u-blox SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

u-blox Bundle

What is included in the product

Analyzes u-blox’s competitive position through key internal and external factors

Provides a high-level overview for quick stakeholder presentations.

What You See Is What You Get

u-blox SWOT Analysis

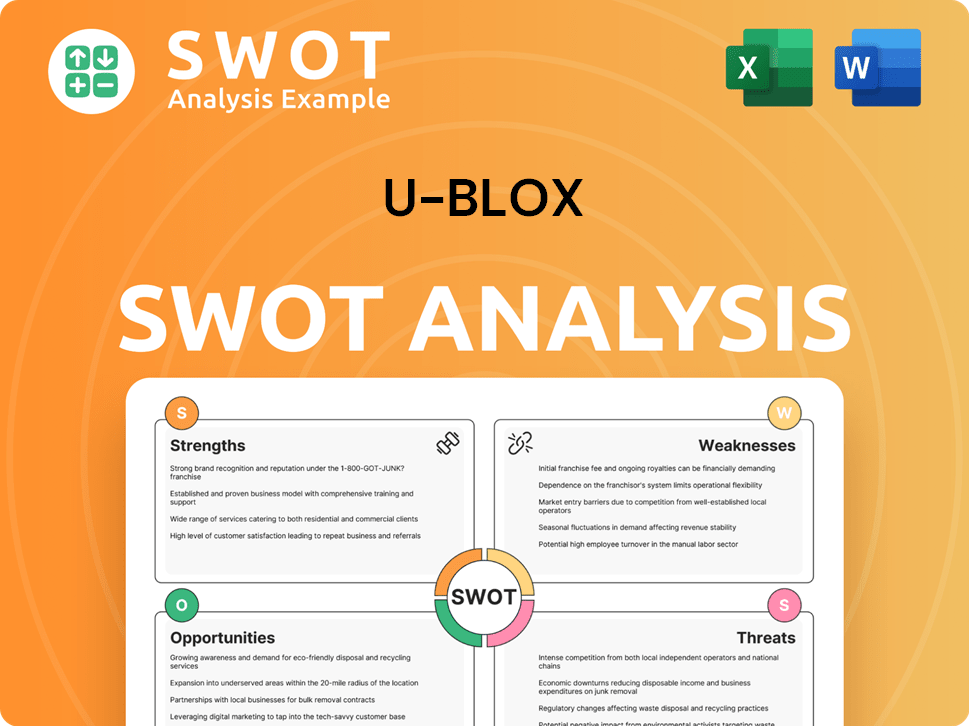

Get a glimpse of the real SWOT analysis you'll get! This preview shows the exact content, offering a look into u-blox's Strengths, Weaknesses, Opportunities, and Threats. Purchasing grants full access. It's structured and complete, like the paid version.

SWOT Analysis Template

Discover u-blox's core advantages: strong market presence, innovative tech. Uncover vulnerabilities like supply chain dependencies, fierce competition. Identify growth opportunities in emerging markets, new applications. Understand threats like economic downturn, changing regulations.

The full SWOT analysis delivers more than highlights. It offers deep, research-backed insights and tools to help you strategize, pitch, or invest smarter—available instantly after purchase.

Strengths

u-blox's strategic pivot emphasizes its core strengths in Locate (GNSS) and Short-Range communications. This concentrated approach allows for deeper expertise and resource allocation. Focusing on these high-growth areas improves innovation and market penetration. In 2024, GNSS and short-range solutions are projected to comprise over 80% of u-blox's revenue.

u-blox excels as a market leader in automotive GNSS. This is driven by rising demand for GNSS in vehicles. Specifically, ADAS and automated driving features boost demand. In 2024, the automotive segment generated CHF 281.8 million in revenue, showcasing its strength. This leadership fuels future growth.

u-blox has shown improved profitability, significantly cutting losses in Q1 2025 versus the prior year. This is due to a successful 2024 cost optimization program that surpassed its goals. A leaner cost structure opens doors for margin growth as the market strengthens.

Robust Financial Health and Liquidity

u-blox demonstrated resilience in 2024, maintaining robust financial health and liquidity. The company's strong current ratio reflects its ability to meet short-term obligations. Positive free cash flow generation in 2024 highlights effective financial management. This solid financial standing provides stability for future investments and growth.

- Current Ratio: u-blox's current ratio remained healthy, indicating strong short-term liquidity.

- Free Cash Flow: Positive free cash flow in 2024, showcasing efficient capital management.

- Net Cash Position: u-blox ended 2024 with a solid net cash position.

New Product Innovation and Partnerships

u-blox excels in innovation, recently unveiling the X20 GNSS platform and advanced connectivity modules. Partnerships are key, like the collaboration with Topcon. This bolsters u-blox's ability to provide cutting-edge location solutions.

- X20 GNSS platform offers enhanced positioning accuracy.

- Partnerships expand market reach.

u-blox benefits from a strategic focus on Locate (GNSS) and short-range tech, fueling market growth. Leadership in automotive GNSS, especially in ADAS, drives significant revenue. Improved profitability and resilient financials strengthen u-blox.

| Strength | Details | 2024 Data |

|---|---|---|

| Focused Strategy | Concentration on GNSS and short-range solutions | Over 80% of revenue from GNSS and short-range |

| Market Leadership | Strong in automotive GNSS | CHF 281.8 million automotive revenue |

| Financial Resilience | Improved profitability, healthy liquidity | Positive free cash flow, improved net cash position |

Weaknesses

U-blox's exit from the cellular IoT module business, though strategically sound, means leaving a revenue stream behind. This shift leads to restructuring costs, causing a short-term negative impact on EBIT. Managing the transition carefully is crucial for employees, customers, and partners. In 2024, they announced the strategic exit from the cellular business, impacting the financial results.

The cellular segment faced significant challenges, reporting substantial adjusted EBIT losses in the first half of 2024. This financial strain was a key factor in u-blox's decision to exit the cellular market. The difficulties in finding a buyer underscored the segment's underperformance and the strategic complexities involved. These losses negatively impacted the company's overall financial health in 2024.

In 2024, u-blox faced headwinds as customers worked through excess inventory, impacting revenue and profitability. Market softness, especially in industrial and automotive, further dampened demand. For example, u-blox reported a 10.8% decrease in revenue in 2024. While 2025 shows signs of recovery, overstocking continues to influence performance.

Exposure to Currency Fluctuations

u-blox faces challenges from currency fluctuations, especially with the USD/CHF exchange rate. A weaker USD against the Swiss Franc has negatively affected revenue and margins. For instance, currency movements can hinder financial results despite operational progress. The company's financial guidance already accounts for these FX impacts. Unfavorable currency movements pose a significant risk.

- Impact: Weak USD vs. CHF affects revenue.

- Challenge: Currency fluctuations can reduce margins.

- Mitigation: Guidance includes FX impact forecasts.

- Risk: Unfavorable FX movements are a headwind.

Intense Competition in Wireless Markets

u-blox faces intense competition in wireless markets, leading to pricing pressures. The cellular market saw increased competition from low-cost Chinese manufacturers. u-blox exited the cellular segment partly due to these pressures. Maintaining market share and profitability demands constant innovation and effective competition.

- In 2023, u-blox's revenue decreased by 6.8% due to intense competition.

- The wireless module market is expected to grow, but competition will remain fierce.

- Low-cost manufacturers have significantly impacted pricing in the cellular module sector.

Exiting the cellular IoT business created immediate restructuring expenses, which affected profitability in 2024. The segment's adjusted EBIT reported significant losses. Overstocking and market softness decreased u-blox's revenue by 10.8% in 2024. Currency fluctuations, such as a weaker USD, also negatively impacted financial outcomes.

| Weakness | Details | Impact |

|---|---|---|

| Cellular Exit | Restructuring Costs, EBIT losses in 2024. | Short-term profitability hit. |

| Market Conditions | Inventory, market softness in industrial & automotive sectors. | 2024 revenue decreased by 10.8%. |

| Currency Fluctuations | Weaker USD vs CHF. | Negative impact on revenue & margins. |

Opportunities

The rise of autonomous vehicles, robotics, and industrial IoT fuels demand for high-precision positioning. u-blox's focus on these areas, backed by new GNSS platforms, is key. Revenue growth is expected, with the global GNSS market projected to reach $6.8 billion by 2025.

The global positioning market presents significant expansion opportunities for u-blox. The company's strategic focus on its Locate business allows it to capitalize on these opportunities. This concentration accelerates the development of advanced location solutions. In 2024, the global GNSS market was valued at approximately $60 billion, with projections for continued growth. u-blox's strategic positioning is set to benefit from this expansion.

Following 2024's hurdles from overstocking and softer markets, u-blox eyes recovery in automotive and industrial sectors. These are crucial for u-blox, with demand expected to rise. A surge in customer demand for GNSS in L2+ vehicles, starting in 2026, fuels revenue growth hopes. In Q1 2024, u-blox saw CHF 123.9 million in revenue, hinting at market stabilization.

Demand for Advanced Short-Range Technologies

The Short-Range business, including Wi-Fi and Bluetooth modules, is poised for a comeback, aiming for break-even by the second half of 2025. This recovery is fueled by the launch of cutting-edge modules, such as automotive-grade Wi-Fi 7. These advancements address the increasing need for smooth and secure short-range connectivity. This is especially true in sectors like in-vehicle infotainment and industrial applications.

- Wi-Fi 7 market is projected to reach $10 billion by 2027.

- Bluetooth LE device shipments are expected to exceed 7 billion units annually by 2026.

Potential in Emerging Markets and New Use Cases

Emerging markets, including the Middle East and Africa, are experiencing a surge in IoT and smart city projects, creating growth opportunities. This expansion aligns with u-blox's expertise in positioning and wireless communication. The firm can capitalize on rising demand from these regions. The integration of wireless tech in e-scooters and drones expands the market.

- Middle East & Africa IoT market expected to reach $25.7 billion by 2025.

- Global drone market is projected to hit $41.3 billion by 2025.

u-blox can seize expansion from the booming GNSS market, projected at $6.8B by 2025, targeting autonomous vehicles. Its focus on the Locate business and recovering automotive/industrial sectors are key growth drivers. Emerging markets, such as the Middle East, are fostering new chances within IoT and smart city initiatives.

| Opportunity | Details | Data Point |

|---|---|---|

| GNSS Market Growth | Expansion driven by autonomous vehicles, robotics. | $6.8B by 2025 |

| Automotive & Industrial Recovery | Focus on these sectors fuels u-blox's growth. | L2+ vehicle demand from 2026. |

| Emerging Markets | IoT and smart city projects in MEA. | $25.7B MEA IoT market by 2025. |

Threats

u-blox confronts fierce competition, especially from budget-friendly options. Its exit from the cellular market highlights this pressure. This competition affects both positioning and short-range segments. Continuous R&D investment is crucial for u-blox to stay competitive. In 2024, R&D expenses were CHF 106.7 million, reflecting this focus.

Geopolitical tensions and pricing pressures are significantly reshaping global supply chains, particularly in the semiconductor sector. These factors can lead to component shortages and increased costs, impacting profitability. u-blox must address market access challenges and ensure component resilience to reduce disruption risks. In 2024, geopolitical issues caused a 15% increase in logistics costs for some semiconductor firms.

The semiconductor market's volatility, including overstocking, poses a threat. This can cause demand drops, affecting revenue, as observed in 2024. u-blox faces these challenges, with future market fluctuations being a concern. For example, the global semiconductor market is projected to reach $588.2 billion in 2024.

Need for Continuous Innovation

The rapid advancement in positioning and wireless tech poses a constant need for u-blox to innovate. Competitors are also launching new products; for example, 5G positioning modules. To stay competitive, u-blox must consistently develop new products and invest in R&D. In 2024, u-blox spent CHF 177.7 million on R&D, highlighting its commitment to innovation.

- 5G positioning modules are a competitive threat.

- R&D investment is crucial for staying ahead.

- u-blox spent CHF 177.7 million on R&D in 2024.

Challenges in Cellular Business Transition

Transitioning out of the cellular business poses challenges in managing employee impacts, customer support, and partner relations. u-blox must ensure seamless support for existing cellular products throughout the phase-out to maintain customer trust. A smooth transition is crucial to avoid reputational damage and financial losses. Effective communication and support are key to mitigating risks during this shift.

- Employee layoffs or reassignments can lead to morale issues and loss of expertise.

- Customer dissatisfaction may arise from product discontinuation or reduced support.

- Partners might seek alternative suppliers, impacting revenue streams.

- Operational complexities can arise from managing the phase-out process itself.

Intense competition from low-cost rivals and rapid tech changes require continuous innovation. Geopolitical tensions and supply chain disruptions may increase costs and limit access. Volatility in the semiconductor market presents demand risks affecting u-blox's financials.

| Threats | Description | Impact |

|---|---|---|

| Competitive Pressure | Intense competition from budget-friendly options, new 5G positioning modules. | Pricing pressures, reduced market share, requires high R&D (CHF 177.7M in 2024). |

| Supply Chain & Geopolitical Risks | Tensions affecting supply, increasing costs (logistics up 15% for some firms in 2024). | Component shortages, cost increases, impacting profitability & access. |

| Market Volatility | Semiconductor market fluctuations (projected $588.2B in 2024), potential overstocking. | Demand drops, impacting revenues; requires adaptation. |

SWOT Analysis Data Sources

This SWOT analysis leverages financial reports, market research, expert opinions, and industry publications for reliable, data-backed insights.