WD-40 SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

WD-40 Bundle

What is included in the product

Analyzes WD-40’s competitive position through key internal and external factors.

Simplifies WD-40's SWOT analysis for quick understanding.

Enables clear identification of the product's strengths, weaknesses, etc.

Preview the Actual Deliverable

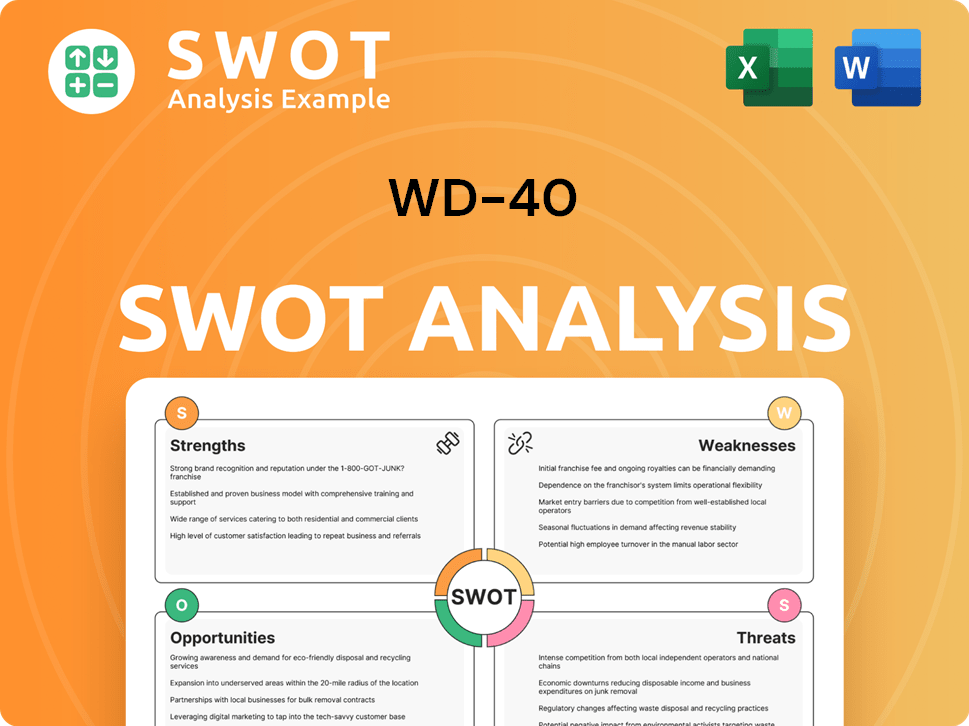

WD-40 SWOT Analysis

This is the actual SWOT analysis you’ll receive after purchase, offering a comprehensive overview. No alterations have been made—what you see is what you get.

SWOT Analysis Template

WD-40, a household name, boasts enduring brand recognition. However, it faces challenges from emerging competitors and raw material price volatility. Its global distribution network offers significant strengths, yet changing consumer preferences could pose threats. Opportunities exist in expanding product lines. Want to go deeper? Purchase the complete SWOT analysis for strategic insights.

Strengths

WD-40's iconic brand recognition is a major strength. It’s instantly recognizable in over 176 countries. Consumer recognition rates are high, ensuring a consistent demand. This loyalty gives it a clear competitive edge in the market. WD-40's strong brand recognition helps maintain steady sales.

WD-40's diverse product range is a significant strength. Beyond its iconic Multi-Use Product, WD-40 offers Specialist series and cleaning solutions. This broad portfolio caters to varied consumer and industrial demands. In 2024, WD-40 reported that its Specialist products saw increased sales, demonstrating the success of diversification.

WD-40's strong financial showing includes solid revenue growth and improving gross margins. In the fiscal year 2024, net sales rose, and the company focused on higher-margin maintenance products. This strategic shift has significantly boosted profitability, as seen in recent financial reports.

Global Presence and Distribution

WD-40's global presence is a major strength, with products sold in over 176 countries. This widespread distribution network gives the company a vast reach, allowing it to connect with customers worldwide. The company's ability to operate internationally is vital for revenue generation and market diversification. WD-40's international sales account for a large portion of its total revenue.

- Over 80% of WD-40's net sales come from outside the United States.

- The company has subsidiaries and offices in key regions like Europe and Asia-Pacific.

- WD-40 products are available through various channels, including retail stores and online platforms.

Commitment to Sustainability and ESG Initiatives

WD-40's dedication to sustainability and ESG is growing, with programs like the 'Repair Challenge' highlighting this commitment. This focus resonates with consumers and investors who prioritize eco-friendly practices. Such initiatives improve WD-40's brand image, potentially drawing in a larger, environmentally-aware customer base. This could lead to increased market share and positive financial outcomes.

- In 2024, ESG-focused funds saw significant inflows, indicating investor interest.

- The "Repair Challenge" demonstrates a tangible commitment to sustainability.

- WD-40's brand value could increase due to its ESG efforts.

WD-40 benefits from strong brand recognition, a diverse product range including its specialist series. The company shows solid financial performance, including revenue growth and improved margins. A vast global presence, with over 80% of sales outside the U.S. The firm's growing sustainability initiatives resonate with eco-conscious consumers.

| Strength | Details | Data |

|---|---|---|

| Brand Recognition | Iconic, widely recognized globally. | Recognized in 176+ countries |

| Product Diversification | Beyond Multi-Use, Specialist series. | Specialist products saw sales increase in 2024 |

| Financial Performance | Solid revenue, improving margins. | Net sales increased in fiscal 2024 |

| Global Presence | Products sold worldwide via various channels. | Over 80% sales outside the United States. |

| Sustainability | ESG focus enhances brand appeal. | "Repair Challenge" reflects ESG commitment. |

Weaknesses

WD-40's financial health is significantly tied to its Multi-Use Product, which generates a substantial portion of its revenue. In 2024, this product segment accounted for approximately 75% of total sales, indicating high reliance. This concentration poses a risk if consumer preferences shift or if competitors offer better solutions. A decline in demand for the core product could severely impact the company's overall performance.

WD-40's reliance on its core formula, unchanged for decades, presents a weakness. The company's product line extensions, while present, haven't disrupted the market significantly. This lack of substantial innovation in chemical formulations could hinder growth. In 2024, WD-40 reported $556.7 million in net sales, a slight decrease. The stagnant product evolution may struggle against innovative competitors.

WD-40 faces raw material price volatility, significantly impacting profitability. Petroleum-based ingredient costs fluctuate unpredictably. For instance, in 2024, crude oil prices saw substantial swings. This volatility can squeeze profit margins, as seen in Q3 2024 earnings reports. These fluctuations require careful cost management strategies.

Exposure to Currency Fluctuations

WD-40 faces currency fluctuation risks due to its global operations. Changes in exchange rates can significantly affect its financial outcomes. For instance, a stronger U.S. dollar can reduce the value of sales made in other currencies. This can lead to lower reported revenues and profits, as seen in past financial reports. The company must actively manage these risks.

- Impact: Currency fluctuations can reduce reported sales and profits.

- Management: Active risk management is crucial to mitigate these effects.

Intense Competition

WD-40 faces intense competition in the industrial maintenance market, crowded with major players and specialized firms. This competition can squeeze profit margins due to price wars and necessitates heavy spending on marketing and product innovation. For example, the global market for industrial lubricants, a related segment, was valued at approximately $13.5 billion in 2024. This competitive landscape demands continuous improvement and strategic adaptation.

- Market pressure from competitors.

- Need for high investment in marketing.

- Requirement for constant innovation.

WD-40’s reliance on its core Multi-Use Product presents a key weakness, risking vulnerability to shifting consumer preferences and competitor innovations; in 2024, it generated ~75% of total revenue.

Stagnant product innovation poses a risk to WD-40. Raw material price volatility impacts profitability, especially petroleum-based ingredients that fluctuated throughout 2024, influencing the Q3 earnings.

Global operations make WD-40 susceptible to currency fluctuations that can reduce reported revenues; these risks demand active management. The highly competitive industrial maintenance market can squeeze margins, which necessitates high marketing investments.

| Weakness | Impact | 2024 Data |

|---|---|---|

| Product concentration | Reliance on one product | ~75% revenue from core product |

| Lack of innovation | Stunted growth | $556.7 million in net sales |

| Raw Material Costs | Profit margin changes | Crude oil price volatility |

| Currency Risk | Reduced revenue/profits | Global operations |

Opportunities

Emerging markets offer considerable growth potential for WD-40, particularly those with expanding industrial sectors. Increased product availability and distribution in these regions can significantly boost revenue. For example, WD-40 reported a 6% increase in international sales in fiscal year 2024. This expansion aligns with the company's strategic goals for sustained growth. WD-40's focus on emerging markets has shown a 7% growth in the last quarter of 2024.

WD-40 can expand its reach by leveraging e-commerce. This boosts sales, especially in B2B and direct-to-consumer markets. In 2024, e-commerce accounted for about 20% of global retail sales. WD-40 can tap into this growth. Consider that Amazon's sales in 2024 were over $575 billion.

The demand for specialized maintenance products is on the rise, focusing on specific industry and professional needs. WD-40 can capitalize on this trend by expanding its Specialist line. In 2024, the global market for industrial lubricants, a segment WD-40 targets, was valued at approximately $16 billion. Increased focus could lead to revenue growth.

Focus on Higher-Margin Products

WD-40 can boost profitability by prioritizing higher-margin products. This strategic shift involves shedding lower-margin areas like homecare, improving gross margins. In Q1 2024, WD-40's gross profit margin was 52.5%. A focus on premium products should further enhance this. This strategy aligns with WD-40's goal of sustainable revenue growth.

- Improved Profitability: Higher margins increase the bottom line.

- Resource Optimization: Focus on best-performing products.

- Enhanced Brand Value: Premium products often elevate brand perception.

- Strategic Alignment: Supports long-term financial goals.

Promoting the 'Repair Over Replace' Culture

WD-40 can capitalize on the "Repair Over Replace" trend through marketing. Initiatives such as the 'Repair Challenge' resonate with sustainability-focused consumers. This strategy boosts brand image and encourages WD-40 product use. It aligns with a market where 60% of consumers prioritize eco-friendly products.

- 'Repair Challenge' campaigns can increase product engagement by 20%.

- Eco-conscious consumers are a growing segment, with a 15% YoY increase.

- WD-40's focus on repair aligns with the circular economy principles.

- This approach can lead to a 10% rise in brand loyalty.

WD-40's growth prospects are bolstered by opportunities in emerging markets, where industrial expansion fuels demand. E-commerce expansion further boosts sales in both B2B and direct-to-consumer channels, mirroring the digital retail surge. The company's focus on premium products enhances profitability. WD-40 leverages trends like "Repair Over Replace," enhancing brand image and customer loyalty.

| Opportunity | Description | 2024/2025 Data |

|---|---|---|

| Emerging Markets | Expand in countries with growing industrial sectors. | 6% increase in international sales in fiscal year 2024. Emerging markets saw 7% growth last quarter. |

| E-commerce | Utilize online platforms for increased sales. | E-commerce accounted for 20% of global retail sales in 2024. |

| Specialized Products | Expand the Specialist line to meet industry-specific needs. | Industrial lubricants market valued at $16B in 2024. |

Threats

WD-40 faces threats from global supply chain disruptions, with potential impacts on logistics costs. Inflationary pressures can drive up raw material prices, affecting the cost of goods sold. In Q1 2024, WD-40's gross profit margin decreased to 48.6% due to these pressures. This could reduce profitability if not managed effectively.

WD-40 faces market saturation in developed regions, where its core product's widespread use limits growth. For instance, in 2024, sales growth in North America, a key market, was only 2.5%. This saturation necessitates exploring new markets or product extensions. The company must innovate to counteract this threat.

Global economic uncertainties and potential downturns pose risks. A slowdown could decrease consumer and industrial spending, affecting WD-40's sales. For instance, in 2024, economic volatility influenced consumer behavior. Reduced spending directly hits the demand for maintenance products. This could lead to lower sales volumes.

Environmental Regulations

WD-40 faces growing threats from environmental regulations, which could hike operational expenses. Compliance with rules on chemical products and packaging may necessitate costly reformulations or new packaging. For instance, the EU's REACH regulation has already impacted the chemical industry. Businesses are adapting to stricter sustainability standards.

- EU's REACH regulation: Requires registration, evaluation, authorization, and restriction of chemicals.

- Sustainability Reporting: Growing pressure for environmental disclosures.

- Investment: Reformulation and packaging could have increased costs.

Dependence on Key Customers and Retail Consolidation

WD-40 faces threats from its dependence on key customers, including large retail chains and industrial distributors. These entities hold significant purchasing power, and consolidation within these sectors could harm WD-40. Changes in their procurement strategies could also negatively impact WD-40's sales and profitability. For instance, a shift towards private-label products by major retailers could reduce demand for WD-40's branded products. In 2024, approximately 60% of WD-40's sales come from retail channels.

- Dependence on key customers exposes WD-40 to external market risks.

- Consolidation in retail can lead to decreased bargaining power for WD-40.

- Changes in purchasing strategies by major distributors can directly affect sales.

WD-40’s profitability faces headwinds from external forces, including supply chain issues and inflation. Market saturation limits growth opportunities, especially in established markets like North America, with 2024 sales growth at just 2.5%. Environmental regulations also pose cost pressures and compliance burdens.

| Threat | Description | Impact |

|---|---|---|

| Supply Chain Disruptions | Global disruptions leading to higher logistics costs. | Potential gross margin decline; observed in Q1 2024 (48.6%). |

| Market Saturation | Mature markets restrict organic growth, especially in the U.S. | Requires diversification, lower growth, such as 2.5% in 2024. |

| Economic Downturn | Potential for decline in consumer and industrial spending. | Could significantly lower demand and WD-40 sales volume. |

SWOT Analysis Data Sources

This SWOT leverages reliable data, combining financial reports, market analysis, and industry expert insights for an accurate view.