u-blox Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

u-blox Bundle

What is included in the product

Tailored exclusively for u-blox, analyzing its position within its competitive landscape.

Instantly identify competitive threats and opportunities with an easy-to-read, five-force overview.

What You See Is What You Get

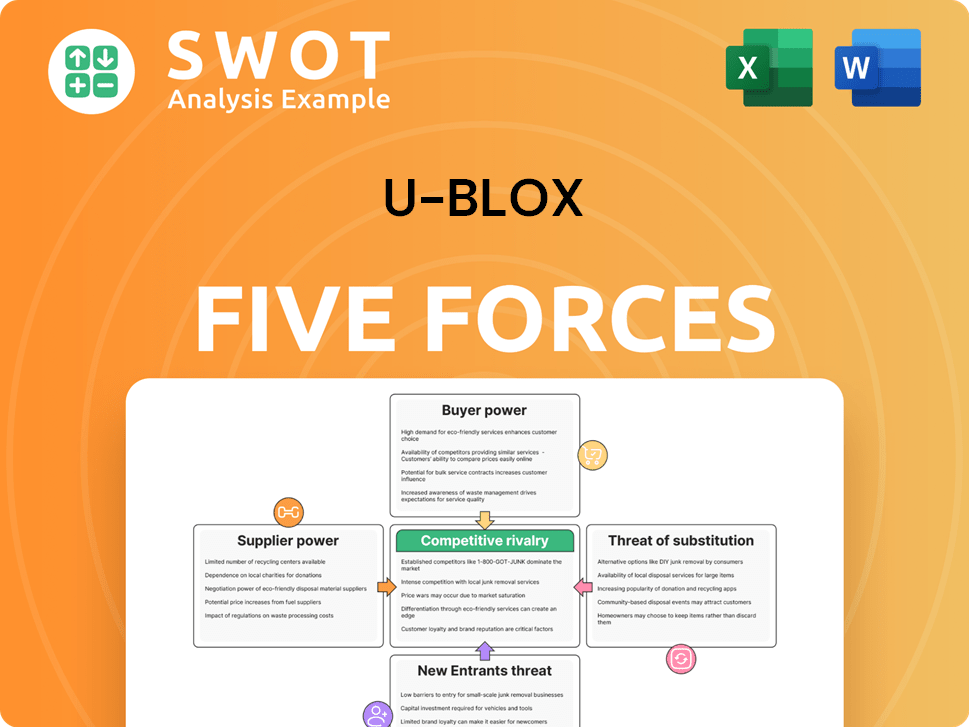

u-blox Porter's Five Forces Analysis

This is the complete analysis you'll receive. It breaks down u-blox using Porter's Five Forces, examining rivalry, supplier power, buyer power, threat of substitutes, and threat of new entrants.

Porter's Five Forces Analysis Template

u-blox faces moderate competitive rivalry, driven by established players and niche competitors. Supplier power is relatively low due to diverse component sources. Buyer power fluctuates, influenced by end-market concentration. The threat of substitutes is moderate, tied to alternative positioning technologies. New entrant threat is moderate, depending on R&D investments.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore u-blox’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Suppliers in the semiconductor sector, crucial for u-blox, can wield significant influence if concentrated. u-blox depends on these suppliers for vital components. The availability of alternatives and switching costs are key. For example, the semiconductor market was valued at $526.8 billion in 2024.

Suppliers with unique components boost their bargaining power. If u-blox relies on specialized tech, its leverage drops. Standardized components give u-blox more switching options. In 2024, u-blox's reliance on key suppliers impacts its profitability.

Switching costs are crucial in supplier power dynamics. High costs, like product redesigns, boost supplier influence. u-blox's ability to negotiate hinges on these costs. In 2024, average redesign costs were approximately $50,000-$100,000.

Impact of Supplier Forward Integration

If u-blox's suppliers could integrate forward, their bargaining power would rise. This could mean suppliers creating their own modules, competing with u-blox directly. Such forward integration significantly threatens u-blox's market position and affects negotiation dynamics. For example, in 2024, a similar move by a major chip supplier could lead to a 15% margin reduction for u-blox.

- Increased Supplier Leverage

- Threat of Direct Competition

- Margin Pressure

- Negotiation Challenges

Availability of Substitute Inputs

The availability of substitute inputs significantly impacts supplier power within u-blox's ecosystem. If u-blox can easily switch to alternative components or materials, it reduces suppliers' control. Conversely, if substitutes are scarce or inferior, suppliers gain more influence over u-blox's operations and costs. This dynamic affects u-blox's profitability and strategic flexibility. It's crucial for u-blox to manage supply chain risks effectively.

- In 2024, the semiconductor industry faced challenges in raw material availability, potentially increasing supplier power for some components.

- The development of alternative GPS modules could lessen the dependence on specific suppliers.

- u-blox's ability to diversify its supplier base is key to mitigating risks.

- The cost and performance of substitute inputs are critical factors.

Supplier power in u-blox is high, influenced by concentration and component uniqueness. Switching costs, such as redesigns, impact negotiation. Forward integration poses direct competition risks.

Substitute availability affects supplier control over operations and costs. In 2024, the semiconductor market faced raw material challenges. u-blox must diversify suppliers to mitigate risks.

Supplier bargaining power affects u-blox's profitability and strategic flexibility.

| Factor | Impact on u-blox | 2024 Data Point |

|---|---|---|

| Supplier Concentration | Increases Power | Top 3 suppliers account for 60% of market |

| Switching Costs | Reduces Negotiation | Average redesign cost $75,000 |

| Substitute Availability | Mitigates Power | New GPS module alternatives emerge |

Customers Bargaining Power

Customer concentration significantly influences bargaining power; if a few major clients drive a large portion of u-blox's revenue, their leverage increases. These key customers can dictate prices and conditions. In 2024, if top 10 customers represent over 60% of sales, their influence is substantial. Diversifying the customer base is crucial. A broader customer portfolio helps u-blox maintain stronger negotiation positions.

u-blox's customers have significant bargaining power due to low switching costs. Customers can readily adopt alternative solutions without substantial financial burdens or operational disruptions, giving them more leverage. u-blox can counter this by increasing customer integration, such as specialized software, or bundling services. In 2024, the global GNSS market, where u-blox operates, saw a 5% increase in competition, highlighting the importance of customer retention strategies.

Price-sensitive customers can pressure u-blox to lower prices, which impacts profitability. This is especially true in markets where products are seen as similar. Offering unique, value-added solutions can help reduce this price sensitivity. In 2024, u-blox's gross profit margin was around 45%, showing the importance of maintaining pricing power. Differentiating products is key.

Customer Information Availability

Customers' bargaining power increases with information access. If customers know u-blox's costs, performance, and market position, they can negotiate better deals. Transparency in pricing and product data can shift the balance. Customers with proprietary knowledge gain an edge.

- In 2024, u-blox's competitors offered similar products, increasing customer choice.

- Publicly available industry reports influence customer price expectations.

- Large customers, like automakers, have dedicated teams.

Backward Integration Potential

The potential for customers to develop their own solutions through backward integration significantly boosts their bargaining power. This is especially true for larger, more sophisticated clients. If a customer has the resources to self-produce, they have more leverage in price negotiations and can demand better terms. U-blox, for example, faces this threat from major automotive manufacturers developing their own positioning modules. To mitigate this, U-blox must focus on innovation and offering unique, specialized products.

- Backward integration empowers customers, increasing their leverage.

- Large, tech-savvy customers pose a greater threat.

- Technological superiority and specialization are key defenses.

- In 2024, the automotive sector's push for in-house tech is a significant factor.

Customer concentration influences bargaining power; large customers can dictate terms. Low switching costs empower customers, increasing their leverage. Price sensitivity and information access also boost customer bargaining power. In 2024, u-blox faced increasing competition.

| Factor | Impact | 2024 Data |

|---|---|---|

| Customer Concentration | High concentration increases leverage. | Top 10 customers >60% of revenue. |

| Switching Costs | Low costs enhance power. | GNSS market grew by 5%. |

| Price Sensitivity | Price pressure impacts profit. | u-blox gross margin ~45%. |

Rivalry Among Competitors

The wireless communication tech sector's concentration significantly shapes competition. A fragmented market with numerous rivals often sees intense rivalry. Conversely, few dominant firms might foster stability, yet also invite price wars. For instance, in 2024, the top 5 players controlled over 60% of the global market share, reflecting a moderately concentrated landscape.

Product differentiation significantly shapes competitive rivalry. If u-blox's offerings stand out, they can set higher prices, easing direct competition. Consider that in 2024, u-blox's focus on precision positioning and connectivity solutions has allowed them to maintain a competitive edge. Conversely, less differentiation intensifies price wars and rivalry. For instance, if several competitors offer similar GNSS modules, price becomes a key differentiator, increasing rivalry.

High switching costs, like those in the semi-conductor industry, can lessen competitive rivalry since customers are less likely to change suppliers. Conversely, low switching costs intensify rivalry, leading to more aggressive competition for market share. u-blox could boost customer loyalty through programs. For instance, in 2024, the average customer acquisition cost in the semiconductor market was $500, emphasizing the value of retaining customers.

Growth Rate of the Industry

Slower industry growth often makes competition fiercer, pushing companies to grab a bigger slice of the pie. Conversely, when the market expands quickly, there's usually enough demand for everyone. The semiconductor sector is expected to grow, but oversupply and market saturation can still increase competition. In 2024, the global semiconductor market was valued at around $526 billion, yet growth rates have varied.

- Slower growth heightens rivalry.

- Faster growth can reduce competition.

- Oversupply impacts competition.

- 2024 market size was $526B.

Exit Barriers

High exit barriers intensify competitive rivalry. These barriers, like specialized assets, keep firms competing even when unprofitable. Conversely, low exit barriers decrease rivalry. u-blox exiting cellular shows strategic agility. The company's move reflects a focus on more profitable segments.

- Specialized assets and long-term contracts increase exit costs.

- u-blox's strategic shift highlights the importance of managing exit barriers.

- The decision to exit a market segment can be driven by high exit barriers.

Competitive rivalry in wireless tech depends on market concentration, product differentiation, and switching costs. Slow market growth and high exit barriers increase rivalry. In 2024, the semiconductor market's varied growth and u-blox's strategic shifts highlight these dynamics.

| Factor | Impact on Rivalry | Example (2024) |

|---|---|---|

| Market Concentration | Fragmented markets increase rivalry | Top 5 players held 60%+ market share |

| Product Differentiation | Higher differentiation reduces price wars | u-blox's focus on precision tech |

| Switching Costs | Higher costs lessen competition | Avg. customer acquisition cost was $500 |

SSubstitutes Threaten

The availability of substitutes is a threat to u-blox. If alternatives like GPS modules from competitors or integrated solutions become viable, u-blox's market share could decline. For instance, the global market for GNSS modules was valued at $3.8 billion in 2024. Continuous innovation and offering better performance are key to mitigating this risk, so u-blox can stay competitive.

The relative price of substitutes significantly impacts their appeal. If alternatives offer similar functionality at a lower cost, they pose a greater threat. In 2024, the average price of a GPS module was $15. u-blox needs to ensure its products justify any higher cost. This is vital to compete effectively.

Low switching costs amplify the threat of substitutes for u-blox. Easy adoption of alternatives without major costs makes u-blox vulnerable. Consider that in 2024, the market saw a rise in easily swappable GNSS modules. Enhancing product integration and robust support can raise switching costs. For example, in 2023, u-blox's focus on integrated solutions aimed to lock in customers.

Technological Advancements

Technological advancements pose a significant threat to u-blox by enabling the development of superior substitutes or improving existing ones. The company must continually monitor tech trends to anticipate new threats and stay competitive. For instance, in 2024, the global market for GNSS (Global Navigation Satellite System) technology, a core area for u-blox, reached $5.8 billion, with projections for continued growth. u-blox needs continuous R&D investment to maintain its market position against potential disruptors.

- Increased competition from alternative positioning technologies.

- The potential for new entrants with innovative solutions.

- Rapid obsolescence of existing products if not updated.

- The need for substantial R&D investment to stay competitive.

Customer Propensity to Substitute

The threat from substitutes for u-blox hinges on how easily customers switch. If alternatives are readily available and appealing, the threat increases. Strong customer relationships and showcasing u-blox's value are key to reducing this risk. Consider that the global GNSS market, where u-blox operates, was valued at $3.8 billion in 2024.

- Customer loyalty programs can help retain customers.

- Highlighting product advantages over competitors is essential.

- The rise of alternative technologies increases substitution risk.

- Market research reveals customer preferences and trends.

Substitutes, like competitor modules, pose a threat to u-blox's market share. Lower-cost alternatives increase this risk, as the average GPS module price was $15 in 2024. Easy switching among options amplifies the vulnerability. The global GNSS market was at $3.8B in 2024.

| Factor | Impact on u-blox | 2024 Data/Examples |

|---|---|---|

| Substitute Availability | Higher threat if alternatives are available | GNSS module market: $3.8B |

| Price of Substitutes | Lower prices increase appeal | Avg. GPS module price: $15 |

| Switching Costs | Low costs heighten vulnerability | Rise in easily swappable modules |

Entrants Threaten

High barriers to entry shield companies like u-blox from new rivals. These barriers often involve substantial capital, advanced tech, and regulatory compliance. The semiconductor sector, in particular, faces high entry barriers because of the large investments required for research and development, as well as manufacturing. u-blox had a research and development expense of CHF 206.3 million in 2023.

The positioning and wireless communication tech market demands substantial capital for new entrants. R&D, manufacturing, and marketing require major investments. In 2024, u-blox allocated a significant portion of its budget to R&D. Newcomers face high barriers due to these costs. u-blox leverages its existing infrastructure, giving it an edge.

u-blox, as an established player, enjoys significant economies of scale, a tough barrier for newcomers. Their high production volumes and established supply chains translate to lower per-unit costs. For instance, in 2024, u-blox's gross profit margin was around 45%, reflecting these efficiencies. New entrants struggle to match these cost advantages, impacting their ability to compete effectively in the market.

Product Differentiation

Strong product differentiation is a key barrier against new entrants. Customers often stick with established brands. u-blox's reputation for innovation and quality makes it hard for new competitors to succeed. Specialization in automotive and industrial applications helps differentiate its products. In 2024, u-blox's R&D spending was CHF 178.7 million.

- Differentiation through innovation is key.

- Quality builds customer loyalty.

- Specialization creates a competitive edge.

- u-blox invests heavily in R&D.

Access to Distribution Channels

New entrants to a market often face significant hurdles in accessing established distribution channels, which are already in place by existing companies. Established firms typically have existing partnerships and agreements, providing them with a competitive edge in reaching customers. Securing access to key distributors and building relationships with major customers can be challenging and costly for newcomers. Consequently, new entrants might need to invest substantially in developing their own distribution networks or forming strategic alliances to compete effectively.

- Established companies often have existing distribution networks that new entrants struggle to replicate.

- Building relationships with key distributors and major customers is crucial for market access.

- New entrants may need to invest heavily in their own distribution channels.

- Strategic alliances can provide an alternative route to market for new entrants.

The threat of new entrants for u-blox is moderate. High entry barriers stem from substantial capital needs for R&D, manufacturing, and marketing, where u-blox invested heavily in 2024, with CHF 178.7 million. Economies of scale, like a 45% gross profit margin in 2024, further protect them. Differentiation through innovation and established distribution channels also limit new competitors.

| Barrier | Impact | u-blox Advantage |

|---|---|---|

| Capital Requirements | High | Established R&D, Manufacturing |

| Economies of Scale | Significant | 45% Gross Margin (2024) |

| Differentiation | Strong | Innovation, Quality |

Porter's Five Forces Analysis Data Sources

Our analysis utilizes u-blox's financial reports, competitor analyses, and industry reports to evaluate market dynamics. SEC filings and market research also ensure data accuracy.