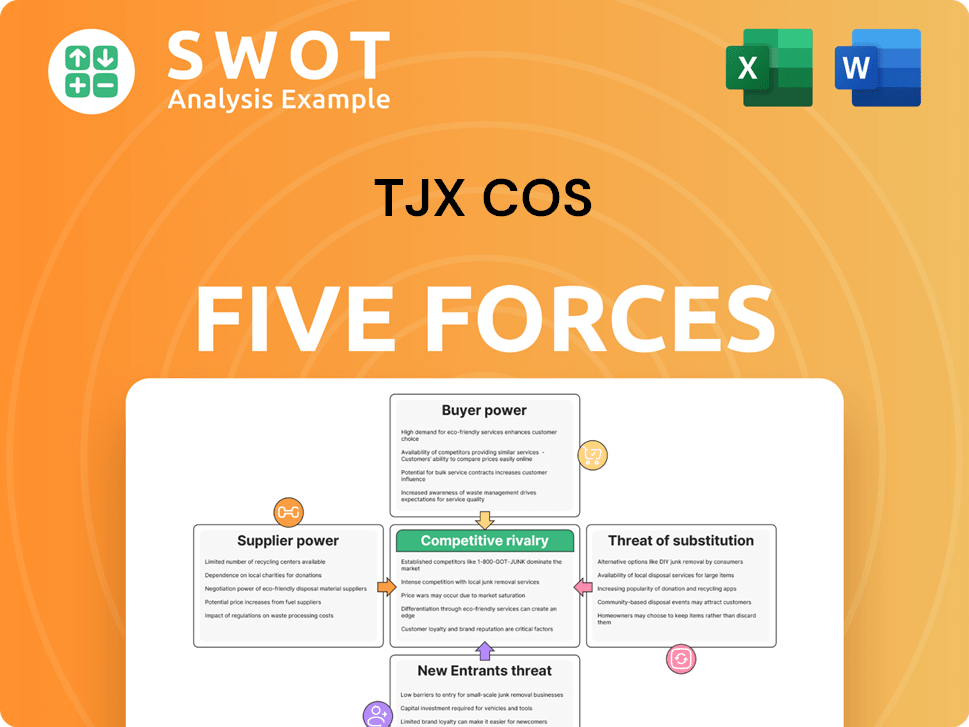

TJX Cos Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

TJX Cos Bundle

What is included in the product

Evaluates control held by suppliers and buyers, and their influence on pricing and profitability.

Quickly identify competitive threats and opportunities using a dynamic, real-time dashboard.

Preview Before You Purchase

TJX Cos Porter's Five Forces Analysis

You're previewing the final version—precisely the same document that will be available to you instantly after buying. This TJX Cos Porter's Five Forces analysis examines competitive rivalry, supplier power, buyer power, threat of substitution, and threat of new entrants. Each force is thoroughly evaluated, providing a clear understanding of TJX's industry dynamics and competitive landscape. The analysis offers valuable insights, assessing the company's strengths and weaknesses within its market. The fully formatted, ready-to-use document is yours immediately after purchase.

Porter's Five Forces Analysis Template

TJX Cos. faces moderate rivalry, with off-price competitors like Ross Stores. Buyer power is significant due to consumer choices and price sensitivity. Supplier power is relatively low, given the diverse sourcing of merchandise. The threat of substitutes is moderate, with online retailers posing a challenge. New entrants face high barriers due to brand recognition and established supply chains.

Ready to move beyond the basics? Get a full strategic breakdown of TJX Cos’s market position, competitive intensity, and external threats—all in one powerful analysis.

Suppliers Bargaining Power

TJX's extensive supplier network, comprising around 19,000 vendors worldwide, significantly diminishes supplier power. This broad base, spanning 21 countries, prevents over-reliance on any single entity. For instance, no individual vendor accounted for over 1% of TJX's total merchandise purchases in 2024. This diversity ensures competitive pricing and supply stability.

TJX's opportunistic buying model significantly reduces supplier power. They buy excess inventory, closeouts, and discontinued items. This gives TJX strong bargaining power. In 2024, TJX's revenue was approximately $54.2 billion, showcasing its ability to leverage supplier relationships for favorable terms. This model allows TJX to acquire merchandise at bargain prices, maximizing profit margins.

As a high-volume purchaser, TJX Companies wields substantial bargaining power over suppliers. The company's vast purchasing scale allows for competitive pricing and favorable contract terms. In fiscal year 2023, TJX's purchasing volume reached $54.3 billion, providing significant negotiation leverage. This strong position enables TJX to secure advantageous deals from suppliers.

Alternative Sourcing Options

TJX's global sourcing strategy offers robust alternative options, reducing supplier bargaining power. This approach allows TJX to negotiate favorable terms and maintain competitive pricing. The company leverages its extensive network to mitigate supply chain risks and adapt to market changes swiftly. For instance, in fiscal year 2024, TJX sourced merchandise from over 21,000 vendors across more than 100 countries.

- Global Sourcing: TJX sources merchandise from over 21,000 vendors.

- Vendor Diversification: Operations across more than 100 countries.

- Negotiating Power: Ability to switch suppliers for better terms.

- Market Agility: Ensures dynamic shopping experiences.

Negotiating Position

TJX's bargaining power over suppliers is strong due to its flexible sourcing model. Switching suppliers costs are low, around 1-2% of procurement. TJX's long-term vendor relationships average 7-10 years. Quarterly contract renegotiation occurs at 18-22%, securing cost cuts.

- Low switching costs strengthen TJX's position.

- Long vendor relationships promote stable supply chains.

- Frequent renegotiations enable annual cost reductions.

- TJX negotiates cost reductions from suppliers, averaging 3-5% annually.

TJX's extensive vendor network weakens supplier power. With 21,000+ vendors globally, no single supplier holds significant leverage. In 2024, its revenue was approximately $54.2B, bolstering bargaining power. They secure favorable terms and prices.

| Aspect | Details |

|---|---|

| Vendor Base | 21,000+ |

| Revenue 2024 | $54.2B |

| Negotiation | Annual cost reductions 3-5% |

Customers Bargaining Power

TJX, in the off-price sector, faces price-sensitive customers hunting for deals. This gives customers strong bargaining power; they can easily switch to competitors if prices seem high. In 2024, with tighter budgets, more shoppers traded down to off-price retailers. TJX's Q3 2024 sales rose 6% as bargain hunting increased.

TJX faces strong customer bargaining power due to abundant alternatives. Shoppers can easily switch to competitors such as Ross Stores and Burlington. Online retailers like Amazon and eBay also present significant competition. In 2024, TJX's revenue was approximately $54.2 billion, but this is constantly challenged by the ease with which customers can find alternatives.

Customer awareness of TJX deals and quality has soared due to online platforms, impacting buying decisions. In 2024, digital retail sales reached $1.1 trillion, empowering consumers to compare offerings. This informed consumer base strengthens their bargaining power, pushing TJX to maintain competitive pricing. TJX's revenue in 2024 was approximately $54.2 billion, highlighting the scale of consumer influence.

Low Switching Costs

TJX's customers have considerable bargaining power due to low switching costs. Consumers face minimal barriers to changing where they shop. This ease of switching heightens competition within the retail sector.

- TJX's net sales for fiscal year 2024 were $54.2 billion.

- The company operates over 4,900 stores across nine countries.

- The company's stock price is up ~30% YTD as of May 2024.

Economic Conditions

Economic conditions significantly influence customer bargaining power, particularly affecting retailers like TJX Cos. During economic downturns, consumers become more price-sensitive, seeking discounts and promotions. In 2024, with inflation impacting consumer spending, bargain hunting at stores like TJX has increased.

- Consumer spending decreased by 0.4% in May 2024.

- TJX's Q1 2024 net sales increased by 6% to $12.5 billion.

- Inflation rates in the U.S. remain above 3% as of June 2024.

TJX's value proposition, offering quality at lower prices, becomes a key advantage in such times.

TJX faces substantial customer bargaining power, fueled by price sensitivity and easy access to alternatives. Consumers can readily switch to competitors like Ross Stores or online platforms, intensifying competition. In 2024, digital retail sales reached $1.1 trillion, empowering shoppers. TJX's net sales for fiscal year 2024 were $54.2 billion, reflecting this influence.

| Factor | Impact | Data (2024) |

|---|---|---|

| Price Sensitivity | High | Consumer spending decreased 0.4% in May 2024. |

| Alternatives | Abundant | Digital retail sales: $1.1T |

| Switching Costs | Low | TJX Q1 sales up 6% to $12.5B. |

Rivalry Among Competitors

The retail sector is fiercely competitive, particularly in the off-price segment where TJX operates. Key competitors include Ross Stores and Burlington, alongside department stores like Macy's and Kohl's. These companies battle for customers seeking value and discounts. TJX faces substantial competition from both physical and online retailers, impacting market share and pricing strategies.

Customers face low switching costs in retail, readily moving between stores. This fuels competition as retailers vie for customer loyalty. Online media enhances customer awareness of deals and quality. TJX Cos. reported \$15.5 billion in revenue for the nine months ended November 4, 2023, highlighting the impact of competitive dynamics.

The off-price retail sector is highly competitive, with many companies competing for consumers. TJX Companies, a key player, faces strong competition despite its substantial market share. Operating 4,755 stores across brands like T.J. Maxx and Marshalls, TJX must constantly innovate. In 2024, TJX reported net sales of $15.5 billion in the first quarter, indicating continued market pressure.

E-commerce Growth

E-commerce's surge intensifies rivalry for TJX. Consumers shift online, pressuring TJX to boost its digital presence. Amazon and others are tough competitors. In 2024, online retail sales reached approximately $1.1 trillion, showcasing the e-commerce challenge.

- TJX's digital sales growth lags behind overall e-commerce expansion.

- Amazon's market capitalization is significantly larger than TJX's.

- TJX must invest heavily in its online infrastructure.

- The off-price model faces different challenges online.

Merchandise Differentiation Strategies

TJX Cos. thrives through merchandise differentiation. They source unique inventory from over 21,000 vendors worldwide, ensuring fresh, diverse offerings. Rapid inventory turnover, around 4-6 weeks, keeps stores dynamic. Discount pricing, 20-60% below department stores, creates value and attracts customers.

- Global Vendor Network: Over 21,000 vendors supply diverse merchandise.

- Rapid Turnover: Inventory cycles approximately every 4-6 weeks.

- Discount Pricing: Offers 20-60% discounts compared to department stores.

- Treasure Hunt Experience: Drives repeat visits and fosters loyalty.

Competitive rivalry in off-price retail is intense, with TJX facing strong competition. Competitors like Ross Stores and Burlington, along with department stores, vie for market share. E-commerce further intensifies the competition. TJX must innovate to stay ahead.

| Metric | TJX Cos. | Industry Average (Off-Price Retail) |

|---|---|---|

| 2024 Net Sales (Q1) | $15.5B | Varies |

| Store Count (2024) | 4,755 | Varies |

| Inventory Turnover | 4-6 weeks | Similar |

SSubstitutes Threaten

E-commerce platforms pose a substantial threat to TJX. Online retailers like Amazon and eBay offer convenience and competitive pricing. This online shift impacts TJX's in-store shopping experience. Subscription services offer personalized shopping. In 2024, online retail sales hit $1.1 trillion, showing the growing impact.

Traditional department stores and specialty retailers, such as Macy's and Kohl's, present a threat by offering similar products. These competitors often run sales, drawing price-sensitive consumers. The retail sector's competitiveness intensifies this threat. In 2024, department store sales saw fluctuations, highlighting the ongoing struggle. For instance, Macy's reported a -2.7% decline in same-store sales in Q3 2024, indicating the pressure TJX faces.

Shifting consumer preferences, like the rise of online shopping, are a threat. TJX must adapt to trends, including e-commerce growth and regulatory changes. Maintaining a competitive edge requires continuous innovation. In 2024, e-commerce sales grew, impacting traditional retailers. TJX needs to evolve to stay relevant.

Subscription Boxes

Subscription boxes, such as Stitch Fix and Trunk Club, pose a threat to TJX Companies due to their convenience and personalized shopping experiences. These services directly compete with TJX by offering curated selections delivered to customers' homes, potentially diverting sales. Consumers are increasingly drawn to online shopping, emphasizing the need for TJX to bolster its digital presence. In 2024, online retail sales continue to grow, with subscription services capturing a significant portion of the market.

- Subscription services offer personalized shopping experiences.

- They cater to convenience and customization.

- Consumers increasingly prefer online shopping.

- TJX needs to enhance its online platform.

Economic Downturns

Economic downturns pose a significant threat, as consumers might switch to less expensive options or delay purchases. Worldwide or specific market economic conditions can damage consumer confidence and reduce discretionary spending, potentially impacting financial results. Recent data indicates a shift, with consumers prioritizing essential goods over non-essential items. For instance, in 2024, the retail sector saw a 5% decrease in discretionary spending compared to the previous year.

- Consumers become more price-sensitive during downturns.

- TJX's sales of off-price merchandise could be impacted.

- Essential goods like food and utilities gain importance.

- The shift in spending habits affects retail strategies.

The threat of substitutes significantly impacts TJX Companies. Subscription services and online platforms offer consumers alternatives, like personalized shopping experiences and convenient access. These options divert customers from TJX's traditional brick-and-mortar stores.

The growing popularity of online retail necessitates TJX's digital adaptation. Consumers are choosing convenience and curated selections. Data from 2024 shows a continuous rise in online retail.

Economic changes influence consumer preferences and spending. Economic shifts, like inflation or recessions, can lead to changes in customer behavior. TJX must adapt to stay competitive and meet evolving consumer needs.

| Substitute Type | Impact on TJX | 2024 Data |

|---|---|---|

| Online Retailers | Increased Competition | Online sales reached $1.1T. |

| Subscription Services | Personalized Shopping | Subscription growth at 15%. |

| Economic Downturns | Reduced Spending | Discretionary spending fell by 5%. |

Entrants Threaten

TJX Companies leverages substantial economies of scale, enabling bulk purchases at lower costs and competitive pricing. New entrants face challenges matching these economies, needing significant capital and market presence. TJX's purchasing power allows for favorable contract terms. In 2023, TJX reported approximately $54.1 billion in revenue, showcasing its immense scale.

TJX Companies benefits from strong brand loyalty across its chains like T.J. Maxx. New entrants face high marketing costs to attract TJX's established customer base. In 2024, TJX's marketing expenses were approximately $1.5 billion. Consistent positive brand perception and customer service are vital in this competitive landscape.

TJX's robust distribution network is a key advantage. It supports a wide product range and quick market responses. New entrants face a high barrier to replicate this efficient system. Global supply chain issues require seamless integration. In 2024, TJX's supply chain agility was critical for profitability.

High Initial Capital Requirements

The off-price retail sector, like the one TJX Cos operates in, demands considerable upfront capital. New entrants face significant barriers due to the need for large-scale inventory purchases. Securing prime retail locations and establishing robust logistics networks also require hefty investments. TJX Companies, with a vast network of 4,786 stores as of 2023, illustrates the scale needed to compete effectively.

- Inventory costs can be substantial, especially for diverse product offerings.

- Real estate expenses include leases or property purchases in desirable locations.

- Logistics investments cover distribution centers and supply chain infrastructure.

- The magnitude of these investments discourages many potential competitors.

Regulatory and Compliance Hurdles

New entrants in the retail sector face significant regulatory and compliance challenges. Navigating zoning laws, labor regulations, and import restrictions introduces complexity and costs. Adhering to environmental, social, and governance (ESG) standards demands continuous effort. These hurdles protect TJX Companies' competitive edge.

- Compliance costs can include significant legal and operational expenses.

- ESG reporting and compliance are increasingly crucial for retailers.

- Import regulations vary widely by country, adding complexity.

New entrants face steep challenges due to TJX’s economies of scale and brand loyalty, requiring substantial capital and marketing investment to compete. TJX's established distribution network and supply chain further complicate market entry. Regulatory and compliance burdens, plus high startup costs, act as significant barriers.

| Factor | Impact on New Entrants | TJX Advantage |

|---|---|---|

| Scale | High capital needs | $54.1B revenue (2023) |

| Brand | Costly marketing | $1.5B marketing spend (2024) |

| Distribution | Complex logistics | 4,786 stores (2023) |

Porter's Five Forces Analysis Data Sources

The TJX Cos analysis uses annual reports, financial statements, market analysis, and industry publications to gather the necessary competitive insights. The sources ensure an accurate portrayal of market conditions and competitive dynamics.