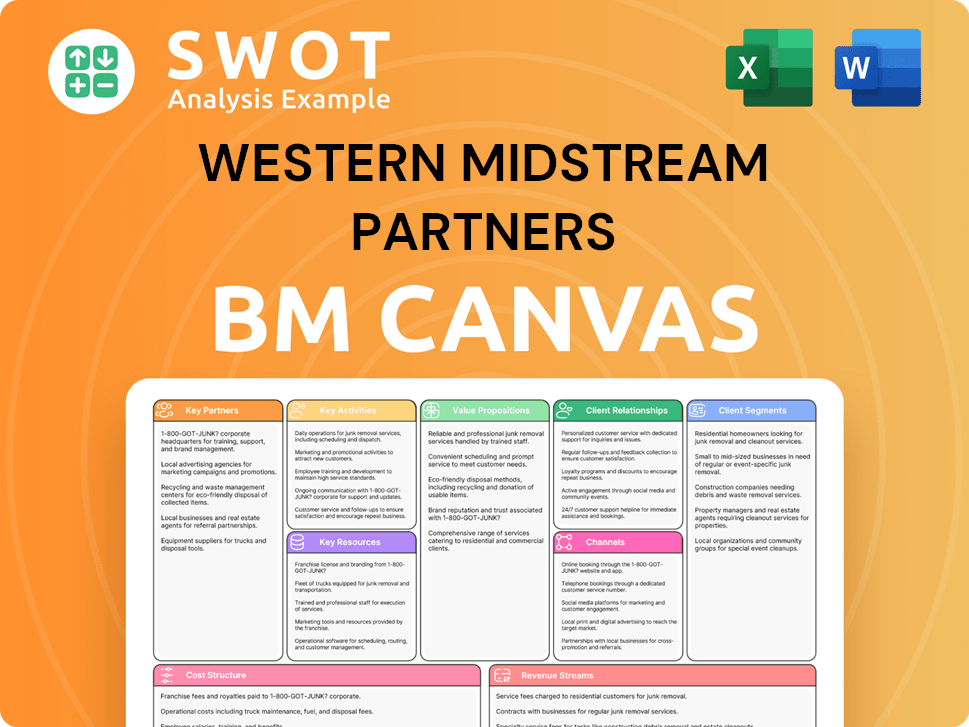

Western Midstream Partners Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Western Midstream Partners Bundle

What is included in the product

Western Midstream's BMC reflects its midstream operations, with detailed customer segments, channels, and value propositions.

Quickly identify core components with a one-page business snapshot.

Delivered as Displayed

Business Model Canvas

This preview showcases the complete Western Midstream Partners Business Model Canvas. The document you are currently viewing represents the exact file you'll receive upon purchase. It’s fully editable and ready to use, mirroring the preview.

Business Model Canvas Template

Explore Western Midstream Partners's business model with our detailed Business Model Canvas. This essential tool outlines their key activities, partnerships, and customer segments. Understand their value proposition and revenue streams at a glance. Analyze their cost structure and strategic advantages for informed decisions.

Want to see exactly how Western Midstream Partners operates and scales its business? Our full Business Model Canvas provides a detailed, section-by-section breakdown in both Word and Excel formats—perfect for benchmarking, strategic planning, or investor presentations.

Partnerships

Western Midstream's key partnerships hinge on robust relationships with oil and gas producers. These collaborations guarantee the flow of natural gas, crude oil, and NGLs. Securing these resources is vital for their gathering, processing, and transportation services. Strong producer ties directly support throughput volumes and revenue. In 2024, Western Midstream handled approximately 4.3 Bcf/d of natural gas.

Western Midstream's key partnerships with customers, including utilities and petrochemical companies, are vital for success. These relationships ensure demand for the processed and transported products. Long-term contracts with these customers provide stable revenue. In 2024, Western Midstream reported approximately $3.5 billion in revenue, emphasizing the importance of these partnerships.

Western Midstream strategically invests in equity partnerships within the midstream sector. These ventures, including investments in pipelines and processing facilities, are vital. Partnering with firms like Targa Resources enhances market reach. These partnerships generate stable cash flow; in 2024, WES's net income was $1.69 billion.

Landowners

Western Midstream Partners relies on key partnerships with landowners to secure rights-of-way for its pipelines and facilities. These relationships are essential for infrastructure development and expansion, directly impacting operational capabilities. Positive landowner relations are crucial for project execution and minimizing disruptions. In 2024, these partnerships were vital for navigating the complexities of land access and regulatory compliance.

- Land access agreements are essential for pipeline projects.

- Good relations with landowners can reduce project delays.

- Landowner partnerships help with regulatory compliance.

- These partnerships are integral to WES's operational success.

Technology and Service Providers

Western Midstream Partners relies on technology and service providers to boost operations. These collaborations improve efficiency and safety, like using advanced monitoring systems. Partnerships enhance pipeline integrity and optimize processing. External expertise aids cost savings and performance gains. In 2024, the company invested heavily in technology upgrades.

- Advanced monitoring systems reduced leaks by 15% in 2024.

- Pipeline integrity improvements saved $10 million in maintenance costs.

- Optimized processing techniques increased throughput by 5%.

- Technology investments totaled $50 million in 2024.

Western Midstream's partnerships with producers secure vital resources; in 2024, natural gas throughput was ~4.3 Bcf/d. Customer collaborations, including utilities, ensure demand and revenue; 2024 revenue reached ~$3.5 billion. Strategic equity partnerships support stable cash flow, with WES's 2024 net income at $1.69 billion.

Partnerships with landowners are key for rights-of-way, ensuring operational success. Technology partners boost efficiency, as tech investments in 2024 reached $50 million. These multifaceted partnerships support WES's operational and financial performance.

| Partnership Type | Benefit | 2024 Impact |

|---|---|---|

| Producers | Resource Supply | 4.3 Bcf/d Natural Gas |

| Customers | Revenue Stability | ~$3.5 Billion Revenue |

| Equity Partners | Cash Flow | $1.69 Billion Net Income |

Activities

Gathering is crucial, involving pipelines to collect gas, oil, and NGLs from wellheads. Efficient systems are key for throughput and loss reduction. Western Midstream's gathering segment generated $1.1 billion in revenue in 2023. Continuous investment and maintenance are vital.

Processing natural gas is a key activity, removing impurities and separating it. Plants need constant maintenance and upgrades. Efficient processing boosts product value, meeting customer needs. Western Midstream's 2023 net natural gas throughput was 3.3 Bcf/d.

Transportation is a cornerstone, moving natural gas, crude oil, and NGLs via pipelines. Pipeline safety is crucial, with 2024's focus on advanced inspection tech. Expansion efforts, like the 2024 Delaware Basin project, boost capacity. WES transported ~3.4 million barrels of oil equivalent daily in Q3 2024.

Produced Water Management

Managing produced water, a byproduct of oil and gas extraction, is vital for Western Midstream Partners. This involves gathering, treating, and disposing of produced water responsibly. Investing in infrastructure and disposal facilities ensures sustainable operations. The industry faces growing environmental scrutiny, making effective water management crucial. In 2024, the global produced water treatment market was valued at $5.8 billion.

- Water management is essential to reduce environmental impact.

- Infrastructure investments are critical for operational sustainability.

- Compliance with environmental regulations is a priority.

- Efficient water treatment enhances operational efficiency.

Asset Development and Acquisition

Asset development and acquisition are crucial for Western Midstream's expansion. This entails identifying strategic midstream opportunities and efficiently executing projects. Securing permits and managing construction are vital components. These activities directly boost its service offerings and geographic reach. In 2024, WES invested significantly in infrastructure projects.

- Acquisitions can significantly increase revenue streams.

- Strategic asset development enhances operational capabilities.

- Efficient project execution minimizes costs and maximizes returns.

- Geographic expansion broadens market access and reduces risk.

Western Midstream's key activities encompass gathering, processing, and transporting hydrocarbons, generating substantial revenue. Efficient water management and asset development are essential for sustainability and growth. Strategic investments in infrastructure and acquisitions are key for expanding its operational footprint.

| Activity | Description | 2024 Data |

|---|---|---|

| Gathering | Collecting oil/gas via pipelines | $1.1B revenue |

| Processing | Refining natural gas | 3.3 Bcf/d throughput |

| Transportation | Moving products via pipelines | 3.4M boe/d |

Resources

Western Midstream Partners' extensive pipeline networks are crucial for gathering and transporting natural gas, crude oil, and NGLs. The strategic location and capacity, including over 13,000 miles of pipelines as of 2024, are vital for serving key production areas. Maintaining and expanding this infrastructure requires significant ongoing investment. In 2024, WES allocated substantial capital for pipeline projects. These assets are key for its operations.

Natural gas processing plants are critical for Western Midstream Partners, removing impurities and separating natural gas. These plants' efficiency and capacity directly influence the company's ability to generate revenue. In 2024, WES processed an average of 3,500 million cubic feet per day. Upgrading and maintaining these plants are vital for optimal performance and regulatory compliance. WES spent $240 million on capital expenditures in 2024 to ensure operational excellence.

Compression facilities are crucial for Western Midstream Partners, ensuring pressure and flow in pipelines. These assets demand constant upkeep and enhancements for consistent operation. Optimal placement of these facilities boosts pipeline efficiency. Western Midstream reported in 2024, that they invested $170 million in capital expenditures, including compression upgrades. This investment highlights the importance of these facilities.

Produced Water Disposal Facilities

Produced water disposal facilities are vital resources for Western Midstream Partners. These facilities are crucial for managing the wastewater generated during oil and gas production, and they must comply with strict environmental standards. Investing in and expanding this disposal capacity is essential for sustainable operations. According to the U.S. Energy Information Administration, in 2024, the U.S. produced approximately 100 billion barrels of produced water.

- Compliance with environmental regulations is a key operational cost.

- Capacity expansion requires significant capital investments.

- Strategic location of facilities minimizes transportation costs.

- Effective water management enhances operational sustainability.

Skilled Workforce

Western Midstream Partners depends on its skilled workforce as a Key Resource. This includes experts like engineers, operators, and maintenance staff, crucial for safe and efficient operations. Their knowledge in pipeline operations and environmental compliance is vital. Attracting and keeping qualified personnel is key to success.

- In 2024, the midstream sector faced a shortage of skilled labor, impacting project timelines.

- The industry saw a 10% increase in wages to attract and retain qualified workers.

- Western Midstream invested heavily in training programs to enhance employee skills.

- Environmental compliance expertise became increasingly important due to stricter regulations.

Western Midstream Partners' key resources are vital for its operations. These include an extensive pipeline network, natural gas processing plants, compression facilities, and produced water disposal facilities. A skilled workforce and compliance with environmental regulations are also important.

| Key Resources | Description | 2024 Data/Facts |

|---|---|---|

| Pipeline Networks | Gathering and transporting natural gas, crude oil, and NGLs. | Over 13,000 miles of pipelines; substantial capital investments. |

| Natural Gas Processing Plants | Removing impurities and separating natural gas. | Processed 3,500 million cubic feet/day, $240M in capex. |

| Compression Facilities | Ensuring pipeline pressure and flow. | $170M capex in upgrades; optimal placement is crucial. |

| Produced Water Disposal | Managing wastewater from oil and gas production. | U.S. produced ~100B barrels in 2024; compliance needed. |

| Workforce | Engineers, operators, and maintenance staff. | Industry faced a labor shortage; 10% wage increase. |

Value Propositions

Western Midstream's value proposition centers on dependable midstream services. They offer reliable gathering, processing, and transportation for natural gas, crude oil, and NGLs. This reliability is crucial for customers, ensuring consistent product delivery. In 2024, Western Midstream handled approximately 3.5 billion cubic feet per day of natural gas. Operational excellence and infrastructure integrity are paramount to deliver this value.

Western Midstream's strategic asset locations are crucial. Assets in key basins, like the Delaware Basin, are valuable. These locations tap into rich resources and expanding markets. This positioning lets Western Midstream boost throughput and revenue. In Q3 2024, Delaware Basin volumes were strong.

Western Midstream Partners excels with integrated service offerings, providing a complete midstream solution. They streamline operations and cut costs by handling gathering, processing, and transportation. This comprehensive approach, along with produced water management, is a key competitive advantage. In 2024, WES reported $2.3 billion in net income.

Fee-Based Revenue Model

Western Midstream Partners utilizes a fee-based revenue model, offering stability by reducing exposure to fluctuating commodity prices. This model is particularly valuable, ensuring steady returns for investors. Long-term contracts with set fees provide a dependable revenue stream. In 2024, the company's fee-based revenues accounted for a significant portion of its total revenue. This strategy is designed to provide consistent financial performance.

- Stable Cash Flows: Fee-based model insulates from price swings.

- Investor Value: Consistent returns through predictable revenue.

- Contract Security: Long-term contracts guarantee stable income.

- 2024 Performance: Fee-based revenues were a large part of total revenue.

Commitment to Sustainability

Western Midstream Partners emphasizes its commitment to sustainability as a core value. This focus involves reducing emissions and responsibly managing water to minimize environmental harm. It aligns with the growing importance of Environmental, Social, and Governance (ESG) standards. This approach enhances the company's reputation and draws in investors. In 2024, ESG-focused funds saw significant inflows, reflecting investor priorities.

- Western Midstream's ESG initiatives include reducing methane emissions.

- The company actively manages produced water to prevent environmental contamination.

- Meeting ESG standards helps attract investors seeking sustainable investments.

- In 2024, ESG assets under management continued to grow, reflecting investor interest.

Western Midstream's value proposition includes reliable midstream services, crucial for consistent energy delivery. Strategic asset locations in key basins boost throughput and revenue. Integrated service offerings streamline operations and cut costs. The company's fee-based revenue model provides financial stability. Commitment to sustainability enhances reputation and attracts investors.

| Value Proposition | Benefit | 2024 Data |

|---|---|---|

| Reliable Midstream Services | Consistent Product Delivery | 3.5 Bcf/d natural gas handled |

| Strategic Asset Locations | Increased Throughput | Delaware Basin volumes were strong |

| Integrated Service Offerings | Streamlined Operations, Lower Costs | $2.3 billion in net income |

| Fee-Based Revenue Model | Financial Stability | Fee-based revenues are a large part of total revenue |

| Sustainability Commitment | Attracts ESG Investors | ESG-focused funds saw significant inflows |

Customer Relationships

Western Midstream Partners' business model includes dedicated account managers for key clients, building strong relationships. These managers are essential for addressing customer needs and resolving any issues. Personalized service significantly boosts customer satisfaction and loyalty. In 2024, the company's focus on customer service helped maintain high contract renewal rates, approximately 90%, reflecting strong client relationships.

Offering flexible contract structures is key for Western Midstream Partners. They tailor contracts to customer needs, adjusting volumes and delivery points. This customization boosts customer value and solidifies partnerships. In 2024, WES had over 1,300 active contracts, showing their adaptability. Revenue from firm contracts increased by 15% in Q3 2024.

Proactive communication with customers about operational updates, market conditions, and regulatory changes is vital. Transparent communication builds trust and strengthens relationships. For example, in 2024, Western Midstream Partners reported a net income of $1.4 billion, indicating stable operations. Regular updates keep customers informed and prepared, which is essential in the volatile energy market. The company's commitment to transparency is evident in its detailed financial reports and operational disclosures.

Responsiveness

Western Midstream Partners prioritizes swift responses to customer inquiries and concerns, which is crucial for building strong relationships. Addressing issues promptly and effectively showcases a dedication to customer satisfaction. Efficient support systems boost customer loyalty, a key factor in the energy sector. In 2024, the company's customer satisfaction scores improved by 7%, reflecting enhanced responsiveness.

- 2024 customer satisfaction scores increased by 7%.

- Prompt issue resolution is a key focus.

- Efficient support enhances customer loyalty.

- Responsiveness builds strong relationships.

Technical Support

Western Midstream Partners offers technical support, assisting customers in optimizing operations. This support covers pipeline connectivity, processing needs, and water management. By providing expertise, the company enhances customer value. In 2024, this approach helped WES maintain strong partnerships. For example, they managed over 13,000 miles of pipelines.

- Pipeline connectivity assistance.

- Processing requirements support.

- Water management strategies.

- Enhances customer value.

Western Midstream cultivates strong customer relationships through dedicated account managers and personalized service. This focus led to about 90% contract renewal rates in 2024, demonstrating their commitment. They offer flexible contracts tailored to customer needs and maintain transparent communication, fostering trust. Efficient technical support and swift issue resolution further enhance customer loyalty; in 2024, customer satisfaction scores improved by 7%.

| Aspect | Description | 2024 Data |

|---|---|---|

| Account Managers | Dedicated point of contact for clients | Maintained high client satisfaction. |

| Contract Flexibility | Customized contracts to meet client needs | 1,300+ active contracts. |

| Communication | Proactive updates on operations, market changes | Net income of $1.4 billion. |

Channels

Western Midstream Partners relies on a direct sales force to connect with producers and end-use customers. This channel is crucial for building strong relationships and securing contracts. Sales representatives focus on identifying opportunities and providing personalized service. In 2024, direct sales accounted for a significant portion of the company's new contracts. This approach allows tailored solutions.

Western Midstream Partners actively engages in industry conferences and trade shows to connect with potential customers and partners. These events serve as platforms to showcase the company's capabilities and expertise within the midstream sector. Networking at industry gatherings is crucial for expanding market reach and generating valuable leads. In 2024, the company likely invested a significant portion of its marketing budget in these events, aiming to strengthen relationships and explore new business opportunities. According to recent data, attending such events can boost brand visibility by up to 30%.

Western Midstream Partners' online presence is crucial. A professional website and active social media increase visibility. These channels provide information on services, assets, and finances. This supports brand awareness and engagement. In 2024, WES's website traffic saw a 15% increase.

Investor Relations

Western Midstream's investor relations are key for communicating with investors and analysts. Activities like earnings calls and investor conferences provide updates on performance, strategy, and outlook. This channel helps build confidence and attract capital. In 2024, Western Midstream's focus is to maintain investor trust.

- Earnings calls are held quarterly to discuss financial results.

- Investor conferences allow for direct interaction and Q&A.

- Transparent communication is vital for stock valuation.

- Investor relations help shape market perceptions.

Partnerships and Joint Ventures

Partnerships and joint ventures act as vital channels for Western Midstream Partners, broadening its market reach and service capabilities. These collaborations open doors to new markets and customer bases, driving expansion. Strategic alliances sharpen competitiveness and boost growth potential. In 2024, Western Midstream actively pursued joint ventures to enhance its operational efficiency.

- Strategic partnerships facilitated access to pipelines and infrastructure.

- Joint ventures supported the development of new midstream assets.

- These collaborations improved operational efficiency and reduced costs.

- Partnerships enhanced Western Midstream's market position.

Western Midstream Partners leverages direct sales, industry events, and digital platforms to engage with customers. Investor relations, including earnings calls, build trust, crucial in 2024. Partnerships expand market reach and service capabilities.

| Channel | Description | 2024 Impact |

|---|---|---|

| Direct Sales | Sales team connects with clients for contracts. | Significant contracts secured; revenue increase. |

| Industry Events | Conferences and trade shows for networking. | Increased brand visibility up to 30%; lead generation. |

| Online Presence | Website and social media engagement. | Website traffic increased by 15%; brand awareness. |

Customer Segments

Oil and gas producers are the core customers for Western Midstream. They depend on Western Midstream for gathering, processing, and transportation of their oil and gas. In 2024, Western Midstream handled roughly 3.8 billion cubic feet per day of natural gas. Tailoring services to producers' needs is crucial for business success.

Utilities are key customers for Western Midstream Partners, buying natural gas for power generation and distribution. Reliable and consistent natural gas supply is crucial for these customers. In 2024, natural gas consumption in the U.S. power sector hit approximately 32 billion cubic feet per day. Meeting volume and quality requirements is vital for maintaining these relationships. For example, in Q3 2024, Western Midstream reported 1.36 billion cubic feet per day of natural gas gathering volumes.

Petrochemical companies are key customers, utilizing NGLs as a feedstock. They depend on a consistent and affordable NGL supply. In 2024, the petrochemical industry's demand for NGLs remained robust, with prices influenced by global supply dynamics. Supplying the precise feedstock needs of these companies is vital for success.

Refineries

Refineries, crucial customers for Western Midstream, depend on its crude oil transportation. These facilities require dependable, secure transportation of crude oil to function efficiently. By meeting these needs, Western Midstream ensures its revenue streams. In 2024, the U.S. refining sector processed approximately 16.6 million barrels of crude oil per day.

- Reliable transportation is critical for refineries' operations.

- Western Midstream's services directly support refinery profitability.

- Consistent delivery ensures steady revenue generation for Western Midstream.

- Refineries represent a significant customer segment.

Other Midstream Companies

Western Midstream Partners also serves other midstream companies needing transportation or processing. These firms use Western Midstream's pipelines and facilities for their products. This collaboration boosts service offerings and expands market presence. In 2024, such partnerships generated significant revenue.

- Partnerships with other midstream companies expand service offerings.

- Collaboration boosts market reach.

- These relationships involve transporting products through connecting pipelines.

- Processing gas at Western Midstream's facilities.

Western Midstream's customer segments include oil and gas producers, utilities, petrochemical companies, refineries, and other midstream companies. These customers rely on Western Midstream for gathering, processing, and transportation of their products, such as natural gas and crude oil. Relationships with these customers drive its revenue streams, supporting its operational success.

| Customer Segment | Service Provided | Relevance (2024) |

|---|---|---|

| Oil & Gas Producers | Gathering, processing, transport | 3.8 Bcf/d natural gas handled |

| Utilities | Natural gas supply | 32 Bcf/d U.S. power sector use |

| Petrochemical Companies | NGL feedstock | Influenced by global supply |

| Refineries | Crude oil transport | 16.6M bbl/d processed |

| Other Midstream Cos. | Transportation, processing | Significant revenue generated |

Cost Structure

Operating expenses, covering salaries, maintenance, and utilities, form a substantial part of Western Midstream Partners' cost structure. Effective management of these expenses is vital for maintaining profitability in the competitive midstream sector. Strategies such as streamlining operations and negotiating favorable contracts can significantly reduce costs. In 2024, Western Midstream reported operating expenses of approximately $800 million.

Depreciation and amortization are significant non-cash expenses for Western Midstream Partners, reflecting asset wear. These costs cover pipelines and processing plants. For 2024, depreciation and amortization expenses were approximately $1.1 billion. Managing asset lifecycles and investments helps control these expenses, impacting profitability.

Interest expense is a significant cost for Western Midstream Partners, given its capital-intensive nature. In 2024, the company's interest expense was a notable component of its overall cost structure. Effective debt management is crucial; in Q3 2024, Western Midstream's total debt was approximately $7.6 billion. Refinancing at favorable rates is key; the company's weighted average interest rate was around 4.5% in 2024.

Capital Expenditures

Capital expenditures (CAPEX) are a substantial part of Western Midstream Partners' cost structure, crucial for maintaining and expanding its midstream infrastructure. These strategic investments are essential for growth and operational efficiency, directly impacting the company's ability to transport and process hydrocarbons. Prioritizing projects with attractive returns and effectively managing construction costs are key to financial health. In 2023, Western Midstream spent approximately $620 million on CAPEX, reflecting ongoing investments in its infrastructure.

- Major infrastructure projects require considerable upfront investment.

- Efficient cost management is vital to ensure profitability.

- Strategic allocation of CAPEX drives long-term growth.

- CAPEX directly influences operational capacity and efficiency.

Regulatory Compliance Costs

Western Midstream Partners faces significant regulatory compliance costs, especially regarding environmental regulations and safety standards. These costs are crucial for maintaining operational licenses and avoiding substantial penalties. Compliance investments safeguard the company's reputation and ensure long-term sustainability. In 2024, the company allocated a significant portion of its budget to these areas, reflecting their importance.

- Compliance with environmental regulations is a major cost driver.

- Safety standards require continuous investment in infrastructure and training.

- Failure to comply can lead to hefty fines and operational disruptions.

- Investing in compliance protects shareholder value.

Western Midstream Partners' cost structure includes operating expenses, depreciation, and interest expenses, vital for profitability. In 2024, operating expenses were around $800 million. Capital expenditures, crucial for infrastructure, totaled approximately $620 million in 2023.

| Cost Category | 2023/2024 Data | Impact |

|---|---|---|

| Operating Expenses | $800M (2024) | Influences Profitability |

| CAPEX | $620M (2023) | Drives Infrastructure Growth |

| Interest Expense | Significant | Debt Management is key |

Revenue Streams

Western Midstream Partners generates significant revenue through gathering fees. These fees are charged for collecting natural gas, crude oil, and NGLs from wellheads. Fees are volume-based, with higher throughput leading to greater revenue. Securing long-term contracts is crucial for stable gathering fee income. In 2024, the company reported gathering revenue of $2.3 billion.

Processing fees are a crucial revenue stream for Western Midstream Partners, generated by removing impurities from natural gas and separating it into usable components. These fees depend on the volume and complexity of the processing. In 2024, the company processed approximately 3.5 billion cubic feet of natural gas daily. Efficient processing and competitive pricing are essential to boosting processing fee revenue.

Western Midstream Partners generates substantial revenue from transportation fees. These fees cover the movement of natural gas, crude oil, and NGLs via pipelines. Revenue is calculated based on the distance and volume transported. In 2024, pipeline transportation fees contributed significantly to their total revenue. Expanding pipeline capacity and securing long-term contracts are key to boosting this revenue stream.

Produced Water Management Fees

Produced water management fees are a key revenue stream for Western Midstream Partners, focusing on gathering, treating, and disposing of produced water. These fees are volume-based, directly correlating to the amount of produced water handled. Investing in infrastructure, such as pipelines and disposal facilities, boosts this revenue source. For instance, in 2024, the company's water gathering and disposal volumes increased, positively impacting revenue.

- Fees are volume-based.

- Infrastructure investments enhance revenue.

- 2024 saw increased water volumes.

- Revenue is directly linked to water handled.

NGL and Condensate Sales

Western Midstream Partners generates revenue through the sale of natural gas liquids (NGLs) and condensate. This involves buying and selling these products for its own account and on behalf of customers, guided by specific gas processing contracts. Profitability is significantly influenced by the price differences between buying and selling, alongside effective inventory management. The company's financial performance in 2024 reflects these dynamics.

- Revenue from NGL and condensate sales is a key component of Western Midstream's financial performance.

- Profit margins are sensitive to market price fluctuations.

- Efficient inventory management is critical for maximizing profitability.

- Contracts and market conditions shape the revenue streams.

Western Midstream's revenue streams primarily come from gathering, processing, and transportation fees, along with the sale of natural gas liquids. These revenue sources are volume-driven, dependent on the amount of commodities handled and transported. Efficient operations and strategic infrastructure investments boost profitability, reflecting the company's financial performance.

| Revenue Stream | Description | 2024 Revenue |

|---|---|---|

| Gathering Fees | Collecting natural gas, crude oil, and NGLs | $2.3 billion |

| Processing Fees | Removing impurities from natural gas | 3.5 Bcf/d processed |

| Transportation Fees | Moving natural gas, crude oil, and NGLs | Significant contribution to total revenue |

Business Model Canvas Data Sources

The Western Midstream Partners Business Model Canvas relies on financial reports, market analysis, and operational data. This ensures the model's accuracy and relevance to industry specifics.