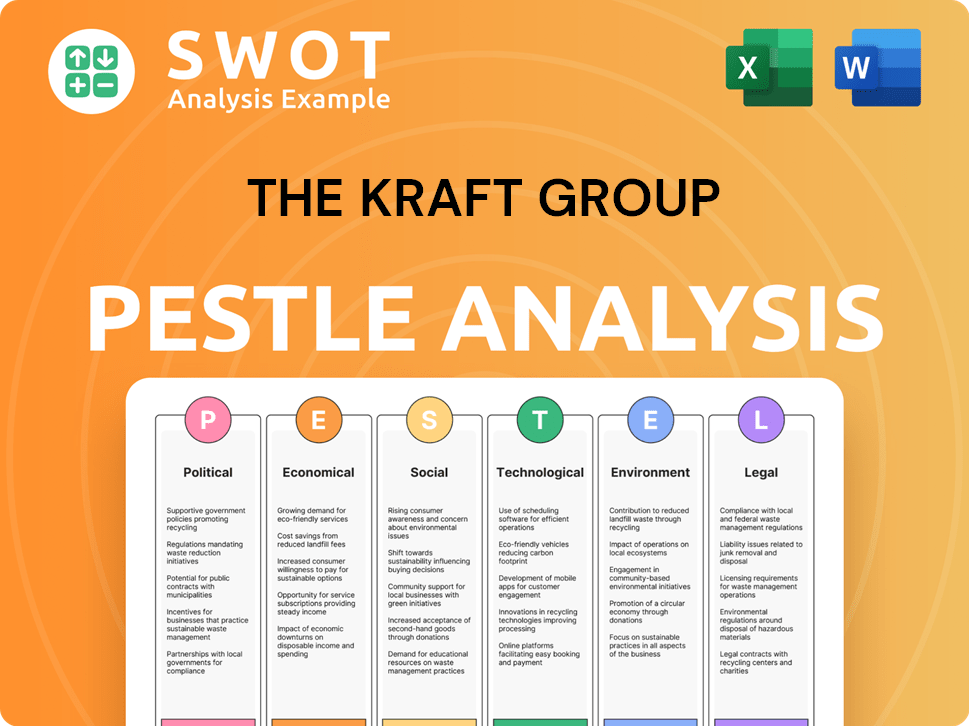

The Kraft Group PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

The Kraft Group Bundle

What is included in the product

Analyzes how external factors affect The Kraft Group, covering Political, Economic, Social, Technological, Environmental, and Legal aspects.

The Kraft Group PESTLE Analysis highlights key external factors and aids strategic decision-making.

What You See Is What You Get

The Kraft Group PESTLE Analysis

The file you’re previewing now is the final version—ready to download right after purchase. This The Kraft Group PESTLE Analysis comprehensively assesses political, economic, social, technological, legal, and environmental factors.

PESTLE Analysis Template

Explore the external factors shaping The Kraft Group. Our PESTLE Analysis reveals political, economic, social, technological, legal, and environmental impacts. Uncover crucial trends affecting its business and strategy. This in-depth analysis offers actionable insights. Download the full report for strategic clarity and make informed decisions. Gain a competitive advantage today.

Political factors

Government policies, particularly in trade and agriculture, are critical for The Kraft Group. Tariffs on imported materials for their paper and packaging divisions directly influence costs. Agricultural policies also affect ingredient costs for food investments. For example, in 2024, the U.S. imposed tariffs on certain paper products. Compliance with food safety regulations is vital. The FDA's budget for 2024 was $6.6 billion, underscoring the importance of regulatory adherence.

Political stability is crucial for The Kraft Group's operations and investments. Trade agreements significantly impact market access and costs. For example, the USMCA agreement affects their North American businesses. Changes in such agreements present both chances and risks, especially in sectors like sports and real estate, which are sensitive to policy shifts. The Kraft Group closely monitors these factors to adapt its strategies. In 2024, fluctuations in international trade policies continue to pose challenges.

Government spending significantly impacts The Kraft Group's ventures. Infrastructure projects can boost real estate values and create opportunities. For example, the Everett stadium plan is a direct political influence. In 2024, Massachusetts allocated $1.1 billion for infrastructure, directly affecting such projects.

Lobbying and Political Contributions

The Kraft Group, including Kraft Heinz, actively lobbies and makes political contributions. This influences policies impacting their sectors, shaping their operating environment. Analyzing these activities reveals their political strategies and priorities. For example, in 2024, Kraft Heinz spent over $1 million on lobbying efforts. Examining these political engagements offers insight into their strategic navigation of the political arena.

- Kraft Heinz spent over $1 million on lobbying in 2024.

- Lobbying efforts focus on food industry regulations and trade.

- Political contributions support candidates and causes aligned with business interests.

Local Government and Community Relations

The Kraft Group's interactions with local governments are vital, especially for its sports venues and real estate projects. Securing permits and fostering positive community relations are essential for operational success. For instance, the proposed New England Revolution stadium has faced discussions regarding local government approvals. Positive relationships can lead to smoother project approvals and community support. Conversely, negative interactions can result in delays or opposition.

- The Kraft Group's Patriot Place, a major retail and entertainment complex, demonstrates the importance of positive community relations.

- In 2024, the New England Revolution's stadium project continued to navigate local government processes.

- Maintaining a strong reputation is crucial for The Kraft Group's long-term success.

The Kraft Group navigates political factors by influencing policies through lobbying and political contributions; Kraft Heinz spent over $1 million on lobbying in 2024. Government spending and policies directly impact operations, with US tariffs and FDA regulations affecting costs. The Everett stadium and the New England Revolution's stadium reflect political influence.

| Political Factor | Impact | Example |

|---|---|---|

| Lobbying | Shapes regulations and trade | Kraft Heinz spent over $1M (2024) |

| Government Spending | Affects infrastructure and real estate | $1.1B in Massachusetts infrastructure spending |

| Trade Policies | Impacts market access and costs | USMCA, tariffs on paper products |

Economic factors

Inflation poses challenges for The Kraft Group, especially in sectors like paper and packaging, due to rising raw material costs. The consumer price index (CPI) rose 3.1% in January 2024, impacting costs. Food-related investments also face inflationary pressures. Managing costs and adjusting pricing strategies are vital economic considerations.

Consumer spending is crucial for The Kraft Group, influencing demand for food, beverages, and sports-related merchandise. A decrease in consumer confidence often leads to reduced spending. For example, in 2024, consumer spending growth slowed to 2.2% in the U.S. due to inflation. This directly impacts their revenue streams.

Overall economic growth significantly affects real estate development opportunities, crucial for The Kraft Group. A robust economy boosts the financial health of markets where their sports teams are based. Increased demand for their diverse offerings, including entertainment, is also expected. The U.S. GDP growth for 2024 is projected around 2.1%, potentially impacting their ventures.

Interest Rates and Investment Climate

Interest rate fluctuations significantly impact The Kraft Group's investment strategies. Higher rates increase borrowing costs for real estate and other projects, potentially reducing investment activity. A favorable investment climate encourages private equity deals and expansions.

- In 2024, the Federal Reserve maintained a high interest rate environment to combat inflation.

- The prime rate, influencing borrowing costs, was around 8.5% as of late 2024.

- Real estate investment slowed due to higher financing costs.

- Private equity activity remained robust, adapting to the economic conditions.

Currency Exchange Rates

Currency exchange rates are crucial for The Kraft Group, especially with its global operations. Changes in these rates can significantly affect the value of international revenues. For example, a stronger U.S. dollar can reduce the value of foreign earnings when converted back. This directly impacts profit margins and the overall financial performance reported by the company.

- In 2024, the Euro-Dollar exchange rate fluctuated significantly, affecting revenues from European operations.

- A 10% change in the exchange rate can alter profit margins by up to 5%.

- Hedging strategies are essential to mitigate currency risks.

Economic factors, like inflation and consumer spending, profoundly shape The Kraft Group's performance, influencing costs and demand. Inflationary pressures impact costs, with CPI at 3.1% in January 2024. Fluctuations in consumer spending, evidenced by a 2.2% growth in 2024, further affect revenues.

Overall economic growth impacts The Kraft Group, influencing their diverse offerings like sports and entertainment. Changes in currency exchange rates and interest rate environments impact international revenues and investment strategies, particularly in real estate and other projects, potentially affecting margins.

| Economic Factor | Impact on Kraft Group | 2024 Data/Observations |

|---|---|---|

| Inflation | Rising costs, pricing adjustments | CPI: 3.1% (January 2024) |

| Consumer Spending | Revenue fluctuations | Spending grew 2.2% (2024) |

| Interest Rates | Investment and borrowing costs | Prime rate: ~8.5% (late 2024) |

Sociological factors

Consumer preferences are constantly evolving, with a growing emphasis on health and sustainability. For instance, in 2024, the market for plant-based foods reached $8.1 billion, reflecting a shift towards healthier eating habits. The Kraft Group must adapt its product offerings and packaging to meet these demands. The sports and entertainment sectors also face changing leisure preferences, impacting event attendance and merchandise sales; in 2024, live sports viewership saw a slight decline.

Demographic shifts significantly influence The Kraft Group. An aging population might reduce demand for some food items, impacting revenue. Simultaneously, a growing younger demographic could boost interest in sports and entertainment. For example, data from 2024 shows a 5% rise in youth sports participation. These trends require strategic adaptation.

Lifestyle and leisure trends significantly influence The Kraft Group's sports and entertainment divisions. For instance, NFL viewership averaged 17.9 million in 2023, showing sustained interest. Increased spending on leisure, with projections of a 6% rise in 2024, boosts event attendance. The Patriots and Revolution's success hinges on adapting to evolving fan preferences and leisure spending habits.

Social Responsibility and Ethical Consumerism

Consumers are increasingly considering social and ethical factors when making purchasing decisions. The Kraft Group's commitment to corporate social responsibility, such as sustainable sourcing, is critical. This impacts brand image and consumer loyalty, with ethical consumers often prioritizing brands aligned with their values. According to a 2024 Nielsen study, 73% of global consumers are willing to pay more for sustainable products.

- 73% of global consumers willing to pay more for sustainable products (Nielsen, 2024)

- Kraft Heinz's focus on sustainable packaging and reducing waste.

- Community involvement initiatives to enhance brand reputation.

- Growing consumer demand for transparency in supply chains.

Community Engagement and Impact

The Kraft Group prioritizes community engagement, particularly near its stadiums and real estate projects. Community impact agreements are essential, addressing local concerns to foster positive relationships. For example, Gillette Stadium's economic impact in 2024 was estimated at $800 million, supporting thousands of local jobs. Addressing community needs is crucial for project success.

- Gillette Stadium's economic impact: $800M (2024).

- Focus: Community impact agreements.

- Goal: Positive relationships and project success.

Social factors significantly influence consumer behavior and brand perception for The Kraft Group.

Consumers prioritize health, sustainability, and ethical sourcing, reflected by the $8.1 billion plant-based food market in 2024.

Community engagement, highlighted by Gillette Stadium's $800 million economic impact in 2024, shapes relationships.

| Factor | Impact | Example |

|---|---|---|

| Health & Sustainability | Product Demand, Brand Loyalty | $8.1B plant-based food market (2024) |

| Community Engagement | Brand Reputation, Local Support | $800M Gillette Stadium impact (2024) |

| Ethical Consumerism | Purchasing Decisions, Value Alignment | 73% willing to pay more for sustainable goods (2024) |

Technological factors

Automation and manufacturing tech advancements significantly impact The Kraft Group. New tech can boost efficiency and cut costs in paper and packaging. Investing in these technologies improves productivity and product quality. In 2024, the global paper and packaging market is valued at over $800 billion, with automation driving a 5-7% annual growth.

Digitalization and e-commerce are crucial. The Kraft Group must adapt to online trends to boost sales. E-commerce sales in the US food sector reached $106 billion in 2023, a 10.5% increase. Effective digital strategies also impact sports teams' ticket sales and fan engagement.

Technology significantly impacts sports, influencing player performance and fan experiences. The Kraft Group can use data analytics to boost team performance, as seen by the increased use of wearable tech. Gillette Stadium can also improve fan engagement using tech, with 70% of fans now using mobile apps during games.

Innovation in Packaging Technology

The Kraft Group's paper and packaging businesses are significantly impacted by advancements in packaging technology. Sustainable packaging solutions, such as those using recycled materials or biodegradable options, are gaining traction. Functional packaging innovations, like those that extend shelf life or improve product protection, also play a crucial role. These technological shifts can create new product lines and market opportunities for The Kraft Group.

- The global sustainable packaging market is projected to reach $433.5 billion by 2030.

- Demand for eco-friendly packaging is rising due to consumer and regulatory pressures.

- The Kraft Group can leverage these technologies to meet evolving consumer demands and environmental standards.

Cybersecurity and Data Protection

Cybersecurity and data protection are paramount for The Kraft Group, given its diverse businesses. They handle customer data in sports and entertainment, alongside potentially sensitive information in their other ventures. The global cybersecurity market is projected to reach $345.7 billion by 2025. Ensuring data privacy and security is crucial to maintain customer trust and avoid financial penalties.

- Data breaches cost companies an average of $4.45 million in 2023.

- The sports and entertainment industry is increasingly targeted by cyberattacks.

- Compliance with data protection regulations like GDPR and CCPA is vital.

Technological shifts drive The Kraft Group's strategic choices. Automation in manufacturing boosts efficiency and cuts costs, particularly in the $800 billion paper/packaging market. Digital adaptation, critical for e-commerce, is fueled by a $106 billion food sector. Moreover, sports tech enhances performance and fan experience; 70% use mobile apps. Sustainable packaging, valued at $433.5B by 2030, is a must.

| Aspect | Impact | Data |

|---|---|---|

| Automation | Boosts Efficiency, Reduces Costs | Paper/Packaging Market: $800B (2024), 5-7% annual growth |

| Digitalization | Enhances E-commerce, Fan Engagement | US Food E-commerce: $106B (2023), 10.5% increase |

| Sustainable Packaging | Meets Consumer Demand, Environmental Standards | Global Market: $433.5B by 2030 |

Legal factors

The Kraft Group faces extensive regulatory compliance across its diverse operations. This includes environmental standards in manufacturing and labor laws for its workforce. Specific regulations also apply to its sports and entertainment ventures. The company's adherence to these laws impacts its operational costs and strategic decisions. In 2024, regulatory fines for non-compliance in the sports industry alone reached $50 million.

Food safety regulations are critical for any food investment. Compliance is essential to avoid product recalls, financial penalties, and reputational harm. In 2024, the FDA issued over 1,500 warning letters for food safety violations. The Kraft Group must adhere to these to ensure consumer trust. The average cost of a food recall in the US can range from $10 million to $30 million.

Zoning and land use laws significantly impact The Kraft Group's real estate projects, particularly the new soccer stadium. These laws dictate what can be built where, affecting project feasibility. Obtaining necessary approvals is crucial. In 2024, zoning regulations delayed several major stadium projects nationwide. Compliance is essential for project success.

Intellectual Property Laws

The Kraft Group, like all major businesses, must navigate intellectual property laws to safeguard its assets. Protecting their brands, especially for the New England Patriots and consumer goods, is crucial. This involves securing trademarks, logos, and other proprietary assets to maintain brand value. In 2024, trademark filings in the U.S. reached over 700,000, highlighting the importance of IP protection.

- Trademark registration costs can range from $225 to $400 per class of goods/services.

- Infringement lawsuits can cost millions, emphasizing proactive IP management.

- Licensing revenue from trademarks and other IP is a significant revenue stream.

Labor Laws and Union Relations

The Kraft Group must adhere to all labor laws and manage union relations. This is crucial for their diverse businesses, including manufacturing and sports. Compliance ensures fair practices and avoids legal issues. Effective labor relations are vital for operational efficiency and positive public image.

- The NFL and NFLPA (players' union) have a collective bargaining agreement (CBA) that significantly impacts the Patriots.

- Manufacturing facilities must comply with OSHA regulations.

- Labor costs represent a significant portion of operational expenses.

Legal factors significantly impact The Kraft Group's operations. Strict adherence to regulations, including environmental, labor, and IP laws, is vital for compliance. The NFL's CBA impacts team finances. Compliance costs, potential fines, and the need for IP protection influence strategic decisions.

| Aspect | Impact | 2024 Data |

|---|---|---|

| Regulatory Compliance | Operational Costs | Sports industry fines: $50M |

| Food Safety | Reputation | FDA warning letters: 1,500+ |

| Intellectual Property | Brand Value | Trademark filings: 700,000+ |

Environmental factors

Environmental regulations heavily influence The Kraft Group, particularly in paper and packaging. They must comply with rules on manufacturing, waste, and emissions. Sustainability is a key focus, with the company aiming to reduce its environmental impact. For example, in 2024, they invested $50 million in eco-friendly packaging.

Climate change poses risks. Extreme weather events could disrupt The Kraft Group's operations, affecting stadiums and facilities. For instance, in 2024, the US experienced 28 weather/climate disasters exceeding $1 billion each. This impacts supply chains and infrastructure. Investments in resilience are vital for sustained operations.

The Kraft Group's paper and packaging depend on managing resources responsibly. Water, energy, and fiber are vital for production. The company focuses on efficiency and sustainable sourcing. In 2024, 80% of paper fiber came from certified sustainable sources.

Waste Reduction and Recycling

The Kraft Group, like other major manufacturers, faces increasing pressure to minimize waste and enhance recycling programs. This impacts their production processes and also significantly affects how consumers view their brands, especially concerning packaging. Sustainable practices are increasingly expected by consumers, influencing purchasing decisions and brand loyalty. Investing in waste reduction can also lead to cost savings and improve operational efficiency.

- Kraft Heinz has set a goal to make 100% of its packaging recyclable, reusable or compostable by 2025.

- In 2023, the global recycling rate for plastics was around 9%.

- The market for sustainable packaging is projected to reach $432.8 billion by 2028.

Land Use and Biodiversity

Real estate developments, like stadiums, significantly impact land use and biodiversity. The Kraft Group's projects must assess these effects, considering habitat loss and fragmentation. For instance, a new stadium could disrupt local ecosystems. The goal is to mitigate these impacts through sustainable land management practices.

- In 2023, the U.S. lost an estimated 2.5 million acres of natural areas to development.

- Biodiversity loss is a growing concern, with 28% of assessed species threatened with extinction.

Environmental concerns significantly shape The Kraft Group’s operations, particularly concerning sustainability. Regulations on emissions, waste, and sustainable sourcing are vital. The group aims to lessen environmental impact, with initiatives like eco-friendly packaging, influenced by a market projected to reach $432.8 billion by 2028.

Climate change presents considerable risks, threatening infrastructure and supply chains. In 2024, the US faced 28 weather disasters exceeding $1 billion each, impacting operations. Proactive resilience investments are essential for continued function and cost-saving opportunities.

Sustainable land management, including real estate, is also very crucial. New stadium projects can disturb ecosystems, leading to habitat loss. As of 2023, the US lost 2.5 million acres of natural areas. Biodiversity preservation through effective practices is the core of strategic planning.

| Environmental Aspect | Impact on Kraft Group | Relevant Fact (2024/2025) |

|---|---|---|

| Regulations & Sustainability | Compliance costs, brand perception | Kraft Heinz aiming for 100% recyclable packaging by 2025 |

| Climate Change | Operational disruptions, supply chain issues | US had 28 climate disasters, each exceeding $1B in damage |

| Resource Management | Input costs, sustainable sourcing | Market for sustainable packaging projected to $432.8B by 2028 |

PESTLE Analysis Data Sources

The Kraft Group's PESTLE Analysis uses official economic indicators, policy updates, market research reports, and industry-specific data for reliable insights.