WHSmith SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

WHSmith Bundle

What is included in the product

Analyzes WHSmith’s competitive position through key internal and external factors

Facilitates interactive planning with a structured, at-a-glance view.

Full Version Awaits

WHSmith SWOT Analysis

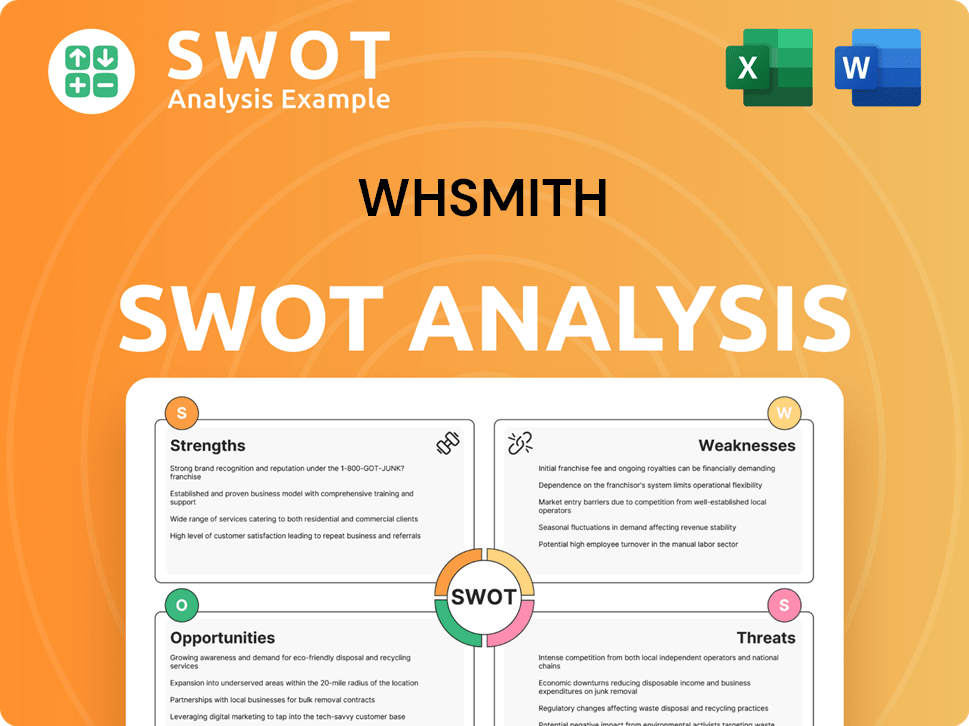

This is the SWOT analysis document you'll get! See the actual file below, including all Strengths, Weaknesses, Opportunities, and Threats facing WHSmith. Purchase gives immediate access. The full version is structured & ready for your use.

SWOT Analysis Template

This quick peek reveals WHSmith's market stand. You've seen some strengths and weaknesses. It also highlights potential opportunities. But there's so much more. Want deeper insights?

Purchase the full SWOT analysis to reveal the company's strategic picture. Get research-backed insights for smart planning, investment or research.

Strengths

WHSmith's strength lies in its global travel retail focus. In fiscal year 2024, travel accounted for most of the group's revenue. This shift enables WHSmith to capitalize on the growing travel market. It reduces dependence on the struggling high street sector. This strategy boosted the company's financial performance.

WHSmith's broad international presence, spanning 32 countries, is a key strength. This global reach, including locations in high-traffic areas, diversifies revenue streams. In 2024, international sales accounted for a significant portion of total revenue, around 40%. Continued expansion, with a focus on North America, is expected to further boost growth. Projected store openings in North America for 2025 are estimated to be around 50.

WHSmith's travel division boasts a robust pipeline of new store openings. Over 90 new locations are secured, including over 70 in North America. This expansion is a key growth driver. The company aims to open over 60 stores this financial year. This strategy boosts WHSmith's market presence.

Diversified Product Offering in Travel

WHSmith's strength lies in its diverse product offerings within travel retail. They've expanded beyond books and news. This includes high-margin items like food, health & beauty, and tech accessories. This 'one-stop-shop' strategy boosts spending. The company actively re-engineers store space to improve sales.

- Travel division sales rose 10% to £859 million in the first half of fiscal year 2024.

- Like-for-like revenue growth in Travel was 8% for the same period.

- The average transaction value increased due to the broader product range.

Cash Generative Travel Business

WHSmith's travel business is a major strength, known for generating substantial cash. This robust cash flow allows for strategic investments, such as new store openings. The strong financial performance also supports shareholder returns, enhancing the group's appeal. In 2024, the travel division's revenue increased by 11%, showcasing its financial health.

- High free cash flow generation.

- Supports strategic investments.

- Enables shareholder returns.

- Boosts overall financial profile.

WHSmith benefits from its focus on travel retail, with substantial revenue from its travel division. This shift provides resilience in challenging times and supports expansion through new store openings. WHSmith has a diverse product range and its travel division generates substantial cash, enabling strategic investments and shareholder returns.

| Strength | Description | Data |

|---|---|---|

| Travel Retail Focus | Concentration on the travel sector | Travel revenue share in FY24 is most of total revenue |

| Global Presence | Operations in 32 countries, boosting revenue | Around 40% of total revenue from international sales |

| New Store Openings | Expansion through secured locations | Over 90 new locations are secured, ~50 in North America (2025 projected) |

Weaknesses

The £76 million sale of WHSmith's UK High Street business, finalized in 2024, was below initial expectations. This move, while strategic, included complex negotiations concerning the brand. The division faced challenges from changing consumer habits and online competition, as evidenced by a 3% decline in like-for-like sales in 2023. Transition and integration could pose short-term hurdles.

WHSmith's strong reliance on travel hubs makes it vulnerable to travel disruptions. Economic downturns, geopolitical events, or health crises can significantly reduce passenger numbers. For example, in 2024, a 5% drop in air travel could reduce footfall by 3% in key locations. External factors affecting travel remain a key weakness.

WHSmith's high dividend payout ratio raises concerns about its sustainability. The company's focus on travel retail might expose it to earnings volatility. Investors will likely scrutinize the dividend policy, especially with potential shifts in travel patterns. This is crucial as the company navigates market changes. In 2024, WHSmith's payout ratio was approximately 90%.

Operational Challenges in Diverse Geographies

WHSmith's global presence across 32 countries introduces operational hurdles. Compliance with varied regulations, including labor laws and taxation, poses a challenge. Managing intricate supply chains and logistics adds complexity to operations. Overcoming these diverse landscapes is vital for efficient growth.

- In 2024, WHSmith's international sales grew, yet faced localized operational issues.

- Regulatory compliance costs vary significantly across different countries.

- Supply chain disruptions impacted profitability in certain regions.

Integration of Acquired Businesses

WHSmith's growth strategy heavily relies on acquisitions, especially in its travel division. Integrating acquired businesses like Marshall Retail Group and InMotion presents significant challenges. These challenges include merging different operational structures and ensuring consistent financial performance post-acquisition. Failure to integrate effectively can undermine the expected benefits of these strategic moves. As of 2024, the company's success hinges on how well it manages these integrations to boost overall profitability.

- Acquisition of Marshall Retail Group and InMotion.

- Challenges in combining operations.

- Need for consistent financial performance.

- Risk of undermining benefits if integration fails.

WHSmith's 2024 sale of its UK High Street business for £76 million fell short, and this division struggled due to changing consumer behaviors. High dependence on travel makes the company vulnerable to disruptions, affecting foot traffic and sales. A high dividend payout ratio, approximately 90% in 2024, along with acquisition challenges, strains the sustainability.

| Weakness | Details | Impact |

|---|---|---|

| UK High Street Sale | Sale price was below expectation; declining like-for-like sales. | Strategic setbacks, brand perception concerns, sales decline (-3% in 2023). |

| Travel Dependence | Vulnerability to disruptions; impact on passenger numbers. | Reduced footfall, decreased sales in key locations, possible revenue decline (-5% air travel). |

| High Payout Ratio | Dividend sustainability scrutiny. | Investor concern, earnings volatility with shifts in travel patterns, potentially reduced growth. |

Opportunities

North America presents substantial growth potential, particularly in airport locations. WHSmith plans over 70 new stores there. In 2024, North American sales increased, showing strong momentum. The company aims to boost its market share significantly.

The surge in global passenger numbers, a key opportunity, fuels WHSmith's travel retail sector. Passenger traffic is expected to rise, with figures potentially reaching pre-pandemic levels by late 2024 or early 2025. This growth translates to more shoppers within WHSmith's stores in airports and stations. The company is poised to capture this increased customer base, boosting sales.

WHSmith eyes expansion in Europe and Asia Pacific, beyond the UK and North America. Recent store openings signal a global push. In 2024, international sales rose, showing potential. More space availability boosts growth prospects. This strategy aims to diversify revenue streams.

Enhancing the Travel Essentials Offering

WHSmith can boost its travel business by expanding its product range and improving store layouts to be a comprehensive 'one-stop-shop'. This includes offering high-margin items and tailoring products to local preferences. Innovative store formats and tech can improve the customer journey. In 2024, the global travel retail market was valued at $75.7 billion, showing growth potential.

- Expand product ranges to cover a broader spectrum of travel needs.

- Optimize store layouts for better product visibility and customer flow.

- Focus on high-margin categories like electronics and gifts.

- Use technology to enhance the shopping experience, such as self-checkouts.

Leveraging Digital Platforms in Travel Retail

WHSmith can boost travel retail using digital platforms. Click-and-collect, personalized offers, and in-store tech can improve customer experience. Data analytics offers insights into customer behavior. This can drive sales and enhance operational efficiency. The global travel retail market was valued at $73.2 billion in 2023, expected to reach $115.5 billion by 2027.

- Click-and-collect services can reduce wait times and improve customer satisfaction.

- Personalized offers can increase sales by targeting customer preferences.

- In-store technology, like digital displays, can enhance product discovery.

- Data analytics enables better inventory management and targeted promotions.

WHSmith has multiple opportunities to increase profits. North America's growth and global passenger increases fuel expansion, aiming to boost sales and market share. Expansion in Europe and Asia Pacific broadens revenue streams, offering new growth prospects. A product range and tech can drive more growth.

| Opportunity | Details | Data |

|---|---|---|

| North America Expansion | Opening new stores and increasing market share | Over 70 new stores planned in North America; North American sales increased in 2024. |

| Travel Retail Growth | Capitalizing on rising global passenger numbers | Passenger traffic expected to rise to pre-pandemic levels by late 2024/early 2025. |

| International Expansion | Growth in Europe and Asia Pacific. | International sales rose in 2024. |

Threats

Global economic and geopolitical events present substantial risks to WHSmith. Uncertainty can affect travel and consumer spending. Reduced economic growth could curb travel, impacting WHSmith's sales. For example, in 2024, geopolitical tensions led to a 10% decrease in travel in some regions.

WHSmith confronts fierce competition in travel retail. Competitors include newsagents, bookstores, convenience stores, and specialist retailers, all vying for customer spending. Maintaining a competitive edge demands continuous innovation. For 2024, the travel retail market is projected to reach $75.4 billion.

WHSmith faces currency exchange rate risks due to international operations, especially impacting its North American performance. Fluctuations can hurt revenue and profits when translated back to the reporting currency. In 2024, the British pound's volatility against the US dollar could have affected their results. Hedging strategies are vital to lessen this financial risk.

Execution Risks in International Expansion

Rapid international expansion presents execution risks for WHSmith. Successfully navigating local regulations is crucial. Adapting the business model to diverse cultural contexts is also key. Managing logistical complexities effectively is essential. Failure to execute the expansion could impact profitability. WHSmith's international sales grew by 10% in 2024, indicating the stakes.

- Regulatory hurdles can delay market entry.

- Cultural differences may require significant business model adjustments.

- Logistical challenges can increase operational costs.

- Ineffective execution can lead to lower-than-expected returns.

Potential for Disruption from New Technologies

WHSmith faces threats from new technologies reshaping retail. Disruptive tech or online models could harm its travel retail format, which represented 60% of its revenue in 2024. The company invested £15 million in digital in 2024, but must keep pace. Failure to adapt could affect its 2024/2025 revenue, which was £1.6 billion.

- Online retail growth poses a challenge.

- Tech adoption is crucial for survival.

- Failure to adapt can impact revenue.

WHSmith's global reach exposes it to geopolitical risks, affecting travel and spending; in 2024, some regions saw a 10% travel drop due to tensions.

Stiff competition, especially in travel retail, requires continuous innovation. For example, the travel retail market's projected size for 2024 is $75.4 billion, demanding sharp competitive strategies.

Currency fluctuations and execution challenges during international expansion are also risks, with hedging and adaptability critical for sustained financial health.

| Risk | Description | Impact |

|---|---|---|

| Geopolitical & Economic | Global events, economic downturn. | Travel decline, reduced sales. |

| Competition | Newsagents, bookstores, etc. | Need for innovation, price wars. |

| Currency Exchange | International operations exposure. | Revenue/profit volatility. |

| Expansion | Regulatory, cultural, and logistical hurdles. | Execution challenges, lower ROI. |

| Technology | Digital retail disrupting traditional. | Revenue impact if unaddressed. |

SWOT Analysis Data Sources

The WHSmith SWOT is derived from financial data, market research, and industry analysis, all for accurate insights.