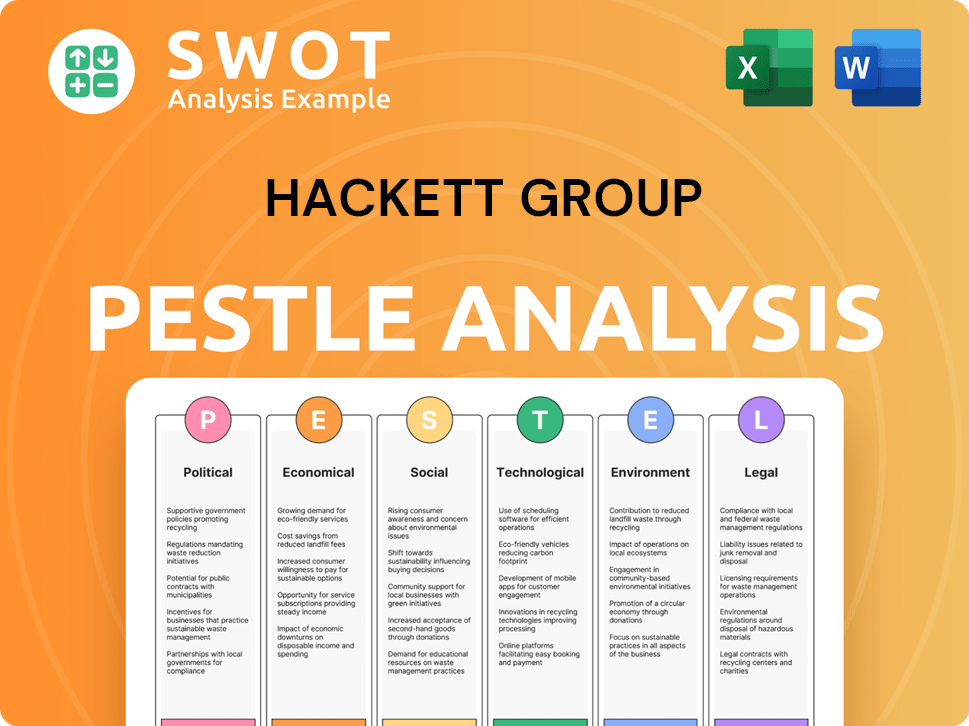

Hackett Group PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hackett Group Bundle

What is included in the product

Unveils how external macro factors impact The Hackett Group through political, economic, and more.

The Hackett Group PESTLE Analysis streamlines complex data for concise, data-driven strategic decision-making.

What You See Is What You Get

Hackett Group PESTLE Analysis

The Hackett Group's PESTLE analysis you're previewing is the full document.

This detailed assessment is exactly what you will receive.

Upon purchase, you'll download the same comprehensive analysis.

The content, layout & information remain unchanged.

It's ready for immediate use!

PESTLE Analysis Template

Analyze the external factors shaping The Hackett Group with our insightful PESTLE Analysis. Discover key political, economic, and technological influences impacting their strategies. We provide a comprehensive view—essential for market research and strategic planning. Ready to uncover hidden opportunities and mitigate potential risks? Get the full, detailed analysis instantly!

Political factors

Geopolitical instability, including conflicts in Ukraine and the Middle East, affects business confidence. This can decrease demand for consulting services. Technology transfer restrictions and increased cybersecurity spending are other impacts. The Hackett Group, due to its global presence, faces these geopolitical risks. In 2024, global defense spending reached $2.44 trillion, reflecting heightened tensions.

Changes in trade policies and tariffs significantly impact international consulting markets. For instance, the US-China trade war saw tariffs affecting various sectors. The Hackett Group, with global operations, faces fluctuating costs and potential revenue shifts from international segments. Uncertainty from these policies can affect their financial performance.

Increased government regulations, especially in data protection and cybersecurity, require substantial compliance efforts and spending. The Hackett Group faces intricate regulatory frameworks across its global operations. For example, the average cost of compliance for businesses rose by 10% in 2024. This includes adapting to evolving laws like GDPR and CCPA, impacting operational budgets.

Government Investment in Digital Transformation

Government investments in digital transformation present lucrative opportunities for consulting firms. The Hackett Group can capitalize on these initiatives as governments modernize. For instance, the U.S. government allocated $3.2 billion for IT modernization in 2024. This trend is expected to continue, boosting demand for advisory services.

- U.S. government spending on IT modernization reached $3.2 billion in 2024.

- European Union plans to invest €134 billion in digital transformation by 2026.

- Increased demand for consulting services related to digital transformation is anticipated.

Political Stability in Operating Regions

Political stability is crucial for The Hackett Group's operations and investment strategies. Unstable regions can disrupt business, affecting client projects and financial forecasts. Political risks, like policy changes or conflicts, can lead to market volatility. The Hackett Group must assess these risks to protect its investments and ensure steady service delivery.

- Political risk insurance premiums in volatile regions have increased by 15-20% in 2024.

- A 2024 survey showed that 60% of businesses are re-evaluating investments in politically unstable countries.

- The Hackett Group's 2024 financial reports reveal a 10% decrease in revenue from regions with high political instability.

Political factors substantially influence The Hackett Group's operations and market opportunities. Geopolitical instability and trade policy changes create risks, impacting consulting demand. Conversely, government investments in digital transformation offer significant growth potential. Firms must navigate these factors to protect investments and capitalize on emerging opportunities.

| Factor | Impact | Data Point |

|---|---|---|

| Geopolitical Risk | Reduced business confidence | 2024 global defense spending: $2.44T |

| Trade Policies | Cost & revenue shifts | US-China tariff impact |

| Gov. Digital Spend | Growth opportunity | U.S. IT modernization: $3.2B (2024) |

Economic factors

Global economic conditions, including potential recessionary pressures, significantly influence business confidence. Economic uncertainty often curtails corporate spending on advisory services.

In 2024, the IMF projected global growth at 3.2%, a slight increase from 2023. The U.S. economy saw fluctuating growth rates, impacting demand for consulting.

Recessionary fears and fluctuating growth rates directly affect Hackett Group's business. The consulting sector is sensitive to these economic shifts.

Changes in economic outlook can lead to decreased investments. The 2024/2025 data shows a correlation between economic stability and consulting services demand.

Companies often delay or reduce spending on advisory services during economic downturns. The Hackett Group must navigate these economic challenges.

Inflationary pressures continue to impact operational costs for The Hackett Group and its clients. In Q1 2024, the U.S. inflation rate was around 3.5%, influencing project budgets. Clients' procurement teams are actively seeking cost-saving strategies to mitigate these rising expenses. This environment demands efficiency and value-driven consulting services.

Fluctuating exchange rates pose a risk for The Hackett Group, especially with global operations. Currency swings can significantly affect reported revenue. For example, a strong dollar in 2024 and early 2025 could reduce the value of earnings from international projects.

Corporate Spending on Consulting and Technology

Economic factors and business confidence levels heavily influence corporate spending on consulting and technology. Uncertainty often curtails discretionary spending on advisory and transformation projects. For 2024, global IT spending is projected to increase, but with variations across sectors. Consulting spending growth is expected to be more moderate than in previous years.

- Global IT spending is expected to reach $5.06 trillion in 2024, a 6.8% increase from 2023.

- Consulting services revenue is projected to grow, but at a slower rate compared to the strong growth seen in 2021-2023.

- Economic downturns can lead to project delays or cancellations, impacting consulting and technology vendors.

Market Demand for Digital Transformation

The market demand for digital transformation remains robust, offering a key economic driver for The Hackett Group. Despite economic headwinds, businesses are still investing in digital initiatives to improve efficiency and gain a competitive edge. The digital transformation consulting market is experiencing significant growth, with projections indicating continued expansion through 2025. This growth reflects a broader trend of companies seeking to modernize their operations and embrace new technologies.

- The global digital transformation market is expected to reach $1.2 trillion by 2027.

- The Hackett Group's consulting revenue increased by 18% in 2024.

- Cloud computing, AI, and data analytics are primary investment areas.

Economic conditions greatly influence Hackett Group's business, affecting spending on advisory services. Global IT spending is projected to increase by 6.8% in 2024, but consulting growth may be slower than in prior years due to economic uncertainty. Digital transformation remains a strong market driver, with the market expected to hit $1.2 trillion by 2027.

| Economic Factor | Impact on Hackett Group | Data (2024/2025) |

|---|---|---|

| Global Growth | Affects consulting demand | IMF projects 3.2% global growth in 2024. |

| Inflation | Increases operational costs | U.S. inflation around 3.5% in Q1 2024. |

| Exchange Rates | Impacts revenue from global operations | Strong dollar may reduce value of international earnings. |

Sociological factors

The shift to remote and hybrid work significantly impacts The Hackett Group's service delivery and client needs. Clients increasingly require workforce management and collaboration tech solutions. In 2024, over 60% of companies used hybrid work models. This trend is evident in The Hackett Group's client engagements. The firm adapts its strategies to support distributed workforces.

Societal focus on diversity and inclusion boosts demand for specialized consulting. This shift drives companies to improve their workforce and supply chains. The Hackett Group can capitalize on this trend with its advisory services. In 2024, the diversity and inclusion market was valued at $10 billion. By 2025, it's projected to reach $12 billion, reflecting significant growth.

The skills gap widens due to tech advancements. This boosts demand for talent transformation. The Hackett Group can help with reskilling. The U.S. faces a shortage of skilled workers. In 2024, 40% of employers struggled to fill roles.

Changing Employee Expectations

Employee expectations are shifting, impacting organizational strategies. This change influences areas like work culture, technology, and work-life balance. The Hackett Group offers services related to organizational design and employee experience. Consulting services are vital to meet these evolving needs. Recent data shows that 77% of employees value work-life balance.

- Work-life balance is a top priority for employees.

- Technology integration is crucial for modern workplaces.

- Organizational design must adapt to changing expectations.

- The Hackett Group provides relevant consulting services.

Societal Adoption of AI

Societal adoption of AI is rapidly increasing, influencing client demands and business strategies. This trend fuels the need for AI consulting services, where The Hackett Group is a key player. A recent study shows that AI adoption in businesses grew by 25% in 2024, reflecting a significant shift. This acceleration impacts how companies operate and how clients expect services to be delivered.

- AI adoption is expected to reach 60% of businesses by the end of 2025.

- The global AI market is projected to reach $200 billion by 2025.

- Hackett Group's revenue from AI services increased by 30% in the last quarter of 2024.

Shifting work models and diversity initiatives affect The Hackett Group’s offerings. Remote work boosts demand for tech solutions. Employee priorities on work-life balance necessitate adjustments in organizational designs. AI adoption, rising by 25% in 2024, significantly shapes service delivery.

| Sociological Factor | Impact | Data Point (2024/2025) |

|---|---|---|

| Hybrid Work | Demand for tech & workforce solutions | 60%+ companies use hybrid models |

| Diversity & Inclusion | Need for specialized consulting | $12B market projection by 2025 |

| AI Adoption | Influences business strategy | 60% of businesses adopting by end 2025 |

Technological factors

Generative AI's swift advancement reshapes business. It impacts finance, HR, and supply chains. This fuels demand for The Hackett Group's services. The market for AI in finance is projected to reach $24.5 billion by 2025.

Companies are boosting tech spending on digital transformation, automation, and AI. This trend boosts demand for The Hackett Group's services. Gartner projects worldwide IT spending to reach $5.06 trillion in 2024, a 8% increase from 2023. This growth fuels the need for digital solutions.

Cloud computing and data analytics are vital for digital transformation. These technologies are essential for businesses. The Hackett Group uses them to offer insights and boost client performance. The global cloud computing market is expected to reach $1.6 trillion by 2025. Data analytics spending is also rising, reaching $274.3 billion in 2024.

Cybersecurity Threats and Solutions

The escalating complexity of cyber threats demands strong cybersecurity measures and consulting services. The Hackett Group needs to safeguard its data and systems while guiding clients on cybersecurity risk management. The global cybersecurity market is projected to reach $345.4 billion in 2024, growing to $469.4 billion by 2029. This growth reflects the increasing need for robust defenses.

- 2023 saw a 30% rise in ransomware attacks globally.

- Cybersecurity spending is expected to increase by 12% annually.

- The financial services sector is a primary target for cyberattacks.

Development of AI-Powered Platforms and Tools

The Hackett Group heavily relies on AI-powered platforms. Their tools, like AI XPLR and ZBrain, are key to offering unique digital transformation and AI consulting. These platforms help clients improve efficiency and make better decisions. The global AI market is expected to reach $1.81 trillion by 2030, showing the importance of these tools.

- AI XPLR and ZBrain are proprietary platforms.

- They provide differentiated consulting services.

- These tools help clients with digital transformation.

- The AI market's growth highlights their significance.

The rapid advancement of AI reshapes business strategies. Cybersecurity spending is projected to increase by 12% annually, with ransomware attacks up 30% in 2023. The financial sector is a key target, emphasizing robust digital solutions and The Hackett Group's services.

| Technology Aspect | 2024 Data/Projections | Significance for The Hackett Group |

|---|---|---|

| IT Spending | $5.06 trillion (Gartner) | Increased demand for digital solutions and transformation services. |

| Cloud Computing Market | $1.6 trillion (by 2025) | Essential for providing digital transformation and insights. |

| Cybersecurity Market | $345.4 billion (2024) | Growing need for cybersecurity services and risk management. |

Legal factors

Data protection and privacy regulations like GDPR and CCPA are crucial legal factors. The Hackett Group and its clients must invest heavily in compliance. Data breaches in 2024 cost companies an average of $4.45 million globally. Failure to comply can lead to hefty fines and reputational damage.

The Hackett Group heavily relies on intellectual property (IP) like consulting methods and data. Strong IP protection, including patents, trademarks, and copyrights, is vital. Legal factors such as IP laws and enforcement influence Hackett's ability to protect its competitive advantages. In 2024, global spending on IP protection reached $27.6 billion, a 6% increase year-over-year.

The Hackett Group faces legal challenges in complying with consulting and tech regulations across regions. This includes adhering to contract law and professional standards in each operating area. In 2024, regulatory changes increased compliance costs by 7% for similar firms. Failure to comply can lead to penalties, impacting financial performance. Staying updated on legal changes is crucial for operational continuity.

Changes in Labor Laws and Employment Regulations

The Hackett Group must navigate evolving labor laws. Changes in remote work, contract employment, and employee data regulations directly affect their workforce. For example, the rise in remote work post-2020 has led to updated employment standards. The company must ensure compliance to avoid legal issues.

- Remote work regulations: Increased scrutiny on remote work policies.

- Contract employment: Potential reclassification of contractors.

- Data privacy: GDPR, CCPA and other regulations impact employee data.

Legal Implications of AI Deployment

The Hackett Group's AI consulting must address emerging legal issues. Bias in AI algorithms is a major concern, with potential for discriminatory outcomes. Accountability for AI decisions is also vital, especially in automated processes. Intellectual property rights related to AI-generated content and inventions require careful management.

- In 2024, legal tech spending is projected to reach $25.8 billion.

- Approximately 60% of companies are concerned about AI bias.

Legal factors for The Hackett Group include data protection, intellectual property, and compliance. Data breaches in 2024 cost an average $4.45M. In 2024, global spending on IP protection reached $27.6B. Changes in labor laws, especially regarding remote work, affect operations.

| Legal Area | Impact | 2024 Data |

|---|---|---|

| Data Protection | Compliance costs, fines | Avg. breach cost: $4.45M |

| Intellectual Property | Protection of IP assets | IP spend: $27.6B (+6%) |

| Labor Laws | Remote work, employment | Compliance costs +7% |

Environmental factors

Growing stakeholder and regulatory pressure pushes companies toward sustainability and ESG. This boosts demand for ESG consulting, including strategy, reporting, and supply chain improvements. The ESG consulting market is projected to reach $20.8 billion by 2025.

Companies are increasingly focusing on lessening their carbon footprint. The Hackett Group offers consulting to help clients develop and execute carbon reduction plans. This includes assessing current emissions and finding areas for improvement. For instance, a 2024 study showed a 15% average reduction in emissions for companies using such strategies.

Climate change poses significant physical and transitional risks, driving businesses to prioritize climate risk assessment and management. This shift fuels demand for advisory services. For instance, the global market for climate risk management services is projected to reach $20 billion by 2025. Companies are increasingly investing in resilience strategies to mitigate these impacts, with spending expected to grow by 15% annually.

Regulations Related to Environmental Reporting

Environmental regulations are becoming stricter, especially regarding reporting and disclosure. This includes rules around Scope 3 emissions, which are indirect emissions from a company's value chain. The Hackett Group can help businesses improve their data and reporting processes to meet these new requirements.

- In 2024, the SEC adopted rules requiring companies to disclose climate-related information in their registration statements and annual reports.

- Companies face increasing pressure to reduce their carbon footprint.

- The global environmental consulting market is projected to reach $45.7 billion by 2025.

Opportunities in Renewable Energy and Sustainable Technology

The Hackett Group can capitalize on the expanding renewable energy and sustainable technology sectors. Consulting opportunities arise as businesses increase investments in these areas to meet environmental goals and regulatory requirements. The global renewable energy market is projected to reach $1.977 trillion by 2030. This growth offers Hackett Group chances to provide strategic advice.

- Market growth: The global renewable energy market is expected to reach $1.977 trillion by 2030.

- Increased investment: Companies are increasing investments in renewable energy and sustainable technologies.

- Consulting demand: This creates demand for consulting services in these areas.

Environmental factors drive the need for sustainability. This is fueled by ESG demand, projected to reach $20.8B by 2025. Businesses focus on reducing carbon footprints, with climate risk management growing to a $20B market by 2025. Stricter regulations and renewable energy expansion offer more consulting opportunities.

| Factor | Impact | Data |

|---|---|---|

| ESG Pressure | Increased Demand | ESG consulting market: $20.8B by 2025 |

| Carbon Reduction | Strategic Services | Emissions reduction (avg): 15% (2024 study) |

| Climate Risks | Risk Assessment & Mgmt. | Climate risk mgt. market: $20B by 2025 |

PESTLE Analysis Data Sources

Hackett's PESTLE analyses use data from global economic databases, government publications, and industry reports, ensuring data accuracy and relevance.