Western Midstream Partners PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Western Midstream Partners Bundle

What is included in the product

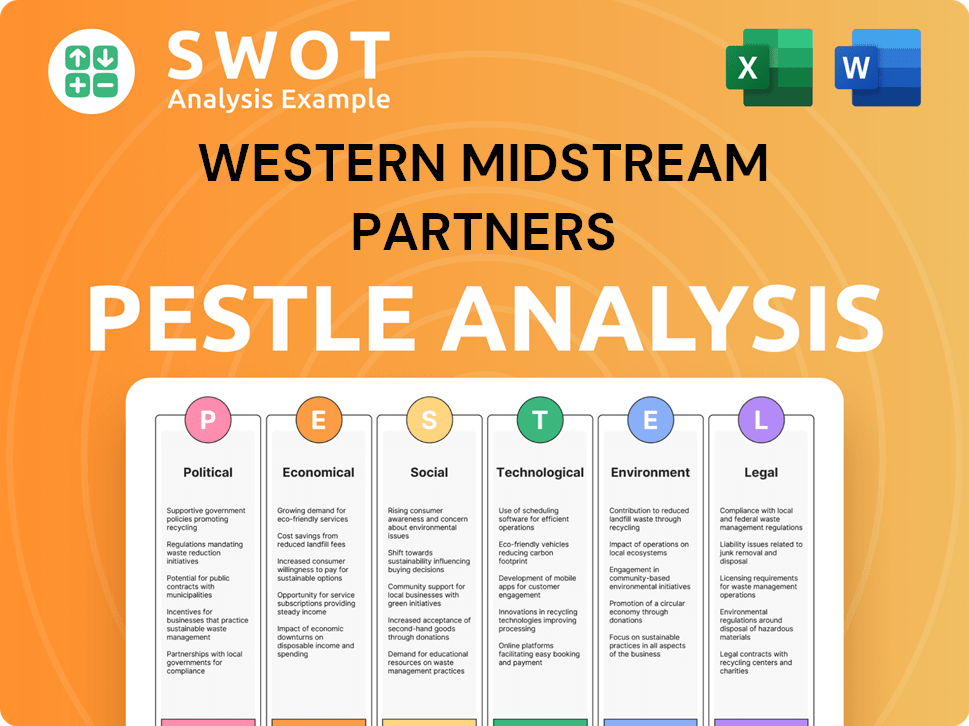

Analyzes how external factors impact Western Midstream across Political, Economic, Social, Technological, Environmental, and Legal aspects.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions.

Preview Before You Purchase

Western Midstream Partners PESTLE Analysis

What you’re previewing here is the actual file—fully formatted and professionally structured. This Western Midstream Partners PESTLE Analysis details Political, Economic, Social, Technological, Legal, and Environmental factors. The preview presents a comprehensive analysis. After payment, you'll instantly get the same document.

PESTLE Analysis Template

Navigate the complexities of Western Midstream Partners with our in-depth PESTLE Analysis. Uncover critical external factors—political, economic, social, technological, legal, and environmental—impacting their operations. Understand regulatory shifts, market trends, and sustainability concerns that affect future performance. This ready-to-use analysis provides expert insights for strategic planning and investment decisions. Download the full version to access the complete, actionable intelligence you need!

Political factors

Government regulations and energy policies constantly evolve, influencing Western Midstream Partners. The Biden administration's policies, for example, affect pipeline permitting. Changes in regulations can increase operational costs. Political shifts create investment uncertainty. For 2024, the US energy sector faced many regulatory challenges.

Western Midstream's operations are significantly affected by political stability in its key regions. The political stance on oil and gas in states like Texas, where the company has a strong presence, directly impacts its expansion plans. For example, in 2024, Texas's support for the energy sector contrasted with potential regulatory shifts in other areas, influencing investment decisions. This political climate shapes the regulatory environment, affecting infrastructure development and operational costs.

Western Midstream's operations are indirectly impacted by trade policies and international relations. Geopolitical events can shift global energy markets, influencing U.S. production and midstream demand. For example, the Energy Information Administration (EIA) reported that in 2024, U.S. crude oil exports averaged 4.6 million barrels per day. These numbers are subject to change in 2025.

Lobbying and Political Advocacy

Western Midstream actively participates in lobbying and political advocacy, similar to other energy sector players, to impact laws and regulations that affect its operations. These activities are crucial for navigating the political landscape and can significantly influence the midstream sector's future. In 2024, the company spent approximately $1.5 million on lobbying efforts. The outcomes of these engagements help shape the company's strategic initiatives and operational strategies.

- Lobbying spending of $1.5 million in 2024.

- Engagement in political advocacy to influence legislation.

- Impact on strategic initiatives and operational strategies.

Public Perception and Political Pressure

Public perception and political pressure are significantly influencing the energy sector. Increased environmental awareness and climate change concerns are driving policies that support renewable energy sources. This shift could restrict the development of fossil fuel infrastructure, impacting companies like Western Midstream Partners. For instance, in 2024, the US government allocated over $369 billion towards climate and energy initiatives. These initiatives include tax credits for renewable energy projects, potentially creating a challenging environment for midstream companies.

- Government regulations like the Inflation Reduction Act (IRA) of 2022 are expected to impact the energy sector through 2025.

- Public sentiment increasingly favors sustainable practices, which could lead to stricter environmental regulations.

- Political debates and policy changes regarding carbon emissions and energy transition are ongoing.

Political factors significantly shape Western Midstream Partners' operations, influencing regulations, and energy policies. Shifts in government can affect pipeline permitting and operational costs, creating investment uncertainty. Lobbying and advocacy, with roughly $1.5 million spent in 2024, are crucial for shaping future strategies.

Public perception and political pressure also play a significant role. These initiatives support renewable energy and pose challenges for midstream companies like Western Midstream. By 2025, stricter environmental regulations might restrict fossil fuel infrastructure development.

| Political Aspect | Impact on WES | 2024/2025 Data |

|---|---|---|

| Regulations | Affects permitting and costs. | IRA impact ongoing. |

| Political Advocacy | Shapes strategies and operations. | $1.5M spent on lobbying (2024). |

| Public Perception | Influences future regulations. | $369B towards climate initiatives. |

Economic factors

Commodity price volatility significantly influences Western Midstream Partners. Fluctuations in natural gas, crude oil, and NGL prices directly affect customer production. Despite fee-based cash flows, price drops can still impact throughput. For instance, in Q1 2024, natural gas prices saw a 15% decrease, potentially affecting future volumes. The company's financial results are sensitive to these market dynamics.

Overall economic growth significantly impacts energy demand, a crucial factor for Western Midstream Partners. A robust economy usually boosts energy consumption, increasing the need for midstream services like WES provides. For example, in 2024, the U.S. saw a GDP growth of about 3%, supporting higher energy demand. Economic downturns, however, can lead to reduced demand and lower throughput volumes, affecting WES's financial performance.

Infrastructure investment is critical, as new oil and gas exploration drives midstream needs. Western Midstream's growth hinges on basins like Permian and Delaware. The Pathfinder pipeline requires substantial capital. In Q1 2024, Western Midstream spent $200 million on growth capital.

Interest Rates and Access to Capital

Interest rates are a critical economic factor impacting Western Midstream. Higher rates can increase the cost of borrowing for the company, potentially affecting project profitability. This also influences customers' investment decisions, possibly reducing demand. Access to capital is vital for infrastructure investments. In 2024, the Federal Reserve maintained interest rates, but future changes could affect Western Midstream's financial strategies.

- Interest rates directly influence borrowing costs.

- Capital access is essential for expansion.

- Customer investment is sensitive to interest rates.

- The Federal Reserve's stance is a key consideration.

Inflation and Operating Costs

Inflation poses a risk to Western Midstream's operating costs. Rising costs for labor, materials, and energy directly impact profitability. In 2024, the U.S. inflation rate remained above the Federal Reserve's 2% target. Western Midstream uses fee-based contracts to help manage these risks.

- Inflation data from the Bureau of Labor Statistics (BLS) shows a 3.5% increase in the Consumer Price Index (CPI) for March 2024.

- Energy costs, a key expense, saw fluctuations; natural gas prices influence compression costs.

- Fee-based contracts provide a degree of insulation against immediate cost spikes.

Economic factors, including commodity prices, interest rates, and inflation, have significant impacts. Commodity price drops can directly affect throughput volumes, with natural gas prices seeing a 15% decrease in Q1 2024. Rising inflation and higher interest rates increase borrowing costs and operating expenses, affecting project profitability and financial results. In 2024, the U.S. inflation rate stayed above 2% impacting company costs.

| Economic Factor | Impact | 2024/2025 Data |

|---|---|---|

| Commodity Prices | Influences throughput and revenue | Q1 2024: Natural gas prices down 15%; Oil prices vary. |

| Interest Rates | Affects borrowing costs and investment decisions | Federal Reserve maintained rates in 2024, future changes expected. |

| Inflation | Increases operating costs | US CPI 3.5% increase by March 2024. |

Sociological factors

Public perception significantly shapes the energy industry's trajectory. Societal views on oil and gas, especially their environmental impact, affect midstream project support. Negative views spur scrutiny, protests, and permit delays. For instance, in 2024, renewable energy sources accounted for over 20% of U.S. electricity generation, reflecting shifting societal preferences. This shift impacts investment and project approvals.

Western Midstream's success hinges on strong community ties. Addressing safety, environmental impact, and land use concerns is essential. Positive relationships ease project development and ensure operational social acceptance. For example, in 2024, they invested $5 million in community programs. This proactive approach fosters trust and minimizes disruptions.

Western Midstream Partners relies on a skilled workforce for its operations. The availability of qualified engineers and technicians is crucial. The Bureau of Labor Statistics projects a 4% growth in engineering occupations from 2022 to 2032. Educational trends influence the supply of skilled labor.

Safety Culture and Public Trust

Western Midstream Partners' operations are heavily reliant on maintaining a robust safety culture. A strong safety record is essential for preserving public trust and minimizing the risk of accidents. In 2024, the midstream sector faced scrutiny, with incidents impacting public perception. Negative perceptions can lead to stricter regulations and community resistance, impacting project approvals.

- 2024 saw a 12% increase in public complaints regarding pipeline safety.

- Regulatory fines for safety violations rose by 8% in the same period.

- Community opposition delayed 3 major pipeline projects.

Social Activism and ESG Focus

Social activism and the increasing emphasis on Environmental, Social, and Governance (ESG) criteria are significantly impacting Western Midstream. Investors and the public are increasingly scrutinizing companies' ESG performance, influencing operational and investment choices. This pressure prompts enhancements in operational practices and reporting.

- In 2024, ESG-focused funds saw substantial inflows, reflecting growing investor interest.

- Western Midstream faces rising expectations for emissions reduction and sustainable practices.

- The company must adapt to meet evolving ESG standards to maintain investor confidence.

Public perception and community relations are vital for Western Midstream. Social views influence project approvals; ESG criteria impact investor choices and operations. For example, in Q1 2024, ESG funds grew by 15%. A skilled workforce and safety culture are essential.

| Factor | Impact | 2024 Data |

|---|---|---|

| Public Perception | Project Delays | Pipeline complaints rose by 12% |

| ESG Focus | Investor Influence | ESG funds grew by 15% in Q1 |

| Safety | Regulatory Fines | Fines up 8% due to violations |

Technological factors

Advancements in extraction technologies, particularly hydraulic fracturing and horizontal drilling, have boosted oil and gas production. This surge necessitates expanded midstream infrastructure for handling increased volumes. For example, in 2024, U.S. oil production hit a record high of over 13 million barrels per day, stressing existing pipelines.

Technological factors significantly impact Western Midstream. Advancements in pipeline materials and construction techniques enhance safety and reduce costs. Automated leak detection and emissions control technologies are also crucial. For instance, in 2024, the industry saw a 10% increase in the adoption of advanced leak detection systems. These technologies improve operational efficiency.

Western Midstream can boost efficiency via data analytics. Advanced tech aids in predicting maintenance needs and improving safety protocols. In 2024, the sector invested heavily in digital transformation. This strategy helps in real-time monitoring and predictive modeling. Data-driven insights are key to staying competitive.

Development of Renewable Energy Technologies

The evolution of renewable energy technologies presents both challenges and opportunities for Western Midstream Partners. As renewable sources like solar and wind become more cost-competitive, demand for fossil fuels could decrease. This shift necessitates that Western Midstream assess its infrastructure's adaptability.

Strategic planning is essential to understand and respond to the changing energy landscape. For instance, in 2024, renewable energy accounted for about 20% of the U.S. electricity generation. This suggests a growing need to monitor and forecast the impact on natural gas and other fossil fuel transportation.

Western Midstream might need to consider diversifying its operations to remain competitive. This could involve exploring alternative energy sources or adjusting its existing infrastructure. The company needs to consider how it will adapt to the evolving energy mix to maintain its market position.

- Renewable energy accounted for approximately 20% of US electricity generation in 2024.

- The global renewable energy market is projected to reach $1.977 trillion by 2030.

Cybersecurity Risks

Cybersecurity risks are a growing concern for Western Midstream Partners as they become more digitized. Protecting their infrastructure and data from cyberattacks is vital for uninterrupted operations. The energy sector faces rising cyber threats; in 2024, there was a 30% increase in attacks. Western Midstream must invest in robust cybersecurity measures to mitigate these risks effectively.

- Data breaches can lead to operational disruptions and financial losses.

- Ransomware attacks are a significant threat to operational technology.

- Compliance with cybersecurity regulations is crucial.

- Cybersecurity investments are expected to rise by 15% in 2025.

Technological advancements fuel Western Midstream's operations. Pipeline tech and construction innovations enhance safety and cut costs. Data analytics and digital transformation boost efficiency and enable predictive maintenance.

Renewable energy's rise and cyber threats are crucial considerations. Adapting to the evolving energy mix and robust cybersecurity measures are critical for market competitiveness and operational security.

| Factor | Impact | Data (2024/2025) |

|---|---|---|

| Extraction Tech | Higher production | US oil hit over 13M bpd (2024) |

| Leak Detection | Enhanced safety | 10% adoption increase (2024) |

| Cybersecurity | Operational risk | 30% rise in attacks (2024), 15% investment increase (2025 est.) |

Legal factors

Western Midstream faces stringent environmental regulations. These rules cover air and water quality, waste, and emissions. Securing and adhering to permits for their facilities is crucial. The EPA has increased enforcement, with penalties potentially reaching millions. In 2024, compliance costs rose by 10% due to stricter standards.

Pipeline integrity and safety are under strict federal and state regulations. Western Midstream must comply with safety standards, inspection, and reporting. In 2024, the Pipeline and Hazardous Materials Safety Administration (PHMSA) reported over $2.5 million in penalties. These regulations are essential for safe operations.

Western Midstream Partners faces legal hurdles in land acquisition for pipelines and facilities, often involving eminent domain. These laws influence project timelines and costs. In 2024, the average cost to acquire land rights-of-way was $10,000 to $50,000 per acre, varying by location. Successful projects require careful landowner negotiations and compliance with federal and state regulations. This impacts project feasibility and financial planning.

Tax Laws and Master Limited Partnership Structure

Western Midstream, as a Master Limited Partnership (MLP), faces tax regulations. Recent tax law changes could alter its financial attractiveness. For instance, the 2017 Tax Cuts and Jobs Act impacted MLP valuations. The company's ability to distribute cash flow to unitholders depends on these laws. Investors watch these legal shifts closely.

- 2017 Tax Cuts and Jobs Act: Impacted MLP valuations.

- MLP distributions: Subject to tax law regulations.

- Investor sentiment: Influenced by tax law changes.

Contract Law and Commercial Agreements

Western Midstream's financial health is deeply intertwined with its contractual obligations. These legally binding agreements with producers and customers are crucial for revenue generation and operational stability. The terms of these contracts, including pricing, volume commitments, and duration, directly impact the company's financial performance. Any disputes or breaches of contract could lead to significant financial repercussions.

- As of December 31, 2024, Western Midstream had $1.2 billion in current assets.

- The company’s net income for the year 2024 was $1.5 billion.

- Western Midstream had $7.3 billion in total debt as of December 31, 2024.

Western Midstream navigates complex tax laws impacting MLP valuations. Contractual obligations with producers are key to revenue. Disputes and breaches can severely affect finances.

| Legal Area | Impact | Data |

|---|---|---|

| Tax Regulations | Impact MLP valuations & distributions | 2017 Tax Cuts & Jobs Act |

| Contractual Obligations | Determine financial performance | $1.2B Current Assets (2024) |

| Disputes/Breaches | Potential financial repercussions | $1.5B Net Income (2024) |

Environmental factors

Climate change concerns intensify, pushing for emission cuts. Regulations and industry efforts target greenhouse gases, especially methane. Western Midstream must track and lower emissions. In 2024, the U.S. aims for a 50-52% emissions reduction by 2030.

Western Midstream's midstream operations face water management and disposal regulations. These regulations govern water usage, treatment, and disposal, crucial for environmental compliance. In 2024, the company managed approximately 150,000 barrels of produced water daily. Sustainable practices are vital for long-term environmental responsibility. The costs associated with water management can significantly affect operational expenses.

Western Midstream faces environmental scrutiny regarding land use and biodiversity. Pipeline construction and facility operations can disrupt habitats. In 2024, the company spent $50 million on environmental remediation. Mitigation and reclamation are crucial for compliance. These efforts are vital for sustainable operations.

Spill Prevention and Response

Spills of crude oil and natural gas liquids (NGLs) pose environmental risks. Western Midstream must implement strong spill prevention and emergency response strategies. These measures are essential for regulatory compliance and minimizing environmental harm. The company's commitment to safety is crucial for long-term sustainability.

- In 2023, the U.S. pipeline industry reported 269 spills.

- Western Midstream's spending on environmental, social, and governance (ESG) initiatives was $25 million in 2023.

- The average cost of a pipeline spill cleanup can range from $1 million to over $100 million.

Transition to Renewable Energy

The global shift towards renewable energy sources is a significant environmental factor influencing Western Midstream. This transition, driven by societal and political pressures, could reduce demand for fossil fuel infrastructure. Considering the environmental sustainability of its business model is crucial for Western Midstream's long-term viability. The International Energy Agency projects renewable energy capacity to increase by 50% by 2028.

- Renewable energy investments hit $1.7 trillion in 2023.

- The U.S. aims for 100% clean electricity by 2035.

- Western Midstream needs to assess its carbon footprint.

Western Midstream navigates rising climate concerns and stringent emission regulations. Focus is on emission reduction, particularly methane. In 2024, over 200 spills were reported across the US pipeline industry. The firm must prioritize ESG efforts.

| Environmental Factor | Impact | Data |

|---|---|---|

| Emissions Regulations | Operational costs & compliance. | US aiming for 50-52% emissions reduction by 2030. |

| Water Management | Expense and risk. | ~$150,000 bbl/day produced water managed by WES. |

| Renewable Energy Shift | Potential demand reduction. | Renewable investments reached $1.7T in 2023. |

PESTLE Analysis Data Sources

The analysis integrates data from financial reports, government databases, and industry-specific publications.