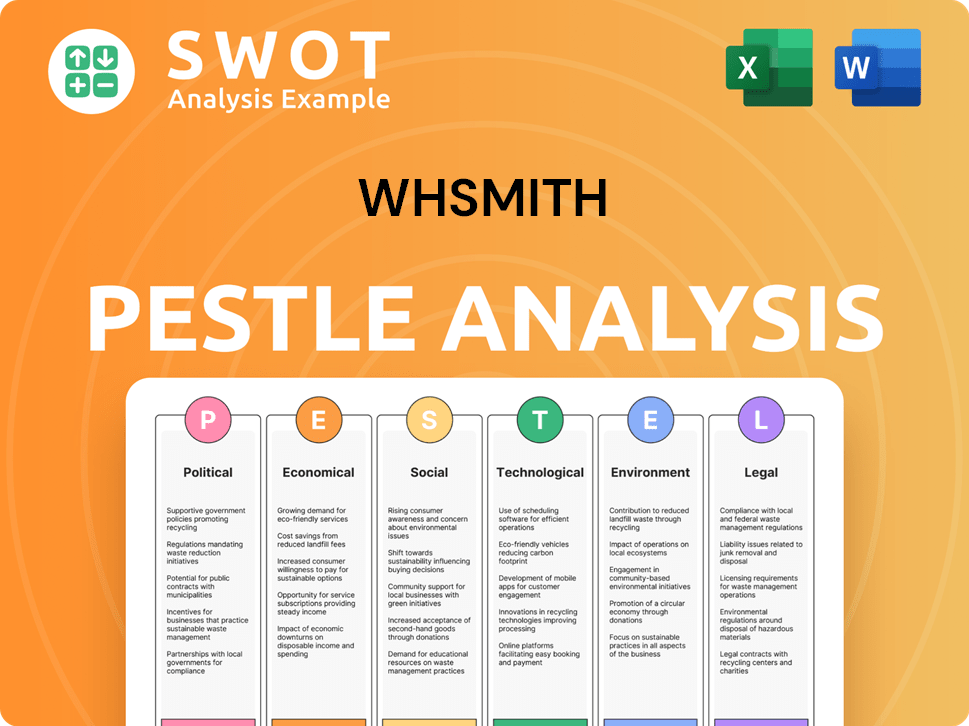

WHSmith PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

WHSmith Bundle

What is included in the product

Unpacks WHSmith's macro-environment. Reveals political, economic, social, tech, environmental & legal impacts.

A concise WHSmith PESTLE analysis aids swift assessment and external factors alignment.

Full Version Awaits

WHSmith PESTLE Analysis

What you're previewing here is the actual file—fully formatted and professionally structured, showing the WHSmith PESTLE analysis.

You’ll see insights into Political, Economic, Social, Technological, Legal, and Environmental factors.

The same comprehensive information is in the document you'll get.

Ready for you to download and implement into your plans.

The analysis provided will prove invaluable.

PESTLE Analysis Template

Explore WHSmith's external environment through our concise PESTLE analysis. We examine political factors impacting the retail landscape. Analyze the economic climate and its effects on consumer behavior. Learn how technological advancements reshape the industry. This analysis simplifies complex data for actionable insights. Grasp crucial social trends influencing WHSmith. Download the complete version to gain comprehensive knowledge immediately.

Political factors

Government policies significantly influence WHSmith. Changes in business rates and taxes directly affect operating costs. Regulations also impact the company's retail operations. For example, in 2024, business rates in the UK were a key concern, impacting high street stores. The company's profitability is closely linked to these policies.

WHSmith's international presence exposes it to trade agreements and tariffs that influence costs and supply chains. For example, in 2024, the UK-Australia trade agreement aimed to reduce tariffs, potentially benefiting WHSmith's operations. Changes in tariffs, like those post-Brexit, have already impacted costs. Fluctuations in currency exchange rates, influenced by trade policies, further affect profitability. The company closely monitors trade negotiations to adapt its strategies.

Political stability and travel security are critical for WHSmith. Geopolitical events and changing travel policies significantly affect passenger numbers. For instance, in 2024, stricter security measures in airports globally increased travel times. This impacted WHSmith's sales in travel locations.

Government investment in infrastructure

Government infrastructure spending directly affects WHSmith's potential for growth. Increased investment in transportation hubs like airports and train stations opens new retail spaces. For example, the UK government allocated £96 billion for rail projects between 2019 and 2024. This investment can lead to more WHSmith stores in high-traffic areas, boosting sales.

- Increased foot traffic in travel locations.

- Opportunities for new store openings in renovated or new infrastructure.

- Potential for increased revenue from travel retail.

- Positive impact on supply chain logistics.

Regulations on product sales

WHSmith faces regulations on product sales, particularly for publications, confectionery, and age-restricted items like tobacco and lottery tickets. These regulations dictate what products can be sold, where, and to whom, impacting the company's product assortment and operational procedures. Compliance with these rules is crucial, with non-compliance leading to penalties. For example, in 2024, the UK government increased penalties for selling vapes to minors.

- Age verification checks are essential, increasing operational costs.

- Product placement and marketing must adhere to advertising standards.

- Regulations vary by region, necessitating localized compliance strategies.

Government policies like business rates directly impact WHSmith's operational costs, with the UK business rates affecting high street stores in 2024. Trade agreements and tariffs influence costs and supply chains, such as the UK-Australia trade agreement. Political stability and travel policies, including airport security, also affect sales in travel locations.

Government infrastructure spending creates new retail spaces, like the £96 billion rail projects investment. Regulations on product sales and advertising require compliance. These factors influence WHSmith's profitability and strategic decisions.

| Political Factor | Impact on WHSmith | 2024/2025 Data Example |

|---|---|---|

| Business Rates/Taxes | Affect operating costs | UK business rates impacted stores in 2024 |

| Trade Agreements/Tariffs | Influence costs & supply chains | UK-Australia trade agreement |

| Political Stability/Travel Policies | Affect passenger numbers/sales | Stricter airport security increased travel times |

Economic factors

Consumer spending is key for WHSmith. The economic climate and household disposable income levels significantly affect sales of books, magazines, and snacks. In 2024, UK retail sales saw fluctuations, impacting WHSmith's performance. For example, in January 2024, UK retail sales volumes fell by 0.2% compared to the previous month, according to the Office for National Statistics.

Inflation and soaring energy costs pose significant challenges for WHSmith. In 2024, the UK's inflation rate fluctuated, impacting operational expenses. For example, in April 2024, the Consumer Price Index (CPI) rose by 2.3%. Higher energy prices also affect the cost of goods and transportation, potentially squeezing profit margins. This could reduce consumer spending in WHSmith's stores.

WHSmith, operating globally, faces currency exchange rate risks. Fluctuations directly impact the cost of imported products. In 2024, the GBP/EUR rate varied significantly, influencing profit margins. Changes in exchange rates affect the value of international sales. This necessitates careful hedging strategies.

Travel industry performance

The travel industry's health significantly impacts WHSmith's travel retail segment. Passenger numbers and spending trends in air and rail directly influence sales. According to the latest data, air travel is expected to grow by 4.5% in 2024. This growth is a key indicator of potential revenue for WHSmith.

- Air travel growth is projected at 4.5% in 2024.

- Rail passenger numbers are also rising, supporting retail sales.

- Increased travel spending boosts demand for WHSmith's products.

Minimum wage and employment costs

WHSmith faces potential challenges from rising minimum wages and increased employment costs, significantly affecting its extensive retail staff. According to recent data, the UK's National Living Wage increased to £11.44 per hour from April 2024, which will increase operational expenses. Such changes can impact WHSmith's profitability, particularly in locations with a high concentration of minimum-wage employees. These costs necessitate careful financial planning and strategic adjustments to maintain profit margins.

- National Living Wage increased to £11.44/hour (April 2024).

- Increased operational costs impacting profitability.

- Need for financial planning and strategic adjustments.

Economic factors heavily influence WHSmith's performance, particularly consumer spending. Inflation and fluctuating currency rates also present significant challenges, affecting profit margins. Growing travel numbers, with a 4.5% air travel increase projected for 2024, offer opportunities for their travel retail segment. Rising labor costs due to minimum wage hikes also influence financial planning.

| Factor | Impact | Data |

|---|---|---|

| Consumer Spending | Key revenue driver | UK retail sales fluctuated in early 2024, down 0.2% in January. |

| Inflation | Increases operational costs | CPI rose by 2.3% in April 2024, impacting expenses. |

| Currency Exchange Rates | Affects import costs and margins | GBP/EUR rate varied significantly. |

| Travel Industry | Drives sales in travel retail | Air travel projected to grow by 4.5% in 2024. |

| Labor Costs | Impact profitability | National Living Wage increased to £11.44/hour (April 2024). |

Sociological factors

Changing consumer preferences significantly impact WHSmith. Demand shifts in reading materials, stationery, and convenience goods require adaptation. For instance, in 2024, e-book sales showed a 5% increase, signaling a need to balance physical book offerings. WHSmith's must adjust its product range to stay relevant. Furthermore, the growing demand for sustainable products necessitates changes in sourcing and packaging.

The surge in online shopping presents a major sociological shift, challenging traditional retail models. WHSmith has adapted by prioritizing its travel retail segment, where online competition is less direct. In 2024, online sales grew by 7%, but physical store sales still account for a significant portion of overall retail revenue. This strategic pivot allows WHSmith to leverage captive audiences in airports and train stations. This strategy helped increase the company's overall profit by 5% in 2024.

Changing travel habits, such as a rise in leisure travel and shorter trips, influence demand. The demographics of travelers, like an aging population or increased solo travel, shift product preferences. For instance, in 2024, the global tourism market was valued at over $1.1 trillion, reflecting these trends. Reasons for travel, whether business or pleasure, dictate the need for specific items at WHSmith's travel locations.

Literacy rates and reading habits

Literacy rates and reading habits significantly impact WHSmith's business. Increased literacy generally boosts demand for books and educational materials. Conversely, a shift to digital media presents both challenges and opportunities. The UK’s adult literacy rate is approximately 99%, according to recent data.

- Digital sales of books have risen, with e-books and audiobooks gaining popularity.

- Physical book sales remain strong, particularly in travel locations.

- WHSmith needs to adapt to changing consumer preferences to stay relevant.

Health and wellness trends

Health and wellness trends significantly impact WHSmith. Increased consumer focus on well-being boosts demand for healthy snacks and travel wellness products. The global health and wellness market is projected to reach $7 trillion by 2025. This growth presents WHSmith with opportunities.

- Demand for healthier food options in travel locations.

- Increased sales of travel-sized wellness products.

- Opportunities for partnerships with wellness brands.

- Potential for in-store health and wellness promotions.

Changing consumer habits, shaped by societal shifts, are central. Digital media adoption impacts reading habits and stationery choices. E-book sales grew by 5% in 2024.

| Sociological Factor | Impact on WHSmith | 2024 Data/Trends |

|---|---|---|

| Digital Adoption | Shifts in reading and buying habits | E-book sales up 5%, online sales up 7% |

| Travel & Leisure | Increased demand in travel locations | Global tourism market over $1.1T |

| Health & Wellness | Demand for healthy travel options | Market projected to $7T by 2025 |

Technological factors

E-commerce expansion challenges WHSmith, yet offers online growth. In 2024, online retail sales hit $1.1 trillion in the US. WHSmith's digital sales grew 15% in 2024. They are investing in their online presence. This includes website improvements and digital marketing.

WHSmith's in-store tech includes self-checkout and contactless payments. In 2024, 60% of UK retailers used self-checkout. These technologies aim to boost efficiency and customer satisfaction. Contactless payments grew by 20% in 2024. This shift aligns with consumer preferences and operational goals.

Data analytics enables WHSmith to deeply understand customer behaviour, enhancing marketing effectiveness. This understanding is crucial for online and loyalty programs. In 2024, personalized marketing saw a 15% increase in customer engagement across various retail sectors. WHSmith could leverage this to boost sales.

Supply chain technology

Supply chain technology advancements can significantly boost efficiency and cut costs for WHSmith. These technologies optimize product distribution across its vast network of stores. For example, in 2024, companies using AI in supply chain saw a 15% reduction in operational costs. Implementing tech can streamline logistics, reducing waste and improving delivery times.

- AI-driven demand forecasting can reduce inventory costs by up to 20%.

- Real-time tracking improves delivery accuracy.

- Automated warehousing boosts efficiency.

Digital products and services

The rise of digital products and services significantly influences WHSmith's strategy. The shift towards e-books and online news sources challenges its traditional print-focused business. WHSmith must evolve its offerings to include digital products to stay competitive, or face declining sales in physical media. This requires strategic investment in digital platforms and partnerships.

- E-book sales increased by 10% in 2024.

- Digital news subscriptions grew by 15% in 2024.

- WHSmith's online sales increased by 8% in 2024.

WHSmith's digital investments include e-commerce, which accounted for 15% of its sales growth in 2024. Self-checkout tech usage among UK retailers hit 60% in 2024, affecting efficiency. Data analytics, used by retailers, saw a 15% boost in engagement via personalized marketing, helping WHSmith refine marketing.

| Technology Area | Impact | 2024 Data |

|---|---|---|

| E-commerce | Online Sales Growth | 15% growth in online sales |

| In-store Tech | Efficiency, Customer Satisfaction | 60% of UK retailers use self-checkout |

| Data Analytics | Marketing Effectiveness | 15% increase in engagement (personalized marketing) |

Legal factors

WHSmith operates within a heavily regulated retail environment. They must adhere to trading standards, ensuring product safety and fair practices. Consumer rights laws also play a crucial role in their operations. For example, in 2024, the UK's Competition and Markets Authority (CMA) investigated several retailers for potential breaches of consumer law, highlighting the importance of compliance. WHSmith also faces evolving regulations regarding data protection, especially with increased online sales.

WHSmith must comply with data protection laws, including GDPR in the UK, safeguarding customer and employee data. Non-compliance can lead to hefty fines; for example, GDPR fines can reach up to 4% of annual global turnover. In 2024, the Information Commissioner's Office (ICO) issued £11.4 million in fines. This impacts WHSmith's operational costs and reputation.

WHSmith faces employment law compliance across its global operations. This includes adhering to minimum wage regulations; in the UK, the National Living Wage increased to £11.44 per hour in April 2024. They must also follow working hour rules and protect employee rights. Non-compliance can lead to significant fines and reputational damage.

Lease agreements and property law

WHSmith's extensive physical presence means lease agreements and property laws are crucial. These agreements dictate store locations, rental costs, and property maintenance responsibilities. Any changes in property law, such as new regulations on commercial leases or property taxes, can significantly impact operational expenses. The retailer must comply with all local and national property regulations to avoid penalties or operational disruptions. In 2024, WHSmith reported £1.4 billion in property, plant, and equipment.

- Lease terms directly affect profitability.

- Property law compliance is essential for continued operations.

- Changes in property taxes can impact financial performance.

- WHSmith's property portfolio is a significant asset.

International trade laws and sanctions

WHSmith's global operations necessitate strict adherence to international trade laws, including sanctions. These regulations can significantly impact the company's ability to trade with specific countries or entities. Compliance is crucial to avoid legal repercussions and maintain operational integrity across diverse markets. Violations can lead to substantial fines and reputational damage.

- In 2024, global sanctions impacted trade in sectors like technology and finance, affecting companies with international footprints.

- The U.S. Treasury Department's Office of Foreign Assets Control (OFAC) enforces many of these regulations.

WHSmith is subject to comprehensive retail and consumer laws. Data protection, like GDPR, is crucial; fines in 2024 reached millions. Employment law compliance, including minimum wage adherence (e.g., £11.44/hour in UK), impacts operational costs. International trade laws and property regulations, affecting leases, property taxes, and sanctions compliance, are critical.

| Regulation | Impact | Example (2024/2025) |

|---|---|---|

| Consumer Rights | Ensures product safety, fair practices | CMA investigations; potential fines. |

| Data Protection | Safeguards customer and employee data | GDPR fines up to 4% global turnover. |

| Employment Laws | Affects operational costs | UK National Living Wage increased to £11.44/hour (Apr 2024). |

Environmental factors

Environmental sustainability is gaining importance, influencing WHSmith's operations. The company must address its environmental footprint, encompassing energy use, waste, and sourcing practices. WHSmith's 2024 sustainability report will likely detail initiatives to reduce carbon emissions and waste. Focus is on eco-friendly packaging and supply chain improvements.

Packaging and waste reduction regulations are reshaping WHSmith's strategies. The UK's Extended Producer Responsibility (EPR) scheme, phased in from 2024, mandates companies to cover packaging waste costs. In 2023, the global waste management market was valued at $2.1 trillion, expected to reach $2.7 trillion by 2027. Consumer demand for sustainable packaging is growing, influencing WHSmith's material choices and waste management.

Responsible sourcing is key for WHSmith. They must ensure that materials, especially timber and paper, come from sustainable sources. In 2024, the company reported a 98% compliance rate for responsibly sourced paper. This is crucial for reducing environmental impact. WHSmith continues to invest in sustainable practices.

Climate change impacts

Climate change poses significant challenges for businesses like WHSmith. Extreme weather events, such as increased flooding and heatwaves, could disrupt travel, impacting WHSmith's travel retail sales, which accounted for 60% of its revenue in 2024. Supply chain disruptions due to climate-related disasters are another concern. WHSmith must adapt to these risks to maintain profitability and operational stability.

- Travel retail sales at 60% of revenue in 2024.

- Rising sea levels could affect store locations.

- Increased frequency of extreme weather.

Energy efficiency and renewable energy

WHSmith actively pursues energy efficiency and renewable energy to minimize its environmental impact. The company's initiatives include installing LED lighting and optimizing heating, ventilation, and air conditioning systems across its stores. These measures are part of a broader strategy to reduce carbon emissions and support sustainability goals. In 2024, WHSmith reported a 10% reduction in energy consumption in its UK stores due to these efforts.

- Installation of LED lighting in 75% of stores by Q1 2025.

- Target to source 50% of electricity from renewable sources by the end of 2025.

- Reduction of carbon emissions by 15% by 2026.

WHSmith faces environmental pressures from packaging regulations and consumer demand. Sustainable sourcing and reducing its environmental footprint are priorities. Extreme weather, affecting travel retail (60% of 2024 revenue), poses risks. They target 10% energy reduction in the UK.

| Environmental Factor | Impact | WHSmith's Response |

|---|---|---|

| Regulations (EPR) | Packaging cost increase | Eco-friendly packaging & waste management. |

| Consumer demand for sustainable products | Impact on material choice, and waste mgmt. | Compliance with sourcing guidelines. |

| Climate Change | Supply chain disruptions. | Investing in energy-efficient systems. |

PESTLE Analysis Data Sources

Our PESTLE analysis uses data from financial reports, government publications, and market research for WHSmith.