Vermilion Energy Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Vermilion Energy Bundle

What is included in the product

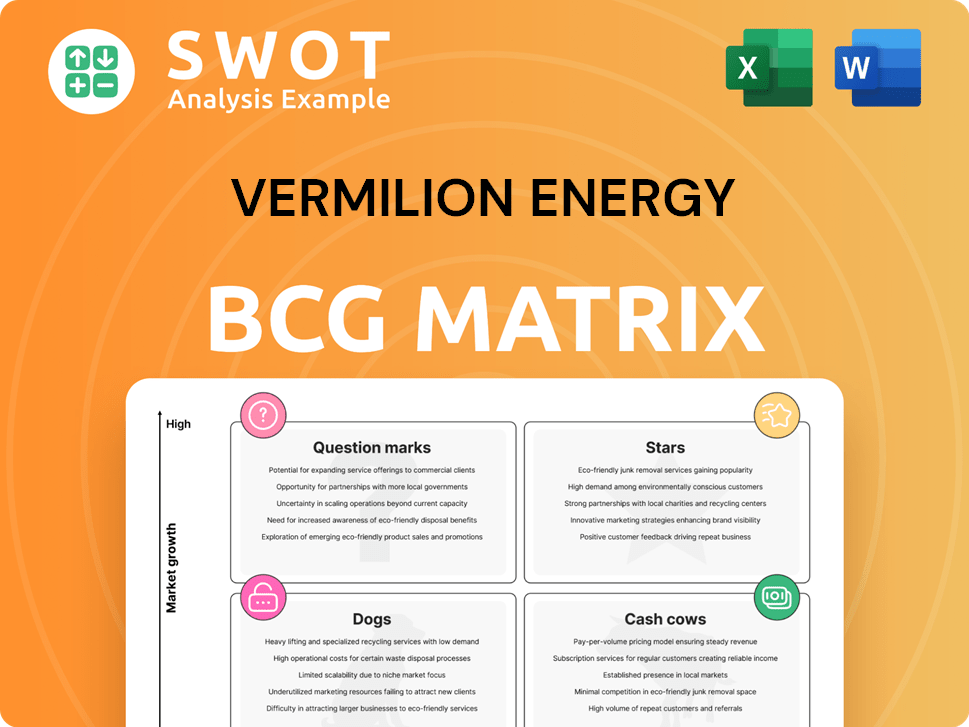

Vermilion Energy's BCG Matrix analysis of business units, identifying growth, investment, and divestment strategies.

Export-ready design for quick drag-and-drop into PowerPoint, so Vermilion Energy can present data fast.

What You See Is What You Get

Vermilion Energy BCG Matrix

The displayed preview showcases the complete Vermilion Energy BCG Matrix report you'll gain access to after purchase. This is the exact document, fully formatted and ready for your strategic review and implementation, without any alterations. Download it instantly and utilize it for your business analysis; what you see is what you get. No hidden content, just the complete matrix ready for your use.

BCG Matrix Template

Vermilion Energy's BCG Matrix offers a snapshot of its product portfolio, revealing strengths & weaknesses.

See how various assets perform: Stars, Cash Cows, Dogs, or Question Marks.

This overview hints at potential investment strategies and future growth areas.

The matrix helps understand market share & growth rate dynamics.

Discover detailed quadrant placements and strategic recommendations.

Gain a competitive edge with a full strategic breakdown.

Buy now for a ready-to-use strategic tool and deeper analysis!

Stars

Vermilion's Montney asset is a Star in its BCG Matrix, showing high growth. It has had significant investment, improving well costs. Production is expected to rise, supporting free cash flow. In 2024, Vermilion's Montney production averaged approximately 140,000 boe/d. It is a key growth driver with a substantial drilling inventory.

Vermilion Energy's European natural gas operations, especially in Germany and the Netherlands, are a strategic "Star" due to premium pricing and strong netbacks. The company's European production in Q1 2024 was 28,387 boe/d. Successful exploration boosts cash flow. Vermilion is exploring debottlenecking to increase production.

Vermilion's Westbrick acquisition boosts North American operations. Deep Basin assets add production and drilling locations. This strengthens Vermilion's scale and margins. The deal, finalized in 2023, involved $3.8 billion. It's a key move for growth.

Global Gas Portfolio

Vermilion Energy's global gas portfolio is a star in its BCG matrix. It features assets in Canada and Europe, allowing for a premium realized natural gas price. High-netback, low-decline European gas production and growing Canadian liquids-rich gas assets are key. Vermilion's focus is on growing international assets through acquisitions.

- Vermilion's 2024 production guidance is between 87,000 and 91,000 boe/d.

- European gas production offers strong margins.

- Canadian assets include liquids-rich gas.

- Vermilion actively seeks international acquisitions.

Shareholder Returns

Vermilion Energy prioritizes shareholder returns, showcasing financial health and growth. They've boosted quarterly dividends and repurchased shares, increasing per-share value. This capital return strategy makes Vermilion appealing to investors. In 2024, the dividend yield was around 8%, and share buybacks totaled $200 million.

- Dividend Yield: Approximately 8% in 2024.

- Share Buybacks: $200 million in 2024.

- Consistent Dividend Increases: Demonstrated over time.

- Focus: Enhancing shareholder value.

Vermilion's assets are strategic "Stars" in its BCG matrix, indicating high growth and market share. The Montney and European gas operations are significant contributors. These assets enjoy premium pricing and strong netbacks.

| Asset | Status | Key Benefit |

|---|---|---|

| Montney | Star | High Growth |

| European Gas | Star | Premium Pricing |

| Westbrick Acquisition | Star | Production Boost |

Cash Cows

Vermilion Energy has a solid production base in the Netherlands, a key component of its cash cow status. These assets offer consistent, low-growth cash flow. In 2024, Vermilion's Netherlands operations generated significant revenue. The company is focusing on drilling and infrastructure upgrades to boost efficiency. This ensures sustained profitability.

Vermilion Energy's Croatian operations are a cash cow, particularly from the SA-10 block. The gas plant's full utilization ensures a stable cash flow stream. In 2024, Vermilion's Croatian production contributed significantly to its overall revenue. The company is assessing new discoveries for further development, ensuring sustained profitability.

Vermilion's Australian operations are a cash cow, providing steady production and cash flow. These assets, benefiting from established infrastructure, show consistent performance. In 2024, Vermilion's Australian output was approximately 10,000 boe/d. The company focuses on cost management to sustain profitability, ensuring reliable revenue.

Corrib Natural Gas Project (Ireland)

The Corrib Natural Gas Project in Ireland is a cash cow for Vermilion Energy, offering a steady stream of revenue. Vermilion's increased stake makes it the largest domestic gas provider in Ireland. The company focuses on optimizing production and managing costs. This ensures consistent profitability.

- In 2024, Corrib's production is expected to contribute significantly to Vermilion's total output.

- Vermilion's operational focus aims to keep operating costs low.

- The project's stable cash flow is a key asset for Vermilion.

- Corrib's strategic importance is highlighted by its contribution to Ireland's energy needs.

Hedged Production

Vermilion Energy uses commodity hedging to manage financial risk and secure cash flow. They've hedged a substantial part of their 2025 output, covering European gas, North American gas, and crude oil. This strategy protects against price swings, promoting steady financial results. Vermilion's hedging program is designed to provide stability.

- Vermilion's 2024 production hedges include approximately 60% of its European gas.

- The company has hedged around 50% of its North American gas production for 2024.

- For crude oil, Vermilion has hedged roughly 40% of its 2024 output.

Vermilion Energy's cash cows, including operations in the Netherlands, Croatia, Australia, and Ireland, generate consistent cash flow. These assets benefit from established infrastructure and operational efficiency. In 2024, hedging strategies protected against market volatility, securing financial stability.

| Asset | 2024 Production (approx.) | Key Benefit |

|---|---|---|

| Netherlands | Significant Revenue | Consistent, low-growth cash flow |

| Croatia | Significant Revenue | Stable cash flow from gas plant |

| Australia | 10,000 boe/d | Steady production and cash flow |

| Ireland (Corrib) | Significant contribution | Steady revenue stream |

Dogs

Vermilion Energy is selling its southeast Saskatchewan assets, as part of its portfolio optimization strategy. These assets, with limited growth, offer lower returns. The sale aims to boost Vermilion's deleveraging and enhance its portfolio. In 2024, Vermilion's debt reduction is a key focus.

Vermilion Energy might sell its U.S. assets. These assets might not perform as well as others. A sale could speed up debt reduction. In 2024, Vermilion's total debt was $1.8 billion. This move could improve the company's portfolio.

Mature oil fields within Vermilion Energy's portfolio likely fit the "Dogs" category in a BCG matrix. These fields often exhibit low growth and declining production. For example, in 2024, Vermilion's mature assets might show a production decline of around 5-10%. The company could explore divestiture options or concentrate on cost-cutting measures to boost their profitability.

Non-Core Exploration Projects

Certain non-core exploration projects with limited growth potential are classified as Dogs in Vermilion Energy's BCG matrix. These projects often demand substantial investment, yet their returns remain uncertain. In 2024, Vermilion might reassess these projects, potentially leading to divestiture or alternative development strategies to optimize capital allocation. The company's 2023 annual report showed a focus on streamlining operations.

- High investment, low return potential.

- Requires re-evaluation.

- Divestiture or alternative strategies.

- Focus on operational streamlining.

High-Cost, Low-Production Wells

High-cost, low-production wells, or "Dogs," represent a challenge for Vermilion Energy. These wells, characterized by elevated operating expenses and minimal output, can drag down overall profitability. In 2024, Vermilion's operating costs per barrel of oil equivalent (boe) are around $15.00. These wells often have a negative impact on cash flow.

- Vermilion must cut costs to improve financial performance.

- Decommissioning these wells is an option.

- High operating costs reduce profits.

- Low production rates impact cash flow.

Dogs represent assets with low growth and returns, like mature oil fields or high-cost wells. In 2024, these might include assets with declining production, potentially down 5-10%

These assets often have high operating costs, impacting profitability. Vermilion's 2024 operating costs were approximately $15.00 per barrel of oil equivalent.

Vermilion might sell these assets to improve the portfolio and focus on more profitable areas. The company's focus is on debt reduction.

| Category | Characteristics | Impact |

|---|---|---|

| Mature Oil Fields | Low growth, declining production. | Reduced profitability, negative cash flow. |

| High-Cost Wells | Elevated operating expenses, minimal output. | Low returns, increased debt. |

| Non-Core Projects | Limited growth potential, high investment. | Uncertain returns, capital inefficiency. |

Question Marks

Vermilion Energy is exploring shallow gas wells in Europe, with plans to drill one in Germany. These wells are a potential growth area, but face exploration and development risks. The success of these wells will determine their future, potentially becoming Stars. In 2024, Vermilion's production was approximately 80,000 boe/d.

Vermilion Energy is set to drill two exploration wells in Slovakia, marking a strategic move into potentially lucrative areas. These projects represent a high-growth, high-risk venture, fitting the "Question Mark" quadrant of a BCG matrix. The success of these wells is pivotal; a positive outcome could elevate them to "Stars," while failure might necessitate further investment. In 2024, the oil and gas exploration sector in Slovakia saw fluctuations, with investment decisions heavily influenced by global energy market dynamics.

Vermilion Energy is resuming drilling in the Netherlands, focusing on Rotliegend prospects. Two wells are planned, and their performance will be crucial. Success could elevate these prospects to Stars within Vermilion's portfolio. However, further investment might be needed if results are less promising.

New Technologies and Pilot Projects

Vermilion Energy's ventures into new technologies and pilot projects are classified as question marks within the BCG matrix, indicating high potential but also high risk. These projects, like those focused on carbon capture utilization and storage (CCUS), demand substantial initial investments. The outcomes are uncertain, influencing their progression towards becoming Stars or requiring more funding. For instance, in 2024, Vermilion allocated a portion of its $1.1 billion capital expenditure budget towards these innovative initiatives.

- High investment needs and uncertain outcomes characterize these ventures.

- Success hinges on converting these projects into profitable assets.

- These investments are crucial for future growth and sustainability.

- Pilot projects include carbon capture and storage initiatives.

Future Acquisitions

Future acquisitions are potential growth avenues for Vermilion Energy, yet they are marked by significant upfront investments and inherent uncertainty. These ventures could become Stars, generating substantial returns, or remain Question Marks, demanding further capital infusion. The success hinges on effective integration, market conditions, and operational synergies. In 2024, Vermilion's strategic moves in this area will be crucial for its long-term value creation.

- Acquisitions represent potential growth but carry high uncertainty.

- Success depends on integration and market dynamics.

- 2024 strategic moves are crucial for long-term value.

- Investments may lead to high returns or require more capital.

Vermilion's "Question Mark" projects require high investment with uncertain outcomes, like CCUS initiatives, potentially becoming Stars or needing more capital. Success hinges on converting these ventures into profitable assets, supported by strategic investments, such as the $1.1B allocated in 2024. In 2024, acquisitions and exploration wells are marked by uncertainty.

| Project Type | Risk Level | Investment |

|---|---|---|

| Exploration Wells | High | Significant |

| CCUS Initiatives | High | Large |

| Acquisitions | Moderate-High | Varies |

BCG Matrix Data Sources

The Vermilion Energy BCG Matrix is data-driven, using financial statements, market reports, and analyst forecasts for reliable analysis.