WHSmith Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

WHSmith Bundle

What is included in the product

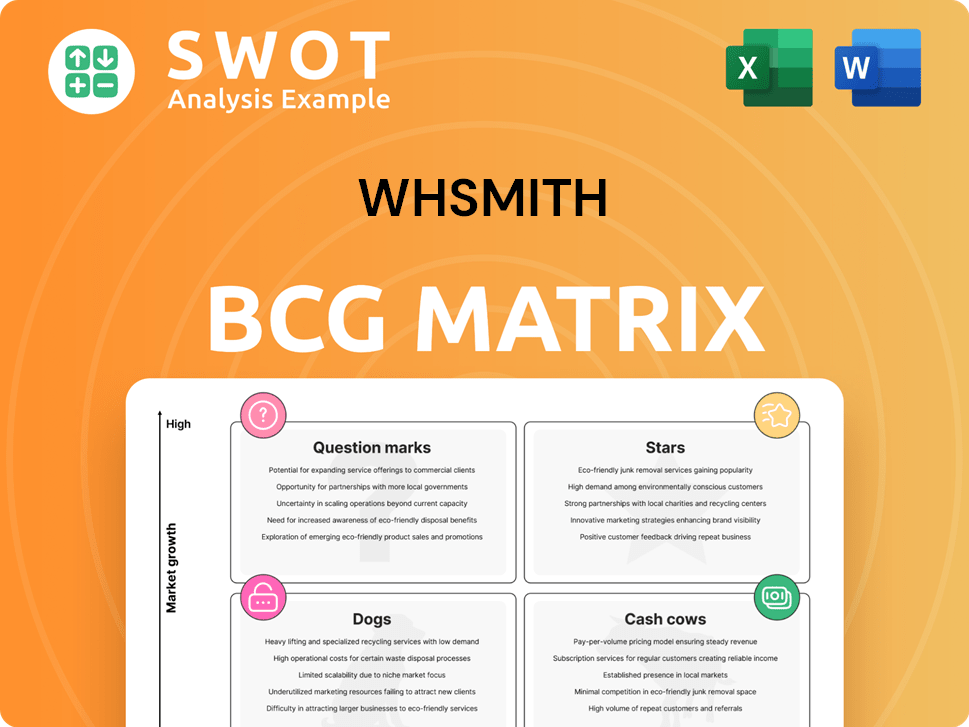

Strategic overview of WHSmith's business units using the BCG Matrix, analyzing market growth and relative market share.

Export-ready design for quick drag-and-drop into PowerPoint

Delivered as Shown

WHSmith BCG Matrix

The preview showcases the complete WHSmith BCG Matrix you'll receive after purchase. This is the fully editable, high-quality document, ready for your strategic analysis and presentation.

BCG Matrix Template

WHSmith's BCG Matrix helps visualize its diverse portfolio. This framework categorizes products into Stars, Cash Cows, Dogs, and Question Marks. Understanding this breakdown is crucial for strategic decisions. This snapshot shows just a glimpse of the company's complex landscape. Unlock the full potential with our detailed report! Purchase the full version for deep analysis and actionable strategies.

Stars

WHSmith's Travel division shines, particularly in North America, with robust expansion through new stores and contract wins. This growth is fueled by rising air travel and airport upgrades, solidifying WHSmith's market leadership. The Travel division's revenue surged by 15% in 2024, with North America contributing significantly. This stellar performance positions it as a "Star" in the BCG Matrix, driving substantial revenue and profit increases.

The one-stop-shop format in WHSmith's UK Travel locations is a star, boosting sales. It offers a range of travel essentials, increasing average transaction values. This format, including food, drinks, and tech, drives growth. In 2024, Travel sales rose, with average transaction values up 10%.

North America is a key growth area for WHSmith, aiming to boost its market share. In 2024, it's actively opening stores and securing new airport contracts. This region is now the second-largest profit contributor, following Travel UK. WHSmith's North American revenue increased by 18% in the first half of 2024.

Strong Financial Performance

WHSmith's "Stars" status in the BCG matrix reflects its robust financial health. The company's 2024 performance highlights strong revenue and profit growth, especially within its Travel division. This indicates a solid capacity for sustained returns. The Group's profit before tax and non-underlying items rose significantly.

- Headline Group profit before tax and non-underlying items up 16% to £166m.

- Excellent performance throughout the year, particularly over the key summer trading period.

- Strong revenue and profit growth, particularly in the Travel division.

- Demonstrates its ability to generate sustainable returns.

Digital Growth Initiatives

WHSmith's "Stars" category focuses on digital growth. They're investing in digital sales platforms and a retail media network. This boosts customer engagement and drives sales. They offer advertising activations to reach travelers. This creates engaging retail experiences.

- Digital sales platforms are a focus.

- Retail media network launch.

- Advertising activations across touchpoints.

- Enhances customer engagement.

WHSmith's Travel division is a "Star" due to its high growth and market share, especially in North America. The one-stop-shop format boosts sales, increasing average transaction values by 10% in 2024. They are investing in digital platforms and a retail media network to enhance customer engagement, driving sales and offering advertising activations.

| Metric | 2024 Performance |

|---|---|

| Travel Division Revenue Growth | +15% |

| North America Revenue Growth | +18% |

| Average Transaction Value Increase | +10% |

| Group Profit Before Tax Increase | +16% to £166m |

Cash Cows

The UK Travel business is a cash cow for WHSmith, generating steady revenue and profit. It leverages its presence in key locations like airports and train stations. This division's strong performance is fueled by rising passenger numbers and retail strategies. In the first half, trading profit was 8% up.

WHSmith's core retail offerings, including books and stationery, are cash cows, especially in travel hubs. These products consistently bring in revenue, meeting travelers' immediate demands. In 2024, these segments saw a 3% sales increase. The company is capitalizing on reduced competition by expanding its card and stationery selections.

WHSmith's partnership with the Post Office, active in over 200 stores, generates consistent revenue and boosts foot traffic. This collaboration is a reliable income stream, bolstering the profitability of High Street locations. The Post Office services ensure the sustainability of postal and governmental services. This strategic move helps maintain the relevance of High Street stores.

Travel Essentials

The Travel Essentials segment of WHSmith, a cash cow, generates consistent revenue from its presence in travel hubs and hospitals. This includes convenience items that travelers and patients need. These locations ensure high foot traffic and immediate purchasing needs, contributing to reliable sales. The segment's profitability is supported by the steady demand for its essential goods.

- In 2024, Travel Essentials saw a revenue increase of 5.2%, driven by strong like-for-like sales growth.

- This segment benefits from high customer frequency.

- The business model is designed for efficiency.

- It is a key element of WHSmith's portfolio.

Strategic Partnerships

WHSmith's strategic partnerships, including collaborations with Toys 'R' Us and Tinc, bring in consistent revenue by drawing in more customers. They're now integrating branded items, like fashion stationery, into some High Street locations. These partnerships boost store appeal and increase sales. In 2024, WHSmith reported a 10% increase in like-for-like sales in its travel division, partly due to such partnerships.

- Partnerships with brands expand customer reach.

- Branded implants boost store appeal.

- These relationships drive sales growth.

- Travel division sales rose 10% in 2024.

WHSmith's diverse cash cow segments, from Travel to partnerships, ensure consistent revenue. Travel Essentials saw a 5.2% revenue increase in 2024, fueled by high customer frequency. The Post Office partnership and core retail offerings also act as stable income sources.

| Segment | Performance Driver | 2024 Revenue Change |

|---|---|---|

| Travel Essentials | High Customer Frequency | +5.2% |

| Travel Division | Partnerships | +10% (like-for-like) |

| Core Retail | Steady Demand | +3% Sales Increase |

Dogs

Prior to the March 2025 sale, WHSmith's UK High Street division was a 'Dog'. This was due to declining sales; in 2024, sales were down by 3% year-over-year. The division struggled against online competitors and changing consumer habits. The sale allowed a strategic shift toward travel retail, which saw a 9% revenue increase in 2024.

InMotion, a part of WHSmith's portfolio, faces challenges despite its role. Like-for-like (LFL) revenue decreased by 5% in 2024. The headphone market's lack of innovation impacts InMotion. WHSmith focuses on higher-margin tech accessories to improve margins. Sales trends are not expected to change soon, but margin accretion is anticipated longer-term.

The Resorts business, primarily in Las Vegas, experienced an 8% revenue decrease on a constant currency basis due to the closure of 16 stores. This downturn reflects shifts in consumer behavior within resort locations. WHSmith's strategic adjustments in this segment aim to address these challenges. The closure of stores impacted the overall financial performance.

Underperforming High Street Stores

Underperforming High Street stores are categorized as "Dogs" in WHSmith's BCG matrix. These stores often struggle due to poor locations or low sales. WHSmith focuses on improving profitability by closing these underperforming locations. In the 13 weeks leading up to June 1, total revenue in the UK High Street division decreased by four percent. This highlights the strategic importance of managing store performance.

- Poor locations or low sales volume lead to underperformance.

- WHSmith actively manages its store portfolio.

- UK High Street division revenue down 4% in 13 weeks to June 1.

- Closing underperforming stores improves profitability.

Low-Margin Product Lines

Dogs in WHSmith's BCG Matrix include low-margin product lines within the High Street division. These are products with slow sales and low-profit margins. Examples might be outdated media formats or items with limited appeal. The company actively manages space to boost returns and maintain a flexible cost structure. In 2024, WHSmith's High Street division faced challenges with lower foot traffic and changing consumer preferences.

- Outdated media formats and items with limited customer appeal.

- Focus on space management to maximize returns.

- Flexible cost structure is maintained.

- High Street division faced challenges in 2024.

WHSmith's "Dogs" are underperforming divisions with low growth and market share. In 2024, the UK High Street division was a Dog. Like-for-like revenue decreased by 5% in InMotion in 2024. Closing these improves profitability.

| Division | Performance | 2024 Revenue Change |

|---|---|---|

| UK High Street | Dog | -3% |

| InMotion | Dog | -5% LFL |

| Resorts | Dog | -8% |

Question Marks

Smith's Kitchen cafés, a new venture, are Question Marks. They show high growth potential, but their market success is still unproven. WHSmith is trying out this format in a few spots to see if it works and can expand. The Princess Anne Hospital location is a first, combining WHSmith's brand with food offerings. In 2024, WHSmith's revenue was £1.5 billion, showing potential for new growth avenues like Smith's Kitchen.

International expansion, especially outside North America, positions WHSmith as a Question Mark in the BCG Matrix. Although offering high growth potential, it faces uncertainties. Adapting to local markets is key, with success hinging on understanding consumer preferences. In 2024, WHSmith's North American travel business saw significant growth; however, global expansion presents higher risks. For 2024, WHSmith reported strong performance in North America, with sales up 10%.

WHSmith's North American retail media network is a Question Mark in its BCG Matrix. This new venture faces uncertain market acceptance, despite high potential. The company is strategically testing this format in select locations. WHS Media aims to connect brands with 900 million travelers yearly. Its success hinges on proving viability and scalability.

New Food-to-Go Range

WHSmith's Smith's Family Kitchen food-to-go range is a Question Mark, showing high growth potential but with uncertain market acceptance. The company is strategically testing this format in select locations to assess its viability and scalability. WHSmith plans a significant food offer expansion in 2025. This strategic move aims to capitalize on the growing demand for convenient food options.

- Sales of food-to-go products rose by 15% in the first half of 2024.

- The company is investing £10 million in store upgrades in 2024, with a portion allocated to expanding food offerings.

- WHSmith plans to open over 100 new food-to-go locations by the end of 2025.

- The average transaction value for food-to-go items increased by 7% in 2024.

Tech Accessories Expansion

The tech accessories expansion, spearheaded by InMotion in travel locations, is a Question Mark within WHSmith's BCG Matrix. Success hinges on effective competition and adapting to evolving consumer demands in the tech market. The closure of stores in major locations such as Las Vegas, Charlotte, and Denver airports reflects the challenges.

- Store closures in North America included 10 stores across two major hotels in Las Vegas.

- The closure and refurbishment of 5 stores across Charlotte and Denver airports.

- WHSmith must navigate the competitive tech market to succeed.

- Adapting to changing consumer preferences is crucial.

Question Marks for WHSmith include ventures with high growth potential but uncertain market acceptance. These initiatives require strategic testing and adaptation to prove their viability. Success depends on how well WHSmith navigates new markets and consumer demands. For 2024, strategic investments focused on growth areas, with careful risk management.

| Venture | Growth Potential | Market Acceptance |

|---|---|---|

| Smith's Kitchen | High | Unproven |

| Int. Expansion | High | Uncertain |

| Retail Media | High | Uncertain |

| Food-to-Go | High | Uncertain |

BCG Matrix Data Sources

WHSmith's BCG Matrix relies on financial reports, market analysis, and industry trends for a robust and reliable assessment.