u-blox Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

u-blox Bundle

What is included in the product

Tailored analysis for u-blox's product portfolio, revealing strategic recommendations.

Printable summary optimized for A4 and mobile PDFs, making u-blox BCG Matrix accessible anywhere.

What You’re Viewing Is Included

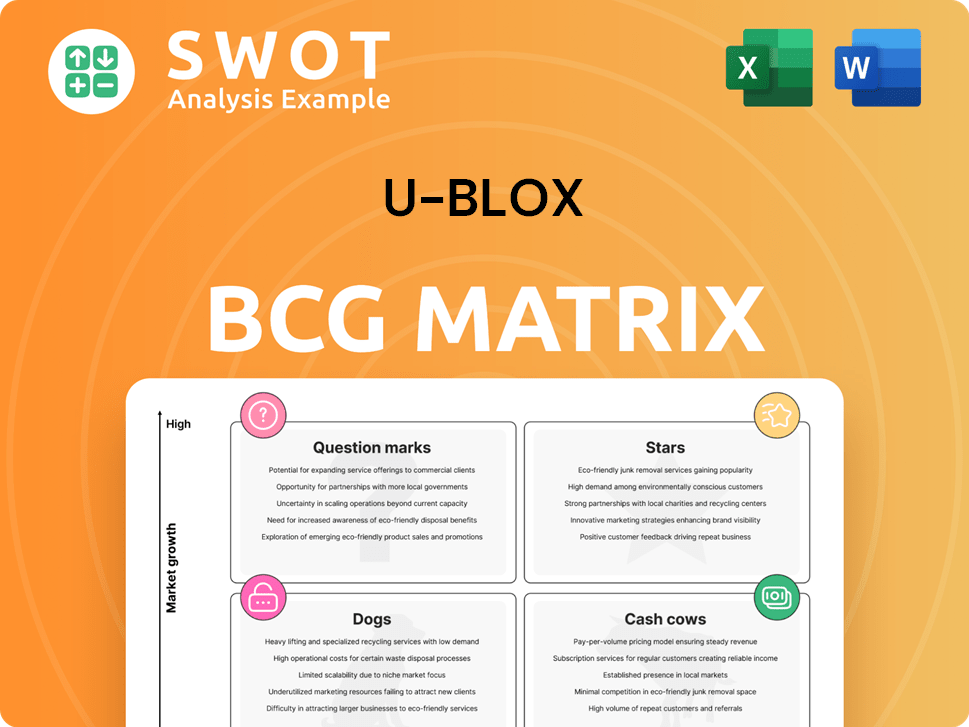

u-blox BCG Matrix

The preview showcases the complete u-blox BCG Matrix document you'll receive upon purchase. It's the final, fully functional version, ready for immediate analysis and strategic planning—no hidden content or alterations. This document provides the same precise data and insights as the purchased version, ensuring your analysis is consistent and reliable. The downloaded file is designed for seamless integration into your presentations or internal reports.

BCG Matrix Template

Uncover u-blox's strategic landscape with a glimpse into its BCG Matrix. See how its diverse product portfolio—from Star performers to Dogs—is positioned. This sneak peek offers a taste of the company's investment potential. Gain deeper insights into market share and growth. Purchase the full BCG Matrix for actionable strategies and a competitive edge.

Stars

The Locate business, centered on GNSS solutions, targets high-growth markets like automotive and IoT. U-blox strategically prioritizes Locate, aiming for market leadership after divesting its Cellular business. This focus allows for innovation and leveraging unique tech assets. In 2024, the GNSS market is projected to reach $6.5 billion, supporting U-blox's strategy.

U-blox excels in automotive GNSS, crucial for automated driving. The market is booming, with 30% of new vehicles using GNSS by 2024. U-blox's presence in China, a leader in autonomous tech, boosts this segment. This positions GNSS solutions as a "Star" product.

The market for high-precision positioning (HPP) is expanding, fueled by automotive and robotics. U-blox's GNSS and RTK tech offers centimeter accuracy. Their F9 and X20 platforms are key. This makes HPP a star, with strong growth potential. U-blox saw a 17.5% revenue increase in 2023, showing market demand.

Short-Range Wireless Solutions

The Short-Range Wireless Solutions, including Wi-Fi and Bluetooth modules, is a star in u-blox's BCG matrix. This segment is on track for a financial turnaround, with expectations to reach break-even by the second half of 2025. Growing revenues in automotive and industrial sectors highlight its potential. For 2024, u-blox anticipates a revenue of CHF 545-595 million in communication technologies. Further strategic efforts could strengthen its leading position.

- Expected break-even: H2 2025.

- 2024 Revenue forecast (communication technologies): CHF 545-595 million.

- Key applications: Automotive and industrial.

Satellite IoT-NTN Cellular Module

The SARA-S528NM10 module, introduced in September 2024, is a key offering in u-blox's portfolio. It facilitates global coverage and precise positioning for satellite IoT applications. This module is designed to meet the growing need for dependable global connectivity, particularly for asset tracking in areas with limited terrestrial network access. It represents a product with significant growth prospects, driven by the expanding IoT market.

- Launched in September 2024.

- Supports global coverage.

- Targets asset tracking in remote areas.

- Addresses the growing IoT market.

Stars in u-blox's BCG matrix include Locate, automotive GNSS, HPP, and Short-Range Wireless Solutions. These segments show strong growth potential and align with market trends. In 2023, u-blox reported a 17.5% revenue increase. New offerings like the SARA-S528NM10 module, launched in September 2024, also contribute.

| Category | Key Features | Financials/Status |

|---|---|---|

| Locate | GNSS solutions for automotive and IoT. | 2024 GNSS market projected at $6.5B. |

| Automotive GNSS | Crucial for automated driving. | 30% of new vehicles use GNSS by 2024. |

| High-Precision Positioning (HPP) | GNSS and RTK tech. | 17.5% revenue increase in 2023. |

| Short-Range Wireless | Wi-Fi and Bluetooth modules. | Break-even expected H2 2025, CHF 545-595M revenue in 2024 (comm tech). |

Cash Cows

U-blox's GNSS modules are cash cows, dominating with top-tier quality and precision. These modules are essential in automotive and industrial sectors, ensuring steady revenue streams. In 2024, u-blox's revenue was CHF 543.4 million, with strong growth in key markets. Innovation and partnerships will be key to keeping this market share and cash flow strong.

Industrial automation solutions are a cash cow for u-blox, generating substantial revenue. The increasing use of high-precision tech fuels consistent demand. Reliable, efficient solutions ensure a steady cash flow. In 2024, this segment saw a 15% revenue increase.

The automotive sector's demand for navigation and infotainment, fueled by EVs, generates steady revenue. U-blox's solutions in this area have shown consistent growth. Securing long-term contracts with automotive OEMs is key. In 2024, the infotainment market is estimated at $35 billion. U-blox's automotive segment revenue grew by 15% in Q3 2024.

Global Market Presence

U-blox boasts a robust global footprint, with offices strategically located in Europe, Asia, and the USA, facilitating consistent revenue streams across varied geographies. This extensive network allows u-blox to effectively serve diverse markets. In 2024, u-blox reported significant growth in Asia-Pacific, with revenues increasing by 15%. Further investment in regional alliances and market expansion can fortify its cash cow status.

- Global presence with offices in Europe, Asia, and the USA.

- Consistent revenue generation across different regions.

- Caters to diverse markets.

- Focus on regional partnerships.

Secure Data Services

U-blox's secure data services and connectivity solutions are a cash cow, providing a reliable revenue stream. Their silicon-to-cloud offering enables customers to gather and encrypt geo-tagged data securely. Enhancing data security features is key to attracting more clients and fostering long-term revenue. In 2024, the global market for IoT security is projected to reach $15.8 billion, highlighting the importance of secure data services.

- Stable revenue stream from connectivity solutions.

- Silicon-to-cloud offering for secure data collection.

- Focus on enhancing data security features.

- IoT security market projected at $15.8B in 2024.

U-blox's cash cows include GNSS modules, industrial automation solutions, and automotive solutions. These segments generate significant, steady revenue, as evidenced by a 15% revenue increase in the automotive segment in Q3 2024. Secure data services further bolster this status. By focusing on innovation, partnerships, and global expansion, u-blox aims to maintain its strong financial position.

| Cash Cow Segment | Key Features | 2024 Performance Highlights |

|---|---|---|

| GNSS Modules | Top-tier quality, precision; essential for automotive & industrial. | U-blox's 2024 revenue was CHF 543.4 million; strong market growth. |

| Industrial Automation | High-precision tech; consistent demand; reliable solutions. | 15% revenue increase in 2024. |

| Automotive Solutions | Navigation & infotainment; fueled by EVs; consistent growth. | Infotainment market estimated at $35 billion; 15% growth in Q3 2024. |

Dogs

U-blox is phasing out its Cellular business due to fierce competition and financial losses. Despite generating revenue, the segment suffered significant EBIT losses, classifying it as a 'dog' in the BCG Matrix. This strategic move allows u-blox to concentrate on more lucrative areas. The Cellular business saw a decline in revenue in 2024.

Revenue from u-blox's consumer segment has dropped, signaling a weak market position, potentially placing related products in the 'dog' category. For example, in 2024, consumer electronics sales decreased by about 7% due to slower demand. A strategic shift towards more profitable sectors, like industrial or automotive, could improve overall performance.

In 2024, u-blox's cellular IoT modules, battling Chinese competitors, suffered from low margins. The company saw a substantial drop in cellular IoT module shipments. This market segment's exit aims to cut losses and allow u-blox to concentrate on its profitable areas. For instance, in Q3 2024, u-blox reported a significant decrease in revenue from this sector.

Products Dependent on Legacy Technologies

Products dependent on legacy technologies face market challenges. Outdated tech can hinder competitiveness, like with older GNSS modules. Investing in innovation is crucial; u-blox spent CHF 157.6 million on R&D in 2023. Discontinuing obsolete lines improves efficiency.

- Legacy tech products struggle in the market.

- Investment in new tech is essential.

- Discontinuing outdated products boosts efficiency.

Unsuccessful Market Penetration Attempts

Products failing to gain traction despite efforts are 'dogs' in the BCG Matrix. Turnaround plans are often costly and ineffective for these. Divesting or discontinuing these products may be the most prudent financial move. U-blox's revenue in 2024 was approximately CHF 1.7 billion, so decisions impact the whole structure.

- Focus on core competencies.

- Reduce financial drain.

- Assess market relevance.

- Free up resources.

In the u-blox BCG Matrix, "Dogs" represent segments struggling with low market share and growth, often leading to financial losses. Cellular, consumer electronics, and certain IoT modules have been classified as "Dogs" due to poor performance. This strategic stance allows u-blox to focus on higher-growth, profitable areas to improve overall financial health.

| Category | 2024 Revenue Impact | Strategic Action |

|---|---|---|

| Cellular Business | Significant EBIT losses | Phasing out business |

| Consumer Electronics | Sales decreased by 7% | Shifting to new sectors |

| Cellular IoT modules | Drop in shipments | Exiting market segment |

Question Marks

The SARA-S528NM10 module signifies a potential, but satellite IoT remains a question mark. High expenses and limited adoption currently hinder growth. In 2024, the satellite IoT market was valued at approximately $1.7 billion. Strategic moves are crucial for u-blox to gain traction.

Venturing into new GNSS applications in emerging markets positions u-blox as a question mark. Success hinges on market acceptance and navigating regulatory landscapes. For example, 2024 saw a 15% growth in GNSS device sales in Southeast Asia. Careful analysis and strategic investments, like the planned $50 million expansion in India, are vital.

Integrating AI and ML in u-blox solutions offers substantial growth potential. However, this also introduces uncertainty. Market demand and tech advancements will dictate success. In 2024, AI in semiconductors grew, with revenues reaching $77.6 billion. R&D investment is crucial for capitalizing on AI opportunities.

Automated and Autonomous Driving Solutions Beyond GNSS

u-blox's foray into automated and autonomous driving beyond its GNSS stronghold presents a question mark in its BCG matrix. The market is competitive, with established automotive technology providers already present. Technological hurdles and the need for significant R&D investments pose challenges. Strategic partnerships and focused innovation are critical for u-blox to succeed.

- The global autonomous driving market was valued at $63.01 billion in 2023 and is projected to reach $241.11 billion by 2030.

- Key competitors include Bosch, Continental, and NVIDIA.

- u-blox's revenue in 2023 was CHF 550.4 million.

LTE-M and NB-IoT Technologies

LTE-M and NB-IoT present opportunities, but the market is still developing. u-blox's success hinges on adoption rates and competition. Strategic investments are crucial for market share growth. Monitoring technology adoption is essential. Product development is key to competing effectively.

- Global NB-IoT connections reached 380 million in 2024.

- LTE-M connections are projected to reach 200 million by the end of 2024.

- u-blox's revenue from cellular modules in 2023 was CHF 488.4 million.

- Competition includes module providers like Quectel and Telit.

Question marks in u-blox's BCG matrix represent high-growth potential areas with uncertain outcomes. These ventures require strategic investments and careful market analysis. For example, u-blox needs strategic partnerships in automated driving. In 2024, u-blox's cellular modules brought in CHF 488.4 million.

| Category | Challenge | 2024 Data |

|---|---|---|

| Satellite IoT | High Costs, Limited Adoption | $1.7 billion market value |

| GNSS in Emerging Markets | Market Acceptance, Regulation | 15% GNSS device sales growth (SEA) |

| AI/ML Integration | Market Demand, Tech Advancements | $77.6B AI in semiconductors revenue |

| Automated Driving | Competition, R&D Needs | $63.01B (2023) autonomous driving market |

| LTE-M/NB-IoT | Adoption Rates, Competition | 380M NB-IoT connections |

BCG Matrix Data Sources

The u-blox BCG Matrix utilizes data from financial reports, market analysis, and expert opinions for accurate positioning.