Vivendi Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Vivendi Bundle

What is included in the product

Uncovers key drivers of competition, customer influence, and market entry risks tailored to the specific company.

Customize pressure levels based on new data, helping to quickly adapt to changing industry factors.

Same Document Delivered

Vivendi Porter's Five Forces Analysis

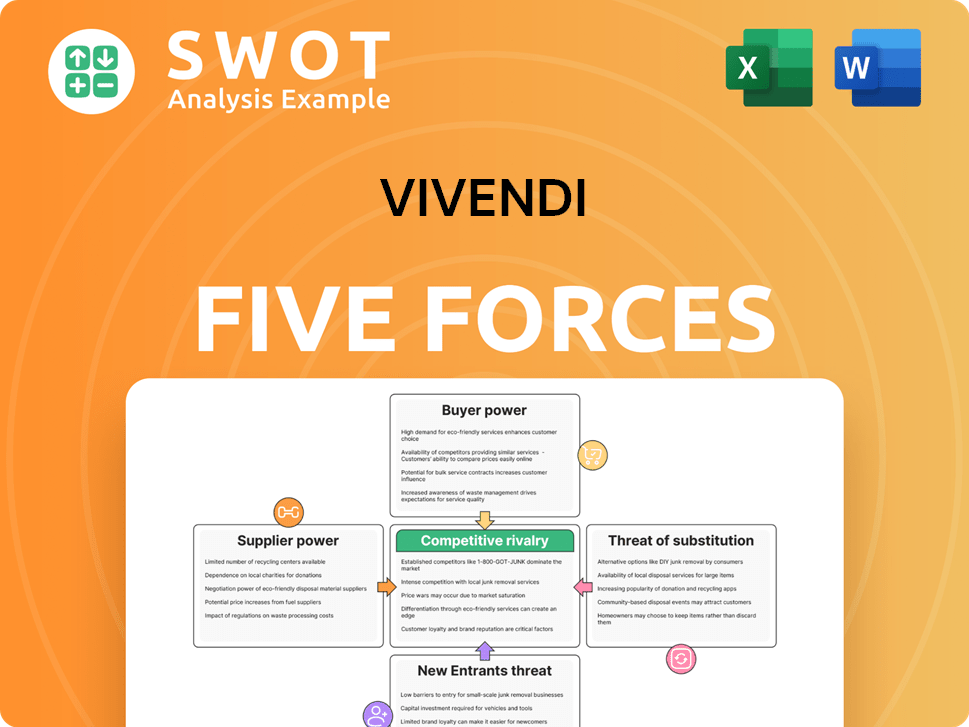

The Vivendi Porter's Five Forces analysis you see provides a comprehensive look at the company's competitive landscape. This detailed preview showcases the complete analysis. It dissects industry rivalry, supplier power, buyer power, threat of substitutes, and the threat of new entrants. This thorough, professionally crafted document is the same version you'll receive immediately after purchase.

Porter's Five Forces Analysis Template

Vivendi faces a complex competitive landscape, significantly influenced by the Entertainment industry's dynamics. The threat of new entrants is moderate, while the bargaining power of buyers is relatively high, due to available alternatives. Suppliers have a moderate influence. Competitive rivalry among existing players is intense. The threat of substitutes is also a significant factor.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Vivendi’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Content creators wield growing influence. Their high-quality content is vital to Vivendi's platforms. Attracting and retaining these creators is crucial. Independent distribution channels boost creators' leverage. In 2024, the entertainment industry saw content creators’ revenue increase by 15%.

Talent agencies wield considerable influence, representing key performers vital to Vivendi's content. They negotiate favorable deals, affecting production expenses and talent sourcing. Vivendi competes with rivals for top talent, necessitating strong agency relationships. In 2024, agency fees for A-list talent could represent up to 30-40% of a production's budget.

Technology providers significantly impact Vivendi's operations. Cloud storage, streaming infrastructure, and software development are crucial. The bargaining power of these suppliers rises with specialization. In 2024, Vivendi's tech spending was about 10% of its operational costs. Diversifying tech suppliers can help reduce this power.

Copyright Holders

Copyright holders, like music labels and film studios, have substantial power over Vivendi. Securing content licenses is crucial for Vivendi's media operations. The process is increasingly complex and expensive as content distribution diversifies across platforms. Vivendi must carefully manage these licensing costs alongside its original content investments. For instance, in 2024, content licensing accounted for roughly 40% of Vivendi's total expenses.

- Licensing costs are a significant part of Vivendi's expenses.

- Content fragmentation increases licensing complexity and costs.

- Vivendi must balance licensing with original content creation.

- In 2024, licensing was about 40% of total expenses.

Distribution Networks

Distribution networks significantly impact Vivendi's content delivery and revenue. Cable providers and streaming platforms negotiate carriage fees, influencing content visibility. Vivendi needs strong distributor relationships and direct-to-consumer strategies. Digital distribution has lessened their power, yet they remain important.

- In 2024, streaming services like Netflix and Disney+ accounted for a large portion of media consumption, highlighting the importance of digital distribution.

- Vivendi's Canal+ is a major player in pay-TV, but faces competition from global streaming services.

- Carriage fees from distributors heavily influence Vivendi's revenue streams.

- Direct-to-consumer platforms offer Vivendi more control over content distribution and revenue.

Content creators have increasing influence, vital for Vivendi's platforms. Independent distribution strengthens their leverage. Talent agencies also have considerable power. Technology providers and copyright holders also have strong influence.

| Supplier Type | Impact | 2024 Data |

|---|---|---|

| Content Creators | High, due to content value | Revenue increase of 15% |

| Talent Agencies | Significant, influencing costs | Agency fees: 30-40% of budget |

| Tech Providers | Growing with specialization | Tech spending: 10% of costs |

| Copyright Holders | Substantial, licensing-driven | Licensing: ~40% of expenses |

Customers Bargaining Power

Customers wield significant bargaining power due to numerous subscription service options. Competition is fierce in the media industry, offering many substitutes. Consumers can easily switch providers based on content, price, or user experience. Vivendi needs continuous innovation to retain subscribers. Netflix, for example, had 260.8 million global paid memberships as of Q4 2023, showing the scale of competition.

Customers are highly price-sensitive in digital media. If Vivendi's prices increase, customers may cancel subscriptions or switch to cheaper alternatives. For example, Netflix saw a subscriber decline in 2022 after raising prices. Vivendi must balance pricing with content quality to retain customers.

Changing content consumption habits are reshaping customer power. On-demand streaming and digital downloads give customers flexibility in how they watch content. Vivendi needs to adapt to these evolving preferences. Customers now expect content across various devices. In 2024, streaming services saw a 20% increase in subscribers globally.

Demand for Exclusive Content

The demand for exclusive content significantly shapes customer loyalty, driving subscriptions across various platforms. Consumers readily subscribe to multiple services to access specific content, like movies or games. Vivendi must invest heavily in original content to distinguish itself and attract subscribers. To compete effectively, Vivendi needs to offer unique content that captivates audiences.

- Netflix spent $17 billion on content in 2024.

- Disney+ saw 150 million subscribers in 2024.

- HBO Max's subscriber count was at 97.7 million in Q4 2024.

Social Media Influence

Social media significantly boosts customer bargaining power by amplifying their voices. Platforms like X (formerly Twitter) and Facebook allow for instantaneous sharing of opinions, which can rapidly affect a company's standing. For Vivendi, this means that positive or negative online feedback directly impacts purchasing decisions. Vivendi must actively monitor and engage on social media to protect its brand image. Social media's influence can make or break a company's reputation.

- In 2024, 74% of consumers reported that social media influences their purchasing decisions.

- Negative reviews on social media can lead to a 22% decrease in sales for a company.

- Vivendi's social media engagement strategy must include rapid response to customer feedback.

- The Entertainment & Media industry saw a 15% increase in social media-driven brand reputation changes in 2024.

Customers possess strong bargaining power due to numerous media choices. Price sensitivity is high; customers can easily switch for cheaper options, impacting Vivendi's revenue. The need for exclusive content is critical to customer loyalty. Netflix invested $17 billion in content in 2024.

| Aspect | Impact | 2024 Data |

|---|---|---|

| Switching Costs | Low | 20% increase in streaming subscribers globally. |

| Price Sensitivity | High | Netflix saw subscriber declines after price hikes. |

| Content Influence | Critical | Disney+ had 150 million subscribers. |

Rivalry Among Competitors

The media landscape is a battlefield. Vivendi faces stiff competition across its segments. Disney, Netflix, and others fiercely compete for viewers. This rivalry demands constant innovation. In 2024, streaming services saw revenue growth, intensifying the fight for market share.

The streaming platform market is fiercely competitive, with Netflix, Amazon Prime Video, and Disney+ dominating. Canal+ faces intense pressure from these established global competitors. To compete, Vivendi must invest significantly in original content and cutting-edge technology. Netflix reported over 260 million paid memberships globally in Q4 2023.

The video game market is fiercely competitive, with giants like Tencent, Sony, and Microsoft vying for market share. Vivendi's Gameloft faces intense pressure to create hit games amid this rivalry. The industry demands continuous innovation; in 2024, the global games market generated over $184 billion in revenue, showing the stakes. Staying ahead requires significant investment in new technologies and content.

Advertising Market Competition

The advertising market is highly competitive, with traditional players like Vivendi's Havas facing intense pressure. Digital platforms such as Google and Meta (Facebook) dominate market share, intensifying rivalry. Havas must innovate and adapt to evolving digital trends to stay relevant. This includes aligning with client needs and investing in digital advertising solutions.

- In 2024, digital advertising spending is projected to exceed $350 billion globally.

- Google and Meta control over 50% of the digital ad market.

- Havas's 2023 revenue was approximately $2.7 billion, facing pressure from larger competitors.

- The shift towards programmatic advertising requires Havas to invest in technology and data analytics.

Content Piracy

Content piracy presents a substantial competitive challenge for Vivendi, eroding potential revenues through illegal downloads and streaming. The media giant needs to allocate resources to anti-piracy strategies and collaborate with industry peers to mitigate this risk. For instance, in 2024, the global losses due to digital piracy were estimated to be around $31.8 billion. Vivendi's ability to safeguard its content directly impacts its profitability and market position.

- Estimated global losses due to digital piracy in 2024: $31.8 billion.

- Vivendi's need to invest in anti-piracy technologies.

- Importance of industry collaboration to combat piracy.

- Impact of piracy on Vivendi's revenue streams.

Vivendi faces tough rivals across its sectors. Streaming competition from Netflix & others demands content & tech investments. Gameloft competes with giants like Tencent, needing constant innovation. Havas battles Google & Meta; digital ad spend is projected at over $350 billion in 2024.

| Market Segment | Key Competitors | Competitive Pressure |

|---|---|---|

| Streaming | Netflix, Disney+ | Intense; requires investment in content. |

| Gaming | Tencent, Sony, Microsoft | High; necessitates continuous innovation. |

| Advertising | Google, Meta | Dominant; demands digital adaptation. |

SSubstitutes Threaten

The rise of free online content poses a significant threat to Vivendi. User-generated videos and ad-supported streaming services offer alternatives to paid subscriptions. In 2024, the global ad-supported video-on-demand (AVOD) market reached an estimated $45 billion, indicating substantial consumer preference for free options. Vivendi needs to provide unique, high-value content to compete.

Social media platforms pose a significant threat to Vivendi by providing alternative entertainment options. Platforms like TikTok and Instagram compete for consumer attention, diverting time from traditional media. In 2024, the average daily social media usage was over 2.5 hours globally, highlighting this shift. Vivendi must integrate social media strategies to stay competitive; for example, in 2023, digital ad revenue hit $225 billion. Social media’s influence is directly impacting traditional media's market share.

Video games present a significant threat to Vivendi's Gameloft. They offer immersive experiences, competing with traditional media. The gaming market is vast; in 2024, it's projected to generate over $200 billion globally. Gameloft faces competition from consoles, PCs, and mobile games. This necessitates continuous innovation and adaptation.

Live Events

Live events, like concerts and sports, pose a substitution threat to Vivendi's entertainment offerings. These events provide unique, immersive experiences that streaming struggles to match. Consumers might choose a live concert over watching a streamed performance. For instance, in 2024, live music revenue reached $13.5 billion in North America.

- Live events offer a social and immersive experience.

- Streaming services cannot fully replicate the excitement of live attendance.

- Vivendi needs to consider this when pricing its services.

- Live events' popularity impacts content consumption choices.

Alternative Media

Alternative media, such as podcasts and blogs, pose a threat to Vivendi. These platforms offer niche content, potentially attracting audiences away from Vivendi's mainstream offerings. For example, in 2024, podcast ad revenue reached $2.1 billion. Vivendi must diversify its content to compete effectively.

- Podcasts and blogs offer niche content.

- Alternative media can attract Vivendi's audience.

- Vivendi needs content diversification.

- Podcast ad revenue was $2.1B in 2024.

Consumers can substitute Vivendi's offerings with live experiences, which directly impacts media choices. Streaming services struggle to match the social appeal of live events. In 2024, North American live music revenue hit $13.5 billion, signaling this preference.

| Substitute | Impact | 2024 Data |

|---|---|---|

| Live Events | Direct Competition | $13.5B (North America Live Music) |

| Social Media | Attention Shift | 2.5+ hrs/day usage |

| Podcasts/Blogs | Niche Audience | $2.1B (Podcast Ad Revenue) |

Entrants Threaten

Digital disruption significantly lowers entry barriers in media. New entrants use online platforms and streaming, reaching audiences directly. Vivendi needs to innovate to counter these forces and adapt. Digital distribution has made market entry easier. In 2024, streaming grew, with Netflix adding 9.3 million subscribers in Q4.

Tech giants pose a significant threat due to their vast resources and tech prowess, potentially disrupting Vivendi's market position. With massive customer bases and strong distribution, they can quickly gain market share. For example, in 2024, Amazon's media revenue hit $35 billion. Vivendi must compete with these well-funded, innovative rivals. Their expansion into media, fueled by substantial capital, intensifies competition.

Independent content creators pose a growing threat by directly reaching audiences, bypassing traditional media. This shift is evident in the rise of platforms like YouTube, where channels can generate significant revenue. For instance, in 2024, YouTube ad revenue reached approximately $31.5 billion. Vivendi must strategically engage these creators.

Niche Streaming Services

Niche streaming services pose a threat by attracting subscribers with specialized content. These platforms can erode the subscriber base of larger entities like Vivendi. To counter this, Vivendi needs to broaden its content to cover varied interests. In 2024, the global streaming market is valued at $93 billion. Niche services are increasingly popular, with some seeing subscriber growth of over 20% annually.

- Content diversification is crucial to compete.

- Niche services target specific demographics effectively.

- The streaming market's value shows the stakes.

- Vivendi must adapt to retain subscribers.

Consolidation

Mergers and acquisitions (M&A) can reshape the competitive landscape, creating larger, more formidable players. This consolidation can lead to new competitors with enhanced market power and resource capabilities. Vivendi needs to closely track industry consolidation trends to anticipate and respond effectively. The media and entertainment industry has seen significant M&A activity in recent years.

- In 2023, media and entertainment M&A reached $129.9 billion globally.

- Consolidation can result in stronger rivals, potentially impacting market share.

- Vivendi must analyze the strategic moves of consolidated entities.

- Adaptation is key to maintain a competitive edge.

New entrants leverage digital platforms, lowering barriers to entry in the media sector.

Tech companies with substantial resources pose a significant competitive threat.

Independent content creators also challenge traditional media through direct audience access.

| Aspect | Details | Data |

|---|---|---|

| Digital Impact | Lowers entry barriers | Streaming growth in 2024 |

| Tech Giants | Resource-rich rivals | Amazon's $35B media revenue |

| Content Creators | Direct audience access | YouTube ad revenue ~$31.5B |

Porter's Five Forces Analysis Data Sources

Our Vivendi analysis uses financial reports, market research, competitor strategies, and industry news. We incorporate data from company filings, and analyst reports for competitive landscape accuracy.