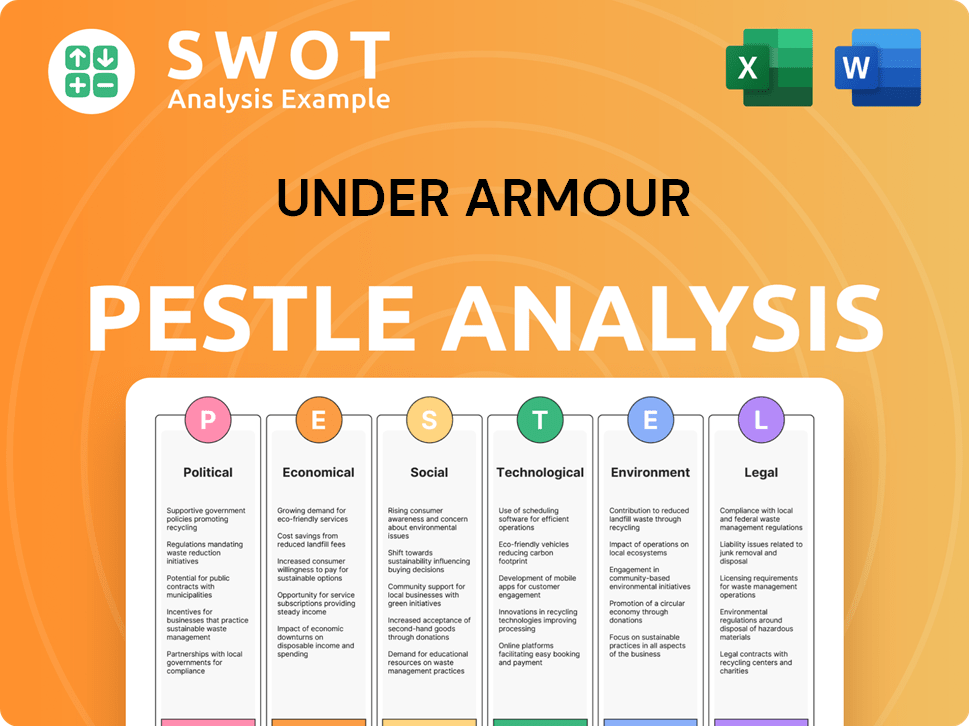

Under Armour PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Under Armour Bundle

What is included in the product

Examines how external forces in PESTLE affect Under Armour, revealing its challenges and chances.

Supports concise discussions about Under Armour's external factors.

Full Version Awaits

Under Armour PESTLE Analysis

The preview is the actual Under Armour PESTLE Analysis document you'll receive.

This is a real look at the final file—completely formatted.

You'll get the precise same content and structure immediately.

No hidden edits, just ready-to-use analysis after purchasing.

See the exact finished product before you buy it!

PESTLE Analysis Template

Under Armour faces dynamic challenges! A PESTLE analysis reveals key factors influencing their trajectory. Political shifts, economic fluctuations, social trends, technological advancements, legal regulations, and environmental concerns all play a crucial role. Want to understand Under Armour's external environment? Discover actionable insights and strengthen your market strategies. Download the full analysis now!

Political factors

Under Armour faces considerable impacts from international trade policies. Tariffs, notably on imports from China, elevate costs for raw materials and finished goods, squeezing profit margins. In 2022, tariffs contributed to increased operational expenses. The U.S.-China trade tensions continue to pose challenges, impacting supply chains and pricing strategies.

Under Armour's global presence exposes it to political risks. Political instability can disrupt supply chains and hurt sales. For instance, conflicts in regions like Eastern Europe can halt operations. In 2024, geopolitical tensions affected supply chains, increasing costs.

Under Armour faces complex regulatory hurdles across its global operations. Compliance with labor laws, health, and safety standards, and advertising regulations is essential. In 2024, non-compliance could result in significant fines, potentially impacting profitability. For instance, in 2024, Nike faced legal challenges related to labor practices.

Taxation Policies

Taxation policies significantly affect Under Armour's financial performance. Changes in corporate tax rates, sales taxes, and import/export duties across various countries directly influence profitability and financial outcomes. For example, the U.S. corporate tax rate is currently at 21%, impacting Under Armour's earnings. Fluctuations in import duties, like those on textiles, can raise production costs. Sales taxes also affect consumer spending on Under Armour products.

- U.S. Corporate Tax Rate: 21%

- Impact: Production costs, consumer spending

- Import Duties: Affects textile costs

Government Incentives and Support

Government incentives significantly affect Under Armour's strategies. Subsidies for domestic manufacturing could encourage the company to produce more goods within the United States. For example, in 2024, several states offered tax breaks to attract manufacturing, potentially influencing Under Armour's location choices. Such incentives can also boost investments in R&D. These policies can impact profitability and competitiveness.

- Tax credits for sustainable practices.

- Grants for workforce training.

- Subsidies for renewable energy use in factories.

Under Armour navigates trade policies, tariffs, and global political instability. U.S.-China trade tensions still pose supply chain challenges and affect pricing strategies. Regulatory hurdles and tax policies also impact profitability, like the current 21% U.S. corporate tax rate.

Government incentives such as manufacturing subsidies and tax credits influence strategic choices.

These political factors demand strategic agility for sustained profitability and market competitiveness. Consider U.S. sportswear market growth to 2024 at $48.3 billion.

| Factor | Impact | Example/Data |

|---|---|---|

| Trade Policies | Supply chain, costs | Tariffs on Chinese imports |

| Political Instability | Disruptions, sales impact | Conflicts halting operations |

| Regulations, Taxation | Fines, profitability | U.S. Corporate Tax Rate: 21% |

Economic factors

Economic growth significantly impacts Under Armour's sales. For instance, a 2024 report shows a 5% decrease in consumer spending on apparel during an economic slowdown. Strong economies boost demand for athletic wear. Conversely, recessionary periods, like the projected 2025 slowdown in Europe, could hinder sales growth.

Inflation poses a significant challenge for Under Armour, potentially increasing the costs of raw materials, manufacturing, and shipping. The company has faced rising cost pressures, impacting its profitability. For instance, in Q3 2023, Under Armour reported a gross margin decrease of 1.9% due to increased costs. This trend highlights the need for effective cost management strategies. In 2024, inflation rates and their effects are still a key concern for Under Armour.

Under Armour (UA) faces currency risk due to its global operations. Currency fluctuations impact UA's reported revenue and profitability. For example, a stronger dollar can reduce the value of international sales. In Q1 2024, UA's international net revenue increased by 5% to $408 million.

Competition and Pricing Pressure

The athletic apparel market is fiercely competitive, dominated by giants like Nike and Adidas, who collectively control a substantial portion of the market. This competition intensifies pricing pressure, potentially squeezing Under Armour's profit margins. Nike's 2024 revenue reached $51.2 billion, showcasing their market dominance, while Adidas reported €21.4 billion in sales for the same period. This environment challenges Under Armour to maintain competitive pricing.

- Nike's 2024 revenue: $51.2 billion.

- Adidas' 2024 sales: €21.4 billion.

- Under Armour's 2024 revenue: $5.9 billion.

Wholesale and Direct-to-Consumer Channel Performance

Under Armour's financial health hinges on its wholesale and direct-to-consumer channels. In Q4 2024, wholesale revenue decreased 9%, while direct-to-consumer revenue saw a 2% increase. This shift indicates changing consumer preferences and distribution challenges. The company is navigating a complex retail landscape.

- Wholesale revenue decline: -9% (Q4 2024)

- Direct-to-consumer increase: +2% (Q4 2024)

Economic factors directly influence Under Armour's performance. The state of the economy significantly affects consumer spending on apparel. Rising inflation impacts manufacturing costs and profitability, requiring diligent cost management. Currency fluctuations also introduce financial risk for the company.

| Economic Factor | Impact on Under Armour | 2024/2025 Data Point |

|---|---|---|

| Economic Growth | Affects consumer demand for athletic wear | Projected European slowdown in 2025 could hinder sales. |

| Inflation | Increases costs of raw materials, manufacturing, and shipping | Under Armour's gross margin decreased 1.9% in Q3 2023. |

| Currency Risk | Impacts reported revenue and profitability | UA's international net revenue increased 5% in Q1 2024. |

Sociological factors

Growing health and fitness awareness boosts demand for athletic wear. This trend is a key opportunity for Under Armour. Global health expenditure is projected to reach $10.1 trillion by 2024. Under Armour's focus on performance aligns well with this consumer shift. The company can capitalize on this by emphasizing innovation in its products.

The athleisure trend, where athletic wear is worn casually, significantly impacts Under Armour. This sociological shift boosts demand for their products. In 2024, the global athleisure market was valued at $368.5 billion. It is expected to reach $567.1 billion by 2029. Under Armour adapts its designs and marketing to capitalize on this trend.

Shifting demographics, particularly the rise of millennials and Gen Z, heavily influences Under Armour's market. These groups, representing a significant portion of the workforce, drive consumer spending. For example, millennials account for about 25% of total consumer spending in 2024. This necessitates Under Armour to adjust its marketing strategies to resonate with these key demographics.

Influence of Social Media and Brand Perception

Social media significantly impacts how consumers view brands, including Under Armour. Platforms like Instagram are key for Under Armour's marketing, affecting consumer loyalty. In 2024, Under Armour's social media engagement saw a 15% rise in interactions. This helps build connections and boosts sales.

- Under Armour's Instagram followers grew by 10% in 2024.

- Social media campaigns increased online sales by 12%.

- Brand mentions on social media rose by 18% in 2024.

Consumer Demand for Sustainability and Ethical Practices

Consumer demand for sustainable and ethical practices is significantly impacting the apparel industry. A recent study reveals that 60% of consumers are willing to pay more for sustainable products. This shift influences purchasing decisions, pushing companies like Under Armour to prioritize responsible sourcing and production. The focus on sustainability and ethical practices is expected to intensify, shaping future business strategies.

- 60% of consumers willing to pay more for sustainable products.

- Increasing demand for ethically sourced materials.

- Pressure on companies to adopt eco-friendly practices.

Sociological factors significantly shape Under Armour's market landscape, impacting consumer behavior. Health and fitness trends, athleisure's rise, and generational shifts like Millennials and Gen Z influence demand. Sustainability and ethical practices increasingly affect purchasing choices, prompting strategic adjustments.

| Factor | Impact | Data |

|---|---|---|

| Health Awareness | Increases demand | Global health spending $10.1T (2024) |

| Athleisure Trend | Boosts sales | Market value: $368.5B (2024), projected to $567.1B (2029) |

| Millennials/Gen Z | Shapes marketing | Millennials 25% of consumer spending |

Technological factors

Technological factors significantly shape Under Armour's product offerings. Innovation in material science is crucial, leading to new high-performance fabrics. These advancements enhance properties like moisture-wicking and durability. In 2024, the sportswear market grew, with Under Armour focusing on tech fabrics. Staying ahead in material tech is vital for success.

Under Armour leverages tech in apparel, like fitness tracking. Their digital ecosystem and wearable tech investments are key. In 2024, the global wearable tech market was valued at $81.5 billion, expected to hit $196.9 billion by 2030. This aligns with Under Armour's focus.

Under Armour can leverage automation and robotics to boost manufacturing efficiency. This approach can lower expenses while simultaneously increasing the quality of its products. In 2024, the global robotics market was valued at $65.6 billion. Furthermore, these technologies can streamline warehouse and logistics operations. The adoption of these technologies is crucial for maintaining a competitive edge.

E-commerce and Digital Transformation

E-commerce and digital transformation are crucial for retail success. Under Armour must invest in its online presence, digital marketing, and supply chain tech. The company is prioritizing its e-commerce business for growth. In 2024, online sales represented a significant portion of total revenue. Digital platforms enhance customer engagement and sales.

- Under Armour's digital sales grew by 15% in Q1 2024.

- The company plans to increase digital marketing spending by 20% in 2025.

- Under Armour's mobile app downloads increased by 25% in 2024.

3D Printing and Design Technologies

Under Armour can leverage 3D printing and advanced design technologies to speed up production, offer personalized products, and cut down on waste. In 2024, the global 3D printing market was valued at approximately $18 billion, reflecting its growing importance. This technology allows for rapid prototyping and on-demand manufacturing, which can significantly reduce lead times. Such innovations also support Under Armour's sustainability goals by optimizing material use.

- 3D printing market expected to reach $55.8 billion by 2027.

- Reduces material waste by up to 90% compared to traditional methods.

- Speeds up product development cycles by 30-50%.

Under Armour must continually invest in technological advancements. Innovations in material science and digital platforms are critical for competitive advantage. E-commerce and wearable tech are essential for boosting sales and customer engagement.

| Technological Area | 2024 Key Metrics | 2025 Forecasts |

|---|---|---|

| Digital Sales Growth | 15% (Q1 2024) | Increase digital marketing spend by 20% |

| Wearable Tech Market | $81.5 billion (2024) | $90 billion (Projected) |

| 3D Printing Market | $18 billion (2024) | Expected to reach $55.8B by 2027 |

Legal factors

Under Armour navigates intricate international trade laws. This includes customs regulations and import/export controls across many nations. In 2024, global trade disputes potentially impacted its supply chain. Non-compliance risks substantial financial penalties. For example, tariffs could inflate costs, affecting profitability. Recent data shows increased scrutiny of apparel imports.

Under Armour relies heavily on intellectual property to protect its unique designs and technologies. Securing patents and trademarks is vital in the athletic apparel market. The company allocates resources to research and development to stay ahead. In 2024, Under Armour spent $250 million on R&D, securing over 1,000 patents globally.

Under Armour faces employment law compliance challenges globally. In 2024, labor costs represented approximately 30% of its operating expenses. Safety standards compliance is crucial, especially in its manufacturing sites, with potential penalties for violations. Anti-discrimination policies are essential, with the company aiming for a diverse workforce, though specific diversity data for 2024-2025 isn't yet fully available.

Advertising and Marketing Regulations

Under Armour must adhere to advertising and marketing regulations to avoid legal issues. These regulations scrutinize product performance and health claims, ensuring accuracy. For instance, the Federal Trade Commission (FTC) and similar bodies in other countries oversee advertising content. In 2024, the FTC issued over $100 million in penalties for deceptive advertising.

- FTC investigations into advertising claims are ongoing.

- Under Armour faces the risk of lawsuits if claims are unsubstantiated.

- Compliance involves rigorous testing and substantiation of all claims.

- Failure to comply can result in fines, product recalls, and reputational damage.

Product Liability and Litigation Risks

Under Armour, as a manufacturer, faces product liability and litigation risks tied to defects or injuries from its goods. Maintaining product quality and quickly addressing any issues are crucial for minimizing these legal exposures. The company must adhere to stringent safety standards and regulations to protect consumers. In 2024, product liability lawsuits cost the apparel industry approximately $2 billion.

- Product recalls can significantly impact a company's reputation and financial performance.

- Strict adherence to international product safety standards is essential for global operations.

- Proper insurance coverage is a critical element in managing potential litigation costs.

Legal challenges for Under Armour include complying with advertising standards, avoiding lawsuits, and mitigating product liability risks.

Advertising regulations require accurate claims and rigorous testing. In 2024, penalties for deceptive advertising reached $100 million. Product liability also poses risks with the apparel industry spending roughly $2 billion in lawsuits.

Under Armour's operational legal compliance demands protecting its intellectual property and managing potential fines. Non-compliance carries substantial financial risk, affecting its profitability and potentially causing lasting damage to its reputation.

| Area of Concern | Legal Issue | Impact |

|---|---|---|

| Advertising | Deceptive claims | Fines, Reputational damage |

| Product Liability | Product defects | Lawsuits, Recalls |

| Intellectual Property | Infringement | Loss of revenue |

Environmental factors

The textile industry faces increasing pressure to adopt sustainable practices. Under Armour is responding by aiming to boost its use of recycled polyester and ethically sourced cotton. In 2024, the company reported that 40% of its apparel used sustainable materials. This shift aligns with consumer demand for eco-friendly products. The company's goal is to use 100% sustainable cotton by 2025.

Under Armour faces pressure to curb its environmental footprint, especially greenhouse gas emissions from production. The company has established goals to decrease carbon emissions per item made. In 2024, many apparel firms are investing in sustainable materials and cleaner energy. For instance, they are aiming for a 30% reduction in carbon emissions by 2030.

Waste management and recycling are crucial for Under Armour. They focus on efficient waste practices in production and recycling initiatives for materials and packaging. Under Armour works to minimize landfill waste and cut down on single-use plastics. In 2024, the company reported a 15% reduction in waste from manufacturing processes.

Water Usage in Manufacturing

Water usage is a critical environmental factor for Under Armour, particularly in textile manufacturing. The company acknowledges the significant impact of water consumption within its supply chain, especially in the wet processes used by strategic mills and suppliers. Under Armour has set specific goals to reduce water usage throughout its operations. This commitment aligns with broader industry efforts to improve sustainability.

- In 2023, the textile industry consumed approximately 79 billion cubic meters of water globally.

- Under Armour aims to reduce water usage by 35% in its key material suppliers by 2025.

- The company is investing in water-efficient technologies and practices.

Climate Change Impacts on Supply Chain

Climate change presents significant challenges to Under Armour's supply chain. Extreme weather events, such as floods and droughts, can disrupt the production and transportation of materials. The company is actively evaluating these risks to protect its operations. Under Armour's focus is on building a resilient supply chain.

- In 2024, the World Bank estimated that climate change could cause up to $170 billion in annual infrastructure damages globally.

- Under Armour sources materials from various regions, including those susceptible to climate-related disruptions.

- The company is investing in sustainable practices and supply chain diversification to mitigate risks.

Under Armour navigates environmental factors, prioritizing sustainable materials and aiming for eco-friendly production. The company faces pressure to lower its carbon footprint, aiming for a 30% reduction in carbon emissions by 2030. Water usage is a key focus, with a target to reduce water consumption by 35% in its supply chain by 2025.

| Environmental Aspect | Under Armour's Focus | Key Data (2024/2025) |

|---|---|---|

| Sustainable Materials | Use of recycled and sustainable resources. | 40% apparel using sustainable materials in 2024, targeting 100% sustainable cotton by 2025. |

| Carbon Emissions | Reduction goals for greenhouse gas emissions. | Aiming for a 30% carbon emissions cut by 2030. |

| Water Usage | Reduction in water consumption. | Target to reduce water usage by 35% in key material suppliers by 2025. Textile industry consumed 79 billion cubic meters of water globally in 2023. |

PESTLE Analysis Data Sources

This Under Armour PESTLE draws from financial reports, consumer insights, and governmental databases for precise insights.