Vivendi PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Vivendi Bundle

What is included in the product

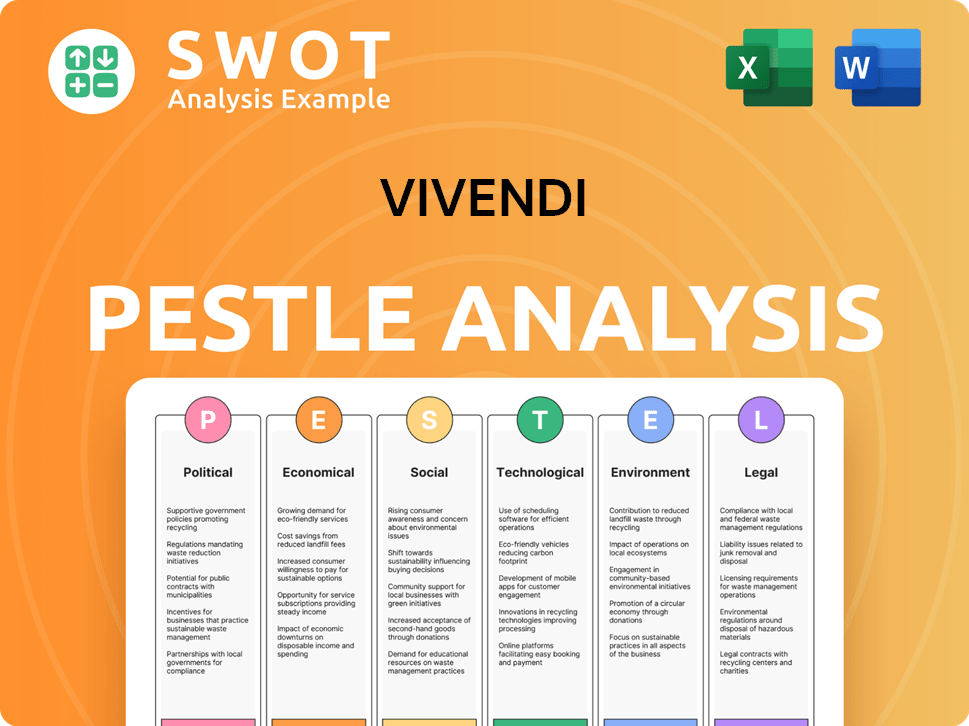

Analyzes the macro-environment influencing Vivendi, covering Political, Economic, Social, Technological, Environmental, and Legal aspects.

Helps identify the potential issues impacting Vivendi, assisting in proactive strategic planning and minimizing business risks.

Preview Before You Purchase

Vivendi PESTLE Analysis

What you’re previewing here is the actual file—fully formatted and professionally structured. This comprehensive Vivendi PESTLE analysis covers political, economic, social, technological, legal, and environmental factors. The report provides in-depth insights and a strategic overview of Vivendi. Immediately after purchase, you'll download this exact same document.

PESTLE Analysis Template

Vivendi's future is intertwined with global shifts. Our PESTLE Analysis unveils these influences, from political climates to technological advancements. Identify risks and opportunities shaping Vivendi's strategy. Equip yourself with expert insights. Download the full analysis for a strategic advantage!

Political factors

Vivendi faces significant government influence, especially in France and the EU. Regulations affect content, distribution, and advertising revenues. French law requires a minimum of European content. In 2024, EU media regulations continue to evolve, impacting Vivendi's strategic planning. These regulations shape Vivendi's operational strategies.

Media ownership regulations significantly influence Vivendi's strategic moves. Changes in these rules can impact its ability to acquire new assets. For instance, in 2024, France's media landscape saw debates over ownership limits. The political environment directly affects how strictly these rules are enforced, potentially altering Vivendi’s growth plans.

The political advertising market is a possible revenue stream for media firms like Vivendi's Havas. However, it's affected by rules, election cycles, and political stability. Recent EU rules on transparency and political ad targeting create operational and legal issues. For instance, in 2023, the EU's Digital Services Act boosted ad transparency.

Geopolitical instability

Geopolitical instability poses a significant risk to Vivendi's international operations, potentially disrupting content distribution and market access. Conflicts and evolving international trade policies can directly impact Vivendi's ability to operate effectively in certain regions. For instance, changes in trade agreements can affect the import and export of media content, influencing revenue streams. Vivendi's exposure to geopolitical risks necessitates robust risk management strategies to navigate these uncertainties.

- In 2024, global political risk rose, affecting media markets.

- Trade restrictions and sanctions can limit content distribution.

- Changes in international relations impact market access.

- Vivendi must adapt to fluctuating geopolitical landscapes.

Government support for cultural industries

Government backing for cultural industries significantly impacts Vivendi. Policies like production subsidies or content quotas can be beneficial. For example, France's film industry receives substantial support, potentially boosting Canal+ film investments. Conversely, stringent quotas might limit international content distribution. Recent data shows that in 2024, French film production reached €1.5 billion.

- Subsidies in France's film industry totaled €700 million in 2024.

- Quotas in the EU mandate 30% of content on streaming platforms be European.

- Vivendi's Canal+ heavily invests in French and European productions.

- Changes in government support can affect Vivendi's content costs and revenue.

Political factors significantly shape Vivendi's strategies, particularly due to regulatory oversight and government support. French and EU regulations affect content production, distribution, and advertising revenue, notably impacting media ownership limits. Geopolitical risks also affect Vivendi, influencing international operations and content distribution, requiring proactive risk management.

| Factor | Impact | Example (2024) |

|---|---|---|

| Regulations | Affects content and ad revenue | EU's Digital Services Act |

| Media Ownership | Influences growth plans | Debates in France on ownership limits |

| Geopolitical Instability | Disrupts international operations | Trade restrictions affecting content. |

Economic factors

Vivendi's earnings are sensitive to exchange rate shifts. The Euro's value against currencies like the USD affects its global revenue. For instance, a stronger Euro could reduce the value of sales from the U.S. market, impacting reported financials. In 2024, currency fluctuations were a key factor in media sector earnings.

The streaming market's expansion fuels Vivendi's revenue, benefiting Canal+. Collaborations with streaming platforms and strong performances from music and gaming are crucial. In 2024, the global streaming market was valued at $85.7 billion. Vivendi's Universal Music Group saw a 9.9% revenue increase in Q1 2024, driven by streaming.

The advertising market's health directly impacts Havas's revenue. Digital advertising's growth and overall ad spending trends are key. In 2024, global ad spending is projected to reach $758.3 billion. Economic uncertainty can affect marketing budgets, influencing Havas's performance.

Consumer spending habits

Consumer spending habits are crucial for Vivendi. Economic uncertainties significantly influence consumer behavior, impacting entertainment sectors like TV, film, and video games. Discretionary spending, vital for Vivendi's revenue, is highly sensitive to economic fluctuations. Reduced spending can directly affect the profitability of Vivendi's diverse portfolio. Consider these points:

- Consumer confidence index in the U.S. was at 102.9 in March 2024, a slight decrease.

- Global video game market revenue reached $184.4 billion in 2023, a 2.2% decrease from 2022.

- Subscription services spending is expected to continue to grow, but at a slower rate in 2024.

Mergers and acquisitions activity

Mergers and acquisitions (M&A) activity in the media and entertainment sector is a key economic factor for Vivendi. The economic climate significantly impacts Vivendi's ability to grow through acquisitions or restructure its portfolio by selling off assets. Regulatory scrutiny also plays a crucial role in shaping the feasibility of these transactions. M&A volume in the sector has fluctuated; for instance, in 2023, the total value of media and entertainment M&A deals was approximately $100 billion.

- Economic conditions and regulatory environment directly affect M&A deals.

- Vivendi's strategic decisions depend on the M&A landscape.

- 2023 saw around $100 billion in M&A deals in media and entertainment.

Economic factors greatly influence Vivendi’s financials. Exchange rate shifts and the strength of the Euro impact global revenue and earnings, notably in markets like the U.S.. Streaming and advertising market conditions, are crucial; global ad spending is forecasted to reach $758.3 billion in 2024.

Consumer spending and industry M&A also affect Vivendi. The 2023 global video game market, for example, saw $184.4 billion in revenue. M&A deals in the sector in 2023 were worth about $100 billion, influencing the firm’s expansion.

| Factor | Impact on Vivendi | Data (2024/2023) |

|---|---|---|

| Currency Fluctuations | Revenue & Profitability | USD/EUR exchange rate changes |

| Streaming Market | Revenue (Canal+) | $85.7B (Global streaming market, 2024) |

| Advertising | Revenue (Havas) | $758.3B (Global ad spending, 2024 est.) |

| Consumer Spending | Revenue across sectors | Video game market ($184.4B, 2023) |

| M&A | Portfolio growth & restructuring | $100B (M&A deals in sector, 2023) |

Sociological factors

Changing media habits, driven by digital platforms and on-demand content, challenge Vivendi's traditional TV and publishing sectors. In 2024, streaming services like Netflix and Disney+ saw continued subscriber growth, impacting traditional TV viewership. Vivendi must adapt to stay relevant. Digital ad revenue is growing.

Vivendi faces rising demands for diverse content, influencing its film, TV, and publishing divisions. Societal expectations for inclusivity drive production choices. The industry feels pressure to reflect varied social norms. In 2024, diverse content saw a 15% increase in viewership compared to 2023.

Social media significantly shapes how Vivendi's content reaches audiences. Platforms like TikTok and Instagram are key for content discovery, particularly for younger demographics. In 2024, social media ad spending is projected to reach $227 billion. These platforms can also amplify cultural and political discussions that can impact Vivendi's content.

Impact of cultural fragmentation

Cultural fragmentation presents hurdles for Vivendi, especially in advertising and media. Creating content that appeals to diverse audiences in a polarized environment becomes complex. Vivendi must navigate varied consumer segments effectively to succeed. This includes understanding evolving audience preferences and political sensitivities. For example, in 2024, media consumption habits showed a significant shift, with streaming services accounting for over 30% of total viewing time in many markets.

- Adaptation to diverse consumer preferences is essential.

- Political polarization influences content reception.

- Media consumption is shifting towards streaming.

- Vivendi must tailor campaigns for specific segments.

Trust in media

Declining trust in traditional media is a key sociological factor impacting Vivendi. This erosion of trust, especially in regions like North America and parts of Europe, challenges the credibility of Vivendi's news outlets. Adapting to these shifting perceptions and focusing on verifiable information is critical for maintaining audience engagement and revenue. The Reuters Institute's 2024 Digital News Report indicates that trust in news varies significantly by country, with some nations showing steep declines. This requires Vivendi to reassess its content strategies and distribution methods.

- 2024 Reuters Institute Digital News Report: Significant variations in trust across different countries.

- Vivendi's news operations must prioritize fact-checking and transparency.

- Adaptation is needed to engage audiences in a fragmented media landscape.

Vivendi navigates cultural fragmentation in media and advertising. Adapting content for varied audiences in a polarized environment is crucial. Traditional media trust declines; transparency becomes key. Streaming services’ rise impacts content distribution.

| Factor | Impact | Data |

|---|---|---|

| Audience Diversity | Content must reflect varied norms. | Diverse content viewership grew 15% in 2024. |

| Social Media Influence | Content discovered on platforms like TikTok, Instagram. | Social media ad spend projected at $227B in 2024. |

| Trust Erosion | Need to focus on verifiable information. | Reuters Report: Varying news trust by nation in 2024. |

Technological factors

Technological advancements in streaming have fundamentally changed how people consume media, which significantly affects Vivendi's Canal+ and similar platforms. Offering high-quality, on-demand streaming is now essential. Vivendi's revenues from streaming grew, with Canal+ adding subscribers. In 2024, streaming services like Netflix and Disney+ saw a combined market share of over 30% in key markets, influencing Vivendi's strategy.

Artificial Intelligence (AI) is transforming Vivendi's operations. In 2024, AI applications saw a 15% increase in content personalization. However, ethical concerns are growing. The EU's AI Act, finalized in 2024, will significantly impact Vivendi's AI use. This includes content moderation in gaming, where AI is increasingly used.

Technological advancements are crucial for Vivendi's Gameloft. Mobile gaming, VR, and metaverse are key. In 2024, mobile gaming revenue reached $93.5 billion. Successful games depend on staying ahead. Vivendi must invest in these areas to engage audiences.

Digital advertising technologies

Digital advertising technologies are reshaping the advertising industry, impacting companies like Havas. Hyper-personalization and predictive analytics are becoming essential tools for crafting effective campaigns. These advancements allow for more targeted and efficient ad delivery, enhancing engagement. Agencies must adopt these technologies to stay competitive and meet evolving consumer expectations. The global digital advertising market is projected to reach $786.2 billion in 2024.

Content distribution technologies

Content distribution technologies have radically changed, with online platforms and mobile networks now crucial for Vivendi. This shift impacts how Vivendi reaches its audience. Adapting to these new channels is vital for maintaining market relevance and growth. For instance, in 2024, digital music revenue accounted for 68% of Universal Music Group's total revenue, a key part of Vivendi.

- Digital music revenue constituted 68% of UMG's total revenue in 2024.

- Mobile networks and online platforms are critical for distribution.

- Adapting to new distribution channels is essential for Vivendi.

Streaming and AI drive media consumption and operational efficiencies at Vivendi. AI saw a 15% increase in personalization, with the EU's AI Act impacting AI use.

Mobile gaming and metaverse are vital for Gameloft; digital advertising reached $786.2B in 2024. Online platforms are crucial.

Digital music generated 68% of UMG's revenue in 2024. Adaption to evolving digital channels is crucial for sustained relevance and growth.

| Technological Aspect | Impact on Vivendi | 2024 Data/Trends |

|---|---|---|

| Streaming | Alters content consumption | Streaming services have 30%+ market share |

| Artificial Intelligence | Transforms operations, ethical concerns | 15% rise in content personalization |

| Mobile Gaming/Metaverse | Crucial for Gameloft | $93.5B in mobile gaming revenue |

Legal factors

Vivendi's media ventures face legal hurdles like content quotas and advertising restrictions. These rules, alongside licensing mandates, shape how they operate. For example, EU law dictates that at least 30% of broadcast content must be of European origin. In 2024, Vivendi's compliance with these regulations cost an estimated €150 million. Any shifts in these laws directly affect Vivendi's strategic planning and financial outcomes.

Vivendi, particularly through Havas, must adhere to data protection laws like GDPR. These regulations govern how they handle user data across digital services and advertising. Non-compliance can lead to substantial fines; for instance, GDPR fines can reach up to 4% of annual global turnover. In 2024, the EU intensified enforcement, increasing the risk of penalties for data breaches.

Vivendi heavily relies on intellectual property laws to safeguard its creative assets. Copyright and related legal protections are critical for its film, music, and publishing divisions. In 2024, the global music market, a key area for Vivendi, generated approximately $28.6 billion in recorded music revenue. Effective enforcement of these laws combats piracy, which in 2023, cost the global entertainment industry an estimated $31.8 billion.

Antitrust and competition law

Vivendi's expansion through acquisitions faces antitrust scrutiny, particularly concerning its market dominance. Legal challenges related to mergers and market control can significantly affect Vivendi's growth strategies. The European Commission has the power to block mergers that restrict competition. For example, in 2023, the EU blocked the merger of two companies due to competition concerns. The company's legal team must navigate these complexities to ensure compliance and avoid operational disruptions.

- Vivendi must comply with antitrust laws to avoid penalties.

- Market dominance can lead to legal challenges.

- Strategic growth is impacted by legal scrutiny.

- The European Commission can block mergers.

Labor laws and employment regulations

Vivendi, as a major employer, navigates complex labor laws globally. These regulations impact everything from working conditions to unionization and employee relations. Compliance costs are significant, with potential fines for non-compliance. For 2024, Vivendi's employee-related expenses totaled approximately €2.5 billion. These legal factors are crucial for operational efficiency and financial planning.

- Compliance with labor laws is essential to avoid penalties.

- Employee-related expenses are a substantial part of operational costs.

- Unionization can influence wage negotiations and working conditions.

- Changes in labor laws require constant monitoring and adaptation.

Vivendi manages substantial legal obligations, from antitrust to labor laws, shaping its operational framework. These include adherence to data protection regulations, influencing digital service management and marketing practices. Labor laws affect employee relations, potentially increasing operating costs.

| Legal Area | Impact | 2024/2025 Data |

|---|---|---|

| Antitrust | Mergers scrutinized | EU blocked mergers in 2023; affects growth. |

| Data Protection | GDPR compliance | Fines up to 4% of global turnover. |

| Labor Laws | Employee relations, unionization | Vivendi’s employee expenses: €2.5B in 2024. |

Environmental factors

Vivendi is actively working to lower its environmental impact, focusing on its carbon footprint. The company has set specific goals to cut emissions. They are also investing in green content creation. For instance, in 2024, Vivendi invested €10 million in eco-friendly production.

Sustainable production is increasingly important. Vivendi's Canal+ and other content creators must adapt. In 2024, eco-friendly practices reduced production waste by 15%. This aligns with consumer demand for responsible content. It can also improve brand image and potentially reduce costs.

Vivendi must adhere to environmental regulations. The EU's Green Deal, for example, sets emission standards for media firms. These regulations could lead to increased compliance expenses. Operational decisions will be affected by these requirements.

Energy consumption and renewable energy

Vivendi acknowledges energy consumption's environmental impact. They are committed to renewable energy sources. Canal+ aims for 100% renewable electricity use in France. This is part of their sustainability strategy.

- Vivendi's goal is to reduce its carbon footprint.

- Canal+ actively seeks renewable energy options.

- Environmental impact is a key consideration for Vivendi.

- Renewable energy use aligns with global sustainability goals.

Stakeholder expectations on sustainability

Stakeholder expectations are significantly shaping Vivendi's environmental strategies. Investors and consumers increasingly prioritize corporate social responsibility. This influences Vivendi's reporting and actions on environmental sustainability, driving the need for transparent and impactful initiatives. For example, in 2024, ESG-focused funds saw inflows of over $100 billion. Vivendi must meet these demands to maintain its market position.

- Increased demand for sustainable products and services.

- Pressure from investors for ESG integration.

- Enhanced scrutiny from regulatory bodies.

- Growing consumer awareness of environmental issues.

Vivendi's environmental efforts focus on carbon footprint reduction and renewable energy. They are investing in eco-friendly production and aiming for 100% renewable electricity at Canal+ in France. Regulations like the EU's Green Deal influence their strategies. Investors and consumers drive demand for ESG practices, exemplified by $100B inflows into ESG funds in 2024.

| Aspect | Focus | 2024 Data |

|---|---|---|

| Carbon Footprint | Reduction | €10M invested in eco-friendly production |

| Renewable Energy | Adoption | Canal+ targeting 100% renewable electricity in France |

| Sustainable Practices | Implementation | 15% reduction in production waste |

PESTLE Analysis Data Sources

This Vivendi PESTLE Analysis uses data from financial reports, government publications, tech news, and market research.