Wirecard Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Wirecard Bundle

What is included in the product

BCG Matrix analysis reveals which Wirecard units to invest in, hold, or divest based on growth and market share.

Export-ready design for quick drag-and-drop into PowerPoint, enabling fast strategic discussions.

Delivered as Shown

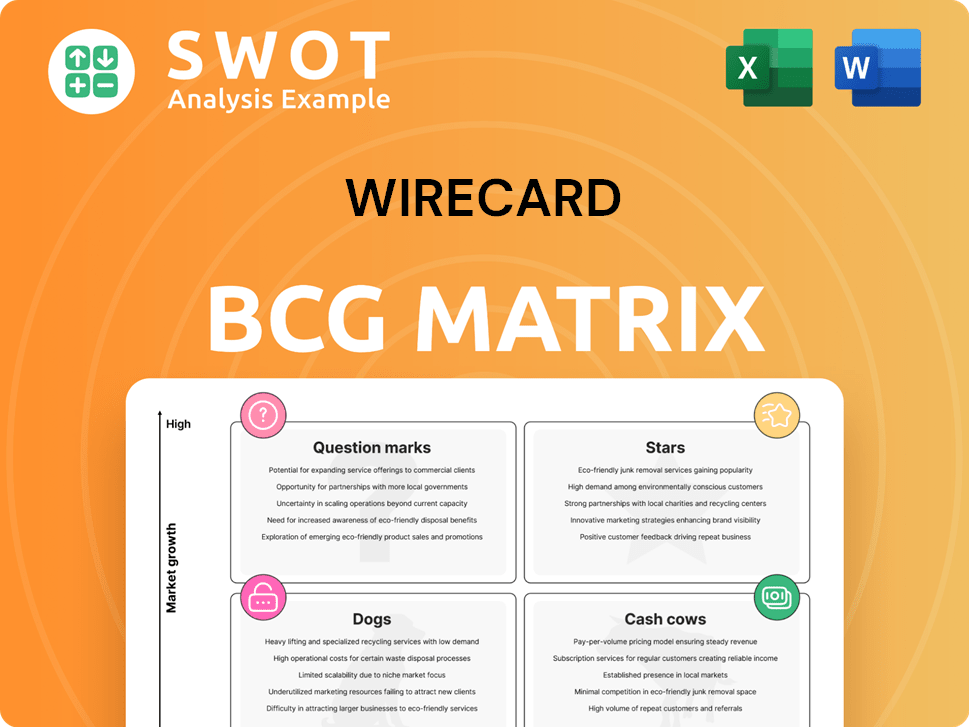

Wirecard BCG Matrix

The preview showcases the complete Wirecard BCG Matrix you'll receive upon purchase. This is the final, fully functional report, ready for immediate application without any hidden elements or alterations needed. It's designed for comprehensive analysis and strategic planning.

BCG Matrix Template

Wirecard's turbulent journey is reflected in its likely BCG Matrix. Preliminary analysis suggests a complex mix of product performance. Some services may have been "Stars," boasting high growth. Others may have quickly become "Dogs," facing decline.

This snapshot hints at the company's strategic challenges. To get a clear view of the exact product positions, purchase the full BCG Matrix report.

Stars

Wirecard initially showed high-growth potential as a fintech star. It expanded rapidly, attracting considerable investor interest and a peak market cap of over €24 billion in 2018. This growth, however, was fueled by deceptive accounting practices. The scandal led to its collapse, exposing the fraudulent foundation of its success.

Wirecard's payment solutions initially looked promising, attracting businesses with streamlined transactions. The company's risk management tools were also a selling point. Wirecard's revenue in 2018 was around €2 billion. Sadly, these innovations were undermined by the scandal.

Wirecard's global expansion included operations in Asia, Europe, and North America, aiming for market leadership. By 2019, Wirecard processed €200 billion in transactions worldwide. This broad reach, however, masked fraudulent activities across multiple countries, contributing to the company's downfall.

Strategic Partnerships

Wirecard's strategic partnerships were key to its growth. These alliances aimed to boost service offerings and expand the customer base. They helped Wirecard build its reputation. Yet, some partnerships may have been used to hide financial issues.

- Partnerships included collaborations with various fintech and e-commerce companies.

- These alliances were meant to enhance Wirecard's market penetration.

- Some partnerships were allegedly involved in fraudulent activities.

- The collapse revealed the misuse of these strategic relationships.

Early Fintech Adoption

Wirecard's early embrace of fintech, like mobile payments, set it apart in the digital finance arena. This head start helped it gain a strong foothold and brand recognition, especially in Europe. Before its collapse, Wirecard's market capitalization peaked at over 24 billion euros, showcasing early investor confidence. Yet, its pioneering role was overshadowed by accounting scandals that led to its downfall.

- Early Mover: Wirecard was an early fintech adopter.

- Market Recognition: Gained initial success and recognition.

- Financial Data: Peak market cap over 24B euros.

- Downfall: Fraudulent practices led to its collapse.

Wirecard, initially a "Star," showed high growth in the fintech sector, reaching a peak market cap exceeding €24 billion in 2018. Its early adoption of digital payments and global expansion fueled this rapid growth. However, deceptive accounting practices undermined its success, leading to its collapse.

| Aspect | Details |

|---|---|

| Peak Market Cap | Over €24 Billion (2018) |

| Revenue (2018) | Around €2 Billion |

| Transactions (2019) | €200 Billion Worldwide |

Cash Cows

Wirecard's core payment processing, before its downfall, was a significant revenue generator. This segment acted as a cash cow, offering a steady income stream. In 2019, this area reported €2 billion in revenue. However, accounting fraud inflated these numbers.

Wirecard provided risk management services to clients, crucial in digital payments. These services generated revenue, a key aspect of their business model. The company’s risk management practices were deeply flawed, leading to its downfall. Despite offering these services, Wirecard's internal controls failed dramatically. The scandal highlighted the importance of robust risk assessment.

Wirecard's credit card issuance and processing offered consistent revenue, especially in areas with strong credit card adoption. This part of the business was a dependable income source. Nevertheless, the broader fraud severely impacted the company's financial health. In 2018, Wirecard processed €170 billion in transaction volume, showcasing its significant market presence before the scandal.

Merchant Services

Wirecard's merchant services formed a crucial part of its cash flow, offering payment gateway integration and transaction processing to many businesses. These services were a cash cow, generating substantial revenue. However, this area also became a point of contention. The services were used to process transactions, with some being illicit.

- In 2018, Wirecard processed €174.5 billion in transaction volume.

- The merchant services segment was a significant revenue driver for Wirecard.

- Fraudulent activities were linked to the merchant services.

- These services were used by numerous retailers.

Acquired Technologies

Wirecard's acquisitions, some of which involved technology, could have been cash cows, providing consistent revenue streams. These technologies should have been managed to generate steady income. The fraud undermined the potential of these acquisitions. The collapse significantly devalued these once-promising assets.

- Acquired technologies aimed for consistent revenue.

- Proper management could have turned them into cash cows.

- Fraud overshadowed the real value of the acquisitions.

- Collapse of Wirecard diminished the asset value.

Wirecard's payment processing generated steady revenue before its collapse, with €2 billion in revenue reported in 2019. Risk management services also contributed to the cash flow, though flawed. Credit card services and merchant services, processing €174.5 billion in 2018, were major income sources, despite fraud issues.

| Segment | Revenue Stream | Impact |

|---|---|---|

| Payment Processing | Steady Income | Fraudulent inflation |

| Risk Management | Service Fees | Flawed Practices |

| Credit Card Services | Transaction Fees | Fraud Impact |

Dogs

The Wirecard scandal inflicted substantial reputational damage, eroding trust among stakeholders. This loss of confidence significantly hindered recovery efforts. The scandal impacted the German financial market's image. Wirecard's collapse, involving billions in missing funds, led to widespread scrutiny. The fallout included a 98% stock price decline in 2020, underscoring the severity of the damage.

The 2020 insolvency proceedings signaled Wirecard's demise. Its assets were liquidated; operations stopped. These proceedings sparked many legal battles and investigations. Roughly €3.2 billion in assets vanished. The fraud exposed a massive accounting scandal.

Wirecard, a "Dog" in the BCG matrix, bore substantial legal liabilities. The accounting scandal triggered lawsuits from investors and creditors. Ongoing investigations and trials continue to reveal financial damage. The company faced billions in claims, highlighting the severe consequences of fraud. By 2024, legal battles persist, impacting its reputation.

Loss of Market Share

The Wirecard scandal led to a massive loss of market share. Customers and partners quickly distanced themselves, fearing association. Competitors, like Adyen and Stripe, took advantage. Wirecard's market position became unsustainable.

- Wirecard's stock price plummeted by over 98% in 2020.

- Revenues dropped by 40% in the first half of 2020.

- Over 1,700 employees were laid off in 2020.

- Adyen's market cap increased by 60% in 2020.

Erosion of Investor Confidence

The Wirecard accounting scandal devastated investor trust, causing a massive plunge in its stock value and overall market worth. Investors faced significant financial setbacks, and the company's access to funding was severely limited. The scandal's impact on investor confidence continues to be profound.

- Wirecard's stock price plummeted by over 90% following the scandal's revelations.

- The company's market capitalization decreased by billions of euros.

- Investor confidence remains at an all-time low.

- The scandal led to significant legal and regulatory scrutiny.

Wirecard, classified as a "Dog" in the BCG matrix, faced dire consequences due to the fraud scandal. Legal liabilities piled up, including investor lawsuits. Market share plummeted as competitors capitalized. By 2024, the company's reputation was severely damaged, and its financial health was in ruins.

| Metric | Impact | Data (2024) |

|---|---|---|

| Stock Price Decline | Significant | Over 98% in 2020 |

| Revenue Drop | Substantial | 40% in H1 2020 |

| Missing Funds | Billions | Approximately €3.2 billion |

Question Marks

After Wirecard's collapse, some assets were left, their future unclear. These assets could have offered a chance for revival or more selling off. But, the actual worth of these remaining assets is still unknown. In 2024, the final asset sales and legal settlements continued to unfold, impacting the final recovery figures. The uncertainty around these assets made it hard to assess Wirecard's true financial outcome.

Wirecard faced numerous legal claims due to its collapse, primarily against former executives. The outcomes of these claims were uncertain, potentially impacting stakeholders. These claims could lead to more liabilities or recoveries. The legal environment was intricate, evolving rapidly. For example, in 2024, investigations continued, with potential implications for asset recovery.

Wirecard's technological IP, a question mark in its BCG matrix, was of uncertain value. This IP, possibly for future development, faced unclear market demand. The company's downfall, with a 2020 collapse, erased any valuation. In 2024, the remnants are legally disputed.

Investigation Findings

Ongoing investigations into Wirecard's fraudulent activities could expose new details and extra liabilities, potentially affecting the company's remaining assets and legal position. These probes are complicated and lengthy, with outcomes still uncertain. The fallout includes potential lawsuits, regulatory fines, and further asset devaluation. For example, KPMG's special audit in 2020 highlighted accounting irregularities, which kickstarted these investigations.

- Investigations are ongoing, with no definitive end date.

- Potential for significant financial penalties and asset recovery.

- Impact on legal standing and reputation.

- Complexity involves multiple jurisdictions and entities.

Shareholder Lawsuits

Shareholder lawsuits against Wirecard and its auditors are a question mark in the BCG matrix, due to uncertain outcomes that could impact asset distribution. These lawsuits involve intricate legal arguments and significant financial claims. The legal battles influence how funds are allocated among creditors and shareholders. The final settlements or judgments will shape the financial recovery.

- Multiple lawsuits were filed seeking damages from Wirecard and its auditors.

- The outcomes of these lawsuits are uncertain.

- Financial claims in these lawsuits are substantial.

- Legal battles influence fund allocation among stakeholders.

The "Question Marks" in Wirecard's BCG Matrix represent areas with uncertain outcomes. Remaining assets' value was unknown, affecting financial recovery. Legal claims, especially shareholder lawsuits, could significantly impact asset distribution. Ongoing investigations and their potential fines add further complexity.

| Aspect | Uncertainty | Impact |

|---|---|---|

| Asset Valuation | Final values of remaining assets | Impacts final recovery figures |

| Legal Claims | Outcomes of lawsuits | Influences fund allocation |

| Investigations | Potential new liabilities | May devalue assets |

BCG Matrix Data Sources

The Wirecard BCG Matrix is based on company financials, market analysis, sector reports, and analyst assessments for a data-driven approach.