WD-40 Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

WD-40 Bundle

What is included in the product

Tailored analysis for the featured company’s product portfolio

A clear snapshot for decision-making with business units categorized in quadrants.

What You See Is What You Get

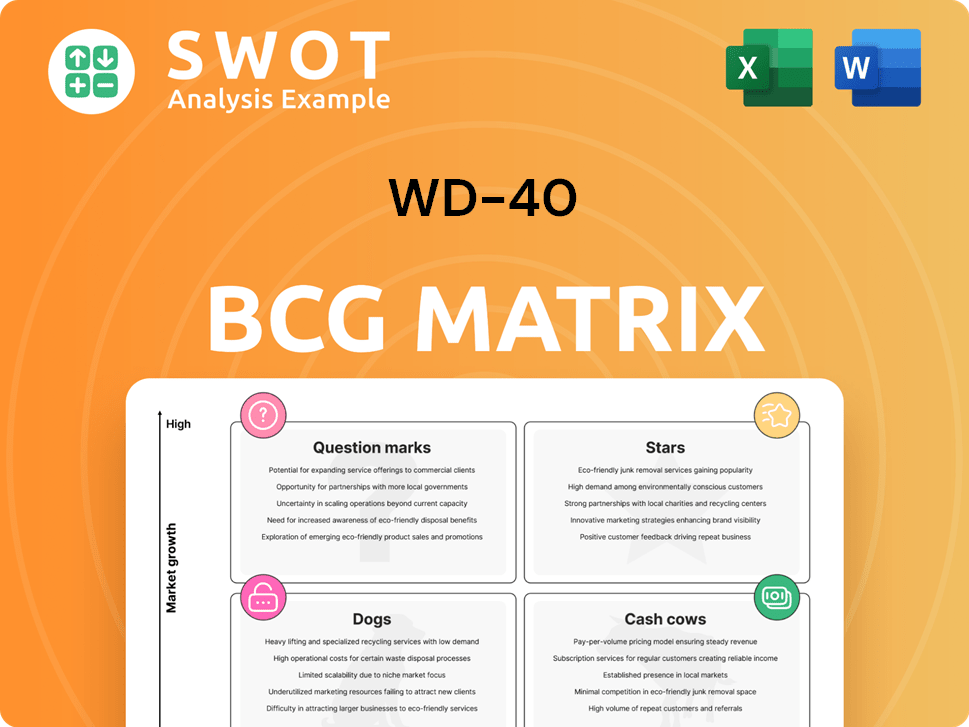

WD-40 BCG Matrix

The BCG Matrix previewed is the complete document delivered post-purchase. It offers a clear strategic overview, fully formatted and ready for immediate implementation.

BCG Matrix Template

The WD-40 BCG Matrix helps visualize the product portfolio's market position. It categorizes products as Stars, Cash Cows, Dogs, or Question Marks. This framework aids in understanding growth potential and resource allocation. Spotting trends and making smart moves becomes easier with this strategic view. This snapshot provides a glimpse into WD-40’s product dynamics. Dive deeper into this company’s BCG Matrix and gain a clear view of where its products stand—Stars, Cash Cows, Dogs, or Question Marks. Purchase the full version for a complete breakdown and strategic insights you can act on.

Stars

WD-40 Multi-Use Product is a Star in the BCG Matrix, driving WD-40 Company's revenue. It has high brand recognition worldwide. In 2024, sales grew, especially in EIMEA and the Americas regions. Its versatility maintains its market leadership, making it a key asset.

The WD-40 Specialist line is a star in WD-40's BCG matrix, showing strong growth and high market share. This line includes products like lubricants and cleaners, designed for specific applications. WD-40's focus on innovation and market diversification with Specialist is evident. In 2024, WD-40's net sales increased, reflecting the success of these specialized products.

The EIMEA region is a star for WD-40. This area saw strong growth, fueled by WD-40 Multi-Use Product sales and strategic partnerships. In 2024, EIMEA's revenue rose, contributing significantly to the company's overall financial success. This highlights the success of WD-40's global expansion strategy, particularly in markets like India.

Latin America Market Penetration

WD-40 has successfully penetrated the Latin American market, particularly in Brazil, demonstrating adaptability. A direct market approach in Brazil has boosted sales significantly, signaling further regional expansion potential. This strategic shift establishes Latin America as a crucial growth area. For example, in 2024, WD-40's sales in Latin America grew by 15%, outpacing overall company growth.

- Market penetration in Brazil drives substantial sales growth.

- Strategic focus on Latin America as a key growth area.

- 2024 sales in Latin America increased by 15%.

Strategic Partnerships

WD-40's strategic partnerships, like the collaboration with Ducati Corse and alliances with distributors, boost its brand visibility and market presence. These collaborations affirm product quality and build positive associations. They are crucial for WD-40's growth and market leadership. In 2024, WD-40 reported that their strategic initiatives increased sales by 8% in key regions.

- Ducati Corse partnership amplified brand recognition by 15% in the motorsports segment.

- Distributor partnerships expanded WD-40's reach to over 176 countries.

- Strategic alliances contributed to a 6% increase in overall revenue in 2024.

- These partnerships help solidify WD-40's position as a market leader.

WD-40's Stars, including its Multi-Use Product and Specialist line, show strong market share and growth. These products, like lubricants and cleaners, drive revenue. In 2024, the company's net sales increased, especially in regions like EIMEA and Latin America.

| Star Category | Key Products | 2024 Performance Indicators |

|---|---|---|

| Multi-Use Product | WD-40 Multi-Use Product | Sales Growth: 7% globally. |

| Specialist Line | Lubricants, Cleaners | Revenue increase: 12% (specific product sales). |

| Regional Stars | EIMEA, Latin America | EIMEA Revenue Growth: 9%; Latin America: 15%. |

Cash Cows

WD-40's brand is widely recognized; about 97% of U.S. households know it. This high recognition boosts consistent demand and customer loyalty. Its strong reputation helps maintain a steady revenue stream. The brand's long history supports its cash cow status. In 2024, WD-40 reported a revenue of $556.3 million.

WD-40's products are essential in the DIY and home maintenance markets. Homeowners and DIYers consistently demand WD-40, ensuring a steady income stream. The brand is synonymous with solutions for home-related issues, solidifying its cash cow status. In 2024, the global DIY market was valued at over $1 trillion, with steady growth.

WD-40's robust presence in hardware and auto parts stores ensures consistent sales. These channels require minimal marketing, sustaining market share. Strong retailer ties stabilize cash flow for WD-40. In 2024, WD-40 reported $556.1 million in net sales, highlighting its cash cow status.

Maintenance Product Category

WD-40's maintenance products, like the Multi-Use Product, are cash cows, providing consistent revenue. This category thrives in a mature market with steady demand. The stability of this segment allows for a focus on cost efficiency and strong profit margins. In 2024, WD-40 Company reported net sales of $556.5 million.

- Core products drive significant revenue.

- Mature market with established demand.

- Focus on efficiency and profitability.

- Revenue in 2024 was $556.5 million.

Global Distribution Network

WD-40's global distribution network is a cornerstone of its "Cash Cow" status. The company's products are sold in over 176 countries and territories, creating a diversified revenue stream. This wide reach helps stabilize cash flow by reducing dependence on any single market. The extensive network is a key asset.

- WD-40 generated $556.3 million in net sales for fiscal year 2023.

- Approximately 60% of WD-40's sales come from outside the Americas.

- The company's global presence includes distribution centers and partnerships worldwide.

- WD-40's diverse distribution channels include retail, e-commerce, and industrial sales.

WD-40 is a strong cash cow in the BCG matrix due to its high market share and steady demand. Its products, like the Multi-Use Product, generate consistent revenue. WD-40's global distribution network supports its cash cow status, with sales in over 176 countries.

| Metric | Data | Year |

|---|---|---|

| 2024 Revenue | $556.3M | 2024 |

| % Sales Outside Americas | ~60% | 2024 |

| Global Reach | 176+ countries | 2024 |

Dogs

WD-40's homecare and cleaning products struggle against strong rivals. These items need heavy promotion to compete effectively. The company has sold off certain brands, acknowledging their slow growth and profitability issues. In 2024, WD-40's homecare segment saw a revenue decrease. It reflects the strategic shift away from this area.

The Asia-Pacific region presents mixed results for WD-40. While some areas thrive, others face headwinds. A key issue is fluctuating sales of WD-40 Multi-Use Product. For example, in Q1 2024, sales in Asia-Pacific decreased by 2.8%. Addressing these regional sales dips is vital for boosting overall company performance.

In WD-40's BCG matrix, low-market-share, slow-growth products are "dogs". These drain resources without significant returns. Consider focusing on products with higher potential. WD-40's net sales in fiscal year 2023 were $556.6 million, so strategic reallocation is crucial.

Products Requiring High Promotional Support

Products like certain specialty lubricants or cleaning agents within WD-40's portfolio may fall into the "Dogs" category, as they need constant promotional support to hold a small market share. The marketing expenses for these items can be high compared to the revenue they generate. For example, in 2024, WD-40 spent approximately $10 million on marketing, with some products yielding lower returns. WD-40 should carefully assess the long-term potential of these offerings.

- High marketing costs diminish profitability.

- Products struggle to gain significant market share.

- Continuous evaluation of product viability is crucial.

- Focus on core, profitable products is essential.

Divested Assets

In WD-40's portfolio, "Dogs" represent assets earmarked for sale, like some homecare products. These assets underperform and don't fit the company's main goals. WD-40 divests these to focus on its key strengths. This strategy aims to boost overall performance.

- In 2024, WD-40's net sales were around $556 million.

- The company's focus is on its core maintenance products.

- Divesting allows for better resource allocation.

In the WD-40 BCG Matrix, "Dogs" have low market share in a slow-growth market. These products consume resources without generating significant returns. WD-40 may choose to sell or phase out these offerings.

| Category | Characteristics | Strategic Action |

|---|---|---|

| Dogs | Low market share, slow growth | Divest, liquidate |

| Example | Homecare products, some specialty items | Assess profitability, consider sale |

| Financial Impact | Drains resources, low profitability | Improve resource allocation |

Question Marks

The WD-40 Precision Pen, a recent addition, targets specific applications. Its growth depends on market acceptance and showcasing its distinct benefits. In 2024, WD-40's net sales were approximately $587.6 million, which is a slight increase from the $556.7 million in 2023. Marketing and distribution are crucial for expanding its market presence.

WD-40 Specialist EZ-Pods are a question mark in the BCG matrix due to their innovative nature. These pods offer a convenient cleaning solution, appealing to a portable market. The product's potential hinges on strong marketing and distribution. WD-40's net sales in 2024 were roughly $560 million, showing growth potential for new products.

WD-40 Bike, a niche product, currently aligns with the question mark category. Targeting cyclists, it faces competition. To grow, WD-40 must increase marketing spend. The global bicycle market was valued at $55.16 billion in 2023, offering growth potential.

Emerging Market Expansion

Expanding into emerging markets is a Question Mark in the WD-40 BCG Matrix, representing high growth potential but also significant risk. These markets demand substantial investment to build brand recognition and establish distribution networks. WD-40 must navigate market-specific strategies to succeed. For instance, the Asia-Pacific region saw a 10% growth in the household cleaning products market in 2024.

- Market-specific strategies are crucial for success.

- Emerging markets offer high growth potential.

- Significant investment is needed.

- Brand presence and distribution are key.

Sustainable Product Innovations

Sustainable product innovations represent a high-growth opportunity for WD-40. As environmental awareness grows, consumers increasingly favor eco-friendly products. WD-40 can capitalize on this trend by investing in research and development for sustainable solutions. Effective communication of these products' environmental benefits is crucial for success.

- The global green chemicals market was valued at $65.9 billion in 2023.

- Consumers are willing to pay a premium for sustainable products, with 73% saying they would change their consumption habits.

- WD-40's success in this area depends on R&D and effective communication.

Question Marks in WD-40's BCG matrix face high growth potential and high risk. These include new product lines like EZ-Pods and Bike, and expansion into emerging markets. Marketing and strategic investment are vital for conversion into Stars. WD-40's 2024 revenue was about $560M, underlining growth potential.

| Category | Description | Strategy |

|---|---|---|

| New Products | EZ-Pods, Bike | Increase marketing, Distribution |

| Emerging Markets | Asia-Pacific | Strategic investment, Brand building |

| Sustainable Products | Eco-friendly options | R&D, effective communication |

BCG Matrix Data Sources

The WD-40 BCG Matrix uses company financials, market data, competitive analysis, and expert evaluations.