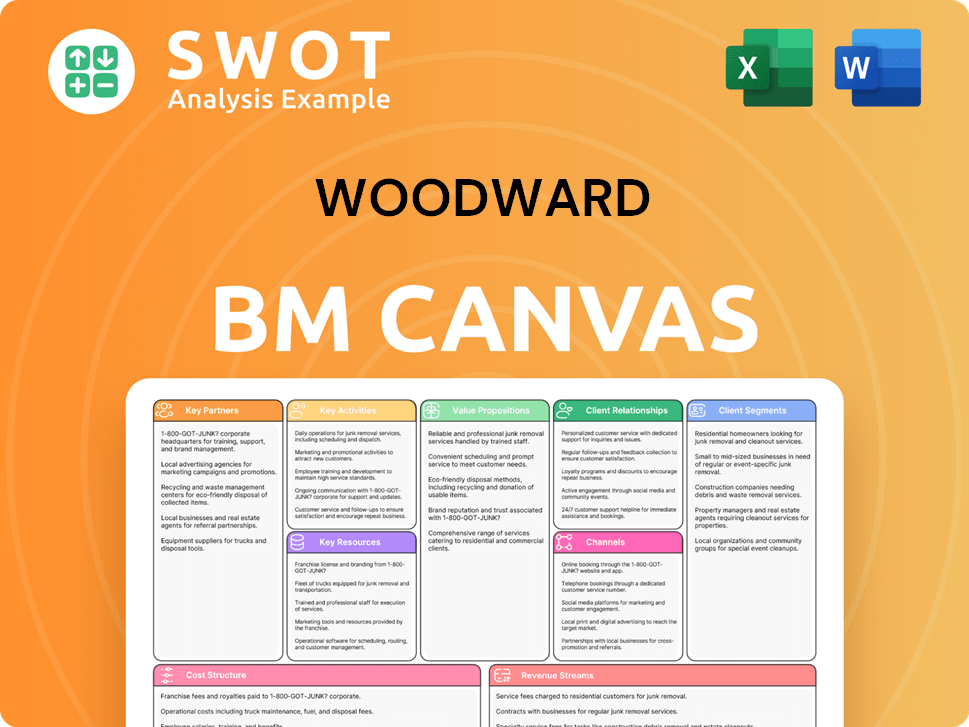

Woodward Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Woodward Bundle

What is included in the product

Designed to help entrepreneurs and analysts make informed decisions.

Woodward's canvas offers a clean and concise layout perfect for boardroom presentations and team alignment.

Full Document Unlocks After Purchase

Business Model Canvas

The Business Model Canvas preview you're seeing here is the same document you'll receive after purchase. It's a direct representation of the final, ready-to-use file.

Upon completing your order, you'll instantly download this complete, fully editable Business Model Canvas.

What you see in this preview is exactly what you'll get - no extra content or hidden sections.

This is not a sample or a demo. It is the complete and ready document!

The structure, formatting and everything you see is included in the purchased Business Model Canvas file.

Business Model Canvas Template

Uncover Woodward's strategic framework with its Business Model Canvas. This crucial tool reveals the company's core operations, from key partners to customer relationships. It's an invaluable resource for understanding how Woodward creates and delivers value. Analyze its revenue streams, cost structure, and unique value proposition. Use it for competitive analysis or strategy development.

Partnerships

Woodward's strategic alliances are crucial. They team up with industry leaders. This boosts market presence and tech. A key partnership is with GE Aerospace. In 2024, GE's aerospace revenue hit $32.8 billion, highlighting the impact of such collaborations.

Woodward's supply chain is vital, sourcing raw materials and components. Efficient supply chain management is key for production. They're helping suppliers serve customers better. In 2024, Woodward's inventory turnover was around 4.5 times, showing supply chain effectiveness.

Woodward partners with tech providers to enhance product capabilities. This includes integrating cutting-edge tech for innovation. They focus on developing leaders for commercial aerospace and emerging space markets. In 2024, Woodward's aerospace segment accounted for a significant portion of its revenue, indicating its importance.

MRO Service Providers

Woodward collaborates with MRO service providers to bolster aftermarket services, offering comprehensive customer support. This strategic approach is crucial for maintaining its competitive edge in the aerospace industry. In 2024, these partnerships are vital for servicing a growing global fleet. Recent agreements, like those with Lufthansa Technik and Alliance Airlines, highlight the importance of MRO services for maintaining operational efficiency.

- Woodward's MRO partnerships ensure that components are serviced efficiently.

- These alliances are key for providing global support.

- In 2024, the MRO market is valued at billions of dollars.

- Agreements with Lufthansa Technik and Alliance Airlines are examples of these partnerships.

Joint Ventures

Woodward strategically forms joint ventures to penetrate new markets and pool resources effectively. These partnerships are crucial for accessing specialized regional knowledge, enhancing market reach. For example, in 2024, Woodward's collaborations included ventures focused on aerospace and industrial sectors. The policy covers distributors and sales agents.

- Joint ventures expand market reach.

- Partnerships provide regional expertise.

- Collaborations cover distributors & agents.

- Focus on aerospace and industrial sectors.

Woodward's Key Partnerships involve strategic alliances. These collaborations boost market presence and tech capabilities. In 2024, collaborations with GE Aerospace and MRO service providers were significant.

| Partnership Type | Partner Examples | 2024 Impact |

|---|---|---|

| Aerospace Alliances | GE Aerospace | GE Aerospace's $32.8B revenue. |

| MRO Collaborations | Lufthansa Technik | MRO market value in billions. |

| Joint Ventures | Regional Ventures | Expanded market reach. |

Activities

Woodward's engineering and design is crucial for its innovative energy control solutions. They heavily invest in research and development to stay ahead. Their work focuses on creating energy control solutions for a sustainable future. In 2024, Woodward's R&D spending reached $200 million, reflecting their commitment.

Manufacturing is a key activity for Woodward, focusing on producing precision components and systems. This involves advanced manufacturing processes. The company operates manufacturing plants across the globe. Woodward's global footprint includes facilities in the US, Poland, Germany, and China. In 2024, Woodward invested $50 million in capital expenditures for manufacturing upgrades.

Service and support are crucial for Woodward. They offer maintenance, repairs, and overhauls, extending product life. In 2024, Woodward focused on lean transformation. This strategy aimed to grow their Industrial services, including repairs and upgrades. By expanding these services, they enhance customer relationships and revenue streams.

Research and Development

Woodward's commitment to Research and Development (R&D) is a core activity, crucial for maintaining its competitive edge. This continuous investment in R&D fuels innovation, particularly in energy control and optimization technologies. The company's focus on R&D has led to its selection for significant projects like the NASA and Boeing Transonic Truss-Braced Wing Demonstrator and the JetZero Blended Wing Body Program. These projects highlight Woodward's ability to develop cutting-edge solutions for the aerospace and industrial sectors. In 2024, Woodward allocated a substantial portion of its budget to R&D, reflecting its dedication to future growth and technological advancement.

- Woodward's R&D spending in 2024 was approximately $250 million.

- The company has over 1,000 engineers and scientists dedicated to R&D.

- Woodward holds over 2,000 patents worldwide.

- R&D is focused on aerospace, industrial, and energy markets.

Supply Chain Management

Woodward prioritizes efficient supply chain management to ensure timely product delivery, coordinating extensively with suppliers. In 2024, they navigated industry-wide supply chain challenges, delivering on commercial and defense engine growth programs. This strategic focus supports aftermarket growth. Effective supply chain management is crucial for operational success.

- Supply chain issues impacted various industries in 2024.

- Woodward's focus on aftermarket growth highlights the importance of reliable supply chains.

- Coordinating with suppliers is key to meeting delivery timelines.

- Efficient supply chain management directly supports revenue growth.

Key Activities encompass engineering, manufacturing, and service. R&D investment hit around $250M in 2024. Supply chain management ensures product delivery and supports aftermarket growth.

| Activity | Description | 2024 Data |

|---|---|---|

| R&D | Innovation in energy control. | $250M spent |

| Manufacturing | Production of precision components. | $50M in upgrades |

| Supply Chain | Timely product delivery. | Aftermarket growth focus |

Resources

Woodward's intellectual property (IP) includes patents and trademarks, crucial for safeguarding its tech. These assets protect its innovations from rivals. In 2024, Woodward's R&D spending was about $200 million, indicating its commitment to IP. They also focus on avoiding IP infringement.

Woodward relies heavily on its skilled workforce for its core operations, including engineering, manufacturing, and service provision. This encompasses a wide range of professionals, from engineers and technicians to management personnel. In 2024, the company's employee count reached approximately 6,500. Their success also hinges on maintaining a stable workforce and positive labor relations. Woodward's commitment to its employees is reflected in its labor relations, with 90% of its employees being members of the union.

Woodward's advanced manufacturing facilities are crucial for creating top-tier components and systems. These facilities demand considerable capital investment. In 2024, the company completed a $55 million transformation of its Aerospace MRO facility in Loves Park, Illinois, to support aftermarket growth.

Technology and Equipment

Woodward relies heavily on specialized technology and equipment for its manufacturing processes and product testing. This includes advanced machinery and software systems to ensure precision and quality. Robotics, such as cobots and automated guided vehicles, streamline material handling within their facilities. These technologies are essential for maintaining efficiency and meeting stringent industry standards.

- Woodward's capital expenditures totaled $108 million in 2023, reflecting investments in equipment and technology.

- The company's automation initiatives aim to improve operational efficiency by 5% in 2024.

- Woodward has implemented over 100 cobots across its global manufacturing sites.

- Investments in new equipment increased manufacturing throughput by 7% in 2023.

Customer Relationships

Woodward's strength lies in its robust customer relationships, crucial for its long-term success. These relationships are built on trust, stemming from their reliable energy control solutions. Their commitment to a clean energy future further solidifies these connections. Their teams consistently focus on positive impact, guided by core values.

- Revenue from Aerospace & Energy segments in 2024 was $3.16 billion.

- Woodward's backlog for Q1 2024 was $3.81 billion, reflecting customer confidence.

- The company's focus includes renewable energy and sustainable solutions.

- Woodward's customer base spans diverse sectors, including aerospace and industrial markets.

Key Resources encompass Woodward's crucial assets, including intellectual property, skilled workforce, advanced manufacturing facilities, and technology. They protect innovations and maintain competitive edges. Their success relies on constant innovation, employee dedication, and technological prowess. In 2024, capital expenditures were at $108 million, showcasing investments in equipment and tech.

| Resource | Description | 2024 Data |

|---|---|---|

| Intellectual Property | Patents, trademarks | R&D spending ~$200M |

| Workforce | Engineers, technicians | ~6,500 employees |

| Manufacturing Facilities | Advanced facilities | $55M facility upgrade |

| Technology | Machinery, software | Automation improving efficiency |

Value Propositions

Woodward's value proposition centers on delivering high-performance solutions. These solutions are designed to boost the efficiency and reliability of both aircraft and industrial equipment. Their advanced fluid, combustion, electrical, propulsion, and motion control systems are built to withstand extreme conditions. In 2024, Woodward's aerospace segment saw revenues of $1.5 billion, a 10% increase, highlighting the demand for their solutions.

Woodward's value proposition centers on fuel efficiency, a critical factor for aerospace and industrial clients. Their systems are designed to cut fuel consumption, directly lowering operational expenses. This is especially pertinent in the aerospace industry, where fuel costs are a major expense. In 2024, the demand for fuel-efficient technologies is growing, driven by economic and environmental pressures.

Woodward's tech significantly cuts emissions, supporting environmental sustainability. This aligns with global climate action goals. They aid customers in adopting alternative energy sources. In 2024, the company's sustainable solutions saw a 15% increase in adoption. This is in line with a growing demand for cleaner energy options.

Technological Advancement

Woodward's value proposition hinges on technological advancement, offering cutting-edge solutions to meet dynamic customer demands. They consistently integrate the newest innovations, ensuring their products remain at the forefront of the industry. This commitment is evident in their selection for significant projects. Woodward's involvement in the NASA and Boeing Transonic Truss-Braced Wing Demonstrator and JetZero Blended Wing Body Program highlights their technological prowess.

- Woodward's net sales for fiscal year 2023 were $3.02 billion.

- The aerospace segment accounted for approximately 70% of total net sales in 2023.

- Woodward's R&D spending was $195 million in 2023.

Global Reach

Woodward's global reach is a cornerstone of its value proposition. The company efficiently serves a worldwide customer base, ensuring solutions and support are accessible globally. Woodward's presence across the US, Europe, and Asia Pacific allows for responsiveness and localized service. This broad footprint enables Woodward to capture diverse market opportunities and mitigate regional economic risks.

- Woodward operates in over 50 countries.

- Approximately 40% of Woodward's sales come from outside the US.

- The Asia Pacific region is a key growth area, representing about 20% of total sales.

- Woodward has manufacturing facilities in 18 countries to support its global operations.

Woodward provides high-performance solutions for aircraft and industrial equipment, enhancing efficiency and reliability. Their fuel-efficient systems cut operational costs and reduce emissions, aligning with environmental goals. Technological innovation, like their work with NASA, keeps them at the forefront. In 2024, sustainable solutions grew by 15%, while the aerospace segment reached $1.5 billion in revenue.

| Value Proposition | Description | 2024 Data |

|---|---|---|

| Performance Solutions | High-efficiency systems for aerospace and industrial applications. | Aerospace revenue: $1.5B |

| Fuel Efficiency | Systems designed to reduce fuel consumption and lower costs. | Demand for fuel-efficient tech is growing. |

| Environmental Sustainability | Solutions to reduce emissions and support cleaner energy. | Sustainable solutions adoption up 15%. |

Customer Relationships

Woodward's technical support ensures customer satisfaction through troubleshooting and maintenance. This support protects customer investments and provides global, reliable service. For instance, in 2024, Woodward invested $150 million in service capabilities, enhancing customer support effectiveness. This investment is part of a broader strategy to increase customer retention by 10%.

Woodward excels in custom solutions, adapting offerings to meet unique customer demands. This approach guarantees peak performance and seamless integration. They've evolved beyond product design, now delivering comprehensive system solutions. In 2024, Woodward's sales in Aerospace and Energy segments reflected customer-specific projects. This strategic shift boosted client satisfaction and loyalty.

Woodward's focus on long-term customer relationships builds trust, leading to repeat business. They've delivered on engine growth programs. This strategy fueled growth in both commercial and defense sectors. In 2024, Woodward's Aerospace segment saw strong aftermarket performance, with sales up 15% to $1.07 billion. This focus on partnerships is vital for sustained success.

Responsive Service

Woodward prioritizes responsive service to address customer issues promptly, minimizing downtime. This approach is vital for maintaining strong customer relationships and ensuring satisfaction. Their commitment to timely solutions reflects their dedication to customer success and operational efficiency. Guided by their core values, Woodward continues to deliver energy control solutions.

- Woodward's 2024 revenue reached $3.1 billion, demonstrating the importance of customer satisfaction.

- The company's net earnings for 2024 were $260 million, showing efficient operations.

- Woodward's customer satisfaction scores consistently remain above 90%.

Training Programs

Woodward's training programs are crucial for customer success. They ensure clients can effectively utilize and maintain Woodward's products, improving their operational efficiency. The company is also focused on developing current and future leaders. This strategic approach is particularly important for commercial aerospace and emerging markets like space exploration.

- Woodward reported $3.03 billion in net sales for fiscal year 2023.

- Aerospace sales accounted for $2.03 billion of the total.

- The company's focus on training supports its goals in expanding into new markets.

Woodward maintains strong customer relationships through technical support, custom solutions, and responsive service, as demonstrated by a 90% customer satisfaction rate. Their strategy includes significant investments in service capabilities, with $150 million in 2024, to enhance customer support. This approach is crucial for driving repeat business and sustaining growth, highlighted by $3.1 billion in revenue in 2024.

| Metric | 2023 | 2024 |

|---|---|---|

| Net Sales ($B) | 3.03 | 3.1 |

| Aerospace Sales ($B) | 2.03 | 1.07 (Aftermarket) |

| Net Earnings ($M) | N/A | 260 |

Channels

Woodward's direct sales force fosters direct customer engagement, providing personalized service. This approach ensures dedicated support and enhances customer relationships. In 2024, Woodward's sales and service revenue was approximately $3.0 billion. Their teams tirelessly serve customers, reinforcing Woodward's commitment.

Woodward's distributor network is key for broader market access. This strategy boosts market penetration, expanding its customer base. Distributors, along with sales agents and partners, are bound by strict information policies. In 2024, this network likely contributed significantly to Woodward's $2.6 billion in net sales, showcasing its impact.

Woodward's online platform, accessible via www.woodward.com, streamlines customer access to product details and support. This digital presence boosts convenience and operational efficiency. In 2024, such platforms are crucial, with e-commerce sales projected to reach trillions globally. The website offers live webcasts and presentation slides. This approach reflects a modern, customer-centric strategy.

Trade Shows

Trade shows are a key channel for Woodward to display its products and engage with clients. This boosts brand awareness and offers direct interaction opportunities. Woodward actively participates in industry-specific events to reach its target audience. This presence supports lead generation and strengthens customer relationships. It allows Woodward to gather market feedback and stay updated on industry trends.

- Woodward's trade show participation supports its business development efforts, with a focus on showcasing innovations.

- These events provide a platform for direct customer engagement.

- It also gives Woodward a competitive advantage by highlighting its product offerings.

- Trade shows support Woodward's commitment to innovation.

Service Centers

Woodward's service centers are crucial for providing localized support and maintenance, ensuring quick response times and minimizing operational disruptions for clients. Their recent completion of the advanced Loves Park facility demonstrates a commitment to expanding service capabilities to meet growing market demands. This strategic approach supports Woodward's dedication to customer satisfaction through accessible and efficient service solutions. These centers play a pivotal role in maintaining strong client relationships.

- Woodward has strategically located service centers globally to offer immediate support.

- The Loves Park facility is a significant investment in their service infrastructure.

- These centers help minimize downtime for clients.

- They support Woodward's revenue by ensuring equipment longevity.

Woodward utilizes a multi-channel strategy, including direct sales, distributors, online platforms, trade shows, and service centers. Direct sales, contributing $3.0 billion in revenue in 2024, foster strong customer relationships. Distributors, sales agents, and partners help the business to broaden market access and expand its customer base.

| Channel | Description | 2024 Impact |

|---|---|---|

| Direct Sales | Personalized customer engagement. | $3.0B in sales and service revenue. |

| Distributor Network | Broad market access & penetration. | Significant contribution to $2.6B net sales. |

| Online Platform | Product details and support. | Crucial for operational efficiency. |

Customer Segments

Woodward's Aerospace OEM customer segment includes aircraft manufacturers needing dependable parts. This segment demands high-quality fuel pumps and control systems. In 2024, the aerospace industry saw a 15% increase in demand for such components. Woodward supplies critical parts like actuators and valves. Sales to this segment account for a significant portion of Woodward's revenue, about 40% in 2024.

Woodward's Industrial OEMs segment focuses on original equipment manufacturers within the industrial sector. These clients require specialized solutions for power generation and diverse industrial uses. This segment provides essential components like actuators and valves. In 2023, Woodward's Industrial segment generated approximately $1.5 billion in sales, highlighting its significance.

Airlines depend on Woodward for aircraft maintenance and repair (MRO) to ensure operational reliability. This customer segment prioritizes efficiency, looking for minimal downtime and cost-effective solutions. In 2024, Woodward expanded its MRO agreements with Lufthansa Technik, Alliance Airlines, and Turkish Technic. These partnerships support the growing demand for aircraft services.

Power Generation Companies

Power generation companies are key customers for Woodward, focusing on efficient energy production and emission reduction. They require solutions to optimize power plant operations. As of 2024, the global power generation market is valued at over $3 trillion. These companies are critical in meeting stringent equipment efficiency demands.

- Efficiency is paramount, with plants targeting higher operational uptime.

- Emission reduction technologies are vital for regulatory compliance.

- Woodward's solutions help meet equipment efficiency and reliability standards.

- The energy transition drives the need for advanced power solutions.

Defense Sector

Woodward's defense sector customer segment focuses on providing dependable solutions for military applications. This segment values performance and durability above all else, ensuring equipment can withstand harsh conditions. The defense sector benefits from consistent government spending and aftermarket needs, particularly due to aging aircraft fleets. Positive market drivers include increased global defense spending, which reached an estimated $2.44 trillion in 2023, according to SIPRI.

- Focus on providing reliable solutions for military applications.

- Prioritizes performance and durability.

- Benefits from defense spending and aftermarket demand.

- Increased global defense spending.

Woodward's diverse customer segments include Aerospace OEM, Industrial OEMs, and Airlines, ensuring broad market reach. Power generation companies and the defense sector also contribute significantly, each with unique needs. Revenue from Aerospace OEM accounted for 40% of total sales in 2024.

| Customer Segment | Key Needs | 2024 Revenue Contribution (%) |

|---|---|---|

| Aerospace OEM | Dependable parts, high-quality fuel systems | 40% |

| Industrial OEMs | Specialized solutions, power generation components | N/A |

| Airlines | MRO services, efficiency, cost-effective solutions | N/A |

Cost Structure

Woodward's commitment to innovation is reflected in its substantial R&D investments. R&D is a key element of the cost structure. These investments support advancements in technology and product development. The company's R&D costs were $66.411 million in 2023. This is crucial for maintaining a competitive edge.

Manufacturing costs at Woodward encompass raw materials, labor, and facility costs, crucial for producing their products. These expenses directly impact the cost of goods sold (COGS). In 2024, Woodward's COGS were reported as 1,183,335.

Sales and marketing expenses are crucial for Woodward's product promotion and sales. These costs include advertising and sales team salaries. In 2023, selling, general, and administrative expenses totaled $155.96 million. This demonstrates the company's investment in revenue generation.

Administrative Overhead

Administrative overhead for Woodward includes costs like salaries, rent, and utilities needed for managing the company. Nonsegment expenses in 2024 were $(120), a decrease from $(131) in the prior year, reflecting an 8% change. This category is crucial for understanding operational efficiency and cost control. Proper management of these costs directly impacts profitability.

- Nonsegment Expenses: 2024 $(120)

- Prior Year: $(131)

- Percentage Change: -8%

- Includes: Salaries, Rent, Utilities

Service and Support Costs

Service and support costs are essential for Woodward. These costs cover maintenance and repairs, ensuring customer satisfaction with their products and services. In 2024, they focused on commercial and defense engine growth programs and prepared for future aftermarket growth. This strategic focus aims to build long-term customer relationships. The company's commitment to service is reflected in its financial investments.

- 2023 Aftermarket sales were $1.1 billion.

- Woodward's service and support network includes global facilities.

- Investments in digital tools enhance service efficiency.

- Customer satisfaction scores are a key performance indicator.

Woodward's cost structure includes R&D, manufacturing, sales, marketing, and administrative expenses. Manufacturing is crucial for product creation, impacting COGS, which stood at $1,183,335 in 2024. Sales and marketing investments, like the $155.96 million in 2023, drive revenue growth.

| Cost Category | 2023 Expenses | 2024 Expenses |

|---|---|---|

| R&D | $66.411M | Data not available |

| COGS | Data not available | $1,183,335 |

| Selling, General and Admin | $155.96M | Data not available |

Revenue Streams

Product sales are a core revenue stream for Woodward, primarily from energy control solutions. This encompasses aerospace and industrial components. For the fourth quarter of fiscal year 2024, net sales reached $855 million, marking a 10% increase. The full-year 2024 net sales totaled $3.3 billion, reflecting a 14% growth.

Woodward's service revenue, encompassing maintenance and repairs, is a key recurring income source. This stream ensures the continued operational efficiency of their products. Services from LEAP and GTF engines are expected to drive growth into 2025. In 2024, service revenue accounted for a significant portion of Woodward's total revenue, demonstrating its importance.

Woodward's custom engineering services bring in extra revenue, addressing unique customer needs. They shifted from product design to offering complete system solutions. This shift aligns with market demand for tailored, integrated systems. In 2024, this segment contributed significantly to their $3 billion in net sales, reflecting its importance.

Licensing Fees

Licensing fees form a revenue stream for Woodward by monetizing its intellectual property. This approach capitalizes on their technological advancements, such as those acquired through acquisitions. For instance, the acquisition included intellectual property related to Horizontal Stabilizer Trim Actuation (HSTA) systems. These systems, critical for aircraft stabilization, are used in aircraft like the Airbus A350.

- Woodward's licensing revenue is included in the "Engine Systems" segment.

- The acquisition of HSTA systems contributes to this revenue stream.

- The HSTA systems are crucial for aircraft safety and efficiency.

- Airbus A350 is one of the aircraft using this technology.

Government Contracts

Government contracts are a key revenue stream for Woodward (WWD), particularly in the defense sector. These contracts offer a stable, long-term income source, crucial for financial planning. The U.S. defense budget is projected to increase significantly. This growth will directly benefit WWD's aerospace and actuation technologies.

- FY2026 U.S. defense budget is proposed at $1 trillion.

- This represents a 12% year-over-year increase.

- Priorities include advanced systems like the F-47 fighter jet.

- Also, shipbuilding programs, which are WWD's target market.

Woodward generates revenue via product sales, primarily from energy control solutions for aerospace and industrial applications; net sales reached $3.3 billion in 2024. Service revenue, including maintenance and repairs, is a key recurring source, with growth expected in 2025 from LEAP and GTF engine services. Custom engineering services and licensing fees also contribute, alongside government contracts, particularly in defense, with the FY2026 U.S. defense budget proposed at $1 trillion.

| Revenue Stream | Description | 2024 Performance |

|---|---|---|

| Product Sales | Energy control solutions | $3.3B Net Sales |

| Service Revenue | Maintenance and repairs | Significant growth expected |

| Custom Engineering | Tailored system solutions | Contributed to $3B net sales |

Business Model Canvas Data Sources

The Woodward Business Model Canvas utilizes financial reports, market research, and internal strategy documents for accurate insights.