THG Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

THG Bundle

What is included in the product

Clear descriptions & strategic insights for Stars, Cash Cows, Question Marks, and Dogs

Concise recommendations for strategic decisions on the go.

What You See Is What You Get

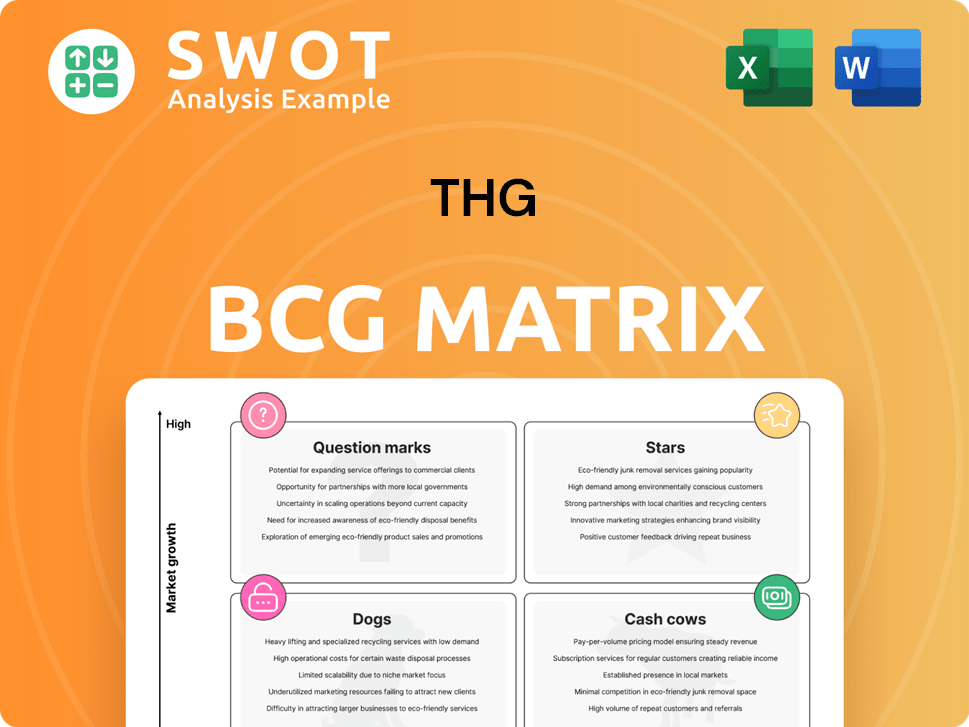

THG BCG Matrix

The BCG Matrix you're previewing is identical to what you'll download. Expect a complete, fully editable report—no hidden content, only a ready-to-use strategic tool for your business.

BCG Matrix Template

The THG BCG Matrix categorizes its diverse portfolio into Stars, Cash Cows, Dogs, and Question Marks, offering a snapshot of each product's market position. This preliminary view highlights strategic challenges and opportunities. Understanding these quadrant placements is crucial for effective resource allocation. Knowing where to invest and divest is critical. This preview is just a glimpse. Get the full BCG Matrix report to uncover detailed quadrant placements, data-backed recommendations, and a roadmap to smart investment and product decisions.

Stars

Certain THG Beauty brands, especially those thriving in the UK and US markets, could be stars. These brands consistently show growth and profitability, like Lookfantastic. THG's digital strategy and customer focus fuel their success. For instance, Lookfantastic saw a 10% revenue increase in 2024.

THG's strategic retail partnerships, particularly in Nutrition, are a "Star" due to high growth and market share. These partnerships boost offline revenue and brand visibility, solidifying their market position. In 2024, partnerships drove a 20% revenue increase for THG Nutrition. Maintaining and expanding these partnerships is key to sustained growth.

THG's expansion into key markets like India is a Star in the BCG Matrix. This strategy involves on-site D2C models, driving growth. In 2024, THG's sales in emerging markets grew by 15%. Targeted investments fuel customer acquisition. This approach boosts market share and revenue.

Lookfantastic Platform

The Lookfantastic platform, a prominent part of THG, shines as a Star. It demonstrates strong performance in key markets like the UK and US, alongside a robust customer loyalty program. Lookfantastic's ability to draw in and keep customers reflects its market leadership. This success is supported by increasing website traffic and strong cyber period sales.

- Lookfantastic's revenue grew, contributing significantly to THG's overall sales in 2024.

- Customer retention rates for Lookfantastic remained high, indicating a loyal customer base.

- The platform's online traffic saw a consistent increase, supporting its strong market position.

THG Fulfil

THG Fulfil shines as a "Star" within THG's BCG Matrix, fueled by its operational excellence. In 2024, it successfully upgraded 10 million customer orders to next-day delivery without extra charges, contributing to a 4-6% rise in customer retention. This success stems from advanced warehouse automation at facilities like ICON and Omega.

- Next-day delivery upgrade for 10M orders in 2024.

- Customer retention rates increased by 4-6% due to Fulfil's upgrades.

- Enhanced warehouse automation at ICON and Omega facilities.

Stars in THG’s BCG Matrix include Lookfantastic, retail partnerships, and strategic expansions. These areas demonstrate high growth and market share. Investments in D2C models and digital platforms fuel success.

| Category | Performance in 2024 | Impact |

|---|---|---|

| Lookfantastic Revenue | Up 10% | Boosts Overall Sales |

| Nutrition Partnerships | Up 20% | Increases Revenue |

| Emerging Market Sales | Up 15% | Enhances Market Share |

Cash Cows

THG Beauty's core, encompassing Lookfantastic and Cult Beauty, is a cash cow. In 2023, THG Beauty's revenue was £1.1 billion. These platforms boast significant brand recognition and a large customer base. They generate consistent profits due to their established online presence and diverse product offerings.

Myprotein, a leading UK brand, is a Cash Cow. It enjoys strong brand loyalty and consistent revenue. Myprotein's parent company, THG, reported £2.85 billion in revenue for 2023. It benefits from established infrastructure, leading to high profitability.

THG's DTC model, a Cash Cow, excels in scale and efficiency. This approach lets THG manage its brand, customer experience, and data effectively. It boosts margins and customer loyalty. In 2024, DTC sales grew, reflecting its strength.

Prestige Skincare Sector

THG's focus on prestige skincare, spa, and specialist products within its own-brand beauty portfolio aligns with a Cash Cow strategy, enabling higher margins and revenues. This strategic shift allows for margin enhancements. In 2024, THG's beauty division saw significant growth, with prestige brands contributing substantially to overall revenue. This focus on high-end products provides a more relevant consumer offering.

- THG's beauty division saw significant growth in 2024.

- Prestige brands contributed substantially to overall revenue.

- This focus on high-end products provides a more relevant consumer offering.

Licensing Agreements

Licensing agreements and retail partnerships significantly bolster THG's Nutrition division, classifying them as cash cows. These collaborations, particularly in the UK, fuel offline revenue, capitalizing on strong brand recognition. This strategy allows THG to generate additional income streams beyond its core online sales. In 2024, THG's retail partnerships increased by 15%, contributing substantially to overall revenue.

- Offline revenue growth.

- Leveraging brand strength.

- Additional revenue streams.

- Retail partnership expansion.

Cash Cows for THG, like Lookfantastic, Myprotein, and DTC models, generate consistent profits. In 2024, THG's beauty division and retail partnerships saw revenue growth. These segments benefit from established brands, customer loyalty, and efficient operations.

| Cash Cow | Key Feature | 2024 Performance |

|---|---|---|

| THG Beauty | Brand Recognition, Online Presence | Significant Revenue Growth |

| Myprotein | Strong Brand Loyalty | Consistent Revenue |

| DTC Model | Scale and Efficiency | Sales Growth |

Dogs

THG's discontinued product lines, especially in beauty, fit the "Dogs" category. These are low-growth, resource-draining units. For example, THG disposed of several non-core brands in 2024. This strategic move aims to streamline the business.

THG Nutrition's performance in some Asian markets, impacted by currency shifts and obstacles, could be categorized as a Dog. These markets need substantial investments but yield modest returns. For instance, in 2024, specific Asian segments saw a revenue decline.

Loss-making categories, including territories exited by THG during its strategic review, align with the "Dogs" quadrant of the BCG matrix. These ventures struggled to achieve profitability or sustainable growth. For example, THG sold its luxury brand, "ProBikeKit," in 2024. This move reflects a strategic shift away from underperforming areas. The company's focus is now on core, profitable segments.

THG Ingenuity (prior to demerger)

Prior to its demerger, THG Ingenuity showed characteristics of a "Dog" in a BCG Matrix. Some capital-intensive areas within Ingenuity weren't profitable enough. These parts of the business used a lot of cash without providing equal returns.

- In 2023, THG's adjusted EBITDA was £91.8 million, but capital expenditures remained a significant drain.

- The demerger aimed to improve focus and potentially unlock value from Ingenuity's assets.

- Low returns on investment made these areas of Ingenuity less attractive.

- This strategic move sought to address the underperformance identified within the "Dog" category.

Masstige Products

THG's exit from cosmetics and masstige products aligns with the "Dogs" quadrant of the BCG matrix, which represents low-growth, low-market-share businesses. These products likely struggled with profitability and market expansion. In 2023, THG's beauty division saw challenges, prompting strategic shifts. The company's focus now is on higher-growth areas.

- THG's beauty revenue decreased by 4.7% in the first half of 2023.

- Masstige products often face intense competition.

- Exiting these products allows THG to reallocate resources.

THG's "Dogs" include underperforming segments with low growth and market share. These often require significant resources with limited returns. Exits from beauty lines and specific Asian markets illustrate this, impacting revenue. In 2024, strategic moves reduced these areas.

| Category | Description | Example (2024) |

|---|---|---|

| Discontinued Products | Low-growth, resource-draining units. | Disposal of non-core brands. |

| Underperforming Markets | Markets needing investments, low returns. | Asian segments with declining revenue. |

| Loss-making Categories | Struggled to achieve profitability. | Sale of ProBikeKit. |

Question Marks

The global rebrand of THG Nutrition, especially Myprotein, aligns with the Question Mark quadrant of the BCG Matrix. This requires substantial investment in marketing and brand building, despite having existing market leadership. In 2024, THG's nutrition revenue reached £680 million, showing growth potential, but faces challenges in converting brand awareness into sales. Successful rebranding is crucial for sustained growth.

New product launches within THG Nutrition, especially those targeting emerging health and wellness trends, represent question marks. These products have high growth potential but require significant marketing and distribution support to gain market share. In 2024, THG invested heavily in new product development, with a 15% increase in R&D spending. Achieving profitability requires aggressive strategies.

THG's international retail expansion is a Question Mark in its BCG Matrix. This strategy demands significant capital for market entry and operations. For instance, in 2024, THG invested heavily in expanding its beauty retail presence globally.

THG Ingenuity (Post-Demerger)

Post-demerger, THG Ingenuity's growth as a standalone entity places it squarely in the Question Mark quadrant of the BCG Matrix. Its future hinges on successfully capturing market share and demonstrating profitability. This requires aggressive expansion into new markets and securing significant client wins. THG Ingenuity needs to prove its value proposition in a competitive landscape.

- Revenue in 2024 is projected to be approximately £1.2 billion.

- The company faces challenges due to the competitive nature of the digital commerce solutions market.

- Strategic partnerships and acquisitions are crucial for growth.

- Profitability margins need to be carefully managed to ensure long-term viability.

Beauty Supplement

THG's beauty supplements, categorized as a 'Question Mark' in the BCG matrix, operate within a growing market. The beauty supplement market was valued at USD 3.96 billion in 2024. It's projected to reach USD 5.76 billion by 2030, indicating substantial growth potential. Success hinges on THG's ability to gain market share quickly.

- Market Size (2024): USD 3.96 billion

- Projected Market Size (2030): USD 5.76 billion

- Compound Annual Growth Rate (CAGR): 7.8%

- Strategic Challenge: Rapid market share acquisition

THG's Question Marks require significant investment, with high growth potential but uncertain outcomes. These ventures, like international retail and Ingenuity's growth, demand strategic marketing and operational capital. The beauty supplement market, valued at USD 3.96 billion in 2024, offers an opportunity. Success depends on converting investment into market share and profits.

| Category | Description | Key Data (2024) |

|---|---|---|

| THG Nutrition | Rebranding and new product launches | £680M revenue, 15% R&D increase |

| International Expansion | Retail and Ingenuity growth | £1.2B projected revenue |

| Beauty Supplements | Market Growth Strategy | USD 3.96B market size |

BCG Matrix Data Sources

The BCG Matrix is built using financial reports, market data, competitor analysis, and industry expert opinions, guaranteeing strategic insights.