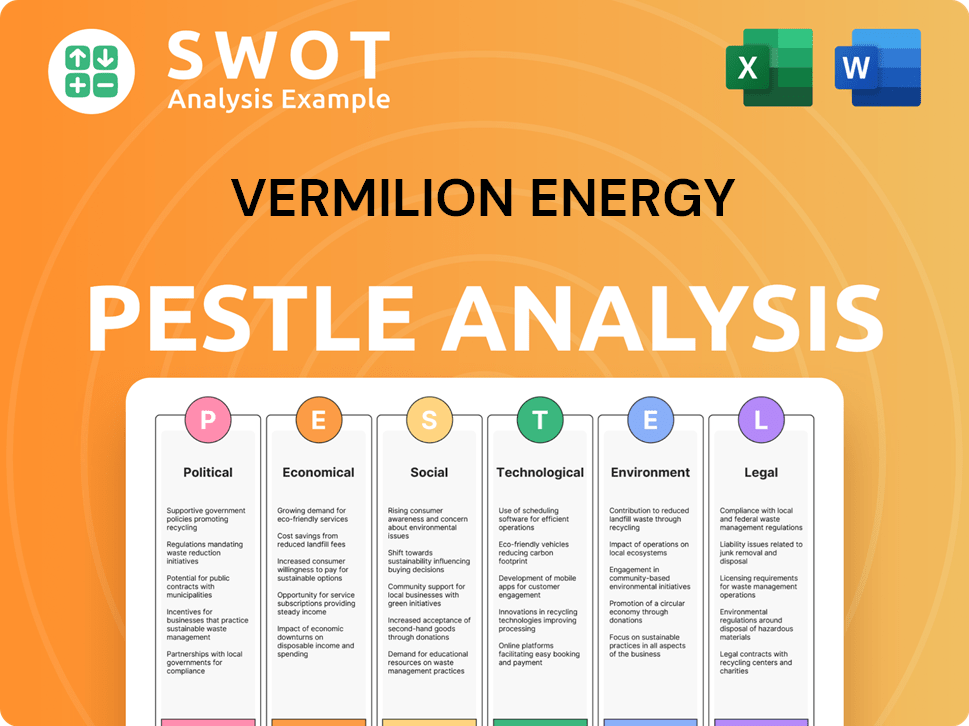

Vermilion Energy PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Vermilion Energy Bundle

What is included in the product

Evaluates how external factors impact Vermilion Energy. Offers data-backed insights into its industry.

A concise summary used during presentations, providing valuable insights.

What You See Is What You Get

Vermilion Energy PESTLE Analysis

What you're previewing here is the actual file—fully formatted and professionally structured. This Vermilion Energy PESTLE Analysis shows the complete document. You will receive the very same comprehensive analysis. No editing or adjustments are needed! Download it immediately after your purchase.

PESTLE Analysis Template

Uncover the forces shaping Vermilion Energy. Our PESTLE Analysis details political shifts, economic trends, and more, impacting its performance. Identify risks and opportunities in the energy sector with our expert insights. This analysis is perfect for strategic planning and competitive analysis. Gain a crucial market edge. Download the full version for complete intelligence.

Political factors

Vermilion Energy faces varied government rules across its operating areas. These regulations, covering oil and gas activities, frequently change. Environmental rules and carbon pricing, like Canada's federal system, directly affect expenses. In 2023, Canada's carbon tax increased operational costs significantly.

Vermilion Energy's operations are significantly impacted by the political stability in North America, Europe, and Australia. Geopolitical instability can disrupt production and supply chains. In 2024, oil and gas production in North America saw fluctuations due to political tensions. Vermilion's European operations are also influenced by energy security concerns, especially given the current global climate.

Vermilion Energy faces risks from shifts in trade policies, tariffs, and barriers. Changes in these areas can affect oil and gas exports and imports, influencing market access and pricing. A key concern is potential U.S. tariffs on Canadian energy imports. In 2024, the U.S. imported approximately $4.8 billion of crude oil from Canada monthly.

Government Incentives and Support

Government incentives significantly impact Vermilion Energy. Support for clean energy could shift focus away from fossil fuels. This might affect Vermilion's operations and investments. Navigating these policy changes is crucial for the company's strategy. The Canadian government invested $40 billion in clean energy projects in 2023.

- Policy shifts can create both risks and opportunities.

- Subsidies for renewables could increase competition.

- Vermilion must adapt to changing energy policies.

- Strategic planning should consider governmental impacts.

Regulatory Compliance and Costs

Vermilion Energy faces substantial costs to comply with international regulatory frameworks. These costs include permits, environmental assessments, and safety measures. In Canada, compliance with the Canada Energy Regulator and Alberta Energy Regulator is a major expense. These costs can significantly impact profitability.

- Operating in Canada, Vermilion must adhere to regulations set by the Canada Energy Regulator (CER) and the Alberta Energy Regulator (AER).

- Compliance costs may include environmental impact assessments, which can range from $50,000 to over $1 million depending on project size and complexity.

- Permitting fees and ongoing compliance audits also add to the financial burden.

- These costs can affect Vermilion's financial performance.

Political stability profoundly impacts Vermilion's operations. Geopolitical events can disrupt supply chains and production significantly. Trade policies like tariffs also affect market access and pricing, posing key concerns. The company must navigate changing government incentives and regulatory frameworks to manage political risks effectively.

| Factor | Impact | Data (2024/2025) |

|---|---|---|

| Geopolitical Stability | Production Disruptions | Global oil price volatility, fluctuating up to $10/barrel due to conflict. |

| Trade Policies | Market Access & Pricing | U.S. imported ~$4.8B crude monthly from Canada, potential tariffs impacting this. |

| Government Incentives | Shift Focus | Canadian gov invested ~$40B in clean energy, which influences Vermilion's long-term investment strategies. |

Economic factors

Vermilion Energy's financial performance is significantly influenced by global oil and natural gas prices. These prices are subject to volatility due to supply-demand dynamics, geopolitical events, and economic conditions. In 2024, oil prices have fluctuated, impacting Vermilion's revenue. The company uses a commodity hedge program to manage price risks. For instance, in Q1 2024, Vermilion reported hedging approximately 50% of its oil production.

Global economic conditions significantly shape energy demand and, consequently, Vermilion Energy's performance. In 2024, global GDP growth is projected at 3.2%, according to the IMF, influencing energy consumption. Economic slowdowns, like the one observed in late 2023 in Europe, can depress energy demand, as seen with natural gas prices. Strong growth, especially in emerging markets, fuels demand; China's oil demand grew by 1.6% in 2023, impacting oil prices.

Vermilion Energy, with operations in various countries, faces currency risk. Fluctuations in CAD, USD, EUR, and AUD impact its financials. For example, a weaker CAD could boost reported earnings. Vermilion's 2023 financials show currency impacts; stay updated on Q1 2024 reports for the latest data. Consider hedging strategies.

Inflationary Pressures and Operating Costs

Inflationary pressures pose a significant challenge, potentially increasing Vermilion Energy's operating costs. Rising costs for labor, equipment, and materials could squeeze profit margins. To mitigate this, Vermilion must leverage commodity prices or enhance operational efficiencies. The 2024 inflation rate in Canada, where Vermilion has significant operations, was around 2.9%.

- Labor costs are a key factor, with potential increases driven by inflation and union negotiations.

- Equipment and material costs, including steel and other supplies, are subject to market fluctuations.

- Operational efficiencies are crucial to offset rising costs.

Capital Availability and Interest Rates

Vermilion Energy's success heavily relies on access to capital for its exploration, development, and acquisition projects. Interest rates directly impact Vermilion's borrowing costs, influencing its financial strategy and investment choices. In 2024, the company has been managing its debt and securing financing for strategic acquisitions. As of Q1 2024, Vermilion's total debt stood at approximately $1.4 billion.

- Interest rate hikes by central banks can increase borrowing expenses.

- Lower interest rates can make projects more financially viable.

- Vermilion's debt levels are closely monitored by analysts.

- Capital availability affects the pace of Vermilion's growth.

Global economic growth significantly affects Vermilion's energy demand, and the projected 2024 GDP growth of 3.2% by the IMF is critical. Inflation, like Canada's 2.9% rate in 2024, increases operational costs. Access to capital and interest rates impact Vermilion’s strategy; Q1 2024 debt was roughly $1.4 billion.

| Economic Factor | Impact on Vermilion | 2024/2025 Data Points |

|---|---|---|

| Global GDP Growth | Influences energy demand and prices. | Projected 3.2% GDP growth (IMF, 2024) |

| Inflation | Raises operating costs (labor, materials). | Canada's 2024 inflation around 2.9% |

| Interest Rates & Capital | Affect borrowing costs, project viability. | Vermilion's Q1 2024 debt ~$1.4B |

Sociological factors

Vermilion Energy's social license depends on strong community ties. They focus on local concerns, development, and minimizing operational impacts. Strategic community investment is a key priority. In 2024, Vermilion allocated $5.2 million for community initiatives. This includes education, health, and infrastructure projects.

Public perception significantly impacts Vermilion Energy. Growing environmental concerns and climate change impacts lead to increased scrutiny. Customer sentiment shifts, with rising opposition to fossil fuels. This influences regulations and social acceptance. In 2024, public concern about climate change remains high, affecting investment decisions.

Workforce health and safety is paramount. A robust safety record boosts efficiency and morale. Vermilion emphasizes safety in its operations. In 2023, Vermilion reported a Total Recordable Injury Rate (TRIR) of 0.34, reflecting its commitment to safety. This is a critical social factor.

Talent Attraction and Retention

Attracting and keeping skilled workers is key for Vermilion Energy. Demographic shifts, education, and how the public views the energy sector impact the workforce. Vermilion focuses on training and development to retain employees. The industry faces challenges in talent acquisition, especially with the shift to renewable energy. Data from 2024 shows a 10% increase in demand for skilled workers in the energy sector.

- Aging workforce and competition for talent.

- Emphasis on STEM education and industry-specific training programs.

- Vermilion's initiatives to promote work-life balance and career growth.

- Public perception impacting recruitment efforts.

Indigenous Relations

Vermilion Energy's operations in North America necessitate robust Indigenous relations. This involves meaningful consultations and addressing potential impacts on Indigenous rights and territories. Failure to effectively manage these relationships could lead to project delays or reputational damage. In 2024, companies faced increased scrutiny regarding their environmental and social governance (ESG) performance, including Indigenous relations.

- Consultation and Engagement: Regular meetings and feedback sessions.

- Impact Assessments: Thorough evaluations of project effects on Indigenous lands.

- Benefit Sharing: Agreements for economic participation.

- Land Rights: Respecting and protecting traditional territories.

Sociological factors are crucial for Vermilion. Community engagement is prioritized with $5.2M allocated in 2024 for local initiatives. Public perception regarding environmental and social issues significantly affects operations and regulations. Safety remains key; Vermilion's TRIR was 0.34 in 2023.

| Factor | Impact | Data/Example |

|---|---|---|

| Community Relations | Enhanced Reputation | $5.2M for community in 2024 |

| Public Perception | Affects Investments | Growing environmental concerns |

| Workforce Safety | Improves Efficiency | TRIR of 0.34 in 2023 |

Technological factors

Technological advancements are crucial for Vermilion Energy. Innovations in seismic imaging, horizontal drilling, and hydraulic fracturing boost efficiency. These technologies can increase reserves and production. For example, in Q1 2024, Vermilion's Canadian production was 106,535 boe/d, showing the impact of tech.

Technological advancements are crucial for emission reduction. Vermilion Energy focuses on reducing methane emissions through new technologies. Their climate strategy relies on these evolving technologies, which may be unproven or costly. In 2024, the company invested $20 million in emission reduction technologies.

Vermilion Energy can significantly boost operational efficiency by using digital technologies and data analytics. In 2024, the global digital transformation market was valued at approximately $767 billion. This includes optimizing production processes and enhancing safety protocols. Data-driven insights also help refine strategic decision-making across all departments. For example, predictive maintenance, enabled by data analytics, can reduce downtime and operational costs by up to 20%.

Infrastructure and Transportation Technology

Technological advancements in pipeline integrity and transportation logistics are crucial for Vermilion Energy. These developments directly impact the cost-effectiveness of delivering products to market. Constraints in processing or transportation can significantly affect production volumes. Vermilion must invest in technologies to mitigate these risks and maintain operational efficiency.

- Pipeline integrity technologies help prevent leaks and ensure safety.

- Advanced logistics optimize the movement of oil and gas.

- Efficient processing facilities are essential for production levels.

- In 2024, pipeline failures cost the industry billions in repairs.

Cybersecurity Risks

As Vermilion Energy integrates more technology, cybersecurity risks grow. Protecting infrastructure and data from cyber threats is crucial. In 2024, the energy sector saw a 30% rise in cyberattacks. These attacks can disrupt operations and damage stakeholder trust. Strong cybersecurity measures are vital for financial stability.

- Cyberattacks on energy companies increased by 30% in 2024.

- Cybersecurity spending in the energy sector is projected to reach $15 billion by 2025.

Vermilion Energy leverages tech for efficiency and production. Advanced tech is critical for emission reduction and strategic decision-making. Cybersecurity investments are rising amid increasing cyberattacks in the energy sector.

| Technology Area | Impact | 2024 Data |

|---|---|---|

| Production Tech | Increases reserves, production | Q1 Canadian prod: 106,535 boe/d |

| Emission Reduction | Reduces methane | $20M invested in 2024 |

| Digital Transformation | Optimizes ops | Global market ~$767B in 2024 |

| Cybersecurity | Protects data | 30% rise in attacks (2024) |

Legal factors

Vermilion Energy faces stringent environmental laws across its operational regions. These laws govern emissions, waste, water use, and land reclamation. Compliance necessitates substantial investment. For example, in 2024, environmental compliance costs were approximately $75 million. Non-compliance can lead to hefty penalties and operational disruptions.

Vermilion Energy operates under stringent health and safety regulations. These regulations are crucial for safeguarding both employees and the general public. Vermilion prioritizes compliance through comprehensive safety protocols, regular risk assessments, and detailed incident reporting. In 2024, Vermilion invested $25 million in safety improvements.

Legal frameworks on resource ownership, like mineral rights, affect Vermilion's operations. Royalty regimes and taxes set by governments directly influence Vermilion's finances. For example, in 2024, changes in Canadian royalty rates could impact their profitability. Vermilion must comply with these evolving regulations to maintain its operations.

Contract Law and Litigation Risks

Vermilion Energy's operations involve various contracts, such as joint ventures and service agreements. These contracts are crucial for its day-to-day business, as of 2024. The company faces potential litigation risks from operational issues, environmental incidents, and contract disputes. Litigation can impact financials; for example, in 2023, legal costs were $10.5 million.

- Contractual obligations are significant in the energy sector.

- Environmental incidents may lead to lawsuits.

- Disputes in joint ventures can cause legal battles.

- Legal costs can affect profitability.

Corporate Governance and Securities Regulations

Vermilion Energy, as a publicly listed entity, navigates stringent corporate governance and securities regulations in Canada and the U.S. These regulations are crucial for maintaining transparency and investor trust. Vermilion's financial reports and disclosures must adhere to these standards, ensuring accuracy. Effective shareholder relations are also essential, involving regular communication and responsiveness.

- Compliance with the Sarbanes-Oxley Act (SOX) in the U.S. is a key focus.

- Vermilion's reporting must align with Canadian securities regulations, such as those from the CSA.

- Regular audits and reviews are conducted to verify financial statements.

- Shareholder meetings and communications are held to ensure transparency.

Vermilion Energy faces complex legal factors across operations. Contractual obligations, environmental incidents, and joint venture disputes are sources of litigation risks. Legal costs affect profitability; in 2023, these reached $10.5 million. Publicly listed, it complies with rigorous corporate governance, securities regulations in Canada/U.S.

| Aspect | Details | Financial Impact (2024 est.) |

|---|---|---|

| Environmental Compliance | Stringent environmental regulations and investments | ~$75 million |

| Health and Safety | Strict regulations and safety investments. | ~$25 million |

| Legal Costs (est.) | Litigation Risks & Legal Expenses | $12-$15 million |

Environmental factors

Climate change is a major factor. Governments worldwide are implementing policies to cut greenhouse gas emissions, influencing the energy sector. Vermilion is under pressure to lower its carbon footprint and disclose its emissions data. The company has set a goal to decrease its Scope 1 emission intensity by 40% by 2028.

Oil and gas operations, like Vermilion's, can be water-intensive. Stricter rules impact water usage and wastewater disposal, increasing operational costs. For instance, water-related expenses for energy firms rose by 15% in 2024 due to compliance needs. Responsible water management is key for environmental compliance and financial stability.

Vermilion Energy's activities, particularly in areas like Canada and Australia, touch upon biodiversity and land use. They must address potential impacts on local ecosystems. Land reclamation is a key consideration after operations. In 2024, Vermilion spent CAD 20 million on environmental protection and remediation. Vermilion's 2024 Sustainability Report details these efforts.

Waste Management and Pollution Prevention

Vermilion Energy prioritizes proper waste management and pollution prevention, crucial for its environmental stewardship. The company focuses on minimizing spill incidents. In 2024, Vermilion invested $15 million in environmental protection. Vermilion’s goal is to reduce environmental impact.

- Vermilion’s environmental spending was $15 million in 2024.

- The company aims to decrease spill incidents.

Environmental Reporting and Transparency

Environmental reporting and transparency are becoming increasingly crucial for companies like Vermilion Energy. Stakeholders expect clear disclosure of environmental performance and associated risks. Vermilion actively reports on sustainability initiatives, striving to adhere to established ESG reporting frameworks, even as methodologies continue to develop. Recent data shows a rise in investor scrutiny; in 2024, over 60% of institutional investors considered ESG factors in their investment decisions.

- Vermilion's ESG reporting aligns with global standards.

- Investor pressure drives transparency in environmental disclosures.

- Methodologies for ESG reporting are continually improving.

- Stakeholders demand clear environmental performance data.

Vermilion faces environmental pressures from climate change and regulatory demands to cut emissions, with a goal to cut its Scope 1 emissions by 40% by 2028. Water usage, land impact, waste management, and pollution are significant factors, with costs increasing due to compliance requirements. Stakeholders and investors are increasing environmental reporting demands as in 2024, over 60% of institutional investors considered ESG factors in their decisions.

| Environmental Factor | Impact | Vermilion's Response (2024 Data) |

|---|---|---|

| Climate Change | Emission reduction targets | Cut Scope 1 emissions by 40% by 2028, focus on ESG reporting. |

| Water Usage | Higher costs | Emphasize water management to lower expenses; expenses rose by 15% in 2024. |

| Land Use | Ecosystem Impacts | Spending $20 million on land reclamation, and focused on detailed biodiversity. |

PESTLE Analysis Data Sources

This PESTLE relies on data from global economic reports, governmental policies, industry-specific studies, and market analyses.