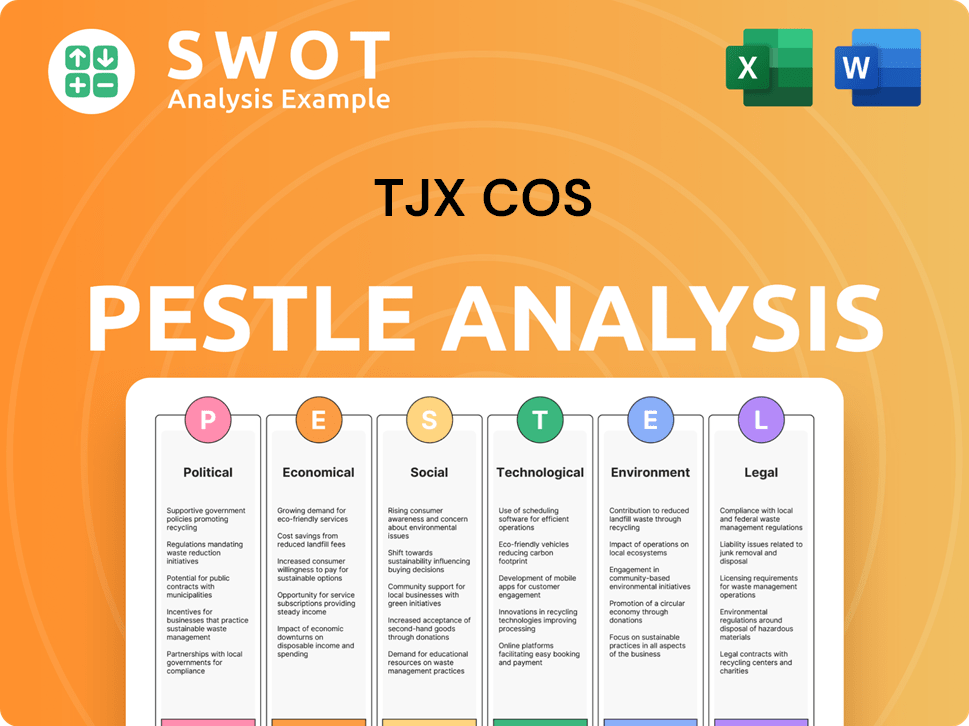

TJX Cos PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

TJX Cos Bundle

What is included in the product

Examines external factors affecting TJX: Political, Economic, Social, Tech, Environmental, Legal, and offers insights.

Provides a concise version for swift risk identification & mitigation planning across all areas.

What You See Is What You Get

TJX Cos PESTLE Analysis

The preview showcases the complete TJX Cos PESTLE Analysis you'll get. The formatting and details displayed are the same in the purchased document. Access this comprehensive analysis instantly after your payment is confirmed. Every element, from the headings to the data points, is fully included. No editing is needed.

PESTLE Analysis Template

TJX Cos faces shifting political landscapes with trade regulations impacting supply chains. Economic volatility, including inflation, influences consumer spending and cost structures. Technological advancements reshape retail experiences and inventory management. Social trends toward value-consciousness affect brand perceptions. Regulatory pressures add complexity to operational compliance, while environmental awareness shapes sourcing practices. Unlock deeper strategic insights—download our full PESTLE analysis now!

Political factors

TJX faces risks from fluctuating trade policies. US tariffs, especially on goods from China, directly affect its global sourcing. In Q4 2024, TJX reported net sales of $16.0 billion, demonstrating its scale. Diversifying sourcing is key to managing these costs and maintaining profitability. The company's strategic adjustments aim to protect its margins.

TJX faces government retail regulations globally, impacting operations. They must adhere to labor laws, import/export rules, and product safety standards. Compliance costs are ongoing, with potential penalties for violations. For instance, TJX spent $4.3 billion on SG&A in fiscal year 2024, a portion of which covers regulatory compliance.

Political stability in sourcing nations significantly impacts TJX's operations. Unstable regions can disrupt supply chains, leading to delays and increased costs. For instance, the 2024-2025 geopolitical tensions might force TJX to diversify its sourcing, potentially increasing transportation expenses by 5-7%. These disruptions can also affect product availability.

Geopolitical Tensions

Geopolitical tensions pose risks to TJX's global supply chains and operations. Disruptions, such as those seen during the Russia-Ukraine conflict, can increase costs and affect product availability. For instance, shipping costs surged in 2022 due to these tensions.

- Increased shipping costs in 2022 impacted retail margins.

- Supply chain disruptions can lead to inventory shortages.

- Political instability affects consumer confidence, potentially reducing sales.

Government Influence on Business

Political factors exert a nuanced influence on TJX Companies. Although its focus on essential goods might limit direct impacts, changes in tax policies and regulations pose risks. TJX operates globally, making it susceptible to varying political climates and investor obligations. The company must navigate these complexities to ensure stable operations and investment returns. For instance, tax reforms in key markets could alter profitability.

- Tax policies significantly affect TJX's financial outcomes.

- International trade regulations impact supply chains.

- Political stability influences consumer confidence and spending.

- Government regulations on labor and employment.

Political factors significantly affect TJX's operations through trade policies and regulations, influencing sourcing costs and supply chains. Government regulations, including labor laws and product safety, add to operational expenses. The company navigates global instability, affecting supply chain stability.

| Impact Area | Specific Risk | TJX's Response |

|---|---|---|

| Trade Policies | Tariffs and trade wars | Diversify sourcing; optimize supply chains |

| Regulations | Compliance costs (labor, import/export) | Invest in compliance; adapt to regional rules |

| Political Stability | Supply chain disruptions and consumer confidence decline. | Flexible logistics and inventory planning. |

Economic factors

Global economic trends significantly affect TJX's performance, especially consumer discretionary spending. During economic uncertainty, consumers seek value, boosting TJX's off-price appeal. In Q4 2023, TJX's sales rose 6%, reflecting this trend. Inflation and economic concerns in 2024/2025 will likely continue to drive consumers to off-price retailers like TJX.

Inflation and economic shifts greatly affect consumer spending and TJX's pricing. In Q1 2024, U.S. inflation was around 3.4%, impacting buying decisions. TJX has shown resilience, maintaining gross margins despite these pressures. This suggests successful pricing and inventory management. The company's ability to adapt is vital for sustained performance.

The economic recovery and growth, especially in the retail sector, are beneficial for TJX. Off-price retail is positioned well to capitalize on consumer demand. In 2024, TJX's sales increased, reflecting this positive trend. This growth allows TJX to consider opening new stores and expanding its market reach.

Interest Rates and Consumer Credit

Interest rate fluctuations significantly shape consumer credit dynamics, directly impacting consumer spending, which is critical for TJX. Higher interest rates typically make borrowing more expensive, potentially curbing consumer spending at stores like TJX. Conversely, lower rates could encourage spending, benefiting TJX's sales, especially given its credit card operations. In Q1 2024, the Federal Reserve held interest rates steady, but future decisions will influence consumer behavior and TJX's financial results.

- As of May 2024, the Federal Reserve maintained the federal funds rate between 5.25% and 5.50%.

- TJX reported $1.6 billion in credit card receivables in fiscal year 2024.

Exchange Rate Fluctuations

Exchange rate fluctuations are a key economic factor for TJX, impacting its global business. Changes in exchange rates affect the cost of goods sold and the profitability of sales in different countries. TJX actively uses hedging strategies to manage these currency risks. For instance, a stronger U.S. dollar can reduce the cost of goods imported by TJX.

- In Q1 2024, TJX reported a 2% increase in overall sales, partly influenced by currency impacts.

- TJX's international segment accounted for approximately 35% of total revenue in fiscal year 2024.

- Hedging strategies aim to offset currency impacts, but they are not always fully effective.

Economic factors are crucial for TJX. Consumer spending trends, influenced by inflation and interest rates, greatly impact sales. Currency fluctuations also play a significant role in global operations, affecting costs and profitability. Hedging helps manage these currency risks.

| Factor | Impact | Data (2024) |

|---|---|---|

| Inflation | Affects consumer spending | Q1 U.S. inflation ~3.4% |

| Interest Rates | Influence borrowing & spending | Fed funds rate: 5.25%-5.50% |

| Currency Exchange | Affects costs/profit | Int'l sales ~35% revenue |

Sociological factors

Consumer value perception significantly impacts TJX. The demand for discounted prices is rising, especially with inflation. TJX's off-price model caters directly to this trend. In Q4 2024, TJX's sales rose 6% to $16.0 billion, showing consumer preference for value. This model resonates well in an environment where consumers seek savings.

The surge in online shopping significantly impacts traditional retail. Consumers now blend online and in-store purchases. TJX's digital sales are climbing; in 2024, they reached a high percentage of total sales, reflecting this shift.

Demographic shifts significantly impact TJX's customer base and market reach. An aging population in key markets like the U.S. (where 16.8% of the population is 65+) could alter consumer preferences. Population growth rates, with the global population exceeding 8 billion in 2024, also affect demand. Career attitudes and financial stability influence spending habits, impacting TJX's sales.

Consumer Preferences for Brands and Quality

TJX Companies thrives by providing branded and designer goods at reduced prices, which resonates with consumers prioritizing quality and style without the premium price tag. This strategy is particularly effective in today's market. TJX's ability to source and sell off-price merchandise caters to value-conscious shoppers. Data from 2024 shows a rise in consumer demand for affordable luxury.

- TJX's net sales for the first quarter of fiscal 2025 were $12.46 billion, a 6% increase over the same period last year.

- Comparable store sales increased by 3% in the U.S. and 4% internationally.

- The company's off-price model continues to be successful.

Cultural Differences in International Markets

TJX faces cultural nuances in international markets, impacting consumer behavior and brand perception. For instance, in 2024, TJX's international sales accounted for approximately 25% of its total revenue. Adapting to local tastes is crucial; in Japan, a market with unique preferences, successful retailers often customize product assortments.

This requires careful market research and flexibility in merchandising. Cultural sensitivity influences marketing strategies; what resonates in the US may not in Europe or Asia. Failure to adapt can lead to poor sales and brand damage.

Consider these aspects:

- Language barriers affect marketing and customer service.

- Religious beliefs influence product choices and store operations.

- Social norms impact shopping habits and brand loyalty.

- Celebrations and holidays affect sales patterns.

Sociological factors, like consumer value perception, heavily influence TJX. Demand for discounts remains high, with a 6% rise in Q4 2024 sales. Demographic shifts and online shopping further impact sales strategies. Cultural adaptations in international markets are essential, particularly for areas like Japan, where unique preferences exist.

| Factor | Impact | Data Point |

|---|---|---|

| Consumer Behavior | Value-driven purchasing | Off-price model success |

| Online Retail | Changing purchase habits | Rising digital sales |

| Demographics | Shifting consumer base | Aging pop. in U.S.(16.8% 65+) |

Technological factors

TJX Cos. has enhanced its e-commerce capabilities. Online retail is growing due to tech advancements. TJX has expanded its digital platforms. In 2024, digital sales reached $6.5 billion. This growth strategy boosts market reach.

Technological advancements are pivotal for TJX's supply chain optimization, boosting cost-efficiency. In 2024, TJX invested significantly in supply chain tech to streamline operations. For instance, in Q4 2024, TJX saw a 3% reduction in supply chain costs due to tech upgrades.

Data privacy and security are paramount for TJX, especially with its growing online presence. The company must comply with evolving consumer protection laws. TJX invests in robust data security measures to safeguard customer information. Breaches can lead to substantial financial penalties and reputational damage. The global data security market is projected to reach $326.4 billion by 2027.

In-Store Technology

TJX Companies leverages technology within its stores to enhance the customer experience and boost operational efficiency. While technologies like visual recognition shopping are emerging, their widespread adoption presents a potential disruption. In 2024, TJX invested significantly in technologies to streamline inventory management and improve checkout processes. These enhancements aim to reduce wait times and optimize store layouts.

- Inventory management systems saw a 15% upgrade in efficiency.

- Checkout processes improved, reducing average customer wait times by 10%.

Inventory Management Systems

TJX relies heavily on inventory management systems to handle its vast and constantly changing inventory. These systems are crucial for tracking merchandise efficiently, which is essential for the off-price model's success. Technology enables TJX to quickly adapt to new trends and manage a diverse product range. In fiscal year 2024, TJX's inventory turnover rate was approximately 5.0, demonstrating effective inventory management.

- Real-time inventory tracking optimizes stock levels.

- Data analytics predict demand and reduce overstocking.

- Automated systems streamline supply chain operations.

- Technology improves markdown strategies.

TJX continues to expand its digital footprint to meet growing consumer demand. In 2024, digital sales were $6.5B. Advanced tech optimizes the supply chain. TJX's tech investments in 2024 saw a 3% reduction in supply chain costs. Cybersecurity is crucial, with a projected $326.4B market by 2027. Tech enhancements also improve customer experiences.

| Tech Area | 2024 Metrics | Impact |

|---|---|---|

| E-commerce | $6.5B Digital Sales | Expanded market reach |

| Supply Chain | 3% Cost Reduction (Q4) | Increased efficiency |

| Customer Experience | 10% less wait time | Better in-store service |

Legal factors

TJX must comply with retail-specific rules, such as product safety standards from the CPSC. Recent data shows that in 2023, the CPSC recalled over 400 products, affecting retail operations. This impacts TJX's sourcing and sales, requiring stringent compliance. Failure to adhere to these regulations can lead to significant penalties and reputational damage. These regulations are crucial for consumer protection and business operations.

TJX must comply with various labor laws, affecting operational costs. Minimum wage hikes, like the $15/hour in some US states, directly increase payroll expenses. Stricter regulations on working conditions and benefits, such as healthcare, also add to these costs. These legal factors influence TJX's profitability and pricing strategies. For instance, in FY2024, TJX's SG&A expenses were $13.9 billion.

TJX Cos. must comply with data protection laws globally. This includes GDPR, CCPA, and other regional regulations. In 2024, data breaches cost businesses an average of $4.45 million. Non-compliance can lead to hefty fines and reputational damage. Maintaining robust data security measures is crucial for TJX.

Trade Agreements and Import/Export Laws

Trade agreements and import/export laws significantly impact TJX's global operations. The USMCA, for example, affects cross-border trade with Canada and Mexico, influencing sourcing costs. Tariffs and international restrictions can increase expenses and disrupt supply chains. Navigating these legal factors is crucial for TJX's profitability and market access. In 2024, TJX's international segment accounted for roughly 30% of total revenue, highlighting the importance of these trade considerations.

- USMCA impacts cross-border trade with Canada and Mexico.

- Tariffs and restrictions can increase costs.

- International segment accounted for ~30% of revenue in 2024.

Consumer Protection and Advertising Regulations

TJX faces scrutiny regarding advertising and consumer protection. They must comply with FTC regulations, ensuring honest pricing and advertising. Non-compliance can lead to hefty fines and damage to brand reputation. In 2024, the FTC's budget for consumer protection was over $400 million.

- FTC enforcement actions in 2024 included cases against deceptive advertising, impacting retail practices.

- TJX must avoid misleading consumers about sales or product quality.

- Compliance costs include legal, marketing, and operational adjustments.

TJX navigates retail regulations, including product safety overseen by the CPSC. Failure to comply with such regulations can lead to fines and impact their operations. Data protection is critical. Moreover, TJX must adhere to consumer protection laws, preventing misleading advertisements.

| Legal Area | Regulation | Impact on TJX |

|---|---|---|

| Product Safety | CPSC Standards | Sourcing, Sales, Compliance Costs |

| Labor Laws | Minimum Wage, Benefits | Operational Costs, Pricing Strategy |

| Data Protection | GDPR, CCPA | Data Security, Fines |

Environmental factors

TJX faces increasing environmental regulations. Stricter rules aim to cut pollution and emissions. Compliance is crucial for operations. For example, in 2024, TJX invested $50 million in sustainable practices. Failure to comply leads to penalties.

TJX is responding to consumer demand by focusing on sustainable sourcing. They are committed to ethical practices, aiming to reduce their environmental impact. For example, in 2024, TJX reported increasing its use of sustainable materials by 15% in its products. This commitment is driven by growing consumer awareness.

TJX Cos. focuses on waste management. They aim to divert operational waste from landfills. Initiatives include eliminating, reusing, and recycling materials. In 2023, TJX diverted 78% of its operational waste. This shows progress in environmental responsibility.

Energy Consumption and Renewable Energy

TJX is focused on lowering its carbon footprint. They invest in energy-efficient tech and boost renewable energy use. For example, TJX aims to increase renewable energy consumption. They are actively working on reducing emissions.

- TJX's sustainability report highlights these efforts.

- They have set specific goals for reducing emissions.

- Details on renewable energy adoption are available.

Supply Chain Environmental Impact

TJX's supply chain faces growing environmental scrutiny. Sustainable practices are becoming increasingly vital. This includes reducing carbon emissions and waste. Investors and consumers are pushing for greener operations. TJX must adapt to stay competitive.

- Supply chain emissions account for a large portion of TJX's overall environmental footprint.

- Consumers increasingly prefer brands with eco-friendly supply chains.

- Regulations, such as those related to waste management, are tightening.

TJX is addressing environmental impacts via regulations and consumer demand. The company invests in sustainability, including sustainable sourcing and waste reduction efforts. In 2024, they increased sustainable material use.

Waste diversion and carbon footprint reduction are major aims, supported by tech and renewable energy adoption. TJX actively works to cut emissions. The supply chain undergoes scrutiny; thus, sustainable practices are key to staying competitive.

| Environmental Aspect | TJX Initiatives | 2024 Data/Targets |

|---|---|---|

| Regulatory Compliance | Investments in sustainable practices | $50 million invested |

| Sustainable Sourcing | Focus on ethical practices, material usage | 15% increase in sustainable materials used |

| Waste Management | Eliminate, reuse, and recycle materials | 78% operational waste diverted (2023) |

| Carbon Footprint | Energy-efficient tech, renewable energy | Ongoing emissions reduction efforts |

PESTLE Analysis Data Sources

This TJX Cos. PESTLE leverages reliable data from financial reports, industry publications, and governmental resources. Data on market trends comes from market analysis firms and credible news outlets.