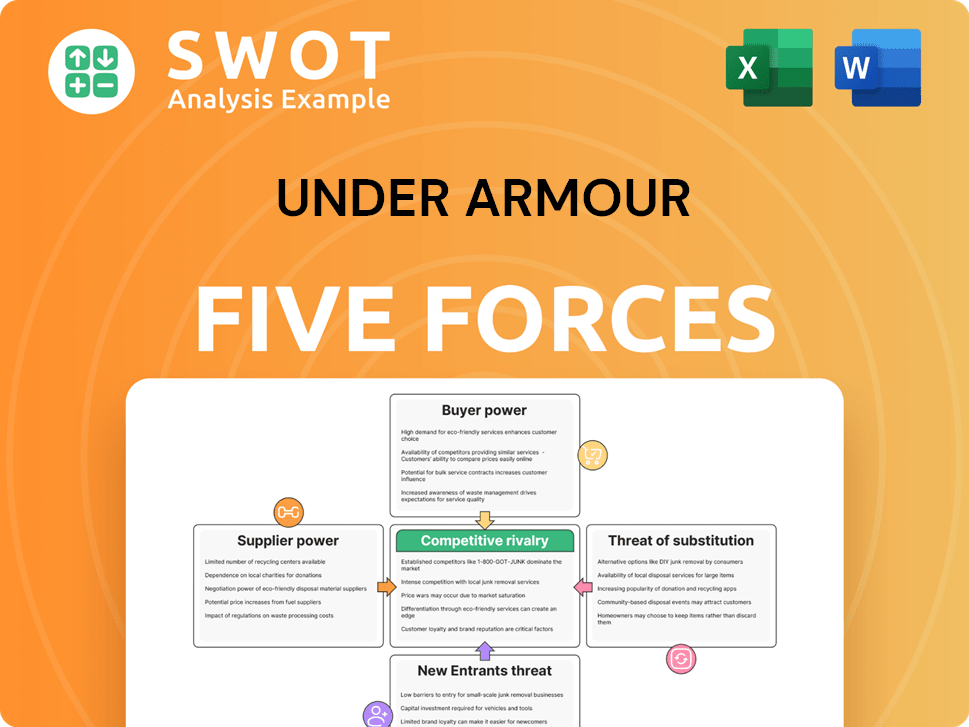

Under Armour Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Under Armour Bundle

What is included in the product

Analyzes Under Armour's competitive landscape, identifying threats, rivals, and influences on market position.

Quickly assess competitive intensity with clear force visualizations—perfect for fast strategy shifts.

Full Version Awaits

Under Armour Porter's Five Forces Analysis

This preview showcases the complete Under Armour Porter's Five Forces analysis. It details competitive rivalry, supplier power, buyer power, threat of substitution, and threat of new entrants. The document is professionally written, fully formatted, and immediately available after purchase. It's the same file you'll download—no editing needed.

Porter's Five Forces Analysis Template

Under Armour faces intense competition in the athletic apparel market, with high buyer power due to many choices and brand loyalty variations. The threat of new entrants is moderate, challenged by established brands and distribution networks. Supplier power is generally low, but fluctuations in material costs exist. Substitute products like athleisure from other brands pose a constant threat. Competitive rivalry is very high, requiring Under Armour to continuously innovate and differentiate.

Ready to move beyond the basics? Get a full strategic breakdown of Under Armour’s market position, competitive intensity, and external threats—all in one powerful analysis.

Suppliers Bargaining Power

Under Armour's supplier power is limited due to its diversified sourcing strategy. In 2024, the company worked with numerous suppliers, reducing reliance on any single entity. This approach enables better negotiation leverage and supply chain flexibility. For instance, Under Armour's cost of goods sold was roughly $2.3 billion in 2023, spread across many vendors. This mitigates risks and ensures a stable resource flow.

Under Armour sources standardized raw materials like fabrics and polymers, diminishing supplier power. Because these materials are widely available, Under Armour has multiple supplier options. This competitive landscape ensures that suppliers can't significantly control pricing or terms. For 2024, Under Armour's cost of goods sold was approximately $1.8 billion.

Under Armour benefits from low switching costs among raw material suppliers. This ease of switching strengthens Under Armour's bargaining power in 2024. The company can readily change suppliers to find better prices. This flexibility helps secure competitive pricing and contract terms. In 2023, Under Armour's cost of goods sold was $2.2 billion.

Backward integration potential

Under Armour could integrate backward, maybe even manufacturing its own fabrics, which could curb supplier power. This potential acts as a deterrent, making suppliers cautious. Such a move needs substantial investment but offers long-term control over costs and quality. Backward integration could lower production expenses, improving profit margins, potentially by 5-10% based on industry data.

- Potential to manufacture own fabrics.

- Acts as a check on supplier power.

- Requires significant investment.

- Offers long-term cost and quality control.

Global sourcing options

Under Armour's global sourcing network gives it an edge in negotiating with suppliers. This strategy allows the company to tap into various markets and secure better prices. By diversifying its supply base, Under Armour reduces its dependence on any single supplier. This approach strengthens its position, especially during disruptions. In 2024, Under Armour's cost of goods sold was approximately $3.1 billion.

- Global sourcing lowers supplier power.

- Diversified suppliers improve resilience.

- Negotiating power increases with options.

- Cost control is enhanced.

Under Armour's supplier power is weak, thanks to varied sourcing and low switching costs. The company's global reach and ability to manufacture its own fabrics, if it chooses, further limits supplier influence. In 2024, they had $3.1 billion in cost of goods sold, spreading their risk. This strategic flexibility keeps costs competitive and boosts profit margins.

| Aspect | Impact | 2024 Data |

|---|---|---|

| Diversified Sourcing | Reduces Dependency | $3.1B Cost of Goods Sold |

| Switching Costs | Lowers Supplier Power | Easily Change Vendors |

| Backward Integration | Potential Control | May Cut Costs 5-10% |

Customers Bargaining Power

Under Armour's customers show sensitivity to brand image and value. The company spends significantly on branding and marketing. In 2024, Under Armour's marketing expenses were about $400 million. Strong brand loyalty makes customers less price-sensitive. This allows Under Armour to charge more for its products, increasing profitability.

Under Armour benefits from a fragmented customer base, encompassing individual consumers, teams, and wholesale partners. This diversity limits the bargaining power of any single customer group. No single entity can dictate pricing or product decisions, protecting Under Armour's margins. In 2024, Under Armour's revenue was $5.9 billion, showing the strength of its broad customer reach.

Customers can easily switch to competitors like Nike or Adidas, giving them strong bargaining power. The availability of substitutes is high, as many brands offer similar athletic apparel. Under Armour needs to innovate to stand out. In 2024, Nike's revenue was $51.2 billion, highlighting the competitive landscape.

Price sensitivity

Customers often show price sensitivity, especially for athletic apparel. Under Armour must balance pricing with perceived value to stay competitive. Promotions can attract price-sensitive customers, but could affect profits. In 2024, the athletic apparel market saw frequent discounts due to oversupply. This environment pressures Under Armour to manage pricing carefully.

- Price wars in the athletic apparel sector were common in 2024, impacting profit margins.

- Under Armour's promotional activity increased, reflecting the competitive landscape.

- Consumers became more value-conscious, seeking deals and discounts.

- Maintaining brand image while offering competitive prices is a key challenge.

Information availability

Customers' access to information significantly impacts Under Armour's market position. Online platforms and review sites allow customers to easily compare products, pricing, and brands. This transparency boosts customer bargaining power, influencing purchasing decisions. Under Armour needs to actively manage its online presence and pricing strategies.

- Digital sales accounted for approximately 40% of Under Armour's total revenue in 2024.

- Customer reviews and ratings heavily influence online sales conversions, with a 1-star increase in product rating potentially boosting sales by 5-10%.

- Competitive pricing is crucial; Under Armour must align prices with competitors like Nike and Adidas.

- Under Armour's net revenue in 2024 was $5.9 billion.

Customer bargaining power at Under Armour is complex, influenced by brand loyalty and price sensitivity. While Under Armour benefits from a fragmented customer base, competition from brands like Nike and Adidas gives customers leverage. The availability of substitutes forces Under Armour to manage pricing and maintain a strong brand image.

| Aspect | Impact | Data (2024) |

|---|---|---|

| Brand Loyalty | Reduces price sensitivity. | Marketing spend: ~$400M |

| Customer Base | Diversifies buying power. | Revenue: $5.9B |

| Competition | Increases customer options. | Nike Revenue: $51.2B |

| Online Influence | Enhances price comparisons. | Digital sales: ~40% |

Rivalry Among Competitors

The athletic apparel market is fiercely competitive. Under Armour contends with industry leaders such as Nike and Adidas. This rivalry intensifies pressure on pricing strategies and innovation. In 2024, Nike held approximately 28% of the global market share, Adidas around 15%, and Under Armour around 3%. This competition impacts Under Armour's profitability and market position.

Companies fiercely compete on brand image, product innovation, and marketing. Under Armour differentiates with performance apparel and tech-driven products. In 2024, Under Armour invested heavily in marketing, with total operating expenses of $1.3 billion. Successful brand differentiation is key for maintaining market share and profitability.

Marketing and promotion are crucial in the athletic apparel industry. Under Armour, like competitors, allocates significant resources to endorsements and advertising. In 2024, Under Armour's marketing expenses were around $600 million, reflecting its commitment to brand visibility. Effective campaigns are vital for capturing market share in this competitive landscape. This strategy helps drive sales.

Product innovation

Product innovation is vital for Under Armour to stay competitive. The company heavily invests in research and development, as evidenced by its spending of $206 million in 2023, up from $183 million in 2022, to create cutting-edge products and technologies. New product launches and tech advancements fuel customer interest and sales, helping Under Armour compete with rivals. This focus is essential in a market that rapidly changes.

- R&D spending was $206 million in 2023.

- R&D spending was $183 million in 2022.

- New products drive sales growth.

- Technological advancements attract customers.

Global competition

Under Armour's competitive landscape is global, with brands battling for market share worldwide. It competes globally, facing rivals from international and local markets. Adapting to local preferences is key for success, requiring a nuanced understanding of regional dynamics. The global sportswear market was valued at $422.4 billion in 2023, projected to reach $579.8 billion by 2029, reflecting intense competition. Under Armour's revenue in 2023 was approximately $5.9 billion, showcasing its global presence.

- Global Competition: Intense rivalry across regions.

- Market Presence: Under Armour operates globally.

- Adaptation: Crucial for success in diverse markets.

- Market Size: $422.4 billion in 2023, growing.

Under Armour faces tough competition from Nike and Adidas, affecting pricing and innovation. In 2024, Nike led with about 28% market share, while Under Armour held around 3%. Successful marketing and product innovation are essential for Under Armour to stay competitive, with marketing spending about $600 million in 2024.

| Aspect | Details | Impact |

|---|---|---|

| Market Share (2024) | Nike: ~28%, Adidas: ~15%, Under Armour: ~3% | Pressure on Under Armour's profitability |

| Marketing Spend (2024) | Under Armour: ~$600 million | Aids brand visibility and sales |

| R&D Spending (2023) | $206 million | Drives product innovation |

SSubstitutes Threaten

Under Armour faces a significant threat from substitutes due to the vast array of options available. Consumers can easily opt for generic athletic wear, private-label brands, or even non-athletic apparel. This wide selection intensifies the competition. In 2024, the global sportswear market is estimated at over $400 billion, with numerous brands vying for market share, increasing the pressure on Under Armour to maintain its competitive edge.

Substitutes, like generic sportswear, frequently have lower prices. Under Armour needs to prove its value with better performance, quality, or brand appeal to justify its higher cost. The price-performance comparison of alternatives greatly sways consumer decisions. In 2024, Under Armour's stock faced pressure, reflecting challenges in maintaining its premium pricing against cheaper rivals.

Changing consumer preferences significantly impact the threat of substitutes. The rise of athleisure wear presents a direct substitute for traditional athletic apparel. Under Armour needs to adapt to these trends to maintain its market position. Continuous monitoring of consumer behavior is crucial for staying ahead. In 2024, the athleisure market is projected to reach $400 billion, highlighting the need for adaptation.

Technological advancements

Technological advancements pose a threat to Under Armour. New materials and manufacturing techniques can lead to innovative substitutes. Under Armour must invest in research and development. This ensures the development of superior products. The company's R&D spending in 2023 was approximately $200 million.

- New materials can replace existing ones, lowering costs.

- Advanced manufacturing creates more efficient processes.

- Under Armour needs to keep pace with innovation.

- R&D spending is crucial for staying competitive.

Brand perception

The perceived brand value of substitutes significantly impacts their appeal to consumers. Under Armour's brand strength is crucial for setting it apart from cheaper options. Maintaining a robust brand image is vital for customer loyalty. Building a strong brand is essential for long-term success. In 2024, Under Armour's brand value was estimated at $4.6 billion.

- Under Armour's brand value: $4.6 billion (2024).

- Competitive landscape: Adidas, Nike.

- Customer loyalty is vital.

- Brand building is ongoing.

Under Armour faces a high threat from substitutes like generic wear and athleisure. The global sportswear market, worth over $400 billion in 2024, offers many alternatives. Under Armour must justify its premium pricing and adapt to changing consumer preferences and innovation. Building brand value, estimated at $4.6 billion in 2024, is key.

| Factor | Impact | Data (2024 est.) |

|---|---|---|

| Market Size | High competition | $400B+ global sportswear |

| Brand Value | Differentiation | $4.6B Under Armour |

| Athleisure Market | Substitute Trend | $400B projected |

Entrants Threaten

The athletic apparel and footwear market demands substantial capital for entry. This includes design, manufacturing, marketing, and distribution investments. High initial costs, such as the $200 million Under Armour spent on marketing in 2023, deter many. Such significant upfront investment creates a formidable barrier for new competitors. This limits the threat from new entrants.

Established brands such as Nike and Adidas dominate the athletic apparel market, boasting significant brand recognition and customer loyalty. New entrants, therefore, struggle to gain visibility and trust among consumers. Building a brand from scratch necessitates considerable marketing expenditure and inventive strategies to stand out. In 2024, Nike's revenue was approximately $51.2 billion, highlighting the challenge for newcomers.

Established companies like Under Armour leverage economies of scale in production, marketing, and distribution. New brands face challenges in matching these lower costs, especially in manufacturing. For example, Under Armour's 2023 revenue was $5.9 billion, reflecting its strong market position and production efficiency. Reaching these economies requires substantial capital and market share gains.

Distribution channels

New entrants face hurdles accessing distribution channels. Under Armour's existing retail partnerships pose a barrier. New brands need alternative strategies or compete for shelf space. Securing distribution often involves significant investments and negotiations. In 2024, Under Armour's wholesale revenue was a significant portion of its total sales, highlighting the importance of its distribution network.

- Under Armour's wholesale revenue significantly contributes to total sales.

- New entrants must secure shelf space.

- Distribution access requires investment.

- Established partnerships create barriers.

Intellectual property

Intellectual property is a significant barrier for new entrants in the athletic apparel market. Under Armour, for instance, heavily invests in protecting its designs and technologies through patents and trademarks. New companies must carefully navigate these existing intellectual property rights to avoid costly legal battles or infringement issues. This need to respect and potentially license existing IP can significantly increase the initial investment required for new entrants. This makes it harder for smaller companies to compete.

- Under Armour's revenue for 2023 was approximately $5.9 billion.

- The company has a wide range of patents and trademarks protecting its unique designs and technologies.

- New entrants face the challenge of creating original designs that do not infringe on existing IP.

The athletic apparel market has high entry barriers. Substantial capital is needed for design, marketing, and distribution. Brand recognition poses challenges for newcomers. This limits the threat from new entrants.

| Barrier | Impact | Example |

|---|---|---|

| High Initial Costs | Discourages new entries | Under Armour's $200M marketing spend (2023) |

| Brand Recognition | Difficult to gain trust | Nike's $51.2B revenue (2024) |

| Distribution Access | Requires investment | Under Armour's wholesale sales in 2024 |

Porter's Five Forces Analysis Data Sources

This analysis leverages annual reports, market research, industry publications, and financial news outlets for competitive insights.