United States Cellular Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

United States Cellular Bundle

What is included in the product

Strategic breakdown of U.S. Cellular's portfolio, detailing Stars, Cash Cows, Question Marks, and Dogs.

Clean, distraction-free view optimized for C-level presentation, revealing strategic insights and growth potential.

What You See Is What You Get

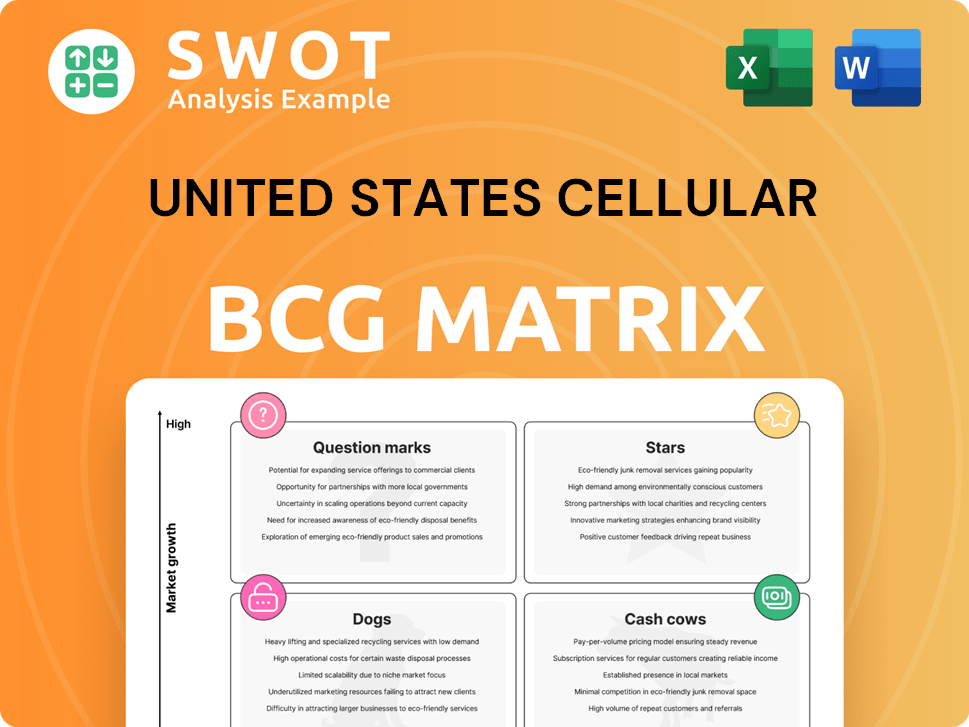

United States Cellular BCG Matrix

The U.S. Cellular BCG Matrix preview mirrors the purchased document. It’s a complete, ready-to-use analysis, ensuring strategic insights. Download it immediately after purchase. Use it for reports and presentations. No extra steps, just the final product.

BCG Matrix Template

United States Cellular's BCG Matrix reveals its product portfolio's position in the market. Identifying "Stars" like advanced data plans is crucial for growth. "Cash Cows" may include established voice services, funding innovation. "Dogs" could be older, less competitive offerings. "Question Marks" require strategic evaluation for investment.

Dive deeper into this company’s BCG Matrix and gain a clear view of where its products stand—Stars, Cash Cows, Dogs, or Question Marks. Purchase the full version for a complete breakdown and strategic insights you can act on.

Stars

UScellular is expanding its 5G network, focusing on mid-band spectrum for speed and coverage. This investment aims to meet rising data demands and support new applications. Despite subscriber losses, financial discipline drove profitability and free cash flow growth. In Q3 2024, they reported a 5.8% increase in Adjusted EBITDA.

UScellular's Fixed Wireless Access (FWA) has seen a 27% increase in its customer base in 2024. This growth highlights the company's successful expansion into home internet services, utilizing its existing wireless infrastructure. The company's strategic focus includes 5G upgrades to boost capacity and improve connectivity. In Q3 2024, UScellular reported a 13% increase in FWA connections.

UScellular's Spectrum Assets, even with the T-Mobile deal, remain substantial. These holdings offer potential for strategic monetization or network upgrades. In 2024, UScellular finalized deals, including agreements with Verizon and AT&T, for spectrum license sales. These sales highlight the value and flexibility of their spectrum portfolio. The company's spectrum assets provide significant value.

Tower Infrastructure

UScellular's tower infrastructure is a key asset, with around 4,400 towers under its ownership. These towers are a source of steady income through colocation deals, representing a stable part of the business. A new Master Lease Agreement (MLA) with T-Mobile is expected to boost tower growth with 2,015 additional collocations. This strategic move should enhance UScellular's market position and revenue.

- Approximately 4,400 towers owned.

- Revenue from colocation agreements.

- MLA with T-Mobile for 2,015 collocations.

- Stable asset base.

Strategic Partnerships

UScellular strategically partners to boost its 5G network. Collaborations, like with Samsung, bring advanced tech and expand services. These partnerships are crucial for staying competitive in the rapidly evolving telecom landscape. Samsung and US Cellular have worked together to deploy a new network architecture. UScellular aims to enhance customer experience through these partnerships.

- Samsung's mmWave and vRAN solutions deployment.

- Enhanced 5G network capabilities.

- Expansion of service offerings.

- Focus on improved customer experience.

UScellular's strategic partnerships and tower infrastructure represent "Stars" in its BCG matrix, driving growth. These investments fuel network expansion and enhance customer services. Revenue from colocation and spectrum deals provides a stable foundation.

| Category | Details |

|---|---|

| Tower Ownership | Approx. 4,400 towers |

| Collocation Growth | MLA with T-Mobile for 2,015 collocations |

| Partnerships | Samsung for 5G network upgrades |

Cash Cows

UScellular's 4.4 million retail connections across 21 states represent a solid foundation. Despite facing churn, this base generates reliable revenue. They offer diverse wireless products and services. Strong customer support and a high-quality network further solidify their position.

UScellular strategically concentrates on rural markets, a move that often gives it an edge over bigger rivals with less presence there. This focus allows the company to maintain a competitive advantage in these specific areas. Network investments are primarily aimed at deploying mid-band spectrum, boosting speed and capacity. In 2024, UScellular invested over $500 million in network upgrades, underscoring its commitment to these regions.

UScellular’s focus on financial discipline boosted profitability and free cash flow, vital for a cash cow. They've cut costs and improved efficiency to maximize cash from existing operations. The company significantly reduced its debt, paying over $200 million. This boosted free cash flow, keeping bank leverage ratios under three times.

Equipment Sales and Service Revenues

UScellular's equipment sales and service revenues remain substantial despite connection declines. Service revenues reached $742 million, surpassing the Zacks estimate of $726.4 million. Equipment sales brought in $228 million, slightly down from the prior year. Focus on customer retention and value-added services is key.

- Service revenues beat expectations, reaching $742 million.

- Equipment sales were $228 million.

- Customer retention is crucial for revenue sustainability.

Monetization of Retained Assets

UScellular is strategically monetizing its retained assets post-T-Mobile deal. This involves leveraging spectrum and towers to generate substantial cash. The company will retain roughly 4,400 towers and about 70% of its spectrum. Last year, equity method investments, including wireless partnerships, yielded approximately $158 million in income. This financial maneuver aims to fuel future investments or shareholder returns.

- Asset monetization includes spectrum and tower assets.

- Approximately 4,400 towers will be retained.

- About 70% of the spectrum will be kept.

- Equity investments, like partnerships, generated $158 million in 2023.

UScellular functions as a Cash Cow within its BCG Matrix, generating consistent profits from its established customer base. They maintain financial discipline, boosting free cash flow through cost-cutting. By monetizing retained assets like spectrum, UScellular aims to fuel future investments.

| Metric | Value | Notes |

|---|---|---|

| Service Revenue (Q1 2024) | $742M | Exceeding expectations |

| Equipment Sales (Q1 2024) | $228M | Slight decrease YoY |

| Network Investment (2024) | $500M+ | Mid-band spectrum deployment |

Dogs

UScellular faces a shrinking subscriber base, signaling customer acquisition and retention issues. This decline may stem from heightened competition or evolving consumer demands. In Q4 2024, revenues fell 3% to $970 million from $1,000 million in Q4 2023. The company is implementing strategic initiatives to combat these challenges.

US Cellular operates on a limited scale, serving parts of 21 states, a stark contrast to national giants. In 2024, Verizon's revenue hit ~$134 billion, dwarfing US Cellular's. This scale disadvantage affects negotiating power and marketing reach. Its regional focus, with a footprint outside urban areas, presents challenges in a market dominated by massive national carriers.

UScellular, classified as a "Dog" in the BCG matrix, faces high debt. The company's debt has grown, limiting financial flexibility. UScellular struggles against strong telecom rivals. Despite 5G investments, subscriber numbers have fallen. In Q3 2023, UScellular's total debt was around $4.4 billion.

Competitive Disadvantages

UScellular struggles due to its small geographic reach and network limitations, putting it at a disadvantage against bigger national carriers. The company’s dispersed footprint has restricted its growth and network abilities. Despite efforts to improve, the situation led to the sale to T-Mobile to maintain service. In 2024, UScellular's market share was around 2.5%, significantly smaller than competitors like Verizon and AT&T.

- Limited geographic reach hampers UScellular's competitiveness.

- Network capabilities lag behind larger national players.

- Structural issues, including dispersed footprint, have limited scale.

- Sale to T-Mobile ensures service continuity for customers.

Regulatory Hurdles

Regulatory hurdles pose a significant challenge for United States Cellular. The pending sale to T-Mobile faces potential delays or even rejection from regulatory bodies. Approval is still pending, with groups like the CWA and the Rural Wireless Association raising competition concerns. The deal's expected to close in mid-2025, assuming regulatory approvals are met.

- Deal Value: The proposed merger is valued at approximately $4.4 billion.

- Regulatory Timeline: The deal's closure is contingent upon regulatory approval, with a projected completion in mid-2025.

- Stakeholder Concerns: Unions and rural wireless associations have expressed concerns.

US Cellular is categorized as a "Dog" due to declining subscriber numbers and financial struggles. The company's revenue dropped to $970 million in Q4 2024. A pending sale to T-Mobile is crucial for service continuity.

| Metric | 2023 | 2024 (Q4) |

|---|---|---|

| Revenue (Millions) | $1,000 | $970 |

| Market Share | 2.7% | 2.5% |

| Total Debt (Billions) | $4.4 | $4.4 (est.) |

Question Marks

UScellular's continuous 5G deployment is crucial. The telecom sector's rapid tech evolution demands ongoing investment to remain competitive. 5G meets rising data demands, enabling new, high-speed services. In 2024, UScellular aimed to expand its 5G coverage to enhance network capabilities. The company's capital expenditures were approximately $600 million in 2023, reflecting ongoing network investments.

UScellular could uncover opportunities in untapped markets to boost its income and draw in new customers. The global telecom market reached $2.32 trillion in 2024. The industry is projected to grow by a 6.15% CAGR from 2024 to 2034. Cloud and business applications grew by 10%.

United States Cellular (USM) is set to receive a substantial cash influx from selling its wireless operations to T-Mobile and spectrum transactions. The company must strategically allocate this capital. As of Q3 2024, USM's net debt was about $2.2 billion. Reinvesting in fiber or new ventures could boost shareholder value.

Evolving Competitive Landscape

The telecom industry is a dynamic field, with new technologies and business models continually reshaping the competitive environment. UScellular is navigating this landscape by adapting to shifts and identifying new opportunities. In May 2024, UScellular sold its wireless operations and around 30% of its spectrum licenses to T-Mobile. Further agreements were made to sell about 35% of its spectrum holdings to Verizon and AT&T.

- UScellular's revenue for Q1 2024 was $961 million.

- The deal with T-Mobile was valued at $8 billion.

- The agreements with Verizon and AT&T helped to enhance its position.

- These strategic moves are aimed at optimizing its market presence.

Customer Experience Transformation

UScellular can improve its customer experience by using AI and automation for self-service options. Businesses can automate the process of getting essential services. Customer experience transformations are expected by 2025. The focus will be on using AI and automation for self-service. This will improve how customers interact with UScellular.

- AI-powered chatbots can handle common inquiries, reducing the need for human agents.

- Automated systems can streamline service provisioning, decreasing wait times.

- Personalized experiences can be created using customer data to anticipate needs.

- Self-service portals can offer account management and troubleshooting tools.

UScellular faces uncertainty. Its recent strategic shifts place its future in question. The company's current position warrants reevaluation. The BCG Matrix framework helps analyze its market strategies.

| Category | Description | Implication for UScellular |

|---|---|---|

| Question Marks | High market growth, low market share. Requires significant investment. | UScellular must decide whether to invest more or divest. |

| Recent Actions | Sale of wireless operations and spectrum. | May limit opportunities in core business. |

| Investment Needs | Fiber optics or new ventures. | Strategic capital allocation. |

BCG Matrix Data Sources

The US Cellular BCG Matrix leverages company financials, market analyses, and industry reports. We also use expert assessments to validate the positioning.