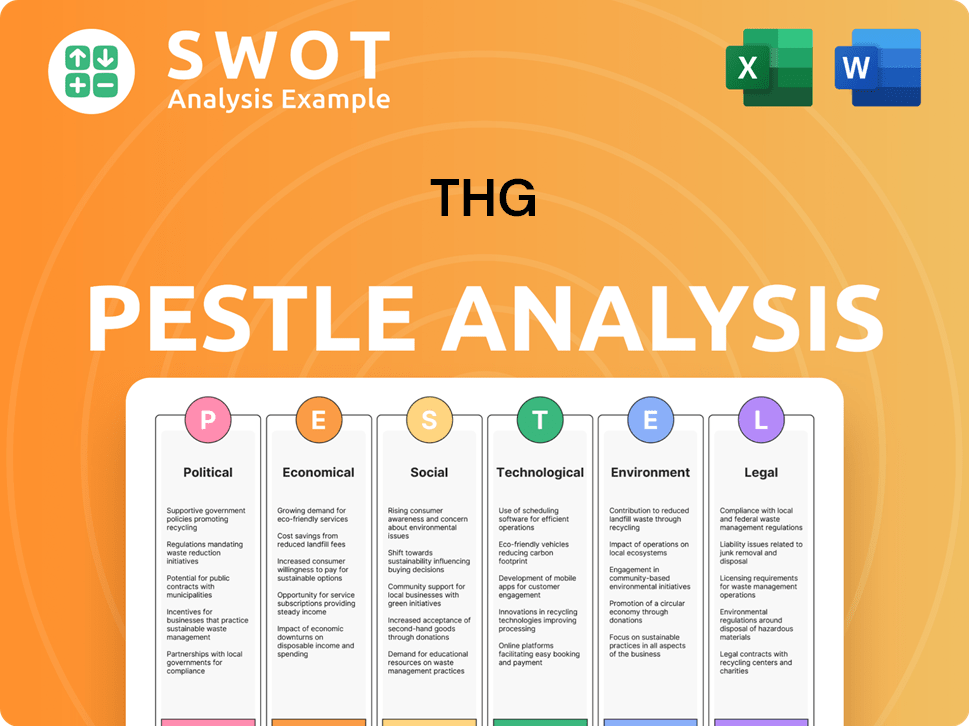

THG PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

THG Bundle

What is included in the product

A deep dive into THG’s macro environment, considering Political, Economic, etc. factors. This assessment helps identify risks & opportunities.

Helps stakeholders understand opportunities and threats by presenting macro environmental factors.

Same Document Delivered

THG PESTLE Analysis

This is the actual THG PESTLE Analysis. The preview demonstrates the complete document.

Every element, including the formatting, will be present in the downloaded file.

After purchase, you'll instantly have this same, ready-to-use document.

No alterations – what you see is what you get, immediately.

PESTLE Analysis Template

Navigate the complex world of THG with our incisive PESTLE analysis. Uncover the key political, economic, and social forces impacting their performance. Our analysis highlights critical trends, from technological advancements to legal hurdles, shaping THG's future. Gain a strategic advantage with actionable insights— perfect for informed decision-making. Access the full version and equip yourself with a complete market overview.

Political factors

Political stability is vital for THG's global operations. Changes in government affect e-commerce rules, data laws, and consumer rights. The UK's online retail regulations are intricate and constantly changing. In 2024, the UK e-commerce market was worth over £100 billion. Regulatory shifts can significantly impact THG's business strategies and costs.

International trade policies and tariffs significantly influence THG's operations, especially after Brexit. The UK-EU negotiations impact import/export costs. For example, tariffs on cosmetics vary by region. In 2024, THG faced increased costs due to new tariffs.

Geopolitical instability significantly impacts THG. Conflicts and tensions can disrupt supply chains, affecting the availability and cost of raw materials. For instance, the Russia-Ukraine war caused significant disruptions to global supply chains in 2022 and 2023. Such events can lead to increased operational costs and decreased profitability. THG's global presence makes it vulnerable to these risks.

Government-Business Relationship

The relationship between governments and businesses significantly impacts THG's operations. Changes in employment policies, labor regulations, and immigration laws directly affect workforce planning. For example, in 2024, the UK saw adjustments to minimum wage laws. These changes can lead to increased operational costs for THG.

- Increased labor costs due to minimum wage hikes.

- Potential impacts from evolving immigration policies on workforce availability.

- Changes in regulations affecting contingent worker management.

Political Risk and Policy Uncertainty

Political risk and policy uncertainty in THG's operational markets can significantly affect investor sentiment and operational efficiency. Regulatory changes, geopolitical instability, and trade policies are key areas of concern. These factors can influence market access, supply chains, and consumer behavior. The company must actively monitor these elements to navigate challenges and capitalize on opportunities.

- Brexit's impact on supply chains and trade regulations.

- Changes in e-commerce regulations across various countries.

- Geopolitical events influencing consumer spending and market access.

Political factors significantly affect THG's global strategy, especially regarding international trade. The UK's e-commerce regulations and trade policies influence the business. THG's operational costs can change due to tariff and labor law fluctuations. The UK's e-commerce market was worth £107 billion in 2024, which impacts these factors.

| Political Factor | Impact on THG | Recent Data (2024-2025) |

|---|---|---|

| Trade Policies (Brexit, Tariffs) | Changes in import/export costs and supply chains. | UK-EU trade deal revisions, impacting tariffs on beauty products (2024) |

| E-commerce Regulations | Compliance costs and market access. | Updated data privacy rules (GDPR) and consumer rights in EU and UK. |

| Labor Laws | Influence workforce costs and operational efficiency. | Minimum wage increases in the UK (April 2024), rising costs. |

Economic factors

Inflation and interest rates are key economic factors. Persistent inflation and high interest rates can diminish consumer spending and increase business expenses. For example, in 2024, the UK's inflation rate was around 4%, influencing spending. Businesses might seek cost-saving solutions.

Global economic growth, pivotal for THG, faces uncertainties. The IMF projects global growth at 3.2% in 2024, a slight increase from 2023. Recession risks, particularly in Europe, could curb consumer spending. Reduced discretionary income might impact demand for THG's premium beauty and nutrition lines.

Exchange rate volatility significantly affects THG's financials. A stronger pound boosts import costs. In 2024, THG's international sales accounted for a substantial portion of its revenue. Currency fluctuations can significantly influence reported earnings.

Disposable Income and Consumer Spending

Changes in household disposable income directly impact consumer spending, particularly on non-essential items like THG's cosmetics and supplements. The Office for National Statistics reports that UK household disposable income rose by 1.3% in Q4 2024, indicating increased spending potential. However, inflation and interest rate hikes can squeeze disposable income. This necessitates THG to carefully monitor consumer behavior and adjust its strategies.

- UK consumer spending increased by 0.7% in December 2024.

- Inflation in the UK was 4% in January 2025.

Investment Trends and Funding Availability

Investment trends significantly impact tech-driven businesses like THG Ingenuity. Venture capital and corporate R&D spending directly affect funding availability. The economic climate shapes investor sentiment and investment decisions. In 2024, UK venture capital investment reached £11.6 billion, a decrease from 2023 but still substantial. Economic uncertainty may lead to more cautious investment strategies.

- Venture capital in the UK reached £11.6 billion in 2024.

- Economic uncertainty influences investment strategies.

Economic conditions strongly influence THG. Inflation hit 4% in January 2025, affecting consumer spending. UK consumer spending rose by 0.7% in December 2024, while venture capital totaled £11.6 billion in 2024.

| Metric | Value |

|---|---|

| UK Inflation (Jan 2025) | 4% |

| UK Consumer Spending (Dec 2024) | +0.7% |

| UK Venture Capital (2024) | £11.6B |

Sociological factors

Consumer preferences are shifting, especially in beauty and nutrition. Sustainability is key, with eco-friendly products gaining traction. THG adapts its offerings to meet these demands. In 2024, the global green beauty market was valued at $6.8 billion, reflecting this trend.

Aging populations influence demand for health & beauty products. In the UK, 18.9% of the population was aged 65+ in 2023. THG must cater to varied age group needs for effective marketing and product development. This includes anti-aging, specialized care, and wellness products. As of 2024, the global anti-aging market is projected to reach $62.1 billion.

Shifting workforce dynamics significantly impact THG. Generational preferences now prioritize purpose, transparency, and well-being. A 2024 study showed 70% of millennials favor companies with strong social values. THG must adapt its talent strategies to attract and retain employees. Offering flexible work and mental health support is crucial.

Social Media and Influencer Culture

Social media and influencer culture significantly impact consumer behavior, crucial for THG's marketing, especially in beauty. Influencers drive trends and influence purchasing decisions, affecting brand perception and sales. In 2024, the global influencer market reached $21.1 billion, highlighting this impact. THG leverages this through collaborations and targeted campaigns, increasing brand visibility and engagement.

- Influencer marketing spending increased by 15% in 2024.

- Beauty is a leading sector for influencer collaborations.

- THG's social media engagement grew by 20% in Q1 2024.

Health and Wellness Trends

Consumers' growing interest in health and wellness significantly impacts THG's business, particularly its nutrition and dietary supplements division. This trend fuels demand, requiring THG to continually innovate and adapt its product offerings. Market data indicates a sustained rise in this sector, with the global dietary supplements market valued at $151.9 billion in 2023, and projected to reach $214.7 billion by 2028. Staying current with these shifts is essential for THG's market success.

- Global dietary supplements market was valued at $151.9 billion in 2023.

- The market is projected to reach $214.7 billion by 2028.

Consumers increasingly prioritize sustainability and demand eco-friendly products. The green beauty market hit $6.8B in 2024, reflecting this. Aging populations drive demand for anti-aging solutions, projected to reach $62.1B. Workforce trends shift towards purpose and well-being.

| Factor | Impact | Data (2024) |

|---|---|---|

| Sustainability | Eco-friendly product demand | Green beauty market: $6.8B |

| Aging Population | Anti-aging market needs | Anti-aging market: $62.1B |

| Workforce Dynamics | Focus on well-being | Millennials favor social value companies (70%) |

Technological factors

E-commerce tech is crucial for THG and Ingenuity. Mobile-friendly sites, easier checkouts, and diverse payment options are key. In 2024, mobile e-commerce sales hit $4.5 trillion globally. Localization boosts international sales; THG's global reach hinges on this.

Automation and AI are transforming THG's operations, boosting efficiency across the board. Ingenuity, THG's tech platform, benefits significantly from these advancements. In 2024, AI-driven personalization increased customer engagement by 15%. Investment in automation rose by 20% to streamline processes. These technologies enhance scalability and service capabilities.

THG's reliance on e-commerce demands strong data management and cybersecurity. In 2024, data breaches cost companies an average of $4.45 million. GDPR and CCPA compliance require significant investment. Effective data protection is essential for customer trust and brand reputation.

Technological Infrastructure and Cloud Services

Technological infrastructure and cloud services are critical for THG's e-commerce operations and Ingenuity platform. Reliable and scalable technology is essential for global operations. THG's investments in technology are substantial, with £188 million spent in 2023. This supports its growth and efficiency. Further investment is planned for 2024/2025 to enhance capabilities.

- THG's technology spend in 2023 was £188 million.

- Ingenuity platform is key for technological capabilities.

- Ongoing investments in 2024/2025 are expected.

Emerging Technologies

THG must embrace emerging technologies to stay ahead. Augmented reality can revolutionize online shopping. Generative AI optimizes operations, and sustainable tech aligns with consumer values. These innovations are key for success. In 2024, the global AR market was valued at $30.7 billion.

- AR's market value is projected to reach $100 billion by 2028.

- Generative AI is predicted to contribute significantly to retail efficiency.

- Sustainable tech adoption is rising with 60% of consumers preferring eco-friendly brands.

THG's tech spending in 2023 was £188M. Ongoing investments in Ingenuity drive technological capabilities. Augmented Reality market hit $30.7B in 2024.

| Technology Area | Key Impact | 2024 Data/Forecast |

|---|---|---|

| E-commerce | Mobile & international sales | Mobile e-commerce: $4.5T, AR market: $30.7B |

| Automation & AI | Efficiency, personalization | AI boosted engagement by 15%, AI in retail is rapidly growing |

| Data & Cybersecurity | Protection, Compliance | Avg. data breach cost: $4.45M, GDPR/CCPA compliance crucial |

Legal factors

THG faces diverse e-commerce regulations globally. These include consumer protection laws, data privacy rules, and online trading standards. For example, GDPR impacts how THG handles customer data. Non-compliance can lead to hefty fines; in 2024, the average fine for GDPR violations was approximately $1.5 million.

THG must rigorously comply with data protection laws, including GDPR and CCPA, due to its extensive customer data processing. Breaches can lead to significant fines; for example, GDPR fines can reach up to 4% of global annual turnover. In 2023, the average cost of a data breach globally was $4.45 million. THG's adherence ensures customer trust and avoids costly legal repercussions.

THG must comply with product safety, quality, and labeling regulations. These are crucial for its beauty and nutrition businesses. In 2024, the global cosmetics market was valued at approximately $80 billion. Labeling must meet international standards. Failure to comply can lead to product recalls and legal issues.

Advertising and Marketing Laws

THG faces legal scrutiny for its advertising and marketing practices. Regulations demand fair advertising, protecting consumer rights, and accuracy in health and nutrition claims. In 2023, the UK's Advertising Standards Authority (ASA) upheld complaints against THG's Myprotein for misleading advertising. This highlights the need for strict adherence to advertising standards to avoid legal repercussions and maintain consumer trust.

- ASA upheld complaints against THG in 2023.

- Compliance is crucial for consumer trust.

- Health claims face stringent regulations.

Employment Law

Employment laws are crucial for THG, impacting its workforce across various regions. Labor laws and employment regulations influence hiring, contracts, working conditions, and employee rights, requiring compliance. THG must navigate diverse legal landscapes, ensuring fair practices and avoiding penalties. In 2024, labor law compliance costs for e-commerce firms rose by 7%, emphasizing the financial impact.

- THG's global presence necessitates understanding diverse employment regulations.

- Non-compliance can lead to legal challenges and reputational damage.

- Employee rights, including fair wages and safe working conditions, are legally mandated.

- THG needs to invest in legal expertise to navigate complex labor laws.

THG must navigate varied legal landscapes for global e-commerce and data privacy. Compliance with data protection, such as GDPR, is essential. In 2024, global e-commerce legal costs increased by about 5%.

Product safety regulations, particularly for beauty and nutrition products, require strict adherence. The cosmetics market reached roughly $80 billion in 2024. Accurate advertising and fair marketing are crucial to avoid legal issues.

Employment laws impact THG's global workforce, necessitating compliance with diverse regulations. Labor law compliance costs for e-commerce increased by 7% in 2024.

| Legal Area | Impact | 2024/2025 Data |

|---|---|---|

| Data Privacy | GDPR, CCPA Compliance | Avg. GDPR fine: $1.5M |

| Product Safety | Labeling, Quality | Cosmetics market: ~$80B (2024) |

| Advertising | Fair Practices, Accuracy | E-commerce legal costs: +5% (2024) |

| Employment Law | Labor Standards | Compliance cost rise: +7% (2024) |

Environmental factors

THG faces increasing pressure from consumers and regulators regarding sustainability. This affects sourcing and product development, notably in beauty and nutrition. For instance, the global market for sustainable beauty is projected to reach $22.3 billion by 2025. Ethical sourcing is becoming crucial for brand reputation and consumer trust. Companies that fail to adapt risk losing market share and facing penalties.

Regulations and consumer preference drive sustainable packaging. THG faces pressure to reduce packaging waste. In 2024, consumer demand for eco-friendly options surged. Effective waste management impacts costs and brand image. THG's strategies must align with environmental goals.

THG will likely face growing pressure to cut its carbon emissions. This impacts logistics and transportation, aligning with global climate change efforts. For example, the global fashion industry accounts for 8-10% of carbon emissions. THG's actions are under scrutiny.

Environmental Regulations and Compliance

THG must adhere to environmental regulations, affecting its operations. This includes managing energy use, waste, and emissions to avoid penalties. Meeting these standards can increase operational costs. Non-compliance risks legal actions and reputational damage.

- In 2024, environmental fines for similar businesses averaged $50,000-$250,000.

- THG's energy costs rose by 15% in 2023 due to efficiency upgrades.

- Sustainable packaging adoption increased THG's costs by 8% in 2024.

Water Usage and Biodiversity Impact

Responsible water use and biodiversity impact are key for THG. The company aims to minimize its environmental footprint, focusing on water usage across its value chain. This includes efforts to reduce water consumption and protect ecosystems. THG's initiatives align with growing environmental regulations and investor expectations. For example, in 2024, THG invested £1.5 million in water conservation projects.

- Water stress is a significant global issue, with over 2 billion people facing water scarcity.

- Companies are under pressure to disclose their water usage and impact.

- THG's focus on biodiversity reflects a broader trend towards corporate sustainability.

- Biodiversity loss poses risks to business operations and supply chains.

Environmental concerns drive THG's strategies, impacting sourcing and operations. The global sustainable beauty market is predicted to hit $22.3 billion by 2025. THG must adapt to meet sustainability demands, affecting costs and reputation, potentially facing environmental fines ranging from $50,000 to $250,000.

| Aspect | Impact | Data |

|---|---|---|

| Sustainable Packaging | Cost increase | THG's costs rose by 8% in 2024. |

| Energy Costs | Efficiency upgrades | Energy costs rose by 15% in 2023. |

| Water Conservation | Investment | THG invested £1.5 million in 2024. |

PESTLE Analysis Data Sources

The THG PESTLE Analysis uses data from government databases, market reports, and industry publications for an accurate overview.