Vivendi Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Vivendi Bundle

What is included in the product

Analysis of Vivendi's diverse portfolio using the BCG Matrix, identifying investment, holding, or divestment opportunities.

Export-ready design for quick drag-and-drop into PowerPoint, saving time during presentations.

Preview = Final Product

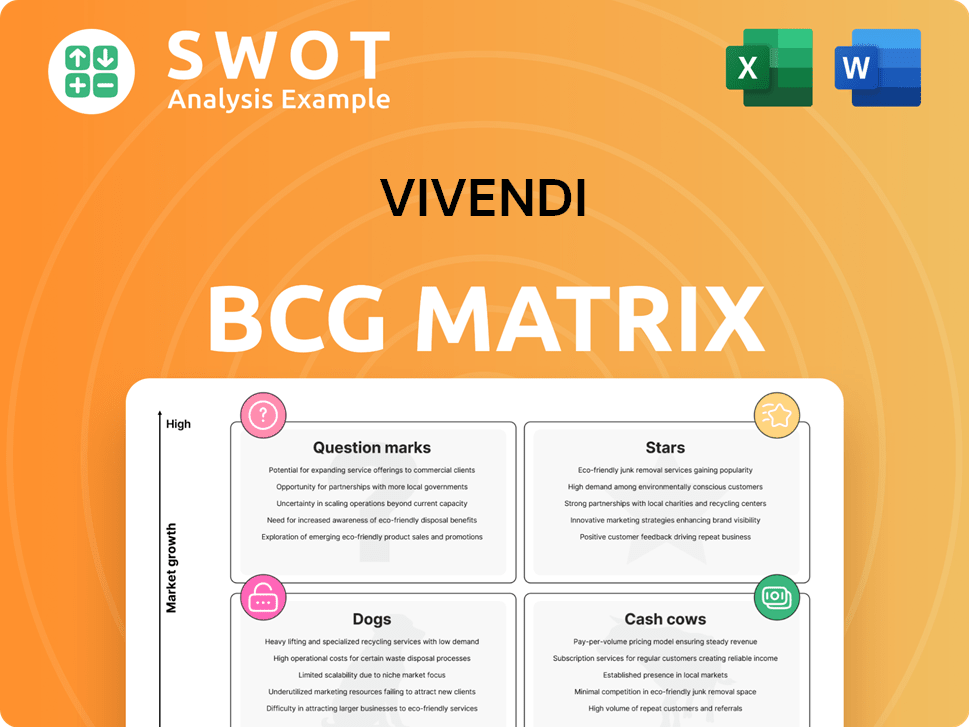

Vivendi BCG Matrix

The preview showcases the complete Vivendi BCG Matrix you'll receive after buying. This is the fully functional report, formatted and ready for your strategic analysis and decision-making process.

BCG Matrix Template

Vivendi's BCG Matrix gives a snapshot of its diverse portfolio. See how each business unit performs in a competitive market. Understand which are cash cows, stars, question marks, or dogs. This is just a glimpse into their strategic positioning.

Uncover detailed quadrant placements, data-driven recommendations, and a roadmap to smart decisions. Purchase the full BCG Matrix for complete strategic insights!

Stars

Lagardère Travel Retail, a key part of Vivendi's portfolio, is a star performer. The company saw double-digit sales growth and profit improvements in 2024. Its strategic focus on travel essentials and duty-free in airports drives success. With air travel expected to grow, Lagardère is poised to maintain its high market share. In 2024, the company generated €6.6 billion in revenue.

Universal Music Group (UMG) is a Star asset for Vivendi due to its strong market position. Vivendi's stake in UMG yields significant dividends, boosting net asset value. UMG's revenue and earnings are consistent drivers of Vivendi's financial success. In 2024, UMG's revenue reached €10.9 billion. This makes UMG a key performer.

Havas, part of Vivendi, has demonstrated strong financial performance. In 2024, it saw organic growth exceeding 2% in Q1. Its successful listing on Euronext Amsterdam and the Converged strategy have been key. Focusing on data, social media, ecommerce, and B2B through M&A deals contributed to its 2024 growth.

Canal+ International Expansion

Canal+ International is a Star in Vivendi's BCG Matrix, showing robust growth. Revenue and subscriber numbers have risen, fueled by expansion in Africa and Asia. Strategic moves, such as the planned MultiChoice acquisition, promise further gains. Canal+'s content and studio partnerships solidify its global media leadership.

- Canal+ saw a 10.3% revenue increase in Q1 2024.

- Subscriber base grew by 9.1% in the same period.

- The MultiChoice deal aims to boost its African presence.

- Partnerships with US studios secure exclusive content.

Gameloft Diversification

Gameloft's strategic shift towards PC and console platforms has fueled substantial revenue growth. In 2024, PC/console revenues accounted for a large percentage of Gameloft's total earnings, highlighting successful diversification. Partnerships with brands like Disney have boosted its portfolio. Efforts to cut operating expenses and boost EBITA are key for future gains.

- PC/console revenues form a large part of Gameloft's total revenues in 2024.

- Multi-platform games and Disney partnerships drive Gameloft's success.

- Cost reduction and EBITA improvements are focus areas.

Vivendi's "Stars" include Lagardère Travel Retail, UMG, Havas, Canal+ International, and Gameloft, all showing strong growth and market positions in 2024. These companies drive significant revenue and earnings, boosting Vivendi's net asset value. They are key performers, strategically positioned for continued success.

| Company | Key Metrics (2024) | Strategic Focus |

|---|---|---|

| Lagardère Travel Retail | €6.6B Revenue | Travel essentials, duty-free in airports |

| Universal Music Group | €10.9B Revenue | Music licensing, artist development |

| Havas | 2%+ Organic Growth (Q1) | Data, social media, ecommerce, M&A |

| Canal+ International | 10.3% Revenue Increase (Q1) | Expansion in Africa & Asia, MultiChoice |

| Gameloft | Significant PC/Console Revenue | PC/Console, brand partnerships |

Cash Cows

Lagardère Publishing is a cash cow for Vivendi, generating consistent revenue and profit. Its strong position in the publishing industry ensures a reliable cash flow, fueled by growth in the US and UK. In 2024, the publishing division saw robust performance, with board games contributing positively. This stability makes it a dependable asset.

Canal+ France, a cash cow for Vivendi, generates steady revenue primarily through direct-to-consumer subscriptions. Despite losing Ligue 1 rights and raising prices, it retains subscribers, showing market strength. In 2024, Canal+ likely maintained its subscriber base, leveraging exclusive content. Partnerships further solidify its position in the French media landscape.

Havas Creative, a significant part of Vivendi, consistently generates substantial revenue, representing approximately 40% of the business globally. Its established client relationships and broad service portfolio contribute to a stable revenue stream, making it a reliable asset. For instance, in 2024, Havas reported a revenue increase, showcasing its strong performance. This segment's robust brand and client loyalty further solidify its position in the market.

Lagardère Radio

Lagardère Radio, a cash cow in Vivendi's BCG matrix, shows positive momentum, particularly with Europe 1's growing audience. Its established listenership and advertising revenue ensure a steady cash flow. The strong brand and loyal audience stabilize its market position. In 2024, radio advertising revenue is projected at $1.4 billion in France.

- Consistent revenue streams from listenership and advertising.

- Europe 1's audience growth is a key driver.

- Strong brand recognition in the radio market.

- Stable cash flow generation for Vivendi.

Disney Magic Kingdoms (Gameloft)

Disney Magic Kingdoms, developed by Gameloft, is a cash cow for Vivendi. It consistently generates revenue, ranking among Gameloft's top-selling games. Its established player base and regular updates guarantee a steady income stream. The game's popularity and brand recognition ensure market stability.

- Revenue: Disney Magic Kingdoms has consistently contributed to Gameloft's revenue, with data from 2024 showing steady in-app purchase figures.

- Player Base: The game maintains a large, active player base, contributing to ongoing revenue generation.

- Updates: Regular content updates keep players engaged, driving continued spending within the game.

- Market Position: Its strong brand recognition helps it maintain a solid position in the competitive mobile gaming market.

Vivendi's cash cows consistently generate robust revenue streams.

These assets, including Lagardère Publishing and Canal+, provide stable financial returns, supporting Vivendi's overall performance.

Havas Creative and Lagardère Radio also contribute significantly, with Havas Creative representing about 40% of global business. Disney Magic Kingdoms from Gameloft is a consistent revenue generator.

| Asset | Revenue Stream | Market Position |

|---|---|---|

| Lagardère Publishing | Consistent Publishing Sales | Strong in US/UK |

| Canal+ France | Direct-to-consumer subscriptions | Subscriber Retention |

| Havas Creative | Client Relations and Services | Robust Brand |

| Lagardère Radio | Advertising Revenue | Audience Growth |

| Disney Magic Kingdoms | In-app purchases | Popular Mobile Game |

Dogs

Vivendi holds an 11.87% stake in Prisa, a media and education leader in the Spanish-speaking world. This investment could be a Dog because it contributes little to Vivendi's financials. Prisa's revenue in 2023 was €955.3 million, compared to Vivendi's €9.8 billion. Market challenges and limited growth may restrict returns.

Vivendi holds a 17.04% stake in Telecom Italia, Italy's top telecom firm. This investment might be a Dog in Vivendi's BCG Matrix. Telecom Italia's revenue contribution is relatively small. Market conditions limit growth, potentially hindering returns. In 2024, Telecom Italia faced challenges.

Vivendi holds a 1.04% stake in Telefonica, a major player in Spanish and Portuguese telecoms. This investment could be a Dog in Vivendi's portfolio. Telefonica's contribution to Vivendi's revenue is likely modest. The telecom sector's growth is currently facing headwinds. In 2024, Telefonica's revenue was €40.3 billion.

Europe 1 Radio Audience

Europe 1, within Vivendi's portfolio, might be categorized as a Dog. The radio station faces limited growth in a competitive market. This could restrict its ability to provide substantial returns to Vivendi. The radio market has seen shifts, with digital platforms gaining traction.

- Europe 1's audience share in France was around 7.5% in 2024.

- Digital radio listening is increasing, affecting traditional radio.

- Vivendi's focus may shift to more profitable areas.

Channel C8

Canal C8, a "Dog" in Vivendi's BCG Matrix, faces closure and contract terminations. This impacts overall revenue, offsetting organic growth expected in 2025. Notably, Disney's contracts are among those ending, affecting content availability. Vivendi's 2023 revenue was €9.6 billion, so the channel's loss will impact it.

- Closure of C8 and contract terminations will hit revenue.

- Disney content contracts are ending in France.

- Vivendi's 2023 revenue was €9.6 billion.

Vivendi's "Dogs" include investments and ventures with limited growth potential. These include Prisa, Telecom Italia, and Telefonica, with comparatively modest revenue contributions. Canal C8 faces closure, reducing revenue, with Europe 1 also struggling in a competitive market. Limited returns, as well as, digital shifts hinder profitability.

| Asset | Revenue (2024 est.) | Vivendi's Stake |

|---|---|---|

| Prisa | €955.3M | 11.87% |

| Telecom Italia | €18.5B | 17.04% |

| Telefonica | €40.3B | 1.04% |

Question Marks

Gameloft's new game launches fit the Question Mark category in Vivendi's BCG Matrix, given their uncertain market performance. These titles demand substantial investment in areas like marketing and development to attract players. Whether these games succeed or fail will dictate if they evolve into Stars or become Dogs. For example, in 2024, Gameloft's investment in new game development increased by 15%.

Havas AI, Vivendi's dedicated AI offering, focuses on automating workflows and improving internal efficiencies. The platform aims to free up talent and develop market-leading solutions. As of 2024, the success of Havas AI remains uncertain, lacking concrete performance data. Vivendi's 2023 annual report mentioned strategic investments in AI, but specific ROI figures for Havas AI weren't detailed.

Canal+'s bid for MultiChoice is a Question Mark. The deal faces regulatory scrutiny and integration difficulties. Success hinges on Canal+'s ability to overcome these obstacles. MultiChoice, with 23.6 million subscribers in 2024, offers significant African market growth potential.

Dailymotion Integration

Dailymotion's inclusion in Vivendi's portfolio is a Question Mark. It faces tough competition in the online video market. The outcome hinges on Vivendi's ability to capitalize on Dailymotion's strengths. Vivendi's 2024 revenue was €10.6 billion, with Canal+ contributing significantly. Dailymotion's user base and revenue growth are key factors.

- Market position uncertainty due to competition.

- Success depends on leveraging Dailymotion's assets.

- Vivendi's 2024 revenue was €10.6B.

- Focus on user base and revenue growth.

Lagardère Live Entertainment

Lagardère Live Entertainment is categorized as a Question Mark within Vivendi's BCG Matrix due to its uncertain future. It currently benefits from positive momentum, suggesting potential growth. However, the exact revenue and profit projections remain unclear at this stage. This uncertainty places it as a high-growth, low-market-share business, demanding strategic investment decisions.

- Vivendi's BCG Matrix categorizes Lagardère Live Entertainment as a Question Mark.

- Positive momentum suggests potential growth.

- Uncertainty exists around revenue and profit projections.

- Requires strategic investment decisions.

Question Marks in Vivendi's BCG Matrix face market uncertainty.

Success demands strategic investment and effective market positioning.

Growth potential varies, requiring focused resource allocation.

| Category | Key Feature | 2024 Data |

|---|---|---|

| Gameloft Games | New game launches | Investment up 15% |

| Havas AI | AI solutions | ROI not detailed |

| MultiChoice Bid | Acquisition | 23.6M subscribers |

BCG Matrix Data Sources

The Vivendi BCG Matrix leverages comprehensive financial reports, market studies, competitor analysis, and expert evaluations to provide dependable strategic insights.