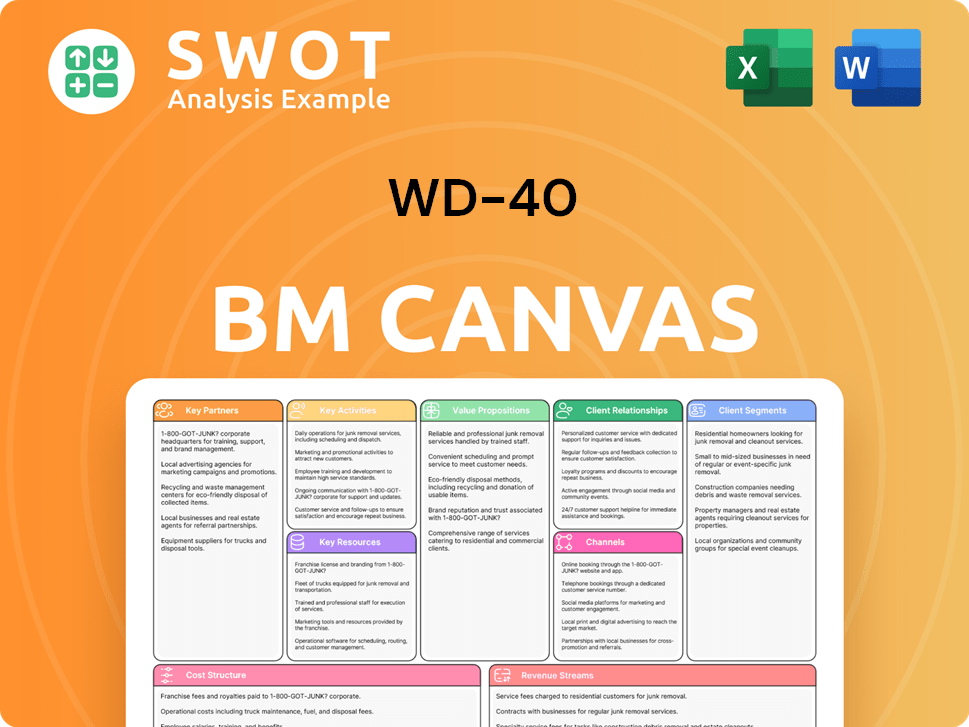

WD-40 Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

WD-40 Bundle

What is included in the product

A comprehensive model reflecting WD-40's strategy, covering segments, channels, and value propositions.

Shareable and editable for team collaboration and adaptation.

What You See Is What You Get

Business Model Canvas

The displayed WD-40 Business Model Canvas preview is identical to what you'll receive post-purchase. This isn't a sample; it's the full document, fully accessible upon completion. Get the same, ready-to-use file for immediate application. No hidden content or different formatting – it’s the same. Purchase it now and get started!

Business Model Canvas Template

WD-40's Business Model Canvas reveals its strategic brilliance. It highlights a simple yet effective value proposition: versatile lubrication and protection. Key partnerships with distributors ensure widespread availability. Understand their customer segments and cost structure. Discover revenue streams that sustain their global reach. Download the full Business Model Canvas today!

Partnerships

WD-40 relies on strategic distributors, including NAPA, to broaden market reach. Collaborations with distributors involve promotional activities to increase sales. These partnerships are key to WD-40's geographic and channel penetration. In 2024, WD-40's distribution network supported $575.2 million in net sales. This underscores the effectiveness of these partnerships.

WD-40's retail partnerships are key to its market strategy. Collaborations with Amazon and hardware stores like Ace Hardware are vital for consumer access. These partnerships include direct website links, boosting online engagement. They're important for omnichannel growth, helping WD-40 reach more customers. In 2024, WD-40's sales reached $574.2 million, a testament to effective partnerships.

WD-40's Technical Partnership with Ducati Corse, renewed for the 2025 season, highlights its focus on the motorcycle industry. This collaboration lets WD-40 showcase its products in top-tier racing, boosting innovation. The partnership includes supplying products for use by Ducati Corse. In 2024, WD-40 reported net sales of $556.2 million.

Marketing Partners

WD-40 strategically teams up with marketing partners like Throtl to boost brand visibility. These collaborations often include co-hosting events and giveaways, fostering strong community ties. Such partnerships generate lasting positive brand memories and loyalty among fans. In 2024, WD-40's marketing spend totaled $10.5 million, reflecting its commitment to these partnerships.

- Partnerships help expand WD-40's reach within the automotive community.

- Co-hosted events and giveaways build brand loyalty.

- Marketing investments support these strategic collaborations.

TechForce Foundation & NAPA

WD-40's collaboration with TechForce Foundation and NAPA is key. This partnership helps address the skilled trades shortage by providing scholarships to students in automotive, collision, and diesel programs. NAPA supports this with discounted WD-40 products, further aiding aspiring technicians. This strategic move supports the company's commitment to the trades.

- TechForce Foundation awarded over $1.5 million in scholarships in 2023.

- NAPA has over 5,000 stores across the US, providing widespread product access.

- The automotive industry faces a shortage of over 642,000 technicians by 2024.

- WD-40's net sales for fiscal year 2023 were approximately $517 million.

Key partnerships boost WD-40's market access and brand presence across diverse sectors. These include strategic alliances with distributors like NAPA and retailers such as Amazon, which boost sales and enhance customer reach. Marketing collaborations, exemplified by partnerships with Throtl, build brand loyalty and engagement.

WD-40's partnerships with Ducati Corse and TechForce Foundation further strengthen its position. These partnerships highlight WD-40's commitment to the automotive industry and address workforce shortages by offering scholarships. These partnerships are vital for sales growth and brand image.

| Partnership Type | Partner Examples | Impact |

|---|---|---|

| Distribution | NAPA | $575.2M Net Sales (2024) |

| Retail | Amazon, Ace Hardware | Omnichannel Growth |

| Marketing | Throtl | $10.5M Marketing Spend (2024) |

Activities

WD-40's product development is key. They invest in R&D to enhance existing products and create new ones. This commitment to innovation is clear in its product range. In 2024, WD-40 reported net sales of $557.5 million, a testament to its successful product development. This includes WD-40 Multi-Use, Specialist, and Bike lines.

Marketing and brand building are vital for WD-40. They use digital marketing and events. The "Repair Challenge" boosts customer engagement. WD-40 spent $16.8 million on advertising in fiscal year 2024.

WD-40's success hinges on wide distribution. They use hardware stores, auto parts shops, and online platforms. This broad reach makes products easily accessible. In 2024, WD-40's sales rose, showing effective distribution.

Geographic Expansion

Geographic expansion is a central key activity for WD-40, targeting growth in top markets worldwide. The aim is to increase product accessibility, ensuring availability for target customers globally. This strategy involves strategic moves like acquisitions. In 2024, WD-40's international sales accounted for a significant portion of its revenue, reflecting successful geographic expansion.

- Focus on top 20 growth markets.

- Increase product accessibility globally.

- Strategic acquisitions and partnerships.

- International sales drive revenue growth.

Operational Excellence

WD-40 prioritizes operational excellence in its supply chain, ensuring efficiency and dependability. They set global supply chain KPIs and collaborate with outsourced manufacturers to maintain high standards. On-time and in-full delivery is a key metric, consistently scoring above 95% in aggregate. This focus helps maintain a robust distribution network.

- Supply Chain KPIs: WD-40 uses Key Performance Indicators to monitor and improve its global supply chain.

- Outsourced Manufacturing: The company partners with external manufacturers to maintain high production standards.

- On-Time Delivery: A primary goal is on-time and in-full delivery, with scores above 95%.

- Distribution Network: Operational excellence supports a reliable and efficient distribution network.

WD-40's key activities include focused geographic expansion, targeting high-growth markets worldwide. They also concentrate on maintaining operational excellence within their supply chain, ensuring efficient distribution. Marketing and brand building are pivotal. Digital marketing is a major channel with $16.8M in advertising in 2024.

| Key Activity | Description | 2024 Metrics |

|---|---|---|

| Geographic Expansion | Growth in key global markets through strategic moves. | International sales growth |

| Supply Chain | Focus on efficiency and dependability. | On-time delivery >95% |

| Marketing & Brand Building | Digital marketing and events. | $16.8M advertising |

Resources

WD-40's brand equity is a cornerstone of its business model. With 97% brand recognition in U.S. households, its name is synonymous with quality. This strong brand recognition supports customer loyalty and market share. WD-40's brand value has also helped it maintain a solid financial performance.

WD-40's product portfolio is a vital resource. It includes WD-40 Multi-Use Product, WD-40 Specialist, and more. These products serve diverse needs. This drives revenue and market growth. In fiscal year 2023, WD-40's net sales were $538.8 million.

WD-40's global distribution network is a key resource, crucial for its worldwide presence. The company's products are available in over 176 countries and territories. This widespread reach is supported by strategic partnerships. In 2024, WD-40's net sales reached $588.1 million, reflecting the strength of its distribution.

Manufacturing Agreements

WD-40 leverages manufacturing agreements to streamline production. This strategy enables the company to concentrate on brand development and sales. Reliable partnerships with manufacturers are critical for maintaining product standards and supply. In 2024, WD-40's net sales reached $556.1 million.

- Outsourced manufacturing ensures cost-effectiveness.

- Focus on marketing and distribution.

- Partnerships are crucial for quality control.

- Supply chain stability is a key benefit.

Intellectual Property

WD-40's formulas, patents, and trademarks are crucial intellectual property assets. These protect its unique products and brand, essential for market competitiveness. Continuous investment in research and development is key to maintaining and growing this portfolio. In 2023, WD-40 spent $4.9 million on R&D, reflecting its commitment. This strategy ensures sustained innovation and brand protection.

- WD-40's patents safeguard its unique formulas.

- Trademarks protect the brand's identity.

- R&D spending in 2023 was $4.9M.

- IP is vital for market advantage.

WD-40's marketing and distribution channels are critical. The company uses various channels to reach customers. WD-40's focus on digital marketing has increased its reach. In 2024, advertising expenses were $10.9 million.

WD-40's team of skilled employees is a key resource, especially in sales, marketing, and operations. The company invests in training and development. This enhances efficiency and innovation. Employee expertise is essential for driving growth. The cost of salaries was $49.8M in 2024.

WD-40's strong financial performance backs its business model. The company's revenue has consistently increased. In 2024, WD-40's net income reached $59.1 million, demonstrating its solid financial health. This success supports investments and strategic initiatives.

| Key Resource | Description | 2024 Data |

|---|---|---|

| Marketing & Distribution | Various channels for customer reach | Advertising expenses: $10.9M |

| Human Resources | Skilled employees in sales, marketing, and operations | Salaries: $49.8M |

| Financial Performance | Strong revenue and profitability | Net income: $59.1M |

Value Propositions

WD-40's value lies in its problem-solving products, addressing maintenance and repair challenges across workshops, factories, and homes. The company's focus is on meeting specific needs, driving innovation through R&D. In 2024, WD-40 reported net sales of approximately $570 million, demonstrating the ongoing demand for its solutions.

WD-40's value proposition centers on reliability and quality, ensuring consistent performance. This builds trust and positive customer experiences. The brand's goal is to be a dependable part of customers' lives. WD-40's strong customer relationships translate to high brand loyalty. In 2024, WD-40 reported consistent sales, highlighting its reliable market position.

WD-40's value lies in its versatility, functioning as a lubricant, rust inhibitor, penetrant, and moisture displacer. This multi-use capability makes it essential in homes and industries. Its broad application range boosts its appeal, supporting WD-40's diverse customer base. In 2024, WD-40 Company reported net sales of $556.6 million, reflecting the product's widespread use.

Positive Lasting Memories

WD-40 fosters positive memories through reliable products and customer engagement. The company aims to build lasting customer relationships by consistently delivering effective solutions, ensuring positive experiences. WD-40 actively engages with its consumer base through marketing and community programs. This approach strengthens brand loyalty and reinforces positive associations with the product.

- WD-40's net sales for fiscal year 2023 were $536.6 million.

- The company's gross profit margin was 48.3% in fiscal year 2023.

- WD-40's market capitalization as of May 2024 is approximately $3.5 billion.

Innovation

WD-40's value proposition centers on continuous innovation. They regularly introduce new products and enhance existing ones. This commitment to R&D keeps them ahead in the market. WD-40's net sales for Q1 2024 were $139.4 million. Their innovation keeps the brand relevant.

- New product development drives growth.

- R&D spending ensures product effectiveness.

- Market dynamics influence innovation.

- WD-40 adapts to customer needs.

WD-40’s value proposition involves versatile, problem-solving products for varied applications. This drives consistent sales and positive customer experiences, enhancing brand loyalty. In 2024, WD-40 reported net sales of $570 million. Continuous innovation ensures they stay relevant, with Q1 2024 sales at $139.4 million.

| Value Proposition Aspect | Description | Impact |

|---|---|---|

| Problem Solving | Products solve maintenance and repair issues | Drives demand |

| Versatility | Multi-use for lubrication, rust inhibition | Broad appeal |

| Innovation | New products, enhancements | Market relevance |

Customer Relationships

WD-40 fosters customer relationships via community engagement. The company sponsors events such as Cars & Coffee. This strategy builds brand loyalty. WD-40's revenue in 2024 was approximately $556.3 million, highlighting the impact of such engagement.

WD-40's digital presence is key for customer interaction and brand building. The Repair Challenge, for example, spans over 40 countries. This digital focus boosts brand awareness and customer engagement. It also improves the overall customer experience. In 2024, WD-40's digital marketing spend increased by 15% to support these efforts.

WD-40 emphasizes top-notch customer service to build loyalty. They quickly handle questions and solve problems. Excellent service boosts their brand image and keeps customers coming back. In 2024, WD-40's customer satisfaction scores remained high, reflecting their commitment.

Educational Content

WD-40 excels in customer relationships through educational content. They offer online resources and tutorials to demonstrate product uses and benefits, boosting customer satisfaction. This approach helps customers maximize product value, fostering loyalty. For instance, WD-40's website saw over 15 million visitors in 2024, indicating strong customer engagement.

- Online resources: tutorials and product demonstrations.

- Educating customers on effective product use.

- Enhanced value and customer satisfaction.

- Website had over 15 million visitors in 2024.

Partnerships and Sponsorships

WD-40 cultivates customer relationships via strategic partnerships and sponsorships. Collaborations, like those with Ducati Corse and the TechForce Foundation, boost brand visibility and trust. These partnerships showcase WD-40’s dedication to its industries and communities. Such initiatives are part of WD-40's broader strategy to connect with its audience.

- Ducati Corse partnership: Enhances brand visibility in motorsports.

- TechForce Foundation: Supports the automotive technician community.

- Sponsorships: Increase brand exposure.

- Community engagement: Supports industries WD-40 serves.

WD-40 connects with customers through community events like Cars & Coffee. They boost brand loyalty, with 2024 revenue at $556.3M. A strong digital presence, including the Repair Challenge in over 40 countries, is key. Digital marketing rose 15% in 2024.

Excellent customer service is a WD-40 priority for customer retention. Quick issue resolution boosts brand image and customer satisfaction scores remain high. Educational content like online tutorials also enhances customer relationships. The website had over 15 million visitors in 2024.

Strategic partnerships, such as with Ducati Corse and the TechForce Foundation, boost visibility. These sponsorships build trust, and community engagement helps WD-40 connect with its audience. These collaborations were part of its marketing strategy.

| Customer Touchpoint | Strategy | 2024 Impact |

|---|---|---|

| Community Events | Sponsorships (Cars & Coffee) | Revenue: $556.3M |

| Digital Engagement | Repair Challenge, Digital Marketing | 15% increase in Digital Marketing |

| Customer Service | Quick Response and Resolution | High Satisfaction Scores |

| Educational Content | Online Tutorials, Website | 15M+ Website Visitors |

| Partnerships | Ducati Corse, TechForce Foundation | Enhanced Brand Visibility |

Channels

WD-40's retail strategy heavily relies on widespread distribution. In 2024, their products are prominently displayed in hardware stores and auto parts retailers. This strategy is key, with around 80% of sales coming from retail channels. Strong retail partnerships ensure product visibility and accessibility to consumers.

WD-40 utilizes online retailers, including Amazon, to boost sales and connect with more customers. Direct website links to these retailers improve online interaction. In 2024, e-commerce accounted for about 30% of WD-40's total sales, showing the importance of online channels. Expanding through online distributors is key for market growth.

WD-40 relies on industrial distributors to reach business and industrial clients, including partnerships with Grainger.com and MSCDirect.com. These distributors are vital for B2B sales and market access. In 2024, WD-40's B2B sales through distributors contributed significantly to its revenue. This approach helps WD-40 manage distribution efficiently. It also ensures product availability in industrial markets.

Direct Sales

WD-40 employs direct sales strategies in select markets, enabling deeper customer engagement and control over distribution. This channel is especially valuable in fostering relationships and gathering market insights. It allows them to bypass intermediaries and tailor their approach. Direct sales can be highly effective, particularly in regions where traditional distribution networks are underdeveloped.

- Direct sales can represent a significant portion of revenue in specific geographic areas, although exact figures are proprietary.

- This approach often supports the launch of new products or expansion into untapped markets.

- The direct sales team focuses on building strong relationships with key accounts.

- Direct sales strategies are regularly evaluated and adjusted based on market feedback.

Specialty Retailers

WD-40's products are distributed through specialty retailers, including farm supply stores and independent bike dealers, reaching specific customer segments. This targeted approach addresses unique needs, enhancing brand visibility within niche markets. For instance, in 2024, WD-40 expanded its presence in the agricultural sector, increasing sales by 7% in that channel.

- Farm supply stores and bike dealers offer niche market access.

- Specialty retailers boost targeted distribution.

- WD-40 saw a 7% sales increase in agriculture in 2024.

WD-40 leverages multiple channels to reach its customers effectively. Retail partnerships contribute a large portion of sales, accounting for around 80% in 2024. E-commerce is also significant, with approximately 30% of total sales through online platforms. Industrial distributors and direct sales further broaden WD-40's market reach.

| Channel | Description | 2024 Sales Contribution |

|---|---|---|

| Retail | Hardware stores, auto parts retailers | ~80% |

| E-commerce | Amazon, company website | ~30% |

| Industrial Distributors | Grainger, MSC Direct | Significant B2B sales |

Customer Segments

DIY enthusiasts, including homeowners and hobbyists, form a key customer segment for WD-40. They appreciate WD-40's versatility for home maintenance and repairs. In 2024, home improvement spending in the U.S. is projected to reach $484 billion, highlighting the segment's significance. WD-40 tailors marketing to this group, with educational content and product demonstrations.

Automotive Professionals, including mechanics and technicians, form a key customer segment for WD-40, demanding reliable products for vehicle maintenance. WD-40's Specialist line, featuring penetrants and degreasers, directly addresses their needs. In 2024, the automotive repair market is estimated at over $400 billion in the US alone, highlighting the segment's significance. WD-40's ability to meet these professionals' specialized requirements is vital for its market share.

Industrial workers are a key customer segment for WD-40. They rely on WD-40 for maintaining machinery in factories and workshops, valuing its effectiveness and longevity. Industrial distributors are crucial for reaching this segment, offering products and support tailored to their needs. In 2024, WD-40's sales to industrial users remained a steady revenue stream.

Homeowners

Homeowners represent a significant customer segment for WD-40, utilizing its products for diverse household applications. They value the product's versatility and ease of use for tasks like cleaning and lubrication. WD-40's widespread availability in retail stores and online platforms ensures convenient access for this segment. In 2024, retail sales of household cleaning products reached $61 billion.

- Versatile product use for various home tasks.

- Easy-to-use solutions for household needs.

- Convenient access through retail and online.

- Significant market share in the home maintenance sector.

Outdoor Enthusiasts

Outdoor enthusiasts represent a key customer segment for WD-40, encompassing individuals engaged in activities like biking, camping, and various sports. They depend on WD-40 products for the maintenance and upkeep of their equipment, valuing its protective and lubricating capabilities. In 2024, the outdoor recreation industry generated approximately $887 billion in economic output, indicating a substantial market for WD-40. Targeted marketing strategies and specialized product lines, such as WD-40 Bike, are crucial for meeting their specific needs.

- Outdoor recreation industry generated $887 billion in economic output in 2024.

- WD-40 Bike is a product line that caters to the specific needs of cyclists.

- Marketing strategies are targeted to attract this segment.

WD-40's customer segments include DIY enthusiasts, automotive professionals, industrial workers, homeowners, and outdoor enthusiasts.

Each segment values WD-40 for specific applications, driving sales across diverse markets.

WD-40 tailors marketing and product lines to meet each group's unique needs, ensuring market share.

| Customer Segment | Key Benefit | 2024 Market Relevance |

|---|---|---|

| DIY Enthusiasts | Versatility for home maintenance. | $484B home improvement spending (U.S.). |

| Automotive Professionals | Reliable vehicle maintenance solutions. | $400B+ automotive repair market (U.S.). |

| Industrial Workers | Machinery maintenance. | Steady sales to industrial users in 2024. |

| Homeowners | Ease of use. | $61B retail sales in household cleaning. |

| Outdoor Enthusiasts | Equipment upkeep. | $887B outdoor recreation economic output. |

Cost Structure

Manufacturing costs are a core element for WD-40, even with outsourced production. This includes raw materials, packaging, and the production process itself. In 2024, the cost of goods sold was approximately $173 million. Effective supply chain management is key for profit.

WD-40's cost structure significantly includes marketing and advertising. The company invests substantially to maintain brand presence and boost sales. This involves digital marketing, promotional campaigns, and sponsorships. In 2024, advertising and sales promotion costs were a significant portion of net sales. These expenses are crucial for maintaining market share.

Distribution expenses are key for WD-40, covering product transport to retailers and distributors globally. This includes managing a complex supply chain and logistics. In 2024, WD-40's focus is on optimizing distribution for efficiency. They aim to reduce costs while ensuring product availability. For example, in 2023, WD-40's cost of goods sold was around $185 million.

Research and Development

WD-40's cost structure includes significant investments in Research and Development (R&D). This allocation supports continuous innovation and enhancement of its product line. The company focuses on improving existing formulas and developing new products to meet market demands. R&D expenses are a key component of WD-40's strategy to deliver effective and relevant solutions.

- In fiscal year 2023, WD-40 spent $5.8 million on R&D.

- This investment represents approximately 1.9% of the company's net sales.

- WD-40 aims to expand its product portfolio to drive long-term growth.

- The company's R&D efforts are primarily focused on its Maintenance products.

Administrative Costs

Administrative costs at WD-40 include salaries, benefits, and overhead, critical for profitability. These costs, encompassing selling, general, and administrative expenses, are closely watched. Efficient management is key to financial health. In 2024, WD-40's SG&A expenses were a significant focus.

- SG&A expenses are closely monitored to enhance profitability.

- Administrative costs are a key component of the cost structure.

- Efficient management of these expenses is essential.

- WD-40's financial reports provide detailed insights.

WD-40's cost structure involves several key areas. Manufacturing, including raw materials and packaging, is a major expense; in 2024, the cost of goods sold was around $173 million. Marketing, advertising, and distribution expenses are also critical for maintaining market presence and global reach. R&D investments, with $5.8 million spent in 2023, ensure product innovation. Administrative costs, including SG&A, are closely monitored.

| Cost Category | Description | 2024 Data (Approx.) |

|---|---|---|

| Manufacturing | Raw materials, packaging, production | $173 million (COGS) |

| Marketing & Advertising | Digital, promotions, sponsorships | Significant portion of net sales |

| Distribution | Transport, supply chain | Focus on optimization |

| R&D | Product innovation | $5.8M (2023) approx. 1.9% of sales |

| Administrative | SG&A expenses | Closely monitored |

Revenue Streams

WD-40's main money-maker is the Multi-Use Product. It's sold worldwide, making up a big chunk of their income. In 2023, this product generated a substantial portion of the company's $556.9 million in net sales. Expanding sales areas and reaching more customers boosts this revenue stream.

WD-40 Specialist products, like penetrants, degreasers, and corrosion inhibitors, boost revenue. This targets pros and industries. In 2024, WD-40 Company's net sales were around $550 million, with Specialist sales playing a key role. Increased distribution and marketing are key for growth.

WD-40's revenue includes homecare and cleaning product sales, mainly in North America, the UK, and Australia. However, the company is strategically moving away from these to focus on higher-margin maintenance products. In 2023, WD-40 reported net sales of $557.9 million. The company is considering selling these brands. This shift aims to boost growth and profitability.

International Sales

WD-40's international sales are a cornerstone of its revenue, with products accessible in over 176 countries and territories. The company strategically prioritizes growth in these global markets. The EIMEA segment significantly boosts overall net sales. In fiscal year 2023, international sales accounted for a substantial portion of total revenue.

- International sales are a key revenue driver.

- Products are sold in over 176 countries.

- EIMEA segment is a major contributor.

- Global market growth is a strategic focus.

Licensing and Royalties

WD-40's revenue streams include licensing and royalties, offering another way to make money besides just selling products. This involves letting other companies use the WD-40 brand or its technology. These agreements generate additional income and broaden the brand's presence in the market. In 2023, WD-40 Company reported net sales of $556.8 million. Licensing can be a smart move for WD-40 to increase its revenue and brand visibility.

- Licensing agreements allow WD-40 to earn royalties.

- This expands the brand's reach.

- It provides an additional revenue stream.

- WD-40's net sales were $556.8 million in 2023.

WD-40 generates revenue through multiple streams, primarily from its core Multi-Use Product. This segment significantly contributed to the $556.8 million in net sales reported in 2023, with continued focus on global expansion. WD-40 Specialist products boost sales, targeting industrial and professional users. The company strategically leverages international sales, with products available in 176+ countries and the EIMEA segment driving revenue. Licensing and royalties further diversify income streams.

| Revenue Stream | Description | 2023 Net Sales Contribution |

|---|---|---|

| Multi-Use Product | Core product sales worldwide. | Significant portion of $556.8M |

| WD-40 Specialist | Sales of specialized products. | Key role in overall revenue |

| International Sales | Sales in over 176 countries. | Substantial portion of total revenue |

| Licensing & Royalties | Income from brand/tech usage. | Additional revenue source |

Business Model Canvas Data Sources

The WD-40 Business Model Canvas leverages market research, financial performance, and company documents. These provide accurate data across key segments.