The Kraft Group SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

The Kraft Group Bundle

What is included in the product

Identifies key growth drivers and weaknesses for The Kraft Group.

Gives a high-level overview for quick stakeholder presentations.

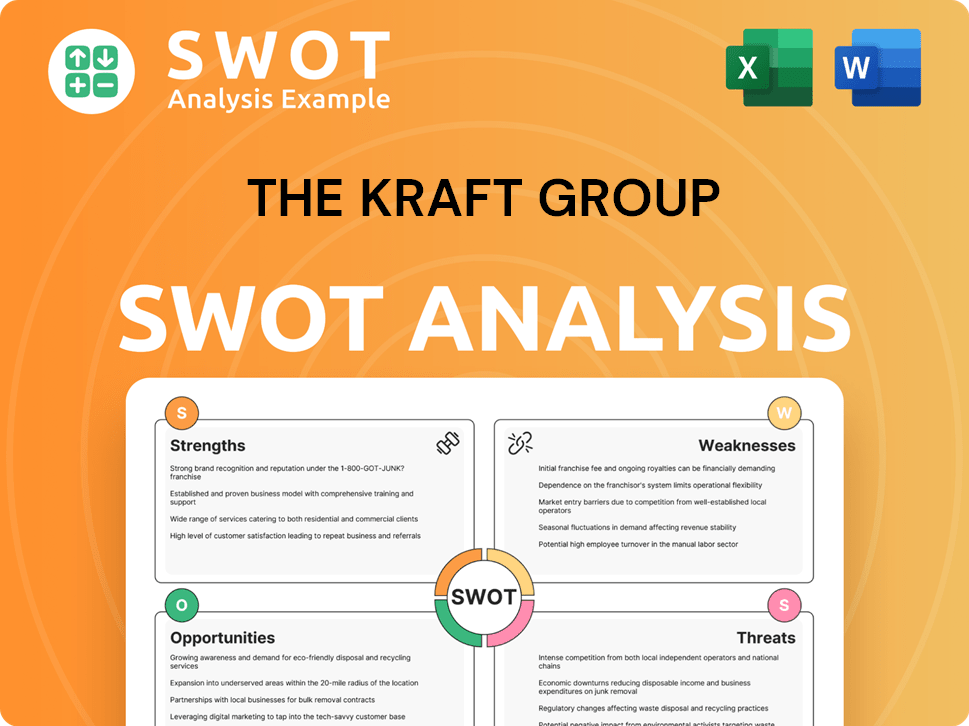

Preview the Actual Deliverable

The Kraft Group SWOT Analysis

The preview accurately reflects the SWOT analysis you'll receive. It's not a watered-down sample. Purchasing provides access to the complete, in-depth The Kraft Group report. All details, findings, and structure remain the same. Download the full document immediately after payment. You’ll get exactly what you see.

SWOT Analysis Template

The Kraft Group, known for its diverse ventures, faces a complex business environment. Our SWOT analysis highlights its strengths like brand recognition & financial prowess. Explore weaknesses, such as dependency on key individuals and market concentration. Opportunities include expansion in growing sectors & digital innovation. Consider threats like competition & economic instability.

Discover the complete picture behind the company’s market position with our full SWOT analysis. This in-depth report reveals actionable insights, financial context, and strategic takeaways—ideal for entrepreneurs, analysts, and investors.

Strengths

The Kraft Group's diverse portfolio spans paper, sports, real estate, and private equity. This broad diversification across sectors, like their $6 billion revenue in 2024, reduces reliance on a single industry. It provides multiple revenue streams, bolstering financial stability. This strategy has helped navigate economic fluctuations effectively.

The Kraft Group's ownership of the New England Patriots, a dominant NFL team, and the New England Revolution, an MLS team, is a major strength. These assets generate substantial revenue. In 2023, the Patriots were valued at $7 billion, while the Revolution's value is also significant. This ownership drives brand recognition through ticket sales, merchandise, broadcasting, and sponsorships.

Gillette Stadium and Patriot Place are significant strengths for The Kraft Group. The stadium hosts various events, boosting revenue streams. Patriot Place, with its retail and entertainment options, further diversifies income. In 2024, the stadium hosted over 50 events, including concerts, generating millions.

Experience in Real Estate Development

The Kraft Group's extensive experience in real estate development is a significant strength. They've successfully developed over $1 billion in projects. This includes stadiums and mixed-use properties, demonstrating their ability to handle large-scale ventures. Their expertise enables them to leverage land assets effectively and identify lucrative development prospects.

- Over $1 billion in real estate projects developed.

- Successful projects include stadiums and mixed-use properties.

- Expertise in maximizing land value and identifying opportunities.

- Proven ability to manage large-scale development projects.

Established Presence in Paper and Packaging

The Kraft Group's strong foothold in paper and packaging, through entities like Rand-Whitney Group and International Forest Products, offers a solid industrial foundation. This sector contributes significantly to its diversified portfolio, including forest products and recycling operations. This established presence helps stabilize the holding company's financial performance. In 2024, the global paper and packaging market was valued at over $800 billion, demonstrating the industry's scale and potential.

- Significant player in paper and packaging.

- Includes forest products and recycling.

- Provides a stable industrial base.

- Global paper and packaging market worth over $800 billion (2024).

The Kraft Group excels in diversified assets and ownership, providing multiple revenue streams and financial stability, achieving $6 billion in revenue by 2024. They benefit from their sports team holdings such as the New England Patriots, valued at $7 billion in 2023. They have developed extensive real estate, like over $1 billion in projects. Their strong industrial foundation is supported by their paper and packaging segment. In 2024, the global paper market exceeded $800 billion.

| Strength | Description | Financial Impact/Statistics (2024/2023) |

|---|---|---|

| Diversified Portfolio | Spans paper, sports, real estate, and private equity. | $6 billion in revenue (2024), reducing industry dependence. |

| Sports Team Ownership | Ownership of New England Patriots (NFL) and Revolution (MLS). | Patriots valued at $7 billion (2023), driving revenue. |

| Real Estate Development | Successful development of stadiums and mixed-use properties. | Over $1 billion in projects completed. |

| Paper & Packaging | Strong presence through Rand-Whitney, etc. | Global paper/packaging market: over $800B (2024). |

Weaknesses

The Kraft Group's reliance on the New England Patriots presents a key weakness. A decline in the Patriots' performance could significantly hurt revenue and brand value. Team success directly impacts attendance, viewership, and merchandise sales. For example, in 2023, the Patriots' disappointing season led to a decrease in game-day revenue. This highlights the vulnerability to on-field results.

Kraft Group's weaknesses include vulnerability to fluctuating raw material costs and market demand within the paper and packaging sector. The price volatility of key inputs like wood pulp and recycled fibers can squeeze profit margins. For instance, in 2024, the price of corrugated containers, a key packaging product, saw fluctuations. This volatility can restrict sales and impact profitability.

The Kraft Group's private status limits public financial data availability, hindering external analysis. This opacity makes it harder to assess the company's true financial health and valuation compared to public firms. Investors lack access to detailed reports, impacting due diligence and investment decisions. For instance, in 2024, private companies' valuation discrepancies were up to 20% higher than public firms.

Potential Impact of Leadership Transition

A change in leadership at The Kraft Group, given Robert Kraft's central role, could bring uncertainty. His influence has shaped the company's strategy and success. Investors might worry about shifts in business direction or a loss of strategic vision. This could affect the company's market position and financial performance. For instance, leadership transitions often coincide with fluctuations in stock value.

- Robert Kraft founded The Kraft Group.

- Leadership transitions can cause uncertainty.

- Stock value can fluctuate during changes.

Geographical Concentration of Sports Assets

The Kraft Group's sports assets, including the Patriots, Revolution, and Gillette Stadium, are heavily concentrated in New England, representing a significant weakness. This geographical concentration makes the company vulnerable to regional economic downturns or shifts in fan interest. A large portion of the revenue is directly tied to the New England market. This dependency limits diversification and can affect overall financial performance.

- Dependence on New England: High revenue concentration.

- Economic Risks: Vulnerable to regional downturns.

- Limited Diversification: Fewer revenue streams.

The Kraft Group faces vulnerabilities due to its reliance on the New England Patriots, impacting revenue if the team underperforms, shown by the 2023 revenue drop. Volatility in raw material costs, like packaging prices (seen in 2024), also presents a weakness, squeezing profits. Limited financial data transparency, common for private companies like Kraft, hampers external assessment, with valuations possibly 20% higher than public firms, influencing due diligence. Further weaknesses are concentrated sports assets tied to New England, making them prone to regional market changes. Finally, leadership transitions and succession bring instability. In 2024, nearly 15% of businesses experienced this challenge.

| Weakness | Description | Impact |

|---|---|---|

| Reliance on Patriots | Performance directly affects revenue, such as lower game-day revenue in 2023. | Vulnerability to team success; regional economic factors |

| Material Cost Fluctuation | Volatility in costs like packaging materials affects profits. | Limits Sales and profitability; supply chain factors |

| Limited Financial Data | Restricts detailed assessments. Private company values are more difficult to assess. | Hindrance to accurate valuation and investment |

| Geographical Focus | Revenue heavily tied to New England market. | Limits diversification and can affect overall performance |

| Leadership Transition | Robert Kraft's key role means transition brings uncertainty | Possible fluctuations and business direction challenges |

Opportunities

The Kraft Group can capitalize on the NFL's global expansion, especially the Patriots' brand. The NFL's Global Markets Program supports this, offering chances for international games and increased marketing. Revenue streams can grow through fan engagement and merchandise sales abroad. In 2024, NFL International generated over $1 billion in revenue, a 10% increase year-over-year, indicating significant growth potential.

The Kraft Group has opportunities to expand real estate holdings. They can develop more land around Gillette Stadium or start new ventures. Patriot Place, a successful retail and entertainment complex, shows their expertise. In 2024, commercial real estate values increased by about 5% in the Boston area. This growth supports further investments in the area.

The Kraft Group's paper and packaging division can capitalize on the rising global demand for sustainable packaging. This shift towards eco-friendly solutions aligns with consumer preferences. Embracing recycled materials and sustainable practices can significantly boost market share. The sustainable packaging market is projected to reach $431.6 billion by 2027, growing at a CAGR of 7.1% from 2020 to 2027.

Strategic Private Equity Investments

The Kraft Group has opportunities in strategic private equity investments. This involves allocating capital to high-growth sectors. Focusing on technology, healthcare, and life sciences can lead to diversification. These investments can generate substantial returns. Private equity deals reached $789 billion in 2024.

- Diversification into high-growth sectors.

- Potential for significant financial returns.

- Leveraging expertise in identifying promising ventures.

- Capitalizing on market trends in tech and healthcare.

Technological Advancement in Sports and Entertainment

The Kraft Group can capitalize on technological advancements to boost fan engagement and operational efficiency. Investing in AI and network infrastructure can transform the fan experience, offering personalized interactions and improved services. This opens avenues for new revenue streams, such as premium content and interactive experiences. The global sports technology market is projected to reach $40.3 billion by 2024, highlighting significant growth potential.

- AI-driven fan engagement tools.

- Enhanced network infrastructure for streaming.

- Development of new revenue-generating experiences.

- Expansion of digital content offerings.

The Kraft Group can expand globally using the Patriots brand. Real estate and sustainable packaging offer further chances. Private equity and tech advancements present strategic investment paths.

| Opportunity Area | Specific Action | Financial Impact/Benefit |

|---|---|---|

| Global Expansion | Increase international marketing, games. | 10% YoY revenue growth ($1B+ in 2024). |

| Real Estate | Develop around Gillette Stadium. | 5% increase in local real estate values (2024). |

| Sustainable Packaging | Use recycled materials. | Market valued at $431.6B by 2027 (CAGR 7.1%). |

Threats

Economic downturns pose a threat to The Kraft Group. Recessions reduce consumer spending on entertainment. In 2023, U.S. consumer spending growth slowed to 2.2%, signaling potential impacts. Demand for paper and packaging, and real estate investments could also decrease. Private equity valuations might decline during economic instability.

The Kraft Group faces intense competition. In sports, the New England Patriots compete with other NFL teams. The paper and packaging sector also sees strong rivalry. Real estate and private equity face challenges from numerous firms. This competition could reduce market share and profits.

Changes in consumer preferences pose a threat. Shifting tastes can decrease demand for The Kraft Group's offerings. For example, evolving preferences for sustainable packaging could pressure the company. The sports and entertainment sector might see attendance declines. In 2024, the average consumer spent $1,700 on entertainment; this could shift.

Regulatory Changes

Regulatory changes pose a threat to The Kraft Group. Stricter environmental standards for paper and packaging could increase costs. Changes in sports league rules might affect the New England Patriots' financial performance. Real estate development regulations could also create challenges. These shifts could limit growth or increase expenses.

- Environmental regulations can affect packaging costs.

- Sports league rule changes can impact team profitability.

- Real estate development regulations can delay projects.

- Compliance costs can reduce overall profitability.

Brand Image and Reputation Risks

The Kraft Group faces threats to its brand image and reputation due to its diverse business ventures. Negative publicity or controversies, whether in sports, real estate, or consumer goods, can tarnish the overall brand. For instance, a 2024 survey revealed that 35% of consumers switch brands after negative press. Damage to reputation can lead to financial losses.

- Loss of consumer trust impacts sales.

- Decreased investor confidence affects stock prices.

- Difficulty attracting and retaining top talent.

- Increased scrutiny from regulators.

Economic downturns, as seen by a slowed 2.2% U.S. consumer spending growth in 2023, threaten demand. Intense competition within sports, paper/packaging, and real estate further squeeze profitability and market share, where the New England Patriots contend with rival NFL teams. Shifts in consumer tastes, with 2024 entertainment spending at $1,700/person, and stricter regulations also pose risks.

| Threat Category | Specific Threat | Impact |

|---|---|---|

| Economic Instability | Slowed consumer spending | Reduced demand |

| Intense Competition | Rivalry in all sectors | Lower market share, profits |

| Consumer Behavior | Changing entertainment preferences | Attendance declines |

| Regulatory Pressures | Stricter rules and requirements | Cost increases |

SWOT Analysis Data Sources

This SWOT analysis relies on dependable financial data, market analysis, and expert commentary to deliver precise assessments.