Under Armour SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Under Armour Bundle

What is included in the product

Delivers a strategic overview of Under Armour’s internal and external business factors.

Offers a high-level overview for swift presentations, perfect for busy Under Armour stakeholders.

Preview Before You Purchase

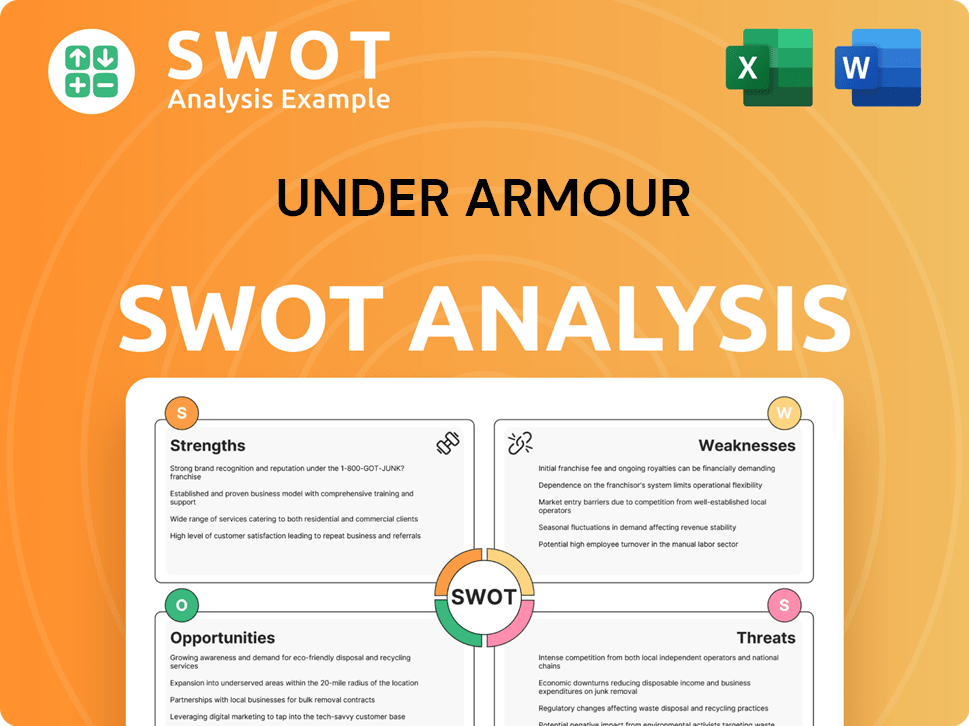

Under Armour SWOT Analysis

This is the actual SWOT analysis document you’ll receive upon purchase, providing a clear snapshot of Under Armour's position.

SWOT Analysis Template

Under Armour faces a dynamic market. Our partial SWOT reveals some core strengths: brand recognition & innovative products. Yet, vulnerabilities such as intense competition remain. There are opportunities, like expanding internationally, plus threats. Identify actionable strategies with our full analysis.

Purchase the full SWOT analysis and get a dual-format package: a detailed Word report and a high-level Excel matrix. Built for clarity, speed, and strategic action.

Strengths

Under Armour's brand recognition is a significant strength, especially in the athletic apparel market. Their brand loyalty is supported by consistent product quality and successful marketing. In 2024, Under Armour's net revenue was approximately $5.9 billion, showcasing their brand's market presence. This strong brand recognition helps drive sales and market share.

Under Armour's strength lies in its performance and innovation focus. The company consistently integrates advanced technologies into its products. This approach has led to a revenue of approximately $5.9 billion in 2024. This focus enhances athletic performance and appeals to a performance-driven market.

Under Armour's diverse product portfolio, encompassing apparel, footwear, and accessories, is a key strength. This variety allows the company to cater to a wider consumer base and mitigate risks associated with over-reliance on any single product category. In 2024, apparel sales accounted for roughly 65% of Under Armour's total revenue, demonstrating the importance of this segment. This diversification supports sustainable growth and resilience against market fluctuations.

Multi-channel Distribution Network

Under Armour's multi-channel distribution strategy is a key strength, combining wholesale and direct-to-consumer avenues. This includes owned stores, e-commerce, and partnerships with retailers like Dick's Sporting Goods. This broad reach supports brand visibility and accessibility worldwide. In 2024, direct-to-consumer sales accounted for a significant portion of Under Armour's revenue.

- Wholesale revenue was $988 million in Q4 2024.

- Direct-to-consumer revenue was $635 million in Q4 2024.

- Under Armour has a global presence with stores in North America, Europe, and Asia.

Strategic Marketing and Partnerships

Under Armour's strengths include its strategic marketing and partnerships. The company effectively utilizes marketing campaigns and collaborations with famous athletes and teams. These initiatives boost brand visibility and establish credibility within the sports industry. Under Armour's emphasis on narrative and inspirational messages resonates well with consumers. For example, in Q1 2024, marketing expenses were $138 million, reflecting continued investment in these areas.

- Increased brand awareness through celebrity endorsements.

- Enhanced market reach via team sponsorships.

- Strong consumer engagement through compelling storytelling.

- Strategic allocation of marketing budgets for maximum impact.

Under Armour's strong brand recognition drives sales; their brand is supported by quality products, with revenue hitting around $5.9B in 2024. The company emphasizes performance, with technologies boosting athletic capabilities. A diversified product range spanning apparel, footwear, and accessories allows them to reach a wider audience.

| Strength | Description | 2024 Data |

|---|---|---|

| Brand Recognition | High brand visibility and consumer trust. | Approx. $5.9B Revenue |

| Performance Focus | Innovation in athletic performance. | $138M Q1 2024 Marketing |

| Product Diversification | Wide range of products to cater to all. | 65% Apparel Sales |

| Multi-Channel Distribution | Wholesale and DTC presence. | Q4 2024 DTC: $635M |

Weaknesses

Under Armour's international presence lags behind competitors like Nike and Adidas. Their global market share is smaller, especially in regions like Europe and Asia. In 2024, international sales accounted for about 30% of Under Armour's total revenue, a figure that highlights room for growth. This limited reach can restrict revenue potential.

Under Armour's apparel segment is a major revenue driver. In 2024, apparel sales accounted for about 65% of total revenue. This dependence poses a risk if demand falters. Fashion shifts or supply chain issues could severely impact Under Armour's financial health. A decline in apparel sales could hinder overall growth.

Under Armour's footwear segment lags, with a smaller market share versus Nike and Adidas. Footwear sales contribute less to overall revenue. In Q1 2024, footwear revenue was $353 million, a 1% decrease. Lower price points also impact profitability.

Slow E-commerce Adoption and Retail Presence

Under Armour's e-commerce growth has lagged behind rivals, potentially limiting its market reach. A substantial portion of its retail footprint consists of outlet stores, which can dilute brand image. In Q3 2023, e-commerce sales decreased by 1% year-over-year, signaling challenges in online competitiveness. This slower digital adaptation contrasts with competitors like Nike, which have aggressively expanded their online presence. These factors collectively pose challenges for Under Armour's market positioning and growth prospects.

- E-commerce sales decreased by 1% in Q3 2023.

- Outlet stores may dilute brand image.

Inconsistent Financial Performance and Profitability

Under Armour's financial performance has shown inconsistencies, impacting its overall stability. Recent years have seen fluctuating sales figures, reflecting challenges in maintaining steady growth. The company has undertaken restructuring to address these issues, aiming for more predictable outcomes. Revenue declines were observed in certain periods, highlighting the need for strategic adjustments.

- 2023 revenue decreased by 1% to $5.7 billion.

- Operating income dropped to $208 million in 2023, a decrease compared to previous years.

- Restructuring charges in 2024 impacted profitability.

Under Armour struggles with a smaller international footprint than its competitors, potentially limiting revenue. It relies heavily on apparel, creating risk if demand falls, with 65% of revenue in 2024 coming from apparel. Inconsistent financial results and slow e-commerce growth further highlight these weaknesses.

| Weakness | Impact | Data |

|---|---|---|

| Limited International Presence | Restricts revenue potential | 30% of revenue from international sales in 2024. |

| Apparel Dependence | Vulnerable to demand shifts | Apparel sales made up 65% of total revenue in 2024. |

| E-commerce Lag | Hindered market reach | E-commerce sales declined 1% in Q3 2023. |

Opportunities

Under Armour can significantly grow internationally, especially in Asia, Latin America, and Africa. These markets offer diversification and reduce reliance on North America. In Q4 2024, international net revenue increased by 14% to $461 million. This growth highlights the opportunity to expand further. By 2025, experts predict continued expansion, driven by rising consumer spending in these regions.

The women's activewear and athleisure sectors are expanding significantly. Under Armour can increase its product range and marketing to attract more customers. In Q1 2024, the global athleisure market was valued at $368.2 billion, with an expected CAGR of 8.3% from 2024 to 2032. UA's focus on this area could boost sales.

Under Armour can capitalize on the growing demand for smart clothing. Integrating technology into sportswear allows for product differentiation. The global smart clothing market is projected to reach $6.8 billion by 2025. This strategy appeals to health-conscious and tech-savvy consumers.

Enhancing Direct-to-Consumer and E-commerce Capabilities

Under Armour can significantly boost its performance by enhancing its direct-to-consumer (DTC) and e-commerce capabilities. This involves refining online platforms for a better customer experience, which directly impacts sales and brand control. A robust loyalty program is crucial for retaining customers and driving repeat purchases. In 2024, DTC sales accounted for approximately 40% of Under Armour's total revenue, showing the segment's importance. This strategic focus aligns with industry trends, where brands are increasingly prioritizing direct customer engagement for higher profitability and brand control.

- Improved Customer Experience: Enhances online platforms for better user experience.

- Increased Sales: Directly impacts sales figures through efficient online channels.

- Brand Presentation & Pricing Control: Allows better management of brand image and pricing strategies.

- Loyalty Program Enhancement: Strengthens customer retention and encourages repeat purchases.

Focus on Health and Wellness Trend

The rising global interest in health and wellness presents a significant opportunity for Under Armour. They can expand beyond their core apparel and footwear lines by introducing health-focused products and services. This includes digital offerings like fitness apps and personalized wellness programs to engage consumers. The global wellness market was valued at $7 trillion in 2024, highlighting the potential for growth.

- Market expansion into wearable technology like smart fitness trackers.

- Development of nutrition and wellness-related digital platforms.

- Partnerships with fitness influencers and wellness brands.

- Creation of athleisure wear that combines style and function.

Under Armour should grow internationally by targeting Asia, Latin America, and Africa. International net revenue increased 14% in Q4 2024. Expanding in athleisure and smart clothing offers significant growth opportunities, as the athleisure market has a high CAGR. Improving DTC and e-commerce drives sales and brand control.

| Opportunity | Description | Data |

|---|---|---|

| International Expansion | Targeting growth in international markets. | Q4 2024 international revenue up 14%. |

| Athleisure Growth | Capitalize on the growing women's activewear sector. | Global athleisure market CAGR 8.3% (2024-2032). |

| Smart Clothing | Integrate tech for product differentiation. | Smart clothing market projected at $6.8B by 2025. |

| DTC and E-commerce | Enhance online platforms. | DTC sales ~40% of total revenue in 2024. |

Threats

Under Armour faces fierce competition in the athletic market. Nike and Adidas dominate, and new brands emerge constantly. This competition squeezes market share and pricing. In 2024, Nike's revenue was $51.2 billion, while Adidas reached $26.3 billion. Under Armour's 2024 revenue was $5.9 billion, indicating the pressure.

Consumer preferences shift quickly, impacting apparel and footwear. Under Armour faces the challenge of rapidly changing fashion trends. For instance, athleisure's popularity fluctuates. In Q1 2024, Under Armour's sales decreased by 10% in North America. The company must swiftly adapt its products and marketing.

Economic downturns pose a significant threat to Under Armour. Consumer spending on athletic apparel, a discretionary item, often declines during economic uncertainties. For example, in 2023, the global apparel market saw fluctuations due to inflation and recession fears. Weakening economic conditions could lead to decreased sales for Under Armour. This could also put pressure on its profit margins.

Supply Chain Disruptions

Under Armour faces supply chain threats, potentially impacting operations. Global events, trade issues, and logistical snags could disrupt production. These issues might reduce inventory and hinder meeting consumer demand. In 2024, supply chain disruptions cost various industries billions.

- Geopolitical instability can disrupt raw material sourcing.

- Trade wars may increase import costs and delays.

- Logistical bottlenecks can lead to inventory shortages.

- Natural disasters can shut down factories and ports.

Reliance on Wholesale and Promotional Activities

Under Armour's heavy reliance on wholesale and promotional activities presents a notable threat. This approach historically drove sales, but reducing promotions to boost brand image could hurt short-term revenue. Wholesale partnerships limit direct control over customer experience and brand presentation. This dependence contrasts with competitors like Nike, which have expanded direct-to-consumer channels.

- Wholesale revenue accounted for a significant portion of Under Armour's sales in 2023.

- Promotional activities have been a key driver of sales, but also impacted profit margins.

- Direct-to-consumer sales growth is a strategic priority to reduce wholesale dependence.

Under Armour confronts market share struggles with dominant rivals Nike and Adidas, pressuring sales and profits. Rapid shifts in consumer preferences demand constant product innovation and marketing adaptation, particularly within the fluctuating athleisure segment. Economic downturns and supply chain disruptions, as well as high reliance on wholesale, pose major financial risks.

| Threat | Description | Impact |

|---|---|---|

| Competitive Pressure | Dominance of Nike and Adidas; constant emergence of new brands. | Market share and pricing are squeezed; potential revenue declines. |

| Changing Consumer Trends | Fluctuating fashion preferences and trends like athleisure. | Requires quick product and marketing changes; risks inventory issues. |

| Economic Downturns | Decreased consumer spending on discretionary items, like apparel. | Reduced sales, pressure on profit margins, and potential decline in profitability. |

| Supply Chain Disruptions | Global events, trade issues, logistical issues affecting production and inventory. | Reduced inventory, ability to meet consumer demand impacted. |

| Wholesale Reliance | Over-dependence on promotions & wholesale. Limited control of brand presentation | Potential damage to brand image; increased risk on promotion dependent sale. |

SWOT Analysis Data Sources

The Under Armour SWOT is informed by financial reports, market analyses, and expert industry commentary.