THG Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

THG Bundle

What is included in the product

Evaluates control held by suppliers & buyers, & their influence on pricing/profitability for THG.

Instantly analyze competitive forces with a visual overview of industry dynamics.

Full Version Awaits

THG Porter's Five Forces Analysis

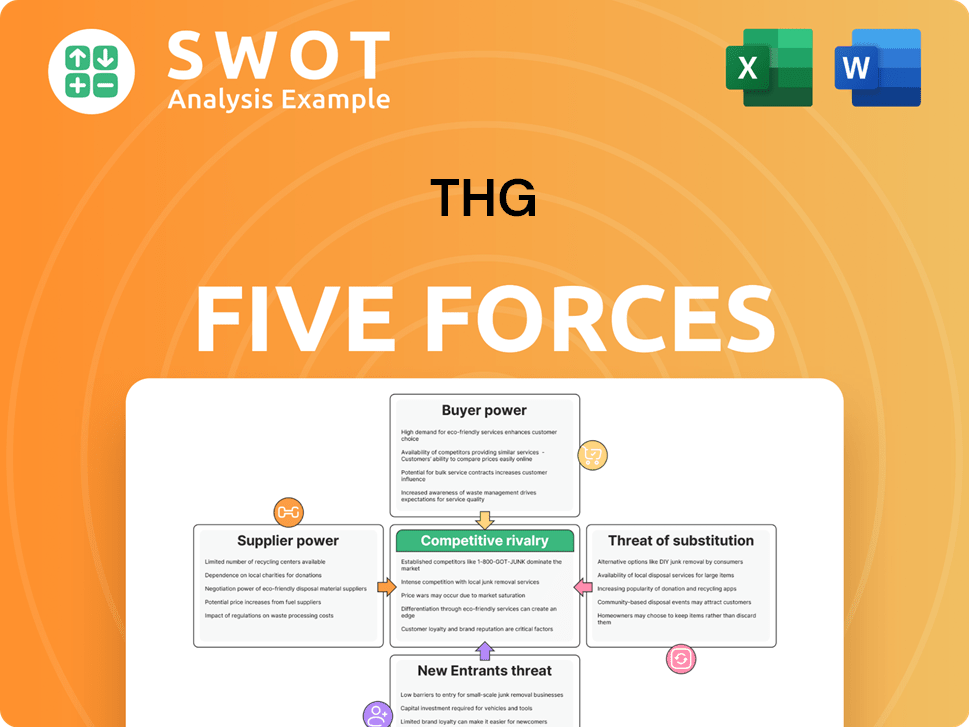

This preview showcases the comprehensive THG Porter's Five Forces analysis you'll receive immediately after purchase. It examines rivalry, buyer power, supplier power, threats of substitutes, and new entrants. The displayed document contains the full, ready-to-use analysis, with no hidden sections. Everything you see is exactly what you'll download and put to use.

Porter's Five Forces Analysis Template

THG's market position is shaped by five key forces. Rivalry is intense due to numerous competitors and pricing pressures. Buyer power is moderate, influenced by consumer choice and loyalty. Supplier power is generally low. The threat of new entrants is moderate. The threat of substitutes is a significant factor.

Our full Porter's Five Forces report goes deeper—offering a data-driven framework to understand THG's real business risks and market opportunities.

Suppliers Bargaining Power

The health and beauty sector, crucial for THG, depends on a few suppliers for specialized ingredients, like botanical extracts, giving them power. The global cosmetic ingredients market, valued at $8.48 billion in 2022, is expected to hit $13.95 billion by 2031, increasing supplier leverage. These suppliers can thus dictate prices and terms.

THG's strong ties with major brands like Unilever and L'Oréal bolster its supplier negotiation power. These partnerships provide THG leverage in securing beneficial terms and pricing. Unilever's 2022 revenue reached €60.07 billion, showcasing the scale of these key relationships.

Some suppliers in the health and beauty sector can integrate backward, influencing pricing. BASF, a significant raw material supplier, reported €68.9 billion in sales in 2023. This integration potential limits THG's negotiating power with suppliers.

Raw Material Cost Trends

The bargaining power of suppliers is significantly influenced by raw material costs. Rising costs, as seen in recent years, strengthen suppliers. In 2022, the prices of raw materials for personal care products increased by about 15%, impacting THG's profitability. This trend gives suppliers more leverage in negotiations.

- Raw Material Inflation: The cost of raw materials has been increasing, especially for ingredients like oils and packaging materials.

- Supplier Concentration: If a few suppliers control a significant portion of the market, their power increases.

- Impact on Profit Margins: Rising costs can squeeze THG's profit margins if they cannot pass these costs to consumers.

- Supplier Switching Costs: High switching costs can further empower suppliers, as THG may find it difficult to change suppliers.

Ethical Sourcing Standards

THG's commitment to ethical sourcing and environmental responsibility significantly impacts supplier relationships. By mandating adherence to ethical standards and environmental due diligence, THG influences supplier dynamics. This commitment adds complexity and potential costs, affecting supplier power within the supply chain. THG conducts regular audits to ensure compliance, with tailored requirements based on the risk profile of the country.

- THG's supplier base includes over 3,000 suppliers globally.

- Ethical sourcing audits cover areas like labor rights, environmental impact, and business ethics.

- In 2024, THG invested £10 million in sustainable initiatives.

- High-risk country audits include on-site inspections and detailed documentation reviews.

THG faces supplier bargaining power, especially from those offering specialized ingredients, potentially affecting costs. Strong partnerships with major brands like Unilever and L'Oréal provide some leverage. However, raw material cost increases and the potential for supplier integration, limit THG's control.

| Factor | Impact | Data Point (2024) |

|---|---|---|

| Ingredient Specialization | Increases supplier power | Botanical extract market expected to grow. |

| Brand Partnerships | Enhances THG's negotiation | Unilever's revenue in 2023: €60.3 billion. |

| Raw Material Costs | Squeezes margins | Personal care raw material costs up ~8%. |

Customers Bargaining Power

THG benefits from a fragmented customer base, which limits individual customer power. The company's diverse brands target specific segments, weakening the impact of any single customer. In 2024, THG's beauty division saw strong growth, indicating customer loyalty and brand appeal. THG's online platforms enable targeted engagement, catering to varied customer needs effectively.

THG's loyalty programs aim to decrease buyer power by boosting customer retention. These programs make customers less likely to switch based on price. By building brand loyalty, THG reduces the impact of customer bargaining power, helping stabilize sales. In 2024, such strategies are crucial for maintaining market share.

THG's product differentiation strategy significantly impacts customer bargaining power. By offering exclusive collaborations and own-brand products, THG reduces customer price sensitivity. THG Beauty, a key segment, operates as a digital retailer, brand owner, and manufacturer. In 2024, THG's own-brand sales accounted for a significant portion of revenue, demonstrating the success of this strategy.

Availability of Alternatives

Customers in the beauty and nutrition sectors wield considerable power because of the wide array of alternatives available. If THG's products or services fall short, buyers can effortlessly turn to competitors or substitutes. This switching ease significantly amplifies the threat to THG. For instance, in 2024, the global beauty market was valued at approximately $510 billion, with countless brands vying for consumer attention, making customer loyalty a constant challenge.

- The beauty market is highly fragmented, with many brands available.

- Customers can easily compare prices, reviews, and product features.

- Switching costs are generally low in the beauty and nutrition spaces.

- Substitutes, such as generic or private-label brands, pose a significant threat.

Price Sensitivity

Customers in the online retail space, like those interacting with THG, often show heightened price sensitivity, thus boosting their bargaining power. THG needs to carefully manage its pricing to protect its profits, as customers can swiftly compare prices across various online retailers. With the cost of living on the rise, consumers are actively seeking the best deals available. This dynamic highlights the importance of competitive pricing strategies.

- THG's gross margin for 2023 was 44.5%, indicating the need for price management.

- Online retail sales in the UK reached £114 billion in 2023, showing the scale of competition.

- Inflation rates in 2024 continue to affect consumer spending habits.

THG faces moderate customer bargaining power, influenced by factors like brand loyalty and online price comparisons. Customer power is lessened by THG’s segmented market approach. However, the easy availability of alternatives in the beauty and nutrition sectors amplifies customer influence. In 2024, managing pricing amid inflation is vital for THG.

| Factor | Impact | Data Point (2024) |

|---|---|---|

| Brand Loyalty | Reduces Customer Power | THG Beauty sales growth |

| Product Alternatives | Increases Customer Power | $510B beauty market size |

| Pricing Pressure | Increases Customer Sensitivity | UK online sales £114B (2023) |

Rivalry Among Competitors

THG faces fierce competition in beauty and nutrition. Established brands and new entrants compete for market share. The beauty market, valued at $511 billion in 2021, is highly contested. This rivalry prevents competitors from increasing profits.

THG's digital-first approach places it head-to-head with online retailers and direct-to-consumer brands. This boosts competition as firms fight for online presence and customer gains. THG's digital commerce strategy generated roughly 85% of its total revenue from direct-to-consumer online marketplaces in 2024.

Companies in beauty and nutrition use promotions to grab customers. This can cause price wars, hurting profits. THG Beauty saw profit margins expand with "promotional discipline." In 2024, marketing spend was a key focus for THG. For example, in the six months ended June 30, 2024, THG reported a marketing spend of £216.9 million.

Focus on Innovation

THG's focus on innovation is crucial for staying ahead in the competitive beauty and wellness market. Continuous development of new products and services necessitates substantial R&D investments, intensifying competitive pressure. The company's strategic progress sets a positive tone, with expectations for 2025. In 2024, THG invested £80 million in technology and infrastructure.

- R&D expenditure is expected to be a significant portion of the company's operating costs.

- THG's brand portfolio needs to maintain a fresh and appealing product pipeline.

- Investments in automation and technology are ongoing.

- The beauty market's competitive landscape continues to evolve.

Global Expansion

THG's global push pits it against diverse international competitors. Navigating varied market conditions and consumer tastes heightens rivalry. Ingenuity supports smooth global expansion, with significant growth in Australia in 2024.

- THG's international revenue grew by 10.7% in 2024.

- Australia's market share increased by 15% in 2024.

- Competitor intensity is high due to diverse global players.

- Adaptation to local markets is critical for success.

Competitive rivalry significantly impacts THG's beauty and nutrition businesses. The digital-first strategy intensifies competition among online retailers. Price wars and promotional activities can squeeze profit margins. Innovation and global expansion require substantial investment.

| Metric | 2024 Data | Impact |

|---|---|---|

| Marketing Spend | £216.9M (H1 2024) | Influences price wars and profit margins. |

| Tech & Infrastructure Investment | £80M | Supports innovation and market competitiveness. |

| International Revenue Growth | 10.7% | Reflects global market competition dynamics. |

SSubstitutes Threaten

The beauty industry faces a significant threat from substitutes. Consumers can easily switch between brands or adopt alternative beauty routines. This wide availability of substitutes, like different skincare brands, increases the competitive pressure on THG. For instance, in 2024, the global beauty market was valued at over $500 billion, showing how many options exist. The more attractive the substitute, the more it can limit a company's profitability.

The Hut Group (THG) faces threats from nutrition alternatives. Consumers may choose whole foods or homemade supplements over THG's products. This shift could happen if alternatives are seen as healthier or cheaper. For example, in 2024, the global health and wellness market reached approximately $7 trillion, indicating significant consumer interest in alternatives.

The rise of DIY beauty trends poses a substitution threat to THG. Consumers are increasingly making their own skincare products, reducing demand for THG's offerings. This shift is similar to consumers switching to ride-sharing apps. In 2024, the DIY beauty market is estimated to be worth $11.6 billion globally. This trend impacts THG's sales.

Generic Brands

The availability of generic beauty and nutrition products poses a threat to THG. These private-label options provide lower-cost substitutes, attracting price-conscious customers. If these alternatives offer comparable or superior performance, consumers are likely to switch. This can directly affect THG's sales and market share.

- In 2024, the private-label beauty market grew, indicating increased consumer adoption.

- Consumers are increasingly open to trying substitutes due to economic pressures.

- THG must maintain a competitive edge to retain its market share.

- The threat is heightened by the convenience of online shopping.

Holistic Wellness Approaches

Holistic wellness poses a significant threat to THG. Consumers are shifting towards lifestyle changes instead of relying solely on beauty or nutrition products. This shift can decrease demand for THG's offerings, as consumers seek alternative routes to wellness. The rise of wellness apps and personalized health programs further intensifies this threat, providing alternatives to traditional beauty and supplement purchases.

- The global wellness market was valued at over $7 trillion in 2023, indicating substantial consumer interest in alternatives.

- The adoption of wellness apps has surged, with downloads increasing by 25% in 2024.

- Consumers are increasingly prioritizing preventive health, with 60% reporting they are actively seeking lifestyle changes.

- THG's revenue growth slowed to 8% in 2024, reflecting the impact of this trend.

THG faces threats from substitutes across beauty, nutrition, and wellness. Consumers can switch to cheaper or healthier alternatives. In 2024, the global beauty market exceeded $500 billion, showing options. The rise of DIY and generic products intensifies this challenge.

| Substitute | Impact on THG | 2024 Data |

|---|---|---|

| Beauty Brands | Increased Competition | Market value over $500B |

| Nutrition Alternatives | Reduced Demand | Health/Wellness at $7T |

| DIY Trends | Lower Sales | DIY market at $11.6B |

Entrants Threaten

The online retail sector often has low barriers to entry, allowing new competitors to easily enter the market. This poses a significant threat to THG, especially in its key markets. New entrants can quickly gain market share, intensifying competition. In 2024, the e-commerce market is valued at $6.3 trillion, highlighting the sector's attractiveness and the ease of entry for new players.

The rise of e-commerce platforms like Shopify and Etsy has made it easier than ever for new brands to enter the market. This increased accessibility lowers the hurdles for startups, intensifying competition. For instance, in 2024, over 2.7 million new businesses were created in the US alone, many leveraging online sales. New entrants often aggressively pursue market share, challenging established companies.

The direct-to-consumer (DTC) trend allows new brands to connect with consumers directly, bypassing traditional retail. This significantly reduces entry barriers, intensifying competition for companies like THG. In 2024, DTC sales in the U.S. reached approximately $175 billion, highlighting the trend's impact. THG utilizes proprietary technology to support multi-channel brand development and customer engagement.

Capital Requirements

Capital requirements pose a significant barrier for new entrants in the online retail space. While the digital realm lowers some hurdles, building a recognized brand and a robust logistics setup demands considerable financial outlay. This can limit the number of new competitors entering the market, reducing the threat to some extent. Entry into this industry necessitates substantial investment in capital and resources.

- Amazon's capital expenditures in 2023 totaled approximately $59.6 billion.

- Establishing a comprehensive fulfillment network, like Amazon's, requires billions in infrastructure investment.

- Marketing and branding efforts to compete with established players can cost millions annually.

- Smaller online retailers often struggle to secure the necessary funding to compete effectively.

Brand Building

Building a strong brand is vital in the beauty and nutrition sectors. THG's existing brands and customer loyalty create a barrier for new competitors. New entrants face challenges in gaining market share against established names. Diversification from other markets poses a significant threat. This can strain existing company profitability.

- THG's core brands include Myprotein and Lookfantastic.

- Brand awareness and loyalty are key competitive advantages.

- New entrants may struggle to match established brand recognition.

- Diversification can provide entrants with resources.

New online retail entrants intensify competition for THG, especially in the $6.3 trillion e-commerce market. Platforms like Shopify ease market entry, with millions of new businesses created annually. Although capital requirements and established brands pose barriers, diversification from other markets creates risks. THG must strategically navigate these competitive dynamics.

| Aspect | Impact | 2024 Data |

|---|---|---|

| Market Attractiveness | High | E-commerce market valued at $6.3 trillion |

| Ease of Entry | Moderate | Over 2.7M new US businesses (2024) |

| Brand Barriers | Significant | THG's Myprotein & Lookfantastic brands |

Porter's Five Forces Analysis Data Sources

The analysis integrates data from SEC filings, industry reports, and market research to gauge competitive dynamics. This ensures an evidence-based evaluation of THG's market position.