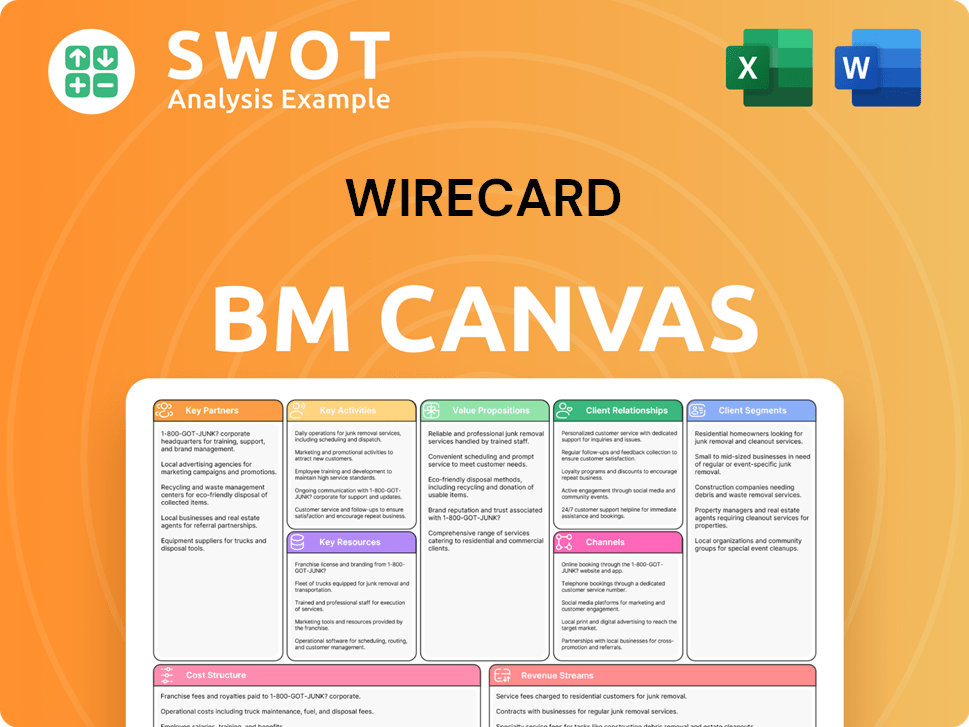

Wirecard Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Wirecard Bundle

What is included in the product

Wirecard's BMC covers customer segments, channels, and value propositions. It's designed for funding discussions and internal use.

Great for brainstorming; the Wirecard Business Model Canvas helps teams visualize and address complex problems.

Full Version Awaits

Business Model Canvas

What you see here is the genuine Wirecard Business Model Canvas, presented for your review. This preview represents the identical document you'll receive upon purchase.

Business Model Canvas Template

Uncover the strategic intricacies of Wirecard's business model. This canvas illuminates its core functions, value propositions, and customer relationships. Analyze their channels, key resources, and cost structure for comprehensive insights. Learn how Wirecard aimed to create and capture value within the financial technology landscape. Identify potential vulnerabilities and growth opportunities by understanding their key partnerships. Access the complete Business Model Canvas for a deep dive into Wirecard's strategic blueprint.

Partnerships

Wirecard's partnerships with acquiring banks were fundamental to its payment processing model, allowing it to handle credit and debit card transactions for merchants. These banks were crucial for Wirecard to offer services where it didn't have its own licenses or infrastructure. Through these alliances, Wirecard accessed payment networks like Visa and Mastercard. For example, in 2019, Wirecard's revenue from payment processing was €2.3 billion.

Technology providers were crucial for Wirecard's payment processing infrastructure, offering software and hardware. Partnerships included POS systems, e-commerce platforms, and security solutions. These collaborations enabled Wirecard to offer advanced technology. In 2019, Wirecard's revenue was €2.8 billion, showing the scale of its tech integration.

Merchants were vital to Wirecard, utilizing its payment services. These partnerships spanned small online shops to global firms. By 2019, Wirecard served 250,000+ merchants. Securing a diverse merchant base was key for revenue and market standing. Wirecard's collapse impacted thousands of merchants globally.

Financial Institutions

Wirecard's partnerships with financial institutions were pivotal. Commerzbank, LBBW, and ING offered credit and services, essential for operations. These relationships fueled Wirecard’s growth and liquidity. Dependence on these institutions created financial vulnerabilities. Loans were at risk, highlighting the risks involved.

- In 2019, Wirecard's total debt was approximately €3.5 billion, indicating a significant reliance on financial institutions.

- Wirecard's collapse in 2020 revealed that a substantial portion of its reported assets did not exist, leading to massive losses for lenders and investors.

- The scandal resulted in major losses for Wirecard's lenders, including banks like Commerzbank, which had significant exposure.

- The involvement of financial institutions in providing credit to Wirecard underscores the importance of thorough due diligence and risk management in lending practices.

Telecommunications Providers

Wirecard teamed up with telecom providers to enable mobile payment solutions via near-field communication (NFC). This collaboration allowed Wirecard to integrate its services into mobile devices, boosting its presence in mobile payments. These partnerships were crucial in areas with high mobile usage. By 2024, mobile payments accounted for over 60% of all digital transactions globally.

- Partnerships expanded Wirecard's payment reach.

- Mobile payments became a key growth area.

- Telecoms offered wide user access.

- High mobile penetration rates were pivotal.

Wirecard's key partnerships involved acquiring banks for payment processing, with 2019 revenue at €2.3 billion. Tech providers were crucial, contributing to €2.8 billion in revenue that year. Merchant collaborations included 250,000+ merchants by 2019. Financial institutions, like Commerzbank, were vital, and mobile payments grew through telecom partnerships.

| Partnership Type | Partner Examples | Impact |

|---|---|---|

| Acquiring Banks | Commerzbank, LBBW | Payment processing, network access |

| Technology Providers | POS, e-commerce platforms | Tech integration, advanced solutions |

| Merchants | Small shops to global firms | Revenue generation, market presence |

| Financial Institutions | ING, others | Credit, services |

| Telecom Providers | Various | Mobile payment solutions |

Activities

Wirecard's Payment Processing was central to its business model. It securely processed electronic payments for merchants, a key service. This included verifying details, routing transactions, and settling funds. Efficient processing was vital for trust; in 2024, global digital payments hit $8.06 trillion, highlighting the value of reliable payment systems.

Wirecard offered risk management to combat fraud and payment risks. This encompassed fraud detection, managing chargebacks, and regulatory compliance, vital for payment integrity. In 2024, global card fraud losses hit $40 billion, highlighting the need for robust services. A 2024 study showed that 60% of merchants saw increased fraud attempts.

Wirecard's core revolved around software development, crucial for payment processing. They built user-friendly interfaces and integrated new payment methods. System security and continuous innovation were vital. In 2019, Wirecard invested €190 million in R&D, mainly for software.

Regulatory Compliance

Wirecard's adherence to financial regulations and maintaining licenses were pivotal. This included compliance with anti-money laundering (AML) laws, data protection, and PCI standards. Non-compliance exposed the company to significant risks. These risks included substantial fines and legal ramifications.

- In 2024, global AML fines reached over $5 billion, indicating the high stakes of regulatory compliance.

- Data breaches, a compliance failure, cost companies an average of $4.45 million in 2023, according to IBM.

- PCI DSS compliance is a must for any firm handling card data; it's a non-negotiable.

- Failure to adhere to GDPR, saw penalties up to 4% of annual global turnover.

Sales and Marketing

Wirecard's sales and marketing were crucial for attracting merchants and increasing its market reach. They promoted their services, fostered client relationships, and attended industry events to boost revenue. In 2018, Wirecard's marketing expenses totaled €137.4 million. Effective strategies were vital for expansion.

- Sales teams focused on acquiring new merchants.

- Marketing campaigns highlighted Wirecard's payment solutions.

- Industry events helped showcase their services.

- These efforts drove revenue and market share growth.

Wirecard's Key Activities centered on processing payments, a vital service. They focused on risk management to tackle fraud and ensure secure transactions. Software development, crucial for innovation, was also a core function.

Wirecard also had to comply with financial regulations, which included AML and data protection. This was important to follow rules. Sales and marketing were critical for customer acquisition and revenue growth.

| Key Activity | Description | Impact |

|---|---|---|

| Payment Processing | Secure electronic transactions | $8.06T global digital payments (2024) |

| Risk Management | Fraud detection and compliance | $40B card fraud losses (2024) |

| Software Development | User interfaces and innovation | €190M R&D investment (2019) |

Resources

Wirecard's tech platform was key. It processed payments, managed risk, and offered extra services. This included software, hardware, and network infrastructure. A strong platform was crucial for handling large transaction volumes. In 2018, Wirecard processed €174.4 billion in transaction volume.

Wirecard Bank AG, a subsidiary, possessed a banking license, crucial for its operations. This license enabled Wirecard to issue cards and handle merchant accounts directly. It reduced dependency on external financial entities, offering greater control. The banking license was a significant competitive advantage for Wirecard. In 2024, the impact of such licenses continues to shape fintech strategies.

Wirecard's strong merchant client relationships were a key resource, driving recurring revenue and upselling opportunities. The company's ability to maintain customer satisfaction was critical. In 2019, Wirecard processed €200 billion in transaction volume. Customer loyalty was essential for long-term stability.

Global Network

Wirecard's global network was a cornerstone, with offices, partners, and clients worldwide. This network allowed them to tap into various markets and revenue streams. A robust global presence was key for serving multinational corporations and expanding. By 2019, Wirecard operated in over 20 countries. The global reach facilitated its growth.

- Global network enabled operations in multiple countries.

- Provided access to diverse markets and revenue streams.

- Crucial for serving multinational corporations.

- Expansion into new territories.

Data and Analytics

Wirecard's prowess in data and analytics was central to its business model. The company amassed extensive transaction data, crucial for spotting patterns and stopping fraud. This capability offered insights, and a competitive edge. Effective data management was key for optimizing operations and improving customer experience. However, the scandal revealed significant data manipulation, with €1.9 billion missing.

- Data analytics enabled fraud detection.

- Transaction data was a key resource.

- Data management was essential.

- Manipulation led to scandal.

Wirecard's success hinged on its advanced tech platform for payment processing, risk management, and supplementary services. This included software, hardware, and network infrastructure, critical for handling large transaction volumes. In 2018, the platform processed €174.4 billion. The tech was core to their scalability.

Wirecard Bank AG, a licensed subsidiary, was essential for issuing cards and managing merchant accounts directly. This banking license reduced reliance on external entities, offering greater control, and creating a competitive advantage. Such licenses remain crucial in shaping fintech strategies in 2024.

Wirecard's robust merchant client relationships were key for driving recurring revenue and providing upselling opportunities, critical for customer satisfaction and long-term stability. In 2019, the company processed €200 billion in transaction volume, emphasizing the importance of customer loyalty for financial health.

Wirecard's global network, spanning offices, partners, and clients worldwide, allowed them to tap into diverse markets and revenue streams. A robust international presence was key for serving multinational corporations and supporting expansion. By 2019, Wirecard operated in over 20 countries, demonstrating global reach.

Wirecard's data analytics capabilities were central to its business model, enabling fraud detection and providing competitive insights. The company amassed transaction data, crucial for identifying patterns, and optimising operations. Despite this, €1.9 billion was missing due to data manipulation.

| Key Resource | Description | Impact |

|---|---|---|

| Tech Platform | Payment processing, risk management, services. | Scalability, high transaction volume. |

| Wirecard Bank AG | Banking license for direct card issuance. | Control, competitive advantage. |

| Merchant Clients | Strong relationships drive revenue. | Recurring revenue, customer retention. |

| Global Network | Offices, partners, clients worldwide. | Market access, serving MNCs. |

| Data Analytics | Transaction data for fraud detection. | Competitive edge, operational insights. |

Value Propositions

Wirecard's value proposition centered on comprehensive payment solutions, providing a broad range of services. This included online and offline payment processing, mobile payments, and risk management. Their "one-stop-shop" approach aimed to simplify payment management for merchants.

Wirecard's global reach enabled merchants to tap into a worldwide payment network. This feature was crucial for international expansion, particularly for e-commerce. In 2018, Wirecard processed €174.2 billion in transactions globally. This reach facilitated cross-border transactions, boosting business opportunities. The global payment solutions were a core part of their value proposition.

Wirecard's innovative tech offered mobile/contactless payments and biometric authentication. This drew in tech-focused merchants and customers. Continuous innovation fueled its competitive edge. In 2018, Wirecard processed €170 billion in transaction volume, showcasing its tech's impact. By 2019, it was a major player in digital payments.

Customizable Solutions

Wirecard excelled in providing customizable payment solutions. These solutions were tailored to meet the unique needs of each business. This approach helped merchants streamline their payment systems and improve customer satisfaction. Tailoring was especially crucial for big companies with intricate needs.

- Wirecard's solutions could be adapted to various e-commerce platforms.

- Customization included options for multiple currencies and payment methods.

- Large clients like airlines benefited from tailored solutions.

- Wirecard's flexibility supported its rapid expansion.

Scalability and Reliability

Wirecard's value proposition included its platform's ability to scale and provide reliable payment processing. This was crucial for managing high transaction volumes, especially as the company expanded rapidly. The focus on reliability ensured minimal downtime, vital for maintaining customer trust and preventing financial losses for merchants. The company's infrastructure was intended to support significant growth.

- Wirecard aimed for 99.99% uptime to ensure reliability.

- The platform was designed to process millions of transactions daily.

- Scalability was key to attracting and retaining large merchant clients.

- Reliability issues could directly impact merchant revenue.

Wirecard's value proposition was its all-in-one payment solutions. These included online, offline, and mobile payment processing, targeting a global reach. Innovation with mobile/contactless payments aimed for tech-savvy merchants.

Customization and scalability were key, adapting solutions to merchant needs. They ensured reliability, which was crucial for transaction volumes. Wirecard processed €174.2B in transactions globally in 2018.

| Feature | Description | Impact |

|---|---|---|

| All-in-one | Comprehensive payment processing services | Simplified payment management |

| Global Reach | Worldwide payment network | International expansion |

| Innovation | Mobile/contactless payments | Attracted tech-focused merchants |

Customer Relationships

Wirecard assigned dedicated account managers to key clients, providing tailored support and guidance. This approach built strong relationships, crucial for customer retention. Prompt issue resolution, facilitated by account managers, enhanced satisfaction. In 2018, Wirecard processed €126.3 billion, highlighting the scale of their customer base and the importance of personalized service.

Wirecard's online support portal provided self-service tools like FAQs and troubleshooting. This allowed merchants to independently solve common problems. Self-service support was a cost-effective way to handle routine inquiries. In 2018, Wirecard's customer service costs were approximately €150 million. By 2024, the goal was to reduce customer service expenses by 10% through online self-service.

Wirecard provided technical integration support to merchants, facilitating the incorporation of its payment solutions. This assistance was key for a smooth onboarding experience, especially for merchants lacking technical expertise. By 2018, Wirecard's technical support helped onboarded over 250,000 merchants globally. This support was a key factor in customer retention, with 80% of merchants staying with Wirecard.

Training and Education

Wirecard invested in training to help merchants use its payment solutions effectively. This included resources to optimize payment processes and improve customer experience. Training was crucial for new clients and those using advanced features. Wirecard's focus was to ensure merchants could fully utilize its services. This support was part of its value proposition.

- Training programs covered topics like transaction processing and fraud prevention, vital for merchants.

- In 2024, the demand for such training increased due to the complexities of digital payments.

- Wirecard aimed for high merchant satisfaction through effective onboarding and ongoing support.

Feedback Mechanisms

Wirecard utilized feedback mechanisms to understand its customers better and refine its offerings. This included employing surveys, feedback forms, and customer forums. Gathering and acting on customer feedback was crucial for continuous service enhancements and boosting customer loyalty. In 2018, Wirecard's customer satisfaction score was 78%, reflecting its efforts. However, by 2020, the company's reputation suffered due to the scandal.

- Surveys were used to gauge customer satisfaction.

- Feedback forms were available for direct input.

- Customer forums provided a platform for discussions.

- In 2019, Wirecard processed €200 billion in transactions.

Wirecard's customer relationships revolved around personalized support, including dedicated account managers and online resources. Technical integration and training programs helped merchants. Feedback mechanisms, like surveys and forums, helped Wirecard improve services. Despite high customer satisfaction scores, the company's reputation plummeted by 2020.

| Customer Support | Data Point | Year |

|---|---|---|

| Customer Service Costs | €150 million | 2018 |

| Transactions Processed | €200 billion | 2019 |

| Customer Satisfaction Score | 78% | 2018 |

Channels

Wirecard's direct sales team targeted merchants directly. This approach enabled them to offer personalized solutions, crucial for securing significant contracts. They focused on large enterprises, a strategy that helped boost their revenue. In 2018, Wirecard's sales and marketing expenses were over €300 million. Direct sales were key to their rapid expansion.

Wirecard's online marketing strategy included SEO, PPC, and social media to attract customers. It was a budget-friendly way to create leads and raise brand recognition, especially for SMBs. In 2024, digital marketing spending is projected to reach $900 billion globally, highlighting its importance.

Wirecard's partnerships were crucial for growth. They used affiliates for market expansion through referral programs. Joint marketing campaigns boosted visibility, and integration with partner platforms was common. This strategy helped them reach new customers. Partnerships were a core part of their business model, driving market penetration.

Industry Events

Wirecard actively engaged in industry events like trade shows and conferences to promote its services and connect with potential clients. These events were crucial for generating leads and building relationships within the payment processing sector. Participation helped establish Wirecard's presence among decision-makers and influencers, crucial for business growth. This strategy aligns with how companies like Adyen and Stripe currently leverage events for brand visibility and market penetration.

- In 2018, Wirecard spent approximately €10 million on marketing, including event participation.

- Industry events offered a platform to demonstrate Wirecard's innovative payment solutions.

- Networking at these events was key for partnerships and client acquisition.

- Wirecard aimed to position itself as a thought leader in the fintech space.

Online Payment Platforms

Wirecard's integration with online payment platforms significantly expanded its reach. This strategy enabled the company to offer services to a broader merchant base. Seamless payment processing within e-commerce ecosystems was a key benefit. Reaching a diverse merchant base was crucial for growth.

- In 2018, e-commerce sales reached $2.8 trillion globally, highlighting the importance of online payment solutions.

- Wirecard's partnerships helped it process transactions for over 250,000 merchants worldwide.

- By 2019, mobile payment transactions were projected to reach $1.35 trillion globally.

Wirecard utilized direct sales, targeting merchants with personalized solutions to secure significant contracts, especially with large enterprises. Online marketing, including SEO and social media, was used to attract customers, particularly SMBs. Partnerships, including affiliate programs and joint campaigns, expanded market reach and boosted visibility.

Industry events like trade shows were crucial for generating leads and building relationships, while integrations with online payment platforms expanded their merchant base. In 2018, e-commerce sales reached $2.8 trillion, highlighting online payment solutions' importance.

| Channel | Description | Impact |

|---|---|---|

| Direct Sales | Targeted merchants directly, focusing on large enterprises. | Secured significant contracts and boosted revenue. |

| Online Marketing | Utilized SEO, PPC, and social media. | Generated leads and raised brand recognition. |

| Partnerships | Employed affiliates and joint marketing campaigns. | Expanded market reach and enhanced visibility. |

Customer Segments

Wirecard's e-commerce clients, including online retailers, were a crucial segment. In 2024, the e-commerce sector saw $7.2 trillion in global sales. These merchants used Wirecard for secure payment processing. Wirecard offered global reach, vital for businesses expanding internationally. Wirecard processed transactions for various e-commerce sizes.

Retailers with physical stores utilized Wirecard for card payments at the point of sale. Wirecard offered POS systems and mobile payment options. Retailers gained from Wirecard's payment solutions and risk management. In 2024, the global POS market is valued at approximately $100 billion. Wirecard's services aimed to streamline transactions for retail clients.

Wirecard collaborated with financial institutions for card issuance and payment processing, broadening their service portfolios. These alliances aided institutions in broadening their customer reach. Wirecard's tech platform and regulatory know-how were key assets. In 2018, Wirecard processed €176.7 billion in transactions.

Mobile App Developers

Wirecard's business model targeted mobile app developers, crucial for integrating payment solutions. They offered APIs and SDKs, simplifying payment processing integration. This allowed developers to monetize apps, including in-app purchases. In 2024, mobile app spending reached $171 billion globally.

- APIs and SDKs streamlined payment integration for developers.

- Developers could easily enable in-app purchases.

- Wirecard facilitated app monetization strategies.

- Mobile app spending surged, indicating market growth.

Travel and Hospitality Companies

Travel and hospitality companies utilized Wirecard for global payment processing. Wirecard provided multi-currency options and fraud protection. These services were crucial for international transactions. The travel sector valued Wirecard’s expertise in their specific needs.

- In 2024, the global travel market is estimated at $8.7 trillion.

- Wirecard processed payments for over 200,000 merchants globally.

- Fraud prevention services are a major cost saver for travel firms.

- Multi-currency transactions are key for international bookings.

Wirecard catered to e-commerce merchants, facilitating secure online transactions. They served retailers by providing POS systems and mobile payment options. Collaborations with financial institutions expanded service portfolios. Mobile app developers also integrated Wirecard's payment solutions for in-app purchases. The travel and hospitality sectors benefited from Wirecard's global payment processing capabilities.

| Customer Segment | Service Provided | 2024 Data/Fact |

|---|---|---|

| E-commerce | Payment processing | $7.2T global sales |

| Retailers | POS systems | $100B POS market |

| Financial Institutions | Card issuance | €176.7B transactions (2018) |

| Mobile App Developers | API integration | $171B app spending |

| Travel & Hospitality | Multi-currency payments | $8.7T travel market |

Cost Structure

Wirecard's technology infrastructure costs were substantial. The company invested heavily in hardware, software, and network infrastructure to support its payment processing services. Maintaining and upgrading this technology was crucial for system reliability and staying competitive. In 2019, Wirecard's IT expenses were approximately €200 million. These costs included depreciation and amortization of IT assets.

Wirecard's cost structure included transaction processing fees paid to payment networks and acquiring banks. These fees, a direct cost of processing payments, significantly impacted profitability. In 2018, Wirecard's payment processing revenue was €2 billion, with associated fees. Effective fee management was vital for sustaining financial health.

Wirecard faced substantial costs to adhere to financial regulations and maintain licenses. These expenses covered compliance staff, systems, and operational processes. In 2024, global financial compliance spending is expected to reach $80 billion. These measures were crucial to prevent fines, legal issues, and reputational harm. Operating globally amplified these costs due to varying jurisdictional demands.

Sales and Marketing Expenses

Wirecard's business model heavily relied on sales and marketing to acquire merchants and grow. This included substantial investments in a sales team, advertising, and industry events. Such aggressive marketing drove revenue, but also inflated costs. Sales and marketing expenses were a significant part of their overall costs.

- Employee costs for the sales team.

- Advertising and promotional campaigns.

- Sponsorships and event participation.

- Market research expenses.

Personnel Costs

Personnel costs were a significant part of Wirecard's cost structure, involving salaries, benefits, and training for its global workforce. This included various roles such as tech staff, customer service, and management. Wirecard's ability to draw and retain qualified employees was crucial for its operations and expansion. In 2019, Wirecard's personnel expenses totaled €477.7 million, reflecting its investment in human capital.

- Salaries and Wages: A substantial portion of personnel costs was allocated to salaries and wages for the employees.

- Benefits: Employee benefits, including health insurance, retirement plans, and other perks, also contributed to the overall personnel costs.

- Employee Training: The company invested in employee training and development programs to improve their skills.

- Employee Count: The company had approximately 5,500 employees worldwide in 2019.

Wirecard's cost structure was multifaceted, with high tech infrastructure spending of €200M in 2019. Transaction fees and regulatory compliance, with global spending expected to reach $80B in 2024, further inflated costs. Significant personnel and marketing expenses, including €477.7M in staff costs in 2019, were also essential.

| Cost Category | Description | 2019 Expense |

|---|---|---|

| IT Infrastructure | Hardware, software, and network costs | €200M |

| Transaction Fees | Fees to payment networks and banks | Significant portion of revenue |

| Compliance | Regulatory adherence | $80B (Global 2024 est.) |

| Sales & Marketing | Sales team, advertising | Significant, variable |

| Personnel | Salaries, benefits, training | €477.7M |

Revenue Streams

Wirecard's main revenue stream was transaction fees, charged to merchants for processing payments. Fees were a percentage of each transaction. This model made up the bulk of Wirecard's income. In 2018, transaction volume was €174.6 billion.

Wirecard's service fees came from value-added services like fraud protection and analytics. These fees were another revenue source, boosting profits. Larger clients needing complex solutions paid more. In 2024, fraud losses hit $40 billion globally, highlighting the value of these services.

Wirecard's revenue model heavily relied on interchange fees. These fees, charged to merchants for processing card transactions, were a crucial income stream. The acquiring business benefited substantially from these fees. In 2018, Wirecard's revenue reached €2 billion, a large portion came from fees. Interchange fees are subject to regulatory changes.

Subscription Fees

Wirecard's subscription fees model offered recurring revenue through payment solutions. Merchants with predictable transaction volumes found this appealing. This approach helped Wirecard secure stable revenue. The subscription-based model was a key part of their financial strategy. Wirecard's revenue in 2018 was EUR 2 billion, with a significant portion from fees.

- Subscription services provided recurring revenue streams.

- Merchants with stable transaction volumes were targeted.

- This model ensured predictable and stable revenue.

- In 2018, Wirecard's total revenue was EUR 2 billion.

Licensing Fees

Wirecard utilized licensing fees as a revenue stream by granting other businesses access to its technology and software. This strategic move enabled Wirecard to monetize its intellectual property, broadening its market footprint. Licensing fees were particularly attractive due to their high-margin nature. This approach allowed Wirecard to generate income without significant additional operational costs.

- Licensing fees contributed to Wirecard's revenue diversification strategy.

- This revenue stream was a high-margin source of income.

- Wirecard's technology was licensed to various companies, expanding its reach.

- The licensing model allowed for scalability with minimal added expense.

Wirecard's revenue streams included transaction fees, the primary source, based on transaction volume. Service fees from value-added solutions, such as fraud protection, generated additional income. Interchange fees from card processing also brought in substantial revenue. In 2018, Wirecard's revenue was about EUR 2 billion.

| Revenue Stream | Description | 2018 Revenue (EUR) |

|---|---|---|

| Transaction Fees | Fees from processing payments. | ~1.7 billion |

| Service Fees | Fees from value-added services. | ~0.2 billion |

| Interchange Fees | Fees for card transaction processing. | ~0.1 billion |

Business Model Canvas Data Sources

The Wirecard Business Model Canvas uses financial statements, market analysis, and news articles for data. This helps build a strategic and informative business overview.