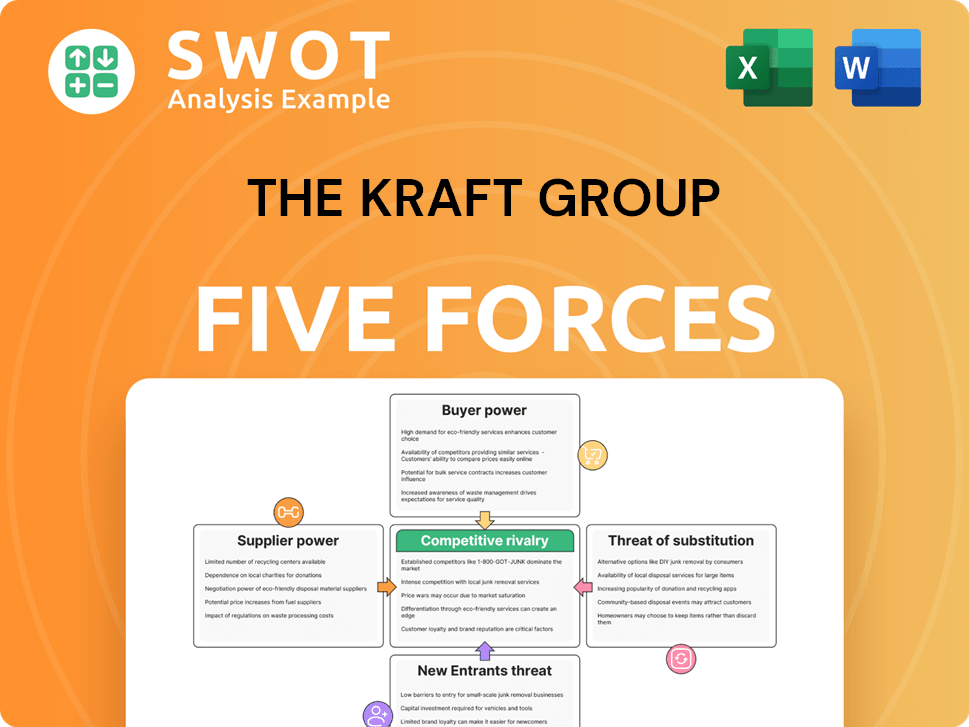

The Kraft Group Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

The Kraft Group Bundle

What is included in the product

Analyzes The Kraft Group's competitive position by assessing industry rivalry, buyer power, and potential threats.

Visualize competitive dynamics immediately with the interactive spider/radar chart.

Same Document Delivered

The Kraft Group Porter's Five Forces Analysis

This preview showcases the complete Porter's Five Forces analysis for The Kraft Group. You're seeing the identical document you'll receive immediately after your purchase. It contains a fully researched analysis of the company's competitive landscape. Expect to download the file formatted and ready for your use. No editing or additional work is necessary.

Porter's Five Forces Analysis Template

Analyzing The Kraft Group's competitive landscape requires understanding industry forces. Buyer power, driven by consumer preferences, significantly impacts pricing strategies. Supplier influence, especially for raw materials, is a crucial factor. The threat of new entrants, considering market barriers, shapes competitive intensity. Substitute products, from entertainment to sports, pose unique challenges. Competitive rivalry among existing players demands constant innovation.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore The Kraft Group’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

The Kraft Group's paper and packaging segment heavily depends on suppliers for materials like wood pulp and chemicals. Concentrated or highly differentiated suppliers possess significant bargaining power. This can drive up costs, potentially squeezing Kraft's profit margins. In 2024, the paper and packaging industry faced fluctuating raw material prices.

For the New England Patriots and Revolution, player unions are key. These unions influence costs through salary negotiations and benefits. In 2024, NFL player salaries averaged around $3.3 million, impacting team budgets significantly. MLS player salaries also influence the club's financial decisions.

Suppliers of construction materials significantly impact Kraft's real estate costs. Price fluctuations in steel, concrete, and lumber directly affect project budgets. For example, in 2024, lumber prices saw volatility, impacting construction costs by up to 15%. Supplier consolidation or material scarcity could further increase expenses, squeezing profit margins.

Media Rights Providers

For The Kraft Group, specifically the New England Patriots and New England Revolution, media rights providers represent a significant supplier. The few major broadcasting companies that control media rights can greatly influence revenue. This affects the group's ability to negotiate favorable deals for broadcasting games. The media landscape saw a shift in 2024, with deals like the NFL's agreement with major networks.

- NFL's 11-year media rights deals with CBS, ESPN, Fox, NBC, and Amazon, worth over $100 billion, underscore the power of media providers.

- In 2024, ESPN paid an average of $2.7 billion per year for Monday Night Football rights.

- The value of sports media rights continues to rise, with the Premier League's 2024-2025 domestic rights deal valued at over £6.7 billion.

Private Equity Funding Sources

The Kraft Group's private equity activities depend on outside funding. Limited or costly funding can squeeze investment capabilities and profits. Increased interest rates in 2024, with the Federal Reserve holding rates steady, could impact funding costs. These dynamics influence The Kraft Group's financial strategies.

- Funding sources are key for private equity's success.

- Higher rates can reduce investment returns.

- The Kraft Group's strategic choices are affected by funding.

- Market conditions in 2024 shape their approach.

The Kraft Group faces supplier bargaining power across its businesses. In paper, fluctuating raw material prices, up to 15% in 2024 for lumber, affect margins. Player unions and media rights holders, such as ESPN, also wield considerable influence.

| Supplier Type | Impact | 2024 Example |

|---|---|---|

| Raw Materials | Cost fluctuations | Lumber prices up to 15% |

| Player Unions | Salary costs | NFL average $3.3M |

| Media Rights | Revenue influence | ESPN, $2.7B/yr |

Customers Bargaining Power

Kraft's paper and packaging division faces customers with varying bargaining power. Large buyers can pressure prices, affecting margins. In 2024, the packaging industry saw fluctuations; for example, paperboard prices changed. Kraft must manage these customer dynamics. Availability of alternative suppliers also influences bargaining power.

Sports fans, though individually diverse, wield collective power via ticket sales, merchandise, and media engagement. For instance, the New England Patriots' revenue in 2023 was approximately $700 million, reflecting fan influence. Lower attendance or viewership directly affects team finances; in 2024, the NFL's average game attendance was about 67,000. The Kraft Group, owner of the Patriots and Revolution, must consider fan sentiment.

Real estate tenants and buyers wield significant bargaining power, particularly in markets with ample supply or economic downturns. For example, in 2024, apartment vacancy rates in major U.S. cities like New York and San Francisco reached over 5%, giving renters leverage. This allows tenants and buyers to negotiate for more favorable lease terms or lower purchase prices, directly impacting Kraft's profitability. The Kraft Group must therefore carefully assess market dynamics to mitigate this customer power.

Gillette Stadium Event Attendees

Event attendees at Gillette Stadium, like concertgoers or game attendees, possess bargaining power because they can choose from various entertainment options. Their sensitivity to pricing, coupled with their demand for high-quality experiences, influences The Kraft Group's revenue generation from the stadium. This power stems from the availability of alternative entertainment venues and activities. The Kraft Group must continually enhance the stadium experience to retain and attract attendees.

- In 2024, Gillette Stadium hosted numerous events, drawing millions of attendees.

- Ticket prices and perceived value significantly affect attendance rates.

- Customer satisfaction directly impacts future event attendance and revenue.

- The Kraft Group invests heavily in improving the stadium experience.

Private Equity Investment Targets

Private equity investments face customer bargaining power. Companies with options or growth can negotiate investment terms. This affects Kraft's investment valuations. The private equity market saw $726 billion in deals in 2023. Deal values are influenced by customer influence.

- Negotiation: Companies can negotiate investment terms.

- Valuation: Customer power impacts investment valuations.

- Market Data: 2023 private equity deals totaled $726 billion.

- Impact: Customer influence affects deal values.

The Kraft Group's diverse customer base exhibits varying bargaining power. Large packaging clients can influence pricing, and fans affect sports revenue. Tenant and event attendee preferences also create leverage. Customer choice, market dynamics, and competitive options shape these influences.

| Customer Segment | Bargaining Power | Impact |

|---|---|---|

| Packaging Clients | High, due to volume | Price Pressure |

| Sports Fans | Moderate, via attendance | Revenue Influence |

| Tenants/Buyers | High, in oversupplied markets | Lease/Price Negotiation |

Rivalry Among Competitors

The paper and packaging industry features intense competition for The Kraft Group. Companies like International Paper and Smurfit Kappa drive price competition. This dynamic can squeeze profit margins, as seen with a 3% dip in overall industry profitability in 2024. Kraft must continuously innovate packaging to stay ahead.

The New England Patriots and Revolution contend with fierce rivals in the NFL and MLS. Success hinges on winning, brand appeal, and fan loyalty. The Patriots' 2023 revenue was approximately $700 million, showcasing the financial stakes in play. The Revolution's 2023 revenue was around $50 million. Both teams must excel to stay competitive.

The Kraft Group's real estate arm faces intense competition from firms like Related Companies and Hines. They vie for prime land, attract tenants, and secure funding. In 2024, the U.S. real estate market saw a 6.3% decrease in commercial property values. Location, project specifics, and market trends are crucial for success. Differentiation is key, as evidenced by the 2024 rise in demand for unique mixed-use developments.

Entertainment Venues

Gillette Stadium faces competition from other entertainment venues like arenas and concert halls. These venues vie for similar events and audiences, impacting Gillette Stadium's event bookings and revenue. The stadium's success hinges on its amenities, location, and event lineup compared to rivals. Competition is fierce; for example, in 2024, the average ticket price for NFL games was around $160, influencing consumer choices.

- Rival venues include TD Garden and Fenway Park, both attracting events.

- Gillette Stadium's location in Foxborough impacts accessibility for some fans.

- Event variety, from concerts to sports, drives revenue and attendance figures.

- The Kraft Group must continually invest to remain competitive.

Private Equity Firms

The Kraft Group's private equity arm faces intense competition from many firms vying for investment opportunities. Success hinges on securing favorable deals, having strong investment expertise, and access to capital. The private equity industry saw over $1.2 trillion in global deal value in 2024, indicating a highly competitive landscape. This competition affects deal terms and investment returns.

- Competition for deals is fierce, impacting pricing.

- Expertise and track record are key differentiators.

- Access to capital is critical for closing deals.

The Kraft Group faces intense competition in its diverse ventures. The paper industry battles rivals like International Paper, affecting profit margins. Sports teams, such as the Patriots and Revolution, compete fiercely for fans and revenue. Real estate and private equity also encounter tough competition for deals and investments.

| Sector | Competition | Impact |

|---|---|---|

| Paper | International Paper | 3% Profit dip in 2024 |

| Sports | NFL/MLS Teams | Patriots $700M Revenue (2023) |

| Real Estate | Related Companies | 6.3% Decrease in property values (2024) |

| Entertainment | TD Garden, Fenway | Avg NFL ticket: $160 (2024) |

| Private Equity | Numerous firms | $1.2T global deal value (2024) |

SSubstitutes Threaten

The Kraft Group confronts substitution risks in paper and packaging. Plastics, biodegradable options, and digital communication offer alternatives to paper products. In 2024, the global biodegradable packaging market reached $26.5 billion, showing growth. These substitutes potentially reduce demand for traditional paper.

The Kraft Group's teams, like the Patriots and Revolution, face competition from diverse entertainment options. These range from other sports leagues to concerts and movies. In 2024, the entertainment industry generated billions in revenue. Consumer spending habits and income levels significantly impact how fans choose to spend their leisure time.

The Kraft Group faces threats from real estate substitutes like existing buildings and diverse locations. These alternatives impact demand for their developments. According to a 2024 report, the commercial real estate vacancy rate in major US cities is around 12%. This competition affects pricing and project viability. Alternative property types, such as mixed-use developments, also offer competition.

Gillette Stadium Event Substitutes

Attendees have many entertainment choices besides Gillette Stadium events. These range from rival venues hosting similar events to enjoying entertainment at home or engaging in recreational activities. The Kraft Group must ensure that the event experience at Gillette Stadium is exceptional to retain its market share. According to a 2024 report, the average household spends $2,500 annually on entertainment. Competition is fierce.

- Alternative Venues: Other stadiums and arenas offer similar events.

- Home Entertainment: Streaming services and home theaters provide alternatives.

- Recreational Activities: Outdoor activities and hobbies compete for attendees' time.

- Value Perception: The experience at Gillette Stadium must be highly valued.

Private Equity Investment Alternatives

The Kraft Group's private equity arm faces competition from various funding sources. Companies can opt for debt financing, venture capital, or strategic investors instead of private equity. To secure deals, Kraft must present attractive investment terms and demonstrate significant value. This includes offering higher returns or unique strategic benefits. The landscape is competitive, with over $2.5 trillion in dry powder globally in 2024.

- Debt financing offers lower costs but less flexibility.

- Venture capital targets high-growth startups.

- Strategic investors bring industry-specific expertise.

- Kraft needs to differentiate its offerings.

For the Kraft Group, entertainment substitutes pose a considerable threat. These alternatives encompass everything from streaming services to other live events. According to a 2024 study, the streaming market alone is worth over $300 billion. The Kraft Group must stay competitive.

| Substitute Type | Examples | Impact on Kraft |

|---|---|---|

| Home Entertainment | Streaming services, home theaters | Reduces demand for live events |

| Other Live Events | Concerts, other sports | Direct competition for attendees |

| Recreational Activities | Outdoor activities, hobbies | Diversion of leisure time |

Entrants Threaten

The paper and packaging sector presents a moderate threat from new entrants to The Kraft Group. Substantial capital investment is needed to start, which limits easy entry. For example, in 2024, the average startup cost for a new paper mill was around $500 million. However, companies leveraging new tech could find niche opportunities.

Establishing a new professional sports franchise, like an NFL or MLS team, faces significant hurdles. League control and incredibly high startup costs act as major barriers. The NFL, for instance, has seen only a few expansion teams in recent decades, like the Houston Texans in 2002. The last MLS expansion team was Charlotte FC in 2022. This scarcity significantly limits the threat of new competitors.

Real estate development faces entry barriers due to high capital needs and specialized expertise. Despite this, well-capitalized entities can enter new markets. In 2024, the US real estate market saw new entrants, particularly in residential projects. According to the National Association of Home Builders, this trend continues.

Entertainment Venue New Entrants

Building a new entertainment venue, like a stadium, is a massive undertaking, demanding substantial capital and intricate planning. The Kraft Group, with its existing venues and established events, benefits from a strong competitive position. New entrants face significant challenges, including high initial costs and the need to compete with already popular destinations. For example, the construction cost for a new NFL stadium can easily exceed $1 billion. This creates a high barrier to entry.

- High Capital Requirements: Stadium construction costs are substantial, often exceeding $1 billion.

- Competition: Established venues and events, like those run by The Kraft Group, pose a major competitive challenge.

- Market Saturation: The entertainment market can be competitive, making it difficult for new venues to attract customers.

Private Equity Firms New Entrants

The private equity landscape is dynamic, allowing new firms to enter with specialized knowledge or innovative investment approaches. The Kraft Group, as a diverse entity, faces potential competition from these new entrants. Success in this sector hinges on securing capital and deal flow, which can be challenging. New entrants must demonstrate a compelling value proposition to compete effectively.

- The private equity industry is competitive.

- New firms may enter with specialized expertise.

- Access to capital is crucial for success.

- Deal flow is vital for private equity firms.

The threat of new entrants varies across The Kraft Group's sectors. Paper and packaging face moderate threats. The sports and entertainment sectors experience high entry barriers due to capital needs. Private equity sees a more dynamic environment, enabling new firms to enter.

| Sector | Entry Barrier | Examples/Data (2024) |

|---|---|---|

| Paper/Packaging | Moderate | Startup costs ~$500M for a new mill. |

| Sports Franchises | High | NFL expansion rare; MLS expansion costs high. |

| Real Estate | Moderate | Residential project entries continue. |

| Entertainment Venues | High | Stadium construction costs exceed $1B. |

| Private Equity | Moderate | Access to capital is crucial. |

Porter's Five Forces Analysis Data Sources

Our analysis leverages diverse sources like SEC filings, industry reports, financial statements, and market share data to assess The Kraft Group's competitive position.