett Group's acquisition of LeewayHertz boosts its Gen AI offerings, providing comprehensive solutions. Strategic acquisitions can broaden its service range, geographic presence, and specialized skills. This integration facilitates faster growth and a stronger market stance. In Q1 2024, Hackett's revenue increased, showing the impact of strategic moves.

Clients are boosting tech spending, especially in finance and IT, fueled by digital transformation and AI. This trend creates a positive market for The Hackett Group's services. Increased tech budgets directly translate to opportunities for new engagements. For example, IT spending is projected to reach $5.1 trillion in 2024, according to Gartner.

Leveraging Partnerships with Technology Giants

The Hackett Group can foster growth by partnering with tech giants like Oracle and SAP. These alliances provide ongoing opportunities in their solution areas. As platforms incorporate AI, Hackett's implementation expertise becomes vital. Such partnerships boost referrals and create joint ventures. In 2024, the global IT services market was valued at $1.02 trillion, highlighting the potential within these partnerships.

- Oracle and SAP partnerships offer sustained growth.

- AI integration enhances Hackett's implementation value.

- Partnerships drive referral business.

- The global IT services market was worth $1.02 trillion in 2024.

Addressing the Enterprise Efficiency Gap

Many businesses struggle with efficiency, especially in areas like Global Business Services (GBS), HR, and procurement, because workloads are increasing while budgets are tight. The Hackett Group's focus on benchmarking, best practices, and digital transformation is directly aligned with helping clients boost efficiency and productivity. This need for improvement creates a constant demand for their services. In 2024, the average efficiency gap across various business functions was estimated to be around 20%, highlighting the ongoing challenge.

- Hackett Group's solutions directly address the need for efficiency.

- The efficiency gap represents a continuous market need.

- Focus on benchmarking and digital transformation.

- Increasing workloads and constrained budgets.

The Hackett Group thrives on the soaring demand for Gen AI consulting and its strategic investments. Its acquisition of LeewayHertz and partnerships fuel expansion and service diversity. Tech spending and the need for efficiency, where the company excels, provide huge opportunities.

| Opportunity Area | Key Drivers | 2024/2025 Data |

|---|---|---|

| Gen AI Consulting | Adoption of AI for efficiency, strategic acquisitions. | AI market to $200B (2025 est.). Revenue growth in Q1 2024. |

| Expanded Service Offering | Tech spending in IT/finance & tech partnerships. | IT spending reached $5.1T (2024 est). Global IT services at $1.02T (2024). |

| Efficiency Solutions | Focus on best practices, digital transformation, market need. | 20% efficiency gap in 2024. |

Threats

The Hackett Group faces fierce competition in consulting and digital transformation. Giants like Accenture and Deloitte have vast resources and strong brands. This can lead to pricing pressures, impacting profitability. In 2024, the global consulting market was valued at over $170 billion.

Rapid technological advancements pose a significant threat. AI and automation developments by competitors could quickly diminish the value of Hackett Group's services. Continuous innovation is crucial to adapt; failure risks service obsolescence. In 2024, the global AI market was valued at $238.4 billion, with expected rapid growth.

Ongoing global economic uncertainty, fueled by inflation and rising interest rates, poses a threat. The risk of recession could curb client spending on consulting services. Geopolitical tensions and trade policy shifts further complicate international consulting markets. These external factors, largely outside Hackett Group's control, can significantly impact demand. Real GDP growth forecasts for 2024 are around 2.1% in the US, impacting consulting demand.

Challenges Related to Data and AI Regulation

The Hackett Group faces increasing challenges from data and AI regulations. Government regulations like GDPR and CCPA demand significant compliance investments. These legal hurdles affect data-intensive consulting services, especially those using AI and advanced analytics. Data quality and privacy concerns hinder AI adoption. For example, in 2024, companies spent an average of $5.2 million on GDPR compliance.

- Compliance costs are rising, with global spending on data privacy expected to reach $13.9 billion by the end of 2025.

- Data breaches cost businesses an average of $4.45 million in 2023, highlighting the importance of cybersecurity.

- The EU AI Act, expected to be fully implemented by 2026, will add further regulatory burdens.

Talent Shortages and Wage Inflation

The Hackett Group faces talent shortages, especially in digital transformation and AI, which can increase operational costs. Wage inflation for skilled professionals is a significant concern. The consulting industry struggles to find and retain employees with the required expertise, impacting profitability and scalability.

- According to a 2024 survey by Korn Ferry, the global talent shortage could reach 85.2 million people by 2030.

- The U.S. Bureau of Labor Statistics reported a 4.4% increase in average hourly earnings for all employees in March 2024.

- Deloitte's 2024 Human Capital Trends report highlighted the difficulty in retaining tech talent as a major challenge.

The Hackett Group faces stiff competition, especially from large consulting firms with established brands, which can squeeze profit margins in the competitive consulting market valued at $170B in 2024.

Rapid technological changes and the rise of AI and automation, particularly developments from competitors, threaten the relevance of existing services, where the AI market was valued at $238.4B in 2024 and is set for significant expansion.

Economic uncertainty, including potential recessions, rising interest rates, and geopolitical tensions, poses financial risks, while the data and AI regulations also increase costs; compliance costs in data privacy are expected to reach $13.9B by the end of 2025.

| Threat | Description | Impact |

|---|---|---|

| Competition | Established competitors like Accenture, Deloitte. | Pricing pressures and potential margin contraction. |

| Technological Advancements | Rapid developments in AI and Automation | Risk of service obsolescence. |

| Economic Uncertainty | Inflation, rising rates, recession risks. | Curbed client spending on consulting services. |

SWOT Analysis Data Sources

Hackett Group's SWOT uses financial data, market analysis, expert views, & reliable industry research, offering data-backed insights.