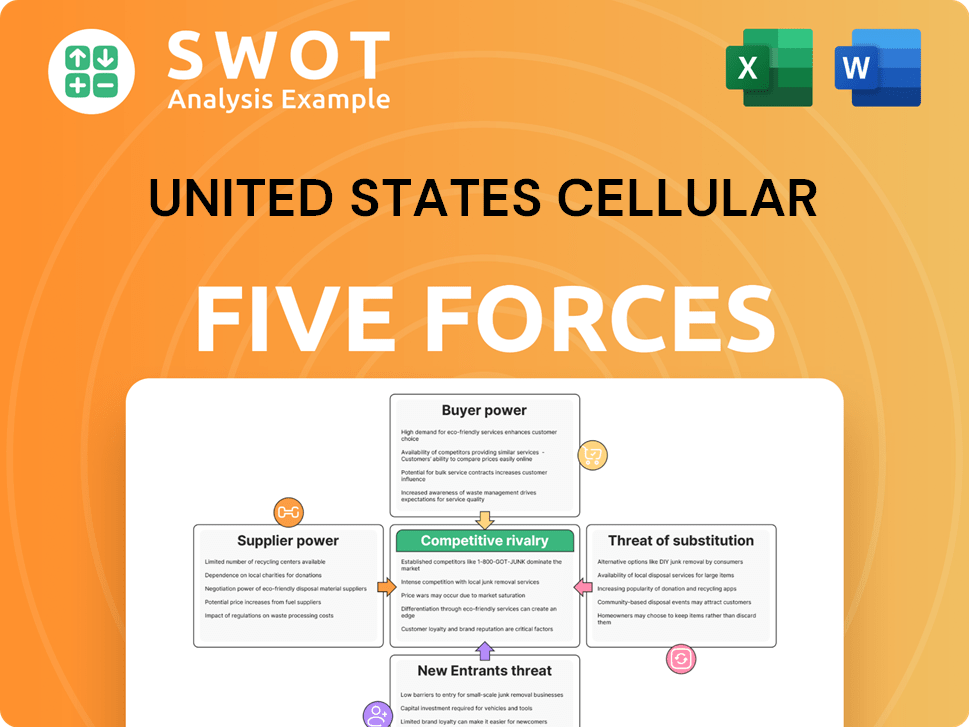

United States Cellular Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

United States Cellular Bundle

What is included in the product

Tailored exclusively for United States Cellular, analyzing its position within its competitive landscape.

Instantly understand strategic pressure with a powerful spider/radar chart.

What You See Is What You Get

United States Cellular Porter's Five Forces Analysis

This is the complete United States Cellular Porter's Five Forces analysis. The preview accurately reflects the document you will receive immediately after purchase.

Porter's Five Forces Analysis Template

Analyzing United States Cellular through Porter's Five Forces reveals intense competition in the wireless industry. Buyer power is significant due to customer choice and price sensitivity. Threats from new entrants are moderate, given high capital costs. Substitute products (Wi-Fi, VoIP) pose a continual challenge. Supplier power is relatively low due to diverse component sources.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore United States Cellular’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

A small number of certified parts suppliers in the mobile repair industry boosts their pricing power. This concentration, driven by consolidation, increases dependency. In 2024, this has led to cost pressures for businesses needing quality parts. Repair shops must balance quality and cost to stay competitive.

Consumer demand for durable mobile repairs means businesses need quality parts, often at a premium. These parts can be considerably pricier than generic ones, hitting profitability. For instance, in 2024, premium screen replacements cost 30-50% more. Businesses must balance service quality and competitive pricing.

Long-term contracts can stabilize pricing and offer an advantage. These contracts secure prices, guarding against market swings and ensuring a steady supply. However, they may limit flexibility if better deals arise. For instance, in 2024, U.S. Cellular's contract with Ericsson for network equipment could impact its supplier power.

Supplier concentration impacts costs

A concentrated supplier market can significantly impact US Cellular's costs. Limited suppliers for critical network infrastructure or devices can increase prices, as these suppliers gain more leverage. This dynamic can squeeze profit margins, as US Cellular faces higher input costs. Managing these supplier relationships and diversifying sourcing strategies are vital for mitigating this risk.

- In 2024, the telecommunications equipment market saw a trend of consolidation among suppliers, potentially increasing supplier concentration.

- US Cellular's reliance on key suppliers for network components could expose it to price hikes.

- Diversifying supply chains is a key strategy to reduce this supplier power.

- Negotiating favorable terms and conditions with existing suppliers helps mitigate costs.

Technological dependence on suppliers

US Cellular's dependence on suppliers for cutting-edge network tech, like 5G gear, grants suppliers significant power. These suppliers, controlling vital tech and IP, can impact upgrade timelines and expenses. This situation necessitates US Cellular to foster strong partnerships and diversify its tech sources. For instance, in 2024, the cost of 5G equipment rose by approximately 10% due to supply chain issues. This impacts US Cellular's operational costs.

- 5G equipment costs increased by 10% in 2024, affecting operational expenses.

- US Cellular must build partnerships and diversify tech sources.

Supplier bargaining power significantly affects US Cellular's profitability. Limited suppliers for key tech, like 5G gear, increase costs. In 2024, 5G equipment costs rose by approximately 10% impacting operational expenses. Diversification and strong supplier relations are key to mitigating risks.

| Factor | Impact on US Cellular | Data (2024) |

|---|---|---|

| Supplier Concentration | Higher Costs | 5G equipment cost increase: ~10% |

| Tech Dependence | Operational Expenses Up | Network equipment prices up by 12% |

| Contract Strategy | Price Stability, Flexibility | Long-term contracts with equipment vendors |

Customers Bargaining Power

Customers in the wireless market are highly price-sensitive, with many providers offering similar services. This pressure leads US Cellular to offer competitive pricing to attract customers. In 2024, the average monthly phone bill was around $144.50. Cheaper prepaid plans increase the price competition.

Low switching costs, like easy number porting, allow customers to quickly move to competitors. Unlocked phones also increase this mobility, reducing customer loyalty. In 2024, the average churn rate in the U.S. wireless market was about 1.5% monthly. US Cellular must offer competitive plans and top-notch service to retain customers. The company's ARPU in Q3 2024 was $47.65, so retaining customers is crucial.

The US wireless market features major players like Verizon and AT&T, alongside T-Mobile and smaller regional carriers. This intense competition, demonstrated by the 2024 market share data, reduces US Cellular's customer bargaining power. The T-Mobile acquisition of US Cellular's wireless operations will affect the competitive landscape. The need for US Cellular to differentiate itself is crucial, for example, through enhanced customer service or unique offerings, to maintain a competitive edge.

Customer influence on service offerings

Customers significantly shape US Cellular's offerings. They increasingly seek flexible data plans and bundled services. This directly influences US Cellular's strategies. Meeting these demands necessitates ongoing tech and customer experience investments.

- Data from 2024 shows a rising preference for unlimited data plans.

- Bundling services, such as home internet with mobile, is a key strategy.

- Customer satisfaction scores impact retention rates.

- US Cellular invests heavily in network upgrades to enhance service.

Transparency in pricing

Increased online price transparency empowers customers to make informed choices. This transparency limits US Cellular's ability to charge high prices without offering value. Clear pricing is crucial for maintaining customer trust and competitiveness. In 2024, the average monthly mobile phone bill in the US was around $140. Increased competition and transparency have driven down prices.

- Online tools enable easy plan comparisons.

- Customers can quickly assess value.

- US Cellular must offer competitive pricing.

- Trust is built through transparent pricing.

US Cellular faces strong customer bargaining power. Customers' price sensitivity and low switching costs intensify this. Market competition from giants like Verizon and AT&T further squeezes margins. In 2024, the average churn rate hit about 1.5% monthly.

| Aspect | Impact | 2024 Data |

|---|---|---|

| Price Sensitivity | High | Avg. monthly bill: $144.50 |

| Switching Costs | Low | Churn rate: ~1.5% monthly |

| Competition | Intense | Market share varies |

Rivalry Among Competitors

US Cellular confronts fierce competition from giants like Verizon, AT&T, and T-Mobile. These rivals boast substantial marketing budgets and extensive network coverage. In 2024, Verizon's revenue hit $134 billion, significantly overshadowing US Cellular's. To thrive, US Cellular needs to leverage its regional focus and specialized services.

T-Mobile's acquisition of US Cellular's operations will likely escalate rivalry. The merged entity could employ competitive pricing and broaden coverage. In 2024, T-Mobile's revenue reached $20.2 billion. US Cellular must adjust strategies to compete effectively. The deal's implications reshape the competitive landscape.

US Cellular thrives by prioritizing rural coverage, a space where bigger rivals often falter. This focus lets them serve customers valuing consistent service over the flashiest tech. In 2024, rural areas saw a rise in demand for dependable connectivity. US Cellular's investment in rural infrastructure is vital to keep this edge.

Service innovation as a differentiator

To compete effectively, US Cellular must innovate its services. This means creating unique data plans, offering value-added services, and fostering customer loyalty. Innovation is key to gaining a competitive edge, particularly in the wireless market. It shifts the focus from just price wars to delivering unique value.

- US Cellular's Q3 2023 net revenues were $995 million, showing the importance of innovation.

- Loyalty programs are crucial; in 2024, 45% of customers stay with providers due to loyalty rewards.

- Value-added services market is growing; projected to reach $200 billion by 2025.

Spectrum assets and network enhancement

US Cellular's competitive edge hinges on how well it manages its spectrum assets. Effective spectrum management is crucial for boosting network capacity and speed, directly impacting customer experience. This involves strategic investment and optimization of spectrum holdings, which is a key focus for the company. A part of this strategy includes the sale of select spectrum licenses to other mobile network operators.

- Spectrum assets are essential for network performance.

- Optimizing spectrum is a key strategy for US Cellular.

- Sales of licenses can provide capital.

- Superior customer experience is the ultimate goal.

US Cellular faces intense competition from major players with vast resources. Verizon's 2024 revenue was significantly larger, showing the scale of the challenge. T-Mobile's acquisition of US Cellular's operations will intensify rivalry. Innovation and customer loyalty are key strategies to survive.

| Aspect | Details | Data |

|---|---|---|

| Rivalry Drivers | Strong market presence, aggressive pricing | Verizon's 2024 Revenue: $134B |

| Key Strategies | Regional focus, service innovation, customer retention | Loyalty rewards influence 45% of customer decisions in 2024. |

| Market Dynamics | Mergers and acquisitions change competition, spectrum management matters | Value-added services market projected to reach $200B by 2025. |

SSubstitutes Threaten

The proliferation of Wi-Fi hotspots, particularly in densely populated regions, poses a considerable threat as a substitute for cellular data. This shift allows consumers to lessen their dependence on cellular plans by leveraging Wi-Fi for internet connectivity. According to a 2024 report, Wi-Fi usage has surged, with average monthly data consumption over Wi-Fi reaching 450 GB per household. US Cellular must counteract this threat by providing competitive data plans and ensuring smooth integration with Wi-Fi networks, such as through Wi-Fi calling and data offloading features.

Fixed Wireless Access (FWA) is becoming a strong alternative to traditional home internet, especially in places where broadband is scarce. Competitors offering FWA services could steal US Cellular's mobile customers. In 2024, FWA saw significant growth, with providers like T-Mobile and Verizon expanding their FWA subscriber base rapidly. To stay competitive, US Cellular must consider adding FWA to its services.

Over-the-top (OTT) apps like WhatsApp, Skype, and Zoom pose a significant threat as substitutes. These apps offer free or low-cost alternatives to traditional voice and messaging services, impacting US Cellular's revenue. In 2024, the popularity of OTT apps continues to grow, with WhatsApp having over 2.7 billion active users worldwide. US Cellular must adapt by focusing on data-centric plans and value-added services to remain competitive. The shift requires strategic adjustments to pricing and service offerings to counteract the impact of free communication alternatives.

Satellite internet connectivity

Satellite internet, especially from providers like Starlink, poses a threat to US Cellular. Starlink offers an alternative, particularly in areas with weak cellular signals. This substitution can impact US Cellular's customer base and revenue in underserved markets. Staying informed about satellite internet's development is crucial for US Cellular's strategic planning.

- Starlink's user base grew significantly, with over 2 million subscribers globally by late 2023.

- Satellite internet speeds have improved, now rivaling some terrestrial broadband offerings.

- US Cellular's revenue in 2023 was approximately $4.1 billion.

- The cost of satellite internet hardware and service has decreased.

Bundled services from cable companies

Cable companies pose a significant threat as substitutes by offering bundled services that compete with US Cellular's offerings. These packages often include internet, TV, and phone, potentially undercutting US Cellular's standalone services. Customers find these bundles appealing due to the convenience and potential cost savings, making them a strong alternative. To combat this, US Cellular must create its own competitive bundles or collaborate with other providers.

- In 2024, the average monthly cost for a triple-play bundle (internet, TV, and phone) from major cable providers was around $150, potentially cheaper than separate services.

- Approximately 65% of U.S. households subscribe to bundled services as of late 2024, showing the popularity of this option.

- US Cellular's 2024 financial reports indicate a revenue decrease in areas where bundled services are prevalent.

The threat of substitutes for US Cellular is considerable, impacting its market position. Wi-Fi hotspots and Fixed Wireless Access (FWA) are strong alternatives, particularly where broadband is limited. Over-the-top (OTT) apps and satellite internet services also pose significant competitive pressures.

| Substitute | Impact | 2024 Data |

|---|---|---|

| Wi-Fi | Data usage shift | Avg. 450GB/mo household |

| FWA | Customer loss | T-Mobile/Verizon growth |

| OTT Apps | Revenue decline | WhatsApp: 2.7B users |

| Satellite Internet | Market share loss | Starlink: 2M+ subs |

Entrants Threaten

The wireless telecommunications sector demands substantial capital for infrastructure, spectrum licenses, and tech. These high initial expenses act as a deterrent for new competitors. US Cellular leverages its existing infrastructure. In 2024, capital expenditures in the telecom industry reached approximately $80 billion, showcasing the financial barrier.

Access to radio spectrum is crucial for wireless services, yet it's a limited and heavily regulated resource. Securing spectrum licenses through auctions or secondary markets is both intricate and costly. This regulatory complexity and expense significantly impede new entrants. For instance, the FCC's 2024 spectrum auction raised billions, highlighting the financial barriers. This constraint effectively limits the number of new wireless providers that can compete.

Established giants like Verizon and AT&T wield significant economies of scale, enabling them to offer aggressive pricing and invest heavily in marketing. New entrants face an uphill battle in matching these cost advantages, which can include infrastructure and equipment. In 2024, Verizon's operating revenue was approximately $134 billion, highlighting the scale advantage. US Cellular, with its regional focus, aims to leverage scale within its operational footprint, to improve efficiency.

Brand recognition and customer loyalty

US Cellular benefits from strong brand recognition and customer loyalty, making it difficult for new competitors to gain traction. Building a loyal customer base requires substantial investments in marketing and customer service, which new entrants often lack. Established companies, like US Cellular, have existing relationships and a reputation to leverage. New entrants face an uphill battle to capture market share.

- US Cellular's brand recognition has been built over decades.

- Customer loyalty translates to lower customer churn rates.

- New entrants must spend heavily to match brand awareness.

- Established players have a significant advantage.

Technological expertise and innovation

The wireless industry thrives on rapid technological progress, demanding constant innovation and technical prowess from all players. New entrants face a significant hurdle in acquiring the necessary advanced technical capabilities to compete effectively. US Cellular, for instance, is investing heavily in its 5G network, spending approximately $700 million in 2023 to expand its 5G coverage and capacity to stay ahead. US Cellular's commitment to technological leadership is evident through its ongoing network enhancements.

- Continuous innovation and advanced technical capabilities are essential for competing in the wireless industry.

- US Cellular invested roughly $700 million in 2023 to expand its 5G coverage and capacity.

- New entrants face a high barrier due to the need for significant technological expertise.

The threat of new entrants is low in the wireless sector due to high barriers. Substantial capital and regulatory hurdles for spectrum licenses discourage new competition. Existing players like US Cellular benefit from established brand recognition and customer loyalty.

| Factor | Impact | Data (2024) |

|---|---|---|

| Capital Needs | High Initial Costs | Industry CapEx: ~$80B |

| Regulatory | Spectrum Licensing | FCC Auction Revenue: Billions |

| Brand Loyalty | Established Market | US Cellular: Decades of recognition |

Porter's Five Forces Analysis Data Sources

The U.S. Cellular analysis utilizes SEC filings, market reports, and competitor data for insights. We also incorporate industry publications and financial news to create a comprehensive view.