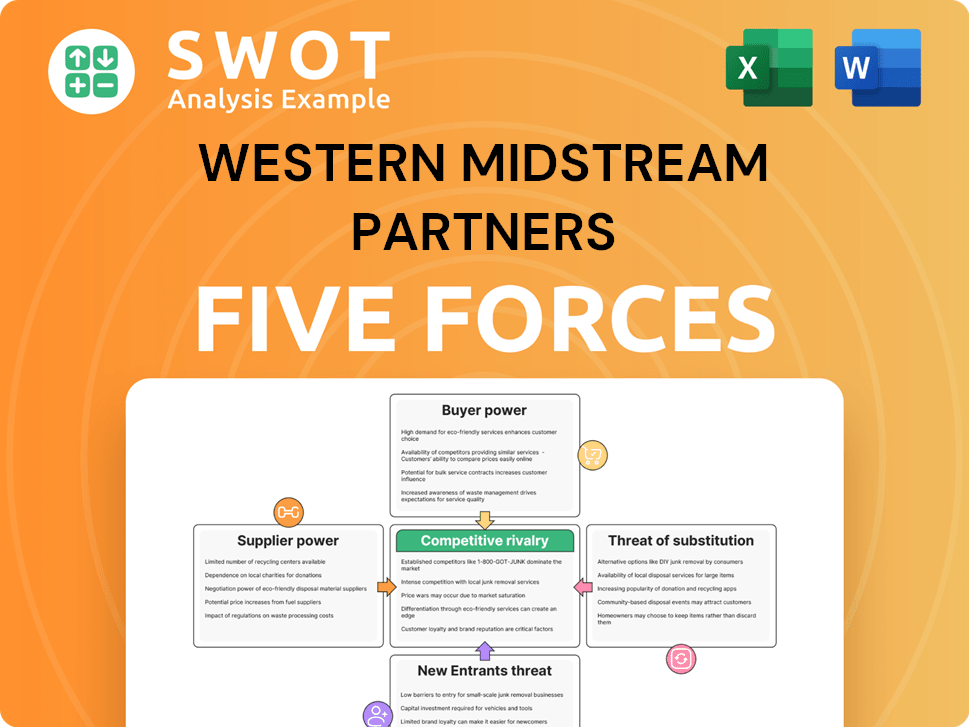

Western Midstream Partners Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Western Midstream Partners Bundle

What is included in the product

Tailored exclusively for Western Midstream Partners, analyzing its position within its competitive landscape.

Instantly visualize competitive forces with a dynamic, easy-to-interpret spider chart.

Same Document Delivered

Western Midstream Partners Porter's Five Forces Analysis

This preview presents the full Western Midstream Partners Porter's Five Forces analysis. The complete document you'll receive details all forces: competitive rivalry, supplier power, buyer power, threat of substitutes, and threat of new entrants. It's a ready-to-use professional assessment. Download the exact file instantly after purchase.

Porter's Five Forces Analysis Template

Western Midstream Partners faces moderate buyer power due to the concentration of its customers. Supplier power is influenced by the availability of pipelines and processing facilities. The threat of new entrants is somewhat limited by high capital costs and regulatory hurdles. Substitute products pose a modest threat given the nature of the energy industry. Competitive rivalry is strong due to a few key players.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Western Midstream Partners’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

The midstream energy sector, including Western Midstream Partners, faces supplier concentration due to specialized equipment and services. This limited supplier pool boosts their bargaining power. Disruptions from a single supplier could severely impact costs and timelines. In 2024, supply chain issues slightly increased operating expenses.

Suppliers of specialized equipment, such as compressors and pipelines, wield significant power. Western Midstream relies heavily on these specialized inputs, hindering quick supplier changes. This dependency empowers suppliers to influence prices and contract specifics. For example, in 2024, the cost of pipeline steel increased by approximately 7%, impacting project budgets.

Long-term contracts significantly influence supplier power. In 2024, Western Midstream's contracts may provide stability or expose it to risks. Favorable contracts can buffer against cost fluctuations. Unfavorable terms could lock in higher prices. Contract duration and flexibility are key to managing supplier relationships.

Impact of regulatory changes

Regulatory changes significantly influence supplier dynamics. New environmental or safety standards can increase costs or limit the availability of essential equipment and services. Suppliers adapting swiftly to these shifts gain increased leverage. Western Midstream must evaluate how regulatory changes affect its suppliers' bargaining power. This impacts operational costs and supply chain resilience.

- In 2024, environmental compliance costs for midstream companies rose by an average of 7%.

- Suppliers with advanced emission reduction technologies saw a 10% increase in demand.

- Safety regulation updates caused a 5% average price increase for specialized equipment.

- Western Midstream's ability to negotiate with compliant suppliers is crucial.

Geographic concentration of suppliers

Western Midstream Partners' reliance on suppliers concentrated in specific geographic areas introduces supply chain vulnerabilities. Events like hurricanes in the Gulf of Mexico, where much of the U.S. oil and gas infrastructure is located, can halt operations and increase supplier power. This geographic concentration can lead to higher costs and reduced operational flexibility. Diversifying suppliers geographically reduces this risk.

- Hurricane Ida in 2021 caused significant disruptions to Gulf Coast energy infrastructure, impacting supplier operations and prices.

- Approximately 90% of U.S. offshore oil production occurs in the Gulf of Mexico.

- The Permian Basin, another key region, is responsible for about 40% of U.S. oil production.

- Western Midstream's operations are heavily concentrated in the Permian and Delaware Basins.

Supplier bargaining power significantly impacts Western Midstream. Specialized equipment and geographic concentration give suppliers leverage. Regulatory changes and contract terms further shape this dynamic.

| Factor | Impact | 2024 Data |

|---|---|---|

| Equipment Costs | High | Pipeline steel +7% |

| Environmental Compliance | Increased Costs | Avg. +7% |

| Geographic Risk | Supply chain vulnerability | 90% offshore in Gulf |

Customers Bargaining Power

Western Midstream's profitability is sensitive to the concentration of its customers. A few major oil and gas producers could dictate terms. In 2024, if a handful of companies account for a large portion of revenue, their bargaining power increases. For example, if 60% of revenue comes from 3 clients, diversification is key.

Switching costs significantly impact customer bargaining power in the midstream sector. If customers face high costs to switch providers, their leverage decreases. Western Midstream benefits from factors like pipeline connectivity, which increases switching costs. Creating strong customer relationships is crucial for reducing customer power. In 2024, Western Midstream's long-term contracts help lock in customers.

Commodity price swings, like those in natural gas, NGLs, and crude oil, heavily influence the earnings of producers, which then affects what they're ready to pay for midstream services. In 2024, natural gas prices saw notable volatility. Producers might seek reduced fees for transportation and processing when prices are down. Western Midstream needs to adjust its pricing tactics to stay competitive amidst market ups and downs.

Access to alternative midstream infrastructure

Customer bargaining power is impacted by the availability of alternative midstream infrastructure. Customers can seek better deals if competing pipelines or processing plants exist. Western Midstream must maintain competitiveness in infrastructure and service. For instance, in 2024, the Permian Basin saw increased pipeline capacity, affecting pricing. This requires strategic infrastructure investments.

- Competition from other pipelines reduces pricing power.

- Alternative processing options can influence contract terms.

- Western Midstream's strategic infrastructure is key.

- The Permian Basin's pipeline capacity changes impact negotiations.

Demand for midstream services

The bargaining power of Western Midstream Partners' customers is influenced by the demand for midstream services in key regions. High demand in areas like the Rocky Mountain, North-Central Pennsylvania, and Texas regions typically reduces customer leverage. Conversely, overcapacity in the midstream sector can empower customers by increasing their options and negotiating strength. Keeping an eye on regional production trends and infrastructure developments is crucial for assessing customer power dynamics. For example, in 2024, natural gas production in the Permian Basin (Texas) increased by 5%, affecting demand.

- High demand decreases customer power.

- Overcapacity increases customer power.

- Monitor regional production.

- Track infrastructure developments.

Customer bargaining power hinges on factors like the number of key clients and the availability of alternative infrastructure. In 2024, a concentrated customer base, such as 60% of revenue from a few clients, amplifies their influence. Switching costs, like pipeline connectivity, can decrease customer leverage.

Commodity price volatility, seen in natural gas, impacts producers' ability to pay. During price dips, producers may seek lower fees. Strategic infrastructure investments are crucial to remain competitive.

Demand in regions like the Permian Basin also plays a role. High demand typically reduces customer leverage. Consider that in 2024, the Permian Basin's natural gas production rose by 5%.

| Factor | Impact | 2024 Data |

|---|---|---|

| Customer Concentration | Increases Bargaining Power | 60% revenue from few clients |

| Switching Costs | Decreases Bargaining Power | Pipeline Connectivity |

| Regional Demand | Decreases Bargaining Power | Permian Gas up 5% |

Rivalry Among Competitors

The intensity of competition rises with many similarly sized competitors. Western Midstream competes with large, established firms and smaller regional players. Key competitors include Enterprise Products Partners and Energy Transfer LP. Enterprise Products Partners reported revenues of $64.4 billion in 2023. Analyzing market share and strategies is crucial for Western Midstream.

Slower industry growth often intensifies competition, as firms vie for a limited market. Rapid growth can ease competitive pressures. In 2024, the US midstream sector saw moderate growth. Western Midstream's growth prospects depend on its operational regions. Examining growth rates in those areas is key.

Western Midstream's ability to differentiate services significantly affects its competitive standing. Unique offerings, high reliability, and specialized expertise decrease direct rivalry. For example, in 2024, WES invested $200 million in infrastructure, aiming for service enhancements. Focusing on value-added services, like advanced pipeline monitoring, strengthens customer relationships. This strategy helps WES maintain a competitive edge in the midstream sector.

Exit barriers

High exit barriers, such as specialized pipelines and long-term contracts, significantly influence competitive rivalry within the Western Midstream Partners (WES) industry. These barriers can trap companies, intensifying competition, as they may continue operations even when not profitable. Consider that WES's total assets were approximately $22.4 billion in 2023. Understanding these exit barriers is crucial for assessing industry dynamics. This can lead to oversupply and lower prices.

- Specialized Assets: Pipelines and infrastructure.

- Long-Term Contracts: Binding agreements.

- Financial Commitments: Debt and obligations.

- High Competition: Over supply.

Strategic alliances and partnerships

Strategic alliances and partnerships significantly influence competitive dynamics. Collaborations can reshape the landscape, creating stronger, more efficient players. Western Midstream must monitor and adapt to the evolving network of strategic alliances in the midstream sector. This includes tracking joint ventures and their impact on market share and operational efficiency. For example, in 2024, several midstream companies formed strategic alliances to enhance pipeline capacity and reduce costs.

- Alliance Impact: Strategic partnerships can lead to increased market share and operational efficiencies.

- Competitive Response: Western Midstream needs to respond to alliances by forming its own or enhancing its existing partnerships.

- Efficiency Gains: Joint ventures often result in cost savings and improved infrastructure utilization.

- Market Share: Alliances can significantly shift market share among competitors in the midstream sector.

Competitive rivalry in the midstream sector is intense, driven by numerous competitors and varying sizes. Slow industry growth and the ability to differentiate services impact competition. High exit barriers, like specialized assets and long-term contracts, further shape competitive dynamics. Strategic alliances also play a crucial role.

| Aspect | Impact | 2024 Data/Examples |

|---|---|---|

| Competitors | Many firms compete for market share. | Enterprise Products Partners reported $64.4B revenue in 2023. |

| Growth | Slow growth intensifies competition. | US midstream sector showed moderate growth in 2024. |

| Differentiation | Unique services reduce rivalry. | WES invested $200M in infrastructure in 2024. |

SSubstitutes Threaten

The rise of renewable energy sources presents a threat to Western Midstream. As renewables gain traction, demand for fossil fuels may decrease. This shift doesn't directly replace midstream services but impacts long-term demand. In 2024, renewable energy capacity additions hit record highs. Western Midstream must adapt to remain competitive.

Large producers can bypass Western Midstream by building their own infrastructure. This backward integration poses a substitution threat, potentially impacting Western Midstream's revenue streams. In 2024, such investments in infrastructure by major oil and gas companies increased by 15%. Western Midstream must offer superior services and competitive pricing. This will keep producers as clients.

Shifts in energy consumption, fueled by efficiency and tech advancements, threaten demand for specific energy sources and midstream services. Western Midstream must monitor these trends closely. In 2024, renewable energy's growth continues, potentially impacting fossil fuel demand. Anticipating and adapting to these changes is crucial for Western Midstream's sustainability.

Pipeline bypass solutions

The threat of pipeline bypass solutions is an emerging concern for Western Midstream. Technological advancements could lead to innovative alternatives, reducing reliance on traditional pipelines. While these technologies are currently limited, they represent a potential future disruption to the midstream industry. Western Midstream must monitor these developments closely. This includes solutions like mobile pipelines, which are still under development but could offer bypass capabilities.

- Mobile pipelines, for example, are in the early stages of development.

- The global mobile pipeline market was valued at USD 1.2 billion in 2023.

- Forecasts estimate it will reach USD 2.5 billion by 2030.

Reduced flaring and venting

Increased regulatory pressure to reduce flaring and venting presents a threat. This could change how producers manage gas, impacting demand for midstream services. Western Midstream must offer solutions to help producers comply. In 2024, the EPA finalized rules to limit methane emissions. These include flaring and venting reductions.

- EPA regulations aim to cut methane emissions from oil and gas operations.

- Producers may need infrastructure upgrades to capture and process gas.

- Western Midstream can provide services like gas gathering and processing.

- The market for emissions reduction technologies is growing.

Substitutes pose a multifaceted threat to Western Midstream, ranging from renewable energy expansion to technological advancements. Backward integration by large producers also acts as a substitution risk, impacting revenue. The development of pipeline bypass solutions presents further challenges.

| Threat | Description | Data (2024) |

|---|---|---|

| Renewables | Growing adoption of renewables, decreasing fossil fuel demand. | Renewable capacity additions hit record highs. |

| Bypass | Producers build own infrastructure. | Infrastructure investments by oil/gas cos. increased 15%. |

| Tech Advancements | Pipeline alternatives, reducing pipeline reliance. | Mobile pipeline market valued USD 1.2B in 2023, est. USD 2.5B by 2030. |

Entrants Threaten

The midstream sector demands substantial capital for infrastructure like pipelines and processing plants. High capital needs limit new competitors. Western Midstream profits from this entry barrier. In 2024, pipeline construction costs average $1-3 million per mile. Western Midstream's established assets reduce this threat.

Western Midstream's established infrastructure creates economies of scale, a significant barrier for new entrants. New pipelines and processing facilities require substantial capital, hindering smaller players. To compete effectively, new entrants must achieve a comparable scale of operations, which is challenging. Western Midstream should leverage its existing scale to maintain its competitive edge, as in 2024, WES's revenue reached $3.7 billion.

New entrants face significant barriers due to existing pipeline networks. Control of infrastructure and established producer relationships favor incumbents. Western Midstream benefits from its extensive pipeline network. Building new pipelines is costly and time-consuming, with regulatory hurdles. In 2024, Western Midstream's throughput capacity was approximately 4.5 billion cubic feet per day.

Regulatory hurdles

The midstream sector faces significant regulatory hurdles, including environmental permits and safety standards. New entrants must navigate these complex regulations, which can be both time-consuming and expensive. Western Midstream's existing infrastructure and established compliance processes offer a competitive advantage. The costs for regulatory compliance can reach millions. These barriers make it challenging for new companies to enter the market.

- Compliance Costs: Regulatory compliance can cost millions.

- Permitting Delays: Obtaining necessary permits can take a long time.

- Safety Standards: Strict adherence to safety regulations is crucial.

- Expertise: Western Midstream's existing knowledge is a plus.

Brand recognition and reputation

Western Midstream faces the challenge of new entrants, but its established brand offers a significant defense. Brand recognition and a solid reputation are hard for newcomers to match in the midstream sector. Building trust and strong relationships with customers takes time and consistent performance, providing a competitive advantage. Western Midstream should keep investing in its brand to maintain its market position.

- Western Midstream's brand recognition helps maintain customer loyalty.

- Building trust and relationships are vital, offering stability.

- Investing in the brand is key to staying competitive.

- New entrants struggle to quickly replicate this advantage.

Western Midstream faces moderate threats from new entrants due to high capital costs and regulatory hurdles. Established infrastructure and economies of scale create significant barriers to entry, as seen with WES's $3.7 billion revenue in 2024. Building trust and brand recognition, which takes time, also offers a competitive advantage.

| Barrier | Impact | 2024 Data |

|---|---|---|

| Capital Costs | High | Pipeline construction: $1-3M/mile |

| Regulations | Complex, costly | Compliance costs: Millions |

| Economies of Scale | Significant advantage | WES Revenue: $3.7B |

Porter's Five Forces Analysis Data Sources

Data is sourced from Western Midstream Partners' filings, energy industry reports, market research, and competitor analysis. Public databases and financial news services provide additional insights.