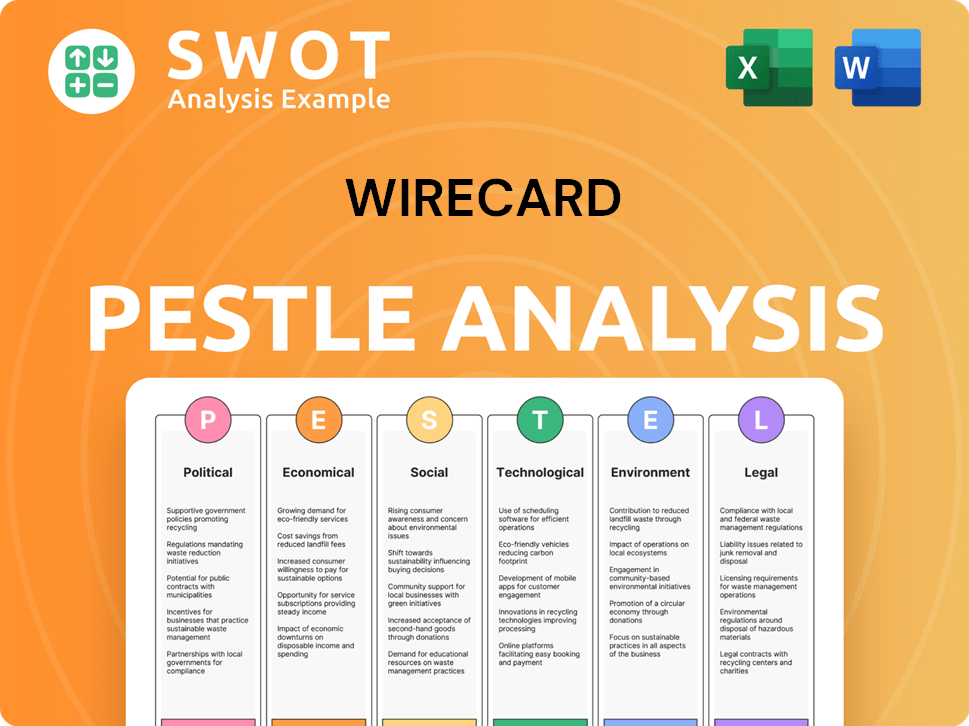

Wirecard PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Wirecard Bundle

What is included in the product

Provides a thorough PESTLE analysis of Wirecard, covering political, economic, social, tech, environmental, and legal aspects.

A concise breakdown, allowing fast identification of the critical PESTLE factors impacting Wirecard.

Full Version Awaits

Wirecard PESTLE Analysis

No placeholders, no teasers—this is the real, ready-to-use file you’ll get upon purchase. This preview displays a comprehensive PESTLE analysis of Wirecard, outlining key political, economic, social, technological, legal, and environmental factors. You'll find this detailed analysis immediately after buying.

PESTLE Analysis Template

Uncover the external forces shaping Wirecard's downfall with our detailed PESTLE analysis.

Explore the political pressures, economic factors, and legal ramifications.

Discover how social trends and technological advancements impacted their strategies.

Our analysis offers actionable insights for understanding Wirecard’s context.

Ideal for investors, researchers, and anyone interested in the scandal.

Download the complete analysis and get essential intelligence now!

Political factors

Wirecard's scandal highlighted regulatory failings by BaFin, Germany's financial watchdog. BaFin faced criticism for delayed actions despite warnings. The collapse prompted calls for stronger regulatory powers and reforms. In 2024, discussions continue regarding regulatory overhaul to prevent future financial fraud. Investigations led to substantial fines and legal repercussions for involved parties.

Wirecard, as a German tech champion, allegedly enjoyed political favor. This suggests that political influence can shape regulatory oversight, potentially affecting how prominent national companies are scrutinized. For example, in 2024, several EU countries faced scrutiny over their handling of tech firms.

Wirecard's global reach, operating via many subsidiaries and partners, showed the issues of international regulatory cooperation. The lack of a single oversight body complicated effective supervision. For instance, the Financial Times reported that Wirecard's operations spanned over 20 countries. This complexity made it hard to spot misconduct. The scandal revealed how challenging it is to oversee financial firms operating globally.

Legislative Reforms

The Wirecard scandal prompted significant legislative reforms in Germany. The Financial Market Integrity Strengthening Act (FISG) of 2021 was enacted to enhance corporate governance. FISG granted regulators greater authority over financial reporting and auditor accountability. This was a direct political reaction to the regulatory failures exposed by Wirecard. The German government continues to refine financial oversight.

- FISG aimed to modernize financial regulations.

- Increased scrutiny of financial statements is now standard.

- Auditors face tougher accountability measures.

- The reforms reflect a broader EU trend in financial regulation.

Investor Protection Policies

The Wirecard scandal highlighted weaknesses in investor protection, particularly in Germany, prompting calls for stronger regulatory oversight. This includes stricter enforcement of existing laws and potentially new legislation to oversee financial technology firms. Investor confidence was severely shaken, with Wirecard's stock price plummeting from over €190 to nearly zero, wiping out billions in market value. The case underscored the need for more robust auditing and independent verification of financial statements.

- Germany's financial regulator, BaFin, faced criticism for its handling of the Wirecard case, leading to a push for reforms.

- The scandal resulted in significant financial losses for both institutional and retail investors.

- Increased scrutiny of financial reporting and auditing practices is expected.

Wirecard's political fallout triggered German regulatory overhauls, specifically FISG. These changes enhance oversight and auditor accountability. Investor protection improved, though trust took a major hit, with billions in market value lost.

| Aspect | Details | Impact |

|---|---|---|

| Regulatory Reforms | FISG implemented in 2021. | Stricter audits and financial reporting. |

| Investor Impact | Stock price dropped from €190 to zero. | Billions in market value vanished. |

| Political Influence | Scrutiny of tech firms in 2024 | Increased political awareness |

Economic factors

Wirecard's collapse, in 2020, caused a ripple effect across the fintech landscape. Trust eroded as investors questioned the stability of other firms. The scandal highlighted the need for more robust regulatory oversight. German fintech investments dipped by 25% in 2020, reflecting the crisis.

The Wirecard scandal decimated investor confidence, causing a sharp decline in its stock value and its eventual bankruptcy. This event underscored how corporate fraud can severely destabilize markets. In 2024, the fallout continues to influence investor behavior, especially in Germany. The DAX index saw fluctuations, reflecting lingering market unease.

Wirecard's downfall caused massive financial losses for stakeholders. The company's debt reached billions. Insolvency proceedings are ongoing, handling damage claims. Investors faced significant losses, impacting market confidence. The scandal highlighted risks in financial technology.

Economic Competition and Growth Pressure

Wirecard faced intense pressure to show rapid growth in a competitive fintech market. This environment may have spurred fraudulent activities to maintain a positive image. The company's need to appear successful likely created incentives for misconduct. The global fintech market was valued at $152.79 billion in 2023, with expectations to reach $324.78 billion by 2029. This growth fueled competition.

- Fintech market growth created competitive pressures.

- Desire for success may have led to misconduct.

- Wirecard aimed to appear competitive.

- 2023 global fintech market: $152.79B.

Complexity of Financial Flows

Wirecard's intricate structure, with its global transactions and many subsidiaries, obscured financial flows, hindering accurate asset verification. This complexity, involving numerous international transactions and a web of subsidiaries and third-party acquirers, allowed fraud to go undetected for extended periods. The opacity made it hard for both external observers and auditors to track money. The situation underscores how convoluted structures can be exploited.

- Wirecard operated in over 30 countries, with 100+ subsidiaries.

- Investigations revealed billions in fake transactions.

- The lack of transparency was a major factor in the collapse.

Wirecard's demise significantly shook Germany's economic landscape, affecting fintech investments. This event negatively influenced investor confidence and market stability. Germany’s 2024 economic outlook sees continued scrutiny of financial reporting.

| Economic Factor | Impact | Data |

|---|---|---|

| Fintech Investment | Reduced | German fintech investments dipped 25% in 2020. |

| Investor Confidence | Eroded | DAX index saw fluctuations. |

| Market Stability | Threatened | Ongoing investigations & claims. |

Sociological factors

The Wirecard scandal severely damaged trust in financial institutions and auditors, eroding confidence in the financial system. The scandal's impact led to significant reputational damage for Germany as a financial hub. This highlighted failures in corporate governance, ultimately impacting investor confidence and market stability. The collapse resulted in over €2 billion in losses for investors.

Wirecard's collapse in 2020 led to job losses for over 5,000 employees. Customers faced payment disruptions, impacting businesses and consumers. The scandal underscored the importance of ethical business practices. Such failures erode trust in the financial system, affecting millions.

Whistleblowers were critical in uncovering Wirecard's fraud, showcasing the need for reporting mechanisms. They faced obstacles, underscoring the importance of a supportive culture. In 2024, regulatory bodies continue to refine protections for whistleblowers, with fines for retaliation. The Wirecard scandal led to increased scrutiny, and new laws aim to prevent future misconduct.

Public Perception of Fintech

The Wirecard scandal significantly impacted public perception of fintech, fostering skepticism. The fraud exposed vulnerabilities, challenging the industry's innovative image. This led to a demand for enhanced transparency and stringent security measures in digital financial services. The incident highlighted the need for robust regulatory oversight to restore trust. According to a 2024 report, global fintech adoption rates dipped slightly following the scandal, with a 3% decrease in consumer confidence in digital payment platforms.

- Consumer trust in fintech firms decreased by 5% in Europe post-scandal.

- Investment in fintech start-ups saw a 10% decline in Q3 2024.

- Regulatory scrutiny of fintech companies increased by 15% globally.

Corporate Culture and Ethics

The Wirecard scandal revealed a corporate culture that prioritized rapid expansion and possibly unethical actions over honesty and accountability. This emphasizes how crucial a strong ethical culture is to prevent fraudulent behavior within companies. The collapse resulted in the loss of billions, impacting investors and stakeholders. In 2020, Wirecard's share price plummeted by over 98% following the revelations of accounting fraud.

- The Wirecard case highlighted the critical need for robust corporate governance and ethical oversight.

- The scandal caused significant damage to investor trust and market integrity.

- The focus should be on promoting transparency and accountability in all business operations.

- Implementing rigorous compliance programs and ethical training is essential.

The Wirecard scandal's impact damaged public trust in finance, and the incident triggered decreased fintech adoption rates in 2024. Ethical failings in corporate culture amplified distrust, influencing investment decisions. It emphasized how societal norms impact business, showing market volatility.

| Aspect | Impact | Data (2024/2025) |

|---|---|---|

| Trust in Fintech | Decreased adoption | 5% decrease in EU consumer trust (2024) |

| Corporate Culture | Erosion of ethics | 10% drop in fintech startup investments (Q3 2024) |

| Regulatory Response | Increased Scrutiny | 15% rise in global fintech regulation(2024) |

Technological factors

Wirecard's tech-driven model, central to payment processing, was intricate. This complexity obscured operations from regulators and auditors. The lack of transparency enabled the concealment of fraudulent practices. In 2024, such opacity remains a key risk in fintech. The Wirecard scandal highlighted the need for robust tech oversight.

Wirecard's primary focus was electronic payment processing, a technology-driven sector. The speed and volume of digital transactions created oversight challenges. The global digital payments market was valued at $8.02 trillion in 2023, projected to reach $14.77 trillion by 2028. This rapid expansion demanded robust technological infrastructure for security and regulatory compliance. Wirecard's failure to adapt to these technological demands contributed to its downfall.

Wirecard's scandal revealed the use of tech to hide fraud. They allegedly manipulated records, potentially using tech to conceal missing funds. This illustrates how technology can be misused in finance. In 2024, fraud cost businesses globally $5.1 trillion.

Asymmetric Technology in Supervision

The Wirecard scandal exposed a significant gap in technological capabilities between fintech firms and regulatory bodies, illustrating 'asymmetric technology' in supervision. Fintech firms leverage advanced technologies, while regulators often struggle to keep pace, hindering effective oversight. This disparity can lead to delayed detection of fraudulent activities and inadequate risk management. For example, in 2024, the global fintech market was valued at approximately $150 billion, with an expected annual growth rate of over 20% through 2025, highlighting the increasing need for regulators to enhance their technological expertise.

- The Wirecard case showed that regulatory tech lagged behind fintech innovation.

- Regulators' tech lag can delay fraud detection.

- Fintech's rapid growth demands better supervision.

Potential of AI in Fraud Detection

The Wirecard scandal highlighted the need for better fraud detection, leading to increased interest in AI. AI's potential for identifying fraudulent activities is significant. Financial institutions are investing in AI-driven solutions. According to a 2024 report, AI could reduce fraud losses by up to 40%. This shift signifies a technological response to prevent future issues.

- AI-driven solutions can analyze vast datasets.

- Real-time fraud detection is possible.

- AI can identify complex fraud patterns.

- Increased investment in AI for fraud prevention.

Wirecard's tech opacity hid fraud. Rapid fintech growth needs strong tech oversight, estimated at $150B in 2024, growing over 20% by 2025. AI's potential in fraud detection is crucial, with reports estimating AI could reduce fraud losses by 40% in 2024.

| Aspect | Details | Impact |

|---|---|---|

| Tech Complexity | Intricate payment processing models | Obscured operations |

| Digital Payments Market (2028 Projection) | $14.77 trillion | Demand for tech infrastructure |

| AI Fraud Reduction (2024) | Up to 40% | Enhanced fraud detection |

Legal factors

The Wirecard scandal exposed weaknesses in fintech regulation, especially for global payment processors. It highlighted the need for more robust oversight. In 2024, regulatory bodies worldwide enhanced scrutiny of financial institutions.

Wirecard's auditors, especially EY, faced scrutiny for missing the fraud. Investigations and penalties followed, highlighting auditor accountability. In 2024, EY settled lawsuits related to Wirecard for over $1 billion. Discussions continue on bolstering auditing standards.

Wirecard's collapse highlighted severe corporate governance failures, lacking independent oversight. Legal battles persist, with former executives facing charges. Investigations revealed fraudulent accounting practices, damaging investor trust. Numerous lawsuits continue, seeking compensation for financial losses. The scandal serves as a stark reminder of governance's importance.

Insolvency Proceedings and Legal Battles

Wirecard's insolvency led to intricate legal challenges, including how shareholder claims would be handled and numerous lawsuits. These lawsuits targeted former executives and auditors, aiming to assign financial blame for the company's failure. The outcomes of these legal battles will significantly impact the financial repercussions of the collapse. As of late 2024, proceedings are still ongoing, with potential for substantial fines and penalties.

- The Munich public prosecutor's office has charged several former Wirecard executives with fraud and other offenses.

- Auditing firm Ernst & Young is facing lawsuits related to its role in auditing Wirecard's accounts.

- Shareholders are seeking compensation for their investment losses through legal actions.

- The legal processes are expected to continue for several years, with uncertain financial outcomes.

Criminal Investigations and Prosecutions

The Wirecard scandal triggered extensive criminal investigations and prosecutions. Former executives, including the CEO, faced charges like fraud, market manipulation, and embezzlement, highlighting the severe legal repercussions. These legal actions underscore the commitment to hold individuals accountable for their actions. As of early 2024, several trials are ongoing. The scandal's legal fallout continues to unfold.

- Significant fines and potential prison sentences are still possible.

- Ongoing investigations in multiple jurisdictions.

- Asset recovery efforts by creditors.

Legal actions followed Wirecard's collapse, with executives facing charges. EY faced lawsuits, and shareholders sought compensation. Ongoing trials continue, potentially leading to fines.

| Legal Aspect | Details | Status (2024-2025) |

|---|---|---|

| Criminal Charges | Fraud, market manipulation, embezzlement. | Trials ongoing; potential prison sentences and fines. |

| Auditor Liability | EY faces lawsuits regarding audit failures. | Settlements and ongoing legal battles. |

| Shareholder Lawsuits | Seeking compensation for investment losses. | Multiple lawsuits, uncertain financial outcomes. |

Environmental factors

Environmental considerations were not a priority for Wirecard. Sustainability was mainly for marketing. This lack of focus suggests a broader operational and strategic issue. Companies with low ESG scores often face higher risk. Data from 2024 shows increasing investor scrutiny on ESG performance.

Wirecard's ESG performance was notably weak, particularly in governance. ESG ratings flagged poor corporate controls and risk management. Although not the direct cause, weak governance, as indicated by ESG metrics, fostered an environment conducive to fraud. In 2020, Wirecard's stock price plummeted after accounting irregularities were revealed. The company collapsed, highlighting the importance of strong governance in financial integrity.

The Wirecard scandal highlighted governance issues within ESG. This led to greater scrutiny of financial institutions and tech companies. Investors now focus on governance as a key risk indicator. For example, in 2024, ESG-focused funds saw inflows despite market volatility, signaling sustained interest.

Climate and Environmental Risk in Finance

Although unrelated to Wirecard's fraud, climate and environmental risks are increasingly scrutinized in finance. Financial institutions face mounting pressure to assess and mitigate these risks, impacting regulatory frameworks. The Network for Greening the Financial System (NGFS) includes over 130 central banks and supervisors working on climate-related financial risks. In 2024, the EU's Sustainable Finance Disclosure Regulation (SFDR) continues to evolve, requiring increased transparency.

- NGFS members: Over 130 central banks and supervisors

- SFDR: EU regulation promoting transparency in sustainable finance

Sustainability Reporting and Transparency

The Wirecard scandal highlights the necessity for comprehensive reporting, extending beyond financials to include environmental and social impacts. Stakeholders increasingly demand transparency in non-financial aspects, influencing investment decisions and corporate reputation. Companies face growing pressure to disclose their sustainability efforts and environmental footprints. This shift is driven by regulatory changes and investor demand for ethical and sustainable practices.

- The Global Reporting Initiative (GRI) is a widely used framework for sustainability reporting, with over 7,000 organizations using it worldwide.

- In 2024, the European Union's Corporate Sustainability Reporting Directive (CSRD) came into effect, expanding the scope of sustainability reporting.

- A 2024 survey by PwC revealed that 73% of institutional investors consider ESG factors when making investment decisions.

Environmental factors at Wirecard were minimal. They prioritized marketing over genuine sustainability, mirroring a larger operational concern. ESG performance, especially governance, was weak, as ESG scores showed. In 2024, stricter regulations are observed, with investors scrutinizing ESG factors.

| Environmental Aspect | Wirecard's Approach | 2024/2025 Context |

|---|---|---|

| Sustainability | Marketing focus; low priority | ESG increasingly important for investors, and CSRD effective. |

| Reporting | Limited environmental disclosures | Growing demand for comprehensive non-financial reporting (GRI, CSRD). |

| Risk Assessment | Ignored climate and environmental risks. | Financial institutions actively assess climate-related risks; NGFS expansion. |

PESTLE Analysis Data Sources

Wirecard's analysis relies on financial reports, industry publications, regulatory filings, and legal documents. Global economic indicators also inform the insights.