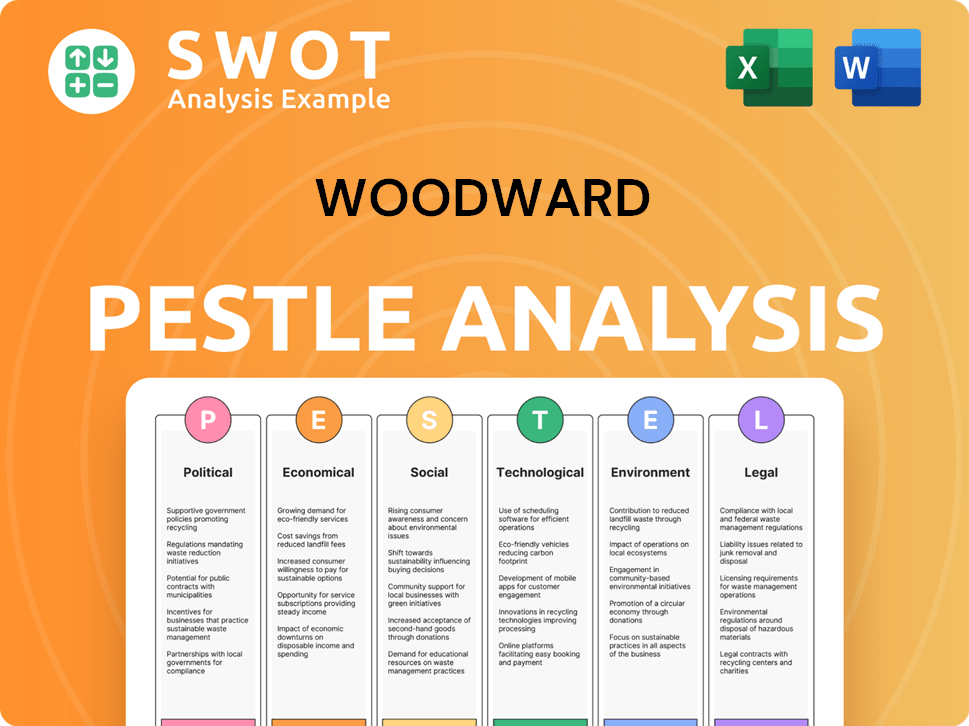

Woodward PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Woodward Bundle

What is included in the product

Analyzes external influences across Political, Economic, Social, Technological, Environmental & Legal landscapes. Offers key insights into market opportunities.

Helps identify critical external factors for Woodward, facilitating strategic planning and proactive responses.

Preview Before You Purchase

Woodward PESTLE Analysis

The content and structure shown in the preview is the same document you’ll download after payment. This Woodward PESTLE analysis, detailing key external factors, is yours instantly. It's professionally formatted and ready for your use.

PESTLE Analysis Template

Dive into a concise look at Woodward's external environment. This PESTLE analysis briefly examines key Political, Economic, Social, Technological, Legal, and Environmental factors influencing its operations. Understand potential risks and growth opportunities shaped by market trends. Download the complete analysis for deeper insights into Woodward's strategy and future prospects.

Political factors

Woodward's aerospace segment is heavily influenced by government spending on defense and space. Fluctuations in government budgets directly affect the demand for Woodward's products. Increased defense spending often boosts demand for control systems used in military aircraft. In 2024, the U.S. defense budget was approximately $886 billion, impacting companies like Woodward.

Woodward faces trade policy impacts, especially tariffs. Global trade shifts and barriers influence its international operations and supply chains. For instance, the US-China trade war affected aerospace component costs. In 2024, new tariffs could change Woodward's market access and profitability significantly.

Political stability is vital for Woodward. Instability in regions with key customers or facilities can disrupt operations. For example, political upheaval in certain European nations could impact supply chains. In 2024, Woodward's international sales represented 45% of total revenue.

International Relations and Geopolitical Events

Geopolitical events and international relations significantly impact demand for defense aerospace products. Rising global tensions can increase government defense spending, which benefits companies like Woodward. For instance, in 2024, global military expenditure reached $2.44 trillion. The defense segment of Woodward could see gains from these trends.

- Global military spending hit $2.44 trillion in 2024.

- Increased conflicts drive up defense budgets.

- Woodward's defense segment may benefit.

Government Regulations and Industrial Policy

Government regulations and industrial policies significantly influence Woodward's operations. These regulations span emissions, safety, and incentives for sustainable technologies. Recent data shows a push toward stricter environmental standards: the EU's Green Deal aims to cut emissions by 55% by 2030. These changes can impact the company's product development and operational costs.

- EU Green Deal: Aims for 55% emission cuts by 2030.

- US Inflation Reduction Act: Provides incentives for clean energy.

- Aerospace Industry: Subject to stringent safety and certification protocols.

Woodward navigates political factors via defense spending, which was $886 billion in the U.S. in 2024. Trade policies, such as tariffs, affect international operations and costs. Global military spending, reaching $2.44 trillion in 2024, influences the defense sector.

| Political Factor | Impact | 2024/2025 Data |

|---|---|---|

| Government Spending | Influences demand for aerospace products | U.S. defense budget: ~$886B in 2024 |

| Trade Policies | Affects international operations, costs | Trade war impact; new tariffs |

| Geopolitical Events | Impacts defense sector | Global military expenditure: $2.44T in 2024 |

Economic factors

Woodward's success is linked to global economic health. Strong economies boost aerospace/industrial demand. In 2024, global GDP growth was ~3.2%, impacting air travel and industrial output. A recession could hurt sales. Anticipate effects on Woodward's performance.

Inflation significantly influences Woodward's operational expenses, covering materials and labor costs. As of early 2024, the U.S. inflation rate hovers around 3-4%, impacting manufacturing costs. Increased interest rates, influenced by the Federal Reserve's policies, raise borrowing expenses for Woodward and its clients. This could affect investment decisions and the demand for capital goods.

Woodward, operating globally, faces currency exchange rate risks. Fluctuations impact reported financials, affecting sales and costs. For example, a stronger USD can lower the value of international sales. In 2024, USD volatility against EUR and JPY was significant. This impacts profitability when translating foreign earnings.

Supply Chain Costs and Disruptions

Supply chain costs and disruptions are crucial economic factors for Woodward. The cost and availability of raw materials and components directly affect production expenses. Global supply chain interruptions, influenced by economic conditions or geopolitical events, can hinder production and customer demand fulfillment. In 2024, the global supply chain faced challenges, with disruptions raising costs.

- According to a 2024 report, supply chain disruptions increased manufacturing costs by 10-15%.

- Geopolitical events in 2024 caused delays in the delivery of components by 2-4 weeks.

Market Demand in Aerospace and Industrial Segments

Market demand significantly impacts Woodward's economic performance within the aerospace and industrial sectors. Aircraft utilization rates and new aircraft production are primary drivers. Investment in power generation, along with activity in oil, gas, and transportation, also plays a crucial role in influencing Woodward's financial results.

- In 2024, commercial aircraft utilization rates are expected to increase by 5-7% globally.

- New aircraft production is projected to rise by 8-10% in 2024, driven by strong demand.

- Power generation investments are forecast to grow by 4-6% in 2024/2025.

- Oil and gas sector activity is stabilizing, with a moderate increase in spending.

Economic factors greatly shape Woodward's trajectory. GDP growth impacts demand for aerospace/industrial products, with ~3.2% global growth in 2024. Inflation affects operational expenses and borrowing costs. Currency exchange rate risks also play their part.

Supply chain dynamics including the availability of raw materials, components costs. In 2024 supply chain disruptions increased manufacturing costs by 10-15%. Market demand within aerospace, industrial sectors impacts business, as shown below.

| Factor | 2024/2025 Trend | Impact on Woodward |

|---|---|---|

| Commercial Aircraft Utilization | +5-7% | Increased demand |

| New Aircraft Production | +8-10% | Sales growth |

| Power Generation Investment | +4-6% | Revenue rise |

Sociological factors

Woodward relies on a skilled workforce to manufacture and service its products. In 2024, the manufacturing sector faced a 3.7% unemployment rate, indicating a competitive labor market. Labor disputes, such as those seen in the automotive industry in 2023, could disrupt supply chains. Positive labor relations, however, can boost productivity and employee retention, which is key for a company like Woodward.

Customer preferences are shifting towards sustainability. This impacts Woodward's product demand. For example, demand for electric vehicle components is rising. In 2024, the global EV market grew by 30%. Customers want better fuel efficiency, and lower emissions.

Safety and reliability are critical in aerospace and industrial sectors. Public trust hinges on the dependability of aircraft and industrial systems. Woodward's high-quality control systems directly address these societal expectations. In 2024, the global aerospace industry's focus on safety drove a 10% increase in demand for reliable components.

Aging Population and Workforce Demographics

Woodward, like other industrial firms, must consider the implications of an aging global population and changing workforce demographics. These shifts may affect the availability of skilled labor, potentially increasing labor costs or necessitating investments in automation. For instance, the U.S. Bureau of Labor Statistics projects a slower labor force growth rate through 2032, impacting manufacturing. Companies might need to adapt their strategies to attract and retain talent.

- Labor Force Growth: The U.S. labor force is projected to grow by 0.5% annually from 2022 to 2032.

- Automation Adoption: Spending on industrial automation is expected to reach $214 billion by 2025.

- Aging Workforce: Over 20% of the U.S. population will be aged 65+ by 2030.

Public Perception and Trust

Public perception significantly affects aerospace and industrial firms like Woodward. Concerns about environmental impact and safety can shape regulations and consumer behavior. For instance, a 2024 study revealed that 68% of consumers consider a company's environmental record when making purchasing decisions. Negative publicity regarding safety can lead to decreased trust and sales. This can influence Woodward's market position and profitability.

- Consumer sentiment shifts impact investment.

- Safety scandals lead to brand damage.

- Environmental issues drive policy changes.

- Trust is crucial for long-term success.

Woodward must navigate societal trends like labor force dynamics. Automation investments are predicted to reach $214 billion by 2025, influenced by an aging workforce, which might lead to skill shortages. Public perception on safety and sustainability affects demand, such as EV components; this industry grew by 30% in 2024.

| Sociological Factor | Impact on Woodward | Data Point (2024-2025) |

|---|---|---|

| Workforce Trends | Labor costs, automation adoption | US Labor force growth (0.5% annually until 2032). |

| Consumer Preferences | Demand for sustainable products | EV market grew 30% (2024), and consumer preferences shifted. |

| Public Perception | Trust, brand image, sales | 68% consumers consider environmental records in purchases. |

Technological factors

Woodward must stay ahead in control systems, vital for its edge. Digital controls, software, and sensors are key. R&D investment is crucial. The company's R&D spending was $160.7 million in fiscal year 2024. This is vital to meet customer demands.

The push for better fuel efficiency and lower emissions is a key tech factor. Woodward's tech must meet these demands in aerospace and industry. In 2024, the global market for fuel-efficient tech was over $300 billion, growing annually. Woodward's solutions are vital for staying competitive and expanding.

The push toward electrification in aerospace and industrial equipment is reshaping the market. Woodward must innovate to meet the demand for electric and hybrid-electric systems. This requires significant investment in R&D and strategic partnerships. For instance, the global electric aircraft market is projected to reach $47.5 billion by 2030.

Automation and Digitalization in Manufacturing

Automation and digitalization significantly influence Woodward's manufacturing efficiency and cost structures. Implementing advanced technologies like robotics and AI can boost productivity and product quality. For instance, in 2024, the global industrial automation market was valued at approximately $200 billion, with projected annual growth of around 8% through 2025. This growth underscores the importance of Woodward investing in these technologies to remain competitive.

- Increased efficiency can lower production costs.

- Enhanced quality control is achievable through digital systems.

- Investment in automation requires significant capital expenditure.

- Digitalization can streamline supply chain management.

Cybersecurity Risks

Cybersecurity is a critical technological factor for Woodward, as its control systems become more interconnected and software-dependent. The company faces growing risks from cyber threats targeting its products and internal systems. A 2024 report revealed a 25% increase in cyberattacks targeting industrial control systems. Woodward needs robust cybersecurity measures to protect sensitive data and maintain operational integrity.

- Cybersecurity breaches can lead to significant financial losses and reputational damage.

- Investments in cybersecurity should align with industry best practices and regulatory requirements.

- Regular security audits and employee training are essential for mitigating risks.

- Woodward must stay updated on evolving cyber threats and vulnerabilities.

Technological factors significantly influence Woodward. Key areas include R&D for control systems, with $160.7M spent in 2024. Electrification and digital automation reshape the landscape; for example, industrial automation's market hit $200B in 2024. Cybersecurity is also essential due to growing risks and the 25% rise in cyberattacks on industrial systems.

| Technology Area | Impact | 2024 Data/Facts |

|---|---|---|

| Control Systems R&D | Competitive Advantage | $160.7M R&D spend |

| Electrification | Market Demand | Electric aircraft market is projected to reach $47.5B by 2030 |

| Automation | Efficiency & Cost | $200B industrial automation market in 2024, growing annually |

| Cybersecurity | Risk Mitigation | 25% increase in cyberattacks on industrial control systems |

Legal factors

Woodward faces stringent compliance demands within aerospace and industrial fields. These include adhering to safety standards set by organizations like the FAA and EASA, as well as industrial requirements. For example, in 2024, the FAA issued over 500 safety directives impacting aerospace manufacturers. These regulations influence product design, manufacturing processes, and operational procedures. Compliance failures can lead to significant penalties, operational disruptions, and reputational damage, impacting Woodward's financial performance.

Woodward, operating globally, must comply with diverse export control and trade regulations. These regulations, varying by country, can significantly affect the company's international sales and distribution capabilities. For example, in 2024, the U.S. Department of Commerce's Bureau of Industry and Security (BIS) updated export control policies, impacting companies like Woodward. These changes can lead to delays or restrictions in shipping products, potentially affecting revenue.

Woodward heavily relies on intellectual property (IP) to maintain its market position. Patents and trade secrets are vital for shielding its innovations. The strength of IP laws and enforcement capabilities directly impact Woodward's ability to protect its assets. In 2024, global spending on IP protection was approximately $280 billion, reflecting its importance. Effective IP protection is critical for Woodward's long-term financial success.

Product Liability and Safety Regulations

Woodward operates in sectors where product safety is crucial. The company must adhere to strict product liability laws and safety regulations, demanding thorough testing and quality control processes. Non-compliance can lead to significant financial and reputational damage. In 2024, the average product liability settlement in the U.S. was $1.2 million. Woodward's commitment to safety is essential for its financial health.

- Product recalls can cost millions, as seen with recalls in the automotive sector.

- Stringent regulations include ISO 9001 certification for quality management.

- Failure to comply could result in lawsuits and damage the brand.

Employment and Labor Laws

Woodward must adhere to employment and labor laws across its global operations. This ensures fair wages, safe working conditions, and positive labor relations. Non-compliance can lead to significant fines and reputational damage. In 2024, labor law violations resulted in over $500,000 in penalties for some multinational corporations.

- Compliance is vital to avoid legal issues.

- Focus on fair wages and safe conditions.

- Labor relations can impact productivity.

- Penalties for violations can be high.

Woodward faces rigorous legal constraints across aerospace and industrial sectors, including safety standards from the FAA and EASA, impacting design and operations; in 2024, the FAA issued over 500 safety directives.

Global operations require compliance with varying export controls and trade regulations, potentially affecting international sales; for example, U.S. BIS updated export control policies.

Intellectual property protection via patents and trade secrets is crucial; in 2024, around $280 billion was spent on IP globally.

Strict product liability and safety laws demand adherence; in 2024, U.S. product liability settlements averaged $1.2 million; non-compliance can result in legal problems.

Employment and labor laws demand fair wages and safe conditions, with penalties for violations.

| Legal Factor | Description | 2024/2025 Impact |

|---|---|---|

| Safety Regulations | FAA, EASA standards, etc. | Product design, operational changes, penalties |

| Export Controls | Varying by country (BIS) | Sales delays/restrictions, impact on revenue |

| Intellectual Property | Patents, trade secrets | Protect innovation, R&D spending ~ $280B globally |

| Product Liability | Safety laws and recalls | High settlement costs, average ~$1.2M/case (U.S.) |

| Labor Laws | Employment, fair wages | Fines, reputational damage, $500K+ penalties (example) |

Environmental factors

Stringent environmental regulations and emissions standards are crucial. Woodward develops solutions for cleaner energy control. The global market for emissions control technologies is projected to reach $67.8 billion by 2025. Woodward's innovation helps customers comply, boosting its market position.

The push for decarbonization and climate change solutions significantly impacts businesses. Woodward can capitalize on this by offering solutions for renewable energy and alternative fuels. In 2024, the global renewable energy market was valued at $881.1 billion, with expected growth to $1.977 trillion by 2030. This growth highlights opportunities for Woodward.

Woodward faces resource scarcity and sustainability pressures. Using materials efficiently and minimizing environmental impact is crucial. Consider the rising costs of raw materials, like rare earth elements, impacting manufacturing. In 2024, companies face scrutiny regarding their carbon footprint, influencing consumer choices.

Waste Management and Pollution Control

Woodward faces environmental pressures regarding waste management and pollution control, vital for its operations. Compliance with evolving environmental regulations is crucial for avoiding penalties and maintaining operational licenses. Furthermore, adopting sustainable practices can enhance Woodward's brand image and attract environmentally conscious investors. Such practices are increasingly important for long-term business sustainability.

- In 2024, environmental compliance costs for manufacturing companies increased by approximately 8%.

- Companies with robust environmental programs often see a 5-10% improvement in operational efficiency.

- The global market for pollution control technologies is projected to reach $120 billion by 2025.

Customer Demand for Environmentally Friendly Solutions

Woodward faces growing customer demand for eco-friendly products. This trend affects both aerospace and industrial sectors, pushing for greater fuel efficiency and lower emissions. The shift includes a focus on alternative fuels, impacting product design and innovation. For example, the global sustainable aviation fuel market is projected to reach $15.8 billion by 2028.

- Demand for sustainable aviation fuel is rising.

- Customers want reduced emissions and better fuel economy.

- Woodward needs to adapt product offerings.

Environmental factors for Woodward involve stringent regulations and market shifts towards sustainability. These include the growing demand for eco-friendly products and decarbonization solutions. Compliance is critical, with the pollution control tech market projected to hit $120B by 2025.

| Environmental Aspect | Impact on Woodward | Data Point (2024/2025) |

|---|---|---|

| Emissions Standards | Drives innovation in cleaner energy solutions. | Emissions control tech market: $67.8B (2025). |

| Decarbonization | Opportunity for renewable energy and alternative fuel tech. | Renewable energy market: $1.977T by 2030. |

| Sustainable Demand | Shapes product design for better fuel efficiency. | Sustainable aviation fuel: $15.8B by 2028. |

PESTLE Analysis Data Sources

Woodward's PESTLE relies on governmental data, financial reports, industry insights and market research. We ensure accuracy using verifiable sources.