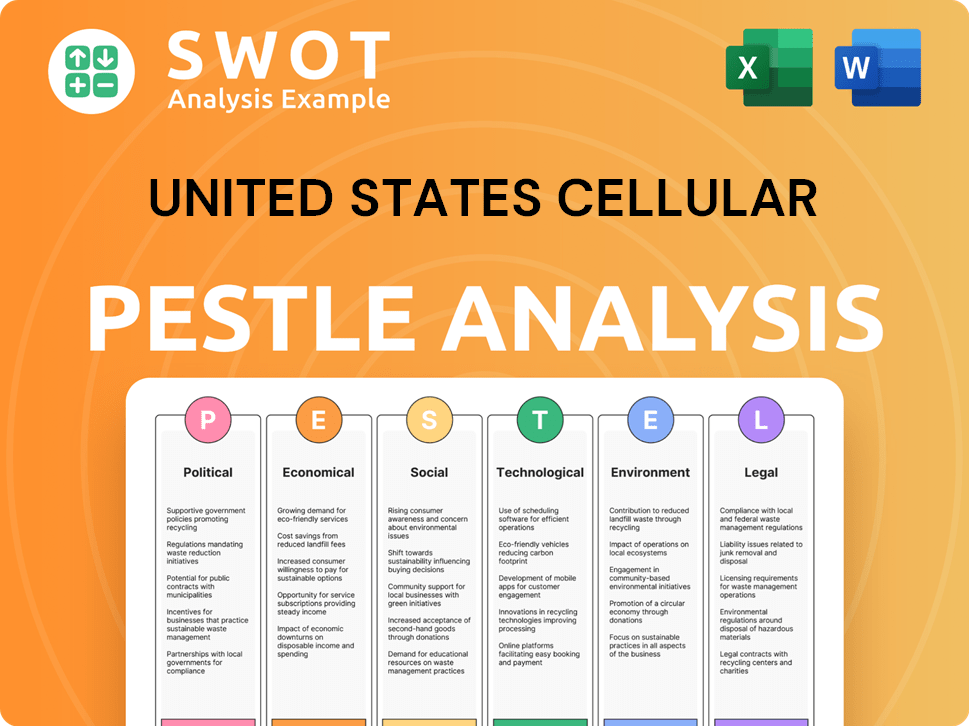

United States Cellular PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

United States Cellular Bundle

What is included in the product

Examines external factors affecting United States Cellular across Political, Economic, etc.

Allows users to modify or add notes specific to their own context, region, or business line.

Full Version Awaits

United States Cellular PESTLE Analysis

The preview shows the complete U.S. Cellular PESTLE Analysis. This is the identical document you'll receive upon purchase. All details and structure remain consistent in the downloaded file. Ready for immediate use. You get exactly what's displayed.

PESTLE Analysis Template

Navigate the complex landscape facing United States Cellular. Our PESTLE Analysis unveils crucial factors shaping the telecom giant's strategies, from regulatory hurdles to technological advancements. Discover the political, economic, social, technological, legal, and environmental impacts impacting its performance. Understand how these external forces create opportunities and risks. Download the full PESTLE Analysis and gain a competitive advantage today.

Political factors

The FCC regulates the U.S. telecom industry, affecting UScellular. Spectrum licensing, network deployment, and service offerings are all impacted. For instance, in 2024, the FCC held auctions for 2.5 GHz spectrum, critical for 5G expansion. Changes in FCC policies, like those on net neutrality, can shift UScellular's strategies. UScellular must navigate these regulations to maintain its competitiveness.

UScellular faces opportunities and challenges due to the political focus on rural broadband. Government funding supports network expansion in these areas. For example, the Infrastructure Investment and Jobs Act of 2021 allocated billions for rural broadband. Political shifts and funding changes could impact growth; in 2024, the FCC continued to oversee these programs.

Government initiatives significantly shape UScellular's competitive landscape. Policies promoting competition, such as those encouraging new entrants, could intensify market pressure. Regulatory decisions favoring larger carriers might disadvantage UScellular. Conversely, support for regional carriers could create a more favorable environment; for instance, in 2024, the FCC continued to evaluate policies impacting regional telecom providers.

Trade Policies and Supply Chain Impacts

UScellular faces political risks from trade policies. Tariffs on imported tech can raise costs. The firm depends on vendors for gear and devices. Changes in trade affect pricing and equipment availability. In 2024, tariffs on key components rose by 5%, impacting operational expenses.

- Tariff impacts on network infrastructure costs.

- Changes in trade agreements affecting device pricing.

- Availability of equipment due to policy shifts.

- Impact of international trade on supply chain.

Political Stability and Geopolitical Events

Political stability and geopolitical events indirectly influence UScellular. Although primarily domestic, global events affect the economy, supply chains, and investor confidence. For example, the US economy grew by 3.3% in the fourth quarter of 2023, according to the Bureau of Economic Analysis. These factors can create both challenges and opportunities for the company.

- Economic impacts from global events, like trade disputes, can affect supply chain costs.

- Political decisions on technology, such as 5G infrastructure, directly influence the company's operations.

- Investor sentiment, which is linked to global stability, affects UScellular's stock performance.

The FCC's regulatory actions critically influence UScellular, especially regarding spectrum allocation and net neutrality; the firm must adeptly manage these regulations for competitive advantages. Government funding initiatives, particularly the Infrastructure Investment and Jobs Act of 2021, which earmarked billions for rural broadband, present growth opportunities, albeit subject to shifts in political priorities. Trade policies pose financial risks; a 5% increase in tariffs on vital components during 2024 impacted operational costs. The US economy grew by 3.3% in the fourth quarter of 2023, as reported by the Bureau of Economic Analysis.

| Factor | Impact on UScellular | Recent Data (2024-2025) |

|---|---|---|

| FCC Regulation | Spectrum, Net Neutrality | 2.5 GHz spectrum auctions; net neutrality policy reviews. |

| Rural Broadband Funding | Network Expansion | Ongoing allocation from Infrastructure Act. |

| Trade Policies | Equipment Costs | 5% tariff increases; supply chain issues. |

Economic factors

The U.S. economic climate strongly influences consumer spending on services like those UScellular provides. Economic slumps often see consumers cutting back on non-essential spending. This can mean less demand for premium plans or postponing new device purchases, which directly hits UScellular's revenue and subscriber numbers. For example, in 2023, overall consumer spending grew by 2.2%, but spending on communication services rose by only 1.5%. This trend continued into early 2024.

Inflation significantly impacts UScellular's operational costs. Rising expenses like labor and equipment can squeeze profit margins. Managing these costs while remaining price-competitive is vital. Consumer affordability is also affected; in 2024, inflation was around 3.1%.

The U.S. telecom market is fiercely competitive, with major players like Verizon and AT&T constantly battling for customers. This competition forces UScellular to offer attractive pricing. In 2024, the average revenue per user (ARPU) for UScellular was around $47, reflecting pricing pressures. These promotional offers impact UScellular's profit margins.

Capital Expenditures and Network Investment

UScellular's ability to invest in capital expenditures, especially for 5G network upgrades, is heavily influenced by economic conditions. Access to capital markets plays a critical role in funding these substantial investments. In 2024, the company allocated a significant portion of its budget to network infrastructure. Economic downturns or rising interest rates could potentially limit UScellular's investment capacity.

- Capital expenditures are vital for competitive services.

- Economic factors directly impact network investment.

- 5G deployment requires substantial financial resources.

- UScellular's financial health affects network upgrades.

Mergers and Acquisitions

Mergers and acquisitions (M&A) in the telecom sector can drastically change market dynamics. UScellular's strategic moves, like selling assets, are reshaping its economic structure. These deals influence its competitive edge and financial performance. For instance, T-Mobile's acquisition of Sprint (completed in 2020) is a major industry example.

- UScellular's asset sales are a key strategic shift.

- M&A activity alters the competitive landscape.

- Financial outcomes depend on deal terms and integration.

Economic factors shape UScellular's financial health. Consumer spending changes impact revenue. Inflation and interest rates affect operational costs and investment capacity.

| Economic Factor | Impact on UScellular | 2024/2025 Data/Forecasts |

|---|---|---|

| Consumer Spending | Influences demand for services. | 2024 growth: 1.5% in communications services, slower than overall spending. |

| Inflation | Affects operational costs and pricing strategies. | 2024: inflation around 3.1%, impacting margins and pricing. |

| Interest Rates | Influences capital expenditure and borrowing costs. | 2024: Interest rates potentially impacting investment in network. |

Sociological factors

Societal shifts in technology adoption significantly impact UScellular. Growing mobile data reliance and demand for faster speeds drive service needs. Recent data shows mobile data usage in the U.S. continues to rise. This trend shapes UScellular's service offerings and investment strategies. Device adoption and application demand also influence plan development.

UScellular's focus on the Midwest and South means it's sensitive to demographic shifts. These regions have seen varied population changes. For example, the South grew by 1.1% in 2023, driven by migration. Rural areas, where UScellular operates, may experience slower growth or even decline, impacting subscriber numbers. Analyzing these trends helps forecast service demand.

Consumer expectations for network reliability, customer support, and innovative features significantly impact satisfaction and churn. UScellular must adapt to these changing needs to maintain its customer base. In 2024, the US mobile customer satisfaction score averaged 78 out of 100, highlighting the importance of service quality. Churn rates within the industry fluctuate, with some quarters reaching as high as 1.5% due to dissatisfaction.

Digital Divide and Connectivity Needs

The digital divide remains a significant sociological factor, with disparities in broadband access impacting various demographics. UScellular can address this by expanding its network, especially in underserved rural areas where connectivity is often lacking. This expansion supports essential services like remote work, education, and telehealth.

- Around 14.5 million Americans still lack access to broadband internet, according to the FCC's 2024 data.

- The cost of broadband services is a barrier for many, with monthly bills averaging $60-$80.

- Demand for remote work increased by 15% in 2024, highlighting the need for reliable connectivity.

Social Media and Public Perception

UScellular's brand is significantly shaped by how it's viewed on social media. Negative posts and news stories can quickly damage its reputation and erode customer trust. In 2024, about 70% of U.S. adults used social media, making it a key platform for public opinion. Addressing customer complaints online and managing its public image are therefore critical.

- Social media usage in the U.S. reached 70% in 2024.

- Negative online reviews can lead to a 10-20% drop in consumer trust.

- UScellular's customer satisfaction scores are closely monitored online.

Sociological factors significantly influence UScellular's business operations. Digital divide persists, with about 14.5 million Americans lacking broadband access in 2024, impacting potential subscribers. Social media's impact requires brand management; 70% of U.S. adults used social media in 2024. Shifts in technology and customer expectations influence network services and reliability.

| Factor | Impact | 2024 Data |

|---|---|---|

| Broadband Access | Affects subscriber growth. | 14.5M Americans lack access. |

| Social Media | Shapes brand perception. | 70% of U.S. adults used social media. |

| Customer Expectations | Impacts satisfaction, churn. | Avg. satisfaction 78/100. |

Technological factors

UScellular faces significant technological factors due to the 5G network's deployment and evolution. In 2024, 5G adoption in the U.S. reached 60%, with projections showing continued growth. UScellular's investment in 5G is essential for competitive data speeds, new services, and meeting customer demand. The company invested $1.2 billion in its network in 2023, a portion dedicated to 5G expansion.

Technological advancements in mobile devices are rapid. High-speed networks are crucial. UScellular must support the latest device features. In 2024, smartphone sales reached $160 billion. Upgrades boost demand for better networks.

The development of new wireless technologies significantly impacts UScellular. Advancements in spectrum utilization and network virtualization, like vRAN, offer potential for improved network efficiency. Fixed wireless access also presents opportunities for service expansion. UScellular must strategically evaluate and integrate these technologies to remain competitive. In 2024, vRAN adoption is expected to grow by 30%.

Cybersecurity and Data Privacy Technologies

UScellular faces significant technological challenges in cybersecurity and data privacy. The company must invest in advanced security measures to protect against cyber threats and ensure customer data privacy. Data breaches can lead to substantial financial losses, regulatory penalties, and reputational damage. According to a 2024 report, the average cost of a data breach in the US is over $9 million.

- Implementing robust encryption protocols for data transmission and storage.

- Utilizing multi-factor authentication to secure user accounts.

- Conducting regular security audits and vulnerability assessments.

- Investing in AI-driven threat detection and response systems.

Artificial Intelligence and Automation

Artificial intelligence (AI) and automation are transforming UScellular's operations. AI enhances network management and customer service, boosting efficiency. This leads to improved service delivery and operational optimization. UScellular is investing in these technologies to stay competitive. According to recent reports, the AI market in the telecom sector is expected to reach $2.5 billion by 2025.

- AI-driven network optimization can reduce operational costs by up to 15%.

- Automated customer service tools can handle up to 70% of routine inquiries.

- UScellular plans to allocate 10% of its IT budget to AI and automation initiatives in 2024-2025.

UScellular's 5G deployment, critical to stay competitive, required a $1.2 billion network investment in 2023. Rapid mobile device tech drives demand, with $160 billion in smartphone sales in 2024. Cybersecurity investment is crucial due to breaches costing over $9 million on average in the U.S.

| Factor | Impact | Data |

|---|---|---|

| 5G Adoption | Essential for data speeds | 60% adoption rate in the U.S. in 2024 |

| Cybersecurity | Financial risk from breaches | Avg. breach cost >$9M in the US in 2024 |

| AI in Telecom | Efficiency & Optimization | Market to reach $2.5B by 2025 |

Legal factors

UScellular navigates a complex regulatory landscape. It must adhere to federal, state, and local telecommunications laws. These regulations cover licensing, consumer protection, privacy, and network operations. Compliance is crucial, with potential penalties including fines, which in 2024, averaged $1.2 million for major violations, and legal challenges.

UScellular operates under strict FCC regulations for spectrum licensing and usage, crucial for its wireless services. The FCC's auction processes determine spectrum acquisition, impacting network capabilities. In 2024, UScellular spent significantly on spectrum, reflecting its commitment to expand its 5G network. Any changes in these regulations can affect UScellular's ability to offer and expand services, potentially influencing its financial performance. For example, in 2024, the FCC adjusted rules on spectrum sharing, which could impact UScellular's operational efficiency.

UScellular must comply with federal and state consumer protection laws. These laws cover billing, advertising, and customer service. For instance, the FCC enforces rules on billing accuracy. In 2024, there were over 17,000 consumer complaints against mobile carriers. Compliance is vital to avoid penalties and maintain customer trust.

Data Privacy and Security Laws

UScellular faces strict data privacy and security regulations. These laws, especially at the state level, dictate how the company handles customer data. Non-compliance risks hefty penalties and reputational damage. Staying current with evolving data protection standards is critical. For instance, the California Consumer Privacy Act (CCPA) impacts data handling practices.

- Compliance costs can be substantial, with potential fines reaching millions.

- Data breaches can lead to significant customer churn and legal liabilities.

- Ongoing monitoring and updates to data security protocols are essential.

- Cybersecurity insurance is a key risk management tool.

Antitrust and Competition Law

Antitrust and competition laws significantly affect the telecom sector, including UScellular. These laws scrutinize mergers, acquisitions, and business practices to ensure fair competition. Regulatory bodies review transactions, such as the proposed sale of UScellular's wireless operations, under these frameworks. For example, the Federal Communications Commission (FCC) and the Department of Justice (DOJ) are key regulators.

- The DOJ and FCC have the power to block or modify deals if they reduce competition.

- In 2024, the DOJ blocked a merger between JetBlue and Spirit Airlines due to antitrust concerns.

- UScellular's sale is subject to similar reviews, potentially impacting the deal's structure or timeline.

- Failure to comply can result in significant fines and legal challenges.

UScellular must adhere to diverse legal requirements. These span spectrum licenses, consumer protection, and data privacy laws. Non-compliance can trigger penalties, like 2024's $1.2 million average for violations.

Antitrust laws also shape operations, with agencies scrutinizing deals. For example, the DOJ blocked a merger in 2024 over competition concerns. These laws influence strategic moves.

Cybersecurity and data protection regulations are also paramount. Keeping up with new data security is a must.

| Legal Aspect | Regulatory Body | Impact on UScellular |

|---|---|---|

| Spectrum Licensing | FCC | Determines network capabilities & expansion; auctions |

| Consumer Protection | FCC, FTC, State AGs | Affects billing practices, marketing; compliance is essential |

| Data Privacy | Federal & State (CCPA, etc.) | Data handling protocols; potential penalties & reputation issues |

Environmental factors

UScellular's business, involving cell towers and network infrastructure, faces environmental regulations. Compliance with land use, emissions, and waste disposal rules is essential. In 2024, the EPA announced stricter rules for emissions, potentially impacting telecom operations. UScellular spent $15 million on environmental compliance in 2023. These costs are expected to rise in 2024/2025.

Climate change presents a significant challenge for UScellular. The rise in extreme weather events, like hurricanes and wildfires, directly threatens the company's network infrastructure. Service disruptions and the need for resilient network investments are ongoing concerns. For example, in 2024, the US experienced 28 separate billion-dollar weather disasters, highlighting the growing risk. These events can lead to increased operational costs for repairs and maintenance.

UScellular's network infrastructure heavily relies on energy, making energy consumption a key environmental factor. The company could face increasing pressure to reduce its carbon footprint. In 2024, the telecom sector's energy use accounted for approximately 2% of global emissions. UScellular might adopt renewable energy to cut costs and improve sustainability.

Electronic Waste (E-waste) Disposal

UScellular faces environmental challenges in electronic waste (e-waste) disposal from its network gear and customer devices. The telecommunications sector is under pressure to comply with environmental regulations regarding e-waste. Proper e-waste management is crucial, given the growing volume of discarded electronics. According to the EPA, in 2021, only 15% of e-waste was recycled in the U.S.

- E-waste recycling rates remain low nationally.

- Regulations like those from the EPA must be followed.

- UScellular should implement responsible recycling programs.

- Consider partnerships with certified recyclers.

Public Perception and Corporate Environmental Responsibility

UScellular faces increasing scrutiny regarding its environmental impact. Public awareness of environmental issues influences customer and investor perceptions. A commitment to sustainability is crucial for the company's reputation and stakeholder relationships. Companies with strong ESG (Environmental, Social, and Governance) scores often attract more investment. According to a 2024 study, 70% of consumers prefer eco-friendly brands.

- Consumer preference for sustainable brands is rising.

- ESG scores impact investment decisions.

- Reputation is tied to environmental responsibility.

UScellular must comply with stricter environmental regulations, including emissions rules and waste disposal.

Extreme weather events linked to climate change, like hurricanes and wildfires, pose a significant threat, potentially increasing operational costs for maintenance. In 2024, the US had 28 billion-dollar weather disasters.

With consumer preference shifting towards eco-friendly brands, a strong ESG score is vital for attracting investors. E-waste regulations also require attention, given the low recycling rates in the U.S.

| Environmental Aspect | Impact | Data |

|---|---|---|

| Regulations | Compliance costs, operational changes | UScellular spent $15M on compliance in 2023; EPA’s stricter emission rules. |

| Climate Change | Network disruption, infrastructure damage | 28 billion-dollar weather disasters in 2024. |

| Energy Use | Carbon footprint, cost of operation | Telecom sector uses 2% of global emissions; renewable adoption needed. |

| E-waste | Compliance, brand image, environmental impact | 15% e-waste recycling rate in the U.S. in 2021. |

PESTLE Analysis Data Sources

This PESTLE analysis uses credible sources. It draws from U.S. government data, financial reports, industry publications, and consumer insights to provide a solid understanding of the external business environment.