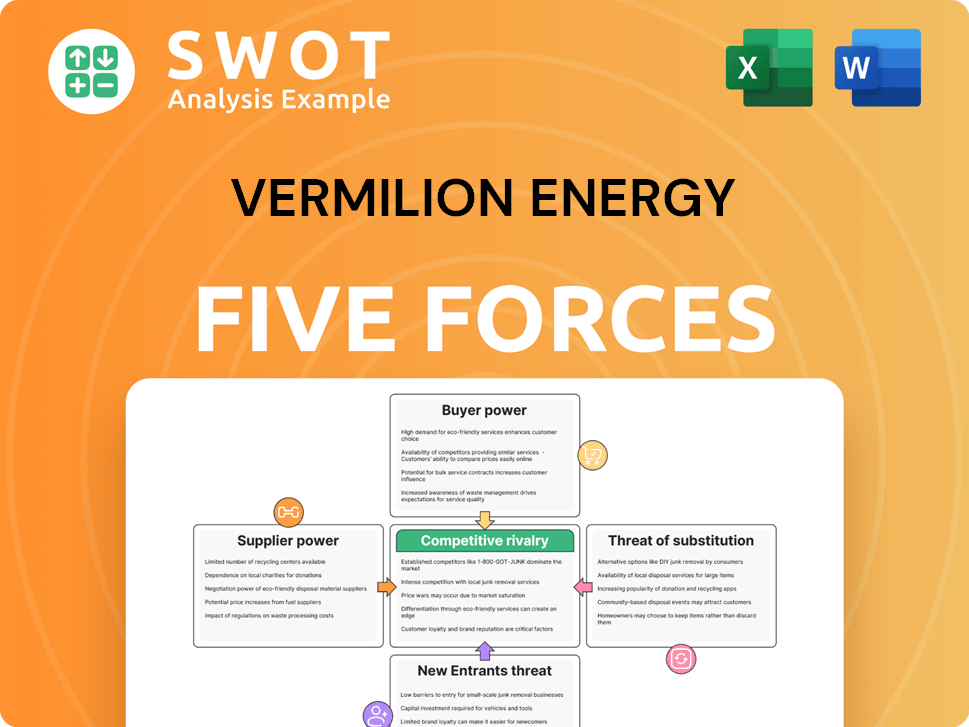

Vermilion Energy Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Vermilion Energy Bundle

What is included in the product

Tailored exclusively for Vermilion Energy, analyzing its position within its competitive landscape.

Instantly understand strategic pressure with a powerful spider/radar chart.

What You See Is What You Get

Vermilion Energy Porter's Five Forces Analysis

This is the Vermilion Energy Porter's Five Forces Analysis you'll receive. The preview reflects the complete, professional document ready for your use. No modifications or hidden content—what you see is what you get immediately after purchase. This analysis is fully formatted and ready to download upon payment. The document contains the final, ready-to-use analysis.

Porter's Five Forces Analysis Template

Vermilion Energy operates in a sector shaped by volatile oil prices, impacting its profitability. The bargaining power of suppliers (e.g., equipment, services) is moderate, dependent on market conditions. Buyer power, mainly from refiners and end-users, fluctuates with energy demand. The threat of new entrants is considered moderate, given high capital investment requirements. Substitutes, such as renewable energy, pose a growing, long-term threat.

This preview is just the starting point. Dive into a complete, consultant-grade breakdown of Vermilion Energy’s industry competitiveness—ready for immediate use.

Suppliers Bargaining Power

Vermilion Energy faces limited supplier concentration due to a diverse supplier base. This includes companies providing drilling equipment and specialized services. The competitive nature of these suppliers allows Vermilion to negotiate favorable terms. For example, in 2024, the average cost of oil and gas equipment decreased by approximately 7% due to increased competition.

Vermilion Energy benefits from robust competition among service providers. Numerous companies offer specialized services like seismic testing and drilling. This competition reduces the influence of any single provider, keeping costs in check. For example, in 2024, the drilling services market saw intense rivalry, with companies vying for contracts. This competitive environment allows Vermilion to negotiate favorable terms and ensure quality service, as demonstrated by their 2024 operational cost efficiencies.

Vermilion Energy faces supplier power due to commodity input pricing. Steel for pipelines and chemicals for processing are globally priced. The company has limited influence on these prices. For instance, steel prices in 2024 fluctuated due to global demand. Vermilion's costs are thus affected by market dynamics.

Long-Term Contracts

Vermilion Energy strategically uses long-term contracts with suppliers to stabilize costs and maintain a reliable supply chain. These agreements are designed to cushion against supplier power, ensuring predictable expenses for crucial services and materials. This approach is particularly vital in the energy sector, where price volatility can significantly impact profitability. For instance, in 2024, Vermilion's operational expenses were carefully managed through such contracts.

- Long-term contracts help Vermilion to manage around 60% of its operational costs.

- These contracts often span 3-5 years to secure favorable pricing.

- This strategy shields against sudden price increases from suppliers.

- Vermilion's 2024 operational expenses were approximately $1.2 billion.

Internal Capabilities

Vermilion Energy's internal capabilities in support functions decrease its dependence on external suppliers, giving it more leverage. This in-house expertise allows for better negotiation and cost management. For example, Vermilion's focus on operational efficiency, as highlighted in its 2024 reports, strengthens its position. This strategic approach supports more favorable supplier agreements.

- Operational efficiency initiatives aim to reduce costs.

- In-house expertise aids in negotiating with suppliers.

- Cost management is improved through internal capabilities.

- Vermilion's 2024 reports show efficiency gains.

Vermilion Energy benefits from a diverse supplier base, reducing supplier concentration. This helps negotiate favorable terms and maintain operational cost efficiencies. The company strategically employs long-term contracts to shield against price volatility. In 2024, the operational expenses were approximately $1.2 billion.

| Aspect | Description | 2024 Data |

|---|---|---|

| Supplier Concentration | Diverse supplier base | Decreased equipment costs by 7% |

| Competitive Services | Rivalry among service providers | Intense competition for contracts |

| Strategic Contracts | Long-term agreements | Approx. 60% of operational costs managed |

Customers Bargaining Power

In the global commodity market for crude oil and natural gas, customers' bargaining power is generally low. Prices are dictated by supply and demand, with significant influence from OPEC+ decisions. For example, in 2024, Brent crude oil prices fluctuated, impacting Vermilion's revenues.

Vermilion Energy benefits from a diverse customer base, selling to various entities like refineries and utilities. This broad customer reach mitigates the impact of any single buyer's actions. In 2024, the company's revenue distribution across different customer segments showed a balanced risk profile. This strategy is crucial for financial stability.

In the oil and gas sector, products like crude oil and natural gas are mostly the same, making it easy for customers to switch suppliers. This similarity means customers have more power because they can shop around for the best prices. For instance, in 2024, the price of Brent crude oil saw fluctuations, reflecting the ease with which buyers can shift their purchases based on cost. The absence of strong product differentiation generally boosts buyer power.

Switching Costs

Switching costs for Vermilion Energy's large-volume customers are significant due to the complex logistics and infrastructure needed for oil and gas transport and storage. These high costs create a barrier, reducing the likelihood of frequent supplier changes. This dynamic grants Vermilion some bargaining power, particularly with customers locked into long-term contracts. For instance, in 2024, the average cost to switch energy suppliers for industrial users in North America was estimated to be between $10,000 and $50,000 depending on the size and complexity of the operation, according to industry reports.

- High Switching Costs: Logistical and infrastructure complexities.

- Reduced Switching Frequency: Less customer inclination to change suppliers.

- Leverage for Vermilion: Increased bargaining power.

- Contractual Stability: Long-term agreements enhance stability.

Long-Term Supply Agreements

Vermilion Energy's long-term supply agreements are strategic. These agreements with major customers stabilize demand, protecting against price volatility. Such contracts diminish customer bargaining power by locking in terms. They offer Vermilion a buffer against short-term market pressures, which is crucial.

- In 2024, Vermilion's hedging strategy aimed to protect revenue from price swings.

- These agreements, effective through 2025, help to secure stable cash flows.

- Vermilion's focus remains on contracts that provide margin assurance.

- The strategy resulted in a significant reduction in market exposure.

In 2024, customer bargaining power over Vermilion Energy was moderate. While the sector has easy supplier switching, Vermilion's diverse customer base and long-term contracts provide some leverage. However, price fluctuations in 2024, such as the Brent crude price changes, did impact revenues.

| Factor | Impact | 2024 Data/Examples |

|---|---|---|

| Customer Base | Diversification reduces power | Revenue distribution in 2024 showed balanced risk profile |

| Product Similarity | High, increases buyer power | Brent crude price volatility in 2024 |

| Switching Costs | High, reduces buyer power | Industrial switching costs: $10K-$50K in North America |

| Long-Term Contracts | Stabilize demand | Hedging strategy aimed to protect revenue in 2024 |

Rivalry Among Competitors

The oil and gas sector is fiercely competitive, with many companies battling for market share. Vermilion Energy competes with major international and national oil companies, plus smaller independent producers. For instance, in 2024, the global oil and gas market was valued at approximately $5 trillion, showcasing the scale of competition. This rivalry pressures profit margins and necessitates strategic efficiency.

The oil and gas industry is seeing significant market consolidation. This trend, fueled by mergers and acquisitions, heightens the competitive landscape. For instance, in 2024, several mid-sized firms were acquired. Vermilion Energy needs continuous innovation. This includes optimizing operations to compete with larger, more efficient companies.

Commodity price volatility profoundly shapes competitive dynamics within the energy sector. When prices decline, companies aggressively compete to preserve margins. For example, in 2024, Vermilion Energy faced challenges due to fluctuating oil prices. High prices can lure in new competitors, intensifying market rivalry. In 2024, the average price of Brent crude oil was around $83 per barrel, influencing Vermilion's strategic decisions.

Geographic Diversification

Vermilion Energy's geographic diversification across North America, Europe, and Australia aims to reduce competitive risks. This strategy, however, means facing unique competitors in each area, demanding specific competitive approaches. For instance, in 2024, Vermilion's European operations saw fluctuations due to geopolitical issues, impacting its competitive standing. The company's success relies on its ability to adapt and compete effectively in diverse markets.

- North America: Focus on efficiency and cost control.

- Europe: Adapt to geopolitical and regulatory changes.

- Australia: Leverage existing infrastructure and expertise.

- 2024 Revenue: Vermilion's revenue reached $2.5 billion.

Operational Efficiency

Operational efficiency is crucial in the competitive oil and gas industry. Companies with lower production costs gain a substantial edge. Vermilion Energy prioritizes optimizing its assets and using new technologies to boost efficiency and cut costs compared to its competitors. For example, Vermilion reported a 2023 operating netback of $38.77 per barrel of oil equivalent (boe), showcasing its efficiency.

- Focus on operational excellence to reduce costs.

- Implementation of new technologies for efficiency.

- Vermilion's 2023 operating netback of $38.77/boe highlights efficiency.

Competitive rivalry in the oil and gas sector is intense, influenced by market size and consolidation. Companies battle for market share, especially during price fluctuations. Vermilion Energy's strategy includes geographical diversification and operational efficiency to maintain its competitive edge, illustrated by its $2.5 billion revenue in 2024.

| Aspect | Description | Impact on Vermilion |

|---|---|---|

| Market Size (2024) | Global Oil & Gas Market: $5 Trillion | Intense competition; pressure on profit margins. |

| Consolidation Trend | Mergers & Acquisitions in 2024 | Requires continuous innovation and efficiency. |

| Price Volatility (2024) | Brent Crude Avg: $83/barrel | Influences strategic decisions; competitive pressures. |

| Geographic Diversification | North America, Europe, Australia | Requires tailored competitive approaches. |

SSubstitutes Threaten

The rise of renewable energy presents a significant threat to Vermilion Energy. Solar and wind power are becoming increasingly competitive, potentially reducing demand for oil and gas. In 2024, renewable energy sources accounted for a growing share of global energy production, with solar and wind capacity additions reaching record levels. This shift could erode Vermilion's market share over time. The International Energy Agency (IEA) forecasts substantial growth in renewables through 2025.

The rise of electric vehicles (EVs) poses a significant threat to Vermilion Energy's revenue streams. EVs reduce the need for gasoline and diesel, both crucial products from crude oil. In 2024, EV sales continued to climb, with about 1.2 million EVs sold in the U.S. This shift could cause reduced demand for Vermilion’s output. Adapting to this change is key for Vermilion to avoid financial losses.

Biofuels and hydrogen pose a threat as potential substitutes for oil and gas. The global biofuels market was valued at $105.5 billion in 2024. Technological progress and government backing could boost their adoption. However, their current impact remains limited compared to established fossil fuels.

Energy Efficiency Measures

The threat of substitutes for Vermilion Energy includes energy efficiency measures. Improvements in energy efficiency, such as better insulation and more efficient appliances, directly reduce energy consumption. This trend impacts the demand for oil and gas, which Vermilion must consider. For instance, the International Energy Agency (IEA) reported in 2024 that energy efficiency investments are growing, potentially lowering demand.

- IEA data from 2024 shows rising energy efficiency investments.

- Energy-saving technologies and practices are becoming more widespread.

- This reduces the overall demand for fossil fuels.

- Vermilion must assess the long-term effects of these trends.

Natural Gas Substitutes

Vermilion Energy confronts competition from substitutes like electricity, particularly from renewable sources. To stay ahead, Vermilion must manage production expenses and ensure consistent natural gas delivery. The shift to renewables is growing, with solar and wind capacity additions globally in 2024. For example, in 2024, the U.S. saw a significant rise in renewable energy consumption.

- Renewable energy adoption is increasing, posing a threat.

- Vermilion must focus on cost-effective production.

- Reliable supply is crucial to compete effectively.

- The rise of renewables influences market dynamics.

Vermilion Energy faces threats from multiple substitutes, particularly in the energy sector. Renewable energy sources like solar and wind are gaining ground, competing with oil and gas. The shift towards electric vehicles further diminishes demand for gasoline and diesel. Biofuels and energy efficiency measures add to this challenge.

| Substitute | Impact | 2024 Data |

|---|---|---|

| Renewable Energy | Reduced demand for fossil fuels. | Global solar/wind capacity additions hit record levels. |

| Electric Vehicles | Lower gasoline/diesel consumption. | ~1.2M EVs sold in the U.S. |

| Energy Efficiency | Decreased overall energy use. | Growing investments in energy-saving technologies. |

Entrants Threaten

The oil and gas industry demands significant initial investments in exploration and infrastructure. These high capital needs create a barrier for new entrants, protecting companies like Vermilion. For example, offshore projects can cost billions, deterring all but the largest firms. In 2024, exploration spending in the industry was approximately $300 billion.

Stringent environmental regulations and complex permitting processes present formidable obstacles for new companies aiming to enter the energy sector. Compliance demands specialized knowledge and substantial financial investment, potentially deterring smaller entities. For instance, in 2024, the average cost to meet environmental standards increased by approximately 15% for energy projects. This regulatory burden significantly raises the initial capital expenditure, making it harder for newcomers to compete effectively.

New entrants face significant hurdles due to resource access. Established companies like Vermilion Energy, often control prime oil and gas reserves. Limited access to these resources restricts new players' competitiveness. For instance, in 2024, Vermilion's proved reserves were approximately 790 million barrels of oil equivalent, a significant advantage. This control over reserves creates a barrier to entry.

Technological Expertise

Technological expertise poses a significant barrier to new entrants in the oil and gas sector. Vermilion Energy benefits from its established technological capabilities in drilling and production. New companies face substantial challenges in acquiring and mastering these technologies. This advantage helps protect Vermilion's market position.

- Vermilion Energy's revenue in 2023 was approximately $2.3 billion.

- R&D spending is crucial, with industry leaders investing heavily in new extraction methods.

- The cost of advanced drilling technology can reach hundreds of millions of dollars.

Established Relationships

Established relationships pose a significant hurdle for new entrants in the energy sector. Vermilion Energy, for instance, benefits from existing ties with governments, suppliers, and customers, a competitive advantage newcomers lack [1]. Building these relationships demands considerable time and resources, increasing the barriers to entry [1]. New entrants often face difficulties securing favorable terms or navigating regulatory landscapes compared to established players like Vermilion [1, 6].

- Vermilion Energy's recent strategic acquisition in the Deep Basin highlights its established market position [6].

- The energy sector requires substantial capital investment and long-term planning, making it tough for new entrants to compete [3].

- Existing relationships can lead to preferential access to resources and markets, further complicating entry for new firms [4].

The oil and gas sector presents high barriers to entry, shielding firms like Vermilion Energy. High capital costs, such as exploration spending of $300 billion in 2024, deter new entrants. Established relationships and technological expertise further solidify Vermilion's market position.

| Barrier | Impact on New Entrants | 2024 Data/Example |

|---|---|---|

| High Capital Costs | Significant barrier due to initial investments | Exploration spending approx. $300B |

| Regulatory Hurdles | Increased compliance costs | Env. standard costs up 15% |

| Resource Access | Limited access to reserves | Vermilion's reserves ~790M boe |

Porter's Five Forces Analysis Data Sources

This analysis is built from SEC filings, financial news, market research, and Vermilion Energy's public statements for robust competitive understanding.